Our research reveals that the best day trading software are Trendspider, Trade Ideas, MetaStock, TradingView, and Benzinga Pro.

Each offers benefits for day traders, like free stock trades, AI automated trading, real-time news, and powerful backtesting.

As a certified market analyst with over two decades of using and testing stock market software, I can help you choose the best day trading software to match your trading style.

Top Picks for Day Trading Tools

- TrendSpider: Best for Scanning, Backtesting & Autotrading Day Trading Strategies

- Trade Ideas: Day Trading AI Buy & Sell Signals Providing Market-Beating Profits.

- TradingView: Best Global Platform for Day Trading Stocks, Forex, and Crypto.

- MetaStock: Best Software for Trading Systems, Forecasting, and Backtesting.

- Benzinga Pro: Real-time News Feed for Day Traders.

- TC2000 Brokerage: Best for Day Trading from Charts US & Canada.

Each day trading software platform offers a unique mix of pricing, services, and software to meet the needs of the day trader. Trading costs are also critical; choosing a low-cost or zero-commission broker can save you thousands of dollars annually.

Day Trading Platforms Ranking Table

| Platform | Rating |

| TrendSpider | ★★★★★ |

| Trade Ideas | ★★★★★ |

| TradingView | ★★★★★ |

| MetaStock | ★★★★✩ |

| Benzinga Pro | ★★★★✩ |

| TC2000 | ★★★★✩ |

| Firstrade | ★★★☆✩ |

| Interactive Brokers | ★★★☆✩ |

| Scanz | ★★★✩✩ |

| TradeStation | ★★★✩✩ |

What Is The Best Day Trading Software for Beginners?

Our extensive testing shows that Trade Ideas is ideal for beginners because it uses powerful AI to assist you in trading and finding good high-probability trades.

Trade Ideas’ artificial intelligence provides clear, specific, audited, high-probability trading signals and automated trading, which give you the best chance of being profitable.

The Best Day Trading Software

According to testing, the top day trading software is TrendSpider’s backtesting, scanning, trading bots, and Trade Ideas with AI-automated trading signals and free stock trades. If you want to learn day trading from a vast global stock, Forex, and crypto community, then TradingView is perfect. If you want to day trade real-time news, then Benzinga Pro wins.

1. TrendSpider: Best for Scanning & Backtesting Day Trading Strategies

TrendSpider ranks number one as our leading day trading software. It automates important day trading tasks such as market scanning, backtesting, chart pattern recognition, trendline analysis, and auto-trade execution.

| TrendSpider Rating |

★★★★★ |

| ⚡ Features |

Charts, Watchlists, Scanning, Point-and Click Backtesting |

| 📈 Day Trading Features |

AI Automated Trendlines, Fibonacci, Pattern Recognition, Trading Bots |

| 💰 Free Stock Trading |

✔ (Broker Dependent) |

| 🤖 Day Trading Bots |

✔ |

| 🎯 Best for | Day Traders |

| 🎮 Trial | ❌ |

| 💰 Price | $107/m or $48/m annually |

| ✂ Premium Discount | Use Code "LST30" for -30% on monthly or -63% off annual plans |

| 🌎 Markets Covered | USA |

Pattern recognition is gaining importance due to its ability to save time and achieve superior accuracy compared to human analysis. Chart patterns like the Inverse Head and Shoulders have proven highly profitable for traders, so having TrendSpider’s machine algorithms find and trade them for you is a distinct advantage.

TrendSpider’s Day Trading Features

TrendSpider offers cutting-edge features like automated candlestick, trendline, and chart pattern recognition. Its point-and-click functionality, which directly plots buy and sell signals on the chart, makes backtesting and strategy development easy.

Beyond this, TrendSpider provides a wealth of financial information, including news scanning, analyst estimates, rating changes, insider trading data, and seasonality charts.

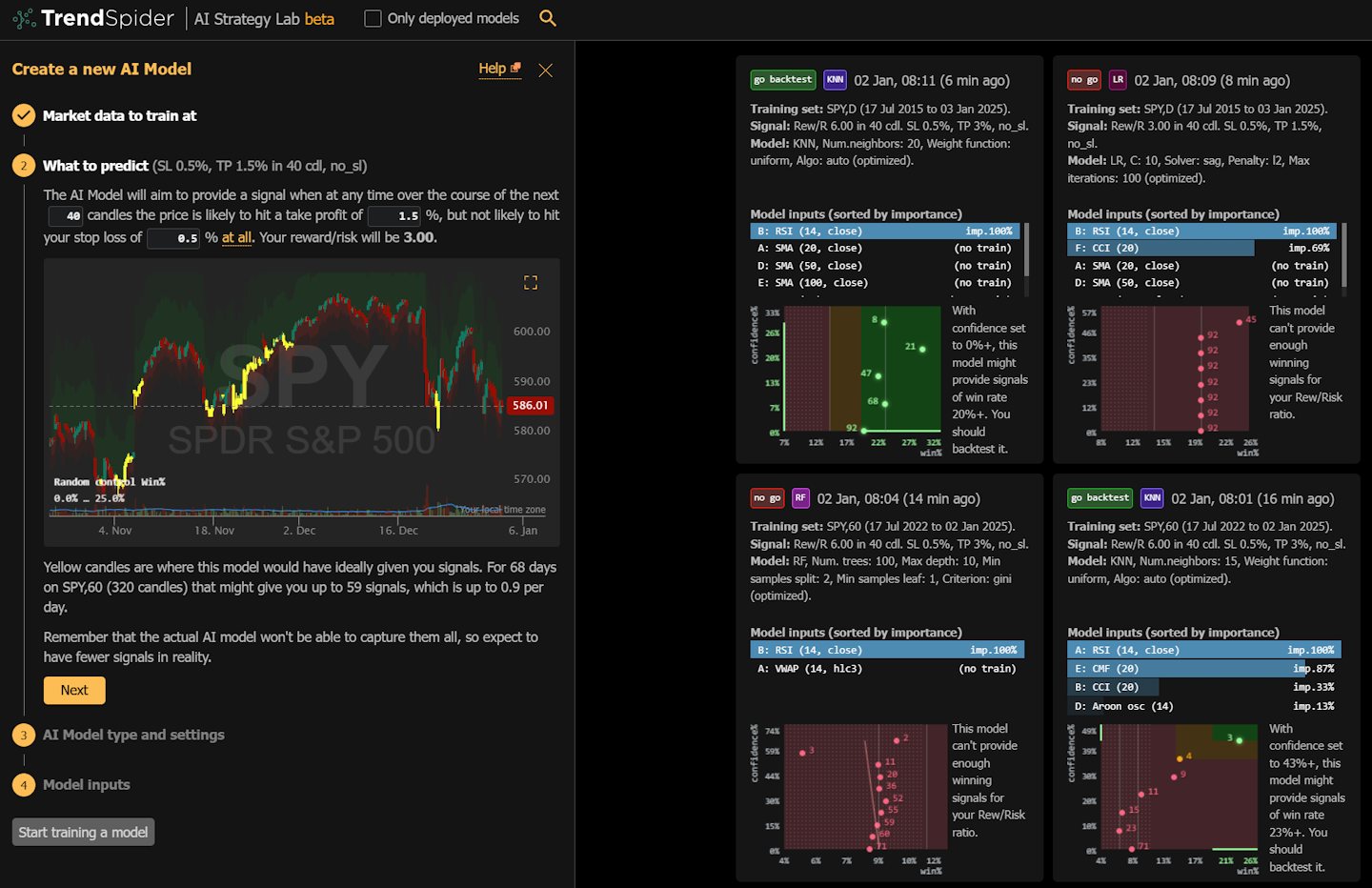

To top it off, the 2024 launch of AI-powered trading assistance and automated trading Bot execution adds an exciting layer of innovation.

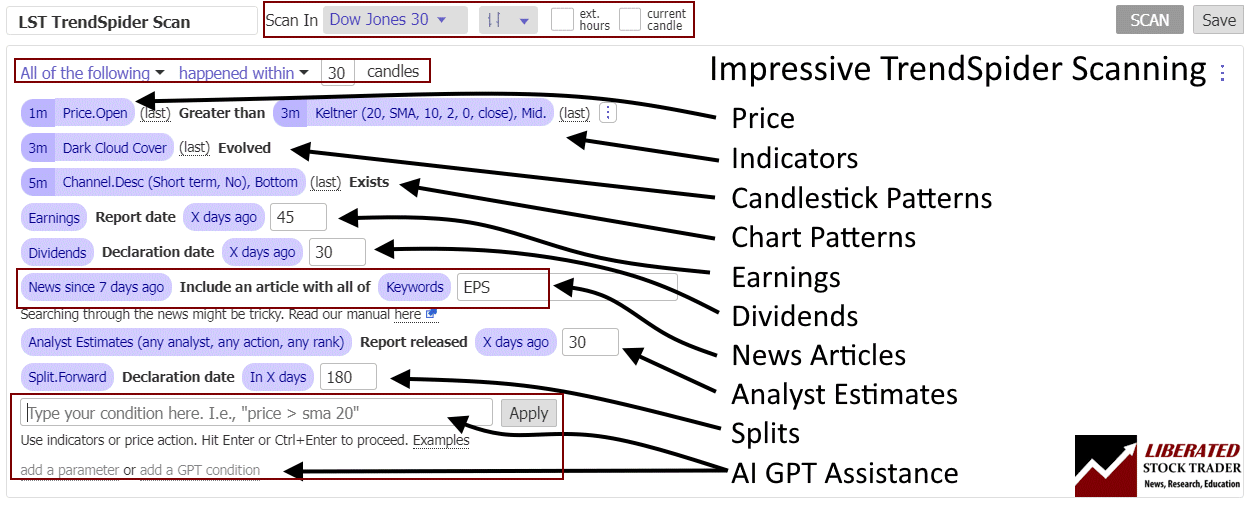

Finding Day Trading Opportunities

Market scanning for precise criteria is a critical process for day traders. With TrendSpider, you can screen for any criteria related to price, indicators, patterns, earnings, dividends, analyst estimates, and stock splits.

For example, you can scan for companies that release their earnings in the next seven days, where analysts expect a positive earnings surprise, and where the news reports mention “Surprise, Surge, or FDA.”

TrendSpider is our top pick for day trading software. One key feature that sets it apart is its ability to screen for news, technicals, and fundamentals. This function lets traders stay updated with market movements, ensuring they make informed trading decisions.

Adding to its robust capabilities, TrendSpider boasts automated trendline, pattern, and candle detection. The AI-integrated assistant further enhances the software’s efficiency, allowing users to navigate the platform seamlessly. The powerful point-and-click backtesting feature proves invaluable for those looking to test their strategies before diving into actual trading.

One of the remarkable things about TrendSpider is that it includes real-time exchange data in its price. It covers a broad range of financial instruments such as US stocks, ETFs, options, Forex, crypto, and futures. Users can access over 220 charts and indicators, providing an all-encompassing market view.

Save 30% on TrendSpider with Code “LST30”

In-person one-on-one training is included to ensure users can maximize the software’s potential. However, it’s worth noting that TrendSpider doesn’t feature a social network, limiting users’ ability to connect with other traders on the platform. Additionally, the software is only available for use on US exchanges.

2. Trade Ideas: Best for Black Box AI Day Trading

Trade Ideas is an excellent day trading service. Its three AI algorithms provide high-probability day trading signals and automated trading.

| Trade Ideas Rating |

★★★★★ |

| ⚡ Features |

Trading From Charts, Watchlists, Scanning, Backtesting, |

| 📈 Day Trading Features |

AI Trade Signals, Automated Trading, 3 AI Bots, Audited Performance |

| 💰 Free Stock Trading |

✔ – eTrade |

| 🤖 Day Trading Bots |

✔ |

| 🎯 Best for | Day Traders |

| 🎮 Trial | Live Trading Room, Free Weekly AI Trade |

| ✂ Premium Discount | -15% With Code “LIBERATED” |

| 🌎 Markets Covered | USA |

Founded in 2003, Trade Ideas is a web & desktop-based software platform for finding day trading opportunities. Historically specializing in real-time scanning for trade opportunities, Trade Ideas now incorporates cutting-edge AI algorithms that backtest every stock in the USA for high-probability trading opportunities.

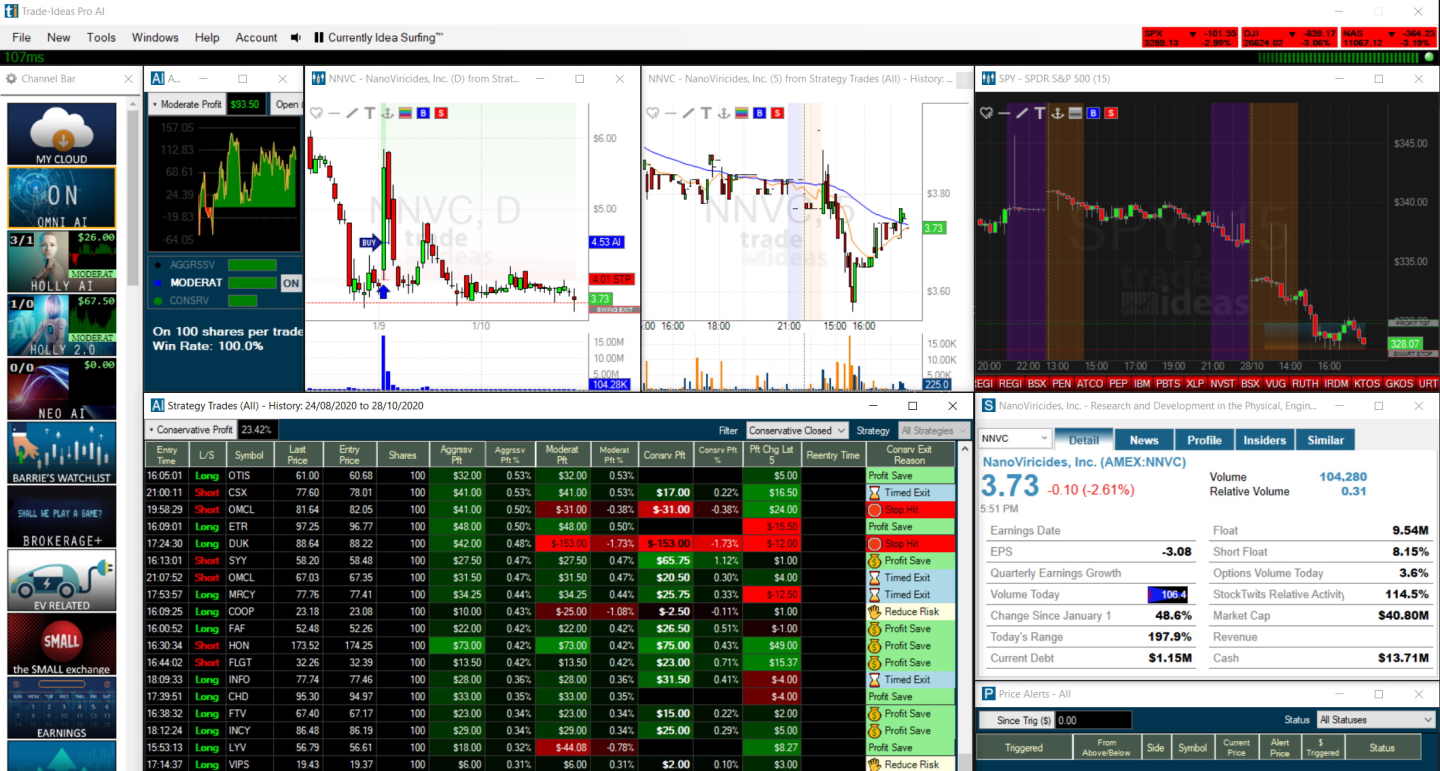

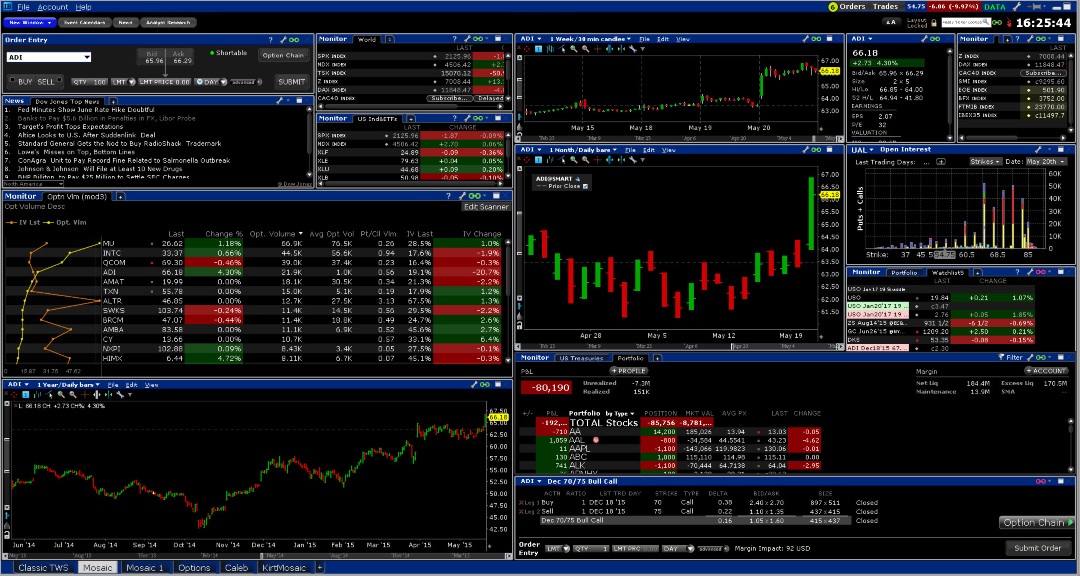

Trade Ideas’ Day Trading Platform

When you first open Trade Ideas on your desktop, the software feels extremely clunky and unfriendly. Every pane in the screenshot below is a separate window, so you must resize all eight windows to resize the view. This seems like a hassle initially and harks back to the age of Windows 98.

But there is a good reason for this design. Operating multiple monitors and large screens gives users like me endless flexibility and window configuration options. Also, even though they are fully separate windows, they can be linked and unlinked to provide a fluid experience.

So, although it is clunky and some of the most important functions are hidden behind right-click menus in certain windows, you start to get used to the design after a few hours.

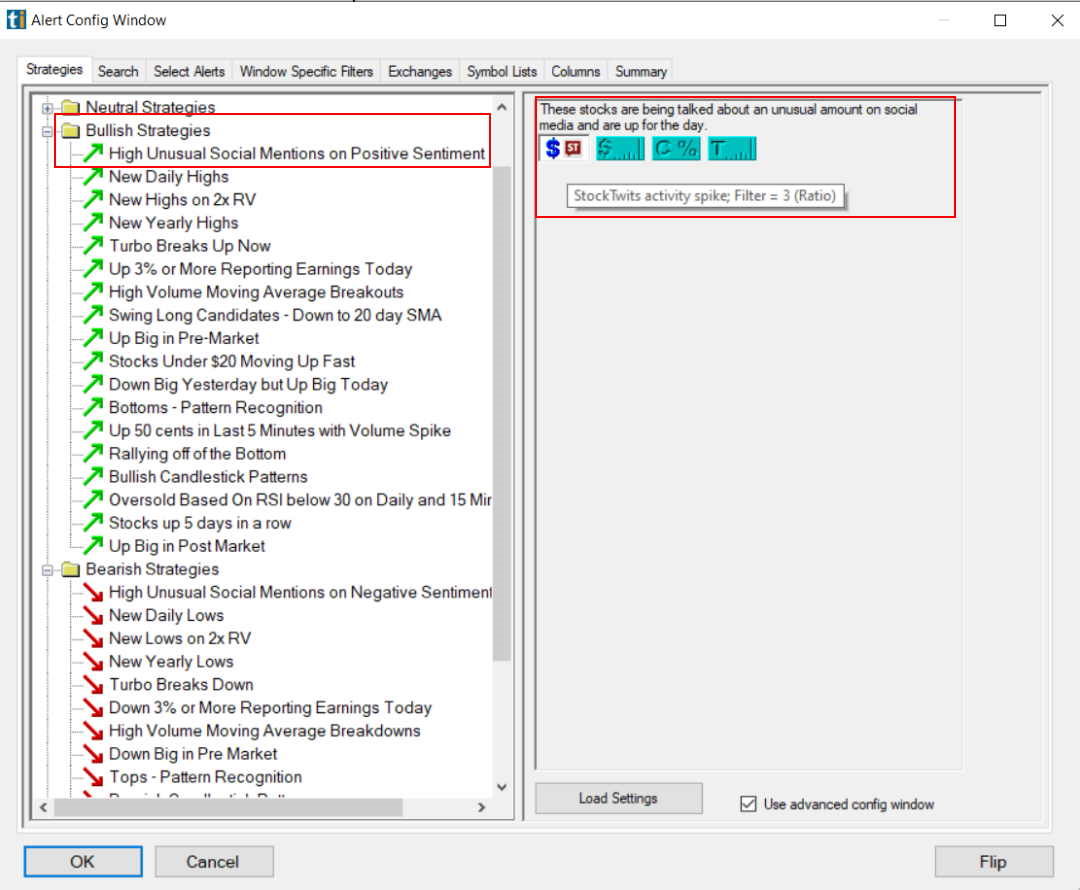

The Day Trading Scanner

The Trade Ideas scanner system is unique and at the heart of the Trade Ideas platform. By clicking New -> Alerts, you can access the Alert Config Window, which gives you immediate access to over 40 trading scans. The screenshot below shows all the in-built scans categorized into Bullish, Bearish, or Neutral. You can easily select a potential day trading strategy depending on the overall market direction.

One thing I love about Trade Ideas is that it has 30+ curated channels. These channels highlight theme-based trading opportunities, such as Electric Vehicles, Small Caps, Social Media, Earnings Plays, China, Biotech, Penny Movers, etc.

Trade Ideas Pro AI

The AI algorithms developed by Trade Ideas are the main reason you want to sign up. I had a lengthy Zoom session with Sean Mclaughlin, Senior Strategist over at Trade Ideas, to delve into how AI works, and I was very impressed. This company is laser-focused on providing traders with the best data-supported trading opportunities. There are currently four AI systems in operation.

Holly is 3 AI Systems Applying Over 70 Strategies Differently.

Holly AI

Holly AI is the original incarnation of the algorithms. Holly applies 70 strategies to all the US & Canadian stock exchange stocks, including pink sheets and over-the-counter (OTC) markets. 70 strategies multiplied by 10,000+ stocks means millions of backtests every day. Only the strategies with the highest backtested win rate of over 60% and an estimated risk-reward ratio of 2:1 will be suggested as potential trades the following day.

Holly 2.0

Holly 2.0 is a more aggressive version of Holly AI, presenting you with more aggressive day trading scenarios. Trade Ideas operates three key trading styles with each AI engine: Conservative, Moderate, and aggressive. Holly 2.0 is aggressive.

Holly Neo

Holly NEO is a newer AI that seeks to trade real-time chart patterns. It utilizes a mix of the following strategies.

- Pullback Long seeks to identify trades in which the stock price is down and wants to start moving up on higher volume.

- Breakout Long – Where stock price breaks out through a key resistance or to new highs.

- Pullback Short – identifying a short pullback opportunity in price.

- Breakdown Short – a shorting opportunity where upward momentum breaks down.

Omni AI

Omni AI is also a real-time AI ideas engine that combines all the above strategies into a straight, short, or long trade recommendation. It is a new development and does not yet have a proven track record, but its performance looks good based on recent trades.

Auto-trading

Trade Ideas integrates with three brokers for stocks: Interactive Brokers, Etrade, and Esignal. The Brokerage Plus functionality is available with the Standard and Premium service. Trade signals generated from Holly AI cannot be autotraded. Still, alert window scans can be auto-executed in a sandbox or live with your brokerage using Brokerage Plus (available in the premium plan).

Get 15% Off Trade Ideas with Code “LIBERATED”

As a partner of Trade Ideas, I requested a discount for all our readers. Use the discount code “Liberated” to get 15% off your first purchase, worth $340 when going for the premium service.

3. TradingView: Best Global Day Trading Platform

TradingView is the best global day trading platform because it covers all stock, forex, and cryptocurrency markets globally and has the largest active trading community. Add to that excellent backtesting and real-time scanning, and you have a great choice for day traders.

| TradingView Rating |

★★★★★ |

| ⚡ Features |

Great Charts, Real-time Market Scanning, Strategy Development |

| 📈 Day Trading Features |

Trading from Charts, Backtesting |

| 💰 Free Stock Trading |

✔ – Tradestation |

| 🤖 Day Trading Bots |

✘ |

| 🆓 Free | Launch TradingView For Free |

| 🎯 Best for | International Day Traders |

| 🎮 Trial | Free 30-Day |

| ✂ Premium Discount | $15 Discount Available + 30-Day Premium Trial |

| 🌎 Markets Covered | Global, Stocks, Forex & Crypto |

There is no doubt about it; I love TradingView and use it every day. I regularly post charts, ideas, and analyses and chat with other traders. Many of the communities on TradingView are focused on day trading, and the service is first class.

TradingView pricing starts at $0 for the Basic ad-supported plan, Pro costs $14.95, Pro+ $29.95, and Premium costs $59.95 monthly. Opting for a yearly subscription will reduce those costs by 16%, representing a significant saving.

Pro+ is the most popular plan, enabling multiple devices and extensive features. Intermediate and experienced traders opt for the Pro & Pro+ plans. In contrast, only the most demanding traders would use the Premium service because it enables publishing scripts, indicators, and strategies.

With TradingView, you get full broker integration, can place trades on charts, and it will take care of profit and loss reporting and analysis. However, it does not cover Stock Options trading or US Trading.

TradingView hits the mark on real-time scanning and filtering and fundamental watchlist; the list of fundamentals you can scan & filter on is genuinely huge. Any idea you have based on fundamentals will be covered.

News & Social Community. As soon as you connect to TradingView, you realize this has also been developed for the community. You can look at community ideas, post your charts and ideas, and join countless groups covering everything from bonds to Cryptocurrency. The news feeds are fully integrated, including Kiplinger, DailyFX, Futures Magazine, FXStreet, and StockTwits. Add that to the social network, and you have a great solution. The news service is only second to MetaStock with their Reuters Feeds.

Technical Analysis & Charts. With over 160 indicators and unique specialty charts such as LineBreak, Kagi, Heikin Ashi, Point & Figure, and Renko, you have everything you need as an advanced trader. With the Premium membership, you also get Level II insight, fully integrated.

Did I mention the charts are fast and beautiful?

Day Trading Systems & Backtesting

I have personally developed trading systems using TradingView, the Market Outperforming Stock ETF System (Moses), and the Stock Market Crash Detector. TradingView will enable you to develop your unique day trading system with some coding skills and imagination.

TradingView has an active community of people who are developing and selling stock analysis systems. Also, there are many indicators and systems from the community for free. The only thing you cannot do is forecast and implement Robotic Trading Automation.

TradingView for Day Traders Video

My thorough testing awarded TradingView a stellar 4.8 stars!

With powerful stock chart analysis, pattern recognition, screening, backtesting, and a 20+ million user community, it’s a game-changer for traders.

Whether you're trading in the US or internationally, TradingView is my top pick for its unmatched features and ease of use.

Explore TradingView – Your Gateway to Smarter Trading!

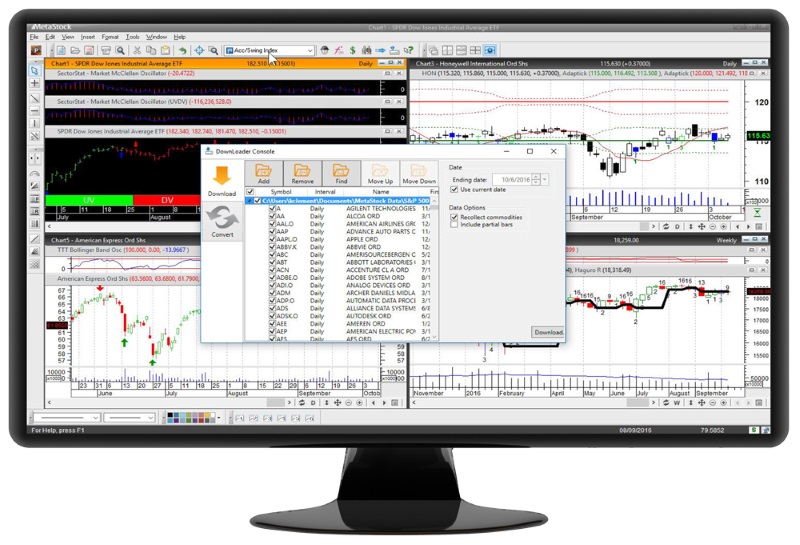

4. MetaStock: Add-on Day Trading Systems

MetaStock is great for day traders because it has superfast data, powerful backtesting and forecasting, real-time news, and a ready-built day trading strategies marketplace. It is best for powerful charting and trading system analysis, excellent real-time news, and global data coverage.

The latest release of Metastock has been a big hit, with improvements across the board. Huge advances in scanning, backtesting, and forecasting make this one of the best offerings on the market. MetaStock is one of the biggest fish in the sea of stock market analysis software. Backed up by the mighty Thomson Reuters, you can expect fast global data coverage and broad market coverage, including equities, futures, Forex, ETF, and options.

Broker Integration. MetaStock does not natively provide broker integration, execution of trades from charts, or live integrated P&L analysis; it is designed as a broker-independent desktop application.

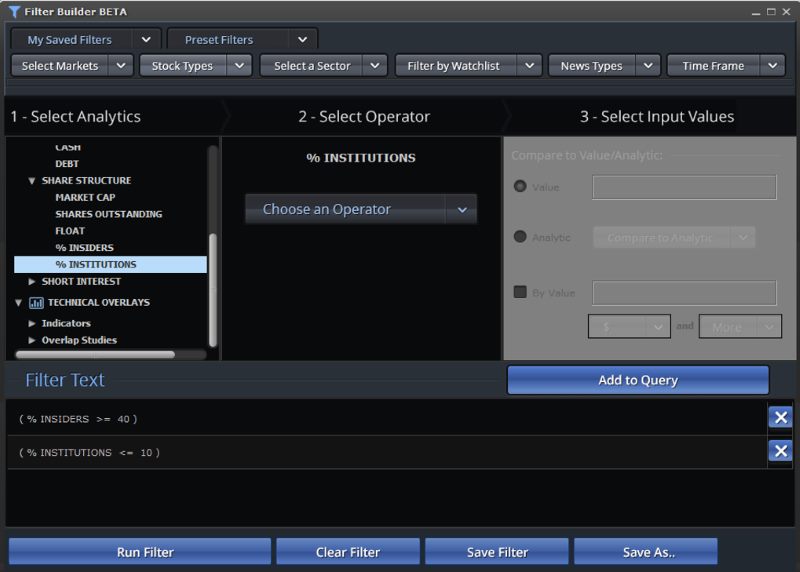

Fundamental Scanning and Screening. Using MetaStock Refinitiv, you can see an in-depth analysis of company fundamentals, from debt structure to the top 10 investors, including level II. Watchlists featuring fundamentals and robust market scanning are excellent.

Real-time News (Winner)—MetaStock Refinitiv integrates with institutional-level news, analysis, and outlook. It is the fastest global news service available, and it includes translations into all major languages.

Technical Analysis: Forex forecasting based on sentiment is an exceptional feature. Despite the broadest selection of technical analysis indicators on the market today, MetaStock is the king of technical analysis, warranting a perfect 10 out of 10.

Stock Systems and Backtesting (Winner): Another area where MetaStock excels is what they call the “expert advisors.” MetaStock harnesses many inbuilt systems to help you understand and profit from technical analysis patterns and well-researched systems as a beginner or intermediate trader. This is a key area of advantage. The biggest addition to the MetaStock arsenal is the forecasting functionality, which is fantastic.

MetaStock Video

Try MetaStock With a 3 Months for 1 Month Deal

5. Benzinga Pro: Best for Real-time News Day Trading

Benzinga Pro is an excellent platform for day traders because it enables you to trade news events by providing the fastest streaming real-time news service. Benzinga’s live squawk box and news sentiment categories are a serious advantage for day traders.

| Benzinga Pro Rating |

★★★★☆ |

| ⚡ Features |

Charts, Real-time Market Scanning, SEC Filings |

| 📈 Day Trading Features |

The Fastest Real-time News, Insider Trading |

| 💰 Free Stock Trading |

✘ |

| 🤖 Day Trading Bots |

✘ |

| 🎯 Best for | Day Trading the News |

| 🎮 Trial | 14 Day Free |

| ✂ Premium Discount | -25% Code “SMARTER” |

| 🌎 Markets Covered | USA |

Benzinga PRO is neither a brokerage nor a stock market analysis charting package. It is simply the best real-time news platform for traders. If you choose any of the packages in this list that do not have a real-time news integration or service included, then, as a day trader, you will want to consider Benzinga as your go-to tool.

Benzinga PRO is the premium real-time news service upgraded from the regular free Benzinga news service. It is a significant upgrade that comes with a price. What makes it unique is not just the fast delivery of news but the insider interviews and direct access to the reporters at the news desk. They also have a considerable amount of news content unavailable to regular subscribers. So what makes it unique? The platform and content.

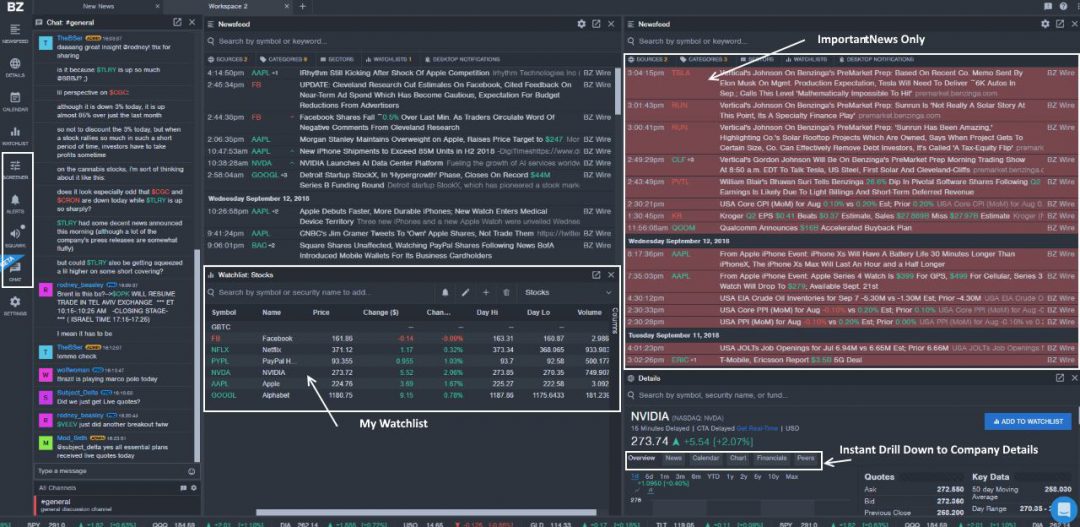

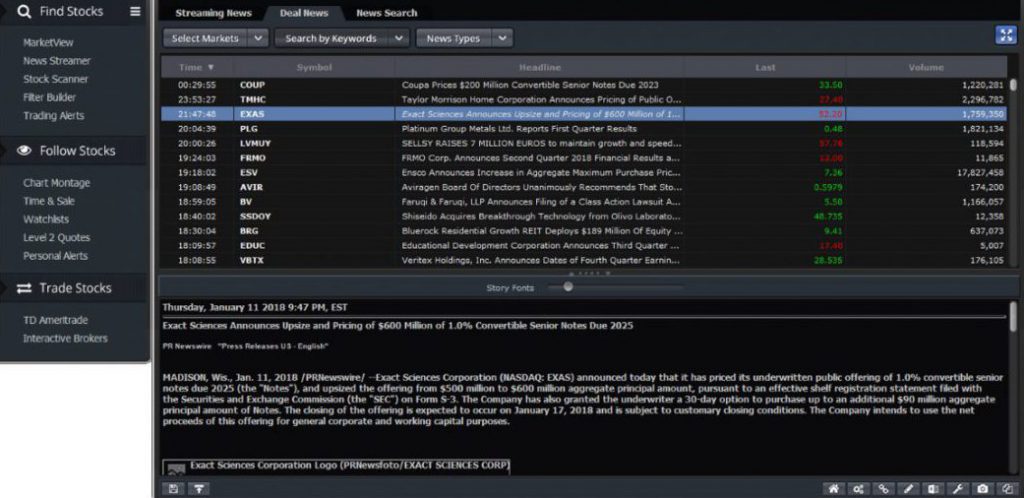

Day Trader News Platform

The news platform is exceptionally configurable and can run in multiple windows on multiple monitors. In the screenshot below, you can see how I have my Benzinga Pro interface configured.

- My Current Trades in the watchlist (middle white box)

- Important news Only –I have configured the top right columns in red only to show me the critical, potentially market-moving news, which is a great feature.

- Instant Company Details Drill Down – Bottom Right for Financial News, Calendar & Charts

- Quick Access to Powerful Features – Stock Screener, Custom Alerts, Squawk Box, and Chat (Left-hand side)

Benzinga Pro is extremely powerful yet easy to use, which is often a delicate balance to strike. To top it all off, they have also added real-time price quotes to the service, so you can see when news breaks the immediate impact on the stock price.

Recommendation For Investors & Traders With A Smaller Portfolio.

If you have only $5,000 or $10,000 to trade or invest, it does not make sense to choose the Essentials Package for $117 per month; this would eat up too much of your investment, so choose the Benzinga Pro Basic Package.

Recommendation For Traders With Larger Trading Positions

Suppose you have a larger portfolio with significant individual short-term trades in specific stocks. In that case, you will want to know the news and sentiment before anyone else and have ringside seats to the corporate earnings announcements and rumors. In this case, you will want to go for the Essentials Package.

If you are serious about trading in the stock market and need real-time access to the news that moves markets, then Benzinga Pro is a realistically priced and high-speed news service designed for traders. In this fast-moving world, Benzinga Pro is an effective tool.

6. TC2000 Brokerage: Best for Day Trading Options

TC2000 is a great platform for day traders who want to trade stocks and options contracts directly from charts using the integrated TC2000 Brokerage.

| TC2000 Rating |

★★★★☆ |

| ⚡ Features |

Great Charts, Real-time Market Scanning, Custom Indicators |

| 📈 Day Trading Features |

Trading from Charts, Options Strategies & Planning |

| 💰 Free Stock Trading |

✘ – $1 per trade |

| 🤖 Day Trading Bots |

✘ |

| 🆓 Free | TC2000 Platinum Free With Brokerage Account |

| 🎯 Best for | US Day Traders |

| 🎮 Trial | Free 30-Day |

| ✂ Premium Discount | -25% for Bi-Annual Subscription |

| 🌎 Markets Covered | USA Stocks, ETFs, Options |

TC2000 is recommended for long-term investors in the USA & Canada with a fundamental bias who need powerful screening and excellent charts.

TC2000 has long been one of my favorite tools; I have been a subscriber for over 20 years and find the latest release another step forward. Endlessly customizable and scalable, the platform offers nearly everything an investor will need.

Day Trading with TC2000

TC2000 Brokerage offers live trading for $1 per trade, which is pricey compared to Firstrade, which offers free stock trades. This service does mean a tight integration between the charting software and the brokerage house. Essentially, it means the holy grail, trading directly from charts visually.

Worden Brothers makes a clean sweep regarding trade management with full Broker Integration (if you choose them as your broker).

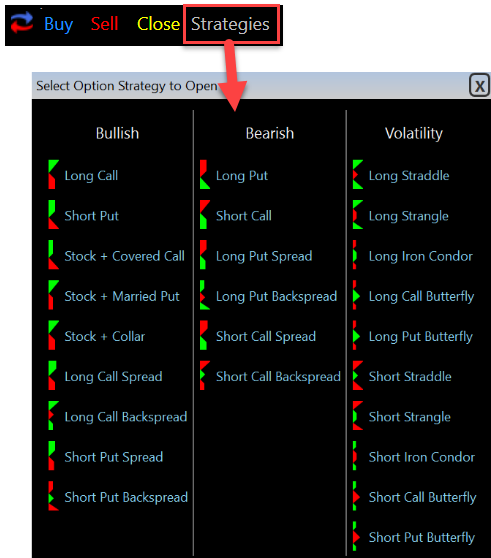

Options Strategies

Use the Options Trading button at the top of the chart to open Options Strategy tickets directly on the chart. The menu divides strategies into bullish, bearish, and volatility categories. Strategies include single-leg, multi-leg, and combinations of the underlying stock.

Multi-leg strategies then open as a single trading ticket on the chart.

TC2000 also offers a nice implementation of options trading and integration; you can scan and filter many options strategies and then execute and follow them directly from the charts.

Good profit and loss tracking reporting makes the package a well-implemented solution.

Opening A Stock Option Trade With TC2000

Industry Leading Live Trading

Looking at the image below, you can see from the chart how well-planned the order execution is. You can open an order and execute it based on a condition.

The interesting thing here is that conditions can be any technical or fundamental condition. So, you could theoretically execute a trade if the EPS for the last quarter exceeds 35%. Alternatively, execute a trade as the real-time price breaks through the Ichimoku cloud on higher volume. The possibilities are limitless and mind-boggling.

7. Scanz: Real-time News & Scanning & Broker Integration

Scanz is a good choice for day traders because it has real-time news and market scanning, broker integration, and live trading from charts.

| Scanz Rating |

★★★☆☆ |

| ⚡ Features |

Real-time News & Charts, Screening |

| 📈 Day Trading Features |

Trading from Charts, Broker Integration |

| 💰 Free Stock Trading |

✔ IB |

| 🤖 Day Trading Bots |

✘ |

| 🎯 Best for | Day Traders |

| 🎮 Trial | Free 14-Day |

| 🌎 Markets Covered | USA |

I recommended Scanz for day traders who want a simple and slick workflow, real-time streaming charts, news, unique level II data, dollar volume information, and broker integration.

Scanz specializes in providing real-time data and news directly to your screen. Scanz has a high price point of $149/mo for the full news and scanning package.

Day Trading with Scanz

Scanz has introduced the “Chart Montage” functionality, enabling an ultrapowerful way of trading off the charts. This single window contains critical trading information, real-time streaming news, level 2 data, time, and sales. Also, Scanz is the only software that offers dollar volume data.

Scanz has integrations with your broker to enable trading directly from the charts, saving you time while trading. Broker integration is enabled for Interactive Brokers.

Scanz contains many technical and fundamental filters on which to screen. But what is the key for day traders? With the ability to scan entire markets for liquidity and volume patterns to find volatility, you can trade for a profit. This functionality makes the Scanz a unique offering.

Scanz News

I like the simple implementation. You can get the lowdown on contracts and deals between companies. Quantifying the deal’s impact on the company’s bottom line can give you an edge.

Scanz also focuses on the news but is let down by having no social integration.

Scanz does not offer as many chart patterns or indicators as its competitors, but it does not have to. Most people will only use 5% of the indicators available, and fortunately, Scanz covers all the important ones. The power here is in the technical analysis screening, which is fast, seamless, and flexible.

8. Firstrade: Best Zero Commission Broker

The Firstrade Navigator trading platform is ideal for day traders. It provides real-time data and commission-free stock, ETF, and Options trading from charts. Firstrade is also an international broker based in the USA, which is ideal for international day traders.

| Firstrade Rating |

★★★☆☆ |

| ⚡ Features |

Great Charts, Real-time Data, Screening, Morningstar Research, Mobile Apps |

| 📈 Day Trading Features |

Free Stock, ETF & Options Trading from Charts, Optionsplay Platform |

| 💰 Free Stock Trading |

✔ |

| 🤖 Day Trading Bots |

✘ |

| 🆓 Free | Trade for Free with Firstrade |

| 🎯 Best for | Frequent Traders |

| 🌎 Markets Covered | USA Stocks, ETFs, Options |

Firstrade Securities has been in business for over 35 years and gained prominence as the first large broker to offer commission-free trading in New York, USA. Firstrade has received multiple awards for best value trading, customer service, and the “Clean Hands Kiplinger Award.”

Commissions are crucial for day traders; making ten trades per week at $5 per trade can amount to over $2,600 in trading costs per year, a considerable saving.

Firstrade is the best for commission-free trading, with no hidden charges, an industry-leading 2,200 commission-free ETFs, and $0 Optionsfrees. The core Firstrade set of excellent tools is free for brokerage clients.

You can also purchase mutual funds for $0, and bond purchases are made on a net yield basis. The only thing you cannot trade with Firstrade is Forex.

Commissions: Firstrade vs. E-Trade, Schwab & Fidelity

| Commissions & Fees | Firstrade | E*Trade | Charles Schwab | Fidelity |

| Online Stock Orders | $0 | $0 | $0 | $4.95 |

| Online Option Orders | $0 | $0 + $0.65/Contract | $0 + $0.65/Contract | $0 + $0.65/Contract |

| Online Mutual Fund Trades | $0 | $49.99 | $49.95 | $49.95 |

| Broker-assisted Stock | $19.95 | $25 | $25 | $19.95 |

| & Options Trades | (+$0.50/contract) | (+$0.65/contract) | (+$0.65/contract) | (+$0.65/contract) |

| Minimum Initial Deposit | $0 | $500 | $0 | $0 |

Table 1: Firstrade Commissions vs. Competitors

Firstrade Trading Platforms

Firstrade’s trading platform has several components. The web-based platform is available for all clients. If you have an account balance over $10,000, you will have complimentary access to download the Firstrade Navigator software; this compelling trading experience runs locally on your PC or Mac.

Advanced Screener, Fundamental Data & Event Calendar

No product set would be complete without scanning and screening stocks based on the fundamental data. Firstrade’s attempt at this is pretty good; it does not match the offerings from Stock Rover, but it is adequate for most investors.

A new event calendar is also available, neatly broken into tabs for Earnings Announcements, Dividends, Rating Changes, Economic Indicators, IPOs, and splits.

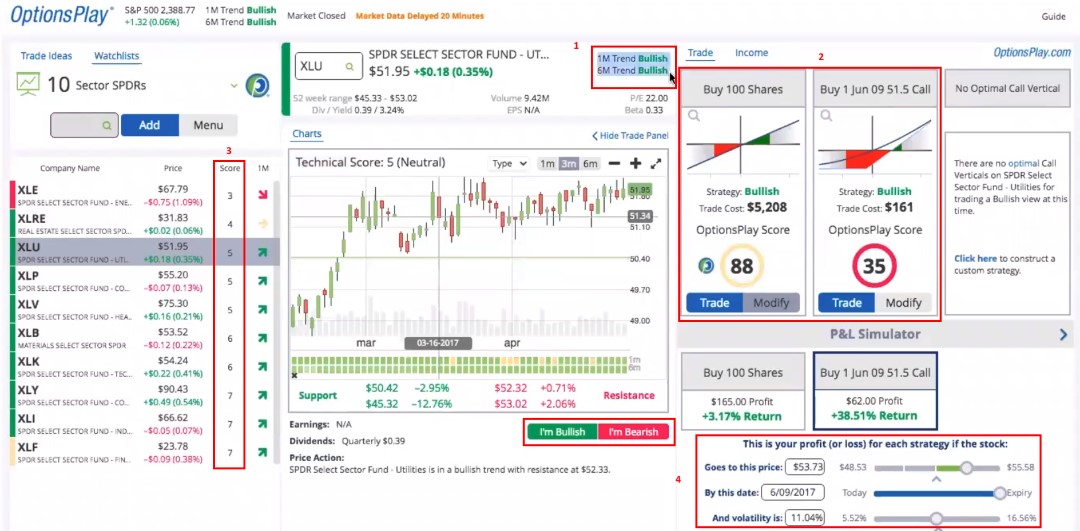

OptionsPlay

Firstrade has put a lot of effort into the Options Trading Platform OptionsPlay. A first-class platform that focuses first on what kind of options strategy you want to implement. You can drill down through industries and sectors and instantly get a technical analysis for the bullish or bearish score for the stock. You can even sort your watchlist based on the bullish or bearish rating.

Finally, the Profit and loss simulator is excellent because it lets you predict your profits based on your investment.

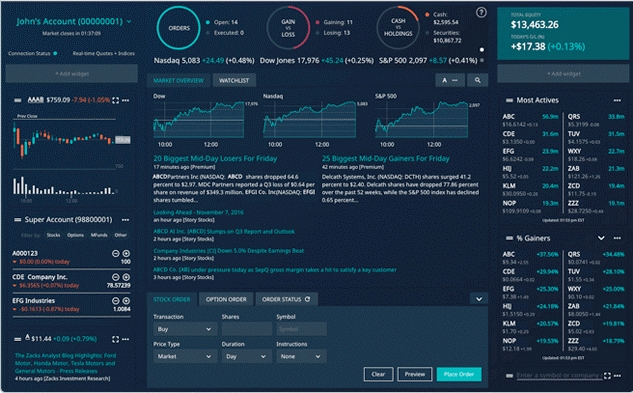

Day Trading Platform – Firstrade Navigator

Firstrade Navigator is a well-designed and robust system with a lot of valuable information instantly available, allowing you to drill down into the details. Navigator is very customizable and has a selection of widgets to embed into the dashboard. Studies and stock chart indicators are, of course, also included.

9. Interactive Brokers: Low Margin Rates

Interactive Brokers is a good choice for day traders because it offers free stock trading in the US and industry-leading low-margin rates for traders using leverage to trade.

Interactive Brokers is ideal for active investors and day traders seeking low trading costs, direct market access for fast execution, and best-in-class margin costs.

Interactive Brokers (IB) is the grandfather of online discount brokers. Not only are they a long-established company, but it is also big.

It has a complete set of services, enabling you to trade practically anything on any market. Stocks, Options, ETFs, Mutual Funds, Bonds, Foreign Exchange, and even futures and commodities. Usually, when a company is well-established and large, it loses its competitive edge. Not so with Interactive Brokers

Day Trading Platform

How do you find the in-play stocks with high volatility and a strong trend? This is the job of the trading platform. You need your trading platform to be fast, intuitive, and powerful. In this section, we rate the brokers on their choice of trading platform.

Interactive Brokers has a unique trading platform based on Trader Workstation (TWS). It is free to download and use as a client, and it is the single place to trade any and every one of the vehicles on offer from IB. It caters to everything: Stocks, Options, Futures, Forex, Bonds, Mutual Funds & ETFs.

10. TradeStation: Good Automated Day Trading

Tradestation is recommended for full broker integration, trading from charts, and automated trading. Tradestation software is free for brokerage clients.

TradeStation is a leading brokerage house with excellent execution and low commissions, but did you know they have great software? TradeStation offers enough software and broker integration to stand tall with the other vendors.

TradeStation has real-time news but does not provide market commentary or a chat community. But do you need that? Some people do; it’s a factor to consider.

TradeStation offers TradeStation University a vast wealth of online videos to help you master their trading platform. They also have a morning briefing that you can tune into online, and their selection of professional analysts will give an opinion on the market action and potential strategies.

TradeStation has also cultivated a systems and strategies marketplace called the “Strategy Network,” where you can purchase stock market systems from an ecosystem of vendors or even contract someone to develop your system in the “Easy Language” code.

Summary

Our extensive testing shows that Trade Ideas provides the best day trading software platform for helping you become a successful day trader. Powered by artificial intelligence, Trade Ideas provides clear, specific, audited, high-probability trading signals that give you the best chance of being profitable.

TradingView is the best choice if you want to learn trading from a vast community. MetaStock is ideal if you wish to develop backtested day trading strategies. Benzinga Pro is the best choice if you want to trade real-time news.

Finally, the best overall day trading platform for social integration and community learning is TradingView.

Chart, Scan, Trade & Join Me On TradingView for Free

Join me and 20 million traders on TradingView for free. TradingView is a great place to meet other investors, share ideas, chart, screen, and chat.