Technical Analysis, Charts, Patterns & Indicators

Learn technical analysis and how to read stock charts. This helps you understand the movement of stock prices, stock trends, and the supply-demand equation. Stock chart indicators and market sentiment are all important factors.

The Best Software for Trading & Stock Chart Analysis

7 Top AI Stock Software & Trading Bots Fully Tested

My research identifies Trade Ideas and TrendSpider as the leaders in AI trading software. Trade Ideas offers automated trading and bots, while TrendSpider offers automated pattern recognition, auto-trading, and backtesting.

Trade Ideas Review 2025: AI Day-Trading Full Test & Rating

My testing awards Trade Ideas 4.7 stars. Its stock scanner, alerting, and algorithmic trading signals are advanced and trustworthy. Brokerage Plus auto-trading is a great feature for experienced traders.

Is TradingView Worth It? An In-Depth 2025 Analysis

My 2025 testing awards TradingView 4.8 stars due to its continued innovation in chart analysis, pattern recognition, screening, and backtesting. TradingView is my top recommendation for US and international traders.

TrendSpider Review 2025: Is Its AI & Automation Worth It?

My testing awards Trendspider 4.8/5 stars due to its innovation. Its powerful algorithms recognize trendlines, chart patterns, and candlesticks automatically. It also has automated trading bots, real AI LLMs, and powerful point-and-click back-

testing.

Benzinga Pro Review 2025: Realtime Trading News On Test

My extensive testing of Benzinga Pro review reveals a trustworthy real-time news screening and charting service for day traders. It includes alerts, insider block trades scanning, and unusual options activity signals for US markets.

MetaStock R/T Review 2025: Full Hands-on Test & Rating

My MetaStock testing highlights it as a robust trading platform. It offers over 300 charts and indicators for global markets, including stocks, ETFs, bonds, and forex.

Stock Trading Courses You Might Enjoy

Liberated Stock Trader Pro: Learn Stock Market Investing

Learn stock market investing with the complete online stock trading course by Barry D. Moore, a certified financial analyst from the International Federation of Technical Analysts (IFTA).

Our Free Stock Trading & Investing Training

Liberated Stock Trader offers free stock investing courses covering value, growth, dividend investing, and technical chart analysis. Our courses are developed by IFTA member and certified financial technician Barry D. Moore.

35 Best Growth Stocks To Buy Now To Beat The Market

Find the best growth stocks to buy now using a 9-year tested and proven strategy system that selects stocks that outperform the S&P 500. Instead of following stock tips from financial websites, you can adopt a structured approach to find stocks with a proven track record of beating the market.

Fear & Greed Index March 2025: Decode Market...

Our Fear and Greed Index goes beyond the basics, offering nine real-time and historical charts to help you stay ahead. With live data from the Federal Reserve, VIX CBOE, and 15 technical stock price signals, you'll have the tools to make smarter decisions today.

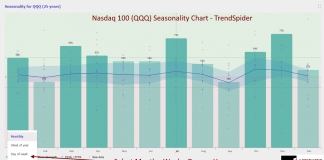

How to Identify & Trade Seasonal Trends in...

Seasonal trends refer to certain sectors, like retail, which often perform better during holiday seasons, while agricultural products might see spikes during harvest times.

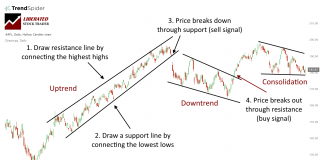

How Pro Investors Use Chart Trendlines to Make...

Drawing trendlines on stock charts is a powerful way to assess the market's direction. They help you understand the trend direction and timeframe to set expectations for future market moves, helping you improve your trading.

How to Trade Market Sentiment Using Live Chart...

Successful traders use market sentiment to gain a competitive edge and improve their chances of making profitable trades.

How To Analyze Stocks with Fundamental & Technical...

There are two ways to analyze stocks. Fundamental analysis, which evaluates criteria such as PE ratio, earnings, and cash flow. Technical analysis, which involves studying charts, stock prices, volume, and indicators.

Price Action Trading: Indicators, Patterns & Setups Guide

Price action trading is a method of day trading that relies on technical analysis but ignores conventional fundamental indicators, focusing instead on the movement of prices.

Our Epic 14-Video Guide to Technical Analysis for...

Our ultimate guide to technical analysis, with its 14 videos and detailed examples covering charts, trends, indicators, patterns, and tools, will fast-track your knowledge.

Elite Guide to Backtesting Trading & Investing Strategies

Experienced investors backtest their trading strategies to optimize their portfolios. Backtesting is a critical step that enables traders to assess the potential viability of a trading strategy by applying it to historical data.

How to Read Stock Charts Like a Boss:...

To read stock charts you need to use stock charting software, select your chart type, configure your timeframe, determine price direction using trendlines and use indicators to estimate future prices.

Top 4 Best Momentum Indicators Explained & Tested

In technical analysis, momentum indicators help traders identify the strength and direction of a stock's price. We explain and test three popular momentum indicators for reliability.

10 Best Free TradingView Indicators & How to Trade Them!

Our testing shows the best TradingView indicators for advanced analysis are Volume Profile HD, VWAP, Supertrend, ATR, Relative Volatility, and RSI. TradingView's candlestick and chart pattern recognition also improve trading outcomes.

Does Ichimoku Cloud Work? Success Rates & Settings Tested

The Ichimoku test results are a dismal 10% win rate, underperforming a buy-and-hold strategy 90% of the time. The Ichimoku indicator is a poor choice for traders.

Volume Indicator: How Pro Stock Market Analysts Use It

Stock volume measures the number of shares traded and indicates market strength. Rising markets with increasing volume are viewed as bullish, and falling prices on higher volume are bearish.

I Tested 606,422 MACD Indicator Trades: Shocking Results

MACD is a trend-following momentum indicator used to identify price trends. We conducted 606,422 test trades to find the best settings and trading strategies.

Stochastic Oscillator Explained: Best Strategy & Settings Tested

The Stochastic Oscillator momentum indicator compares an asset's closing price to a range of its previous prices. It oscillates between 0 and 100; below 20 indicates oversold, and above 80 suggests an overbought market.

Does Fibonacci Trading Work? My Backtesting Says No!

In technical analysis, Fibonacci retracement is used by traders to predict levels of support and resistance by drawing horizontal lines according to the Fibonacci sequence. But Does It Work?

Money Flow Indicator: 1,396 Years of Data Prove Proftability

The Money Flow Index (14), on a daily chart, outperformed the S&P 500 stocks over 26 years. Its total return was 1,690%, compared to a buy-and-hold strategy profit of 881%.

Optimal Keltner Channel Trading Based on Backtested Data

My reliability testing of Keltner Channels on 1,800 years of DJIA data suggests it is not a good indicator. However, it is profitable with the optimal settings.

How to Trade the McClellan Oscillator Effectively

The McClellan Oscillator is a technical analysis tool designed to assess the market breadth of the New York Stock Exchange (NYSE). It is renowned for its effectiveness in revealing the underlying strength or weakness of the market by comparing the number of advancing to declining stocks.

KST Indicator Best Settings & Strategy Tested on 2746 Trades

My research on 2,746 test trades spanning 10 years confirms that using the KST indicator's default settings on daily and weekly charts provides profitable and reliable signals for traders.

Trading the Alligator Indicator Profitably Based On Data

My unique research shows that the Alligator indicator is highly profitable in stocks and indices, using daily and weekly chart timeframes. It is also only profitable on a weekly chart for Forex.

12 Accurate Chart Patterns Proven Profitable & Reliable

Research shows that the most reliable chart patterns are the Head and Shoulders, with an 89% success rate, the Double Bottom (88%), and the Triple Bottom and Descending Triangle (87%). The Rectangle Top is the most profitable, with an average win of 51%, followed by the Rectangle Bottom with 48%.

22 Best Stock Chart Patterns Proven Reliable By Data Testing

Published research shows the most reliable and profitable stock chart patterns are the inverse head and shoulders, double bottom, triple bottom, and descending triangle. Each has a proven success rate of over 85%, with an average gain of 43%.

How to Trade a Descending Triangle’s 87% Success Rate

Twenty years of trading research show the descending triangle pattern has an 87% success rate in bull markets and an average profit potential of +38%.

How to Trade a Cup and Handle’s 95% Reliability & 54%...

Twenty years of trading research show that the cup and handle pattern has a 95% success rate in bull markets and returns an average profit of +54%.

How to Trade the Inverse Head & Shoulders with 89% Accuracy

The inverse head and shoulders pattern is one of the most accurate technical analysis reversal patterns, with a reliability of 89%. It occurs when the price hits new lows on three separate occasions, with two lows forming the shoulders and the central trough forming the head.

Top 10 Best Bullish Patterns Tested & Proven Reliable

My research shows the most reliable and accurate bullish patterns are the cup-and-handle, with a 95% bullish success rate, head-and-shoulders (89%), double-bottom (88%), and triple-bottom (87%).

How to Trade a Double Bottom Pattern’s 88% Success Rate

Decades of research reveal the double bottom pattern has an 88% success rate in bull markets and an average profit potential of +50%. The double-bottom chart pattern is one of the most reliable and accurate chart indicators in technical analysis.

How to Short-Sell an Inverse Cup and Handle’s 82% Reliability

Two decades of trading research indicate that the inverse cup and handle pattern has an 82% success rate and average price drops of 17%. It is an ideal pattern for short-selling.

Why Traders Should Avoid Using Bull Pennant Chart Patterns

Traders must be cautious when using bull pennant chart patterns. Published research reveals a low success rate of 54% and a meager price increase of 7%.