To build a balanced portfolio of stocks, you need a service that will help you track and report on your investments.

As an investor for 20 years, my in-depth research and hands-on testing will provide you with six great options.

My research shows that Stock Rover and Portfolio 123 are the best portfolio trackers, with powerful screening, watchlists, and portfolio management features.

Additionally, Tickeron enables the easy construction of balanced portfolios, and Firstrade provides retirement portfolios and free stock trading.

Editors Top Picks

- Stock Rover: Best Stock Portfolio Tracker for US Investors.

- Portfolio 123: Best for Portfolio Backtesting & Management.

- Tickeron: Best AI Stock Portfolio Construction & Tracking.

- Firstrade: Best Free Broker with Portfolio Management.

- TC2000: Real-time Stock Portfolio Trading.

- Yahoo Finance: Free Portfolio Tracker & News.

My in-depth testing shows that Stock Rover, Portfolio123, and Tickeron are best-in-class, providing intelligent portfolio creation, tracking, and management features. Firstrade provides excellent free stock and ETF trading and retirement portfolio brokerage services.

Portfolio Tracker Comparison Table

| Portfolio Tracker Comparison | Stock Rover | Portfolio123 | Tickeron | Firstrade | TC2000 | Yahoo |

| 🎯 Rating |

4.8 | 4.5 | 4.4 | 4.3 | 4.2 | 3.9 |

| 🔍 Portfolio Tracking |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| 📰 Research & News |

✓ | ✓ | X | ✓ | ✓ | ✓ |

| 💸 Profit & Loss Reporting | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| 📈 Performance Reporting | ✓ | ✓ | ✓ | ✓ | X | ✓ |

| ⚖ Weighting & Rebalancing | ✓ | ✓ | X | X | X | X |

| 🏹 Portfolio Asset Allocation | ✓ | ✓ | ✓ | ✓ | X | X |

| 🖱 Broker Integration |

✓ | X | X | ✓ | ✓ | ✓ |

| 🎯 Future Income & Dividend Reporting | ✓ | X | X | X | X | X |

| 🤖 Automated Portfolio Management |

X | X | X | X | X | X |

| 💰 Price /mo |

Free or $28/m or $23/m annually | Free or $83/m annually | Free or $250/m or $125/m annually | $0* | Free or $60/m or $50/m annually | $0-$35 |

| 🎮 Free Trial/Discount | -25% During Free Trial | 21 Days for $9 | -50% Discount | X | 30-Day Trial | 14-Day Trial |

| ⚡ Jump to Review & Test | Stock Rover | Portfolio123 | Tickeron | Firstrade | TC2000 | Yahoo |

*$500 Account Funding Required.

We independently research and recommend the best products. We also work with partners to negotiate discounts for you and may earn a small fee through our links.What is a Stock Portfolio Tracker?

A stock portfolio tracker lets you track your existing and planned investments, linking stock screening, research, and watchlist management. The best stock tracking solutions will include portfolio analytics, asset allocation, portfolio weighting, and rebalancing services, enabling you to manage your stock portfolio effectively.

1. Stock Rover: Best Stock Portfolio Tracker

My testing selected Stock Rover as the best portfolio tracker. It offers excellent broker-integrated portfolio tracking, performance, and analysis. Outstanding portfolio rebalancing and Monte Carlo forward testing make Stock Rover a worthy winner.

| Stock Rover Rating |

4.8/5.0 |

| 🔍 Portfolio Tracking | ✓ |

| 📰 Research & News | ✓ |

| 💸 Profit & Loss Reporting | ✓ |

| 📈 Performance Reporting | ✓ |

| ⚖ Weighting & Rebalancing | ✓ |

| 🏹 Portfolio Asset Allocation | ✓ |

| 🖱 Broker Integration | ✓ |

| 🎯Future Income & Dividend Reporting | ✓ |

| 🤖 Automated Portfolio Management | X |

| 💰 Price | Free or $28/m or $23/m annually |

| 🎮 Free Trial/Discount | -25% During Premium Trial |

| ⚡ Visit | Get Stock Rover |

Stock Rover is an industry-leading stock screening, research & portfolio tracking service. Benefits include a 10-year historical financial database, earnings, dividend database & Morningstar analyst ratings. Add to this great stock tracking and portfolio analytics, and you have a great choice.

Stock Rover Portfolio Tracking

Stock Rover enables you to powerfully organize and track your stocks with three types of watchlists:

- Screening Watchlists help you identify potential investments using the extremely powerful stock screening & stock rating engine.

- Watchlists help you organize your potential buys and report on hundreds of different financial indicators. Powerful, configurable column sets enable you to see exactly what you want.

- Portfolio Watchlists enable advanced portfolio and analytics reporting. They can be connected to your broker to keep the data in sync or updated manually.

Portfolio Research & News

I rate Stock Rover highly because of its industry-leading stock scanning and screening functionality. It helps you build and track a portfolio of stocks that meet your investing criteria. Stock Rover’s rating engine evaluates a stock’s relative strength compared to its industry and sector competitors.

The list of fundamentals you can scan & filter on is genuinely huge. Any idea based on fundamentals will be covered with over 600 data points and scoring systems.

Watchlists have fundamentals broken into Analyst Estimates, Valuation, Dividends, Margin, Profitability, Overall Score, and Stock Rover Ratings. You can even set the watchlist and filters to refresh every single minute if you wish.

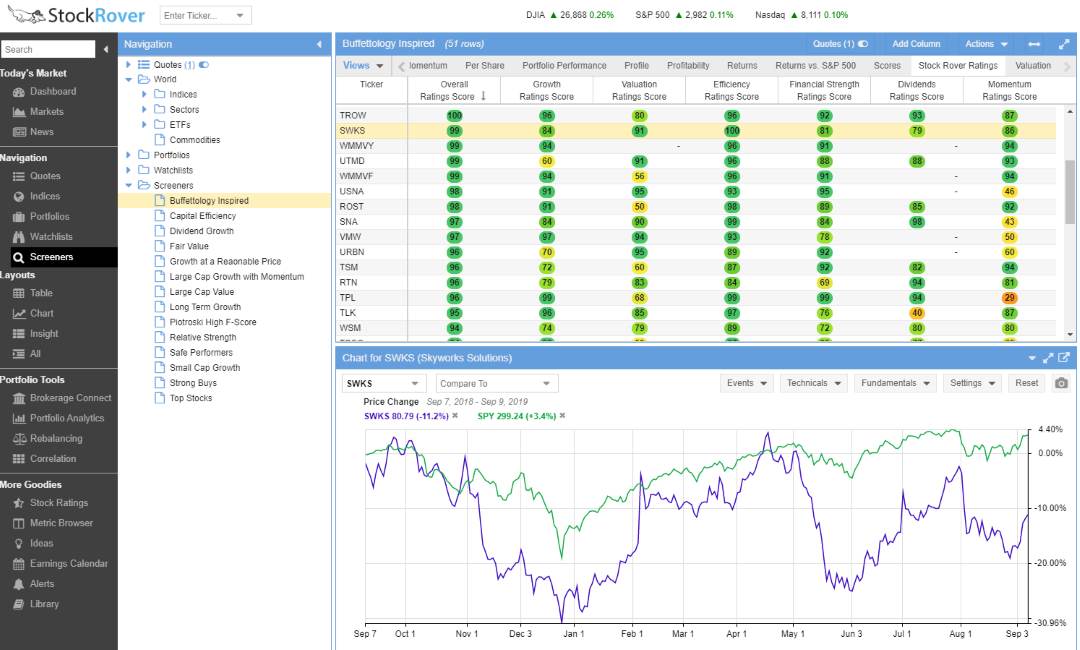

Stock Rover Rates Your Stock Portfolio

The team at Stock Rover has implemented some great functionality; I particularly like the roll-up view for all the scores and ratings. In the screenshot below, I have imported the Warren Buffett portfolio, including his top 25 holdings. I have also selected the “Stock Rover Ratings” tab. This tab rolls all analyses into a simple-to-view ranking system, saving time and effort while providing a wealth of insight.

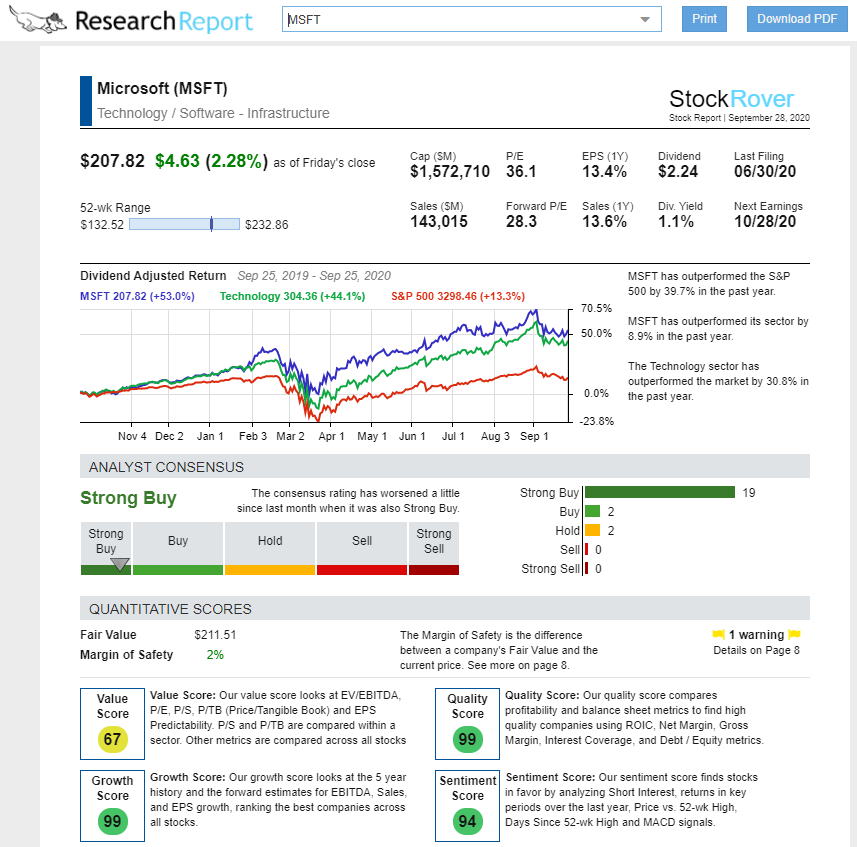

The Stock Rover research reports enable you to generate a professional, readable PDF report on any particular stock’s current and historical performance. The research report creates something new: a human-readable report highlighting a company’s competitive position, market position, and historical and potential dividend and value returns.

The image below shows the dividend-adjusted commentary on Comcast, a company I invested in because I found its excellent potential using my Buffett Stock Screener.

The Research Reports provide a genuinely comprehensive summary of all 10,000+ stocks on the US and Canadian exchanges. Research reports can be viewed in the browser and produced in PDF format for portability and sharing.

The best thing about Stock Rover’s Research Reports is they are Real-time, so the information is always up-to-date.

Portfolio Profit & Loss Reporting

As you would expect from a good stock portfolio tracker, Stock Rover provides integrated profit and loss reporting. Key elements of the reporting are current portfolio value, percentage change, the annual rate of return, return on investment, your income earned from dividends, and so much more.

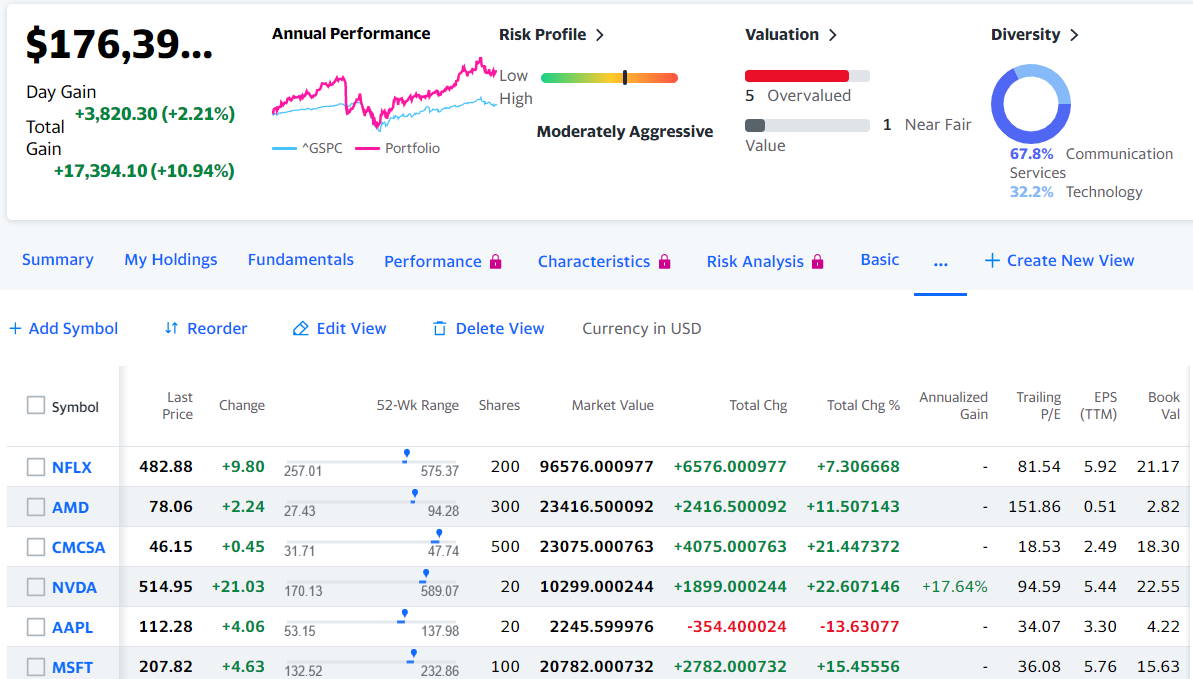

Portfolio Performance Reporting

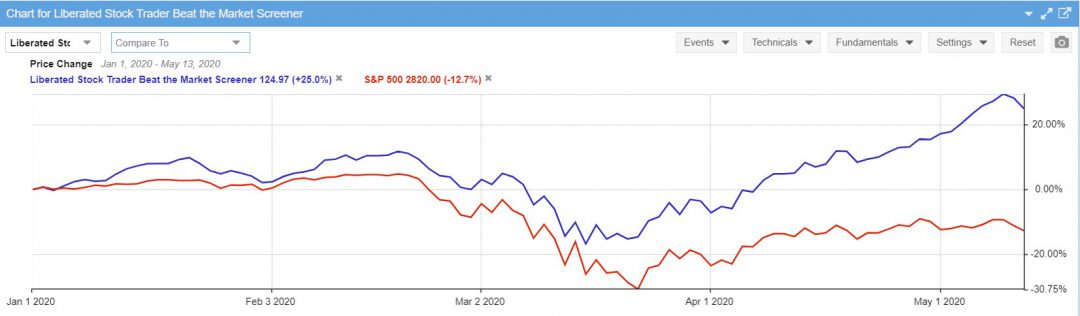

I really like and appreciate that with a few simple clicks, you can compare your portfolio’s performance to an underlying index such as the S&P500 or the NASDAQ 100. You can see if your portfolio is underperforming or outperforming the market. Performance reporting is vital for anyone managing and tracking a portfolio.

But what is a good annual performance, 5%, 8%, or 10% growth? The answer is that any portfolio matching or exceeding the performance of the S&P500 in any given year is deemed a high-performing portfolio.

If the S&P500 grows by 20% in a year, your portfolio should grow at least 20%. If not, you can invest in an S&P500 index-tracking ETF and save yourself the time and effort of actively managing your portfolio.

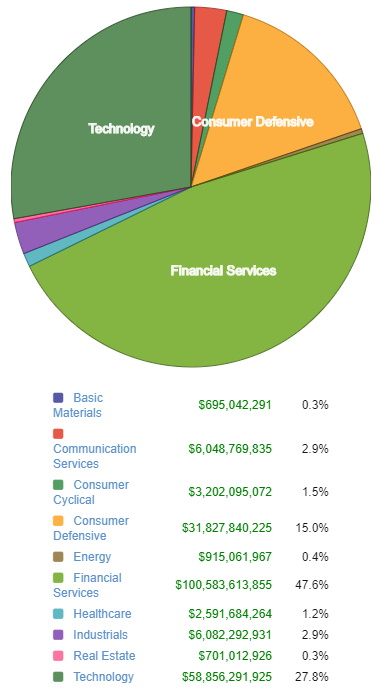

The image below shows the depth of reporting and analytics available in Stock Rover. You can clearly see the percentage of your portfolio in each sector and industry and the dollar amount of the investment.

In this example, I used the Berkshire Hathaway Watchlist, available in Stock Rover, to perform a portfolio analysis of the company’s assets. We can see that Buffett and Berkshire are highly invested in technology and financial services. I guess Warren Buffett and Charlie Munger focus not on diversification but on concentration.

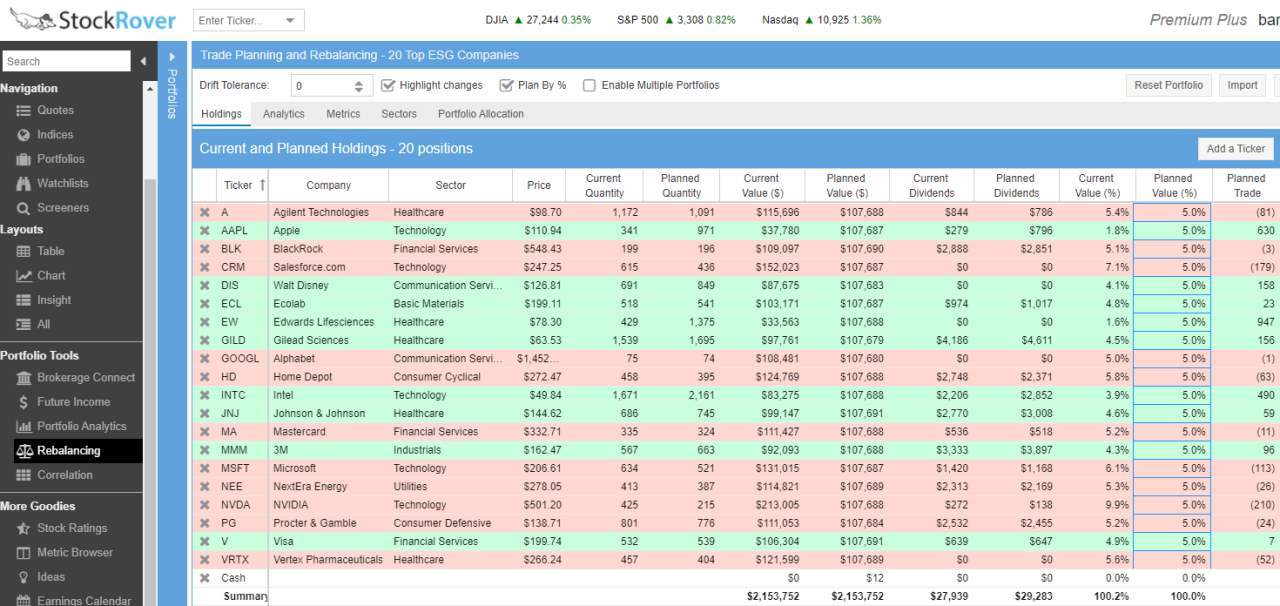

Portfolio Weighting & Rebalancing

Some stocks grow faster than others, meaning they consume more of your overall investment than was typically desired at the portfolio’s inception.

For example, suppose you want to maintain a 5% per stock weighting in your portfolio, and one stock, Microsoft Corp, has grown to consume 10% of the portfolio. In that case, you might want to rebalance by selling a portion of Microsoft shares and purchasing other stocks.

Stock Rover has built-in portfolio rebalancing. It can connect to your brokerage account, perform a detailed portfolio analysis, and suggest which stocks to buy and sell based on your weighting and rebalancing criteria.

Stock Rover helps you see what you need to do to maintain a balance of 5% per stock and how many stocks you need to buy and sell for each asset owned.

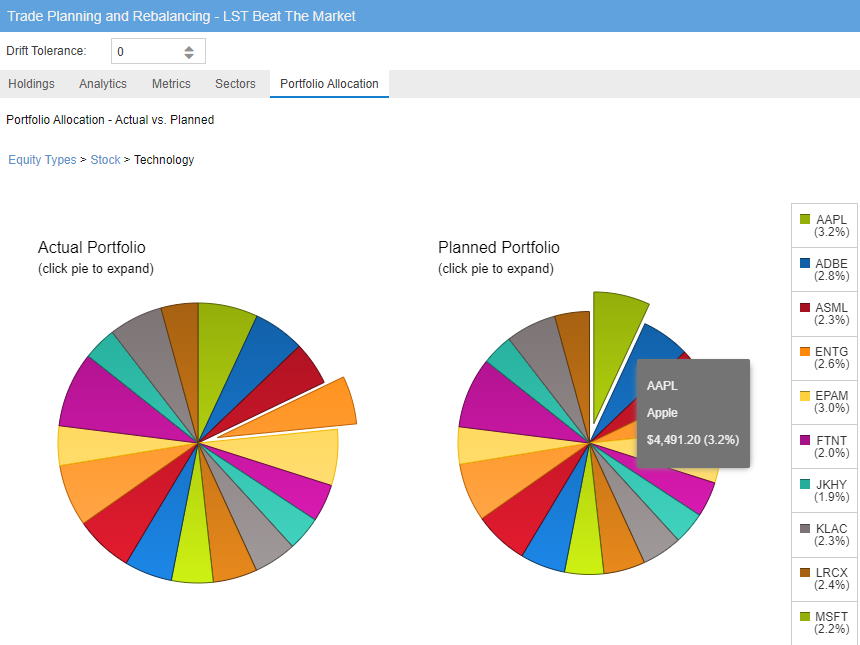

Portfolio Asset Allocation

One of Stock Rover’s standout features is the ability to view your existing and future asset allocation based on weighting and distribution parameters.

Portfolio Broker Integration

With Stock Rover, you get integration with practically every major broker, including Scwab, Firstrade, and Interactive Brokers. Stock Rover is not for day traders but for longer-term investors who want to maximize their portfolio income and take advantage of compounding and margin of safety to manage a safe and secure portfolio.

You cannot place trades from charts, but it will cover profit and loss reporting on your portfolio and provide portfolio rebalancing recommendations. This unique package includes income (dividend) reporting and scoring.

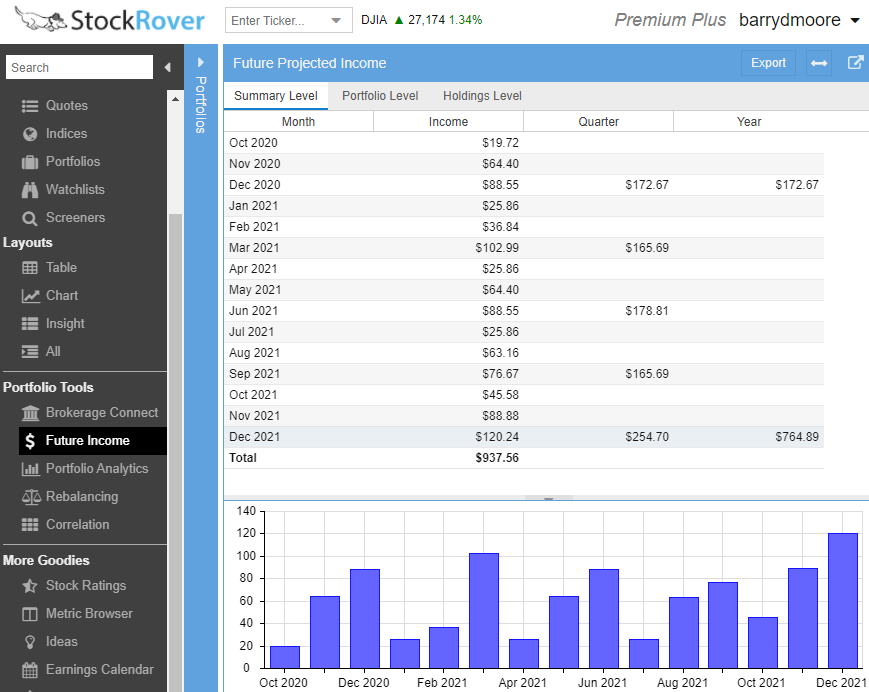

Future Income & Dividend Reporting

As all smart investors know, you need to accrue your dividends to have a chance at excellent market-beating returns. Another reason why I like Stock Rover so much is the detailed dividend and income analysis provided.

Stock Rover provides intelligent analysis to enable you to do just that.

Stock Rover will not automatically manage your portfolio or buy and sell stocks for you, but it does connect to your broker and analyzes your existing portfolio.

2. Portfolio 123: Portfolio Tracking & Backtesting

Hand-on testing shows Portfolio 123 is the best portfolio tracker and backtesting tool due to its 10-year financial database and excellent stock research tools.

| Portfolio 123 Rating |

4.5/5.0 |

| 🔍 Portfolio Tracking | ✓ |

| 📰 Research & News | ✓ |

| 💸 Profit & Loss Reporting | ✓ |

| 📈 Performance Reporting | ✓ |

| ⚖ Weighting & Rebalancing | ✓ |

| 🏹 Portfolio Asset Allocation | ✓ |

| 🖱 Broker Integration | X |

| 🎯Future Income & Dividend Reporting | X |

| 🤖 Automated Portfolio Management | X |

| 💰 Price /mo | Free or $83/m annually |

| 🎮 Free Trial/Discount | 21 Days for $9 |

| ⚡ Visit | Portfolio 123 |

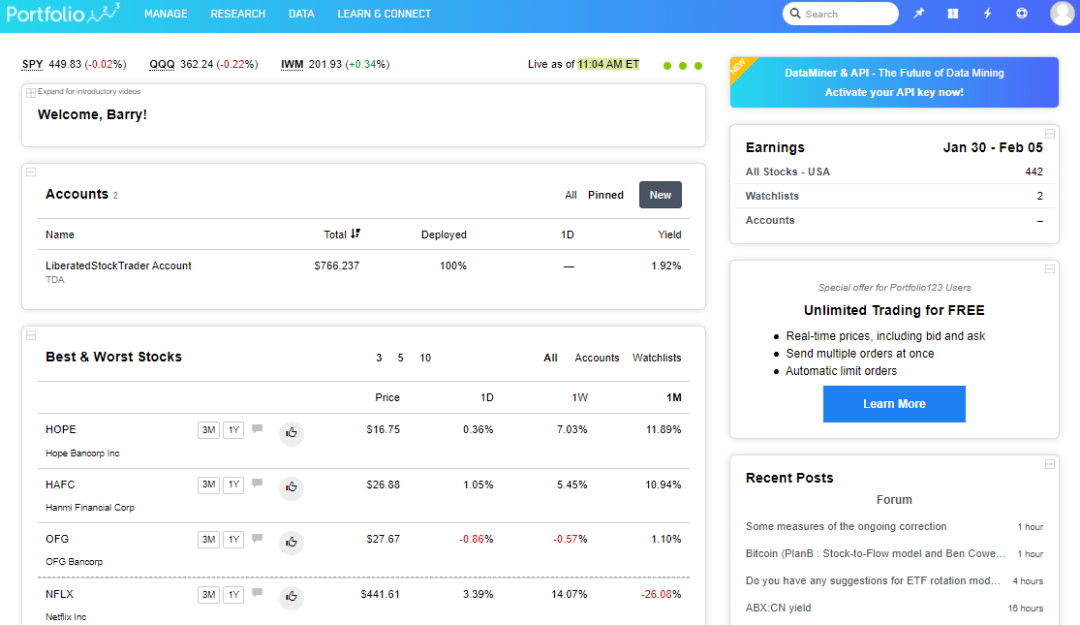

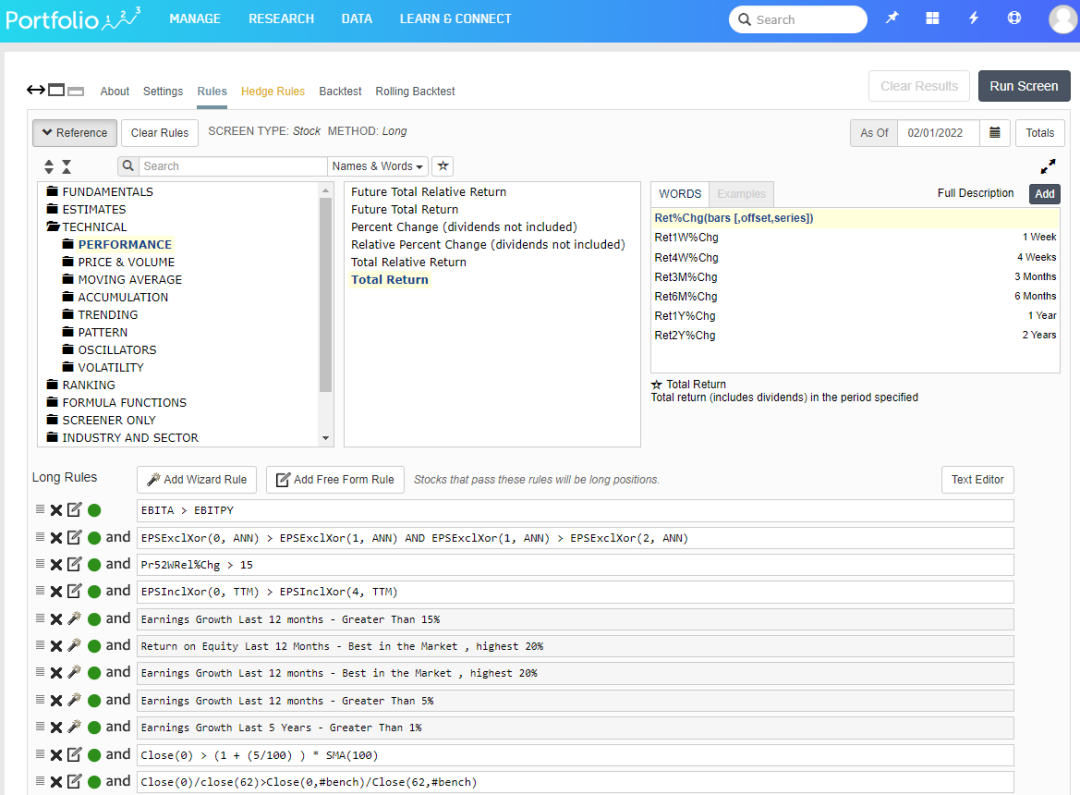

Portfolio123 offers a great balance of powerful portfolio tracking and a 10-year financial database, which you can use to backtest your portfolio strategy.

With Portfolio123, you get tight broker integration with Tradier and Interactive Brokers. You cannot place trades from charts, but you can automate trading based on rules or issue bulk trades; plus, Portfolio 123 will take care of profit & loss reporting.

The Portfolio123 screener allows you to filter 10,000+ stocks and 44,000 ETFs to help you find the investments or trades that match your exact criteria. Portfolio123 also has ranked screening, which enables you to rank the stocks that best match your criteria, filtering a list from hundreds of stocks to a handful. You can also define your custom universes, setting the macro criteria for which stocks are included in the sample.

Over 225 data points will cover most of your fundamental ideas. Portfolio123 has 460 criteria, including analyst revisions, estimates, and technical data.

You can also use Portfolio123 to screen stocks on their performance relative to the S&P500 or any other benchmark. You could develop a strategy to select stocks based on their historical performance versus the market.

Portfolio123 pricing starts at $0 for the Free plan, the screener costs $25/mo, and Pro costs $83/mo. You can have Portfolio123 for free; however, the real power of Portfolio123 is unleashed with the Screener and Pro service. Their screener and pro service pricing is in line with competition and competitive considering the benefits on offer.

3. Tickeron: Best AI Stock Portfolio Tracker

Our research unveils Tickeron as the best AI-power stock portfolio management and tracking software due to its incredible selection of algorithms and ability to quickly create a diversified, balanced portfolio with audited track records.

| Tickeron Rating |

4.4/5.0 |

| 🔍 Portfolio Tracking | ✓ |

| 📰 Research & News | X |

| 💸 Profit & Loss Reporting | ✓ |

| 📈 Performance Reporting | ✓ |

| ⚖ Weighting & Rebalancing | X |

| 🏹 Portfolio Asset Allocation | ✓ |

| 🖱 Broker Integration | X |

| 🎯Future Income & Dividend Reporting | X |

| 🤖 Automated Portfolio Management | X |

| 💰 Price /mo | Free or $250/m or $125/m annually |

| 🎮 Free Trial/Discount | -50% Discount on Annual Plan |

| ⚡ Visit | Tickeron |

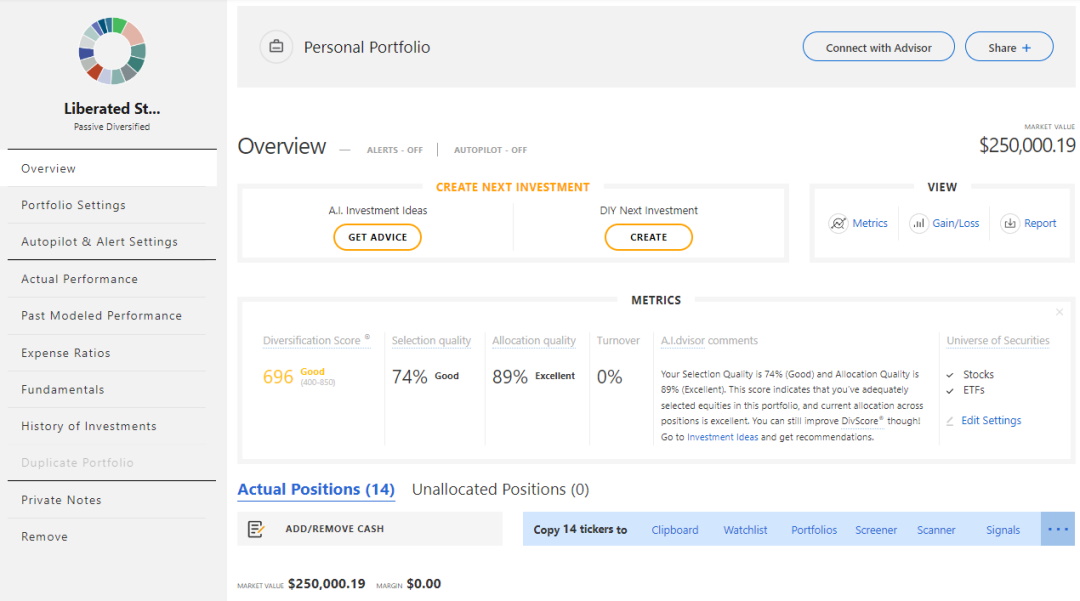

Tickeron has a well-thought-out portfolio management service integrated into the platform. Tickeron makes creating a new portfolio incredibly simple.

By answering a few questions about your age, goals, investment sum, risk tolerance, and preferred assets (stocks, ETFs), Tickeron will create a customized portfolio. You can continue to tweak your portfolio, and Tickeron also assigns a diversification score based on modern portfolio theory (MPT).

The screenshot below shows that I created a Liberated Stock Trader portfolio with a good diversification score and excellent allocation quality. The best thing about a Tickeron portfolio is that AI can help you decide which stocks to buy and sell.

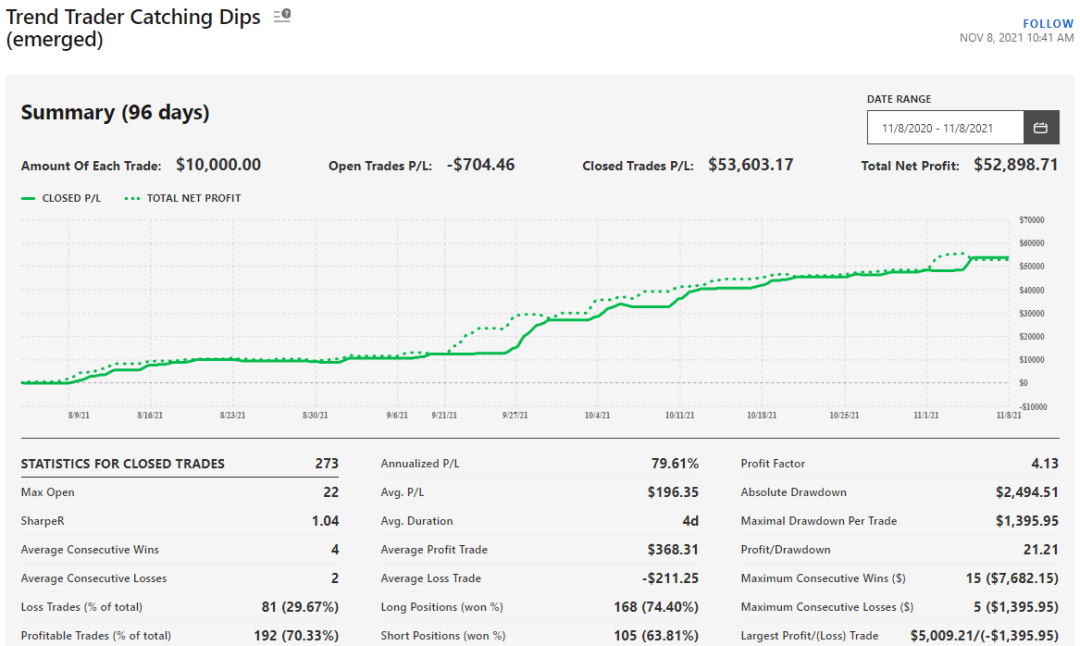

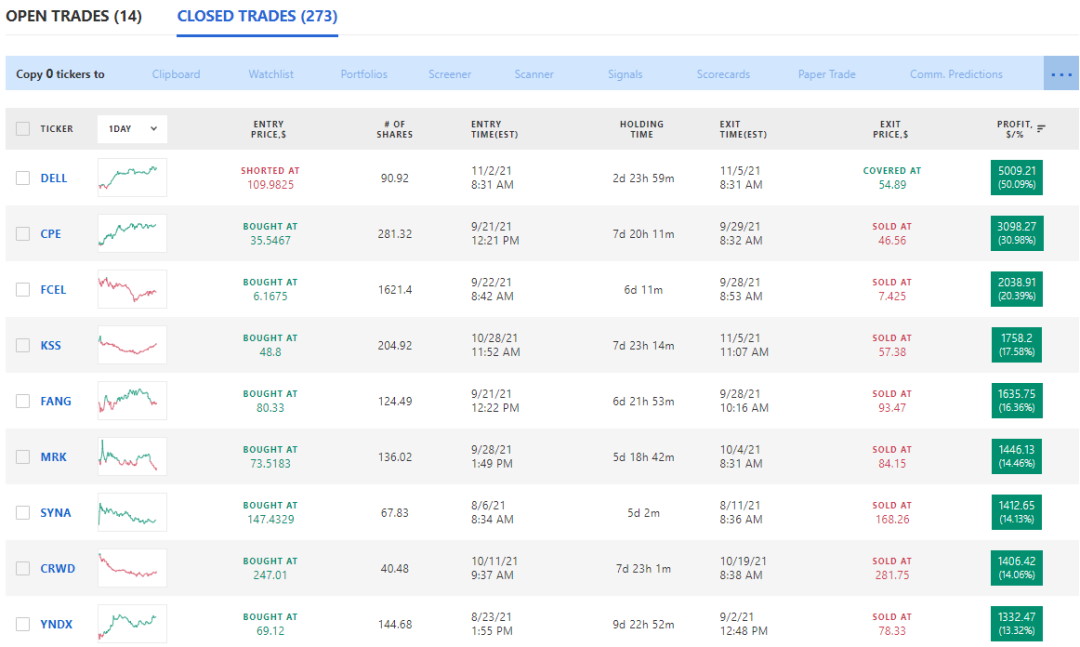

Tickeron Portfolio Reporting

Tickeron illuminates its AI algorithm’s performance by providing a fully audited track record of every stock Bot under management. Before purchasing a strategy, you can see its entire performance summary, trade amounts, percentage profitable trades, Sharpe ratio, and trade duration.

It is also important to be able to audit the individual historical trade alerts issued by the AI software. Trade Ideas and Tickeron allow you to see all historical trades, whether they win or lose; transparency is key.

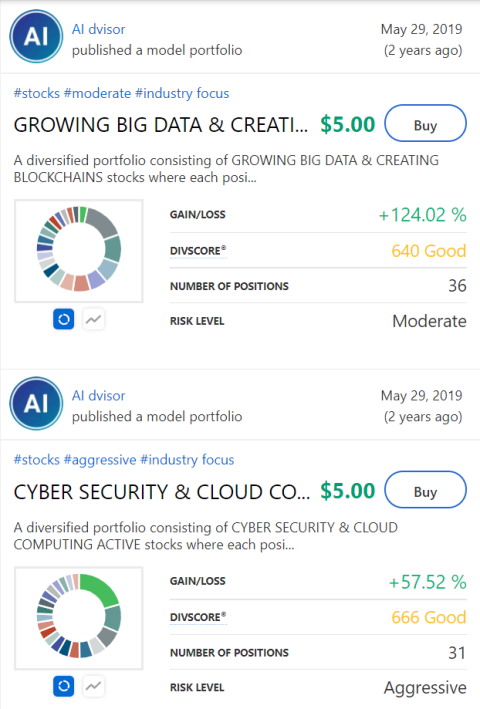

Tickeron AI Portfolios

Tickeron uses its artificial intelligence engine to provide specific stock picks. The algorithm can also be run on a specific index or watchlist to generate trading opportunities on your selection of stocks. Tickeron also offers innovative portfolios that use AI to build a portfolio with characteristics like diversification and high return. One specific AI stock asset allocation is called “GROWING BIG DATA & CREATING BLOCKCHAINS PASSIVE,” which selects the best mix of AI stocks and blockchain companies.

Having tested Tikeron, I have to say that Tickeron is a very professional, sophisticated, and easy-to-use stock market AI software that delivers results. Tickeron is well worth trying.

4. Firstrade: Best Free Broker & Tracker

Firstrade is my choice for the best broker stock portfolio tracking due to its huge range of commission-free ETFs, stocks, options, and full retirement portfolio support.

| Firstrade Rating |

4.3/5.0 |

| 🔍 Portfolio Tracking | ✓ |

| 📰 Research & News | ✓ |

| 💸 Profit & Loss Reporting | ✓ |

| 📈 Performance Reporting | ✓ |

| ⚖ Weighting & Rebalancing | X |

| 🏹 Portfolio Asset Allocation | ✓ |

| 🖱 Broker Integration | ✓ |

| 🎯Future Income & Dividend Reporting | X |

| 🤖 Automated Portfolio Management | X |

| 💰 Price /mo | $0* |

| 🎮 Free Trial/Discount | X |

| ⚡ Visit | Firstrade |

Firstrade offers excellent stock portfolio tracking and retirement planning services. All stock trades are free with Firstrade, and they have the largest selection of commission-free ETFs in the industry.

Firstrade does not charge for using their services. You can open an account for free; they are a broker, and you must fund your account to start trading. The table below shows that Firstrade leads the pack in commission-free trading.

| Commissions & Fees | Firstrade | E*Trade | Schwab | Fidelity |

| Online Stock Orders | $0 | $0 | $0 | $4.95 |

| Online Option Orders | $0 | $0 + $0.65/contract | $0 + $0.65/contract | $0 + $0.65/contract |

| Online Mutual Fund Trades | $0 | $49.99 | $49.95 | $49.95 |

| Broker-assisted Stock | $19.95 | $25 | $25 | $19.95 |

| & Options Trades | (+$0.50/contract) | (+$0.65/contract) | (+$0.65/contract) | (+$0.65/contract) |

| Minimum Initial Deposit | $0 | $500 | $0 | $0 |

Table 1: Firstrade Commissions vs. Competitors

Firstrade focuses on having the industry’s best commissions. Even though E-Trade and Schwab have been forced to join the $0 zero commissions bandwagon, Firstrade still offers the best value across stocks, options, and mutual funds.

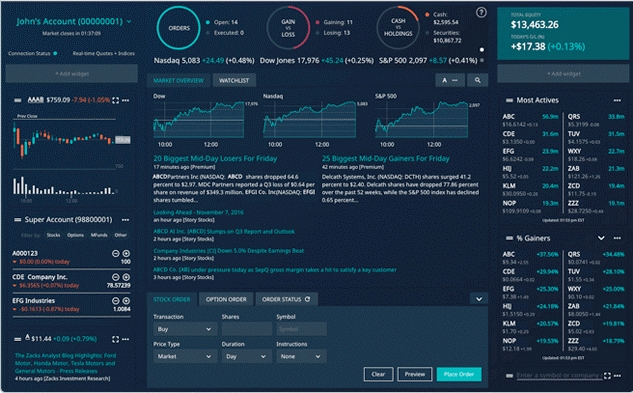

Portfolio Tracking & Reporting

As with any broker, Firstrade provides free watchlist trading and reporting. Firstrade Navigator is a well-designed and robust system that instantly makes valuable information available, allowing you to drill down into the details.

It is very customizable and has a selection of widgets to embed into the dashboard. Studies and stock chart indicators are, of course, also included.

Research & News

Firstrade provides free access to Zacks Research, Morningstar Research & Ratings, Breifing.com & Benzinga News (although not the real-time Benzinga PRO version). These third-party services are quite valuable, and considering Firstrade offers zero commissions, they also add value through these services.

Firstrade excels at being a great broker and leading the industry in zero-cost trading. However, its portfolio management service can be improved to cover portfolio weighting, rebalancing, and future income and dividend reporting. Also, Firstrade is not a robo-advisory service, so do not expect automated portfolio management and trading.

5. TC2000: Real-time Stock Portfolio Trading

TC2000 enables very flexible portfolio tracking through its endlessly configurable watchlists, add to that real-time scanning and stock trading, and is worthy of consideration.

| TC2000 Rating |

4.2/5.0 |

| 🔍 Portfolio Tracking | ✓ |

| 📰 Research & News | ✓ |

| 💸 Profit & Loss Reporting | ✓ |

| 📈 Performance Reporting | X |

| ⚖ Weighting & Rebalancing | X |

| 🏹 Portfolio Asset Allocation | X |

| 🖱 Broker Integration | ✓ |

| 🎯Future Income & Dividend Reporting | X |

| 🤖 Automated Portfolio Management | X |

| 💰 Price /mo | Free or $60/m or $50/m annually |

| 🎮 Free Trial/Discount | 30-Day Trial |

| ⚡ Visit | Get TC2000 Free |

TC2000 will take care of real-time scanning of the markets and track your stocks. Using the TC2000 Brokerage, automatic portfolio reporting and tracking will be included.

Pricing

TC2000 is competitive on pricing with all premium stock market analysis software vendors; it is a leader in pricing, with only TradingView offering a similar price point. For 25 years, the readers of the Technical Analysis of Stocks & Commodities Magazine have voted TC2000 the best software.

You can download TC200 completely for free. The premium version, which we discuss below, unlocks a few limitations. However, the Free version is extremely useful and packed with all the essential features to track your stock portfolio.

Portfolio Tracking

With TC2000, your watchlists are incredibly powerful. With hundreds of configurable columns for technical and fundamental financial indicators, whatever you want to build will be covered. Another great feature of the watchlist is that you have integrated market scanning, meaning you can sort and list your potential stocks based on whether they meet certain criteria. For example, if you are looking for stocks with an EPS % increase of more than 20%, you can.

Research & News

TC2000 does not have integrated research reports like Stock Rover or Firstrade. But it does enable you to scan the market for core financial data such as P/E, EPS, Earnings, Emplyees, or even insider Ownership.

TC2000 is perfect for scanning the entire market in a few seconds for the best fundamental setups of any company. In the Liberated Stock Trader PRO Training, I show how to use TC2000 to find the best companies.

Portfolio Profit & Loss Reporting

TC2000 does enable you to report on the profit and loss of individual stocks, including information on the purchase date, shares owned, and profit/loss. When reporting on your portfolio profit and loss, the capability is there when you use the TC2000 brokerage.

Portfolio Rebalancing & Management

TC2000 lacks functionality in portfolio performance reporting, rebalancing, asset allocation, and future income reporting. It specializes in excellent technical analysis, charting, and scanning the entire market based on your criteria. The stock watchlists are very good and provide solid tracking, but tracking on a portfolio level is missing.

Broker Integration

TC2000 Brokerage is a relatively new offering from Worden Brothers Inc. This well-established company offers one of the best stock market analysis software packages, so expanding into the Brokerage side of the business was logical.

And boy, they did a good job. They offer stock trade commissions at $1, and their options trades fare even better at $1 + $0.65 per contract.

Surprisingly, they lead the pack in margin interest rates. When you buy a stock with a margin, you can leverage that stock with borrowed money. Traditionally, brokerage firms make a lot of profit through this lending.

However, TC2000 Brokerage does not take advantage of the client in this area and offers very low interest rates on margin loans.

The icing on the cake is that you trade directly from the charts with TC2000. TC2000 enables real-time fundamental and technical screening of the entire stock markets, including ETFs, and lets you easily create indicators from market conditions. Not only that, but the Options trading in TC2000 is arguably one of the best in the industry.

TC2000 Brokerage only offers trading in Stocks, Options, and ETFs, but if this is all you need, this is a first-class operation that should meet your needs.

6. Yahoo Finance Portfolio Tracker

The Yahoo Finance portfolio tracker includes broker integration and reasonable free screening but lacks useful portfolio management tools. If you manage a large portfolio, Yahoo Finance will cost you time and effort.

You will need a Yahoo account to get started with watchlist tracking. Once registered, you will get free access to good basic watchlists and portfolio tracking functionality. Yahoo offers a premium service that provides additional reporting and analysis, but nothing compared to the winners, Stock Rover and Portfolio 123.

Yahoo Premium costs $49.99 per month, which is extremely expensive compared to Stock Rover’s $27.99 monthly.

Yahoo has revamped its interactive charting feature, offering a sleek experience with 114 diverse technical indicators. The interactive charts allow you to draw trendlines, linear regressions, and quadrant lines.

Yahoo now provides real-time quotes and charts via the BATS system, a nice new addition. Yahoo Finance is working hard to make its charting system a worthy alternative to other free vendors.

They have done something quite innovative. You can now trade stocks through the Yahoo Finance charts.

Using Yahoo, you can trade stocks with your broker. It is a nice feature, but if you have a brokerage account, you will already have access to real-time data, charts, and quotes and can trade directly with them, so it seems a little redundant but still a step forward.

Yahoo Finance provides a news aggregation engine and contributes original news via the Yahoo Finance news team. If you opt for Yahoo Finance Premium, you will get a good selection of analyst research reports. These static reports could be useful, but again, for the price tag of $49.99 per month, it might not be worth it because most mainstream brokers offer research reports for free. Firstrade offers free stock trades and research reports from both Zacks and Morningstar.

Yahoo Finance can connect to a wide variety of brokers. It can then download your stock position data and perform analytics on your portfolio, but you will require the overpriced Yahoo Premium subscription. There is no functionality in Yahoo Finance Premium for portfolio weighting and rebalancing or automated portfolio management. However, they report your portfolio asset allocation per industry sector and dividend income reporting.

What is the Best Stock Portfolio Tracker?

Our research and tests suggest Stock Rover is the best free and paid stock portfolio tracker. Stock Rover has unique portfolio correlation, management, and rebalancing features. With Broker integration, research reports and a powerful stock/ETF screener with a 10-year financial database are built-in.

If you are looking for free stock trades and a great Roth IRA solution, Firstrade is your choice. TC2000 offers entire market scanning and a powerful watchlist solution for free. Finally, Yahoo Finance offers a simple free watchlist tracking service for less demanding investors.

FAQ

How do I track my stock portfolio?

You can track your portfolio using your broker; the portfolio is automatically updated when you place trades. But I recommend Stock Rover if you want detailed performance data, portfolio balancing recommendations, and dividend forecasting and reporting.

What is the best app to track my stock portfolio?

Our testing shows that Stock Rover is the best portfolio-tracking app for US investors. Stock Rover provides detailed profit and loss, risk, rebalancing, and dividend forecasting reporting to help you manage your portfolio like a professional.

What is the best free stock tracking website?

The two best free stock tracking websites are Stock Rover and TradingView. Stock Rover is best for US stock and mutual fund investors needing detailed performance reporting, forecasting, and rebalancing data. For international stock investors, TradingView has the best international market coverage.

Is Google Portfolio free?

Yes, Google Finance is reborn, and it is free. However, Google's portfolio tracking is very basic compared to Stock Rover, TradingView, Portfolio 123, and Yahoo Finance; each offers a unique blend of simplicity and reporting.

How do I track a stock portfolio in Excel?

Using our free trade tracking Excel spreadsheet, you can easily track your trading in Excel. This Excel sheet reports profit and loss and lets you log the reason and logic behind your trades.

What website can I track stocks on?

You can track stocks on your broker's website, but typically broker tracking lacks detailed reporting. Alternatively, you can track your stock portfolio with several popular tools such as Stock Rover, TradingView, Portfolio 123, and Yahoo Finance. You can also use our free Trade Tracking Excel Sheet for detailed profit and loss tracking.

How do I track all my investments in one place?

To track all your investments in one place with an integrated view of profit and loss and forecasted dividend returns, I recommend Stock Rover. Stock Rover is free and connects securely to your broker to update your portfolio.

Are online portfolio trackers safe?

Online portfolio trackers are a safe and secure way to keep track of your investments. Many online portfolio trackers use encryption technology to ensure secure communication. Any online service is only as secure as your password.

Is there an app that shows all stocks?

The most popular app that shows all stocks globally is TradingView. TradingView covers 52 world stock exchanges, including ETFs, Mutual Funds, Commodities, and currencies.

Is there an app for keeping track of stocks?

The simplest app for mobile to keep track of your stocks is Yahoo Finance. It provides stock news and data and can connect to your broker.

Does Google have a stock screener?

No, Google does not currently have a stock screener. You can look up stock information and news with Google Finance, but there is no active stock screener to help you find stocks that meet your personal criteria. For this, I would recommend FinViz or Stock Rover, both of which are free.

Is Google Finance worth it?

No, Google Finance is not worth it for tracking a portfolio or even for financial news aggregation. I recommend FinViz for fast, free stock screening and news or Stock Rover for effective free screening and portfolio management.

How do I find my investment portfolio?

If you want to find an investment portfolio strategy that meets your requirements, I recommend reading our article 13 Best Stock Portfolios and How to Implement Them.

Should you track your investments?

Yes, tracking your stock portfolio is essential for making informed decisions and ensuring long-term market success. The best way to track your portfolio is to use a portfolio tracker, such as Stock Rover or TradingView, which will provide insight into how your investments perform over time.

How do you manage your portfolio like a professional?

To manage your portfolio like a professional, you should use Stock Rover because it provides expert portfolio management, rebalancing, tax loss harvesting, and risk-reward reporting—everything a professional portfolio manager needs.

What is the riskiest portfolio?

The riskiest portfolio consists of penny stocks or cryptocurrency. These portfolio structures offer little diversification, risk management, or long-term prospects for a budding investor.

What is the best free portfolio tracker?

Stock Rover is the best free portfolio tracker, with broker integration, reporting, and risk management built in. Stock Rover also has a broad selection of model portfolios and robust stock screening strategies to help you build a low-risk, stable portfolio.

How to track my portfolio's performance?

The simplest way to track your portfolio is through your broker; they provide basic performance reporting and automatically generate your tax documents. For more robust portfolio tracking and management services, try Stock Rover.

How often should you update your trading portfolio?

You should update your trading portfolio every time you execute a trade. Buying and selling stock impacts the portfolio's risk and weighting. At a minimum, you should update and rebalance your portfolio in December every year.

How do I track a dividend portfolio?

Tracking a dividend portfolio manually can be time-consuming. Fortunately, companies such as Stock Rover fully automate this process. Stock Rover automatically tracks and forecasts your future dividend payments and provides full on-demand research reports for your dividend stocks.

How to track my mutual fund portfolio?

For a comprehensive mutual fund and ETF tracking service, I recommend Stock Rover. Stock Rover is a trusted US company that can connect to your broker and provide personalized mutual fund reporting and rebalancing recommendations.