Trade Ideas has hundreds of strategies, scans, and automated trading algorithms with audited performance results to satisfy the most demanding traders.

My testing awards Trade Ideas 4.7 stars. Its stock scanner, alerting, and algorithmic trading signals are advanced and trustworthy. Brokerage Plus auto-trading is a great feature for experienced traders.

This review will give you all the information you need to decide whether AI trade signals and auto-trading are right for you.

Test Results & Verdict

My in-depth testing shows Trade Ideas is the ultimate black box AI-powered day trading signal platform with built-in automated bot trading. Three automated Holly AI systems pinpoint trading signals for day traders. Trade Ideas promises and delivers the nirvana of market-beating returns.

Trade Ideas is best for active US day traders seeking real-time AI-driven high probability trades, excellent stock scanning, and a live trading room to learn trading techniques.

Trade Ideas is worth it if you are a pattern day trader trading at least three times daily with an account value of over $25K as this will help you profit after paying the Trade Ideas subscription cost.

Pros

✔ 3 AI Trading Algorithms That Beat the Market

✔ Get A Free Holly AI Stock Trade Every Week

✔ Fully Automated Backtesting

✔ Exceptional Stock Scanning

✔ Specific Audited Trade Signals

✔ Auto-trading & broker integration

✔ Auto trade Commission Free With eTrade integration

Cons

✘ Old School User Interface

✘ No Mobile App

Key Features

| ⚡ Features | Charts, Watchlists, Screening |

| 🏆 Unique Features | AI Trade Signals, Trading Room, Trading Competitions |

| 🎯 Best for | US Day Traders |

| ♲ Subscription | Monthly, Yearly |

| 💰 Price | $254/m or $178/m annually |

| 💻 OS | Web Browser, PC |

| 🎮 Trial | Free Live Trading Room |

| ✂ Discount | -15% Discount Code "LIBERATED" |

| 🌎 Region | USA |

What is Trade Ideas?

Founded in 2003, Trade Ideas is a web & desktop-based software platform for finding day trading opportunities. Historically specializing in real-time stock scanning, Trade Ideas now incorporates cutting-edge AI algorithms that backtest every stock in the USA & Canada for high-probability trading opportunities.

To understand the platform, we must first consider the pricing structure and what you get for your money.

Compare to Similar Products

Our tests compare Trade Ideas versus TrendSpider, MetaStock, and TradingView. Trade Ideas is the best for black box AI-driven day trading. TrendSpider is better for automated stock chart analysis, backtesting, and automated trading. Stock Rover is better than Trade Ideas for long-term investors. Benzinga Pro is a better alternative for trading real-time news.

| Features | Trade Ideas | TrendSpider | TradingView | MetaStock |

| Awards | ||||

| Rating | 4.7 | 4.8 | 4.7 | 4.4 |

| Pricing | $254/m or $178/m annually | $107/m or $48/m annually | Free | $13/m to $49/m annually | MetaStock R/T $100/m, Xenith $265/m |

| Global Market Data | USA | USA | ✔ | ✔ |

| Black Box AI Algorithms* | ✔ | ✘ | ✘ | ✘ |

| Powerful Charts | ✔ | ✔ | ✔ | ✔ |

| Stocks | ✔ | ✔ | ✔ | ✔ |

| Futures | ✘ | ✔ | ✔ | ✔ |

| Forex | ✘ | ✔ | ✔ | ✘ |

| Cryptocurrency | ✘ | ✔ | ✔ | ✘ |

| Social Community | ✔ | ✘ | ✔ | ✘ |

| Real-time News | ✘ | ✘ | ✘ | ✔ |

| Screeners | ✔ | ✔ | ✔ | ✔ |

| Backtesting | ✔ | ✔ | ✔ | ✔ |

| Code-Free Backtesting | ✘ | ✔ | ✘ | ✘ |

| Automated Analysis | ✔ | ✔ | ✔ | ✔ |

*Trade Ideas’ unique black box AI algorithms make it unique.

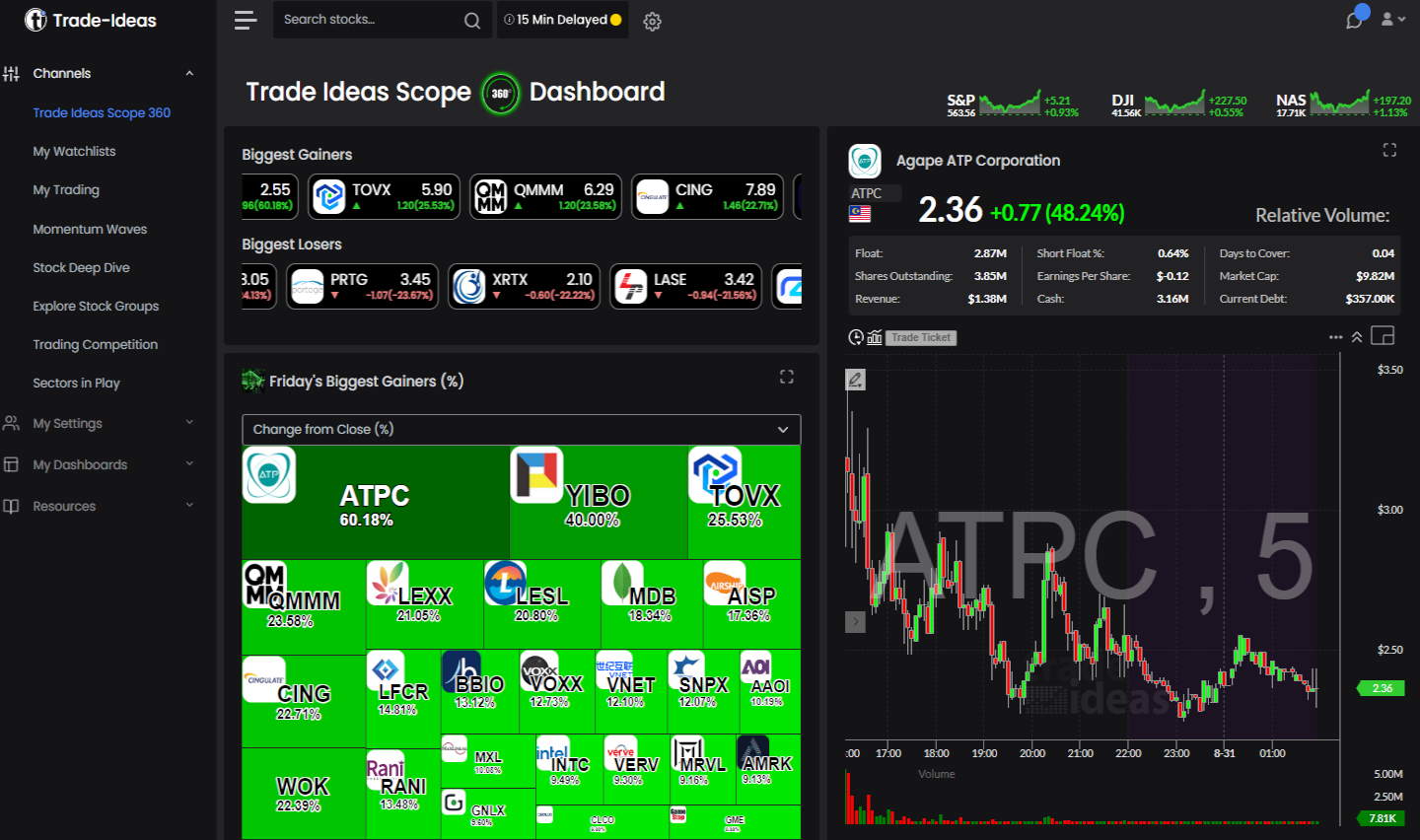

Platform

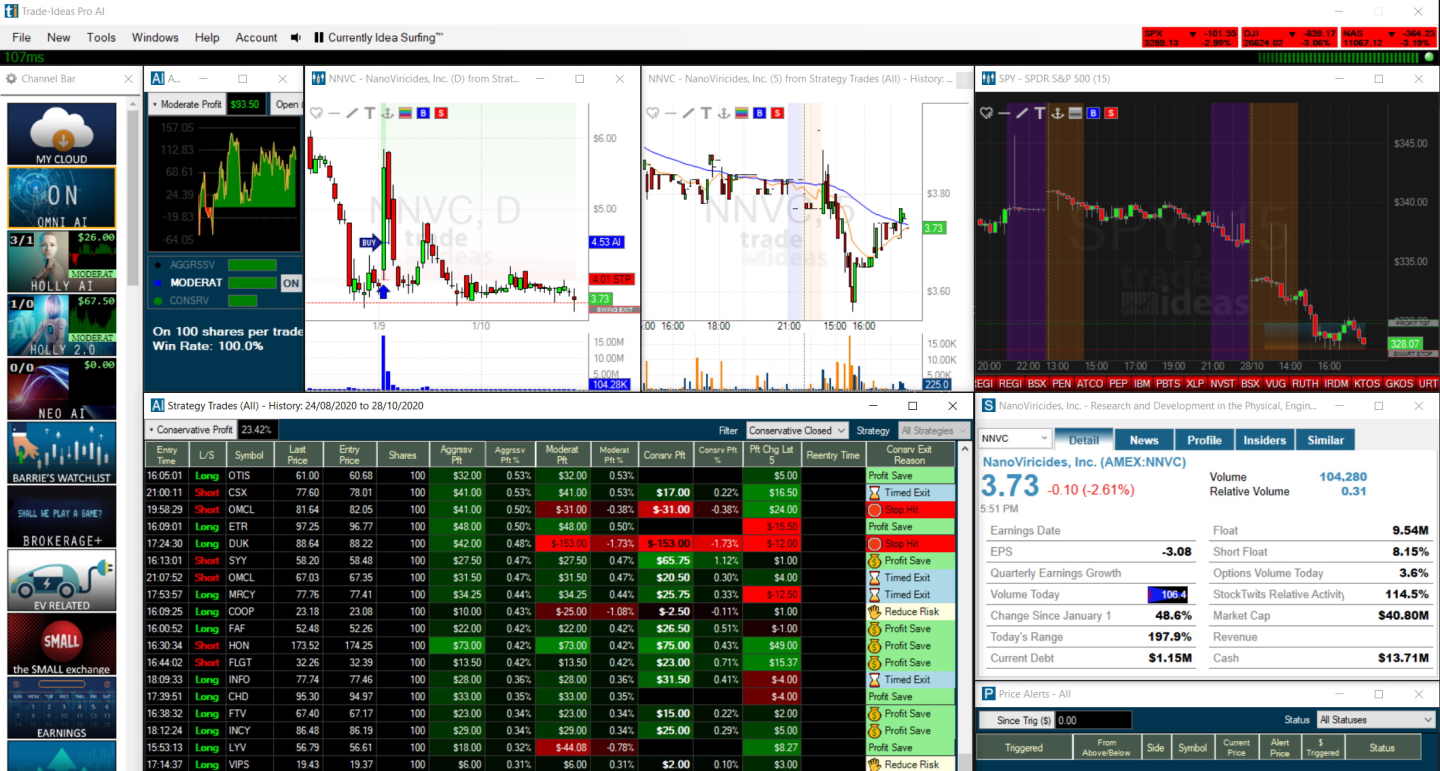

The Trade Ideas has two versions: a full-blown desktop platform and a lighter web version. The Trade Ideas web service can be accessed from any PC or Mac and contains most of the desktop platform’s functionality. Serious traders will want to download and install the desktop platform because it is endlessly configurable and multi-monitor friendly.

When you first open Trade Ideas on your desktop, the software feels extremely clunky and unfriendly. Every element has its window, so if you want to resize the view, you need to resize all eight windows. This seems like a hassle initially and harks back to the age of Windows 98.

But there is a good reason for this design. It gives you endless flexibility and window configuration options when operating multiple monitors and large screens. Also, even though they are fully separate windows, they can be linked and unlinked to provide a fluid experience.

However, the interface is undergoing a huge transformation, making it more interactive and gamified, which is a welcome improvement.

Charts

The one area in which I felt let down was the ability to perform my own technical analysis. Most technical analysis software, backtesting, and charting platforms offer at least 50 different technical analysis tools. Trade Ideas does not play that game, enabling only volume, moving averages, VWAP, and trendlines.

The lack of indicators is not a good look for Trade Ideas compared to MetaStock, which offers over 300 indicators and drawing tools, or TradingView, with 160 indicators and chart types. To counter that argument, one could suggest that the design remit removes the need for you to perform your own technical analysis by running all the backtests and finding all the opportunities for you, which is unique.

In any case, a few more technical analysis tools would help improve the product.

| Technical Charting | Rank | Chart Types | Indicators |

| TrendSpider | #1 | 6 | 206 |

| TradingView | #1 | 17 | 160 |

| MetaStock | #2 | 10 | 150 |

| Finviz | #3 | 5 | 22 |

| Trade Ideas | #4 | 6 | 16 |

Trading & Scanning

Trade Ideas integrates with three brokers for stocks: Interactive Brokers, Etrade, and Esignal. The Brokerage Plus functionality is available with the Standard and Premium service. Trade signals generated from Holly AI cannot be autotraded. Still, alert window scans can be auto-executed in a sandbox or live with your brokerage using Brokerage Plus (available in the premium plan).

| Trading | Autotrading Bot Integration | Brokers Integrated | Exchanges | Ranking |

| Trade Ideas | ✔ | 3 | USA | #1 |

| TradingView | ✘ | 50 | Global | #1 |

| TrendSpider | ✔ | 5 | USA | #2 |

| MetaStock | ✘ | 0 | Global | #4 |

Table: Trade Ideas vs. The Competition – Broker Integration

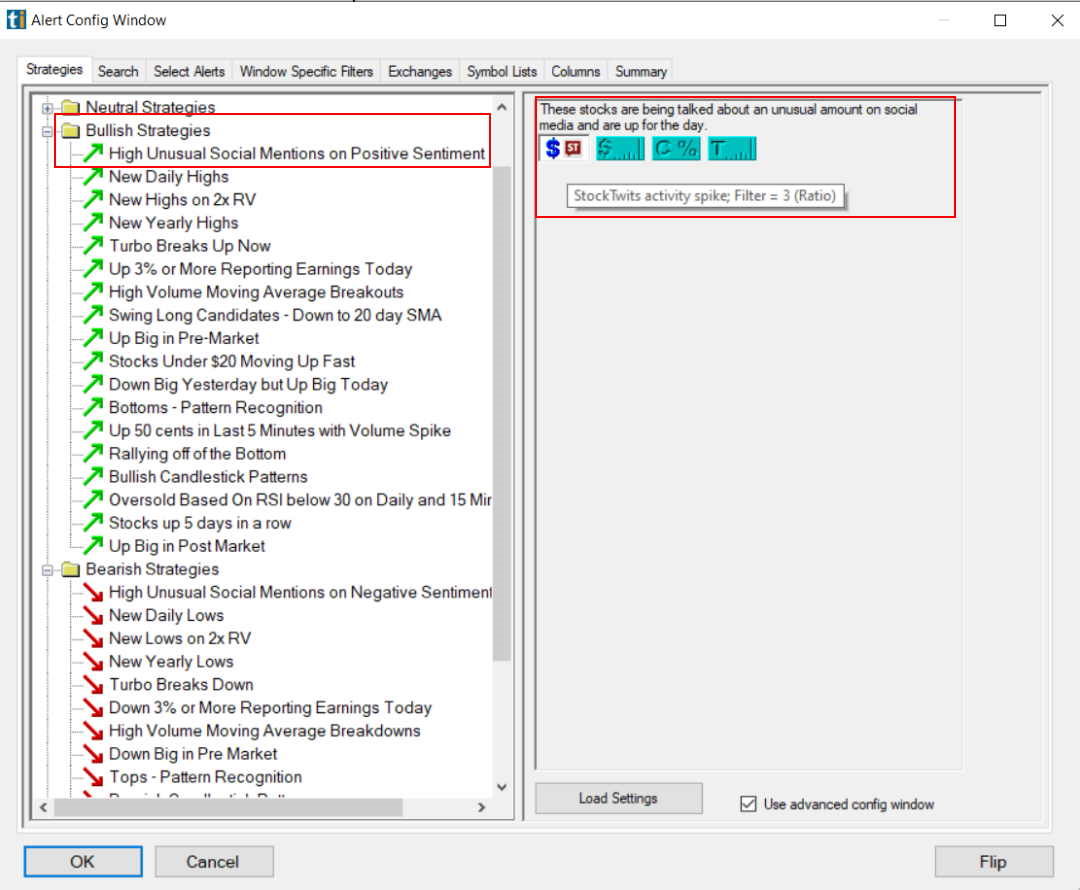

The Trade Ideas scanner is at the system’s heart and uniquely provides access to over 40 innovative market scans. These scans include long and short strategies, volume breakouts, premarket price moves, and price pivot action.

By clicking New -> Alerts, you can access the Alert Config Window, which gives you immediate access to over 40 trading scans. The screenshot below shows all the in-built scans categorized into Bullish, Bearish, or Neutral. Depending on the overall market direction, you can easily select a potential strategy for the day.

One scan I find particularly impressive is the “Unusual Social Mentions Scan.” The Trade Ideas AI engine constantly scans StockTwits for surges in mentions of particular stocks. If you click load settings, you will be immediately presented with a list of stocks spiking on social media. Of course, you can customize any of the scans featured here or create your alerts from scratch.

Trade Ideas Channels

Trade Ideas provides over 30 curated channels highlighting theme-based trading opportunities that the team believes present outsized profit opportunities. The channels cover social media buzz, earning opportunities, and multiple industry plays.

A snapshot of Trade Ideas channels:

- EV Related: Trading strategies in the Electric Vehicle Industry.

- The Small Exchange: if you are interested in small-cap businesses, this is your channel.

- Social Media: Stocks buzzing with positive and negative sentiments on social media. You can go with the crowd or against it.

- Earnings Plays: The channel to play the very lucrative earnings announcement momentum.

- Weed Watchers: For those interested in the fast-growing medicinal cannabis market.

- Enjoy the Show: A Channel that cycles through all the hottest trade setups of the day.

- Trade the Gaps: Highlighting trades exhibiting the clear technical analysis price gap pattern.

- Many Other Channels: China, Biotech, Penny Movers, ETFs, Defense, and Banks.

| Stock Screeners | Rating | Best for: | Free Version |

| TrendSpider | 4.8 | Traders | ✘ |

| TradingView | 4.5 | Traders | ✔ |

| Trade Ideas | 4.4 | Day Traders | ✘ |

| Finviz | 4.2 | Investors | ✔ |

| Tickeron | 4.2 | Investors | ✔ |

| MetaStock | 4.1 | Traders | ✘ |

Backtesting

The Trade Ideas platform has a powerful, easy-to-use backtesting system that requires no programming knowledge. A point-and-click backtesting system is rare in this industry; the only other software with this capability is TrendSpider.

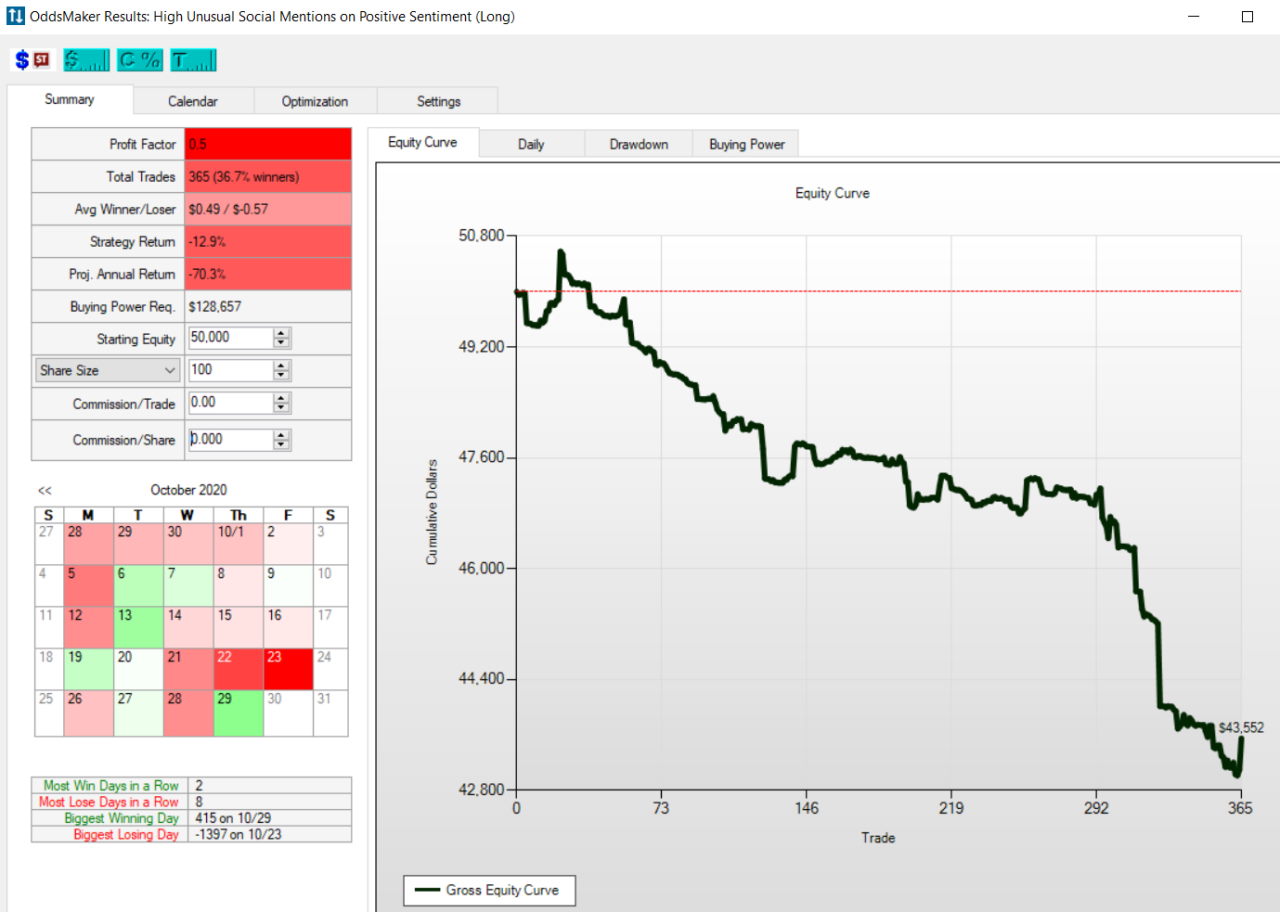

I have run many backtests with Trade Ideas, but the one I wanted to focus on was a backtest of the “Unusual Social Mentions Scan”; this is a good test of the wisdom of crowds.

I wanted to focus on was a backtest of the “Unusual Social Mentions Scan”. This is a good test of the wisdom of crowds.

As you can see in the backtest result above, the crowds are not very wise, as the backtest shows that the system loses 70% per year. This helps me draw three conclusions.

- Do not listen to people on social media.

- Trade Ideas provides an excellent and unique insight into stock market crowd sentiment.

- You may have a winning system if you do the opposite of what people suggest on StockTwits.

| Backtesting Software | Backtesting | No-Code Backtesting | Auto-Trading | Ranking |

| Trade Ideas | ✔ | ✔ | ✔ | #1 |

| TrendSpider | ✔ | ✔ | ✔ | #1 |

| TradingView | ✔ | ✘ | ✔ | #2 |

| Stock Rover | ✔ | ✘ | ✘ | #3 |

| MetaStock | ✔ | ✘ | ✘ | #3 |

Artificial Intelligence Trading

Get A Free Stock Trade Idea Every Week From Holly AI

The Trade Ideas Holly AI algorithms are the software’s biggest benefit for day traders. The Pro AI system has three AI bots: Holly, Holly 2.0, and Holly Neo. The Holly AI bots represent the most innovative trading AI available to retail investors today.

I had a lengthy Zoom session with Sean Mclaughlin, Senior Strategist over at Trade Ideas, to delve into how their AI works, and I was very impressed. This company is laser-focused on providing traders with the best data-supported trading opportunities.

Holly is 3 AI Systems Applying Over 70 Strategies with Differing Risk Levels.

Holly AI

Holly AI applies 70 different strategies to all the stocks on the US stock exchanges; 70 strategies multiplied by 8,000+ stocks means millions of backtests daily.

Only the strategies with the highest backtested win rate of over 60% and an estimated risk-reward ratio of 2:1 will be suggested as potential trades the following day.

Holly 2.0

Holly 2.0 is a more aggressive version of Holly AI, presenting more aggressive day trading scenarios for you to select. Trade Ideas operates three key trading styles with each AI algorithm: conservative, moderate & aggressive. Holly 2.0 is aggressive.

Holly Neo

Holly NEO is a newer AI that seeks to trade real-time chart patterns. It utilizes a mix of long and short trades based on stock price pullbacks and breakouts.

- Pullback Long: This strategy identifies trades in which the stock price is down and seeks to move up on higher volume.

- Breakout Long – Stock price breaks out through a key resistance or to new highs.

- Pullback Short – identifying a short pullback opportunity in price.

- Breakdown Short – a shorting opportunity where upward momentum breaks down.

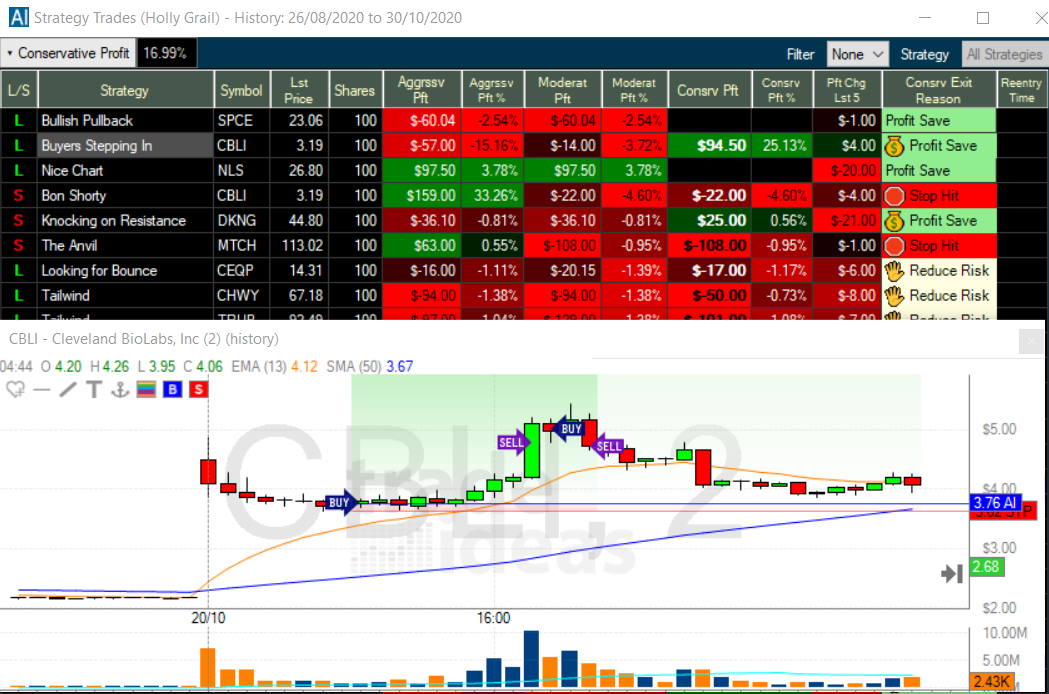

Buy & Sell Signals

While testing Trade Ideas, I was impressed that Holly AI visually shows you every buy and sell signal on a chart. The charts depict in-play and historical trades, making understanding the strategy and potential easy.

I have highlighted a trade Holly AI (Holly Grail) recommended in the chart below. This trade for Cleveland Biolabs (Ticker: CBLI) made a 25% profit within 4 hours. Not how the buy and sell signals are depicted on the chart.

Holly AI Facts

Trade Ideas Holly AI services institutions and retail investors, recommending 3 to 10 trades per day, lasting from a few minutes to a few hours. Holly AI returns at least 20% per year without leverage and has beaten the market over the last three years.

- Trade Ideas has large institutional clients and is a legitimate business.

- Trade Ideas recommends, on average, about 3 to 10 trades per day.

- Each trade duration is from a few minutes to a few hours.

- You must be an active day trader to take advantage of Trade Ideas.

- Trade Ideas returns approximately 20% per year.

- Trade Ideas has, in the last three years, beaten the S&P500.

- You must be able to short and go long to take advantage of the trading strategies.

- Depending on your leverage, trading style, and the trades you take, you could make more than 20% or even a loss.

- You must hold a minimum balance of $25K in your brokerage account to actively pattern day trade in the USA.

Holly AI Performance

Upon downloading and analyzing 65 days of trades, I can confirm the performance numbers claimed by Trade Ideas. Trade Ideas Holly AI’s performance is publicly available and impressive.

To assess a system’s performance, one must compare it to an underlying benchmark. Holly Grail AI has outperformed the S&P 500 by 10% since 2019, and Holly 2.0 beat the market by 31%.

| Holly AI Performance | Starting Capital Jan 2019 | Ending Capital Oct 2020 | Total Return | % Per Year |

| Holly Grail (AI) | $50,000.00 | $71,186.00 | 42% | 23% |

| Holly 2.0 | $50,000.00 | $80,510.00 | 61% | 33% |

| Holly Neo | $50,000.00 | $71,186.00 | 42% | 23% |

| S&P 500 | $50,000.00 | $66,000.00 | 32% | 17% |

Table: Independent Performance Audit: Comparing $50,000 invested in the S&P 500 versus day trading with Trade Ideas.

Interestingly, Holly did not suffer the huge losses incurred in the S&P 500 during the Corona Crash from March to April 2020 or 2022.

Trading Room

I have often joined the Trade-Ideas trading room; skilled trader Barrie Einarson is the moderator and will answer any of your questions. Barrie also shares his screen so you can see his trades, see how he trades, and learn from him. Many trading rooms can cost you a lot more than the entire Trade Ideas Pro subscription, which is an extremely valuable part of the value proposition. You can join the trade ideas trading room now to test it out.

Pricing & Discounts

Trade Ideas offers a Standard Plan that costs $118/mo and includes a live trading room, streaming trade ideas, and powerful scanning and charting. The Premium plan costs $228/mo and adds precise trade signals, 3 AI bots, and auto trading.

Standard Pricing & Savings

Trade Ideas Standard costs $118 per month, but you can save $348 with an annual subscription costing $1068, a 25% discount. Trade Ideas’ Standard plan includes a live daily trading room and the real-time streaming trade ideas scanner, providing access to 40 pre-configured scans. Also included are ten simultaneous charts, chart trading, 500 price alerts, and 30 curated channels of ideas.

Trade Ideas Standard Features:

- Live Trading Room – Full access to the live trading room.

- Real-time Streaming Trade Ideas – Scanner providing access to 40 pre-configured scans.

- Simultaneous Charts – The ability to have ten chart windows open.

- Chart-Based Visual Trade Assistant – The ability to trade directly from charts.

- Up to 500 Price Alerts – Price alerts notify you when a stock meets your criteria.

- Channel Bar Curated Workspaces – Access to 30+ channels of ideas.

Pro AI Cost

Trade Ideas Premium costs significantly more than Standard, $228 per month, but you can save $468 by purchasing an annual subscription for $2268. For this investment, you get robust backtesting, the Holly AI system, and auto trading.

Trade Ideas Premium Features:

- AI Virtual Trading Analyst Holly – 3 different constantly evolving AI algorithms

- Chart-Based AI Trade Assistance & Entry and Exit Signals

- Risk Assessment – Detailed information on the backtested performance of the recommended trade.

- Build and Backtest any Trade Idea – Extremely powerful point & click backtesting system.

- Brokerage Plus – Advanced auto trading using Interactive Brokers or Etrade.

Trade Ideas 15% Discount Coupon Code

Use the Trade Ideas coupon code “LIBERATED” to get an additional 15% off your first purchase, worth $468, when going for the premium service. This is a valid code provided to me as a Trade Ideas partner.

Trade Ideas Standard costs $118 per month for 12 months, or $1416, but you can save $417 by purchasing an annual subscription, which is $999, a 29% discount. Add to that the 15% discount of $150, and the final price is $849, a 40% discount.

Trade Ideas Premium costs $228 per month for 12 months costing $2736. You can save $737 for an annual subscription costing $1999, saving 37%. Add the 15% partner discount; your price will be $1699, a total saving of 38%.

Get 15% Off Trade Ideas Code “LIBERATED”

Is Trade Ideas Legit?

Trade Ideas is a professional company that has been developing strategies to enable traders to beat the market for nearly two decades. Trade Ideas is worth the subscription if:

- You are an active day trader.

- You want to become a full-time day trader.

- You can maintain a minimum trading account balance of $25,000 (if you are a US resident).

- You want to have the power of AI on your side to beat the market.

FAQ

How to get a discount on Trade Ideas?

As a Trade Ideas partner, we have negotiated a 40 percent discount for our readers; simply use the coupon code "LIBERATED" at checkout for an instant 40 percent saving on your first year's subscription.

Does Trade Ideas have level 2 data?

Yes, Trade Ideas provides access to real-time Level 2 data. By subscribing to its Pro subscription plan, you can gain access to streaming quotes and depth of market for stocks traded in the U.S. markets, allowing you to see the full order book of buy and sell orders and track market movements in real time.

Can I use Trade Ideas to find diverging stocks?

Yes, Trade Ideas can be used to find diverging stocks. For example, its MFI Divergence scanner finds stocks diverging with the money flow indicator. Additionally, there is an RSI Divergence scanner for stocks diverging from the Relative Strength Index indicator.

Can Trade Ideas send a text alert?

Yes, Trade Ideas can send text alerts via SMS or email when certain criteria are met. For instance, users can send alerts when a stock crosses over a certain price point or based on technical indicators and strategies.

Does TD Ameritrade partner with Trade Ideas?

No, TD Ameritrade is not currently partnered with Trade Ideas. It is possible to link TD Ameritrade's Think or Swim app to the Trade Ideas app, but that is not the same as a partnership.

Does Think or Swim work with Trade Ideas?

It is possible to get Think or Swim working with Trade Ideas. Open both apps with administrator privileges, then in Trade Ideas, go to Tools > Externally Link > Select The Ticker Box in Think or Swim. Both apps should know loosely work together.

Does Trade Ideas show futures?

Trade Ideas does not work with futures contracts as it is primarily designed for stock trading in the major US exchanges.

Can I use Trade Ideas for automated trading?

Yes, Trade Ideas can be used for automated trading. It offers a variety of tools and strategies that allow users to set custom parameters and create automated trading systems. Additionally, Trade Ideas can be integrated with third-party brokers like Interactive Brokers and ETrade to execute trades automatically.

Does Trade Ideas offer customer support?

Yes, Trade Ideas offers customer support via email and telephone. The company also has an extensive knowledge base with tutorials and helpful articles.

Is the Trade Ideas Scanner Free?

No, the Trade Ideas scanner is not free. Trade Ideas is a premium paid-for subscription service. However, you can try the Trade Ideas Trading Room for free or get a free Holly AI stock trade every week in your inbox.

How much is Trade Ideas?

Trade Ideas offer a Standard Plan that costs $118/mo or $999/year, including a live trading room, streaming trade ideas, and powerful scanning and charting. The Premium plan costs $228/mo or $1999/year, adding precise trade signals, 3 AI bots, and auto trading.