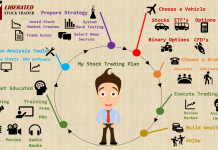

Creating a reliable stock trading strategy involves merging logic, expertise, experience, and data.

A trader’s approach to the market determines their success or failure. Thus, it is crucial to have a well-defined strategy in place before trading.

Your system will need to perform well, historically higher than 8% on average per year, and be expected to perform well in the future, at least for the time frame in which you plan to use it.

A trading system’s nirvana is that it must perform well and require little user interpretation to function. This could mean using trading robots or a mechanical method.

1. Understand The Elements of an Investing System

A good investing process will have the following important elements.

- A sound stock trading system will need to be backtested to prove that it worked in the past. This would prove that the logic on which we base our assumptions is functional.

- A good system allows us to trade with less emotion, providing a market advantage. Emotion is known to be the culprit of many trading errors and losses.

- Automation of the fundamental screening for the stocks will save us time.

- Automating the technical indicators scan will narrow the list and focus on our preferred candidates.

My thorough testing awarded TradingView a stellar 4.8 stars!

With powerful stock chart analysis, pattern recognition, screening, backtesting, and a 20+ million user community, it’s a game-changer for traders.

Whether you're trading in the US or internationally, TradingView is my top pick for its unmatched features and ease of use.

Explore TradingView – Your Gateway to Smarter Trading!

2. Build a Foundation of Knowledge

Take a high-quality stock market training course. This site has a FREE 10-module Stock Market Training Course covering fundamental and technical analysis. Read this Stock Market Training Review to help choose a quality education.

3. Decide if You Trade Short-Term or Invest Long-term

If you have the time to immerse yourself fully in the stock market, you might want to trade shorter timeframes (days to weeks). Day trading comes, of course, with its own set of higher risks. If you have a full-time job and less free time, you may want to trade longer timeframes and only monitor your stocks weekly.

Of course, there is no solid proof that day trading with higher risk yields better results than long-term investing.

4. Choose Your Stock Markets & Timezone

As an active trader, you should choose your Stock Markets wisely. If you want to be active (checking your stocks intra-day or daily), it may be wise to trade a stock market that is not in your time zone.

For example, Mr. Smith has a busy day job and only has time free in the evening. Mr. Smith is based in India. Typically, he would want to trade in the Indian Stock Market. But actually, the European Markets might be a good choice as they open close to the end of his working day. Therefore, he can focus on the stock market in question.

If you are a less longer-term investor, trading the stock market in your time zone might be wise. You may have the advantage of spotting successful companies in your country and investigating them further using your “Local Knowledge.”

5. Understand Your Profit Target

What is your target? Active traders should expect higher profits as they spend more time trading.

Less active traders might expect a slightly lower return as the trade-off for not being as focused. But what is a good target?

Do not believe the scam artists of “Penny Stocks Newsletters” and peddlers of “Microcap Stocks”; in the real world, 100% or 1000% profits are not realistic; in fact, it is irresponsible that they would promote their services in this way.

Warren Buffett has averaged just over 24% annual return over his career. That is only 2% per month. Realistically, choosing this as a viable upper target would be best.

6. Learn To Analyze Stocks

Technical analysis is critical for short-term trading and essential to understanding long-term value investing. Knowing where the company’s stock is relative to its history can illuminate.

There are two essential methods for analyzing a stock. Long-term investors use fundamental analysis of a company’s financial statements, such as earnings, sales, dividends, and future cash flow valuations. Stock Traders use technical analysis of stock charts, prices, patterns, and supply and demand using volume indicators.

What Chart should you use?

- Candlesticks

- Point and Figure Charting

- Ichimoku Cloud Charts

- Market Profile

- Heiken-Ashi (Recommended)

What indicators should you use?

- Price Indicators – the study of price-based chart indicators or oscillators known as Stochastics, Relative Strength (RSI), Rate of Change, Moving Averages, MACD, Parabolic SAR, ADX Average Direction Movement Index.

- Study of Volume – understanding how the volume level has a relationship with the price and how the price has a relationship with volume.

- Study of Price Volume Indicators – On Balance Volume (OBV) or Money Flow.

7. Select Your Investing Screening Strategy

Filtering stocks based on their financial performance may be an integral part of your strategy; here are highly relevant articles to help you get started.

Investing In Stocks Can Be Complicated, Stock Rover Makes It Easy.

Stock Rover is our #1 rated stock investing tool for:

★ Growth Investing - With industry Leading Research Reports ★

★ Value Investing - Find Value Stocks Using Warren Buffett's Strategies ★

★ Income Investing - Harvest Safe Regular Dividends from Stocks ★

"I have been researching and investing in stocks for 20 years! I now manage all my stock investments using Stock Rover." Barry D. Moore - Founder: LiberatedStockTrader.com

10 Best Stock Screeners of 2024: Tested by LiberatedStockTrader

8. Turn Your Choices Into Specific Rules

Quantify your choices of the fundamental screens and technical analysis screens.

At what point would you buy?

- When does the 10-day moving average cross the 20-day moving average and hold above the price for two days?

- When does the RSI hold above the RSI 5-day Moving Average for two days?

At what point do you sell?

- When MACD turns negative?

- When did you see a negative divergence in Money Flow?

9. Backtesting Your Rules

You can implement your rules using backtesting software and see if they work historically. This is a fascinating topic. Most Stock Market Analysis Software allows you to backtest your theories to see if they work historically, and some even allow you to do forecasting forward.

LiberatedStockTrader’s Guide to Backtesting Trading Strategies

The great thing about backtesting is that you can prove if indicators are meaningful. Does it work in the real world because someone tells you how to use MACD? You can find out with backtesting.

10. Let Your Rules Run & Start Investing.

Let your rules run for weeks or months to see if they continue to perform; tweak them as necessary. If you are confident in the results, move to the final phase.

If successful – Implement the system – If unsuccessful – tweak the system and start again from step 5.

If your rules are working, implement your system and start trading it. If not, you may need to refine the system. The best methods have been refined repeatedly to remove logical errors and improve the percentage of winning trades and the percentage of profit per trade.

Summary: A Great Stock Trading System

Building and running a trading system takes time, a logical mind, and patience. Many successful traders have started to make losses because they have deviated from their winning system or strategy through boredom. Try not to make the same mistake.

The results will be profits and plenty of them.

Now that you know the core elements of a sound investing system, look at the 9-Step Stock Market Investing Strategy with free books and videos.

Checklist: Stock Investing System Rules

| Investing System Rules Checklist | Long-term Investing Rules |

| Step 1. Build a Foundation of Knowledge | Free Training Pro Training |

| Step 2. Decide if You Trade Short-Term or Invest Long-term | Long-term Investing |

| Step 3. Choose Your Stock Markets & Timezone | USA, Europe, Asia |

| Step 4. Understand What Is Your Profit Target | > 10% per year |

| Step 5. Select Your Favorite Fundamental Screens & Strategy | CAN SLIM Value Investing Dividend Investing Growth Investing ETF Investing |

| Step 6. Select Your Software, Charts & Indicators | Stock Rover, Best Screening Strategies & Research |

| Step 7. Turn Your Choices Into Specific Rules | Buy on Stock Pullback Buy After Good Earnings Report Buy at the Start of the Year (Tax Harvesting) |

| Step 8. Backtesting Your Rules | Stock Rover BackTesting Article |

| Step 9. Let Your Rules Run. | Stay in the Market Long-Term 10-Year Period Sell Only if Market Dominance / Competitive Advantage is Diminished |

| Step 10. Start Investing/Trading | Choose a Broker Recommended USA – Firstrade $0 Commissions |

Checklist: Stock Trading System Rules

| Trading System Rules Checklist | Short-term Investing Rules |

| Step 1. Build a Foundation of Knowledge | Free Training Pro Training |

| Step 2. Decide if You Trade Short-Term or Invest Long-term | Short-term Investing Swing Trading – Weekly Day Trading – Daily |

| Step 3. Choose Your Stock Markets & Timezone | USA, Europe, Asia |

| Step 4. Understand What Is Your Profit Target | > 1% per day? |

| Step 5. Select Your Favorite Strategy | Trading The News Trading Leveraged ETFs |

| Step 6. Select Your Charts & Indicators | MetaStock for Backtesting TradingView for Trading & Social TC2000 for USA Trading from Charts |

| Step 7. Turn Your Choices Into Specific Rules | Break of 50 MA RSI Breakout MACD Cross Over Chart Patterns 10 Best Candlestick Patterns |

| Step 8. Backtesting Your Rules | Technical Rules Proven |

| Step 9. Let Your Rules Run. | Timeframe for Testing 5 Minute Chart Backtested 1 Year |

| Step 10. Start Investing/Trading | Choose a Broker Recommended USA – Firstrade $0 Commissions |

Creating the system of trading is news to myself.it makes perfect sense. Whats software would I use to create a good system and test it. Mostly interested in U.S stocks

Hi T.

good question, round 6 of our Stock Market Software Review for this year suggest if you want to systematize and backtest, you have 4 good choices.

https://www.liberatedstocktrader.com/top-10-best-stock-market-analysis-software-review/#systems

For Quant Automation, Quuantshre and Tradestation, for sheer number of “Expert Advisors” go metastock.

Admiring the commitment you put into your website and in depth information you provide.

It’s awesome to come across a blog every once in a while that isn’t the same unwanted rehashed material.

Fantastic read! I’ve bookmarked your site and I’m adding your RSS feeds

to my Google account.

great!!!!!!!!!!

I just logged in for the free course, and I did not expect it to be so well done. I am a beginner and this site has just what I need. Thanks Barry. Looks like I’ll also be taking the Pro Course.

I have to say that for the past couple of hours i have been hooked by the impressive articles on this website. Keep up the wonderful work.

hi there, looks like some great discussion going on here

You made some good points there. I did a search on the topic and found most individuals will approve with your website.

Wow man, I didn’t knew this, thankyou.