The double bottom is a technical analysis chart pattern traders use to identify potential buying opportunities in the stock market.

It is formed when a stock’s price reaches a low point, bounces back up, and then falls again to the same level before rebounding.

Decades of research reveal the double bottom pattern has an 88% success rate in bull markets and an average profit potential of +50%. The double-bottom chart pattern is one of the most reliable and accurate chart indicators in technical analysis.

Learn how to identify and trade the double bottom to improve your chances of trading success.

Key Takeaways

- A double bottom pattern looks like a “W”-shaped pattern.

- The double-bottom chart pattern is considered a reliable reversal point in the market.

- It has an 88% success rate in bull markets.

- Its average profit potential is +50%.

What Is a Double Bottom Chart Pattern?

The double bottom chart pattern is a technical analysis trading strategy in which the trader attempts to identify a reversal point in the market. Traders look for two consecutive low points separated by an intervening peak, creating a “W” shape on the price chart.

The double bottom chart pattern is considered a reliable reversal point in the market, with an 88% success rate in bull markets. When the price breaks above the intervening peak, it signals that buyers are beginning to take control of the market, and the trend could change from bearish to bullish.

Auto-detect this Chart Pattern with TradingView

Identifying a Double-Bottom

To identify a Double Bottom chart pattern, look for two distinct lows in the security’s price that form a “W”-shaped pattern. Generally, the pattern should be visible on an intraday and daily chart.

After identifying the two bottoms, look for a confirmation of a trend reversal by watching for a breakout either above the upper resistance line or below the lower support line. If the security price breaks out above the resistance line, it could signal that the security has completed its reversal.

In contrast, a break below the support line could signal a resumption of the downtrend. However, further confirmation of this stock chart pattern should not be relied upon until prices have moved beyond these levels.

Trading a Double Bottom

To trade double-bottom chart patterns, traders should look for a stock that has formed two consecutive low points with an intervening peak. Once the price breaks above the intervening peak neckline, the trader would enter long, with a stop loss set below the neckline. The target can be determined by measuring the height of the lows and setting the target at that distance above the neckline.

Traders should also consider volume when trading a double-bottom chart pattern. Higher volume on the breakout is often considered a confirmation of trend reversal in this setup (see above chart). Traders should be vigilant and wait for higher volumes before entering a trade on any breakout situation.

How Reliable is a Double Bottom Pattern?

A double-bottom stock chart pattern has an 88% success rate on a reversal of an existing downtrend. When the price breaks through resistance, it has an average 50% price increase.

The double bottom occurs when the security price hits the bottom twice, creating a “W”-shaped pattern. This pattern often indicates that the security’s price could soon increase. However, it should be noted that this indicator does not guarantee a reversal in direction.

| Chart Pattern | Success Rate | Average Price Change |

| Double Bottom | 88% | 50% |

Trading Timeframe

Double bottoms can form on any timeframe, from intraday to weekly charts. The most reliable timeframe is on a daily chart that spans multiple months. Intraday timeframes are less reliable because large block trades by institutions can disrupt the pattern.

The Double Bottom pattern typically takes weeks or even months to form. Traders should monitor the stock over a long-term period on a daily chart and be prepared to enter at any time to maximize potential profits.

It can be helpful to use trend lines or other technical indicators, such as moving averages or RSI, to identify the double bottom pattern.

Entry and Exit Points

The entry point for a Double Bottom pattern is at the break of resistance after the second bottom. Traders should place a stop-loss order below the lower low to protect against potential losses. The exit point can be determined by placing an initial target near the resistance level/neckline and then trailing stops behind it until the trend reverses.

It is also important to remember that double bottoms can fail at a rate of 11%, and traders should always have an exit strategy in case of a failed pattern. Furthermore, managing risk during any trade is essential, as the potential for loss is still real. Using proper risk management techniques, traders can maximize profits while limiting losses.

What Happens After Double Bottom Pattern?

Two decades of research by Tom Bulkowski show that after a double bottom pattern is confirmed on a break of the neckline at a higher volume, the price increase averages +50%.

Once the double bottom pattern is confirmed, traders should consider opening a long position near the support area and placing a stop-loss order below the lower low. This will help them better manage their risk as they enter a potential trade.

What Happens with a Failed Double Bottom Pattern?

A double bottom in a bull market fails 12% of the time. When a double-bottom pattern fails, the stock price falls below the support area and continues to decline. This can be used as an opportunity for traders to short-sell or place stop-loss orders at the support level. Proper risk management is essential when attempting to capitalize on failed patterns to limit losses.

My thorough testing awarded TradingView a stellar 4.8 stars!

With powerful stock chart analysis, pattern recognition, screening, backtesting, and a 20+ million user community, it’s a game-changer for traders.

Whether you're trading in the US or internationally, TradingView is my top pick for its unmatched features and ease of use.

Explore TradingView – Your Gateway to Smarter Trading!

Double Bottom Pattern Breakout

When the double bottom is successful, the price breaks out of the support area and continues to rise. This can create a great opportunity for traders to capitalize on the potential gains while limiting losses by placing a stop-loss order above the lower high.

A Double Bottom Uptrend

The double bottom can also form within an existing uptrend. This is usually a sign of strength and often results in the continuation of the uptrend. Traders should be aware that this pattern may provide false signals, as it does not guarantee that the trend will continue, and prices could reverse at any time.

Measuring the Price Target

If the distance from the trough to the neckline is 8%, the logical price target should be 8% above the neckline. It is calculated by adding the pattern’s height to the breakout point. This gives traders a good indication of where to expect prices to move following a successful breakout. Once the double bottom breakout is confirmed, traders should set their stop-loss order below the neckline.

In the chart above, you can see the height/depth of the double bottom is equal to the price target.

How to Automatically Identify Double Bottoms?

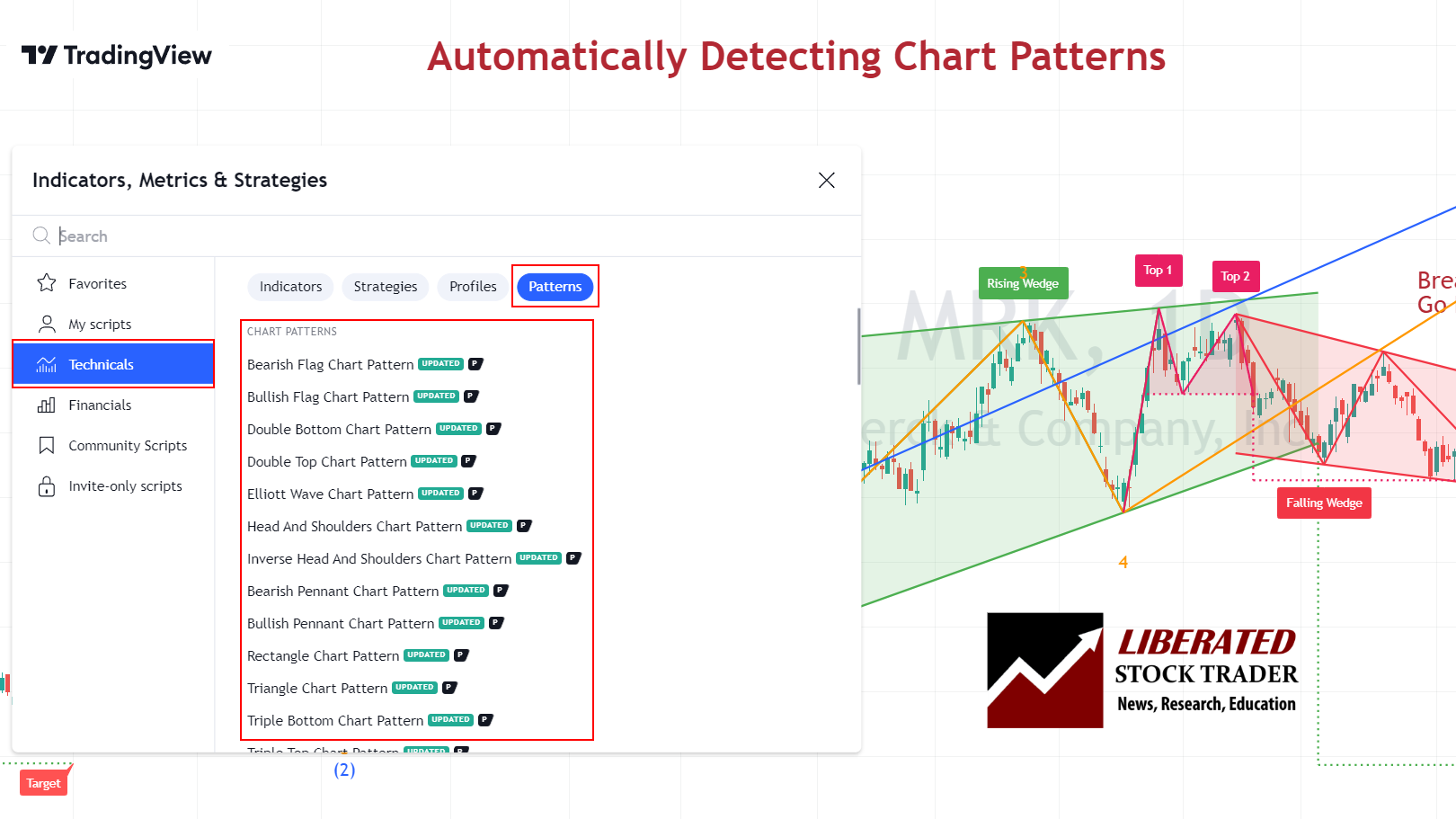

You can automatically identify double bottom patterns using TradingView. Go to TradingView and click Indicators > Technicals > Patterns. Next, select Double Bottom Chart Pattern. Now, a chart with a double bottom pattern will be clearly marked.

Double Bottom Pattern Rules

- The double bottom pattern usually appears after a downtrend and is seen as a sign that the trend is reversing.

- There must be two distinct bottoms with almost equal low price points within 4%.

- The distance between the two lows should not exceed a 10% variation in price.

- The peak between the two lows should be at least 10% higher than the second low.

- After the second bottom, volume must increase, and a break above the peak between the two bottoms is considered a buy signal.

- When trading with double-bottom patterns, traders should set their stop loss below the neckline.

The Best Double-Bottom Pattern Scanners

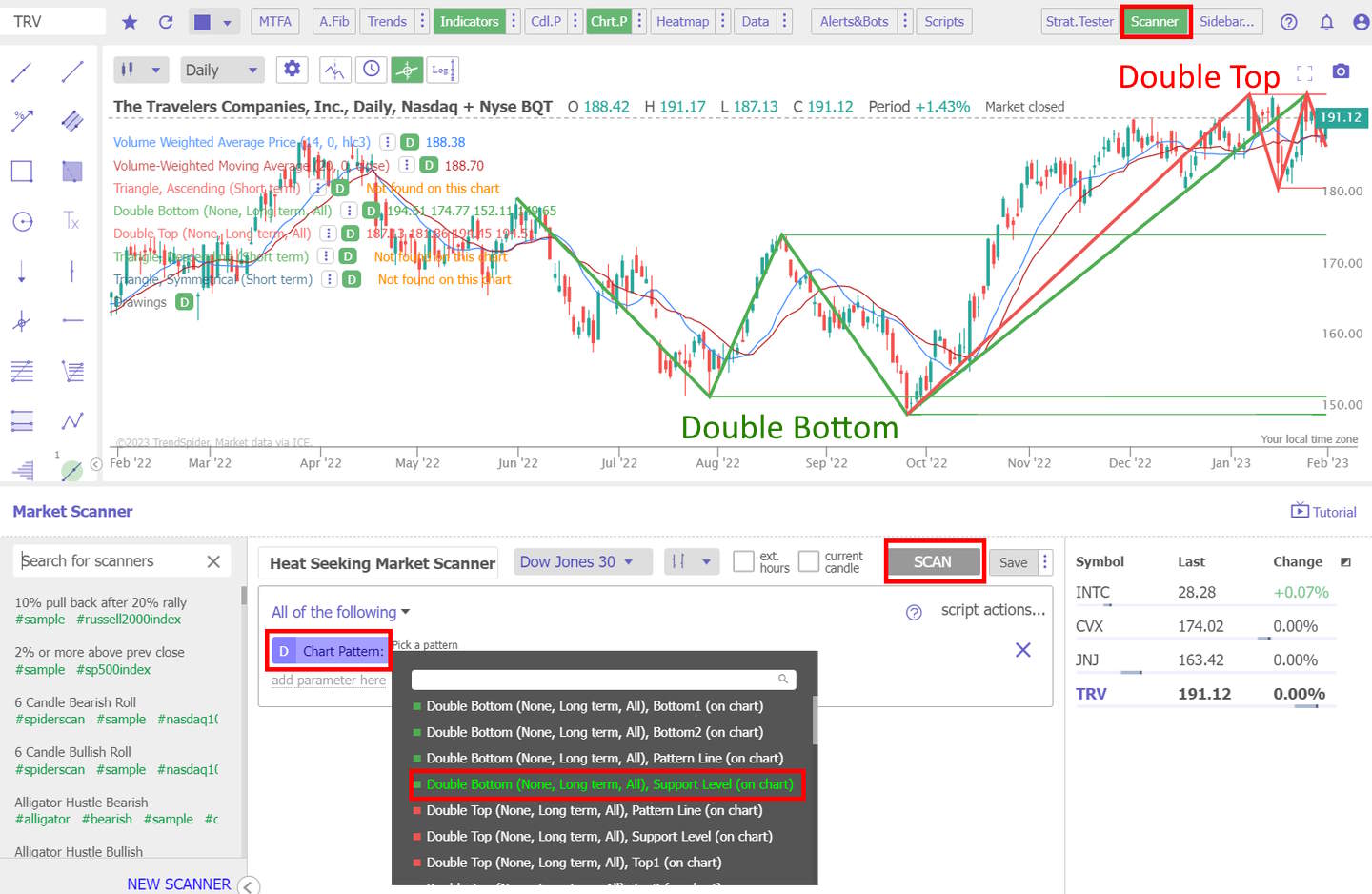

There are currently two trading platforms offering double-bottom scanning/screening. TrendSpider and FinViz enable entire market scanning for double bottoms. Finviz is a good free pattern scanner, whereas TrendSpider enables full backtesting, scanning, and strategy testing for chart patterns.

TrendSpider Double Bottom Scanning in Action

Scanning for double-bottom patterns with TrendSpider is easy. Visit TrendSpider, select Market Scanner > All of the Following >Chart Pattern > Double Bottom > Scan. You will be presented with a list of stocks with double-bottom patterns.

Scan for this Chart Pattern with TrendSpider

TrendSpider is excellent for scanning for Double Bottom Patterns, one of the most reliable patterns in technical analysis, with an 88% success rate. https://t.co/uvXIrVJE5f . @TrendSpider Can we have H&S patterns next? #stocks

— LiberatedStockTrader (@libstocktrader) April 11, 2023

Using AI-Driven Technical Analysis with Double Bottom Patterns

One of the major benefits of using AI-driven technical analysis tools like TrendSpider is the ability to backtest historical data. This allows traders to compare the performance of their strategy over different periods and markets.

With TrendSpider, you can go back in time to find stocks exhibiting double bottom patterns and then use the platform’s advanced analytics tools to analyze how effective this pattern was for trading at any given time. TrendSpider’s AI-driven algorithms also help traders identify the most reliable entry and exit points for double-bottom patterns. This feature can help you maximize your profits from trading this pattern.

By combining AI-driven technical analysis with traditional charting methods, TrendSpider helps traders take full advantage of market opportunities presented by the double-bottom pattern. With features such as automated alerts, backtesting, and real-time market data, you can quickly spot and take advantage of double-bottom patterns as they emerge.

In addition, its interactive charts allow traders to analyze various aspects of the pattern without manually drawing each line onto the chart. This is a great way to save time.

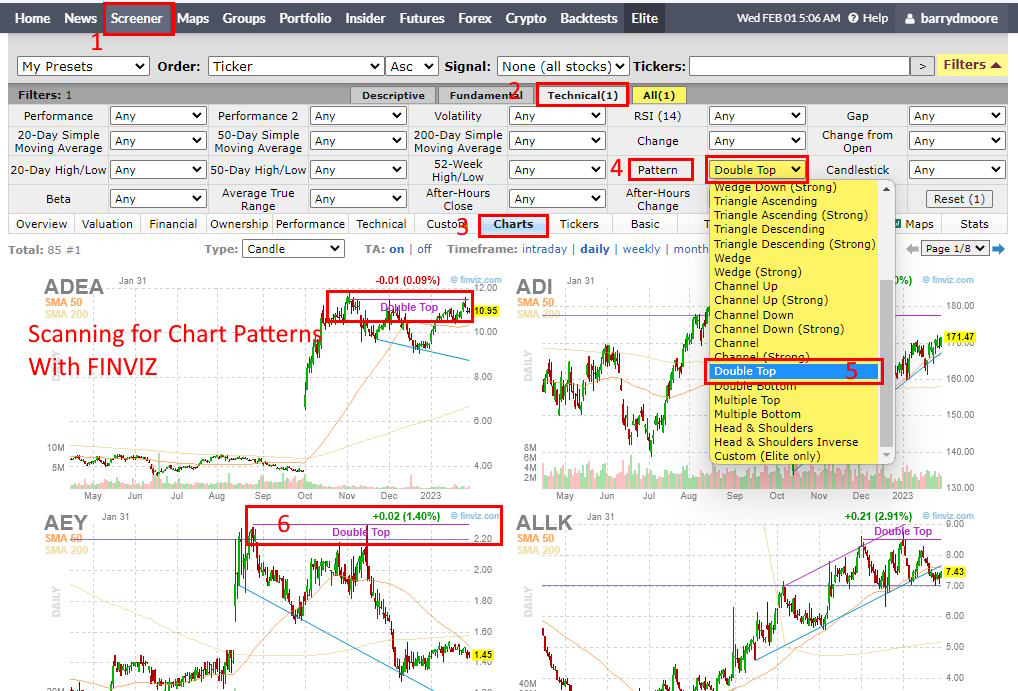

Find Double Bottom Stocks Free with Finviz

FinViz has a great feature for scanning double-bottom patterns. By selecting “Double Bottom/Double Top” as your scan criteria, you can easily find stocks exhibiting this pattern. This is especially useful to traders who want to monitor potential trading opportunities.

Scan for this Chart Pattern with FinViz

The first step to finding stocks with potential double-bottom patterns is to select a set of criteria. Finviz offers a range of pre-defined filters and sorting options, enabling traders to quickly narrow their search by sector, industry, market capitalization, and more. After selecting the desired criteria, traders can apply the filter to the Finviz screener.

Once the filter has been applied, traders can view the results on a chart interface. Depending on the complexity of their search criteria, several stocks may meet the criteria and appear to have potential double-bottom patterns. By clicking on each stock name, traders can open a chart.

- Related Article: Triple Bottom Pattern: Trading an 87% Success Rate

FAQ

Is a Double Bottom Pattern Bearish?

The Double Bottom is not bearish; it is considered a bullish signal in a bull market. It signals with an 88 percent accuracy that the current downward trend may be coming to an end and could reverse into an upward trend soon.

Why Do Some Double Bottom Patterns Delay at the Neckline?

Double bottom Patterns can delay at the neckline because traders who had expected the trend to continue down are now taking profits, causing an increase in selling pressure. This causes the price to remain range-bound until new buyers enter and push prices higher.

Is a Double Bottom Pattern Bullish Or Bearish?

A Double Bottom Pattern is a proven bullish signal in a bull market. It signals with an 88 percent accuracy that the current downward trend may be coming to an end and could reverse into an upward trend soon.

What Are The Benefits of Trading The Double Bottom Pattern?

Trading the Double Bottom Pattern offers traders several advantages over other trading strategies. These include a high degree of accuracy and the potential to generate both short-term and long-term profits. This pattern is relatively easy to identify as it usually involves two consecutive lows at approximately the same price level. This makes it an ideal trading strategy for those just starting trading.

What Are The Risks of Trading The Double Bottom Pattern?

As with any trading strategy, there are risks associated with trading the Double Bottom Pattern. These include the 12 percent potential for false signals, which can cause significant losses if not managed properly. Additionally, a trader should have some knowledge in identifying support and resistance levels to determine when to enter a trade or exit one quickly.

What are Adam And Eve Double Bottom Patterns?

Adam and Eve double bottoms, discovered by Tom Bulkowski, are similar to the traditional double bottom pattern with small differences. The Adam Double Bottom has a V-shaped curve in the center. The Eve Double Bottom has a more rounded curve at the bottom of the trend. However, the outcome of both Adam and Eve bottoms are similar.

What is the success rate of double bottom patterns?

The success rate of double bottom patterns is approximately 88 percent. This means a trader has an 8 out of 10 chance of making a profitable trade with the pattern. However, traders should keep in mind that there is still a 12 percent false signal risk associated with this strategy.

Is a double bottom pattern good?

A double bottom pattern is an exceedingly good signal for traders. It provides an easy and accurate way to identify potential buying opportunities creating high-probability trades. Tom Bulkowski's research confirms an accuracy of 88 percent for double bottom patterns with an average profit potential of 50%.

How do you master a double bottom pattern?

The key to mastering double bottom patterns is practice. Start by studying a double bottom pattern from various time frames, analyze the volume involved with each move, and compare it to prior moves to identify potential breakouts. Alternatively, use AI pattern recognition to find double bottoms for you.

Can double bottom fail?

Double bottoms fail approximately 12% of the time during a bull market. Therefore, it's important to understand the risks associated with this strategy. Always use stop losses and take profits when trading a double bottom pattern to minimize risk and maximize profit potential.

What is the psychology behind the double bottom pattern?

The double bottom pattern is a reflection of sentiment. When the market is bearish, investors hesitate to buy stocks at their current prices, resulting in lower volume and slower price movements. Once sentiment improves and buyers outnumber sellers, volume increases, and prices rise. This is why double bottoms often offer an average profit potential of 50%.

Is a triple bottom better than a double bottom?

Testing has proven that a double bottom is slightly better than a triple bottom pattern. The triple bottom is an excellent chart pattern with a success rate of 87 percent versus the double bottom's 88 percent. Also, a triple bottom average gain is +45 percent versus the double bottom of +50 percent.

How long does a double bottom take?

A reliable double bottom usually takes two to three months to form on a daily chart, but it can take as long as six months. It's important to closely follow the stock during this time frame and wait for confirmation that the second trough has formed before entering a trade.

What is the opposite of double bottom?

The opposite of a double bottom is a double top. A double top often occurs after an uptrend, indicating that the momentum has reversed and it's time to sell. The double bottom and double top are considered reversal patterns in technical analysis. They take two to three months to form on a daily chart, but the average gain for a double top is usually lower than that of a double bottom.

How reliable is a double bottom pattern?

The double bottom pattern is among the most reliable chart indicators, with success rates of 88 percent during a bull market. During a bear market, double bottoms are much less reliable.

How to identify double bottom patterns?

Double bottom patterns can be identified automatically with TradingView or FinViz. Alternatively, you can manually identify it by looking for two price lows over a period of weeks.

How to measure a double bottom pattern?

TradingView can automatically measure a double bottom pattern to set a price target. Alternatively, to measure manually, use an arithmetic chart and plot the distance between the neckline and the bottom. This distance will be the future price target which you should annotate on the chart.

What is a flawed double bottom pattern?

A flawed double bottom pattern is a bullish reversal pattern that doesn't meet all of the criteria for a normal double bottom pattern. Typically, it occurs when the bottoms do not have an equal low or no clear neckline breakout.