The descending triangle is a technical analysis pattern that signals a potential trend reversal. It is formed by drawing a horizontal line at the previous lows and connecting it with an upper descending resistance trendline.

Most traders do not realize how reliable the descending triangle is. It has been proven to be an accurate predictor of future price movements.

Twenty years of trading research show the descending triangle pattern has an 87% success rate in bull markets and an average profit potential of +38%.

I will show you the techniques to harness this pattern’s reliability and accuracy to improve your trading.

Discover how to recognize and capitalize on the descending triangle pattern to enhance your trading success potential.

Key Takeaways

- The descending triangle pattern in stock charts boasts an impressive 87% success rate when breaking out to the upside.

- There is an average price surge of 38% upon breaching resistance levels.

- After a downtrend, the pattern shows a 79% success rate and an average price decrease of 16%.

- The descending triangle has a horizontal support line and a declining slope resistance line.

- If the price breaks out of the triangle in the direction of the previous trend, it is a continuation pattern.

- If the price breaks out of the triangle in the opposite direction of the previous trend, it is a reversal pattern.

What Is a Descending Triangle Chart Pattern?

A descending triangle is a powerful technical analysis pattern with a predictive accuracy of 87%. The pattern is flexible, can break out up or down, and is a continuation or reversal pattern.

A descending triangle has one declining trendline that connects a series of lower highs and a second horizontal trendline that connects a series of lows. A descending triangle can be bearish or bullish or a reversal or continuation pattern, depending on the direction of the price breakout.

- A descending triangle occurring during a price uptrend, with a price breakout above the resistance line, is considered a bullish continuation pattern.

- Conversely, a descending triangle occurring during a price downtrend, with the price breaking out above the resistance line, is considered a reversal pattern.

Descending Triangle Chart

TradingView’s powerful pattern recognition algorithms have autodetected this descending triangle pattern. Notice how the bottom support line is not entirely horizontal because there is an element of forgiveness, and not all descending triangles are perfect.

Auto-detect this Chart Pattern with TradingView

What the Descending Triangle Indicates

The descending triangle chart pattern occurs when sellers are in control, but buyers are not willing to let the trend continue lower without putting up some resistance. As buyers become more active and force prices to stay near the same level, the support line begins to flatten out. Eventually, a breakout occurs in either direction, signaling a reversal or continuation of the trend.

The descending triangle chart pattern is considered a reliable continuation or reversal point in the market. It has an 87% success rate on an upward breakout in bull markets. This is because when the price breaks out above the triangle, buyers begin to take control of the market.

Identifying a Descending Triangle

Look for a horizontal base and lower highs to identify a descending triangle chart pattern. The pattern should generally be visible on an intraday and daily chart. Descending triangles occur more frequently on 15-minute and hourly charts.

My thorough testing awarded TradingView a stellar 4.8 stars!

With powerful stock chart analysis, pattern recognition, screening, backtesting, and a 20+ million user community, it’s a game-changer for traders.

Whether you're trading in the US or internationally, TradingView is my top pick for its unmatched features and ease of use.

Explore TradingView – Your Gateway to Smarter Trading!

After identifying the triangle, look for a trend reversal or continuation confirmation by watching for a breakout either up or down out of the triangle. If the security price breaks out above the triangle resistance, especially with volume increases, it signals a potential 87% chance of going higher.

How Reliable is a Descending Triangle?

A descending triangle stock chart pattern has an 87% success rate on an upside breakout of an existing uptrend. When the price breaks through resistance, it has an average 38% price increase. Following a downtrend, the pattern is 79% successful, with an average price decrease of 16%.

| Chart Pattern | Success Rate | Average Price Change |

| Descending Triangle | 87% | +38% |

It should be noted that this pattern does not guarantee a reversal in direction.

Trading a Descending Triangle

When trading a descending triangle chart pattern, be prepared to trade in the direction of the price breakout. Waiting for at least three consecutive candles before entering the trade is important.

When trading this chart pattern, it is important to set your stop loss inside the triangle pattern and adjust your target level based on the breakdown size. You can expect a target of 50% up to 100% of the distance from the entry point to the triangle resistance line.

Traders should pay attention to volume when trading a descending triangle chart pattern. Higher volume on the breakout is often considered a confirmation of trend reversal in this setup (see above chart). This means traders should be vigilant and wait for higher volumes before entering a trade on any breakout situation.

Descending Triangle Entry and Exit Points

The entry point for a descending triangle pattern is at the price breakout of the triangle, either up or down. Traders should place a stop-loss order below or above the breakout to protect against potential losses. The exit point can be determined by placing an initial target at 50% of the triangle’s height. (See Chart Above)

It is also important to remember that descending triangles can fail at a rate of 13%, and traders should always have an exit strategy in case of a failed pattern. Furthermore, managing risk during any trade is essential, as the potential for loss is still real. Using proper risk management techniques, traders can maximize profits while limiting losses.

Descending Triangle Timeframe

Descending triangles can form in any timeframe but occur more frequently in hourly charts. A clean descending triangle is relatively rare, mostly found on intraday charts, 5, 15, or 60-minute time frames. This makes the descending triangle a great pattern for day traders.

Even on an hourly time frame, a descending triangle pattern typically takes weeks to form. Traders should monitor the stock over a medium-term period on an hourly or daily chart and be prepared to enter at any time to maximize potential profits.

It is important to consider volume as an additional indicator when attempting to identify and trade the descending triangle pattern.

What Happens After a Descending Triangle Forms?

Two decades of research by Tom Bulkowski show that after a descending triangle pattern is confirmed on a break of either the support or resistance line on higher volume, the price increase averages +38%.

Once the descending triangle pattern is confirmed, traders should consider opening a long or short position depending on the direction of the price move.

What Happens if it Fails?

A descending triangle in a bull market fails 13% of the time. When a descending triangle pattern fails, the stock price fails to achieve the price target. At this point, it makes sense to discard the pattern.

A Descending Triangle Pattern in an Uptrend

The descending triangle often forms within an existing uptrend in a bull market. This is usually a sign of strength and often results in the continuation of the uptrend. Traders should be aware that this pattern may provide false signals, as it does not guarantee that the trend will continue, and prices could reverse at any time.

Seting Price Targets

If the distance from the triangle peak to the horizontal support is 10%, the logical price target should be 10% above the breakout. It is calculated by adding the pattern’s height to the breakout point. This gives traders a good indication of where to expect prices to move following a successful breakout. Once the descending triangle breakout is confirmed, traders should set their stop-loss order just below the breakout zone.

In the chart above, the height/depth of the descending triangle is equal to the price target.

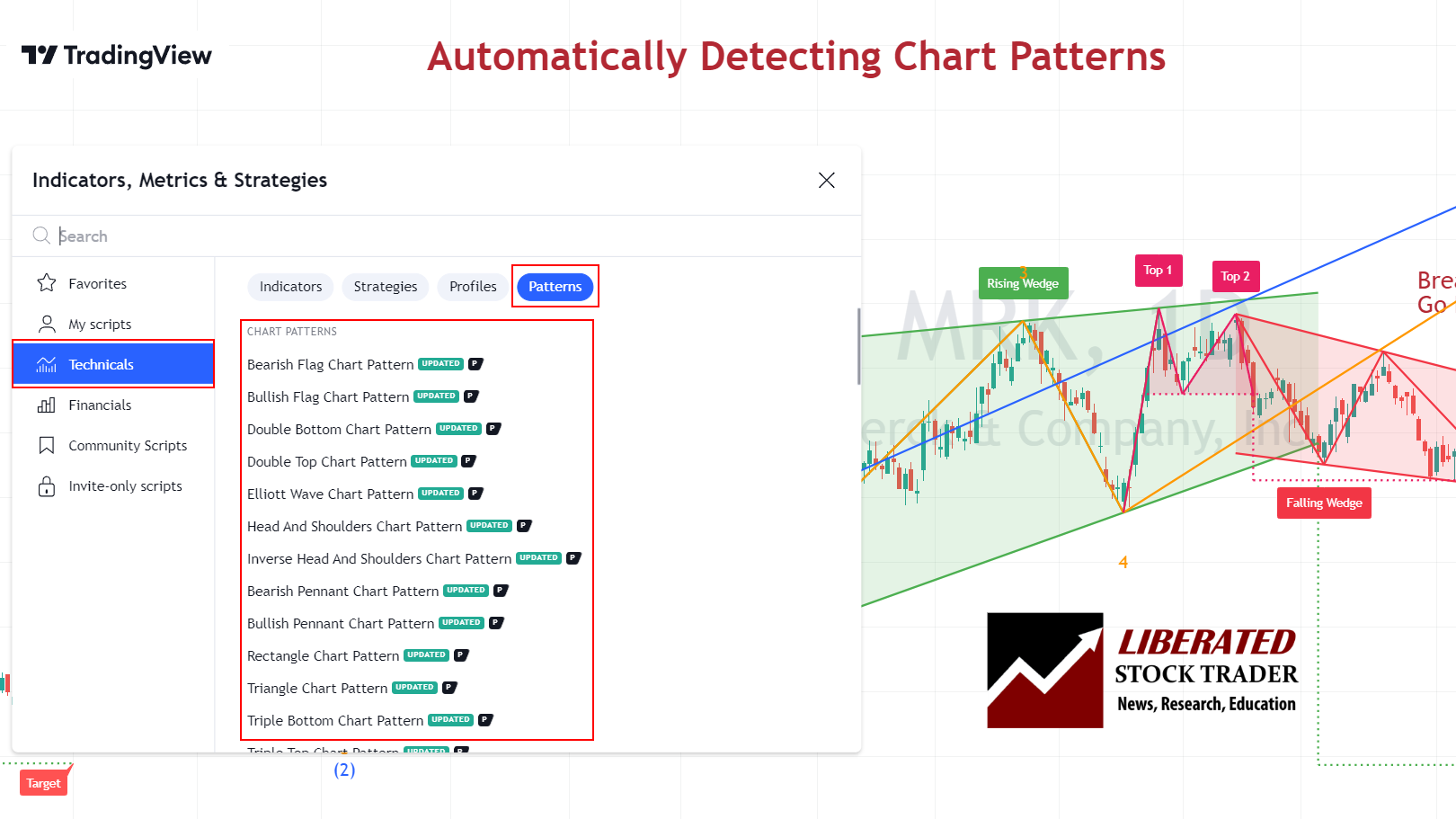

Automatically Identifying Descending Triangles

You can automatically identify descending triangle patterns using TradingView. Go to TradingView and click Indicators > Technicals > Patterns. Next, select Descending Triangle Chart Pattern. Now, a chart with a descending triangle pattern will be clearly marked.

Descending Triangles Rules

- The descending triangle pattern can appear anytime during bull or bear markets.

- There must be five distinct touches on the inside of the triangle.

- The support line should be horizontal with almost equal low price points within 4%.

- Price can break out higher or lower.

- When trading with descending triangle patterns, traders should set their stop loss below the breakout line.

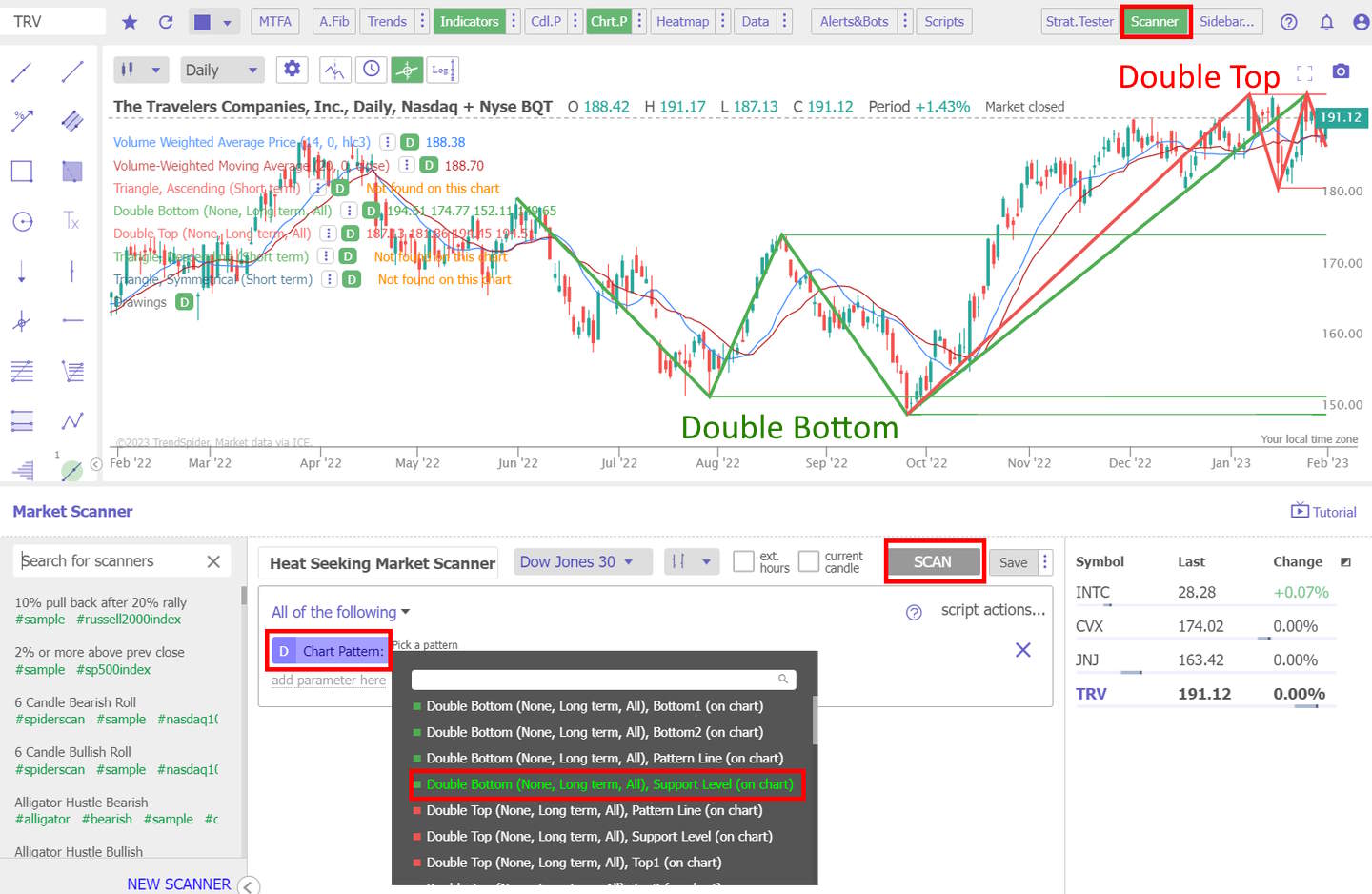

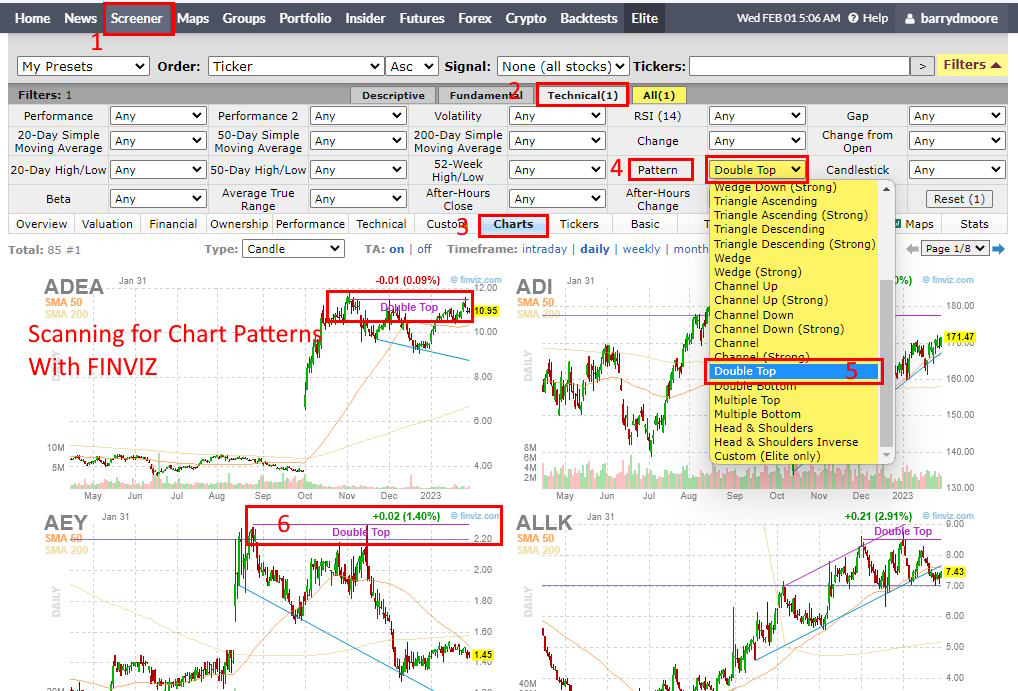

Descending Triangle Pattern Scanners

There are currently two trading platforms offering descending triangle scanning and screening. TrendSpider and FinViz enable complete market scanning for descending triangles. Finviz is a good free pattern scanner, whereas TrendSpider enables full backtesting, scanning, and strategy testing for chart patterns.

TrendSpider Descending Triangle Scanning

Scanning for descending triangle patterns with TrendSpider is easy. Visit TrendSpider, select Market Scanner > All of the Following >Chart Pattern > Triangle, Descending > Scan, and you will be presented with a list of stocks with descending triangle patterns.

Scan for this Chart Pattern with TrendSpider

Using AI-Driven Technical Analysis with Descending Triangle Patterns

One of the major benefits of using AI-driven technical analysis tools like TrendSpider is the ability to backtest historical data. This allows traders to compare the performance of their strategy over different periods and markets. With TrendSpider, you can go back in time to find stocks exhibiting descending triangle patterns and then use the platform’s advanced analytics tools to analyze how effective this pattern was for trading at any given time. TrendSpider’s AI-driven algorithms also help traders identify the most reliable entry and exit points for descending triangle patterns.

By combining AI-driven technical analysis with traditional charting methods, TrendSpider helps traders take full advantage of market opportunities presented by the descending triangle pattern. With features such as automated alerts, backtesting, and real-time market data, you can quickly spot and take advantage of descending triangle patterns as they emerge.

Find Descending Triangle Patterns with Finviz

FinViz has a great feature for scanning for descending triangle patterns. By selecting “Descending Triangle” as your scan criteria, you can easily find stocks exhibiting this pattern. This is especially useful to traders who want to monitor potential trading opportunities.

Scan for this Chart Pattern with FinViz

The first step to finding stocks with potential descending triangle patterns is to select a set of criteria. FinViz offers a range of pre-defined filters and sorting options, enabling traders to quickly narrow their search by sector, industry, market capitalization, and more. After selecting the desired criteria, traders can apply the filter to the Finviz screener.

Once the filter has been applied, traders can then view the results on a chart interface. Depending on the complexity of their search criteria, several stocks may meet the criteria and appear to have potential descending triangle patterns. By clicking on each stock name, traders can open up a chart.

FAQ

How accurate is a descending triangle pattern?

Descending triangle patterns are 87% accurate as an uptrend continuation pattern in a bull market. The accuracy changes if in a bear market and if the pattern acts as a continuation or a reversal pattern. Consult Tom Bulkowski's book, The Encyclopedia of chart patterns, for details.

Why is a descending triangle bearish?

A descending triangle is bearish when it occurs in a bear market during a price downtrend. In this case, the pattern acts as a continuation pattern. When formed in an uptrend during a bull market, it can be either bullish or bearish, resulting in a reversal or continuation of the trend. It all depends on how the stock responds when the price reaches support.

How do you play descending triangles?

The descending triangle is most commonly played as a bearish strategy because of its common occurrence in a bear market. Traders can wait for the price to reach support, then initiate short positions on the break below the triangle. If, however, price action is bullish when it reaches support and breaks out above the triangle, traders might consider initiating long positions instead.

Can a descending triangle be bullish?

Yes, a descending triangle can be bullish. When formed in an uptrend during a bull market, it can result in either a reversal or continuation of the trend. To determine which way the price will go, traders should watch how the stock responds when it reaches support and breaks out above or below the triangle.

Is a descending triangle good or bad?

A descending triangle is neither good nor bad; it depends on the context. When a descending triangle is formed during a bear market, it typically signals a continuation of the downtrend. It usually signals a continuation if it is formed in an uptrend during a bull market. Traders should watch how the stock responds when it reaches support and breaks out above or below the triangle to determine whether they should enter long or short positions.

What is the success rate of a descending triangle?

According to Tom Bulkowski's research, the success rate of a descending triangle is an 87 percent chance of a 38 percent price increase in a bull market on a continuation of an uptrend.

How do you target stop loss in descending triangle patterns?

Traders should set the approximate target stop loss level in a descending triangle at the point above or below the breakout of the triangle. The exact percentage stop loss depends on the price target expectations and the timeframe.

What are the benefits of trading descending triangles?

The primary benefit of trading descending triangles is the high success rate for a price move. Additionally, traders can easily identify and measure the risk/reward ratio of their trade. Descending triangles also help to reduce emotion from trading decisions by creating clear entry and exit points.

What are the risks of trading a descending triangle?

The biggest risk of trading a descending triangle is that the price may not break out in the direction predicted. This could result in losses if an incorrect position is taken and insufficient stop loss orders are placed.

Can descending triangle fail?

Descending triangles fail approximately 13% of the time during a bull market. Therefore, it's important to understand the risks associated with this strategy. Always use stop losses and take profits when trading patterns to minimize risk and maximize profit potential.

What is the psychology behind descending triangles?

The descending triangle pattern reflects sentiment and the battle between supply and demand. When the market is bearish, investors hesitate to buy stocks at their current prices, resulting in lower volume and slower price movements. Once sentiment improves and buyers outnumber sellers, volume increases, and prices rise. This is why descending triangles offer an average profit potential of 38%.

How reliable is a descending triangle pattern?

The descending triangle pattern is a reliable chart indicator, with success rates of 87 percent during a bull market on an upward breakout. During a bear market in an uptrending price, descending triangles are much less reliable.

Do descending triangles hold?

Yes, descending triangle patterns hold 87 percent of the time, according to decades of research compiled by Tom Bulkowski in his book The Encyclopedia of Chart patterns.

How to identify descending triangles?

Descending triangle patterns can be identified automatically with TradingView or TrendSpider. Alternatively, you can manually identify it by looking for a triangle with a horizontal support line that forms over weeks.

How to measure a descending triangle pattern?

TradingView can automatically measure a descending triangle pattern to set a price target. Alternatively, to measure manually, use an arithmetic chart and plot the distance between the triangle's apex and base. This distance will be the future price target which you should annotate on the chart.