Developed by Bill Williams, the Alligator Indicator uses a combination of moving averages to help traders identify market trends and potential entry and exit points.

Many experienced traders ask, “Is the Alligator indicator profitable and worth trading?”

My first thoughts were that this indicator is simply a set of moving averages, and my research shows that moving averages do not perform well in trading. However, after detailed analysis, I hold the following to be true.

My unique research shows that the Alligator indicator is highly profitable in stocks and indices, using daily and weekly chart timeframes. It is also only profitable on a weekly chart for Forex.

Key Takeaways

- The Alligator Indicator helps traders identify market trends.

- It revolves around three smoothed moving averages that represent the jaw, teeth, and lips of the Alligator.

- When these lines converge, the Alligator is perceived to be sleeping, indicating a lack of significant market movement.

- Conversely, when the lines diverge, the Alligator wakes up, signaling a trending market.

- The Alligator is incredibly profitable on weekly stock charts.

Understanding the Alligator Indicator

The Alligator Indicator combines the distinct visual elements of its jaw, teeth, and lips to provide clear and actionable insights. It uses the alligator’s anatomy to symbolize key aspects of market behavior, with each component offering specific information essential for traders.

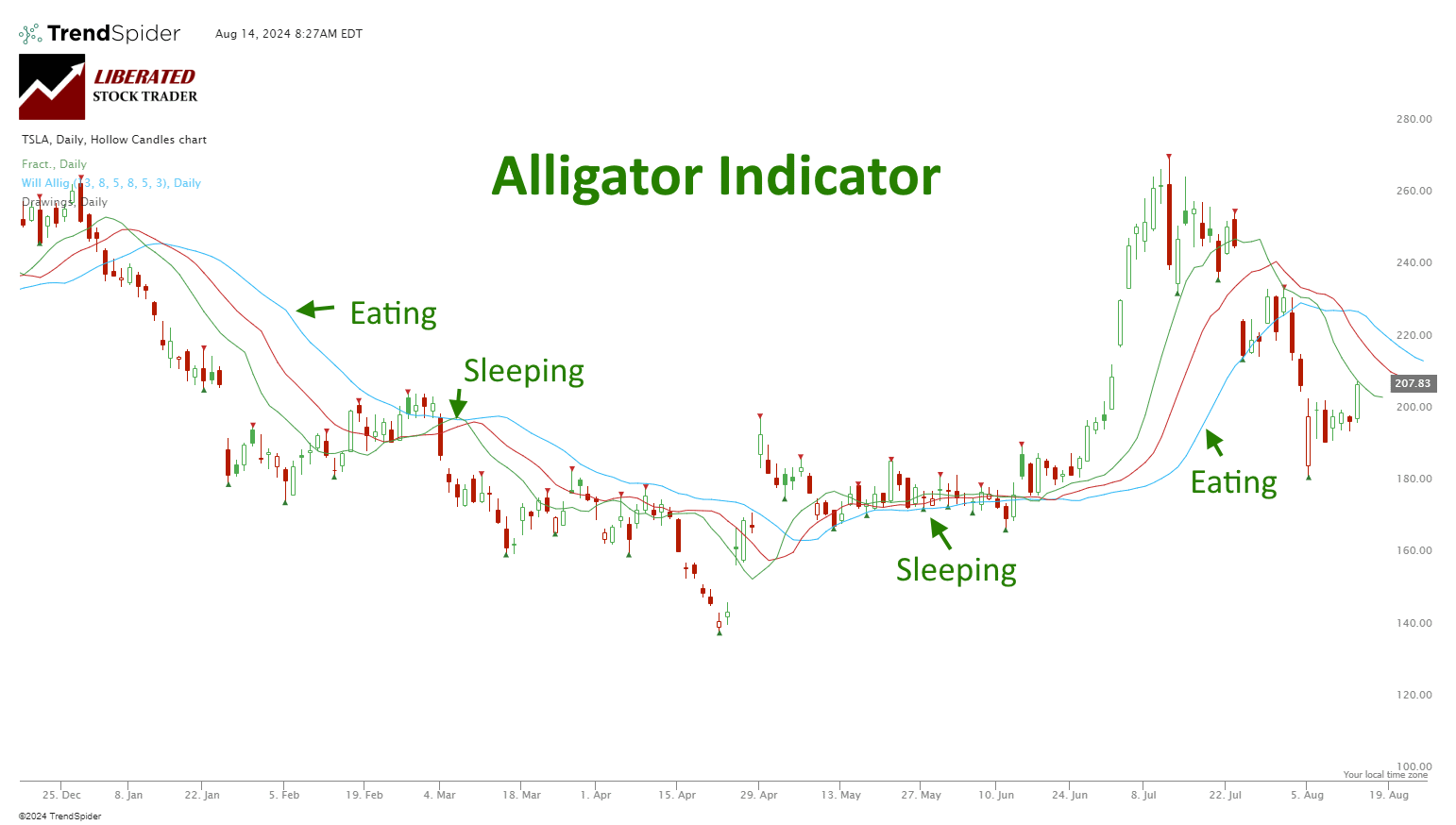

Sleeping & Awake

The Alligator’s anatomy is central to the indicator’s design. The Alligator represents market trends, where the state of the Alligator (sleeping or awake) signifies market activity.

Sleeping Alligator: Indicates low market volatility or sideways trends.

Awake Alligator: Indicates high market activity or trending markets.

This use of symbolism helps traders quickly understand market conditions based on the Alligator’s behavior.

Understanding Jaw, Teeth, and Lips

Each component (jaw, teeth, and lips) serves a different role in the indicator:

- Jaw (Blue line): This line represents long-term trends. When it is above others, it signals a strong bullish trend.

- Teeth (Red line): Indicates intermediate trends and reacts faster than the jaw.

- Lips (Green line): The most responsive of the three, indicating short-term trends and faster market movements.

When the jaw, teeth, and lips are intertwined, the market is considered to be in a low-volatility phase. When the lines spread apart, it indicates the market is trending, and the Alligator is awake. Using these three components allows traders to distinguish between different market conditions and adjust their strategies accordingly.

Alligator Indicator Configuration

The Alligator Indicator consists of three smoothed moving averages, often referred to in terms of the Alligator’s jaw, lips, and teeth.

- Jaw (Blue line): 13-period moving average smoothed by 8-bar values.

- Teeth (Red line): 8-period moving average smoothed by 5-bar values.

- Lips (Green line): 5-period moving average smoothed by 3-bar values.

Alligator Indicator in Market Analysis

The Alligator Indicator is a popular tool in technical analysis. It is used to identify market trends, define trading signals, and locate support and resistance levels. This section breaks down its key applications.

Identifying Market Trends

The Alligator Indicator consists of three smoothed moving averages: the Jaw, Teeth, and Lips. These lines help traders differentiate between trending and choppy markets. In an uptrend, the Alligator’s Lips (green line) stay above the Teeth (red line) and Jaw (blue line). During a downtrend, the sequence is inverted.

When these lines spread apart, they highlight trending periods, indicating a strong market trend. Conversely, when they intertwine closely, they suggest a lack of trend, signaling choppy market conditions.

Trading Signals and Interpretation

Traders use the Alligator Indicator to generate buy and sell signals. A buy signal occurs when the Lips cross above the Teeth and Jaw, indicating the beginning of an uptrend. Conversely, a sell signal emerges when the Lips cross below the Teeth and Jaw, suggesting a downtrend onset.

Market psychology plays a crucial role as the indicator visualizes market sentiment. For instance, the prolonged spreading of the lines confirms a sustained trend, allowing traders to maintain positions. Quick convergence of the lines signals potential trend exhaustion, prompting traders to reconsider their positions.

Support and Resistance

The Alligator Indicator helps identify support and resistance levels. Support occurs when the price chart stabilizes near the Alligator’s Jaw during a downtrend, while resistance is marked when prices stabilize near the jaw in an uptrend.

In the case of market breakouts, the indicator’s alignment can signal impending price movements. A breakout above the Lips can imply strong buying interest, while a breakout below suggests heightened selling pressure. These levels are significant for traders when setting stop-loss orders and planning entry and exit points.

Using the Alligator Indicator, traders in both forex and individual securities markets can gain clearer insights into market dynamics and price behavior.

Backtesting The Alligator Indicator

To test the Alligator indicator, I used my favorite software, TrendSpider. You can use TrendSpider to easily backtest indicators and strategies on multiple timeframes and assets (Forex, Stocks, Futures) without coding.

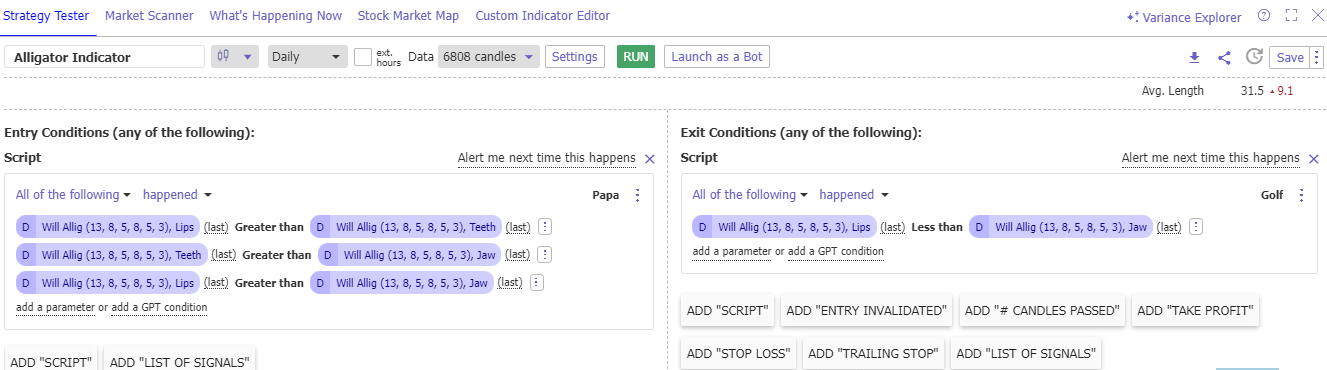

To set up an Alligator backtesting strategy in TrendSpider, follow these steps:

- Register for TrendSpider.

- Select Strategy Tester

- Buy Signal: Entry Conditions

- > Add Parameter > Condition > Indicator > Williams Alligator Lips > Greater Than > Williams Alligator Teeth

- > Add Parameter > Condition > Indicator > Williams Alligator Teeth > Greater Than > Williams Alligator Jaw

- > Add Parameter > Condition > Indicator > Williams Alligator Lips > Greater Than > Williams Alligator Jaw

- Sell Signal: Exit Conditions

- Add Script: > Add Parameter > Condition > Indicator > Williams Alligator Lips > Less Than > Williams Alligator Jaw

- Click “RUN.”

This configuration ensures you buy when a new strong uptrend is starting and sell when the uptrend ends.

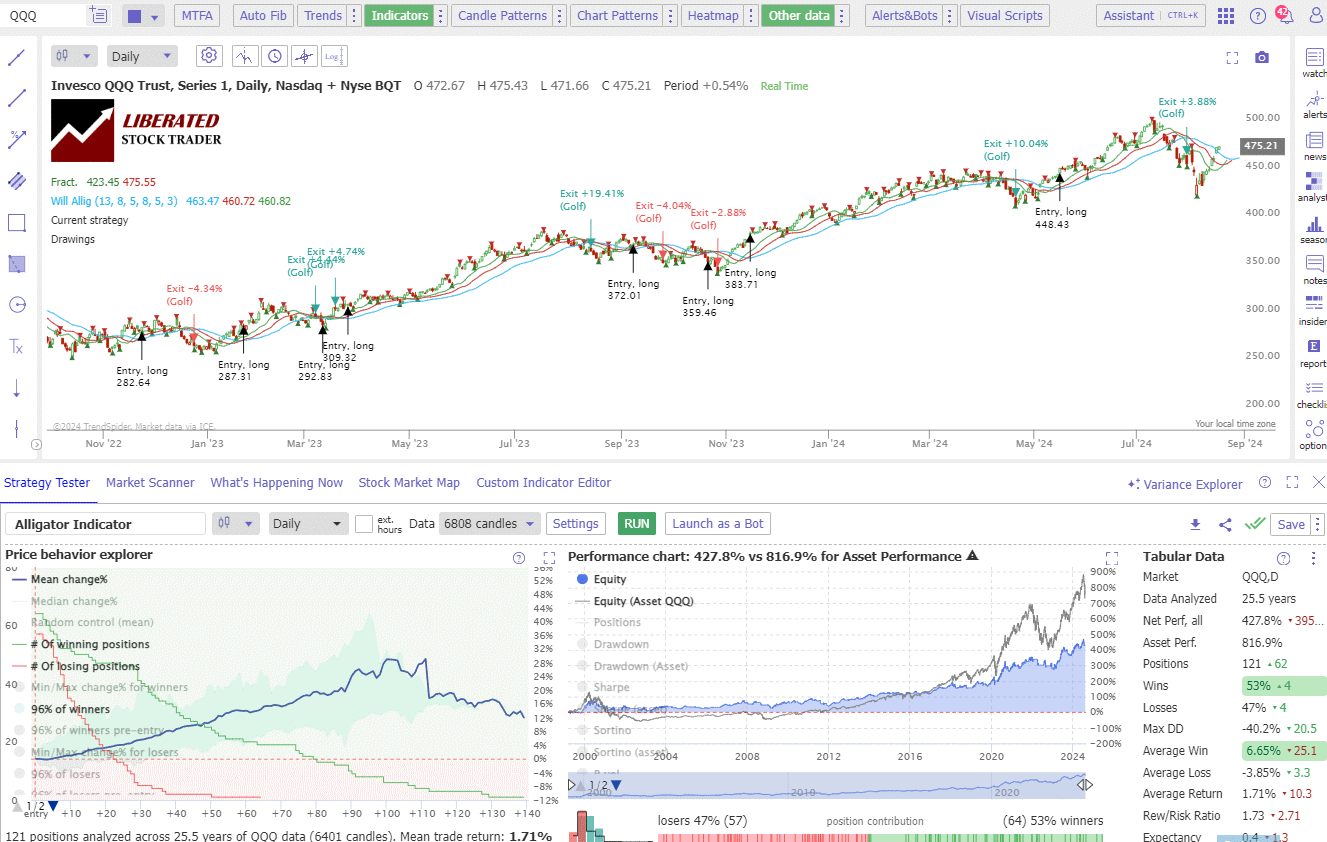

Performance Results (NASDAQ 100)

I tested the Alligator indicator on 25 years of Nasdaq 100 index exchange data, and the results were highly profitable. Testing on a daily chart yielded 121 trades; 53% were profitable, and the average win was 6.65% versus a 3.85% loss. The reward-to-risk ratio was a solid 1.73. See the image below for details.

Automate Alligator Trading with TrendSpider

The overall results across multiple timeframes on the Nasdaq 100 index (QQQ) show that using the Alligator on a weekly and daily chart was the most profitable.

| Results (10-Years) | QQQ,W | QQQ,D | QQQ,60 | QQQ,5 | QQQ,240 | QQQ,1 |

| Net Perf, all | 855.8 | 200.2 | 26.2 | -6.9 | 142.1 | 1.8 |

| Asset Perf. | 730.7 | 577 | 69.1 | -1.4 | 162.6 | 6.7 |

| Positions | 18 | 54 | 57 | 62 | 46 | 56 |

| Wins | 72 | 52 | 53 | 37 | 57 | 41 |

| Losses | 28 | 48 | 47 | 63 | 43 | 59 |

| Average Win | 26.88 | 6.71 | 1.91 | 0.46 | 5.48 | 0.29 |

| Average Loss | -11.93 | -2.53 | -1.2 | -0.45 | -2.27 | -0.15 |

| Average Return | 16.1 | 2.26 | 0.44 | -0.11 | 2.11 | 0.03 |

| Rew/Risk Ratio | 2.25 | 2.65 | 1.59 | 1.02 | 2.41 | 1.97 |

| Expectancy | 1.4 | 0.9 | 0.4 | -0.2 | 0.9 | 0.2 |

| Exposure | 71.1 | 68.8 | 58.1 | 51.1 | 63.8 | 57.8 |

| Avg. Length | 51.4 | 37 | 29.6 | 23.7 | 40.6 | 29.9 |

Table: Performance Nasdaq 100 (QQQ) – Key: W=Weekly, D=Daily, 60, 240, 5,1 = Minutes per Bar.

The performance table shows that the Alligator on a weekly timeframe was the best setting, outperforming the Nasdaq 100 index with 855% over ten years versus a buy-and-hold strategy of 730%. Also, the average winning trade on a weekly chart was an incredible 26.88%, with a reward-to-risk ratio of 2.25, which is very high.

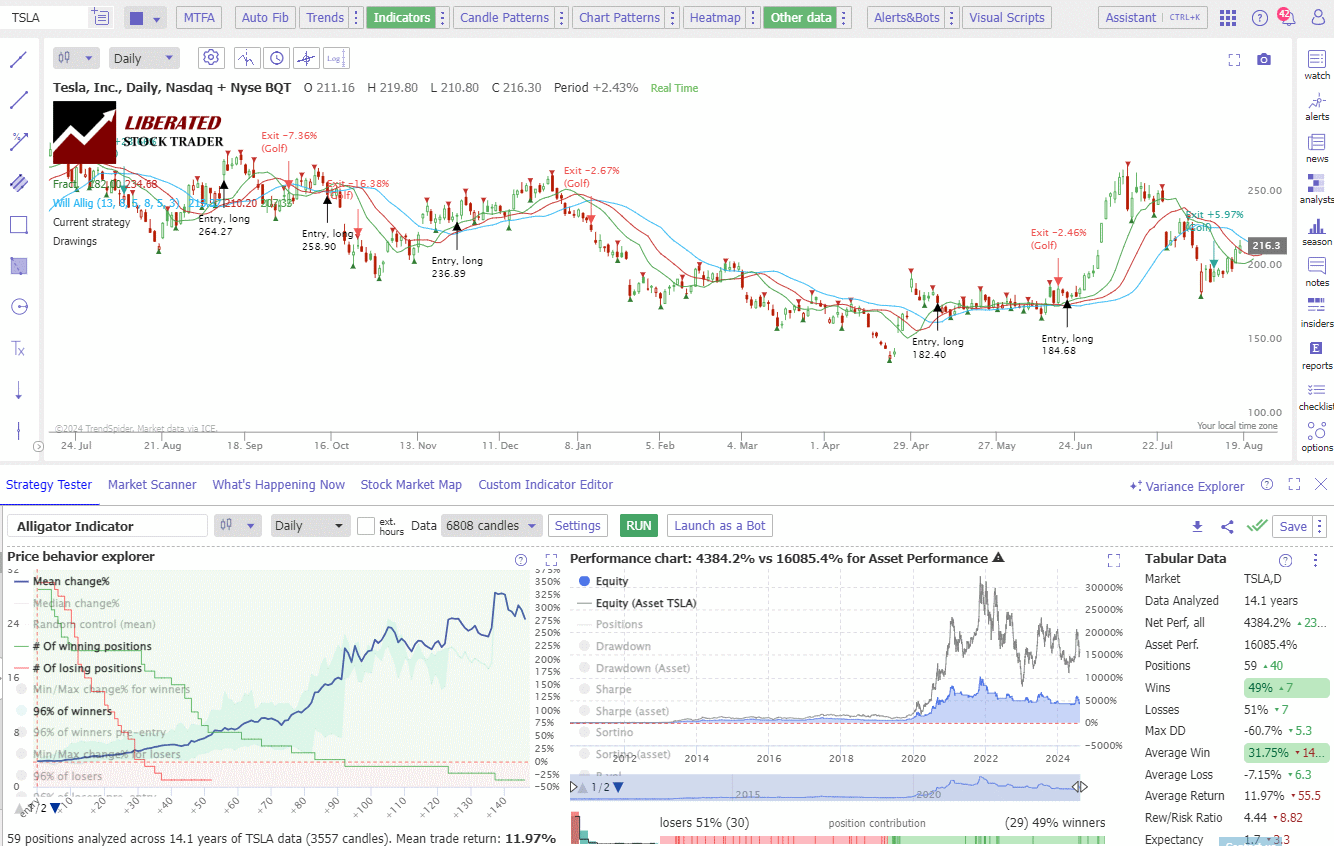

Performance Results (Tesla Inc.)

Testing the Alligator indicator on 10 years of Tesla Inc. exchange data (a trader’s favorite stock) showed mixed results. Overall, the trades underperformed a buy-and-hold strategy on weekly and daily charts. But the profit per trade was unbelievable. I had to double-check the results.

Get Alligator Trading with TrendSpider

On weekly charts, the percentage of winning trades was only 42%, but the average win was 178%, with a reward-to-risk ratio of 13.26, which is huge.

On daily charts, the percentage of winning trades was only 49%, but the average win was 38%, with an excellent reward-to-risk ratio of 5.

Testing on a 4-hour chart proved highly profitable; 50% of trades were profitable, and the average win was 23% versus a 5% loss. The reward-to-risk ratio was a high of 4.46. See the table below for details.

| Results | TSLA,W | TSLA,D | TSLA,60 | TSLA,5 | TSLA,240 | TSLA,1 |

| Net Perf, all | 2042.8 | 4227.1 | 81.4 | 5.9 | 2762.2 | 2.3 |

| Asset Perf. | 14522.2 | 10151 | 19.5 | 17.9 | 933.2 | 7.1 |

| Positions | 19 | 47 | 59 | 53 | 54 | 53 |

| Wins | 42 | 49 | 37 | 51 | 50 | 35 |

| Losses | 58 | 51 | 63 | 49 | 50 | 65 |

| Average Win | 178.9 | 38.43 | 9.03 | 1.38 | 23.25 | 0.87 |

| Average Loss | -13.49 | -7.7 | -2.96 | -1.16 | -5.21 | -0.39 |

| Average Return | 67.51 | 14.87 | 1.51 | 0.13 | 9.02 | 0.05 |

| Rew/Risk Ratio | 13.26 | 4.99 | 3.05 | 1.19 | 4.46 | 2.26 |

| Expectancy | 5 | 1.9 | 0.5 | 0.1 | 1.7 | 0.1 |

| Exposure | 60.2 | 54.4 | 48.7 | 52.2 | 52.1 | 48.7 |

| Avg. Length | 22.4 | 33.6 | 23.7 | 28.5 | 28 | 26.6 |

Table: Performance Tesla Inc (TSLA) – Key: W=Weekly, D=Daily, 60, 240, 5,1 = Minutes per Bar.

Performance Results (EURUSD Forex)

Trading the Alligator on foreign exchange proved profitable only on a weekly trading chart, which yielded a reward-to-risk ratio of 3.66. 63% of trades were losers, and the average win was 10% versus a loss of 2.84%. This suggests that using the Alligator on Forex is not worth it because the win margins are too tight, which could result in losses.

| Market | EURUSD,W | EURUSD,D | EURUSD,60 | EURUSD,5 | EURUSD,240 | EURUSD,1 |

| Net Perf, all | 99.7 | -9.1 | -1.8 | -0.1 | -1.4 | -0.3 |

| Asset Perf. | 79.3 | -15.7 | 1.5 | 1.8 | 9.8 | -0.3 |

| Positions | 46 | 59 | 61 | 69 | 58 | 62 |

| Wins | 37 | 31 | 41 | 42 | 38 | 40 |

| Losses | 63 | 69 | 59 | 58 | 62 | 60 |

| Average Win | 10.38 | 2.1 | 0.19 | 0.08 | 0.73 | 0.02 |

| Average Loss | -2.84 | -1.12 | -0.18 | -0.06 | -0.48 | -0.02 |

| Average Return | 2.05 | -0.14 | -0.03 | 0 | -0.02 | 0 |

| Rew/Risk Ratio | 3.66 | 1.87 | 1.05 | 1.32 | 1.52 | 1.01 |

| Expectancy | 0.7 | -0.1 | -0.2 | 0 | 0 | -0.2 |

| Exposure | 50.2 | 43.3 | 49.9 | 53.9 | 49.9 | 50.4 |

| Avg. Length | 28.8 | 21 | 23.5 | 22.4 | 24.8 | 23.4 |

Table: Performance EURUSD Forex Trades – Key: W=Weekly, D=Daily, 60, 240, 5,1 = Minutes per Bar.

Overall Performance

In over 1,000 test trades, the Alligator indicator performed best on stocks and indices ETFs. Typically, a weekly or daily chart timeframe performed the best. The most surprising result of the testing was that the Alligator enabled traders to outperform the Nasdaq 100 index by over 100% over ten years. Also, weekly and daily charts show very healthy reward-to-risk and average win-size metrics.

Is the Alligator Indicator Profitable?

Yes, according to my testing, the Alligator indicator is profitable when using a weekly chart of stocks and index ETFs. Buy when the lips are above the teeth and jaws, and sell when the lips cross below the jaws.

The Best Alligator Indicator Settings

My test results conclude that the best Alligator indicator settings are on a weekly and daily chart, buying when the lips, teeth, and jaws are aligned and selling when they are inverted.

My thorough testing awarded TradingView a stellar 4.8 stars!

With powerful stock chart analysis, pattern recognition, screening, backtesting, and a 20+ million user community, it’s a game-changer for traders.

Whether you're trading in the US or internationally, TradingView is my top pick for its unmatched features and ease of use.

Explore TradingView – Your Gateway to Smarter Trading!

Trading Strategies

To effectively incorporate the Alligator Indicator into trading strategies, it is crucial to understand how it can be used in conjunction with other technical tools, the timing of entry and exit points, and the management of false signals.

Timing Entry and Exit Points

Precision in entry and exit points is crucial for maximizing profits. The Alligator’s three lines (Jaw, Teeth, and Lips) represent different Simple Moving Averages (SMAs), and traders look for specific crossovers. When the Lips cross above the Teeth and Jaw, it often signifies a buying opportunity. Conversely, when the Lips cross below, it signals potential short positions.

Handling False Signals

False signals, or whipsaws, can occur in sideways ranges where the Alligator Indicator may give misleading cues. Combining the Alligator Indicator with other technical tools can enhance trading decisions. Traders often use the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Stochastic Oscillator for this purpose. For instance, aligning Alligator crossovers with RSI oversold or overbought situations can provide stronger buy or sell signals.

Additionally, by integrating the Alligator Indicator with CCI (Commodity Channel Index) alongside the Alligator, traders can confirm momentum and trend strength. ATR (Average True Range) may help assess volatility and set stop-loss levels.

Practical Examples

The Alligator Indicator is a key tool for forex traders. It helps to identify trends and determine trade entry and exit points. This section provides insights on how to use the indicator effectively on trading platforms and offers real-world examples of its application.

Case Studies and Real Trade Examples

Forex traders use the Alligator Indicator to trade popular pairs like EUR/USD. For instance, during a period when the indicator’s lines diverge, signaling a market awakening, traders might place buy orders as part of a trend-following strategy.

An example involves a trader noticing the jaws, teeth, and lips widening on TradingView. The trader executes a buy order on EUR/USD and sets stop-loss levels just below the Alligator’s jaw to manage risk. This strategy capitalized on the market trend and produced profitable results.

In another scenario, a trader might avoid taking a position when the Alligator Indicator shows intertwined lines, indicating sideways movement in a choppy market. Here, the trader opts for a range trading strategy, buying at support levels and selling at resistance levels to navigate market chaos effectively.

Using the Alligator With Fractals

Bill Williams designed the Alligator indicator to be used with his fractals indicators. Fractals are incredibly interesting and also highly profitable according to my research.

These case studies underscore the importance of combining the Alligator Indicator with other analysis techniques and risk management strategies to optimize trading decisions.

FAQ

What is the best charting software for trading the Alligator indicator?

In my opinion, TrendSpider is the best Alligator trading software. I used its comprehensive backtesting and pattern recognition to test and prove that Alligator indicator trading can be profitable.

What are the optimal settings for the Alligator indicator?

The best Alligator settings are using a weekly or daily chart and:

- Jaw: 13-period Smoothed Moving Average, shifted 8 bars into the future.

- Teeth: 8-period Smoothed Moving Average, shifted 5 bars into the future.

- Lips: 5-period Smoothed Moving Average, shifted 3 bars into the future.

These settings can be adjusted based on individual trading strategies and market conditions.

How is the Alligator indicator applied in trading strategies?

Traders often use the Alligator indicator to determine market phases.

- When the three lines are intertwined, it indicates a lack of a clear trend or a consolidating market.

- When the lines separate and align in a specific direction, it suggests the start and continuation of a trend.

Can you explain the formula and components for the Alligator indicator?

The Alligator indicator consists of three lines:

- The jaw (blue line): a 13-period Smoothed Moving Average shifted 8 bars into the future.

- The Teeth (red line): an 8-period Smoothed Moving Average shifted 5 bars into the future.

- The Lips (green line): a 5-period Smoothed Moving Average shifted 3 bars into the future.

How can one interpret signals from the Alligator indicator when trading?

When the Lips cross above the Teeth and Jaw, it signals a potential uptrend and buy signal. Conversely, when the Lips cross below the Teeth and Jaw, it indicates a potential downtrend or short-sell opportunity. Additionally, the greater the separation between the lines, the stronger the trend.

Which time frames are best suited for using the Alligator indicator?

My testing shows that the Alligator indicator should only be used on a weekly or daily timeframe. It also shows good profitability metrics on a 4-hour chart, but you should perform your tests and confirm this with TrendSpider.

How does the Alligator indicator perform in terms of accuracy and profitability?

The Alligator indicator performs well in trending markets on weekly or daily charts, helping traders catch significant market movements. However, in sideways or choppy markets, it may produce false signals, leading to potential losses.

You want to be a successful stock investor but don’t know where to start.

Learning stock market investing on your own can be overwhelming. There’s so much information out there, and it’s hard to know what’s true and what’s not.

Liberated Stock Trader Pro Investing Course

Our pro investing classes are the perfect way to learn stock investing. You will learn everything you need to know about financial analysis, charts, stock screening, and portfolio building so you can start building wealth today.

★ 16 Hours of Video Lessons + eBook ★

★ Complete Financial Analysis Lessons ★

★ 6 Proven Investing Strategies ★

★ Professional Grade Stock Chart Analysis Classes ★