When it comes to choosing the perfect trading platform, the battle between TradingView and MetaTrader (MT4/MT5) often dominates traders’ considerations. These platforms represent completely different approaches to market analysis and trading execution, each with distinct strengths that cater to specific trading styles and preferences.

MetaTrader and TradingView are fundamentally different platforms.

MetaTrader excels as a robust desktop-based trading automation and execution platform.

TradingView shines as a social-oriented analytical powerhouse with superior charting, indicators, backtesting, and data coverage.

I’ve spent years using both platforms across various market conditions and trading scenarios, and the choice between them ultimately depends on your specific needs as a trader. MetaTrader offers direct broker integration and advanced automation, making it ideal for those focused on execution. At the same time, TradingView provides a more intuitive interface with superior social features that benefit traders who value community insights and visual analysis.

Key Takeaways

- MetaTrader focuses on trading execution and automation while TradingView emphasizes analytical capabilities and social trading features.

- TradingView offers a modern, intuitive interface with superior charting tools compared to MetaTrader’s more technical but powerful trading environment.

- Your choice between platforms should align with your primary focus—analysis and community insights (TradingView) versus direct execution and automated strategies (MetaTrader).

Overall Features Comparison

| Features | TradingView | TrendSpider | Trade Ideas | MetaTrader |

| Rating | 4.8 | 4.8 | 4.6 | 4.1 |

| Pricing | Free | $13/m to $49/m annually | $107/m or $48/m annually | $254/m or $178/m annually | Free |

| Global Market Data | ✅ | USA | USA | ✅ |

| Powerful Charts | ✅ | ✅ | ❌ | ✅ |

| Stocks | ✅ | ✅ | ✅ | ✅ |

| Futures | ✅ | ✅ | ❌ | ❌ |

| Forex | ✅ | ✅ | ❌ | ✅ |

| Cryptocurrency | ✅ | ✅ | ❌ | ❌ |

| Social Community | ✅ | ❌ | ✅ | ✅ |

| Real-time News | ❌ | ❌ | ❌ | ❌ |

| Screeners | ✅ | ✅ | ✅ | ❌ |

| Backtesting | ✅ | ✅ | ✅ | ✅ |

| Code-Free Backtesting | ❌ | ✅ | ❌ | ❌ |

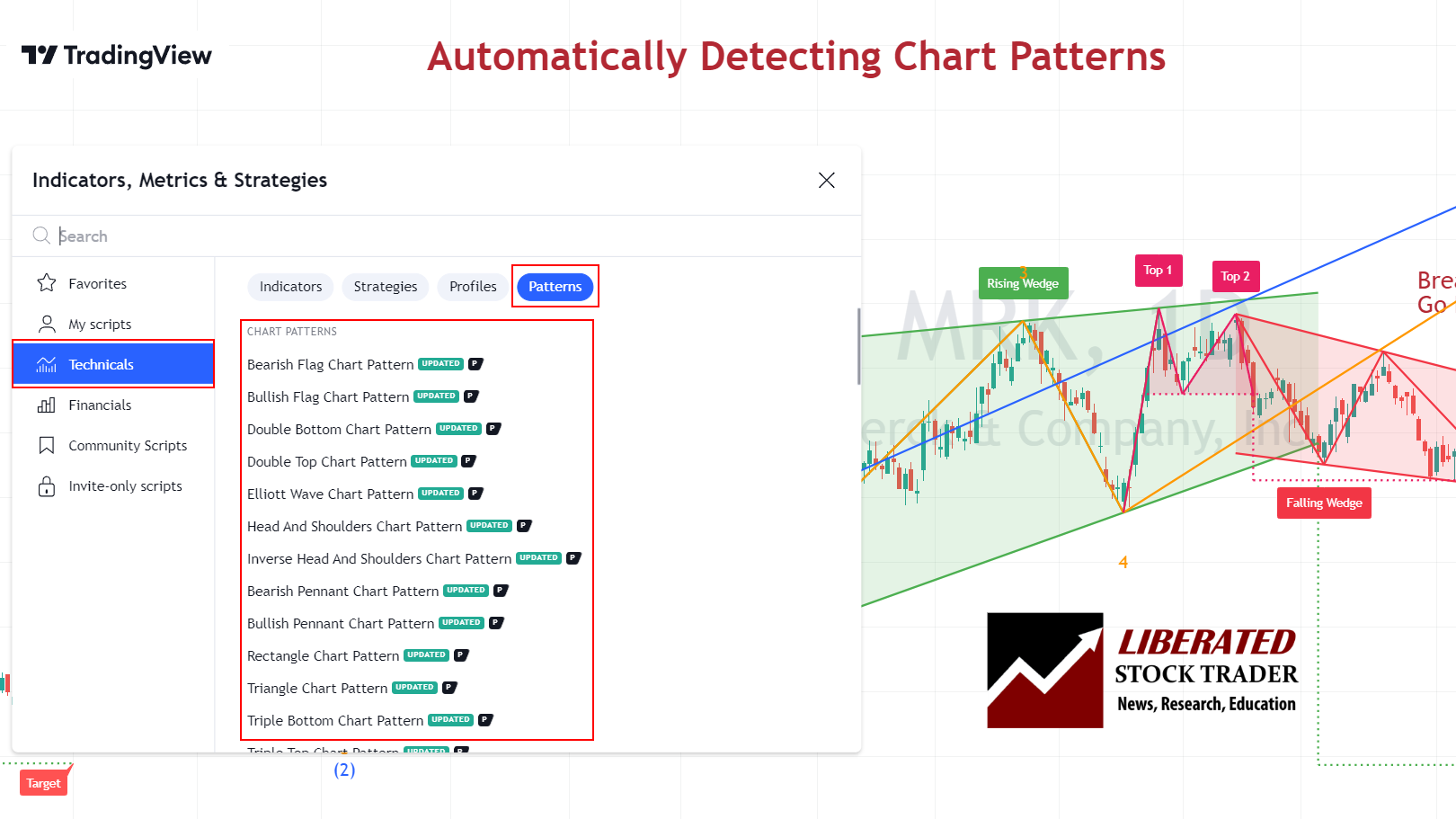

| Pattern Recognition | ✅ | ✅ | ✅ | ❌ |

Trading Platforms Comparison

Both TradingView and MetaTrader 4/5 offer distinctive approaches to meeting traders’ needs. TradingView is a slick modern platform that seamlessly combines global data for stocks, bonds, currencies, futures, crypto, and options. MetaTrader is an old-school desktop app that focuses on Forex and stocks but excels in algorithmic trading.

Understanding TradingView

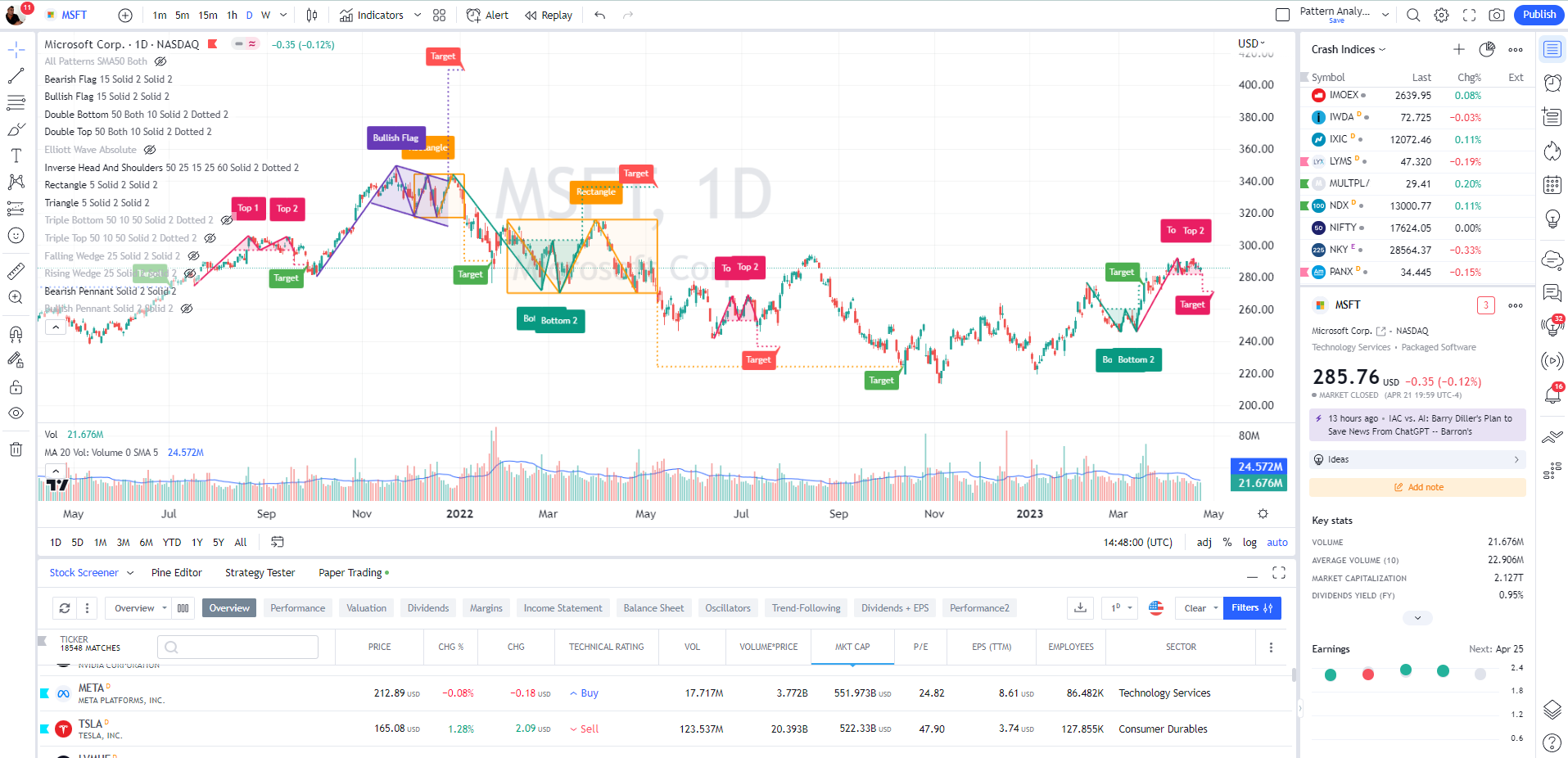

My TradingView review highlights its powerful charting capabilities and social networking features for traders. Its browser-based architecture ensures accessibility across multiple devices, including Mac and Linux systems, without requiring downloads.

TradingView offers smooth charting and the broadest selection of technical indicators and drawing tools. Its clean, modern interface is particularly appealing to novice and experienced traders.

My thorough testing awarded TradingView a stellar 4.8 stars!

With powerful stock chart analysis, pattern recognition, screening, backtesting, and a 20+ million user community, it’s a game-changer for traders.

Whether you’re trading in the US or internationally, TradingView is my top pick for its unmatched features and ease of use.

TradingView excels in providing a collaborative environment where over 20 million users share ideas and strategies. The social aspect allows traders to follow experts and learn from community insights.

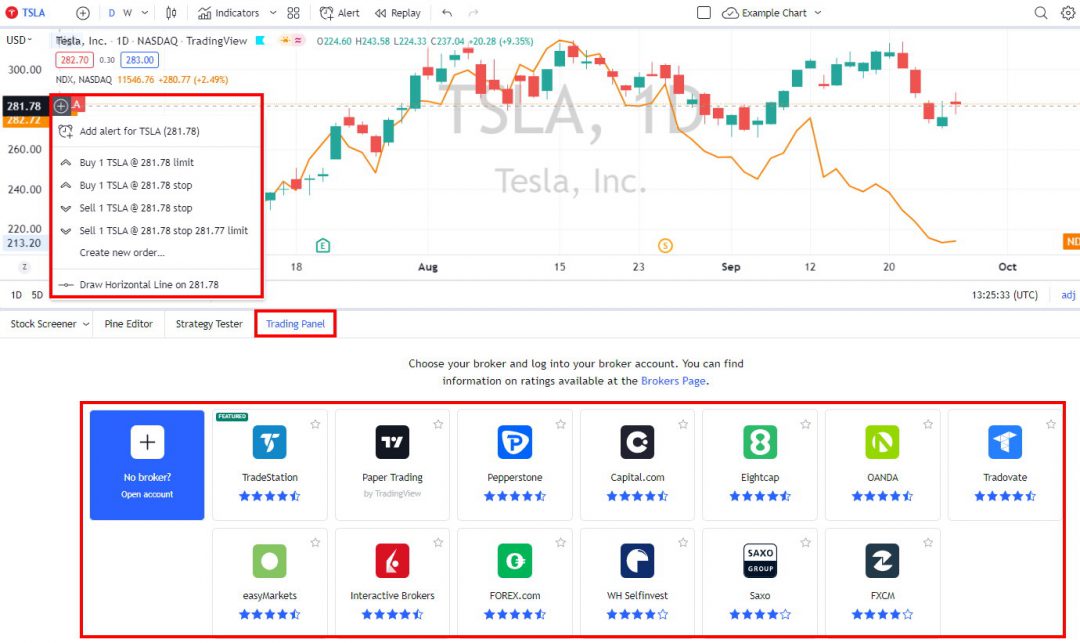

The platform integrates with over 30 brokers, though this connection typically happens through partner relationships rather than direct API access. Its premium subscription tiers unlock advanced features like multiple charts and custom indicators.

Exploring MetaTrader 4/5

MetaTrader 4 and 5 remain industry standards despite their somewhat dated visual presentation. The platform focuses on robust functionality and reliability for serious traders.

MT4’s strength lies in its algorithmic trading capabilities through Expert Advisors (EAs). These automated trading systems can execute strategies without constant human intervention. The MQL4 programming language provides a framework for creating custom indicators and trading robots.

The platform supports multiple order types including market orders, pending orders, and stop losses. Its execution speed and stability make it particularly suitable for high-frequency trading strategies.

I appreciate MT4’s comprehensive charting tools despite the less modern interface. The platform offers deep market access across forex, commodities, and CFDs markets, with customization options to tailor the experience.

MT4’s architecture allows for extensive add-ons and modifications, making it highly adaptable to specific trading requirements despite its aging framework.

User Interface and Experience

TradingView

TradingView features a modern, web-based interface that feels immediately intuitive even for beginners. The platform employs a clean, customizable workspace with drag-and-drop functionality that allows me to arrange multiple charts and widgets according to my preferences. I can easily modify chart types, timeframes, and indicators through clearly labeled buttons and menus.

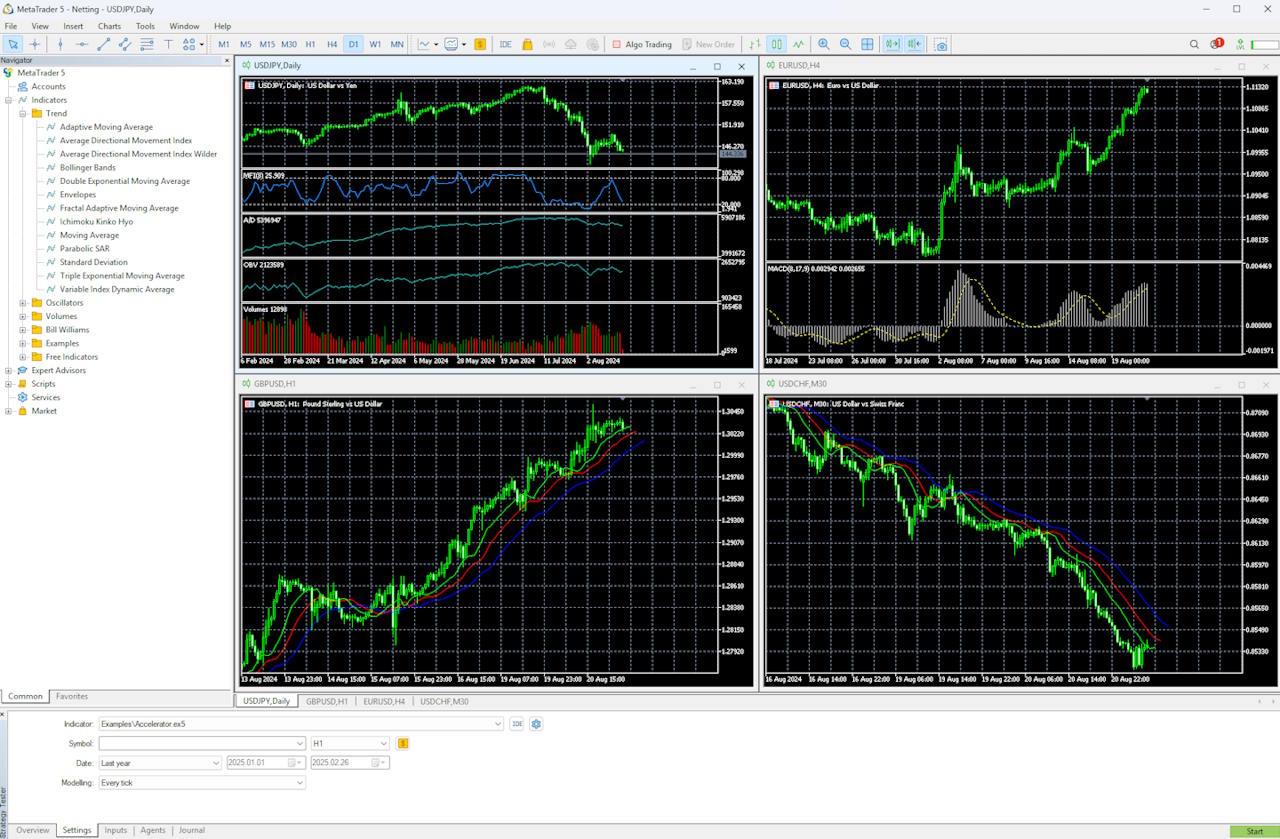

MetaTrader 5

MetaTrader 5 presents a more traditional trading interface with a classic layout divided into four main windows: market watch, navigator, chart area, and terminal. This structured approach may feel dated compared to TradingView but offers efficiency for experienced traders.

TradingView’s social integration is seamlessly built into the interface, with commenting features and idea sharing available directly from charts. This creates a unique collaborative experience not found in most trading platforms.

The platform also offers excellent cross-device compatibility. I can access the same familiar interface whether I’m using the web version, desktop application, or mobile app, with all settings synchronized.

MT5’s strength lies in its trading-focused design. Order placement, position management, and execution are more streamlined than in TradingView, with direct market access features built into the core experience.

MetaTrader’s interface remains consistent across installations, which appeals to traders who value reliability over modern aesthetics. The mobile experience, while functional, doesn’t match the seamless transition TradingView offers between devices.

Charting and Analysis Tools

TradingView outperforms MetaTrader with its broad selection of charts, indicators and drawing tools for technical analysis. TradingView delivers modern, visually appealing charts that stand out in the trading platform landscape. I find its interface intuitive and highly customizable, allowing traders to adjust almost every aspect of chart appearance.

TradingView

TradingView offers 20 chart types including Renko, Kagi, and Point & Figure, plus over 150 indicators, including advanced pattern recognition, a specialized option not commonly found elsewhere. Drawing tools are particularly impressive, with over 100 available options ranging from basic trend lines to complex Fibonacci retracements.

MetaTrader 5

MetaTrader’s indicator library features over 50 built-in technical indicators, covering all essential analysis tools. The platform excels in customization potential through MQL4/MQL5 programming.

Traders can create or modify indicators to match specific trading strategies. This programming capability sets MetaTrader apart for algorithmic traders who need precise technical analysis tools.

While less visually polished than TradingView’s indicators, MetaTrader offers greater precision for strategy backtesting and automated trading implementation.

Trading Functions and Markets

The trading capabilities of both platforms differ significantly in terms of available markets and execution options. TradingView excels in analysis across multiple asset classes while MetaTrader has historically been the preferred choice for direct trading execution.

TradingView

TradingView offers access to a broader range of markets including Forex, cryptocurrencies, commodities, and indices from global exchanges. Users can analyze over 100,000 financial instruments across these markets.

TradingView’s execution capabilities depend entirely on broker partnerships. While improving, its execution isn’t its primary strength. Users must connect to supported brokers through integrations, which sometimes causes slight delays compared to native platforms.

TradingView compensates with superior alert systems and social trading features. Its scripts library allows users to discover trading strategies from other traders.

MetaTrader

MetaTrader was originally designed specifically for forex trading, though MT5 has expanded to include stocks, CFDs, futures, and options. MT4 remains more limited, focusing primarilöy on Forex and CFDs.

MetaTrader platforms excel in trading execution with direct broker integration. They support multiple order types including market, limit, stop, and trailing stops. MT5 adds more advanced order types like fill-or-kill orders that are not available in MT4.

The platforms enable one-click trading and automated strategies through Expert Advisors, making them ideal for active traders and algorithmic trading systems.

Both platforms support cryptocurrencies, but TradingView typically provides more comprehensive coverage of crypto markets and pairs. For traditional forex trading, both platforms offer similar currency pair coverage.

I’ve found that traders focused on stocks, ETFs, and crypto generally prefer TradingView’s breadth, while dedicated forex traders might still lean toward MetaTrader’s specialized tools. For high-frequency trading, MetaTrader generally offers lower latency and more reliable execution, making it preferred for time-sensitive trading styles.

Automated and Social Trading

Both platforms offer distinct approaches to automated and social trading capabilities. MetaTrader excels in powerful algorithmic trading through its robust Expert Advisors system, while TradingView shines with its community-driven approach that encourages sharing and collaboration among traders.

Social Trading with TradingView

TradingView excels as a social trading platform. Its vibrant community of over 20 million users shares ideas and strategies. The platform creates an environment where you can easily follow experienced traders, study their charts, and learn from their analyses.

TradingView also offers excellent algo trading through webhook integration with brokers.

TradingView’s Pine Script language enables users to create and share custom indicators, though it’s primarily designed for analysis rather than automated execution. The platform promotes collaborative learning through comments, likes, and follows.

I appreciate how TradingView’s social features reduce the isolation typically associated with trading. The reputation system helps identify consistently successful traders worth following.

Automated Trading on MetaTrader

MetaTrader 4 stands out with its sophisticated automated trading ecosystem centered around Expert Advisors (EAs). These trading robots execute trades based on pre-defined algorithms without requiring constant human intervention. The platform uses MQL4, a specialized programming language designed specifically for creating custom indicators and automated trading strategies.

I find MT4’s automation capabilities particularly beneficial for traders who want to eliminate emotional decision-making. The platform supports both simple and complex trading algorithms, allowing for extensive backtesting against historical data to validate strategy performance before deploying real money.

MT4’s trading bots can operate 24/7, scanning markets for opportunities based on your specified parameters. Most EAs are customizable, letting traders adjust risk levels, trading pairs, and time frames to match their personal trading style.

Chart, Scan, Trade & Join Me On TradingView for FreeJoin me and 20 million traders on TradingView for free. TradingView is a great place to meet other investors, share ideas, chart, screen, and chat.

Backtesting Capabilities

TradingView’s backtesting system runs through Pine Script, their proprietary coding language. I find it relatively intuitive to learn, even for traders without programming experience. The platform allows testing strategies across multiple symbols simultaneously, which saves considerable time.

MetaTrader uses MQL4/MQL5 for strategy creation and testing. These languages offer more robust capabilities but present a steeper learning curve. MT4/MT5’s Strategy Tester provides detailed performance reports with drawdown analysis and profit factors.

A key difference is processing power. TradingView handles backtesting on their servers, eliminating hardware constraints. Meanwhile, MetaTrader runs locally on your computer, so performance depends on your hardware specifications.

Real-time Data and Tools

TradingView excels with its cloud-based framework that ensures consistent performance across all devices. The platform offers over 50 drawing tools and 100+ pre-built indicators, making technical analysis accessible to traders of all levels.

The alerting system in TradingView is particularly powerful, with notifications available via email, SMS, and mobile push alerts. Their paper trading feature lets you practice strategies in real market conditions without risking capital.

MetaTrader provides solid real-time data but may require additional steps for optimal use on non-Windows systems. The platform shines with its Expert Advisors (EAs) that allow full automation of trading strategies.

MT4/MT5 offers direct broker integration, potentially reducing latency for order execution. However, TradingView’s browser-based approach means you can access your charts and tools from any device without installation requirements.

Web-based and Mobile Trading

TradingView excels with its cloud-based platform, which requires no installation. I can access it on any device with an internet connection by simply logging into my account through a web browser. This flexibility allows for seamless trading transitions between my desktop, laptop, and mobile devices.

MetaTrader platforms (MT4 and MT5) traditionally require software installation on desktop computers. However, they’ve evolved to offer mobile apps and a WebTerminal solution, though with limited functionality compared to the desktop version.

The TradingView mobile app mirrors much of its web functionality, providing comprehensive charting tools and social features. Meanwhile, MetaTrader’s mobile applications are robust for execution but offer fewer analytical capabilities than their desktop counterparts.

Broker Integration and Platform Support

MetaTrader dominates in broker integration with over 750 brokers worldwide supporting MT4 or MT5. This extensive network makes it extremely easy to find compatible forex brokers for direct trading. The platform allows connecting to multiple brokers through a single interface.

TradingView offers direct trading with approximately 50 connected brokers, fewer than MetaTrader, but this number continues to grow. Users can test platform features with a free account, though advanced functionalities require subscription plans starting with their Pro tier.

MetaTrader works well on Windows systems but requires third-party solutions for Mac users. Meanwhile, TradingView, being web-based, operates consistently across all operating systems without compatibility issues. Many brokers offer free MetaTrader accounts, while TradingView provides a free tier with basic features and a 30-day free trial for premium plans.

Pricing and Plans

TradingView operates on a tiered subscription model with several options. The free plan provides basic functionality, but serious traders typically need more. Their Pro+ plan costs $29.95 monthly, while the Premium plan runs $59.95 monthly and includes all available features.

TradingView offers a free trial of their premium features, allowing traders to test advanced functionality before committing financially. This trial period provides excellent leverage to evaluate whether the additional features justify the subscription cost.

The free version of TradingView has permanent access but with restrictions on indicators, alerts, and historical data on lower timeframes.

In contrast, MT4 is generally free to download and use through brokers. This gives MT4 an immediate cost advantage for traders on tight budgets.

The value proposition differs significantly between platforms. TradingView’s paid plans unlock advanced charting tools, additional indicators, and extended historical data that aren’t available in the free version. Meanwhile, MT4 users typically don’t pay for the platform itself, but might face limitations based on what their broker offers.

MT4 typically doesn’t require trials since brokers provide them. However, many brokers offer demo accounts, which allow traders to test MT4’s full functionality without financial commitment.

In this context, I found that leverage isn’t just financial but practical. TradingView’s subscription model provides leverage through more sophisticated analysis tools, while MT4 leverages its broker integration for seamless trading execution.