Real Estate Investment Trusts (REITs) are publicly traded entities that own or finance income-generating real estate assets.

By investing in REITs, individuals can participate in the real estate market without directly purchasing physical properties.

What does REIT stand for?

REIT stands for “Real Estate Investment Trust.” REITs own, operate, or finance income-generating real estate. REITs enable individuals to invest in real estate without direct property ownership.

What are Real Estate Investment Trusts (REITs)?

REITs are publicly traded companies that profit from the ownership or financing of real estate assets. They allow investors to enter the real estate market without buying physical properties. Investing in a REIT can diversify your portfolio with commercial property investments such as office buildings, shopping centers, warehouses, apartments, and hotels.

This provides an opportunity for investors to properly diversify their portfolio and benefit from the potential returns of the real estate sector.

Is a REIT an ETF?

No. A REIT is not an exchange-traded fund (ETF). Although both are traded on exchanges and allow investors to invest in various assets, a REIT must own or finance income-producing real estate assets. In contrast, an ETF may invest in various investments such as stocks, bonds, commodities, and currencies.

Like an exchange-traded fund (ETF), a REIT trades directly on an exchange, but its underlying assets are usually property-related. REITS may also be a mutual fund if the fund is focused on property only.

How to invest in REITs?

Investing in REITs is relatively straightforward. You can open a brokerage account and purchase publicly traded REIT shares through a broker. Alternatively, you can invest in REITs through exchange-traded funds (ETFs) or mutual funds focusing on real estate investment trusts.

5 Popular REITs to Invest In:

When it comes to investing in real estate investment trusts (REITs), there are several popular options that investors can consider. These REITs have shown strong performance and have a reputation for delivering consistent returns. Here are five popular REITs, along with a brief description of their primary business operations, property types, and recent market trends impacting their performance:

1. American Tower Corp. (AMT).

American Tower is a global leader in wireless communication infrastructure. They own and operate a vast portfolio of cell towers and other structures used for wireless communications.

The company leases space to wireless service providers for equipment, antennas, and related infrastructure.

With the ever-increasing demand for mobile data and the ongoing rollout of 5G technology, American Tower has witnessed strong demand for its tower assets, leading to consistent growth.

2. Public Storage (PSA).

Public Storage is one of the largest self-storage REITs in the United States. It owns and operates a large network of self-storage facilities.

The company’s properties consist of storage units of various sizes, which are leased to individuals and businesses for storing personal belongings or inventory.

The demand for storage space has grown due to e-commerce and changing consumer behaviors. Public Storage has successfully capitalized on this trend, demonstrating resilience and consistent growth.

3. Crown Castle International Corp. (CCI).

Crown Castle is a leading provider of shared communications infrastructure in the United States. They own and lease towers, small cells, and fiber optic cables.

The company focuses on leasing space to wireless carriers for their equipment and providing connectivity solutions through its fiber optic network.

The expansion of wireless networks, increased data consumption, and the need for improved connectivity have fueled demand for Crown Castle’s infrastructure, positioning the company for continued growth.

4. Simon Property Group Inc. (SPG).

Simon Property Group is a prominent player in the retail REIT sector. They own and operate a diverse portfolio of shopping malls and premium outlets.

The company’s properties host a wide range of retail stores, including apparel, electronics, entertainment, and dining options.

Retail property has changed due to shifting consumer preferences. However, Simon Property Group has adapted by curating attractive tenant mixes and incorporating experiential elements into their properties, helping them thrive in a changing market.

5. Welltower Inc. (WELL).

Primary Business Operations: Welltower is a REIT that focuses on healthcare real estate. They invest in properties such as senior housing, medical office buildings, and post-acute care facilities.

The company’s properties cater to the needs of aging populations, providing essential healthcare services and accommodations.

The ongoing demographic shift toward an aging population has increased the demand for healthcare-related properties. Welltower has positioned itself well to meet this demand, demonstrating stable performance in the healthcare real estate sector.

How can you find REIT ETFs to invest in?

TradingView offers a superb ETF screener to assist you in discovering and exploring REIT ETFs. By selecting Focus = Real Estate, you will access a comprehensive list of 61 promising options.

Try TradingView’s REIT ETF Screener

What types of properties do REITs invest in?

REITs can invest in various real estate investments, such as office buildings, shopping centers, warehouses, apartments, and hotels. They may also invest in mortgages or loan portfolios secured by real estate.

Key types of properties REITs invest in include:

- Commercial Property: Office Blocks, Event Venues, Shopping Malls, Hotels, and Warehouses.

- Residential Property: Land and Apartment Blocks.

- Mortgage-Backed Securities: REITs that invest in mortgage-backed securities are typically structured to provide investors with a steady and consistent cash flow.

- Other Assets: REITs may also invest in assets such as timberland, infrastructure projects, or foreign real estate investments.

What are the benefits of investing in a REIT?

The key benefit of investing in a REIT is that it provides investors access to a diversified portfolio of real estate investments without owning the properties themselves.

Additionally, REITs are generally easy to buy and sell on the stock exchange, making it simple for investors to adjust their portfolios as needed. Lastly, REITs are often tax-advantaged investments, which may be eligible for certain tax deductions or credits.

It’s important to note that REITs must meet certain criteria and comply with specific regulations to qualify as REITs. These regulations include paying out at least 90% of their taxable income as dividends to shareholders.

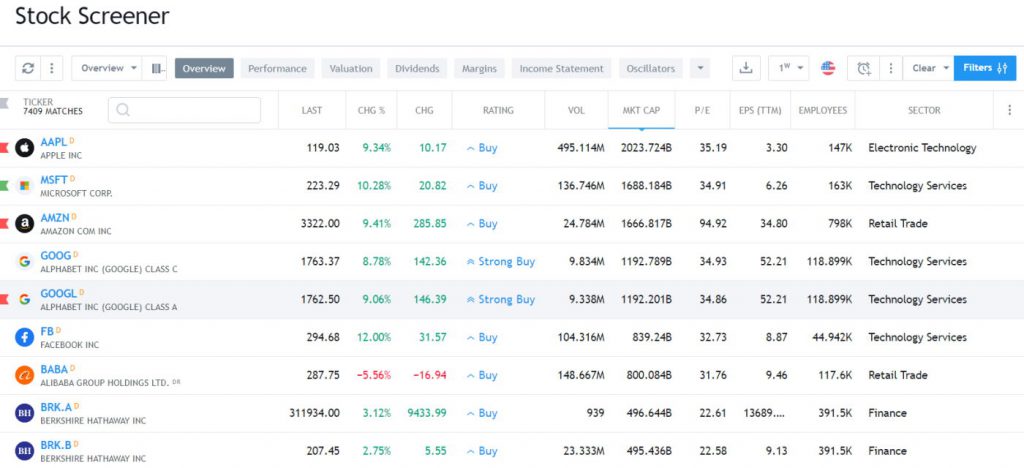

My thorough testing awarded TradingView a stellar 4.8 stars!

With powerful stock chart analysis, pattern recognition, screening, backtesting, and a 20+ million user community, it’s a game-changer for traders.

Whether you're trading in the US or internationally, TradingView is my top pick for its unmatched features and ease of use.

Explore TradingView – Your Gateway to Smarter Trading!

Why to avoid REIT investing

While REITs can offer attractive benefits, there are some considerations to keep in mind. REITs can be sensitive to interest rate changes and may face risks associated with specific property types or geographic locations. Additionally, the performance of REITs can be affected by economic downturns and fluctuations in the real estate market.

How do REITs make profits?

REITs, or Real Estate Investment Trusts, generate profits through rental incomes, property sales, and mortgage interest.

Here are the ways in which REITs make money:

-

Rental Income: REITs own and operate income-producing real estate properties such as apartments, warehouses, malls, and self-storage facilities. They earn revenue from the rental income generated by leasing these properties to tenants.

-

Property Sales: REITs can profit by selling properties they own at a gain. When a property’s value appreciates, the REIT can sell it for a higher price, resulting in a profit.

-

Mortgage Interest: Some REITs invest in mortgages and earn profits through the interest payments from borrowers. These types of REITs are known as Mortgage REITs.

Property REITs seek to profit from renting out property and from the increase in the value of the underlying asset. For example, a REIT may own a building on Wall Street. They may rent that property to several Financial Institutions, thus earning a regular income from the asset, and they may also realize any increase in the value of the property as profit.

Mortgage REITS invest in mortgages that provide the capital for others to buy the property. They supply the capital to fund the mortgages and earn the percentage interest paid on the mortgage for the duration of the agreement. They may also purchase Mortgage-backed securities.

Some REITs may combine both strategies, which is known as a hybrid REIT.

What are the pros of REIT investments?

REITs have a number of clear advantages over traditional investments such as stocks, bonds, and mutual funds:

- Low Barriers to Entry – Investors can enter REITs with relatively small amounts of capital.

- Diversification – REITs provide exposure to the real estate market without having to own property directly.

- REITs provide excellent liquidity as they are readily tradable on major exchanges, making buying and selling them a breeze.

- Professional Management – Professional real estate companies manage Most REITs with a great deal of expertise in the industry.

- Tax Benefits – Some REITs provide tax benefits for investors, such as reduced taxes on dividend income or capital gains treatment.

A key advantage of a REIT is that it has a special tax benefit. It also offers the investor a method of profiting from any increases in property value without having to invest in the property directly by taking out a mortgage and maintaining it.

Note: Investors must conduct thorough research, analyze their investment goals and risk tolerance, and consult with financial advisors before making investment decisions.

FAQ

What is the Best Software for REIT Investing?

Stock Rover is the best software for REIT investing as it allows in-depth research and portfolio management of REIT investments.

Why avoid investing in REITs?

While REITs can offer attractive benefits, there are some considerations to consider. REITs can be sensitive to interest rate changes and may face risks associated with specific property types or geographic locations. Additionally, the performance of REITs can be affected by economic downturns and fluctuations in the real estate market.

How are REITs taxed?

REITs must distribute at least 90% of their taxable income to shareholders through dividends. The income earned from these dividends is typically subject to ordinary tax rates. Investors may also be subject to capital gains taxes when selling REIT shares.

How are REIT dividends taxed?

REIT dividends are typically taxed as ordinary income. The tax rate depends on the individual's income tax bracket. It's important to consult with a tax professional for specific guidance on your tax situation.

Are REIT dividends qualified?

REIT dividends do not typically qualify for the lower tax rates associated with qualified dividends. They are generally taxed as ordinary income.

What is a mortgage REIT?

A mortgage REIT, also known as mREIT, is a type of REIT that focuses on investing in mortgages and mortgage-backed securities. They generate income primarily through interest payments on mortgage loans and are subject to different risks compared to equity-focused REITs.

How to value REITs?

Valuing REITs involves analyzing factors such as the quality of the underlying properties, rental income, occupancy rates, debt levels, and the management team's track record. Common valuation methods include assessing funds from operations (FFO), net asset value (NAV) and comparing valuations to industry peers. Investors should also consider the potential macroeconomic and regulatory risks.

Can REITs be shorted?

Yes, REITs can be shorted. As with any investment, it's important to understand the risks associated with short selling before taking any positions.

What is a private REIT?

A private REIT is a non-traded investment vehicle that provides investors access to real estate investments. They are generally not publicly traded and are typically only available through brokerages or registered advisors. Private REITs may offer certain benefits, such as higher yields and lower fees, but may also involve higher risks and less liquidity than public REITs.

What is a REIT index?

A REIT index is an investable benchmark tracking the performance of real estate investment trusts. Many indices, including the S&P Global REIT Index and the MSCI US REIT Index, are available. Investors can use these indexes to gain access to the broader REIT market and analyze trends in the real estate sector.

Are REITs correlated with stocks?

Generally speaking, REITs have a low correlation with stocks. This means they may not move in tandem with equities, providing investors with additional diversification benefits. However, it's important to remember that correlations can change over time, and other factors must be considered when evaluating correlation.

Are REITs a good investment?

REITs can be a good investment, allowing investors to diversify their portfolio with real estate assets. They provide income potential, capital appreciation, and inflation hedging. However, conducting thorough research, analyzing market trends, and considering your investment goals and risk tolerance before investing in REITs is important.

Are REITs a good hedge against inflation?

REITs may provide some protection against inflation, as their income streams are tied to rental prices, which tend to increase with inflation. However, investors should be aware that rising interest rates can hurt the performance of REITs.

Podcast 007 – Hedge Funds and REITS

A close look at Hedge Funds and Real Estate Investment Trusts

- Published: Sun, 04 Mar 2018 23:00:00 GMT

- Duration 00:10:09

Get More Stock Market Investing Podcasts

Sources:

Lovely writing style. I think that articles like this highlight the advancement and modernisation of fairly brick-and-mortar industries. Hopefully this proceeds in years to come, it’s certainly exciting.