Building a stock trading system lets you base your investing strategy on a logical process that has been fully tested to give you a winning edge in the market.

Developing a stock trading system combines logic, knowledge, experience, art, and science. Your system will need to perform well (higher than 7.5% on average per year) historically and be expected to perform well in the future, at least for the time frame you expect to use it.

The “Nirvana” of a trading system would need to perform well and need little “user interpretation” for it to function. This would mean using “trading robots” or a mechanical method. It is not necessarily a good idea to use a trading robot as that would place your trades for you, as this will essentially take any on-the-fly decision-making out of your hands.

However, you should use a mechanical method (computer) to help you test your systems and create the buy and sell signals for you.

In this context, your systems would have the following requirements.

- A good stock trading system must be backtested to prove that it worked in the past. This would prove that the logic upon which we based our assumptions is working.

- A good system allows us to trade less emotion, providing a market advantage. Emotion is known to be the culprit of many trading errors and losses.

- Automation of the fundamental screening for the stocks will save us time.

- Automating the technical indicators scan will narrow the list to focus only on our preferred candidates.

1. Understand how the stock market works

First, you must develop a hypothesis about how the stock market works. There are many different ways to do this, and you can find plenty of information online or in books. Understanding the fundamental analysis of markets and the technical analysis of stocks is the key to having a well-rounded foundation upon which to build your market hypothesis.

You want to be a successful stock investor but don’t know where to start.

Learning stock market investing on your own can be overwhelming. There’s so much information out there, and it’s hard to know what’s true and what’s not.

Liberated Stock Trader Pro Investing Course

Our pro investing classes are the perfect way to learn stock investing. You will learn everything you need to know about financial analysis, charts, stock screening, and portfolio building so you can start building wealth today.

★ 16 Hours of Video Lessons + eBook ★

★ Complete Financial Analysis Lessons ★

★ 6 Proven Investing Strategies ★

★ Professional Grade Stock Chart Analysis Classes ★

Once you have a hypothesis, you need to design a system that will test it. This system can be as simple or complex as you like, but it should be able to give you accurate data about how your hypothesis is performing.

2. Decide whether you will be an investor, trader, or both.

If you have the time to fully immerse yourself in the stock market, you might want to trade shorter time frames from days to weeks. If you have a full-time job and less free time, you may want to trade longer time frames and only monitor your stocks weekly.

Ultimately, you need to decide what type of investor you will be.

3. Choose your favorite markets

As an active trader, you should choose your stock markets wisely. If you want to be active, checking your stocks intra-day or daily, it may be wise to trade a stock market that is not in your time zone.

For example, Mr. Smith has a busy day job and only has time free in the evening. Mr. Smith is based in India. Normally, he would want to trade the Indian stock markets. But the European markets might be a good choice as they open close to the end of his working day. Therefore, he can focus his spare time on the stock market in question.

If you are a less active trader, it might be wise to trade the stock market in your time zone, as you may have the advantage of spotting successful companies in your country and investigating them further using your local knowledge.

4. Understand your profit target

What is your target? Active traders should expect higher returns/profits as they spend more time trading the market and take more risks. Less active traders might expect a slightly lower return as the trade-off for not being as focused.

But what is a good target?

Do not believe the scam artists of “Penny Stocks Newsletters” and peddlers of “microcap stocks”; in the real world, 100% or 1000% profits are unrealistic; in fact, it is irresponsible that they would promote their services this way.

Warren Buffet has averaged just over 24% annual return over his career. That is just 2% per month. Realistically, it would help if you chose this as a viable upper target.

5. Build a stock screening strategy

All good stock trading systems are based on stock screening. Stock screening filters thousands of stocks based on the criteria you are looking for. This process eliminates the weaker stocks and lists companies that meet your investing criteria.

You need to understand the meaning of Capitalization, Earnings per Share, Earnings Acceleration, five-year revenue % increase, and Price Earnings Ratio. You will learn these topics later in this course.

To adopt a value investing strategy, you will want to understand the best criteria for selecting undervalued stocks.

6. Select your stock charts and indicators

If you are using a mix of selecting growth stocks using screening and timing your stock trades using technical analysis, then you need to be proficient in technical analysis.

What indicators should you use?

- Price Indicators – the study of price-based chart indicators or oscillators are known as Stochastics, Relative Strength (RSI), Rate of Change (ROC), Moving Averages (MA), Moving Average Convergence Divergence (MACD), Parabolic SAR, and Average Direction Movement Index (ADX).

- Study of Volume – understanding how the volume level has a relationship with the price – and how the price has a relationship with volume.

- Study of Price Volume Indicators – On Balance Volume (OBV), Chaikin Money Flow.

My thorough testing awarded TradingView a stellar 4.8 stars!

With powerful stock chart analysis, pattern recognition, screening, backtesting, and a 20+ million user community, it’s a game-changer for traders.

Whether you're trading in the US or internationally, TradingView is my top pick for its unmatched features and ease of use.

Explore TradingView – Your Gateway to Smarter Trading!

7. Turn your hypothesis into rules

Now you understand your stock screening and selection criteria and know what technical signals you will use to make a trade. You need to turn these criteria into a specific set of rules.

Quantify your choices of the fundamental screens and technical analysis screens.

What stock screening strategy will you use for stock selection?

- Find the Best CANSLIM Stocks Using a CANSLIM Stock Screener

- Dividend Growth Stock Screener: 5-Step Timeless Strategy

- 6 Steps to Build Your Dividend Stock Screener & Strategy

- Value Investing Strategy: 7 Proven Value Stock Screeners

What Technical Indicators will you use for buying and selling stocks?

You must select an excellent stock screener to help you formulate your rules.

8. Run your rules and backtest

When you backtest a stock, you look at how it would have done in the past if you had bought it and held it. This can help you determine whether it is a good investment.

To backtest a stock, you need to get historical data. This data can be from a website like Yahoo Finance or Google Finance. Once you have this data, you must put it into a spreadsheet. Then, it would be best to create a formula to tell you how much the stock went up or down each day.

Or you can use the best stock market software that fully automates backtesting without using Excel or downloading and manipulating data.

9. Let your rules run, improve and tweak.

Once you have a system, you have backtested it, and you are happy with it, let it run. You can paper trade the system to confirm your commitment to the system. If it does not work as well as expected, tweak it and improve it.

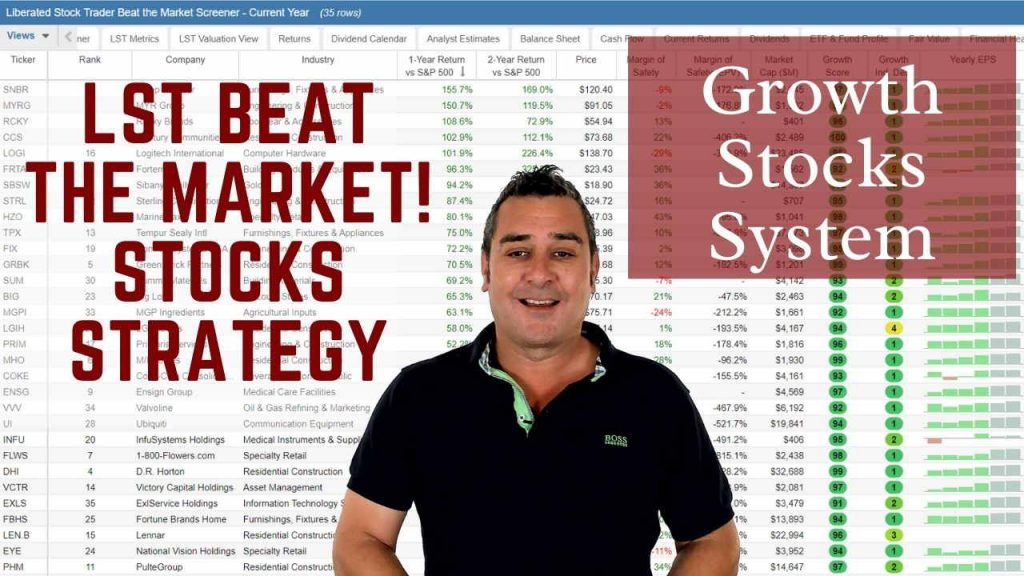

I have been developing systems for 20 years, and here are two examples of investing strategies that are fully backtested and iteratively improved.

Beat The Market, Avoid Crashes & Lower Your Risks

Nobody wants to see their hard-earned money disappear in a stock market crash.

Over the past century, the US stock market has had 6 major crashes that have caused investors to lose trillions of dollars.

The MOSES Index ETF Investing Strategy will help you minimize the impact of major stock market crashes. MOSES will alert you before the next crash happens so you can protect your portfolio. You will also know when the bear market is over and the new rally begins so you can start investing again.

MOSES Helps You Secure & Grow Your Biggest Investments

★ 3 Index ETF Strategies ★

★ Outperforms the NASDAQ 100, S&P500 & Russell 3000 ★

★ Beats the DAX, CAC40 & EURO STOXX Indices ★

★ Buy & Sell Signals Generated ★

MOSES Helps You Sleep Better At Night Knowing You Are Prepared For Future Disasters

Ever Dreamed of Beating the Stock Market

Most people think that they can't beat the market, and stock picking is a game only Wall Street insiders can win. This simply isn't true. With the right strategy, anyone can beat the market.

The LST Beat the Market Growth Stock Strategy is a proven system that has outperformed the S&P500 in 8 of the last 9 years. We provide all of the research and data needed to make informed decisions, so you no longer have to spend hours trying to find good stocks yourself.

The LST Beat the Market System Selects 35 Growth Stocks and Averages a 25.6% Annual Return

★ 35 Stocks That Already Beat The Market ★

★ Buy The Stocks & Hold For 12 Months - Then Rotate ★

★ Fully Documented Performance Track Record ★

★ Full Strategy Videos & eBook ★

Take The Pain Out Of Stock Selection With a Proven Strategy

10. Go or No Go

If your rules are working, implement your stock system and start to trade it. If not, you may need to refine the system. The best systems have been refined repeatedly to remove logical errors and improve the percentage of winning trades and profit per trade.

The results of a great stock trading system

Building and running a trading system takes time, a logical mind, and patience. Many successful traders have started to lose because, through boredom, they have deviated from their winning system or strategy.

Try not to make the same mistake.

Chart, Scan, Trade & Join Me On TradingView for Free

Join me and 20 million traders on TradingView for free. TradingView is a great place to meet other investors, share ideas, chart, screen, and chat.