Automated stock trading uses computer algorithms to execute trades in the market. These programs are designed to analyze market data and make trading decisions based on predetermined rules and criteria set by the user.

This means that traders no longer have to constantly monitor the markets and manually enter and exit trades, as the software can do it automatically.

My testing shows that TrendSpider, Trade Ideas, and TradingView are the best-automated trading software. Each platform offers auto-trading bots, pattern recognition, backtesting, and broker integration.

I’ve thoroughly tested 400 automation features across 25 trading platforms and apps to provide my top picks.

Best Automated Trading Platforms Summary

- TrendSpider: Fully Automated Analysis, Trading & Backtesting

- Trade Ideas: Automated Blackbox AI Algorithm Trading

- TradingView: Auto Pattern Recognition, Scanning & Signals

- SignalStack: Auto-trading Middleware to Connect Platforms

- MetaStock: Charting, Real-time News & Pattern Recognition

Our Top 3 Picks for Automated Trading

| Features | TrendSpider | TradeIdeas | TradingView |

| Awards |  |

|

|

| Rating |

4.8 | 4.6 | 4.5 |

| Buy/Sell Signals |

✅ | ✅ | ✅ |

| Trendline Recognition |

✅ | ✅ | ❌ |

| Chart Pattern Recognition |

✅ | ✅ | ✅ |

| Candlestick Recognition |

✅ | ✅ | ✅ |

| Strategy Backtesting |

✅ | ✅ | ✅ |

| Code-Free Backtesting |

✅ | ❌ | ❌ |

| Automatic Trade Execution |

✅ | ✅ | ✅ |

| Try It | TrendSpider | Trade Ideas | TradingView |

The software with the broadest selection of automated trading features are TrendSpider, Trade Ideas, and TradingView. TrendSpider has a complete set of features, Trade Ideas is a black box solution to auto-trading, and TradingView combines many automated features with a global trading community.

1. TrendSpider

TrendSpider ranks number one in our leading automated trading software testing. It automates market scanning, backtesting, chart pattern recognition, trendline analysis, and auto-trade execution.

Auto-pattern recognition is gaining importance due to its ability to save time and achieve superior accuracy compared to human analysis. Chart patterns like the Inverse Head and Shoulders have proven highly profitable for traders, so having TrendSpider’s machine algorithms find and trade them for you is a distinct advantage.

| TrendSpider Rating |

★★★★★ |

| 💰Buy/Sell Signals |

✅ |

| ⚡Trendline Recognition |

✅ |

| 📈Chart Pattern Recognition |

✅ |

| 🕯️Candlestick Recognition |

✅ |

| 🎯Backtesting |

✅ |

| 🧪Code-Free Backtesting |

✅ |

| 🤖Automatic Trade Execution |

✅ |

| 🌎 Markets Covered | USA |

| 🎮 Trial | ❌ |

| ✂ Discount | Use Code "LST30" for -30% on monthly or -63% off annual plans |

TrendSpider is unique because it can automatically detect support and resistance trendlines on multiple timeframes and display them on a single chart. It also has over 123 candlestick patterns, which it can automatically detect and trade.

One of the best features is TrendSpider’s code-free backtesting solution, “Strategy Tester.” I have used this functionality for indicator, chart, and candle pattern testing to prove their profitability. This functionality is the best backtesting solution I have used because you can create extremely detailed trading strategies without the need to be a programmer.

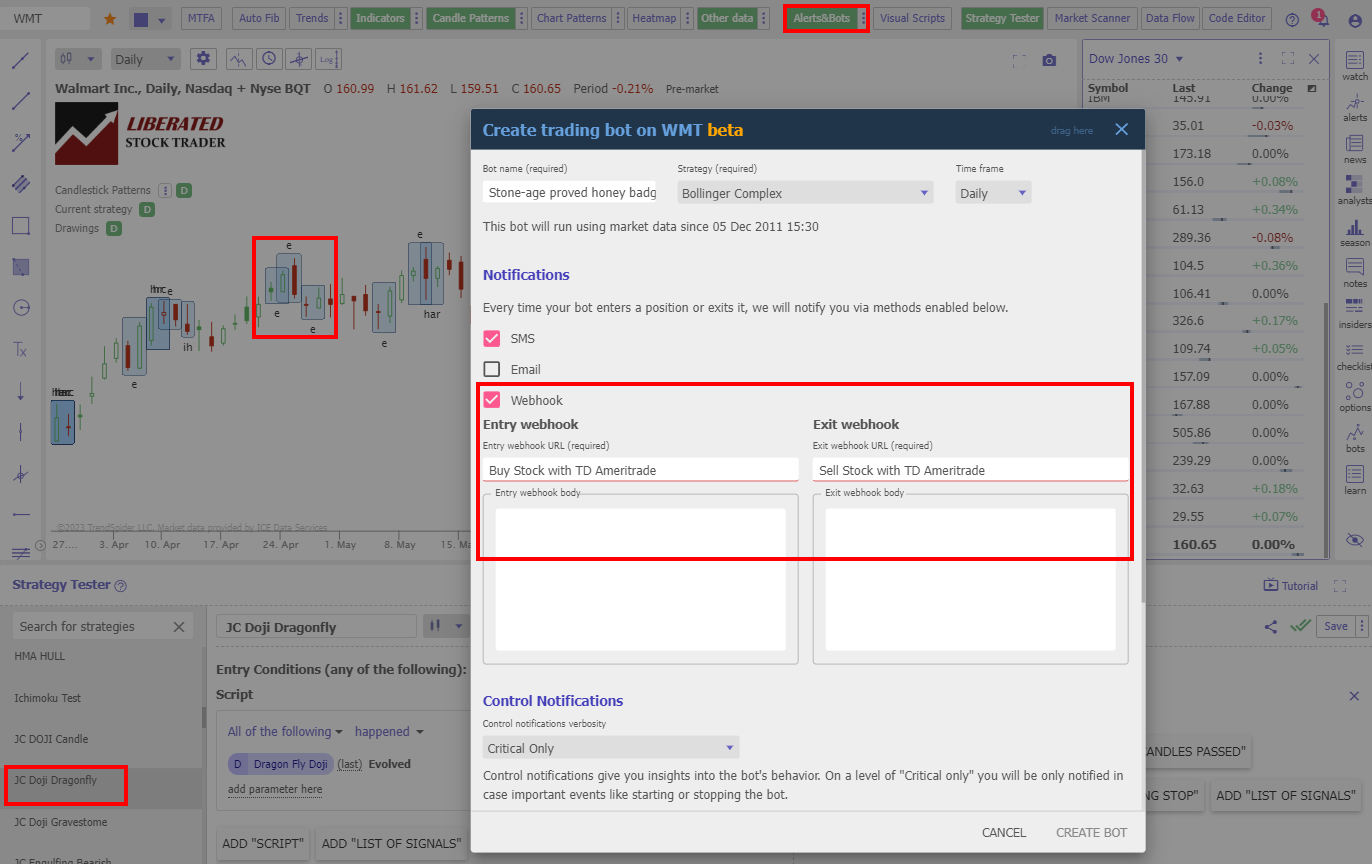

Finally, TrendSpider also enables automated trade execution via its “Alerts & Bots” system (image below); traders can connect to their broker’s API to buy and sell stocks automatically based on the strategy they create with the strategy tester.

Available for US stocks and Crypto exchanges, TrendSpider is a great choice for automated trading.

2. Trade Ideas

Trade Ideas is a powerful AI-powered automated trading platform that generates high-probability trading opportunities, scans the stock market, and backtests strategies.

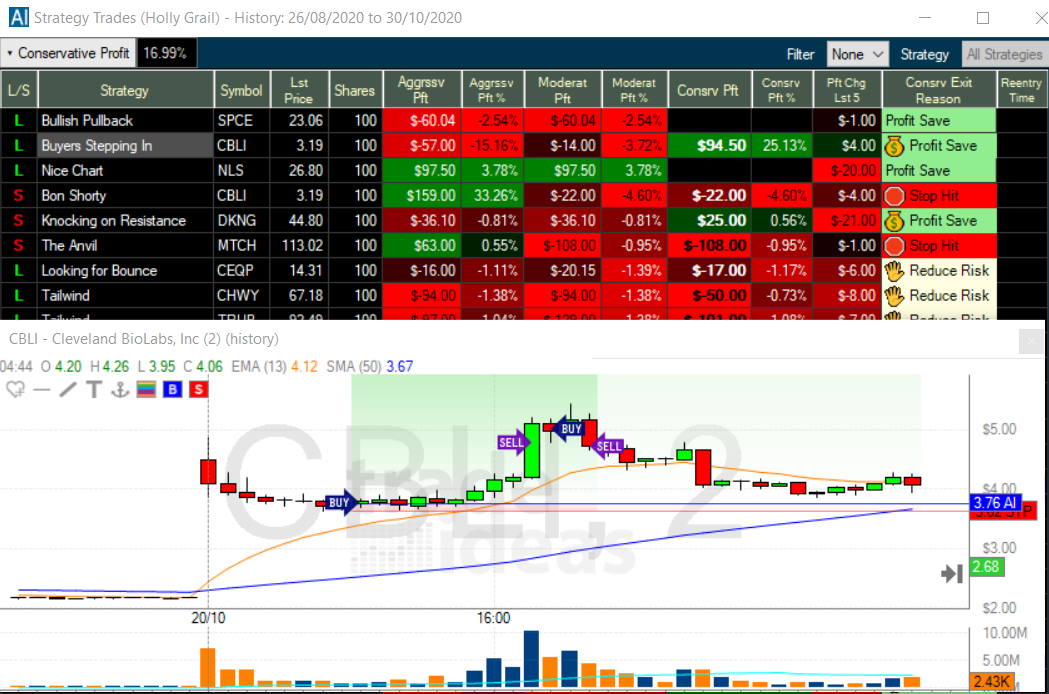

One of Trade Ideas’ most important features is its artificial intelligence (AI)- driven trading algorithms, which continuously scan the market to find potential future trades. Holly AI scans thousands of stocks in real-time to identify an edge in the market based on hundreds of variables.

| Trade Ideas Rating | ★★★★★ |

| 💰Buy/Sell Signals | ✅ |

| ⚡Trendline Recognition | ✅ |

| 📈Chart Pattern Recognition | ✅ |

| 🕯️Candlestick Recognition | ✅ |

| 🎯Backtesting | ✅ |

| 🧪Code-Free Backtesting | ❌ |

| 🤖Automatic Trade Execution | ✅ |

| 🌎 Markets Covered | USA |

| ✂ Free Trial Discount | -15% Discount Code "LIBERATED" |

Trade Ideas allows traders to automate and execute their trading strategies through its broker integration. This allows traders to create a system that can automatically buy and sell stocks without manually entering each trade.

Trade Ideas integrates with three brokers for stocks: Interactive Brokers, Etrade, and Esignal. The Brokerage Plus functionality is available with the Standard and Premium service. Trade signals generated from Holly AI cannot be autotraded, but alert window scans can be auto-executed in a sandbox or live with your brokerage using Brokerage Plus (available in the premium plan).

Trade Ideas offers a wide range of pre-built strategies for market scanning and provides an effective way to implement them with its automated trading functionality. However, it is important to note that Trade Ideas is a black-box solution, meaning if you want the flexibility to create your own unique strategies, you will be better off with TrendSpider.

Trade Ideas’ Holly AI has an excellent performance track record for its stock picks, averaging about 25% per year; you can find out more in our Trade Ideas Review and Test.

3. TradingView

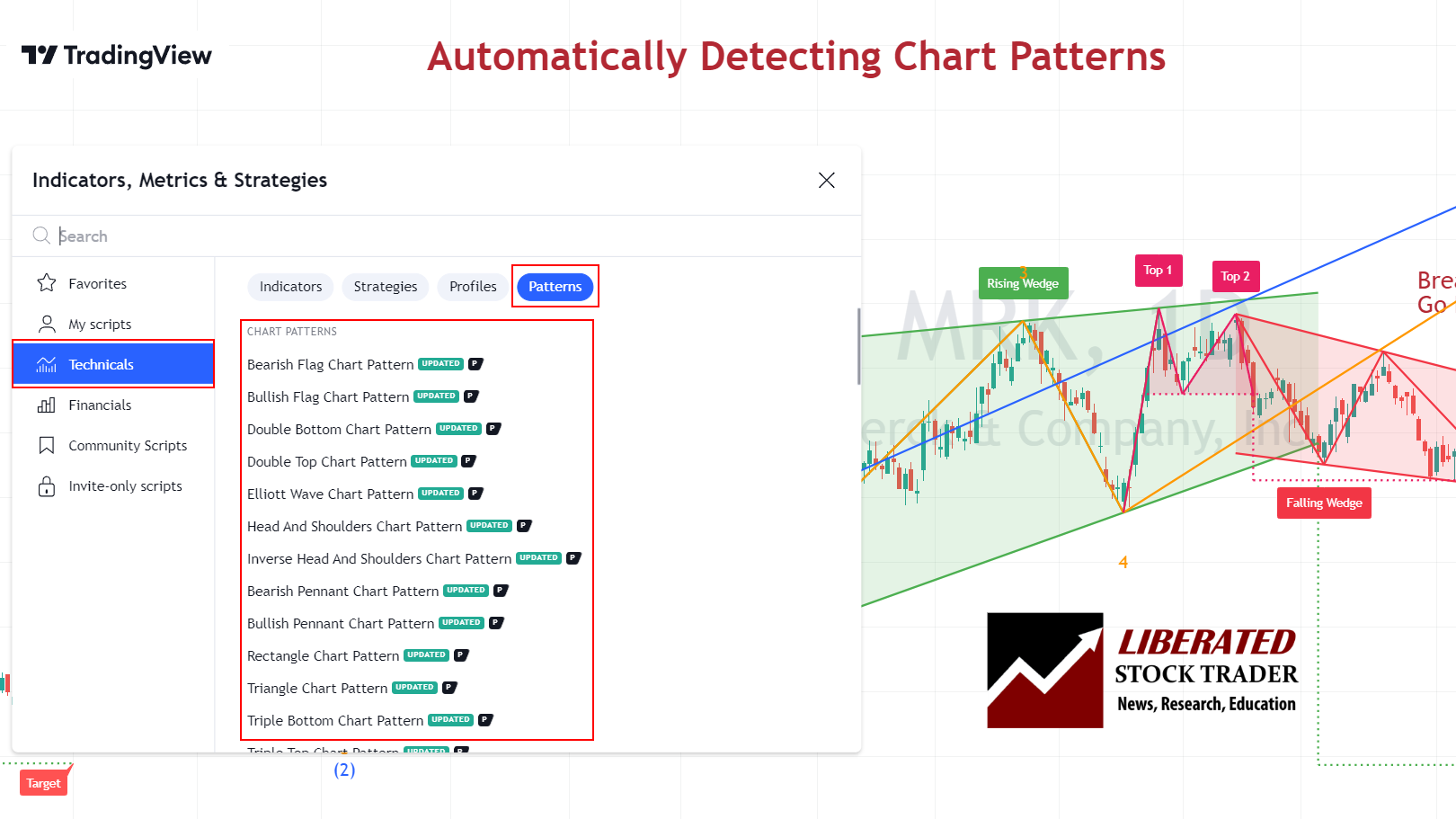

TradingView is the most developed and highly automated platform for international stock, FX, and Crypto traders. It automatically detects chart patterns and candlestick patterns and enables auto-trading.

TradingView can automatically detect and scan entire markets for chart patterns, like the double top or rectangle, and bullish and bearish candle patterns, like Harami, Doji, or Marubozu.

| TradingView Rating | ★★★★★ |

| 💰Buy/Sell Signals | ✅ |

| ⚡Trendline Recognition | ❌ |

| 📈Chart Pattern Recognition | ✅ |

| 🕯️Candlestick Recognition | ✅ |

| 🎯Backtesting | ✅ |

| 🧪Code-Free Backtesting | ❌ |

| 🤖Automatic Trade Execution | ✅ |

| 🌎 Markets Covered | Global |

| ✂ Free Trial Discount | $15 Discount Available + 30-Day Premium Trial |

TradingView has incredibly powerful backtesting, automatically identifying complex trading setups and issuing actionable alerts. To use the Pine script powered backtesting, you must learn basic scripting, which can take some time. There is no code-free backtesting or indicator development engine.

I am not a coder, but I have used TradingView to develop my Market Outperforming Stock & ETF System (MOSES), which identifies potential stock market declines and good opportunities to buy back in.

Finally, TradingView has the largest selection of Brokers integrated into its platform, so wherever you live, you can find an approved and trustworthy broker to execute trades automatically.

My thorough testing awarded TradingView a stellar 4.8 stars!

With powerful stock chart analysis, pattern recognition, screening, backtesting, and a 20+ million user community, it’s a game-changer for traders.

Whether you're trading in the US or internationally, TradingView is my top pick for its unmatched features and ease of use.

Explore TradingView – Your Gateway to Smarter Trading!

TradingView has the largest global community of traders and is the number one investing website in the world. Available globally for stocks, ETF, Forex, and Crypto exchanges, TradingView is a top choice for all traders.

4. SignalStack

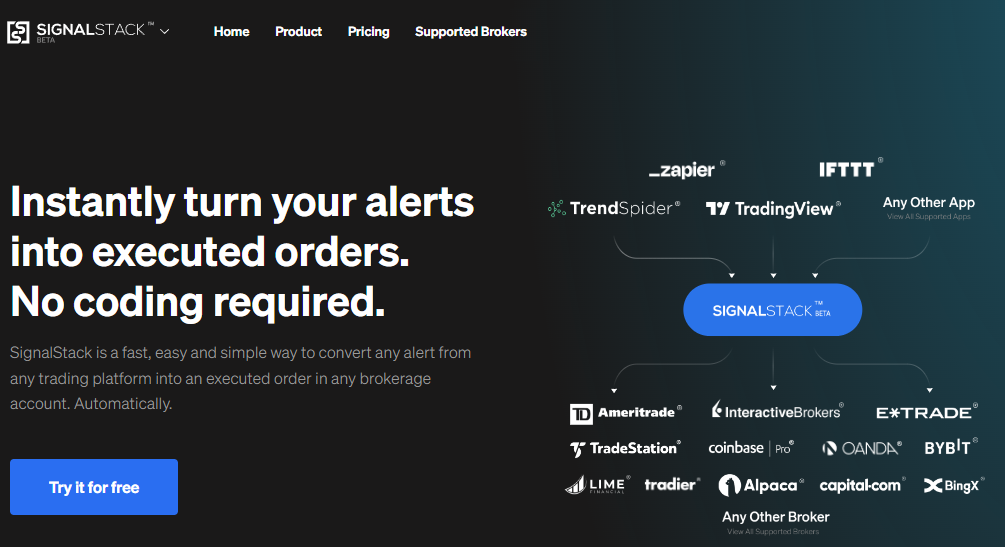

If your current trading software does not have automated trading, then SignalStack might be the solution you are looking for. SignalStack is an intelligent automated platform that connects your trading software to your broker.

SignalStack offers a myriad of features that transform the experience of automated trading. Firstly, it provides efficient order execution, eliminating the need for manual oversight and ensuring rapid market order placements.

Secondly, the platform offers customization and flexibility, enabling traders to personalize their strategies according to their unique investment goals and risk tolerance.

| SignalStack Rating | ★★★★ |

| 💰Buy/Sell Signals | ✅ |

| ⚡Trendline Recognition | ❌ |

| 📈Chart Pattern Recognition | ❌ |

| 🕯️Candlestick Recognition | ❌ |

| 🎯Backtesting | ❌ |

| 🧪Code-Free Backtesting | ❌ |

| 🤖Automatic Trade Execution | ✅ |

| 🌎 Markets Covered | Global |

| ✂ Free Trial | Yes |

Furthermore, SignalStack helps traders stay informed with real-time monitoring and robust error-handling capabilities, ensuring maximum trade control.

Lastly, it supports a wide spectrum of reputable brokers, like Schwab, eTrade, Interactive Brokers, and TradeStation, allowing for seamless connectivity and trade automation. As a result, traders can easily scale up their operations with the confidence that their trades are being handled correctly and efficiently.

Overall, SignalStack is an excellent choice for any trader to streamline their portfolio management process by automating trade execution. It is also highly adjustable, allowing users to customize its functionality to meet their needs and preferences. With its wide range of features, reliable performance, and extensive broker compatibility, it’s no wonder SignalStack has become one of the most popular auto-trade execution tools on the market today.

5. MetaStock

MetaStock is a powerful desktop stock charting software and market data platform that offers advanced charting and automated technical analysis capabilities. MetaStock has the largest selection of indicators, chart formats, and drawing tools of any charting software I have tested.

One of MetaStock’s key features is its ability to automatically scan markets and generate buy and sell signals using price trends, patterns, and candlestick formations. Traders can use this feature to quickly identify potential trading opportunities, saving time and maximizing their chances of success.

| MetaStock Rating | ★★★ |

| 💰Buy/Sell Signals | ✅ |

| ⚡Trendline Recognition | ✅ |

| 📈Chart Pattern Recognition | ✅ |

| 🕯️Candlestick Recognition | ✅ |

| 🎯Backtesting | ✅ |

| 🧪Code-Free Backtesting | ❌ |

| 🤖Automatic Trade Execution | ❌ |

| 🌎 Markets Covered | Global |

| ✂ Free Trial Discount | 3-for-1 Deal |

Additionally, MetaStock provides powerful backtesting and forecasting functionality, allowing traders to test their trading strategies against historical data. This feature enables traders to evaluate the performance of their strategies and make necessary adjustments before risking real capital. However, you must learn to code in MetaStock’s proprietary scripting language to unlock the backtesting features.

MetaStock integrates with Xenith, a real-time financial news platform, providing traders with up-to-date market insights and information. By combining powerful charting tools with real-time news, MetaStock equips traders with the tools to make timely and well-informed trading decisions.

Meta is designed to be broker agnostic, which means it does not offer broker integration, trade execution directly from charts, or live integrated profit and loss analysis. Consequently, you must manually input your trades into your broker’s platform independently.

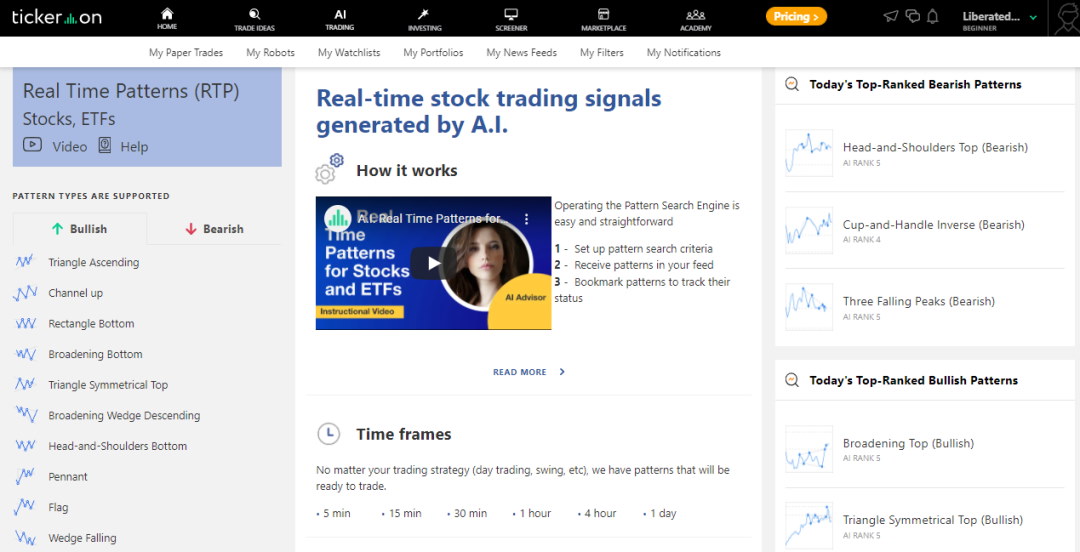

6. Tickeron

Tickeron offers advanced AI-automated chart pattern recognition and prediction algorithms for stocks, ETFs, Forex, and Cryptocurrencies. With an emphasis on thematic model portfolios and precise pattern-based trading signals, Tickeron combines success probability, confidence levels, and the collective intelligence of its trading community.

| Tickeron Rating | ★★★ |

| 💰Buy/Sell Signals | ✅ |

| ⚡Trendline Recognition | ✅ |

| 📈Chart Pattern Recognition | ✅ |

| 🕯️Candlestick Recognition | ❌ |

| 🎯Backtesting | ✅ |

| 🧪Code-Free Backtesting | ❌ |

| 🤖Automatic Trade Execution | ❌ |

| 🌎 Markets Covered | USA |

| ✂ Free Trial Discount | 50% Off All Annual Plans |

Tickeron has introduced a robust feature known as AI Confidence Level. By analyzing historical stock data, the success rate of specific patterns, and the current market direction, Tickeron can provide a confidence level for trade predictions. This enhancement ensures accuracy and reliability when forecasting market trends.

Tickeron’s trading platform is a blend of cutting-edge artificial intelligence and invaluable human insights, allowing you to compare the perspectives of humans and machines. Whether you’re a day trader, swing trader, or investor, Tickeron provides a comprehensive suite of features tailored to your unique investing style.

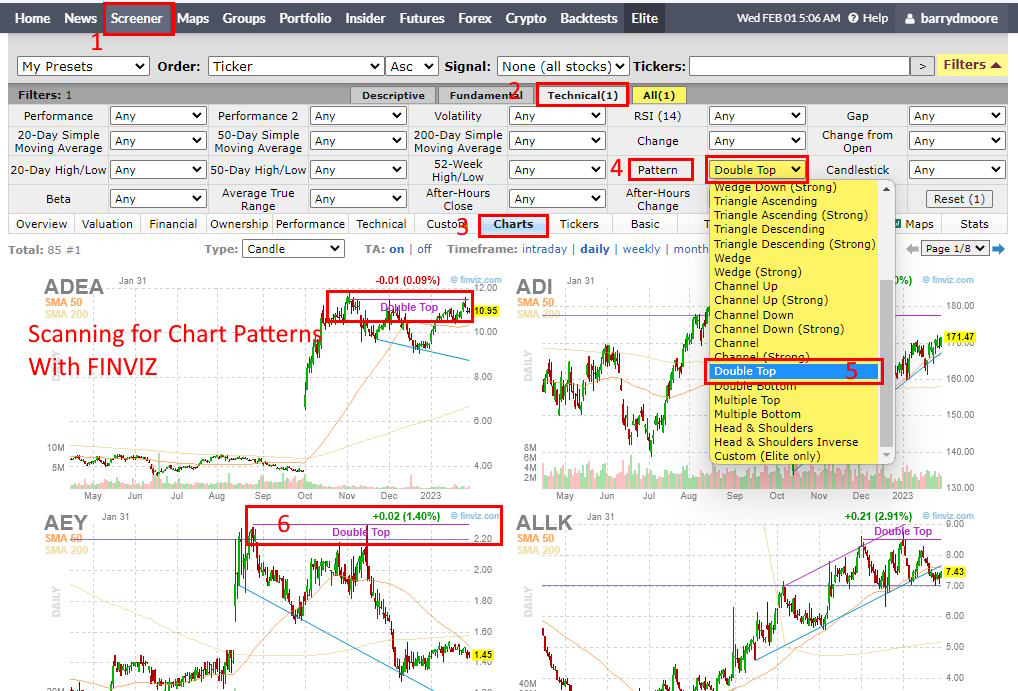

7. Finviz

Finviz has been around for a long time, but it moved forward, offering automated candlestick and trendline recognition for all US stocks. Traders can automatically scan for candlestick patterns, support, and resistance trendlines at blazing-fast speeds.

Finviz also saves traders time by automating the visualization of stock, forex, and crypto heatmaps so traders can quickly see where the action is.

| Finviz Rating | ★★★ |

| 💰Buy/Sell Signals | ✅ |

| ⚡Trendline Recognition | ✅ |

| 📈Chart Pattern Recognition | ✅ |

| 🕯️Candlestick Recognition | ✅ |

| 🎯Backtesting | ✅ |

| 🧪Code-Free Backtesting | ✅ |

| 🤖Automatic Trade Execution | ❌ |

| 🌎 Markets Covered | USA |

| ✂ Free Trial Discount | -40% With Annual Plan |

Finviz stands out due to its unique feature of allowing users to screen ten major candlestick patterns and 30 stock chart patterns. It offers a perfect blend of fundamental screening criteria for investors, technical charts, and candlestick pattern recognition for traders, making it an excellent choice for short-term and medium-term investors.

The Finviz Backtester provides access to an extensive range of over 100 distinctive indicators and effortlessly identifies stock chart patterns, making it an invaluable tool for creating a truly exceptional system. The best part? You don’t need any coding skills to perform backtesting, which boasts significant advantages.

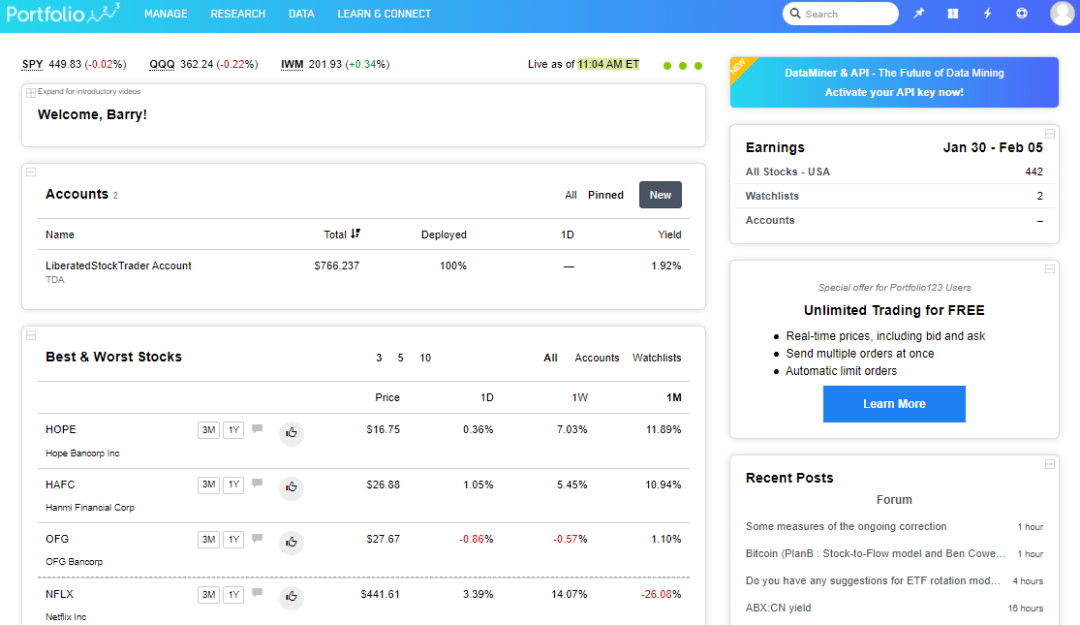

8. Portfolio 123

With its advanced automation capabilities, Portfolio123 simplifies the stock trading process, portfolio creation, and management. Portfolio123 enables users to invest in rules-based stocks and ETF strategies. Its advanced ranking systems and screening tools allow investors to create strategies based on customizable criteria and parameters.

| Portfolio 123 Rating | ★★★ |

| 💰Buy/Sell Signals | ✅ |

| ⚡Trendline Recognition | ✅ |

| 📈Chart Pattern Recognition | ❌ |

| 🕯️Candlestick Recognition | ❌ |

| 🎯Backtesting | ✅ |

| 🧪Code-Free Backtesting | ✅ |

| 🤖Automatic Trade Execution | ✅ |

| 🌎 Markets Covered | USA |

Portfolio123 offers an exceptional backtesting functionality that sets it apart. With this feature, users can simulate their investment strategies using historical data, enabling them to evaluate performance and assess the effectiveness of their trading approaches. This invaluable tool empowers investors to refine their trading rules and make data-driven decisions without needing real capital, ensuring optimal outcomes.

Portfolio123 incorporates tailored risk profiling to ensure investment strategies align with investors’ risk tolerance levels. By understanding each investor’s risk appetite, Portfolio123 helps users build portfolios that reflect their individual goals and preferences. This automated risk assessment feature ensures a personalized and balanced approach to investing.

Portfolio123 now offers broker integration with Tradier, empowering investors to seamlessly execute trades based on their customized strategies.

9. M1 Invest

M1 Finance offers a seamless investment experience. It is an automated advisor that constructs your portfolio and executes trades without fees. It is a comprehensive, user-friendly platform for independent investing, empowering you to make informed financial decisions effortlessly.

M1 is smart; it will manage your portfolio, trade your stocks, and report to you your earnings. Not only that, but it will rebalance your portfolio and perform year-end tax-loss harvesting.

| M1 Invest Rating | ★★★ |

| 💰Buy/Sell Signals | ✅ |

| ⚡Trendline Recognition | ❌ |

| 📈Chart Pattern Recognition | ❌ |

| 🕯️Candlestick Recognition | ❌ |

| 🎯Backtesting | ❌ |

| 🧪Code-Free Backtesting | ❌ |

| 🤖Automatic Trade Execution | ✅ |

| 🌎 Markets Covered | USA |

M1’s investing approach is based on expertly curated portfolios. Each portfolio is called a “Pie”; each pie comprises multiple stocks with specific weightings based on what risk or exposure you seek.

There are close to 100 expert pies, with varying levels of return and past performance. You can select an expert pie or even build your own. The great thing is that when you send funds to your account, the money is automatically fully invested into your pie based on your allocation rules. Because there are no fees, this will not impact your account’s bottom line.

10. VectorVest

Vectorest is a stock analysis and forecasting software that offers various automated tools and features to assist investors. VectorVest utilizes advanced algorithms to analyze and evaluate stocks based on value, safety, and timing. This automated analysis saves time for investors who may otherwise spend hours researching and evaluating individual stocks.

| VectorVest Rating | ★★★ |

| 💰Buy/Sell Signals | ✅ |

| ⚡Trendline Recognition | ✅ |

| 📈Chart Pattern Recognition | ✅ |

| 🕯️Candlestick Recognition | ❌ |

| 🎯Backtesting | ❌ |

| 🧪Code-Free Backtesting | ❌ |

| 🤖Automatic Trade Execution | ✅ |

| 🌎 Markets Covered | USA |

VectorVest provides market timing signals that help users determine the optimal time to buy or sell stocks. These signals are generated based on extensive historical data and technical indicators, providing automated insights into market trends.

VectorVest offers buy/sell ratings for all covered stocks and provides a method for suggesting the stop loss. While VectorVest boldly asserts itself as the sole platform offering buy or sell signals, this claim does not hold. Other stock software offers better signals, such as Trade Ideas, MetaStock, or TradingView. Although the premium package comes with a higher price tag, it can be worthwhile if you make a substantial investment.

Table: Features Comparison

| Automated Trading Features |

TrendSpider | Trade Ideas | TradingView | Signal Stack | MetaStock | Tickeron | Finviz | Portfolio 123 |

| Buy/Sell Signals | ✅ | ✅ | ✅ | ❌ | ✅ | ✅ | ✅ | ✅ |

| Trendline Recognition | ✅ | ✅ | ❌ | ❌ | ❌ | ✅ | ✅ | ❌ |

| Chart Pattern Recognition | ✅ | ✅ | ✅ | ❌ | ✅ | ✅ | ✅ | ❌ |

| Candlestick Recognition | ✅ | ✅ | ✅ | ❌ | ✅ | ❌ | ✅ | ❌ |

| Backtesting | ✅ | ✅ | ✅ | ❌ | ✅ | ✅ | ✅ | ✅ |

| Code-Free Backtesting | ✅ | ❌ | ❌ | ❌ | ❌ | ❌ | ✅ | ✅ |

| Auto-Trade Execution | ✅ | ✅ | ✅ | ✅ | ❌ | ❌ | ❌ | ❌ |

| Broker Integration | ✅ | ✅ | ✅ | ✅ | ❌ | ❌ | ❌ | ❌ |

| Portfolio Management | ❌ | ❌ | ❌ | ❌ | ❌ | ✅ | ❌ | ✅ |

FAQ

Which automated trading software is the best?

Our testing shows that TrendSpider is the best-automated trading software with pattern recognition, powerful code-free scanning, backtesting, and auto-trade execution. It ticked every box in our test.

What automated software is best for international traders?

Based on our testing, the best trading platform for international investors is TradingView. It provides lots of automation and integration with brokers in most countries and has a global community of traders.

What is the best automated day trading platform?

The best automated day trading platform is Trade Ideas because it provides trading signals with the full power of institutional grade AI and enables commission-free auto trading through its Holly AI Bot. This service comes with a price, but for serious traders, it is worth it.

What is the best trading platform for beginners?

Our testing shows that TradingView is the best trading platform for beginners because it has automated candlestick and chart pattern recognition, powerful screening, and commission-free broker integration. Best of all, beginners will have a community of 20 million traders to learn from.

What is the best forex trading platform for beginners?

The best Forex trading platform for beginners is TradingView because it supports all Forex markets globally and has full Forex broker integration in nearly every country. Finally, TradingView has a huge community of Forex traders exchanging ideas, which benefits beginners.

How do I set up automated trading?

Setting up automated trading is easy. Select a platform that supports automated trading, such as TrendSpider, Trade Ideas, or TradingView. Once your account is fully established, seamlessly connect it to a broker.

Who has the best trading bot?

Trade Ideas has the best trading bot according to its audited performance track record. According to its website, Trade Ideas averages 23-25 percent profit annually.

Is automated trading profitable?

The profitability of automated trading depends on various factors, such as the features and settings used, the market conditions, and the broker you are using. However, with the right setup and tools, it can be profitable.

Does automated trading work?

Yes, automated trading can work and be profitable, but it can also be unprofitable. It is important to research the bots you are considering and set realistic expectations. With that said, Trade Ideas has proven successful and profitable for many users.

Can I connect an automated trading bot to my broker?

Yes, SignalStack is designed to connect your charting software to your broker to execute trades automatically. Using SignalStack, you can turn platforms like TrendSpider and TradingView into trading Bots.

What is the best AI-automated trading platform?

The most professional and highly automated AI trading platform we have tested is Trade Ideas. With expert support and an integrated trading room for subscribers, Trade Ideas is not only a leader for institutional investors but also retail traders.

does they work for Indian stock market on NSE and BSE

Hi Subodh, TradingView is the only one on this list that works on the Indian stock markets (NSE/BSE) thanks. Barry

I want to be able to backtest and automatically trade stocks, but I have no coding skills. Which trading software would you be best?

Hi Jade, there are two options. TrendSpider has the most flexible and powerful backtesting, and requires no coding. Trade Ideas provides pre-configured backtesting and tight broker integration for trading bots. Try both for 1 month and see which one you prefer. Let me know how you get on. thanks Barry