Beat the Market Strategy: High-Performing Growth Stock Selection

Are You Ready to Consistently Outperform the Market?

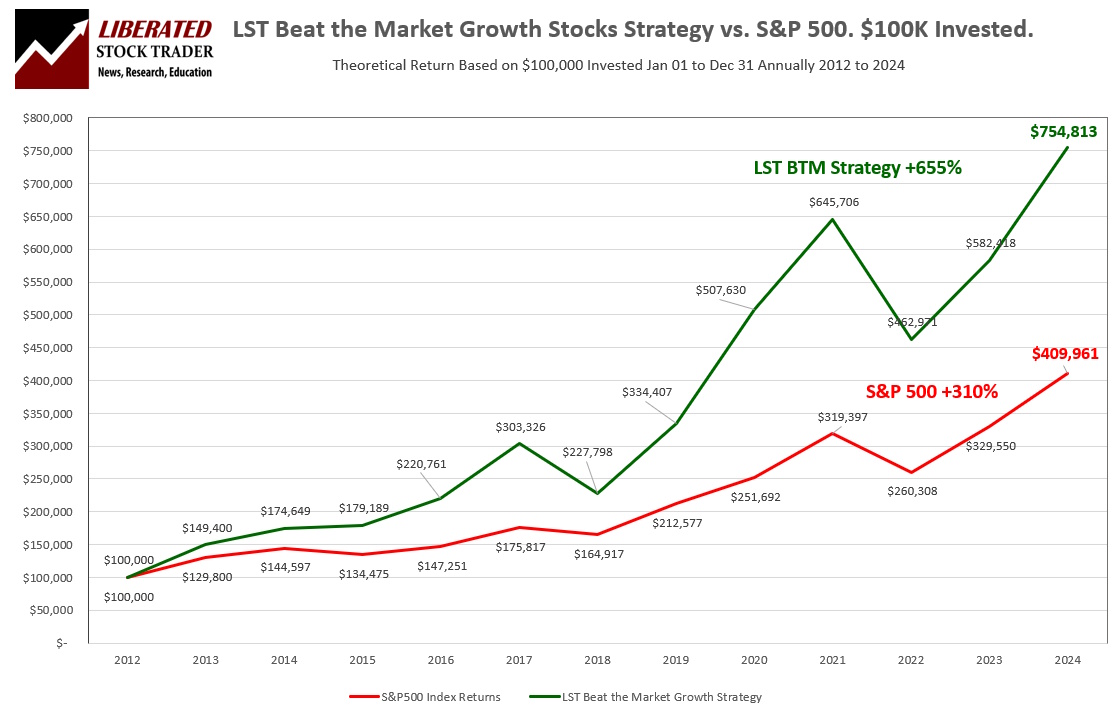

Decades of research and testing have led to the Liberated Stock Trader Beat the Market Strategy, a proven system that has outperformed the S&P 500 in 10 of the last 12 years, delivering a total return of 655% compared to the S&P 500’s 310%.

This strategy gives you an investing edge by identifying the 35 best growth stocks to buy. It helps you beat the S&P500, Nasdaq 100, or Russell 3000 and grow your portfolio.

While 92% of active fund managers fail to outperform the S&P 500 over any three-year period, the Liberated Stock Trader Beat the Market (LSTBTM©) growth stocks strategy identifies the 35 best stocks to buy now with a significant chance of beating the S&P500 returns.

The system uses growth in free cash flow and explosive EPS growth. Combining this with Joel Greenblatt’s ROC and Earnings Yield formulas, “the Magic Formula,” we have a selection of stocks that beat the market in 10 of the last 12 years.

A Unique Market-Beating System That Takes The Pain Out Of Stock Selection

How Does It Work?

Outperforming the S&P 500 benchmark is the goal of active fund managers, but 78% failed to achieve it over the last five years, and here are the market statistics to prove it.

“I have been inspired by the work of Joel Greenblatt and William J. O’Neil. But these strategies need something extra,” said Barry D. Moore, Founder of LiberatedStockTrader.com and certified financial technician.

“Screening for companies with increasing Cash Flow and Earnings Growth is a well-established best practice. Combined with Earnings Yield and Return on Capital, you have a foundation of financially stable growth stocks.”

“The strategy adds a new twist by selecting companies that have beaten the S&P 500 in the trailing 12 months.”

The goal was to create a simple strategy to make yearly profits that exceed the S&P500’s returns. The LST Beat the Market strategy has successfully outperformed the S&P 500 in 10 of the last 12 years, providing a total return of 655% versus the S&P 500’s 310%. The strategy suits individual investors by selecting only 15 to 35 stocks annually.

This system has been very successful in 10 of the last 12 years, but like any stock investing system, it is not guaranteed to be successful in the future.

Beat the Market Growth Stocks Strategy Performance Table

| 12 Year Performance | S&P500 % Gain Jan 1st to Dec 31st | LST Beat the Market Strategy % Gain | Result |

| 2013 | 29.8% | 49.4% | Beat |

| 2014 | 11.4% | 16.9% | Beat |

| 2015 | -0.7% | 2.6% | Beat |

| 2016 | 9.5% | 23.2% | Beat |

| 2017 | 19.4% | 37.4% | Beat |

| 2018 | -6.2% | -24.9% | Lost |

| 2019 | 28.9% | 46.8% | Beat |

| 2020 | 18.4% | 51.8% | Beat |

| 2021 | 26.9% | 27.2% | Beat |

| 2022 | -18.5% | -28.3% | Lost |

| 2023 | 26.6% | 25.8% | Equal |

| 2024 | 24.4% | 39.6% | Beat |

| Average Yearly Return | 14.16% | 21.46% | Beat |

12-Year Results Based on $100,000 Invested.

| Returns | S&P500 Index Returns | LST Beat the Market Growth Strategy |

| Initial Investment | $100,000 | $100,000 |

| 2013 | $129,800 | $149,400 |

| 2014 | $144,597 | $174,648 |

| 2015 | $134,475 | $179,189 |

| 2016 | $147,250 | $220,761 |

| 2017 | $175,817 | $303,326 |

| 2018 | $164,916 | $227,797 |

| 2019 | $212,577 | $334,407 |

| 2020 | $251,961 | $507,630 |

| 2021 | $319,397 | $645,706 |

| 2022 | $260,308 | $462,917 |

| 2023 | $239,550 | $582,418 |

| 2024 | $409,961 | $754,813 |

| Cumulative 12 Year % Gain | +310% | +655% |

As you can see, the S&P500 turned $100,000 into $409,961 over the last 12 years. The LST Beat the Market Growth Stocks Strategy turned $100,000 into $754,813 over the same period. These results show that LST BTM beat the market by 84%.

Strategy Performance vs. S&P500, 2024

In 2024, our strategy delivered an impressive return of 29.6%, surpassing the S&P 500’s 24.4%. Once again, we’ve proven our ability to consistently outperform the market and deliver exceptional results.

Strategy Performance vs. S&P500, 2023

In 2023, our strategy delivered a performance of 25.8%, closely aligning with the S&P 500’s return of 26.6%. This slight difference can be viewed as effectively equivalent when accounting for minor slippage or variations depending on the specific S&P 500 ETF used for comparison.

Strategy Performance vs. S&P500, 2022

The year 2022 proved challenging for the stock market, with the S&P 500 declining by 18.5%. Unfortunately, our strategy underperformed, recording a loss of 28.3% for the year.

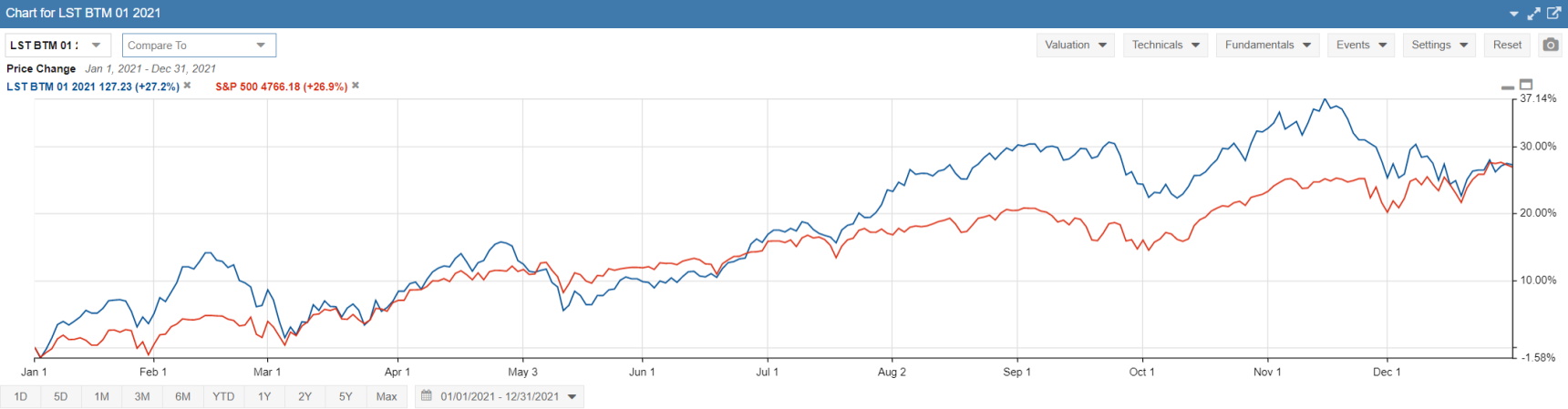

Strategy Performance vs. S&P500, 2021

For 2021, the LST Beat the Market Growth Stock Strategy outperformed the market by 10% in the second half and marginally outperformed the market by 0.3%. In 2021, 35 stocks met the screening criteria.

Strategy Performance vs. S&P500, 2020

For 2020, the LST Beat the Market Growth Stock Strategy has done very well; although only 13 stocks met the criteria, the LSTBTM growth stocks strategy has returned 51.8% versus the S&P500, which gained 18.4%. An outperformance of 33.4% in a year that was hampered by the COVID-19 outbreak.

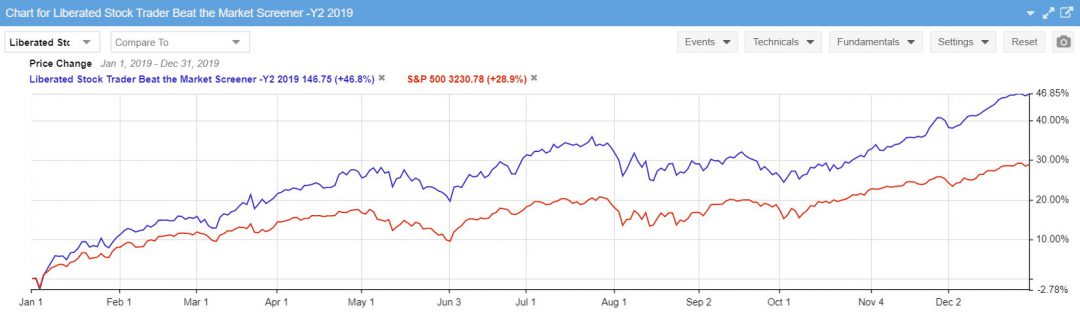

Strategy Performance vs. S&P500, 2019

In 2019, the LSTBTM strategy had a standout year, delivering an incredible 46.8% return! That’s a whopping 17.9% higher than the S&P 500, which gained 28.9% over the same period. Starting the year on January 1st and wrapping up on December 31st, this performance truly set a new benchmark.

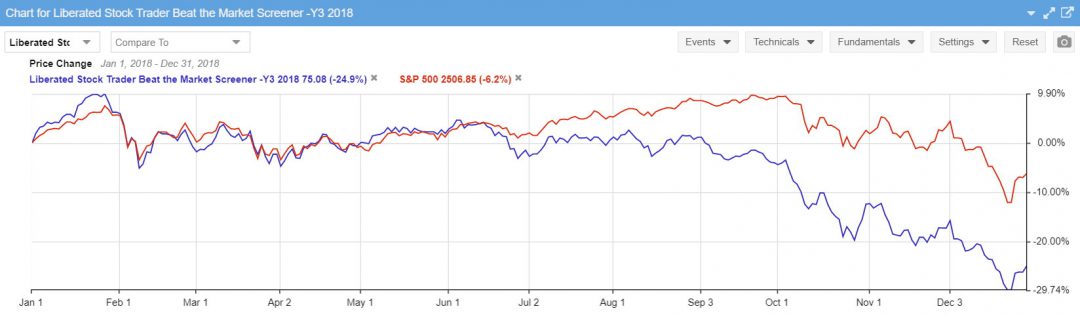

Strategy Performance vs. S&P500, 2018

2018 was the only year where the LST Beat the Market strategy significantly underperformed compared to the S&P 500. Although both the strategy and the market experienced losses that year, the S&P 500 posted a return of -6.2%, while the LSTBTM strategy faced a much steeper decline of 24.9%.

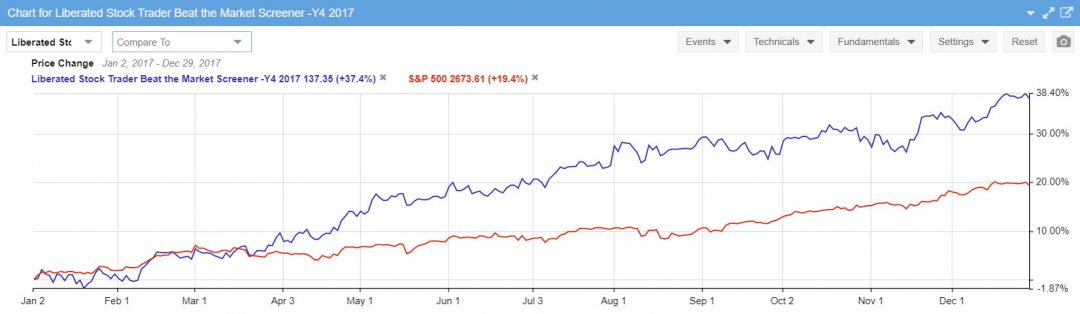

Strategy Performance vs. S&P500, 2017

The LSTBTM growth stocks strategy delivered another impressive performance in 2017, outperforming the market by a remarkable 17.8%. While the S&P 500 enjoyed a strong year with a return of 19.4%, the LSTBTM strategy soared, achieving an outstanding 37.4% return.

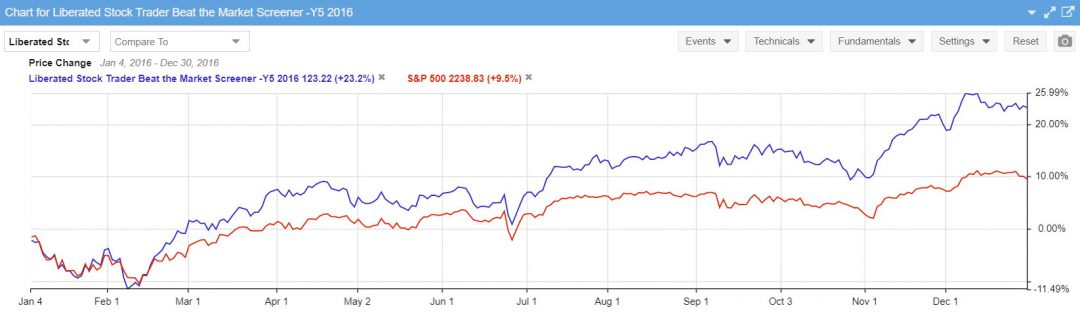

Strategy Performance vs. S&P500, 2016

In 2016, the market had a solid year, with the S&P 500 delivering a respectable 9.5% return. But the real standout was the Beat the Market Growth Stock Strategy, which soared past expectations with an incredible 23.2% profit—more than doubling the market’s performance!

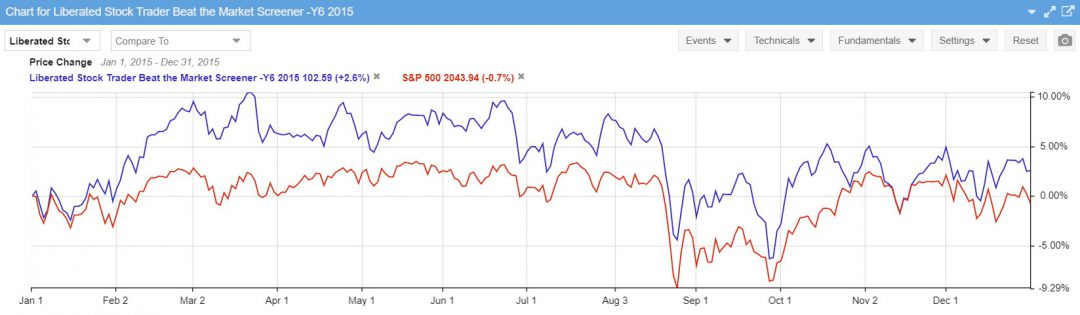

Strategy Performance vs. S&P500, 2015

The year 2015 proved to be a challenging one for generating profits, both for the LST system and the S&P 500. Despite the difficulties, the LST system outperformed the S&P 500 throughout the year. While the S&P 500 recorded a loss of 0.7%, the LSTBTM managed to achieve a modest yet commendable profit of 2.8%.

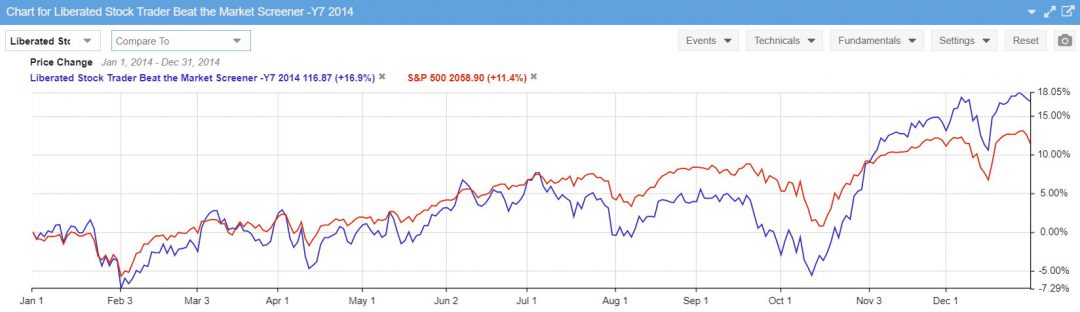

Strategy Performance vs. S&P500, 2014

For most of the year, the S&P 500 had the upper hand over LSTBTM. But in October 2014, everything changed. The selected stocks surged ahead, delivering an impressive 16.9% return, leaving the market’s 11.4% in the dust.

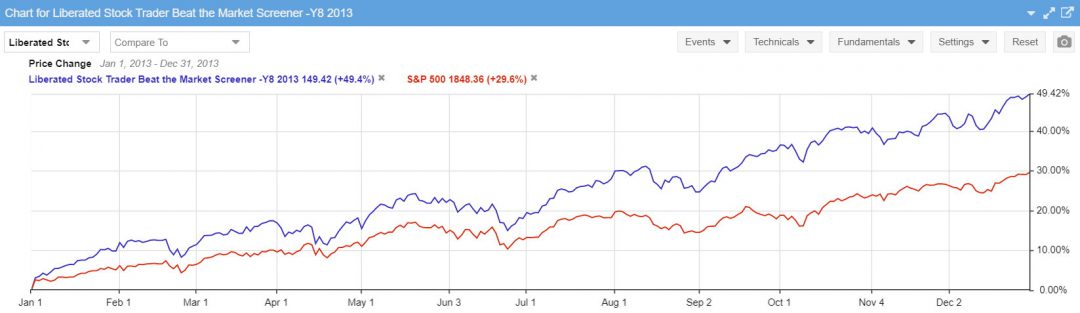

Strategy Performance vs. S&P500, 2013

In 2013, LSTBTM delivered an incredible 49.4% return, leaving the S&P 500’s 29.6% gain in the dust.

What’s Included in the Strategy?

Imagine what it would feel like to have beaten the market for nine years. Wouldn’t that be incredible?

Now is your chance to make that happen.

If you have any questions on the course or issues with the payment process, please get in touch with me directly on

✉ support (at) liberatedstocktrader.com.

Warranty As with any stock market investing system, nothing is guaranteed to work in the future as it did in the past. The more institutions that utilize a system, the more ineffective it becomes. So this beat the market growth stocks strategy, and LiberatedStockTrader.com accepts no liability for your use of this work. Liberated Stock Trader does not recommend purchasing specific stocks and accepts no liability for any losses incurred. By using this or any other published article for investing purposes, you agree to our disclaimer.

- You will need a Stock Rover Premium Plus subscription to use the system with Stock Rover.

To date (2025), this system has proven very effective, but there is no guarantee of future performance.