My testing shows the best backtesting software is TrendSpider for code-free strategy development, Trade Ideas for AI-powered algorithms, and TradingView for international traders.

TrendSpider has powerful pattern recognition, code-free backtesting, and auto-trading. Trade Ideas is the best AI stock backtesting and integrated auto-trading software. TradingView offers flexible, free pine-code backtesting for stocks, Forex, and crypto globally.

With over two decades of investing and trading experience, I have personally developed backtested systems and strategies on all the platforms in this article.

Backtesting Tools Ratings

| Backtesting Tool | Backtesting | Auto-Trading | AI-Powered | Rating | Best for: |

|---|---|---|---|---|---|

| TrendSpider | ✔ | ✔ | ✔ | ★★★★★ 4.8 | Stock, Fx, Futures, Crypto|USA |

| Trade Ideas | ✔ | ✔ | ✔ | ★★★★⯪ 4.7 | Day Traders|USA |

| Tradingview | ✔ | ✔ | ✘ | ★★★★⯪ 4.6 | Stock, Fx, Crypto Traders|Global |

| Stock Rover | ✔ | ✘ | ✘ | ★★★★⯪ 4.5 | Investors|USA |

| MetaStock | ✔ | ✘ | ✘ | ★★★★⯪ 4.4 | Stock, Fx Traders|Global |

| Tickeron | ✔ | ✘ | ✔ | ★★★★⯪ 4.4 | Investors & Traders|USA |

| Portfolio123 | ✔ | ✘ | ✘ | ★★★★☆ 4.1 | Investors|USA |

| IB | ✔ | ✔ | ✘ | ★★★★☆ 3.9 | Investors|Global |

| Tradestation | ✔ | ✔ | ✘ | ★★★★☆ 3.8 | Traders|USA |

| Quantshare | ✔ | ✘ | ✘ | ★★★☆☆ 3.1 | Quant Traders|Global |

Review & Test Methodology: Rating points were awarded for features, benefits, ease of use, backtest reporting, and the ability to execute trades. The use of AI to support the trader has also been awarded extra points.

Backtesting Tools Summary

My research shows the best stock backtesting and auto-trade software are TrendSpider, Trade Ideas, and Tradingview.

My testing process selected TrendSpider as the overall winner because it offers the most flexible, code-free, multilayer backtesting. Plus, the most indicators and patterns recognized, and trading bot integration.

Trade Ideas was also highly rated due to its fully automated AI system, which performs the backtesting for you, and its fully integrated auto-trading.

Tradingview offers a free, intelligent, robust stock backtesting solution, including auto trading using webhooks. MetaStock is the most powerful stock backtesting and forecasting platform for broker-agnostic traders but does not offer automated trading.

Stock Rover and Portfolio123 enable ten years of fundamental financial backtesting for investors but do not have auto-trade functionality.

1. TrendSpider: Winner – AI Backtesting & Pattern Recognition

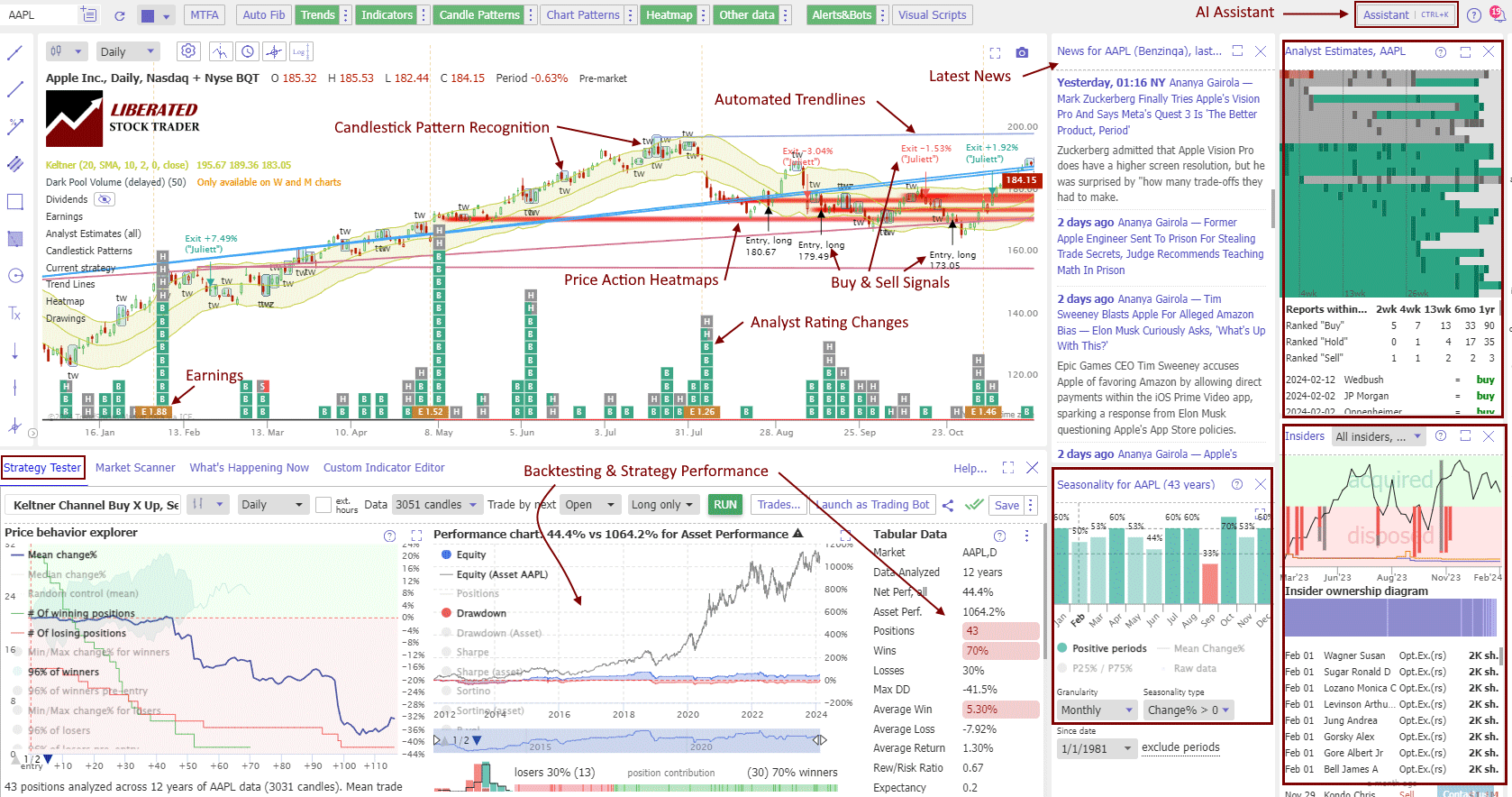

TrendSpider is my go-to backtesting platform. It provides a no-coding system for backtesting, and you can auto-trade using webhooks on alerts.

This means you can point and click to backtest charts and indicators. With TrendSpider, you can even select a one-minute timeframe for intraday backtesting.

TrendSpider has fully automated AI-driven trendlines, Fibonacci, and multi-timeframe analysis for stocks, Forex, crypto, and futures. Add a robust backtesting engine, and you have a great technical analysis platform.

My research reveals that TrendSpider is an excellent choice for US traders seeking AI-driven tools for charting, pattern recognition, and backtesting across stocks, indices, futures, and currencies. The platform stands out by automatically detecting trendlines, Fibonacci levels, and candlestick patterns. With its robust backtesting capabilities and multi-timeframe analysis, TrendSpider is particularly well-suited for seasoned technical traders looking to refine their strategies.

TrendSpider stands out by leveraging AI and machine learning to streamline traders’ workflow, bringing automated trend and pattern recognition to the forefront. With TrendSpider, traders gain access to advanced analysis and strategy testing capabilities, surpassing manual efforts in scale and efficiency.

Pros

✔ 150+ chart and candle patterns recognized

✔ True AI Model Training & Deployment

✔ Point-and-click backtesting

✔ Auto-trading bots

✔ Multi-timeframe analysis

✔ Real-time data included

✔ US Stocks, ETFs, Forex, Crypto, & Futures

✔ Seasonality charts, options flow

✔ News & analyst ratings change scanning

✔ 1-on-1 training included

Cons

✘ Not ideal for value or dividend investors

✘ No social community or copy-trading

Specific Backtesting Features

- Deep Backtesting Strategy Reporting & Analysis.

- Automated Trendline, Pattern & Candle Detection Backtesting.

- Powerful Point-and-Click Multilayered Backtesting.

- Launch Bots from Backtests.

- New – AI Assistant Built-In.

I have researched and backtested hundreds of candlestick patterns, chart patterns, and indicators using TrendSpider, which has features that are uniquely powerful in the industry.

TrendSpider is built from the ground up to automatically detect trendlines, chart patterns, candlesticks, and Fibonacci patterns. This means backtesting has already been built into the heart of the code.

Its most recent features are scanning for and backtesting news events, analyst estimates, financial data, splits, dividends, and earnings. All of this is possible without needing to code.

TrendSpider has implemented a strategy tester that allows you to type what you want to test freely, and it will do the coding for you. This is a smooth, simple, and incredibly user-friendly implementation.

You can also adjust your backtest conditions on the fly, and the “Price Behaviour Explorer” and “System Performance Chart” automatically update with trade statistics like win rate, profitability, and drawdown.

You can jump into coding if you want to, but the key here is that you do not have to.

With TrendSpider’s broker integration, you can turn a successful backtested strategy into an automated trading bot in just a few clicks.

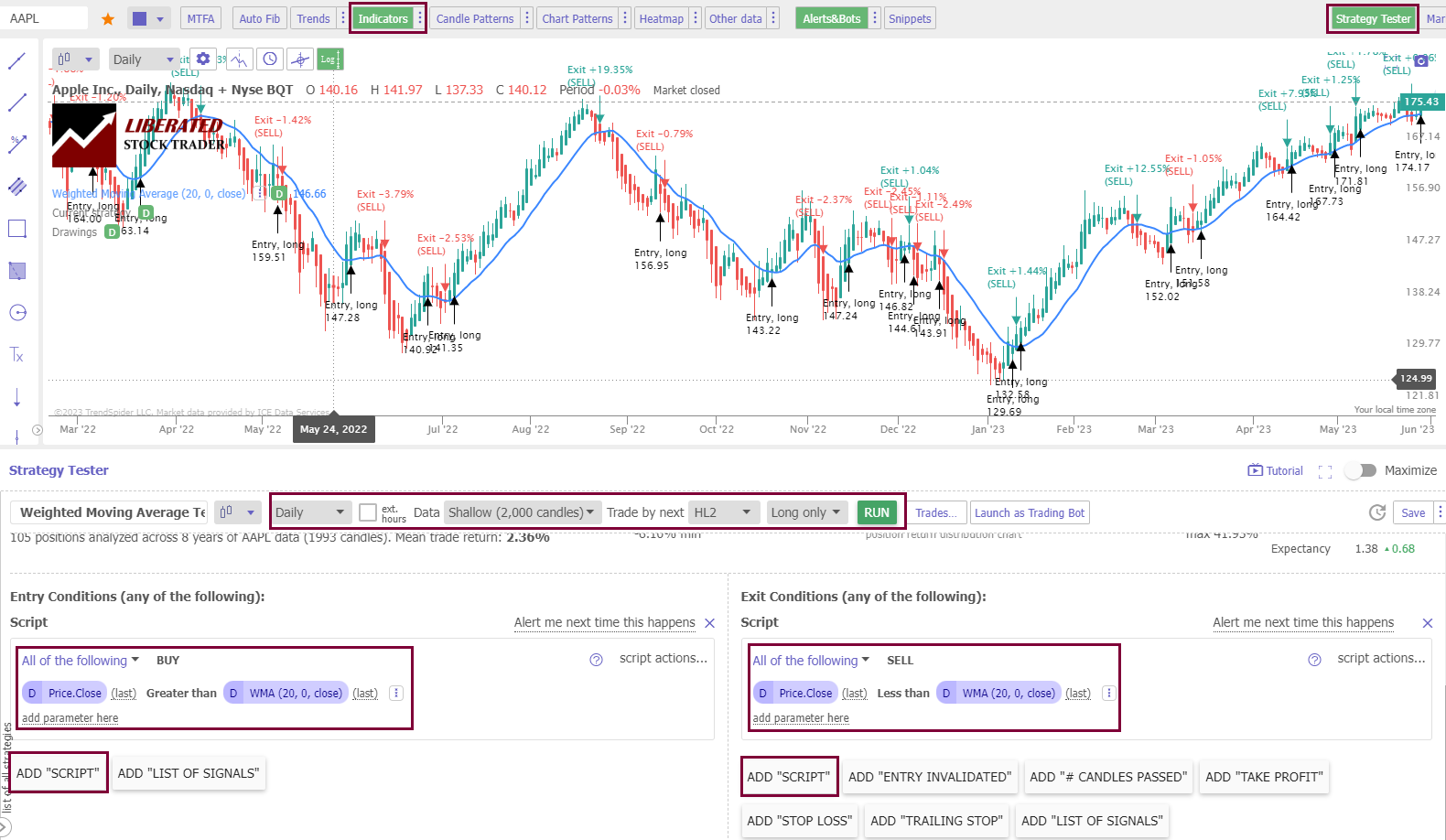

The screenshot below shows one of my backtests for the Weighted Moving Average indicator.

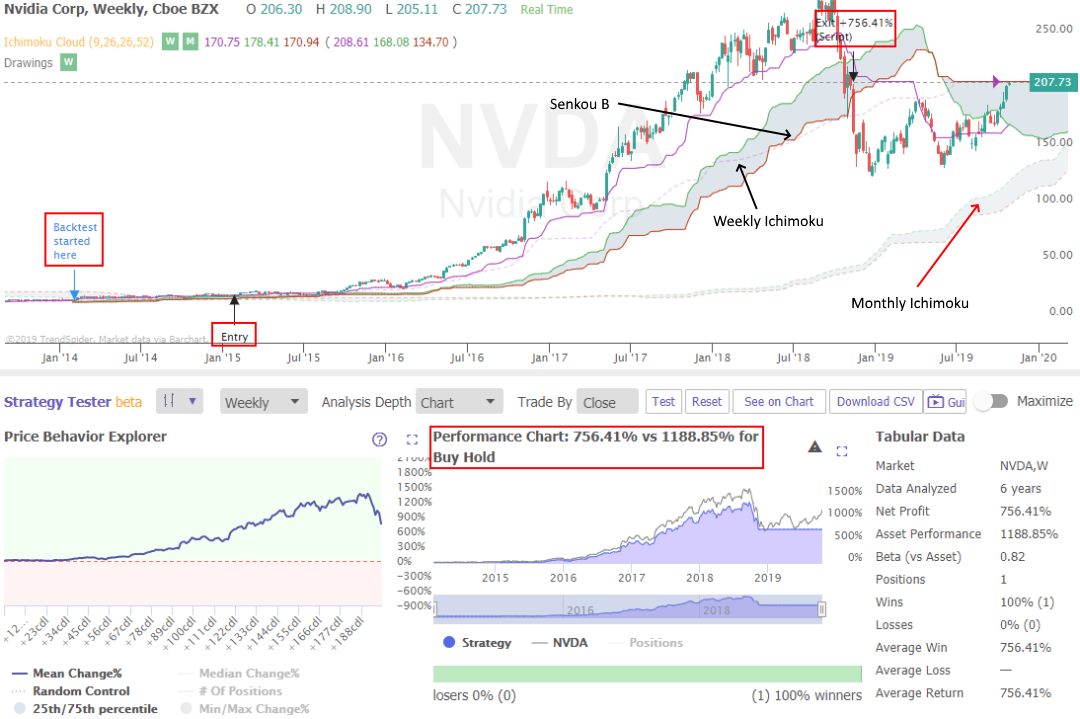

In the screenshot below, you can see the detailed reporting from my backtesting of the Ichimoku Cloud indicator.

Its automation does a better job than a human can; using algorithms, the system can detect thousands of trendlines and patterns and flag the most important ones with the highest backtested probability of success. To find out more, read the full TrendSpider review.

If you are a serious trader, TrendSpider will help you analyze quicker and more accurately and avoid missing an opportunity.

The system runs on all platforms, from smartphones to PCs. Finally, I have tested the customer support and confirmed it is excellent. You have a human to chat with, and you can have free 1-on-1 training to get you up-to-speed quickly.

2. Trade Ideas: Top AI Backtesting & Auto Trading

Trade Ideas provides the best AI-driven automated backtesting and auto-trade software, offering day traders specific audited trading signals for high-probability trades.

I recommend Trade Ideas for day traders wanting specific artificial intelligence-driven backtested trading signals and the option to auto-trade commission-free with eTrade.

Trade Ideas introduces us to a world where you do not need to manually backtest your stock trading theories for hundreds of hours to get an edge in the market. With Holly AI, the work is done for you.

My in-depth testing shows Trade Ideas is the ultimate black box AI-powered day trading signal platform with built-in automated bot trading. Three automated Holly AI systems pinpoint trading signals for day traders. Trade Ideas promises and delivers the nirvana of market-beating returns.

Trade Ideas is best for active US day traders seeking real-time AI-driven high probability trades, excellent stock scanning, and a live trading room to learn trading techniques.

Trade Ideas is worth it if you are a pattern day trader trading at least three times daily with an account value of over $25K as this will help you profit after paying the Trade Ideas subscription cost.

Pros

✔ 3 AI Trading Algorithms That Beat the Market

✔ Get A Free Holly AI Stock Trade Every Week

✔ Fully Automated Backtesting

✔ Exceptional Stock Scanning

✔ Specific Audited Trade Signals

✔ Auto-trading & broker integration

✔ Auto trade Commission Free With eTrade integration

Cons

✘ Old School User Interface

✘ No Mobile App

At first, access to the Holly AI system might seem pricey. You will need to go for Trade Ideas Premium, which costs $228 per month, or you can save $468 by going for an annual subscription, which costs $2268. You can access robust backtesting and the Holly Artificial Intelligence System for this investment.

Trade Ideas has three AI algorithms that automatically backtest stock chart patterns and volume conditions to find high-probability trades for day traders. Holly, Holly 2.0, and Holly Neo are trading algorithms that constantly backtest millions of real-time conditions to find trading opportunities. Each recommended trade has a win probability and a full set of backtested data for you to review.

- AI Virtual Trading Analyst Holly: 3 different constantly evolving AI algorithms

- Chart-Based AI Trade Assistance & Entry and Exit Signals

- Risk Assessment: Detailed information on the backtested performance of the recommended trade.

- Build and Backtest any Trade Idea: Compelling point & click backtesting system.

- Autotrade w/ Brokerage Plus and AI – Advanced auto trading commission-free with Etrade.

Backtesting

Trade Ideas is a powerful backtesting software that is easy to use and requires no programming knowledge. A point-and-click backtesting system is rare in this industry; the only software with this capability is TrendSpider.

I have run many backtests with Trade Ideas, but the one I wanted to focus on was a backtest of the “Unusual Social Mentions Scan.” This is a good test of the wisdom of crowds.

I wanted to focus on was a backtest of the “Unusual Social Mentions Scan”. This is a good test of the wisdom of crowds.

As you can see in the backtest result above, the crowds are not very wise, as the backtest shows that the system loses 70% per year.

Trade Ideas Pro AI

The AI algorithms developed by Trade Ideas are the main reason you want to sign up. I had a lengthy Zoom session with Sean Mclaughlin, Senior Strategist over at Trade Ideas, to delve into how the algorithms work, and I was very impressed. This company is laser-focused on providing traders with the best data-supported trading opportunities. There are currently four AI systems in operation.

Holly is 3 AI Systems Applying Over 70 Black Box Strategies.

Holly AI is the original incarnation of the Trade Ideas algorithm. Holly applies 70 strategies to all US & Canadian stock exchanges, including pink sheets and OTC markets. 70 strategies multiplied by 10,000+ stocks means millions of backtests every day. Only the strategies with the highest backtested win rate of over 60% and an estimated risk-reward ratio of 2:1 will be suggested as potential trades the following day.

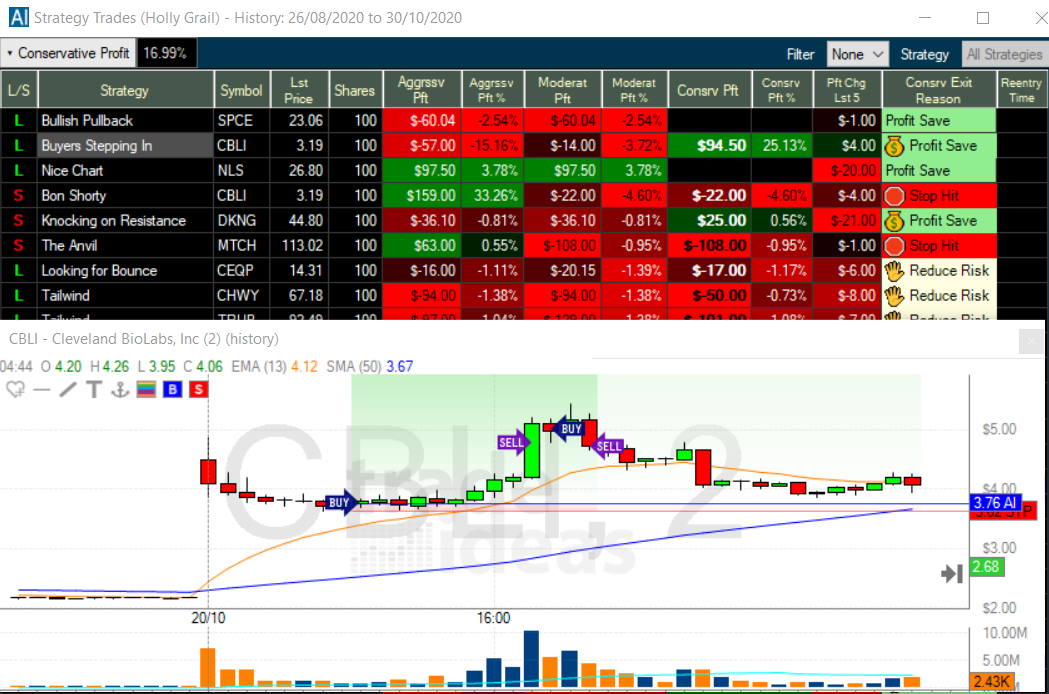

Buy & Sell Signals

Trade Ideas visually shows you every buy and sell signal on a chart. I have highlighted a trade Holly AI (Holly Grail) recommended in the chart below. The chart for Cleveland Biolabs (Ticker: CBLI) made a 25% profit within 4 hours, not how the buy and sell signals are depicted on the chart.

Get 15% Off Trade Ideas Code “LIBERATED”

3. Tradingview: Best Global Backtesting & Auto-trading

TradingView provides excellent free backtesting software for stocks, Forex, and cryptocurrencies. You can also auto-trade using webhooks to third parties and their integrated brokers.

TradingView is the ultimate all-rounder, with global screening and charting for all stock exchanges, plus a community of 20 million active users sharing ideas, strategies, and indicators.

There is no doubt about it; I love TradingView and use it daily. I regularly post charts, ideas, and analyses and chat with other traders. The TradingView community is focused on trading and investing, and the service is first-class.

TradingView stands as the world’s premier trading platform, trusted by over 20 million active traders worldwide. It offers a seamless blend of powerful charting tools, advanced screening features, and in-depth analysis, covering a wide range of assets, including stocks, indices, ETFs, and cryptocurrencies.

TradingView provides best-in-class technical analysis tools to analyze financial markets. It offers heatmaps, super charts, indicators, strategy development tools, and backtesting capabilities. Its vibrant community of traders shares ideas, strategies, and custom indicators, making it an invaluable resource for learning and collaboration.

Pros

✔ 20 million users sharing ideas

✔ Trading from charts

✔ Powerful screening and technical analysis

✔ All stock exchanges globally

✔ 100,000+ user-generated strategies

✔ Free and low-cost plans

✔ Flexible backtesting with pine script

Cons

✘ Not ideal for value or dividend investors

✘ Coding skills required for backtesting and custom indicators

Free Backtesting

The best free backtesting software is TradingView, which allows users of their free plan to backtest stocks, cryptocurrencies, and Forex. TradingView’s pine script engine enables powerful and flexible chart backtesting for up to 100 years of market data.

TradingView has an active community of people who are developing and sharing stock analysis systems. With the premium-level service, you can create and sell your own. The community also offers many indicators and systems for free.

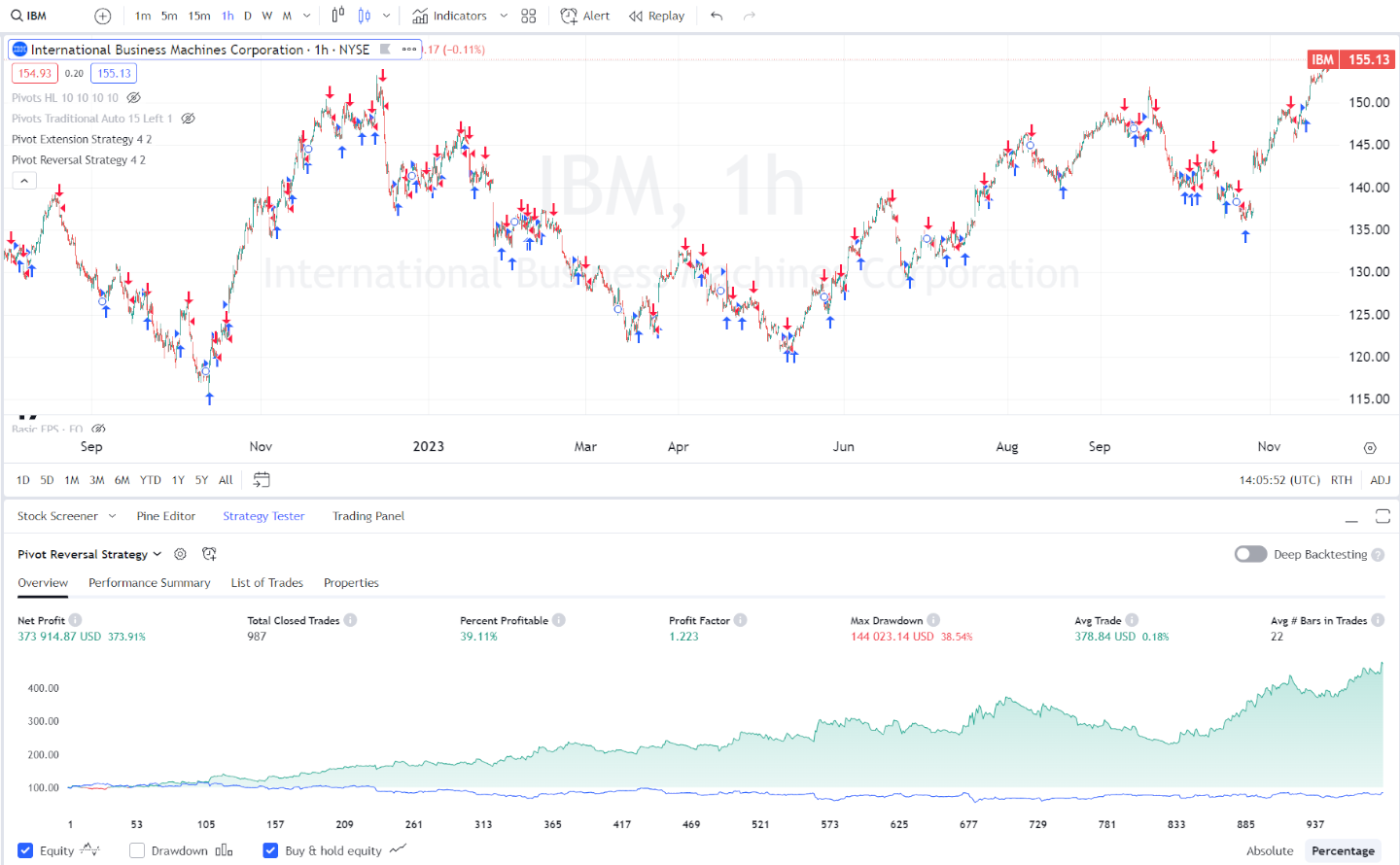

They have implemented backtesting intuitively. In the image below, I have implemented an in-built strategy called “Slow Stochastics,” which initiates a trade when the stochastics indicators are oversold and sells when stochastics are overbought.

I like that you have results in a few clicks [Strategy Tester -> Add strategy]. You can also tweak the strategy parameters, as you can see below, and observe the results.

The TradingView backtesting results reporting is good. The system shows the strategy’s profit performance, including net profit, drawdown, buy-and-hold return, percentage profitable trades, and the number of trades. All the trades are plotted on a chart for valuable visual reference.

I have even implemented my MOSES strategy into TradingView; I am no developer, but the Pine Script language is so natural anyone can do it.

Auto-Trading

It is possible to set up auto trading in Tradingview using the webhooks URL option in your alerts menu. Signal Stack’s specialized webhook engine makes this process more robust.

Market Replay

TradingView also has market replay functionality that lets you play through the timeline. This simple yet powerful feature shows you the chart scrolling and the trades executed. All buy and sell orders are highlighted on the chart. All in all, this is a great package that is included in the free version.

Chart, Scan, Trade & Join Me On TradingView for Free

Join me and 20 million traders on TradingView for free. TradingView is a great place to meet other investors, share ideas, chart, screen, and chat.

With over 160 different indicators and unique specialty charts, such as LineBreak, Kagi, Heikin Ashi, Point & Figure, and Renko, you have everything you need as an advanced trader. With the Premium membership, you also get fully integrated Level II insight.

TradingView is a great way to kick off your life as a backtesting system developer. There is a vast selection of free and premium strategies to test and the biggest and most active community of traders on the planet. TradingView has it all. I recommend going for the Pro or Pro Plus subscription as they enable more charts, indicators, and views, including intraday market data, which you might need for your backtesting.

4. Stock Rover: Best Backtesting for US Investors

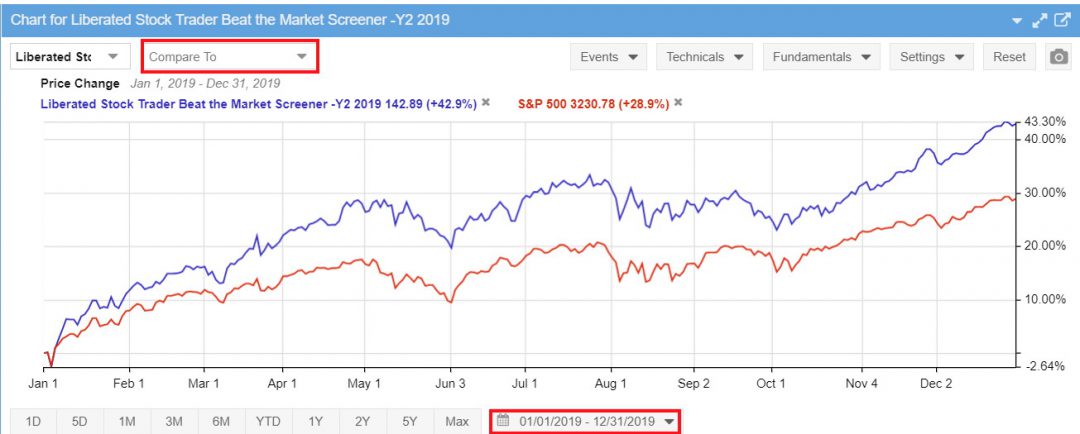

Stock Rover is my favorite backtesting software for value, growth, and dividend investors. I built my Beat the Market growth stock system using Stock Rover’s backtesting capability and excellent 10-year financial database.

My testing shows Stock Rover is best for long-term dividend, value, and growth investors. Its exceptional features are in-depth screening of a 10-year financial database, research reports, and broker-integrated portfolio management.

| Stock Rover Rating | 4.7/5.0 |

|---|---|

| 💸 Pricing | ★★★★★ |

| 💻 Software | ★★★★★ |

| 🚦 Trading | ★★★★✩ |

| 📡 Screening | ★★★★★ |

| 📰 Portfolio & Research | ★★★★★ |

| 📰 News & Social | ★★★✩✩ |

| 📈 Charts & Analysis | ★★★★✩ |

| 🔍 Backtesting | ★★★★✩ |

| 🖱 Usability | ★★★★★ |

Stock Rover is an industry-leading platform that enables the development of intricate dividend, value, and growth investing strategies.

With Stock Rover, I have developed incredible value strategies using its unique fair value, discounted cash flow, and margin of safety data. Its extensive growth investing data, such as performance versus the S&P 500 and industry growth and earnings rankings, make Stock Rover the best choice for serious investors.

Stock Rover’s key benefits include portfolio correlation and balancing and screening for dividends, value, and growth stocks. Its 10-year historical dataset allows you to backtest your screening criteria, which means you can see if your scans were profitable in the past.

Pros

✔ 650+ Financial Screening Metrics

✔ Potent Stock Scoring Systems

✔ Unique 10-Year Historical Financial Data

✔ Warren Buffett Value Screeners & Portfolios

✔ All Important Financial Ratios

✔ Real-time Research Reports

✔ Portfolio Management & Rebalancing

✔ Broker Integration

✔ Winner: Best Value Investing Screener

Cons

✘ No Social Community

✘ Not for Traders

✘ No Cryptocurrency or Forex Data

✘ US Markets Only

Backtesting

Stock Rover provides ten years of backdated financial information and scanning possibilities, better than nearly every other stock screening package. What is unique is that you can backtest screening results.

Below, I share the “Beat the Market Screener Backtest,” which focuses on growth and financial stability. Using Stock Rover, I could backtest the strategy for the previous seven years.

The Liberated Stock Trader Beat the Market Screener seeks to select stocks with a significant chance of beating the S&P500 returns. The screener uses growth in free cash flow and explosive EPS growth. Combining this with Joel Greenblatt’s ROC and Earnings Yield formulas, “the Magic Formula,” we have a selection of stocks that have beat the market for 7 of the last 8 years.

This work has been made possible due to the team’s fabulous work at our partner, Stock Rover, who created a stock research and screening platform that won our in-depth Best Stock Screener Review.

Why is Stock Rover so special in creating superior stock screeners? Because Stock Rover maintains a clean 10-year historical database of hundreds of vital ratios, calculations, and metrics. This means you can travel back in time to test if your stock selection criteria have worked in the past.

This Liberated Stock Trader Beat the Market Screener (LST BTM) is built into the Stock Rover library and is available to all Stock Rover Premium Plus Subscribers.

Get Stock Rover Now + 25% Discount

5. MetaStock: Best Chart Backtesting & Forecasting

MetaStock is one of the best independent, broker-agnostic stock backtesting and forecasting software platforms. It enables over 300 chart indicator backtesting strategies.

My MetaStock testing highlights it as a robust trading platform. It offers over 300 charts and indicators for global markets, including stocks, ETFs, bonds, and forex. MetaStock R/T excels with its advanced backtesting and forecasting features, alongside real-time news updates and efficient screening tools.

MetaStock is best for traders who need excellent real-time news, exceptional technical analysis, a vast stock systems marketplace with global data coverage, and excellent customer service.

However, the full Metastock suite costs $265/m. It rivals the Bloomberg terminal in functionality but lacks the new AI trading features of TrendSpider and Trade Ideas, such as AI Bot trading and pattern recognition.

Pros

✔ Great Selection of Automated “Expert Advisors”

✔ Excellent Deep Backtesting

✔ Unique Stock Price Forecasting

✔ Large Library of Add-on Professional Strategies

✔ Best Charts, Indicators & Real-Time News

✔ Xenith Add-On Rivals Bloomberg Terminals

✔ Works Online & Offline

Cons

✘ Takes Time To Learn

✘ Old School Windows App Design

✘ Too Many Add-ons

Backtesting

MetaStock enables backtesting over 300 chart, price, and volume indicators, enabling the development of an extremely granular trading strategy for stocks, Forex, and commodities.

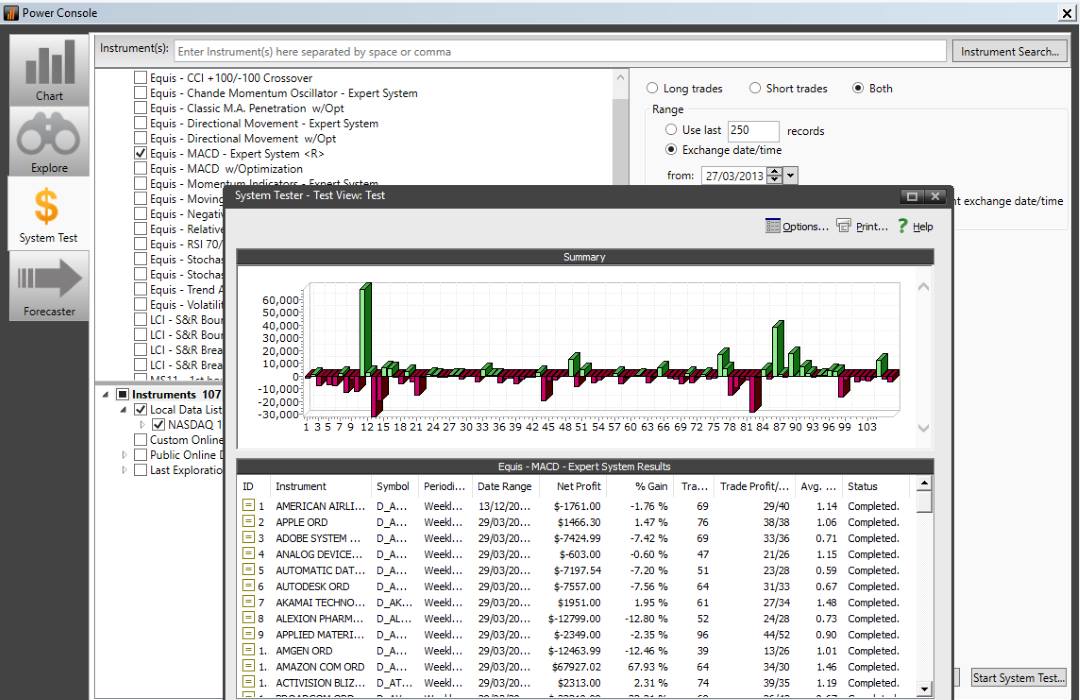

As you launch MetaStock, you are presented with the Power Console, enabling you to select what you want to do quickly. Select System Test, and you will have access to 58 systems you can backtest. In the example below, I selected the Equis MACD Expert System and ran it on the entire Nasdaq 100.

After 60 seconds, the backtest was completed, and I was presented with a list of every buy or sell trade and the drawdown on the portfolio chart that you can see above. You can click through to any trade to see the background of the trade, the size of the trade, duration, and profit or loss.

MetaStock harnesses many built-in systems and expert advisors to help you, as a beginner or intermediate trader, understand and profit from technical analysis patterns and well-researched systems. This is a crucial area of advantage.

Of course, the inbuilt systems will not make you rich, so you will want to backtest and develop your profitable system. Using scripting or programming skills, you can build a unique, backtested strategy with MetaStock. If you do not have the required skills, you can ask MetaStock or one of a considerable number of MetaStock Partners to assist you in creating your system.

Their partners sell many premium stock trading systems for MetaStock and are usually backed up with training and webinars to support the clients.

Forecaster Capability

The most significant addition to the MetaStock arsenal is the forecasting functionality, which sets it apart from the crowd. By selecting Forecaster from the power console, you can choose one or more stocks, ETFs, or forex pairs and click Forecast. You are then presented with an interactive report that enables you to scan through the many predictive recognizers, which help you understand the basis for the prediction and the methodology. This is a powerful forecasting implementation.

You can even use artificial intelligence functionality to test a set of variables within your backtesting. You could, for example, test if the price moves above the moving average of 10,14,18 or 20 in a single test to see which of the moving averages best works with that stock.

Watch this video from my partner Hunter Smith over at MetaStock to learn more about MetaStock forecasting.

Try MetaStock With a 3 Months for 1 Month Deal

MetaStock is one of the few vendors that take forecasting exceptionally seriously. The system backtesting is excellent because it allows you to test if a theory, idea, or set of analyses has worked in the past. Forecasting takes it to a whole new level by playing forward the backtesting to see how successful you might be with a strategy under certain circumstances. The configurable nature of the reporting for both backtesting and forecasting results is powerful.

Technical Analysis & Forex Forecasting

Forex forecasting based on sentiment is an exceptional feature. Despite the broadest selection of technical analysis indicators on the market today, MetaStock is the king of technical analysis, warranting a perfect rating.

MetaStock covers all the core chart types and includes Point & Figure, Equivolume, and Market Profile charts. Regarding indicators, MetaStock has 300+ different types, including Darvas Box and Ichimoku Cloud. MetaStock will also help you develop your indicators based on their coding system.

MetaStock is very good for backtesting and forecasting. The depth of fundamental research and news in MetaStock R/T is staggering, and the in-depth analysis, backtesting, and forecasting in MetaStock are industry-leading.

6. Tickeron: Backtesting, AI Signals & Pattern Recognition

Tickeron’s backtesting is automated, and its impressive AI-powered chart pattern recognition and prediction algorithms for stocks, ETFs, Forex, and Cryptocurrencies are impressive. Tickeron excels at providing thematic model portfolios, specific pattern-based trading signals, success probability, and AI confidence levels.

Tickeron’s trading platform is unique and innovative. It combines artificial intelligence and human intelligence based on the community of traders, so you can compare what humans think versus what machines think.

My Tickeron testing confirms impressive AI-powered chart pattern recognition and prediction algorithms for stocks, ETFs, Forex, and Cryptocurrencies. Tickeron provides reliable thematic model portfolios, specific pattern-based trading signals, success probability, and AI confidence levels.

Tickeron’s trading platform is unique and innovative. It combines artificial intelligence and human intelligence based on the community of traders, so you can compare what humans think versus what machines think.

Tickeron is designed for day traders, swing traders, and investors.

Pros

✔ 45 Streams of Trade Ideas

✔ Real-Time Pattern Recognition for Stocks, ETFs, Forex, and Crypto

✔ AI Trend Prediction Engines

✔ Investing Portfolios with Audited Track Records

✔ Build Your Portfolios with AI

Cons

✘ Custom Charting Limited

✘ Cannot Plot Indicators

✘ Complicated Pricing

Tickeron targets day traders, swing traders, and investors with intricate features and benefits specific to your investing style. Tickeron uses AI rules to generate trading ideas based on pattern recognition.

Firstly, they use a database of technical analysis patterns to search the stock market for stocks that match those price patterns using their pattern search engine. Each detected pattern has a backtested track record of success, and this pattern’s success is factored into the prediction using their Trend Prediction Engine.

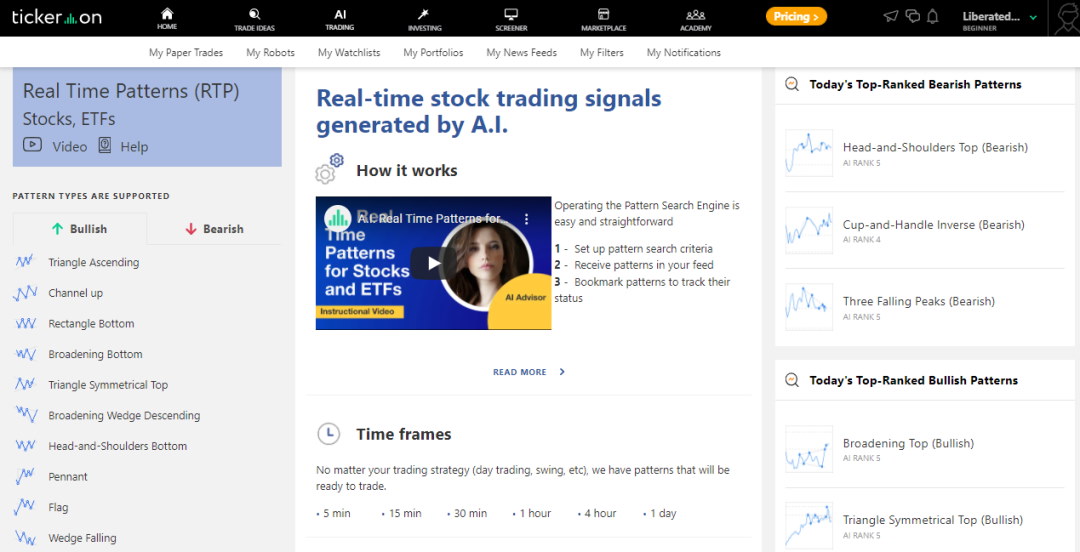

Pattern Recognition, Prediction & Backtesting

At the heart of Tickeron is its AI algorithms’ ability to spot 40 different stock chart patterns in real-time. You can select which pattern you want to trade, and it will filter stocks, Forex, or cryptocurrencies that currently show it. Patterns are split into bullish patterns for long trades or bearish patterns for those who wish to go short.

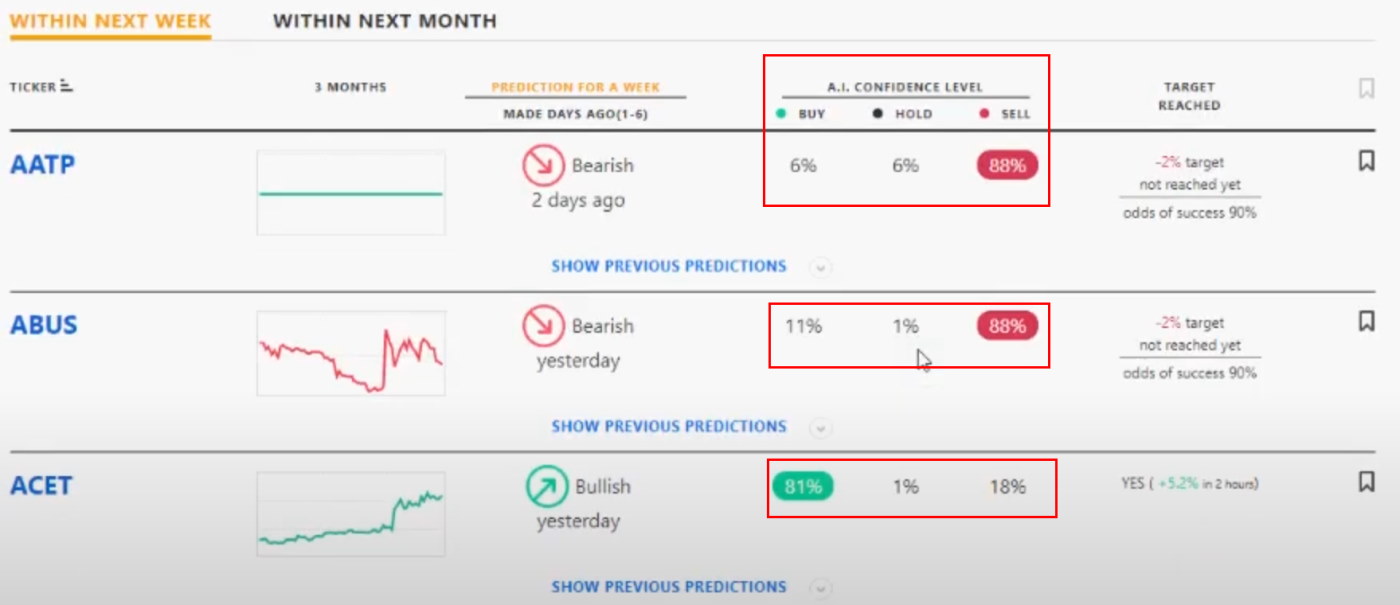

Tickeron’s real-time pattern recognition is particularly useful for swing or day traders, where market timing is the top priority. Tickeron can also scan the entire market and suggest which patterns work best on a particular day. In the screenshot above, you can see “Today’s Top Ranked Patterns,” which rates the potential success of the patterns based on the market’s current trading activity.

Ultimately, pattern recognition saves pattern traders a lot of work hunting for potential trade setups because it does all the work for them.

Trading Signals & Prediction

Tickeron has implemented a powerful feature called AI Confidence Level. Based on the stock’s history, the success rate of a particular pattern, and the market’s current direction, Tickeron can assign a confidence level to a trade prediction.

The screenshot below shows that the Tickeron AI predicts that ABUS has an 88% chance of declining in value and ACET has an 81% chance of increasing in value.

The outstanding feature of the Tickeron prediction engine is that you can click “Show previous predictions” to check if the AI has done a good job in the past with a particular pattern on specific stocks. The prediction engine provides the right level of clarity and granularity so you can make informed trading decisions.

Tickeron is worth buying if you are a short-term trader because it provides high-probability AI-backed trade signals. For active pattern day trading, I recommend a trading account value of over $25K.

7. Portfolio123: Stock Backtesting & Research for Investors

Testing of Portfolio123 shows stock screening and powerful backtesting software with a robust financial database and integrated commission-free trading with Tradier. Portfolio123 can be used by income, value, and growth investors but is also advantageous for swing traders.

My Portfolio123 testing highlights its solid stock screening, financial database, and easy integration for commission-free trading. Charting and usability can be improved, but it is good for dividend and growth investors. Value investors should look at Stock Rover as a better alternative.

| Portfolio123 Rating | 4.1/5.0 |

|---|---|

| 💸 Pricing | ★★★★✩ |

| 💻 Software | ★★★★★ |

| 🚦 Trading | ★★★★✩ |

| 📡 Screening | ★★★★★ |

| 📰 News & Social | ★✩✩✩✩ |

| 📈 Charts & Analysis | ★★★★✩ |

| 🔍 Backtesting | ★★★★✩ |

| 💡 Portfolio Research | ★★★★★ |

| 🖱 Usability | ★★★✩✩ |

Portfolio123 covers stocks, fixed income, and ETFs on US and Canadian exchanges, so it is unsuitable for international stock investors. However, you can design a fully automated real-time trading strategy with a broker that will hold the stocks that pass your screen and sell those that don’t.

Portfolio123 is a Chicago-based company offering stock screening, research, and portfolio management software.

Pros

✔ 470+ Screening Metrics

✔ 10-Year Backtesting Engine

✔ Unique 10-Year Historical Data

✔ Pre-built Model Screeners

✔ 260 Financial Ratios

✔ Integrated $0 Trading

Cons

✘ No Integrated News

✘ No App for Android or iPhone

✘ Initially, Complex To Use

✘ Missing Fair Value & Margin of Safety Metrics

✘ Technical Analysis Charting Needs Improving

My Portfolio123 testing highlights its solid stock screening, financial database, and easy integration for commission-free trading. Charting and usability can be improved, but it is good for dividend and growth investors. Value investors should look at Stock Rover as a better alternative.

| Portfolio123 Rating | 4.1/5.0 |

|---|---|

| 💸 Pricing | ★★★★✩ |

| 💻 Software | ★★★★★ |

| 🚦 Trading | ★★★★✩ |

| 📡 Screening | ★★★★★ |

| 📰 News & Social | ★✩✩✩✩ |

| 📈 Charts & Analysis | ★★★★✩ |

| 🔍 Backtesting | ★★★★✩ |

| 💡 Portfolio Research | ★★★★★ |

| 🖱 Usability | ★★★✩✩ |

Portfolio123 covers stocks, fixed income, and ETFs on US and Canadian exchanges, so it is unsuitable for international stock investors. However, you can design a fully automated real-time trading strategy with a broker that will hold the stocks that pass your screen and sell those that don’t.

Portfolio123 is a Chicago-based company offering stock screening, research, and portfolio management software.

Pros

✔ 470+ Screening Metrics

✔ 10-Year Backtesting Engine

✔ Unique 10-Year Historical Data

✔ Pre-built Model Screeners

✔ 260 Financial Ratios

✔ Integrated $0 Trading

Cons

✘ No Integrated News

✘ No App for Android or iPhone

✘ Initially, Complex To Use

✘ Missing Fair Value & Margin of Safety Metrics

✘ Technical Analysis Charting Needs Improving

The Portfolio123 screener allows you to filter 10,000+ stocks and 44,000 ETFs to help you find the investments or trades that match your exact criteria. Portfolio123 also has ranked screening, which enables you to rank the stocks that best match your criteria, filtering a list from hundreds of stocks to a handful. You can also define your custom universes, setting the macro criteria for which stocks are included in the sample.

Over 225 data points will cover most ideas based on fundamentals. Portfolio123 has 460 criteria, including analyst revisions, estimates, and technical data.

You can also use Portfolio123 to screen stocks on their performance relative to the S&P500 or any other benchmark. You could develop a strategy to select stocks based on their historical performance versus the market.

Building your Portfolio123 screener is theoretically easy; select Research -> Screens, and you can start to play. No programming skills are required to build a Portfolio123 screener, but basic coding will certainly help. If you want to create more powerful screening rules, you must study the coding logic and understand the names of the proprietary criteria.

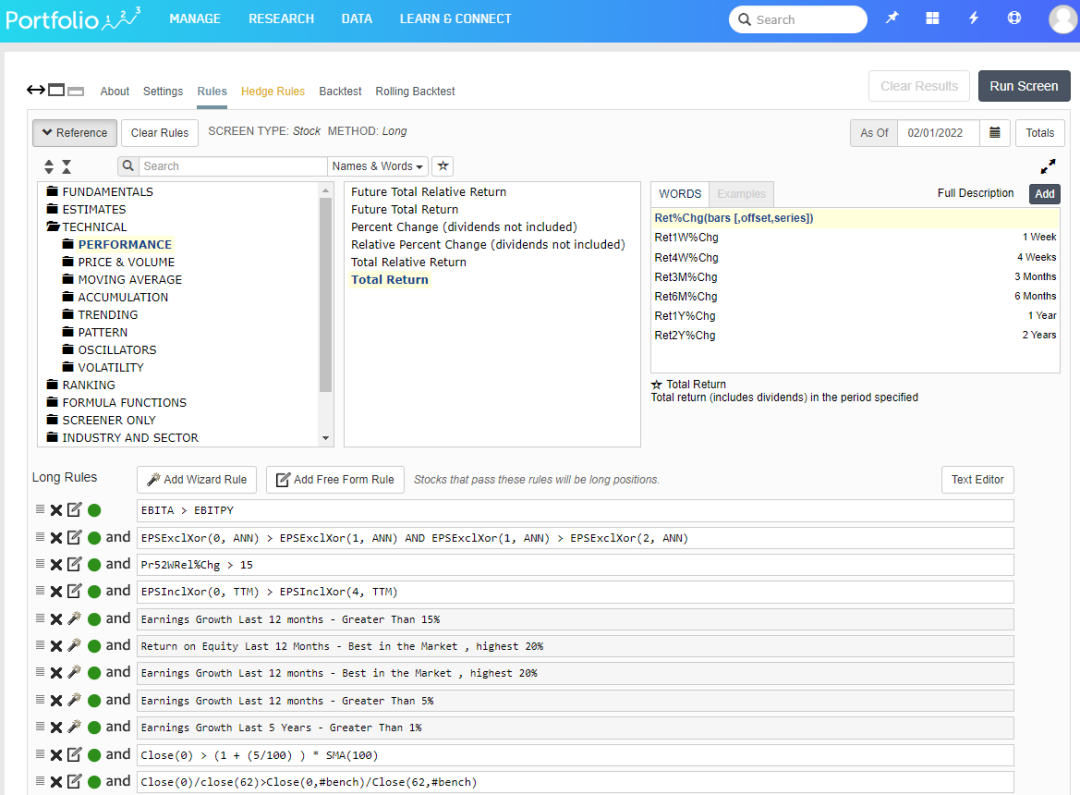

Backtesting

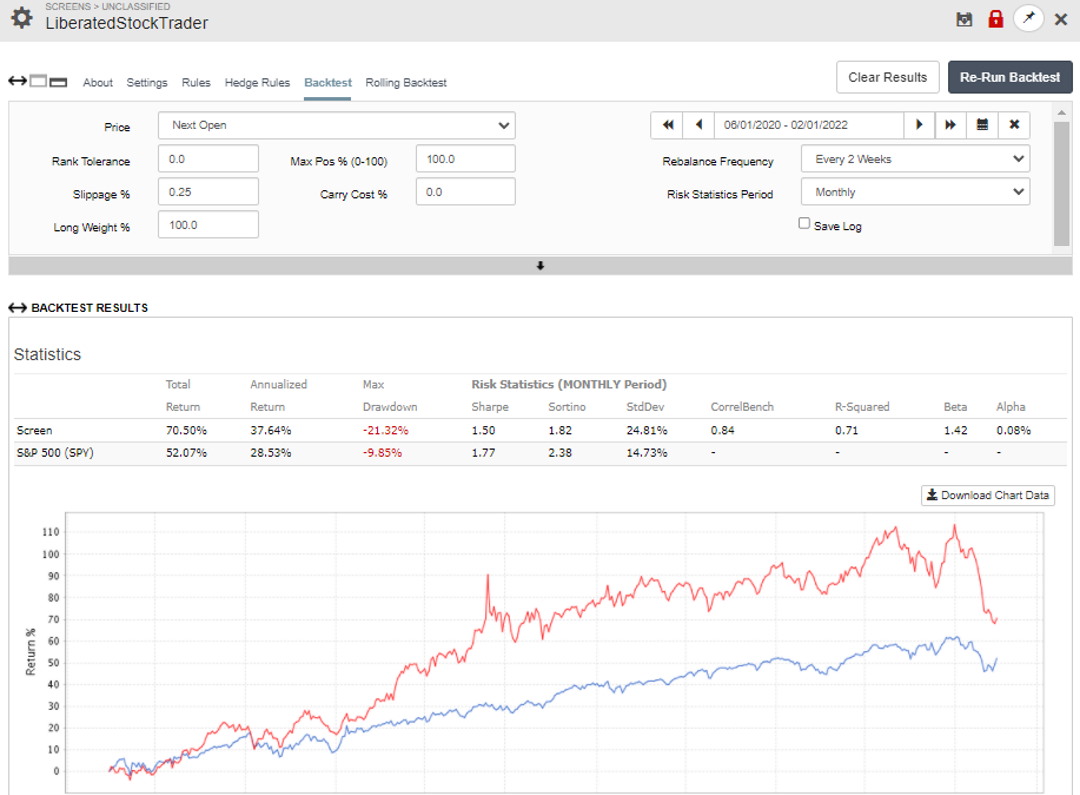

Portfolio123’s backtesting engine is where the software shines. Expertly implemented, fast, and extremely configurable, Portfolio123 has the best backtesting service for people serious about testing fundamental strategies.

Portfolio123 enables you to be very granular in setting up your backtest with entry rules, slippage, weighing, rebalance frequency, and custom timeframes.

The Portfolio123 screener is built to make users test not just pre-built concepts but all sorts of hypotheses. You can use your universe, rank with your multi-factor rank, and run rolling backtests.

The image below shows the LiberatedStockTrader screener I developed in the previous section. I backtested the screener for two years to see how it performed historically. My screener beat the market in this timeframe, returning 70.5% vs. the S&P500’s 52%.

Portfolio123 is a solid screening and backtesting platform for swing traders and medium-term growth investors. Its incredible selection of fundamental criteria, 20-year financial database, and powerful financial backtesting engine make it a great choice for experienced stock system developers.

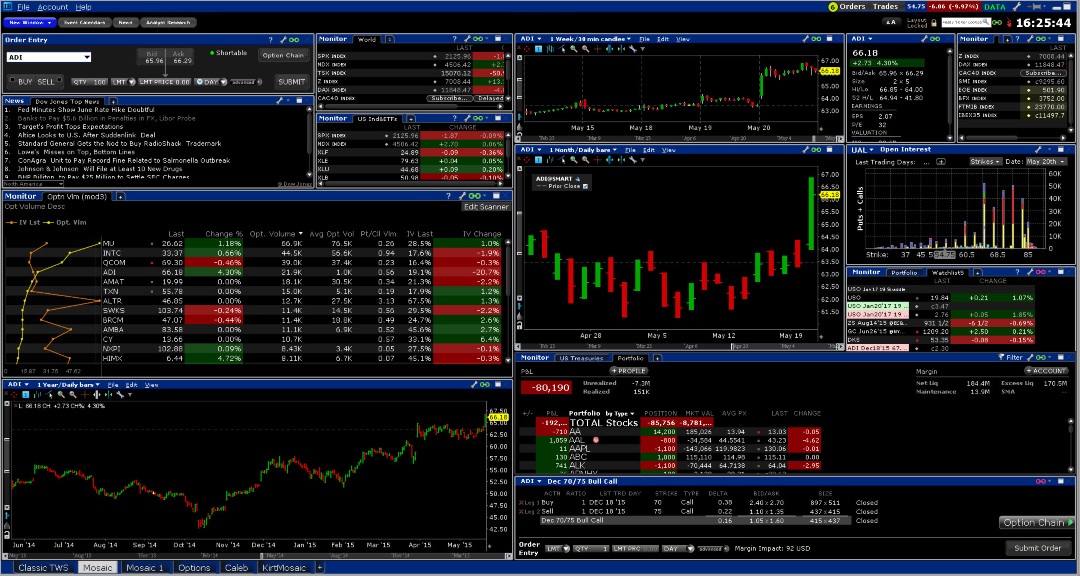

8. Interactive Brokers: Fundamental Portfolio Backtesting

IB is ideal for active investors and day traders seeking low trading costs and direct global market access. Additionally, it offers backtesting and auto-trading through third-party software utilizing Signal Stack.

Pros

- The Best Fundamental Backtesting In The Industry

- Great Trading Platform

- Direct Market Access

- All Markets & Vehicles

Cons

- You Must Be An IB Client

- Limited Backtesting On Chart Indicators & Supply / Demand

Interactive Brokers provides direct market access for fast execution and best-in-class margin costs. They are the grandfather of online discount brokers. Not only are they a long-established company, but they are also large.

It has a complete set of services, enabling you to trade practically anything on any market: Stocks, Options, ETFs, Mutual Funds, Bonds, Foreign Exchange, and even Futures and Commodities. Usually, when a company is well established, it loses its competitive edge. Not so with Interactive Brokers

Interactive Brokers has a unique trading platform based on Trader Workstation (TWS). It is free to download and use as a client and is the single place to trade any of IB’s assets.

Not only that, there are also a considerable number of advanced add-on tools that plug into TWS, such as:

- ChartTrader – for trading directly from charts.

- Continuous Futures – for commodity futures scanning and analysis.

- DepthTrader – for in-depth analysis of market liquidity.

- OptionTrader – deeper Options Analysis with specific Options strategies.

- ProbabilityLab – to test the Probability Distribution of a particular trade

- Portfolio Manager – for backtesting.

In total, there are 27 different advanced trading tools to suit every possible approach to the market.

The “Portfolio Manager” tool within the powerful Trader Workstation (TWS) platform is well-designed and easy to use. It is designed to help portfolio managers balance and manage a portfolio of stocks. Most portfolio managers do not buy and sell shares based on technical indicators like MACD, RSI, or Moving Averages; they buy and sell based on the fundamentals of a particular company. This is reflected in the unique parameters that are available.

You can choose a portfolio to backtest based on nearly all critical fundamentals, such as P/E, EPS growth, and even Analyst ratings. It is unique and powerful. I enjoyed setting up my portfolio and testing the different scenarios, such as buying low P/E stocks with high analyst ratings from Zacks or high EPS growth stocks with small insider ownership.

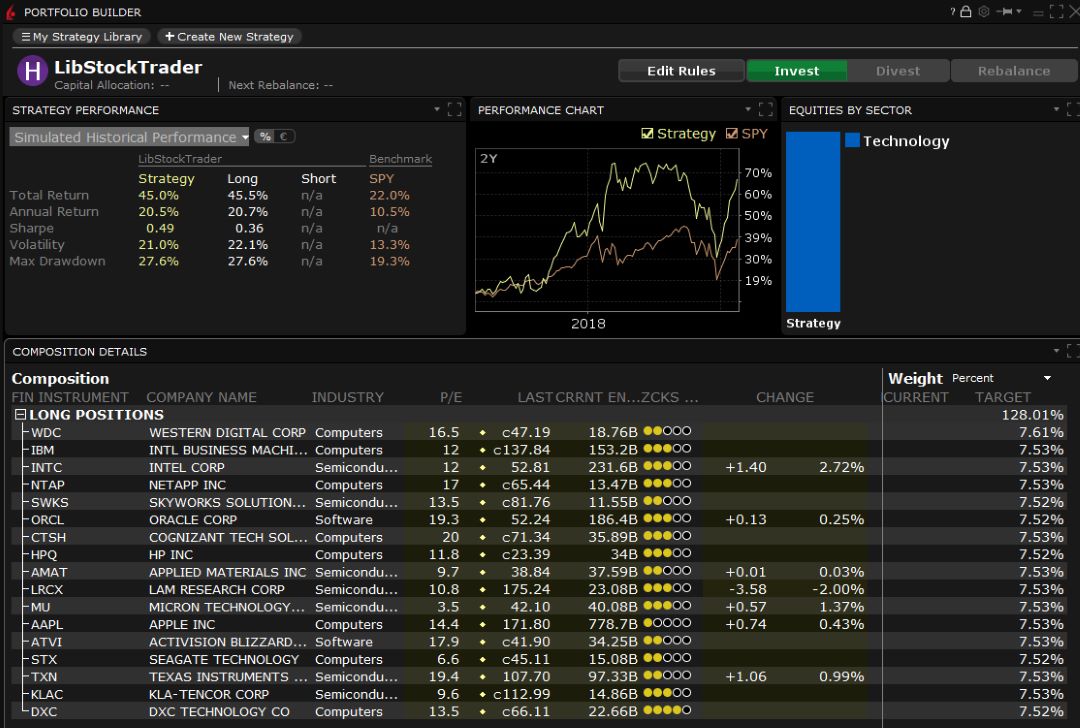

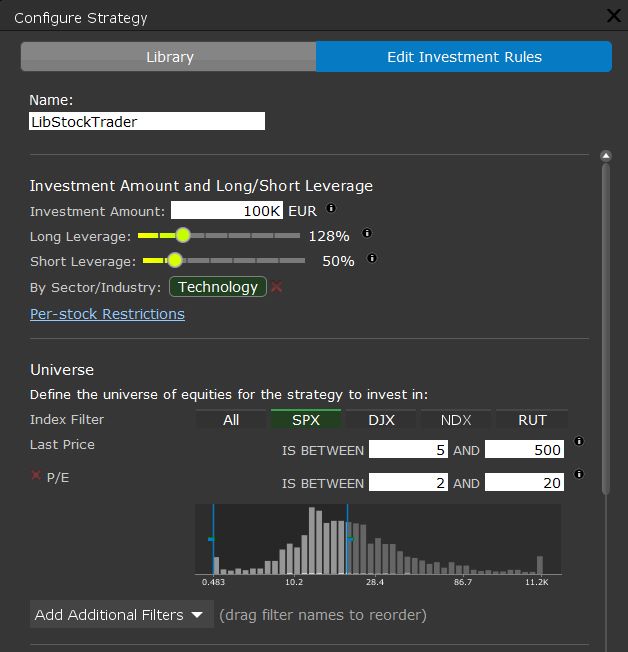

Configuring Backtesting

In this basic backtest, I selected stocks between $5 and $500 with a low price-earnings ratio (P/E) between 5 and 20. I used 128% leverage on my long trades and 50% on my short trades and only targeted the technology stocks on the S&P500.

The testing worked out positively (as seen from the image above), beating the market by 31%, but mostly because of the leverage factor, which introduces increased risk.

It is a positive playground for testing your wildest hypotheses against reality regarding investing rules. Value investors, take note; this is a great tool.

9. Tradestation: Backtesting For Tradestation Clients

TradeStation is a leading brokerage house with excellent execution and reasonable commissions. Did you know they have great backtesting software? TradeStation offers enough software and broker integration to compete with the other vendors.

| TradeStation Rating | 3.8/5.0 |

| ⚡ Features | Free Stock & Option Trades USA |

| 🏆 Backtesting | Point & Click Backtesting & Auto-Trading |

| 🤖 Auto Trading | ✅ |

| 🎯 Best for | US Traders |

| 💰 Cost Per Stock Trade | $1 |

Pros

- Powerful Charting Tools

- Good Algo and Power Tools

- Free Software for Brokerage Clients

- Broker Integration

Cons

- $1 per trade

TradeStation has real-time news and excellent service but fails to score top marks because it does not provide market commentary or a chat community. But do you need that? Some people do; it’s a factor to consider. TradeStation offers TradeStation University a huge wealth of online videos to help you master their trading platform.

TradeStation has also cultivated a systems and strategies marketplace called the “Strategy Network,” where you can purchase stock market systems from an ecosystem of vendors or even contract someone to develop your system in the “Easy Lacharte” code.

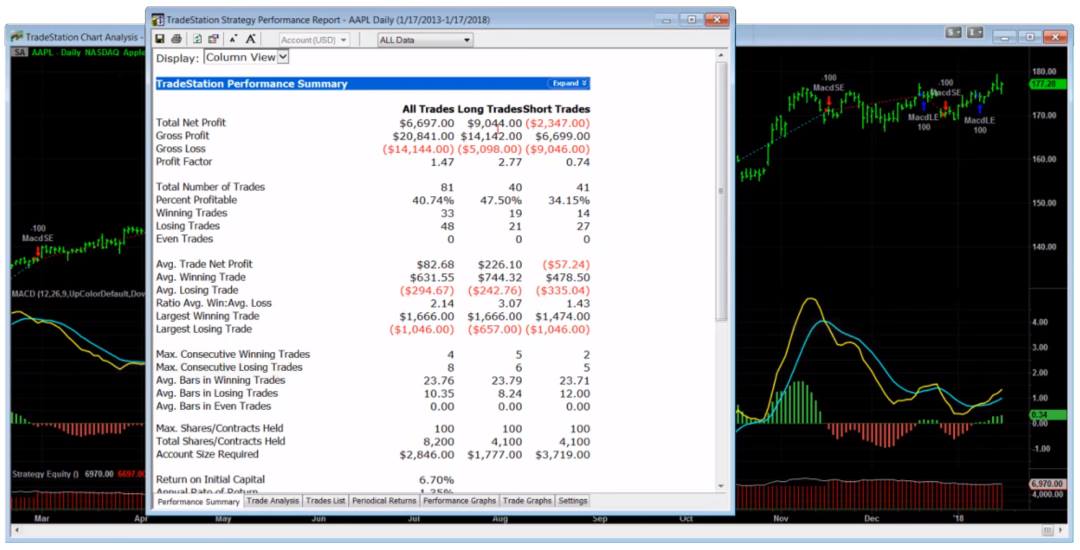

Backtesting

TradeStation’s unique proposition lets you create powerful technical backtesting scenarios directly from the charts. There is no need for programming or script development; it is straightforward. Select your chart, timeframe, and indicators, then plug in the parameters you want for the buy and sell orders. Long and short trades are all covered.

The beauty is that you can turn the hypothetical system into an automated trading system with algorithmic trading applications because this is a broker-integrated solution.

It is called TradeStation because it is where you can build a technical chart-based system and execute it automatically.

10. Quantshare: Low Price Backtesting

Quantshare is recommended for Quantitative Analysts who develop powerful automated systems and value a wide selection of shared user-generated ideas. However, you need to be able to code.

Pros

- For Quants Wanting To Automate Backtesting

- Super Cheap

- Active Community

- Very Good Backtesting

Cons

- Programming Knowledge Required

- Poor Interface

- Challenging to Use

QuantShare was new to me, and I was surprised by its feature set. Do you backtest, forecast, and program algorithms to gain an edge in the market? Are you a hardcore programmer and mathematician? Then QuantShare is for you.

Stock Systems and Backtesting

QuantShare specializes, as the name suggests, in allowing Quantitative Analysts to Share stock systems. They have a huge systems marketplace with a lot of accessible content that you can test and use. You can implement and test endless possibilities if you have a programmatic mind. They also have powerful prediction models using neural networks. This is an advanced software for those with programming skills.

QuantShare is difficult to use, and the interface requires serious development effort. The learning curve will take time on your part.

Summary

TrendSpider is our winner for incredible innovation, AI pattern recognition, backtesting, auto-trading, and broker integration. Trade Ideas deploys black box AI backtesting software and auto-trading to give you a profitable edge in the stock market and is well worth the subscription. TradingView offers global market access, backtesting, auto-trading, and the biggest trading community globally.

FAQ

Which platform is best for backtesting?

Having tested many backtesting solutions, I rate TrendSpider the best. It's no-code backtesting of indicators, patterns, price, financial, and news is simply the best available.

Is there any free backtesting software?

From my testing, the best free backtesting software is TradingView, which allows users of their free basic plan to utilize the powerful Pine script strategy testing environment.

How reliable is TradingView's backtesting?

Based on my backtesting and system development for the MOSES system, TradingView's backtesting is extremely reliable and accurate. TradingView also provides on-chart entry and exit signals so you can prove the backtesting reliability.

What is Stock Backtesting?

Stock backtesting is a process used to test if a set of technical or fundamental criteria for stock selection has resulted in profitable trades in the past. A good backtesting system will report executed trades, the trade duration, the win/loss ratio, and the drawdown and compounded return.

How to backtest a stock?

To begin backtesting a stock, you should follow these steps:

- Select the right software (TrendSpider for traders, Trade Ideas for day traders, or Portfolio 123 for investors)

- Plot a chart and overlay the indicators you want to use in the backtest.

- Select the timeframe and chart data frequency (minutes, days, or weeks).

- Observe how the indicators interact with the stock price.

- Tune the indicator and timeframes that work well with stock price pivots.

- Input the indicators and timeframes into the backtesting software.

- Run the backtest and evaluate the results.

Does backtesting work for stocks?

Yes, backtesting works well for stocks, and the longer the timeframe you use to more predictable backtesting becomes. If you have a minute-by-minute backtesting strategy, there will be lots of false signals because the market is erratic in the short term. Backtesting provides a good way to formulate an investing strategy for medium to long-term trades.

How many years back to backtest stock strategy?

If your trading strategy is medium to long-term (weeks to months), you must select 5 to 10 years of data to backtest. Also, include a stock market crash in your data, for example, 2020 or 2008, so you can see how your strategy performs under extreme market conditions.

How to perform stock backtesting with no coding skills?

Two services allow you to perform powerful backtesting with no programming knowledge. TrendSpider has point-and-click backtesting with built-in AI pattern recognition for traders. For long-term investors, Portfolio 123 has an incredible 10-year financial database and an intuitive backtesting interface.

How to backtest stock screens?

To backtest a strategy formulated from stock screens, you need to use Stock Rover or Portfolio 123. Portfolio 123 provides the most robust system to backtest stock screens over 10 years. See this article testing Portfolio 123's backtesting or my Beat The Market backtested system using Stock Rover.

What does backtesting stocks tell me?

Backtesting stocks tells you what indicators and chart patterns work on which timeframes. You would be surprised to learn that simple indicators like moving averages work much better than complicated indicators like Ichimoku Cloud.

Hi Barry,

Excellent review with great detail!

Have you ever reviewed AmiBroker? That’s the software I used as a research analyst. Similar in some respects to Tradingview with its own language (Amibroker Formula Language or AFL).

Hi Joe, thanks for the question, yes I tested AmiBroker in the past, but to me, it just seemed like a more antiquated version of MetaStock, so it did not make the list.

Barry

Hi, Barry–terrific overview here. Just a couple of quick corrections about Portfolio123. We offer up to 20 years of fundamental data for backtesting, not just 10; and we just expanded our coverage to 6500 European companies so our service is definitely suitable for international stock investors.

Hi Yuval, thanks for the update; I will add this. Great work by the Portfolio123 team. Barry

Hi Barry

Just wondering what you think of Genovest.com’s backtesting software?

Joe

Hi Joe, it looks like a product that is a work in progress. At first glance it does not have the depth of Stock Rover in screening, in-depth research and portfolio management. Nor does it have the backtesting prowess of portfolio123.

Barry

There is no back test tool in IB. Where is and how to access the “Portfolio manager” you wrote? Thanks

Hi Shan, it seems like IB has removed the portfolio builder tool. I will have to update the review, thanks for letting me know.

Barry

which software would be best for option strategies back testing? Can any of these platform pull option volume on equites to be used in back testing or building indicators?

Hi Raymond, there are a few out there like optionstack, but I have not tested them so far.

Barry

I want to have a backtesting system for Stock futures as per my system. Can u customize?

Hi Manan

You can use Metastock to achieve that, and there are many MetaStock partners that can help with customization.

Barry

How can you have a backtesting list and not include Portfolio 123? That service is insanely powerful.

Hi Tony, portfolio 123 will be tested soon, they have reached out to me, so check back in a few weeks.

thanks

Barry

Is Metatrader is useful for any country like Nepal

This is such a great review, really the details are awesome. Is metastock really the king of the review