My hand-picked list of the best books for traders includes The Encyclopedia of Chart Patterns, Technical Analysis Explained, Technical Analysis of the Financial Markets, Dark Pools, and Reminiscences of a Stock Operator.

Editors Picks: 5 Essential Books for Traders

Editors Picks: 5 Essential Books for Traders

- The Encyclopedia of Chart Patterns

- Technical Analysis of the Financial Markets

- Technical Analysis Explained

- Dark Pools

- Reminiscences of a Stock Operator

As a professional market analysis, my hand-picked list contains only high-quality books I have personally read. I also include publications recommended by the Chartered Market Technician and the International Federation of Technical Analysts, of which I am a member.

To be a top trader, you must read the best books covering technical analysis, quantitative analysis, backtesting, and forecasting. Traders also need to understand trading techniques from successful traders.

1. The Encylopedia of Chart Patterns

The Encyclopedia of Chart Patterns by Tom Bulkowski details the reliability and success rates of 65 chart patterns and shows you how to trade them; for any serious pattern trader, this is an indispensable book.

| 🏆 Rating | ★★★★★ |

| 📖 Title | Encyclopedia of Chart Patterns |

| ✍ Author | Thomas Bulkowski |

| 🕜 Released | 2021 3rd Edition |

| 👍 Our Verdict | The number one book for trading profitable chart patterns. |

It is an indispensable resource for traders and investors looking to increase profitability by taking advantage of stock chart patterns. This comprehensive reference book contains in-depth explanations and detailed illustrations of more than 65 pattern types, including how to trade highly profitable patterns like the Head and Shoulders, Double Bottoms, Wedges, Flags, Triple Bottom, and Triangle.

The book begins with an introduction to charting basics, including recognizing trends, support, resistance levels, and other technical analysis tools. It then dives into a discussion of the various pattern types, offering clear descriptions of how to identify them in the markets and practical advice on when it is appropriate to act.

Complete with decades of chart pattern testing, The Encyclopedia of Chart Patterns is a critical resource for trading success.

My thorough testing awarded TradingView a stellar 4.8 stars!

With powerful stock chart analysis, pattern recognition, screening, backtesting, and a 20+ million user community, it’s a game-changer for traders.

Whether you're trading in the US or internationally, TradingView is my top pick for its unmatched features and ease of use.

Explore TradingView – Your Gateway to Smarter Trading!

2. Technical Analysis of the Financial Markets

Technical Analysis of the Financial Markets is the best trading book because it teaches you every aspect of charting and technical analysis and provides deep insight into how finance works.

| 🏆 Rating | ★★★★★ |

| 📖 Title | Technical Analysis of the Financial Markets |

| ✍ Author | John J. Murphy |

| 🕜 Released | 1999 |

| 👍 Our Verdict | The best stock trading book for charting, price, and volume analysis. |

John Murphy’s “Technical Analysis of the Financial Markets” is a comprehensive guide to using technical analysis to trade stocks, bonds, and commodities.

The book covers everything from interpreting charts and trend lines to advanced techniques such as Elliott Wave analysis. Murphy provides real-world examples to illustrate how technical analysis can be used to identify and trade market opportunities.

He also includes several helpful appendices, including one that lists all the indicators and oscillators used in the book.

A very valuable contribution to the understanding of technical analysis of the financial markets, this book is a must-have for the technical trader.

This book is a prerequisite reading for any serious or professional technical analyst and is a core IFTA exam syllabus for the (International Federation of Technical Analysts).

Tip: If you want to trade the financial markets using technical analysis, our stock charting service is TradingView.

3. Technical Analysis Explained

Everything a stock trader needs to know about the financial system is contained within Technical Analysis Explained, an absolute classic and must-study book for serious traders. Martin Pring’s Technical Analysis Explained is a comprehensive guide to understanding and using technical analysis to predict and trade future stock prices.

| 🏆 Rating | ★★★★★ |

| 📖 Title | Technical Analysis Explained |

| ✍ Author | Martin J. Pring |

| 🕜 Released | 2014 |

| 👍 Our Verdict | Best book on technical analysis of financial markets. |

This book is one of the bibles of technical analysis and one of the best. Pring is a popular technical analyst, and the depth of the value of this book is unmistakable.

This book is a prerequisite read for any serious or professional technical analyst. It is the core IFTA exam syllabus for the (International Federation of Technical Analysts) of which I am certified.

The book covers all the basics of technical analysis, from trendlines and channels to oscillators and candlestick charts. It also explains in-depth some of the most popular technical indicators, such as moving averages, OBV, MACD, and RSI. Pring includes numerous case studies to illustrate how technical analysis can be used to predict price movements. Overall, “Technical Analysis Explained” is an excellent introduction to technical analysis for investors of all experience levels.

4. Dark Pools

One of the best books for traders is Dark Pools because it enables you to understand you cannot compete with the machines. Machines make 80% of stock trades; how can you compete? Dark Pools is an excellent book detailing how robots manage your investments and that AI algorithms execute 80% of all trades.

| 🏆 Rating | ★★★★★ |

| 📖 Title | Dark Pools: The Rise of the Machine Traders and the Rigging of the U.S. Stock Market |

| ✍ Author | Scott Patterson |

| 🕜 Released | 2013 |

| 👍 Our Verdict | The best stock trading book on robotic and algorithmic trading. |

A dark pool is a private securities market, typically operated by a broker-dealer, where participants can trade large blocks of shares anonymously, thus reducing the market impact of their trades.

The book Dark Pools tells the story of the rise of these mysterious markets and the battle between the New York Stock Exchange and the upstart electronic exchanges to control them. It also tells the stories of people who have made and lost fortunes in this shadowy world.

Where are your investment retirement accounts, IRAs, and 401Ks invested? In the stock market. So, you must get an understanding of the current state of the stock market and what drives price fluctuations.

Scott Patterson educates us all on the rise of machines and the artificial intelligence algorithms that run on them. While the book lacks details on how AI actually works, the discussion around the rise and impact of AI trading is enlightening and shocking.

As our stock market statistics research article discussed, Bot’s or AI algorithms are estimated to be responsible for 80% of stock market trading. Learn more about AI and what you can do about it in this excellent book.

5. Reminiscences of a Stock Operator

Reminiscences of a Stock Operator is a legendary stock trading book covering how markets really work behind the scenes. The book details fear, greed, market making, and manipulation by one of the greatest investors of the 19th century.

| 🏆 Rating | ★★★★★ |

| 📖 Title | Reminiscences of a Stock Operator |

| ✍ Author | Edwin Lefevre |

| 🕜 Released | 2020 (Revised) |

| 👍 Our Verdict | The ultimate guide to market making and manipulation |

Reminiscences of a Stock Operator, written by Edwin Lefèvre, follows the life and career of Jesse Livermore, a stock trader from the early 1900s. Livermore was a successful trader in his time, making and losing millions of dollars, and his story provides valuable insight into the world of stock trading.

The book offers advice on when to buy and sell stocks, deal with losses, and stay disciplined in the market. It also includes anecdotes about Livermore’s personal life and trading experiences.

This book is great for traders interested in the legendary stock trader Jesse Livermore’s experiences during the 1920s and the great depression.

Reminiscences of a Stock Operator is, in my opinion, one of the most important books on stock trading, and it is still relevant today.

Livermore’s life was a story of riches to ruins and back again, which unfortunately ended with him committing suicide. The life of Livermore and the behavior of financial markets is well worth the time you invest in this classic book.

6. Forecasting Financial Markets

“Forecasting Financial Markets” by Tony Plummer is a guide to forecasting financial markets intended for individual and institutional investors.

| 🏆 Rating | ★★★★★ |

| 📖 Title | Forecasting Financial Markets |

| ✍ Author | Tony Plummer |

| 🕜 Released | 2010 |

| 👍 Our Verdict | A great book for the market trading process |

The book begins by discussing the importance of forecasting and describes different forecasting methods, including technical analysis, fundamental analysis, and sentiment analysis.

Each method is explained in detail, with examples of how it can be used to predict market trends. The book also includes a risk management section covering position sizing, risk tolerance, and hedging. Overall, “Forecasting Financial Markets” provides a comprehensive overview of financial forecasting and is a valuable resource for investors of all levels of experience.

7. Cloud Charts

The book Cloud Charts is about trading with the Ichimoku Technique. Author David Linton is a trader, respected technical analyst, and the author of two other books on technical analysis.

| 🏆 Rating | ★★★★ |

| 📖 Title | Cloud Charts: Trading Success with the Ichimoku Technique |

| ✍ Author | David Linton |

| 🕜 Released | 2010 |

| 👍 Our Verdict | An excellent book for trading Ichimoku Cloud charts |

The Ichimoku Technique is a technical analysis method that relies on four indicators to determine when to buy or sell a security. The Ichimoku Technique can be used to trade stocks, futures, commodities, and forex.

The book describes how cloud charts work and how they can be used together to make trading decisions.

It also includes case studies of how the technique is used for trading various securities. Overall, the book provides a comprehensive guide to using the Ichimoku Technique for trading success.

Recognized as an authority on Cloud Charts, David Linton’s book on Ichimoku Techniques is core IFTA reading.

8. Quantitative Trading Systems

Building a robust trading system is essential to success if you are serious about trading. This is precisely what Quants (Quantitative Analysts) do for their day job.

| 🏆 Rating | ★★★★ |

| 📖 Title | Quantitative Trading Systems Practical Methods for Design, Testing, and Validation |

| ✍ Author | Dr. Howard B. Bandy |

| 🕜 Released | 2011 |

| 👍 Our Verdict | Perfect for those interested in structured backtesting |

Quantitative Trading Systems Practical Methods for Design, Testing, and Validation by Dr. Howard B. Bandy is a book about developing and using quantitative trading systems in the financial markets.

The book covers many topics, from basic concepts to more advanced strategies. One of the key points made by the author is that a successful quantitative trading system is not simply a set of mechanical rules but must be tailored to the individual trader’s risk tolerance and investment goals.

The book includes numerous examples and case studies to illustrate the concepts discussed.

9. Japanese Candlestick Charting Techniques

| 🏆 Rating | ★★★★ |

| 📖 Title | Japanese Candlestick Charting Techniques |

| ✍ Author | Steve Nison |

| 🕜 Released | 2001 |

| 👍 Our Verdict | The ultimate guide to candlestick charting |

From the man who introduced candlestick charting to the West, this is the updated 2nd edition of the original.

The book “Japanese Candlestick Charting Techniques” by Steve Nison is a guide to understanding and using candlestick charts to predict stock prices. The book starts by introducing candlesticks and explaining the different parts of each candle.

It then discusses using candlesticks to identify trends, reversals, and price patterns. The book includes several case studies to help illustrate how candlesticks can be used in real-world trading situations.

Candlestick charts are used routinely today and are essential to building your charting methodology. Candlesticks give insights into short-term supply and demand scenarios and enhance the speed of pattern recognition.

If you are interested in Japanese Candlestick charting, read our guide to candlesticks or learn more about automated candlestick pattern recognition services.

10. R N Elliott’s Masterworks

The book “R N Elliott’s Masterworks, the Definitive Collection” by Robert Prechter is a compilation of the work of R N Elliott, the father of Elliott Wave Theory.

| 🏆 Rating | ★★★★ |

| 📖 Title | R N Elliott’s Masterworks, the Definitive Collection |

| ✍ Author | Robert R. Prechter |

| 🕜 Released | 2017 |

| 👍 Our Verdict | The definitive book on Elliott Waves |

The book contains Elliott’s most important articles and covers everything from the basics of Elliott Wave Theory to advanced topics.

Overall, the book provides a comprehensive overview of Elliott Wave Theory and is a great resource for anyone interested in learning more about this unique approach to market analysis.

I had the pleasure of hearing Robert Prechter speak on socioeconomic theory at the IFTA World Conference in 2014, and he is a giant in the industry. This book compiles R.N. Elliott’s original writings on the Wave Principle and presents it to you in a single, all-inclusive book.

Devour the three ground-breaking works, long out of print, in which Elliott first described the Wave Principle to the world.

If you like Elliott Wave Theory, you will love TradingView’s automated Elliott Wave pattern recognition. Try the Elliott Wave indicator for free at TradingView.

11. Breakthroughs in Technical Analysis

David Keller’s “Breakthroughs in Technical Analysis” is a guide to understanding and using technical analysis to trade the financial markets.

| 🏆 Rating | ★★★★ |

| 📖 Title | Breakthroughs in Technical Analysis |

| ✍ Author | David Keller |

| 🕜 Released | 2007 |

| 👍 Our Verdict | An excellent update on modern charting techniques |

David Keller’s “Breakthroughs in Technical Analysis” is a guide to understanding and using technical analysis to trade the financial markets. The book begins by explaining the basics of technical analysis, including price charts, trendlines, and momentum indicators.

It then discusses more advanced topics such as chart patterns, Elliott wave analysis, and Fibonacci retracements. The book includes numerous real-world examples to illustrate how technical analysis can be used to identify trading opportunities.

It is a comprehensive guide for traders of all levels of experience.

The recommended section in this book is the GANN theory section developed by W.D. Gann.

This is usually a critical piece of the CFTE and CMT exams, but it can also be challenging to learn as the esoteric concepts, in theory, are more like taking a step into the twilight zone.

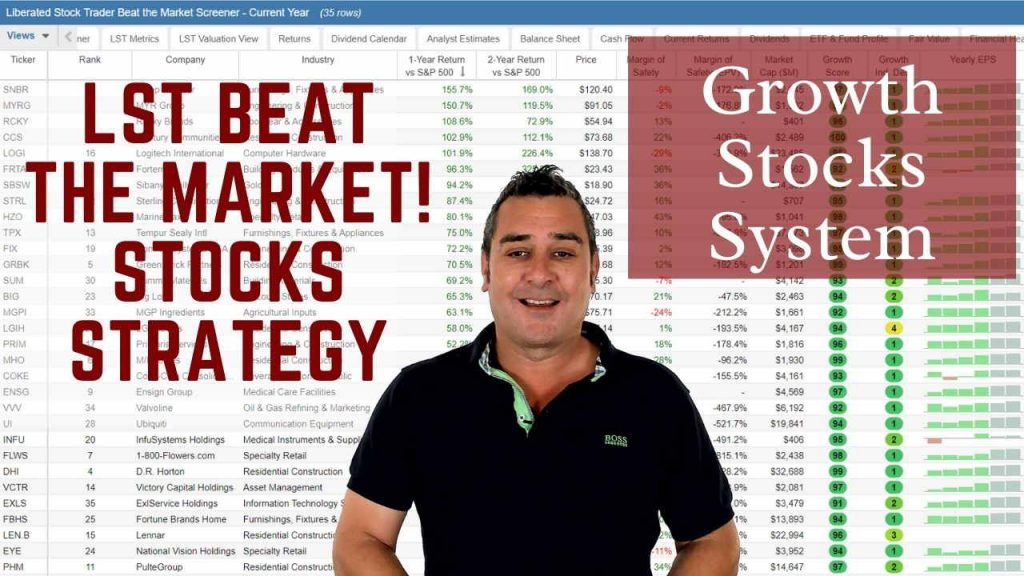

Ever Dreamed of Beating the Stock Market

Most people think that they can't beat the market, and stock picking is a game only Wall Street insiders can win. This simply isn't true. With the right strategy, anyone can beat the market.

The LST Beat the Market Growth Stock Strategy is a proven system that has outperformed the S&P500 in 8 of the last 9 years. We provide all of the research and data needed to make informed decisions, so you no longer have to spend hours trying to find good stocks yourself.

The LST Beat the Market System Selects 35 Growth Stocks and Averages a 25.6% Annual Return

★ 35 Stocks That Already Beat The Market ★

★ Buy The Stocks & Hold For 12 Months - Then Rotate ★

★ Fully Documented Performance Track Record ★

★ Full Strategy Videos & eBook ★

Take The Pain Out Of Stock Selection With a Proven Strategy

12. Winning on Wall Street

Marty Zweig’s classic Winning on Wall Street provides a depth of stock trading knowledge that remains timeless and incredibly useful today. In “Winning on Wall Street,” Marty Zweig offers readers a guide to investing and achieving success in the stock market. Zweig provides an overview of the stock market and explains how to read stock charts to make informed investment decisions.

| 🏆 Rating | ★★★★ |

| 📖 Title | Winning on Wall Street |

| ✍ Author | Martin Zweig |

| 🕜 Released | 1997 |

| 👍 Our Verdict | Best stock book for charts and market timing |

He also discusses specific stock investing strategies, including buying low and selling high, using stop-loss orders, and diversifying one’s portfolio. Zweig provides real-world examples of how investors can use these strategies to succeed in the stock market.

A must-have book for the serious investor, covering economic, fundamentals, and technical analysis. While it may seem outdated, this book is worthwhile and a must-read. It gives excellent insights into how the market works.

Martin Zweig’s work in this book inspired the big picture and macroeconomics section in my Liberated Stock Trader Pro investment training course.

This book is strong in the logical, systematic evaluation of the state of the business environment and its effect on the stock market. The only downside is there are not enough charts; some systems are hard to calculate manually and require a lot of effort to maintain.

13. Market Wizards

Market Wizards is the perfect book for traders wanting to be inspired by different trading systems and the strategies of professional stock traders.

| 🏆 Rating | ★★★★ |

| 📖 Title | Market Wizards – Interviews with Top Traders |

| ✍ Author | Jack D. Schweiger |

| 🕜 Released | 2012 |

| 👍 Our Verdict | The best book for beginner stock traders to learn from successful professional stock traders |

In Market Wizards, Jack D. Schweiger interviews many successful traders to learn what makes them successful. He finds that successful traders share many common traits, including discipline, risk management, and a deep understanding of the markets.

Schweiger also identifies three key factors contributing to success: temperament, skill, and luck. While luck cannot be controlled, he finds that disciplined traders with a good understanding of the markets can increase their chances of success.

Audiobooks are an excellent way to learn about trading, as they provide a first-hand account of the trader’s thought process and how they approach the markets. “Market Wizards” is an essential read for any trader looking to improve their performance.

This book is packed with good interviews with successful stock market traders; this book is a worthwhile addition to your bookshelf. Do not expect solid strategies, but expect insights into how stock market institutional investors operate.

This book is worth buying, with well-selected interviews and easier reading than its predecessor.

The only downside is that it is low on specific strategies and rules to incorporate into your market approach; the interviewees would not want to give away anything useful in case they lose their edge.

14. Secrets for Profiting in Bull and Bear Markets

In Secrets for Profiting in Bull and Bear Markets, Stan Weinstein discusses the factors affecting stock prices and how to capitalize on them.

| 🏆 Rating | ★★★ |

| 📖 Title | Secrets for Profiting in Bull and Bear Markets |

| ✍ Author | Stan Weinstein |

| 🕜 Released | 1991 |

| 👍 Our Verdict | The best book for learning stock trading strategies for bear markets |

First released in the 1980s, this classic investment book covers the Technical Analysis approach to the stock market in a very practical and usable way.

He offers advice on when to buy and sell stocks and tips on money management and risk assessment. Weinstein also provides excellent insights into how to short stocks in bear markets.

The explanations of Bull and Bear Markets and combining price breakout with volume increases to improve the chances of success are excellent.

However, the book is quite old and, therefore, a little dated. It does not use more modern indicators or ways to leverage current technologies to achieve your goals.

15. Trade Like A Stock Market Wizard

In “Trade Like a Stock Market Wizard” by Mark Minervini, the reader is taken through a day in the life of a professional trader. Minervini shares the techniques he has used to achieve consistent success in the markets, and he provides readers with a wealth of information that can be applied to their own trading strategies.

| 🏆 Rating | ★★★★ |

| 📖 Title | Trade Like A Stock Market Wizard |

| ✍ Author | Mark Minervini |

| 🕜 Released | 2011 & Re-Released 2021 |

| 👍 Our Verdict | Best stock trading book for day traders |

One of the key points that Minervini makes is that traders should focus on trading stocks that are liquid and have a large volume. He also recommends using technical analysis to identify trendlines and support and resistance levels, and he provides readers with numerous charts and examples to illustrate his points.

Overall, “Trade Like A Stock Market Wizard” is an excellent guide for those who want to learn how to trade professionally. Minervini’s years of experience as a trader come through loud and clear in this book, and readers will benefit from his insightful tips and advice.

Minervini was featured in the Stock Market Wizards Series. This book is an excellent practical guide to applying technical analysis and how to apply it in the real world.

Practical, usable, and readable, this extremely valuable book explodes myths about the PE Ratio, Valuations, and Wall Street Ratings Services. Packed with insights and strategies, this modern book must be on your bookshelf.

16. Hedge Fund Market Wizards

Hedge Fund Market Wizards is the best book to learn about advanced hedge funds’ stock trading tactics and strategies. Hedge Fund Market Wizards is a compilation of interviews with some of the most successful traders in the hedge fund industry. The traders share their insights and trading strategies, providing a unique perspective on how they have achieved success.

| 🏆 Rating | ★★★ |

| 📖 Title | Hedge Fund Market Wizards – How Winning Traders Win |

| ✍ Author | Jack D. Schweiger |

| 🕜 Released | 2012 |

| 👍 Our Verdict | The best insight into hedge fund trading ever written. |

One trader, for example, relies on technical analysis to make trading decisions, while another focuses on fundamentals. Some traders use a combination of different techniques. However, what unites these traders is their dedication to their craft and willingness to learn from their mistakes.

A mixture of interviews with top traders on topics as far-reaching as trading Futures, Trading T-Bills, aggressive trading, stock selection, and psychology.

The books provide interesting insights into the minds of the traders interviewed and how they operate to achieve that profit. This is a classic book that provides insight into the minds of Wall Street.

The focus is definitely on interviewing and insights into trading styles, which can make it interesting to read and take a break from too many number-crunching and technical analysis books.

The people interviewed provide no practical insight into specific trading systems or actions, yet it is still a good read.

You want to be a successful stock investor but don’t know where to start.

Learning stock market investing on your own can be overwhelming. There’s so much information out there, and it’s hard to know what’s true and what’s not.

Liberated Stock Trader Pro Investing Course

Our pro investing classes are the perfect way to learn stock investing. You will learn everything you need to know about financial analysis, charts, stock screening, and portfolio building so you can start building wealth today.

★ 16 Hours of Video Lessons + eBook ★

★ Complete Financial Analysis Lessons ★

★ 6 Proven Investing Strategies ★

★ Professional Grade Stock Chart Analysis Classes ★

17. The New Market Wizards

The New Market Wizards is a one-of-a-kind market trader book that interviews money market and options traders about how they found success.

| 🏆 Rating | ★★★ |

| 📖 Title | The New Market Wizards – Conversations with America’s Top Traders |

| ✍ Author | Jack D. Schweiger |

| 🕜 Released | 1994 |

| 👍 Our Verdict | The best trading book for Forex and Options traders to learn how professional money market traders operate. |

With very diverse interviews this time, the book would appeal to investment firm insiders, but I feel this will have less value to the independent investor who focuses on the stock market.

Some key trading strategies discussed in the book include trend following, charting, and market timing. Many traders interviewed in the book use technical analysis to help them make trading decisions. They also use various other methods, such as gut instinct and computer models, to help them make informed decisions about when to enter and exit trades.

Overall, “The New Market Wizards” is a helpful guide for anyone interested in successfully learning to trade the markets. The traders featured in the book share a wealth of information and offer valuable insights into their own trading strategies.

Interesting insights on Options Trading, Foreign Exchange (FOREX), and Automated Trading; this book provides insights outside the realms of the stock market.

Finally, a rather weak trading psychology section at the end leaves one wondering what the point was.

Tip: Interested in Trading Forex or BitCoin? Read our TradingView Review.

18. The Liberated Stock Trader

Last but not least, my book, Liberated Stock Trader, A Complete Stock Market Education, is perfect for beginner traders. The book is accompanied by 16 hours of in-depth stock investing lessons, which help build a complete picture of how the stock market functions.

| 🏆 Rating | 4.8 Stars on Amazon.com & 5/5 Stars on Benzinga.com |

| 📖 Title | Liberated Stock Trader, A Complete Stock Market Education |

| ✍ Author | Barry D. Moore |

| 🕜 Released | 2011 & Re-Released 2022 |

| 👍 Our Verdict | Best book and training course for beginner stock traders |

Designed as a complete education, the book covers everything you need to know to get started in investing in stocks. Fundamental analysis, technical analysis, stock screening, risk management, and psychology are all covered.

Investing in stocks means mastering fundamental financial analysis, the foundation for profitable long-term growth, dividend, and value investing strategies.

You want to be a successful stock investor but don’t know where to start.

Learning stock market investing on your own can be overwhelming. There’s so much information out there, and it’s hard to know what’s true and what’s not.

Liberated Stock Trader Pro Investing Course

Our pro investing classes are the perfect way to learn stock investing. You will learn everything you need to know about financial analysis, charts, stock screening, and portfolio building so you can start building wealth today.

★ 16 Hours of Video Lessons + eBook ★

★ Complete Financial Analysis Lessons ★

★ 6 Proven Investing Strategies ★

★ Professional Grade Stock Chart Analysis Classes ★

You must learn stock screening to find great companies and build a balanced portfolio to grow wealth.

What makes it different is that 16 hours of instructor-led video are included, which turns this training from a book to a full stock market seminar training.

Premium stock market education is expensive; this training course is extremely cost-effective—well-rounded education for those who want to take the stock market seriously.

Best Trading Books Summary

The best trading books are Technical Analysis of the Financial Markets, Reminiscences of a Stock Operator, Dark Pools, and Quantitative Trading Systems. These five books will help you understand how trading the financial market works.