Burger King has no stock ticker symbol as it is not publicly traded on a stock exchange.

Its owner, Restaurant Brands International (QSR), is listed on the New York Stock Exchange.

Investors are interested in Burger King because it is the world’s second-largest hamburger chain, with over 18,700 locations in over 100 countries.

Burger King is the seventh largest fast-food chain globally, with a 1.2% share of the global fast-food market.

Note: This is an unbiased research report. The author or Liberated Stock Trader is not affiliated, paid by, or owns stock in any of the companies mentioned in this report.

Burger King Stock

Burger King stock is not available to buy on any stock exchange. You can invest in Burger King by buying shares in its parent company, Restaurant Brands International (Ticker: QSR) on the NYSE.

Burger King Stock Chart

See the QSR (Burger King) Stock Chart Live on TrendSpider

Burger King Asia Stock Chart

Burger King, owned by Restaurant Brands International (QSR), has a sister company called Restaurant Brands Asia Ltd (RBA), which trades on the India NSE stock exchange. Restaurant Brands Asia operates Burger King locations in India and Indonesia.

See the RBA Stock Chart Live on TradingView

Burger King Stock Price

Burger King has no stock price because it is wholly owned by Restaurant Brands International (QSR). Restaurant Brands International’s stock price has increased 45% over the last five years, underperforming the market.

Burger King Stock Symbol

Burger King lacks a stock ticker symbol as it is not publicly traded on any stock exchange. However, its parent company, Restaurant Brands International, trades under the ticker symbol QSR on the New York Stock Exchange.

Burger King Sales Numbers

Burger King claims over 11 million people visit its restaurants each day. Burger King sells 275 burgers each hour, 6,575 burgers a day, and 2.4 million hamburgers a year. The best-selling Burger King product is the Whopper, which sells 2.1 billion a year.

There are 7,257 Burger King locations in the United States, and McDonald’s has 13,914 locations.

Burger King IPO

A Burger King initial public offering (IPO) is improbable because Restaurant Brands’ business model involves operating several fast-food brands. That makes a Burger King spin-off unlikely. A more probable scenario is that Restaurant Brands will buy more fast-food brands to diversify their business further.

My thorough testing awarded TradingView a stellar 4.8 stars!

With powerful stock chart analysis, pattern recognition, screening, backtesting, and a 20+ million user community, it’s a game-changer for traders.

Whether you're trading in the US or internationally, TradingView is my top pick for its unmatched features and ease of use.

Explore TradingView – Your Gateway to Smarter Trading!

3 Alternative Investments to Burger King

Several excellent alternatives to Restaurant Brands International (QSR) include McDonald’s, Shake Shack, and Yum Brands.

1. McDonald’s Corporation.

McDonald’s (MCD) is the world’s most famous burger chain, with over 38,000 locations in 118 countries and territories worldwide.

McDonald’s had a worldwide brand value of $154.9 billion in 2022 and operated 40,031 restaurants worldwide, a difference from the 38,000 locations McDonald’s claims to operate.

View the McDonald’s Chart Live

McDonald’s 2020 North American footprint grew from 13,673 to 15,144 locations in 2021.

Over 69 million people worldwide eat at McDonald’s daily, and McDonald’s sells 3.29 billion pounds of French fries yearly.

Many investors like McDonald’s because of its revenues. Stock Rover estimates McDonald’s revenues grew by 40% between 2020 and 2024, from $19.208 billion to $23.223 billion. Those revenues rose slightly by 3.27% to $23.265 billion in the 2022 fiscal year.

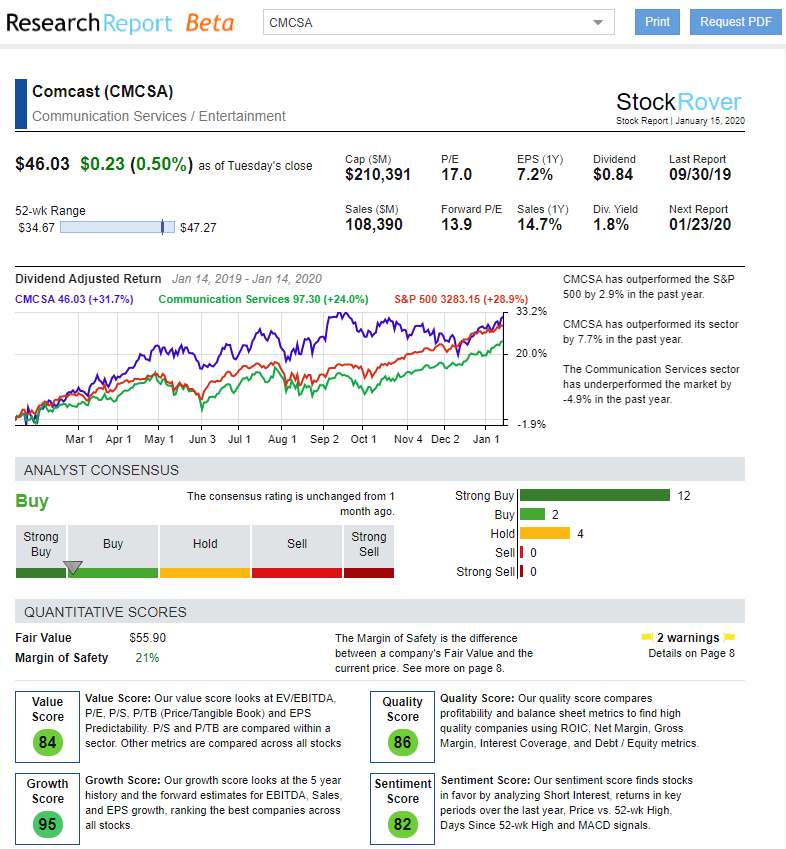

Download a Free McDonald’s Stock Research Report From Stock Rover

International markets are the principal source of McDonald’s revenues. Stock Rover reports show international markets generated 54% of McDonald’s revenues in 2023. The United States was the second largest source of McDonald’s revenues, contributing 41%.

Stock Rover Rankings for McDonald’s 2023

| Profitability | Stock | Industry | S&P 500 |

|---|---|---|---|

| Quality Score | 84 | 56 | 76 |

| Gross Margin | 56.1% | 32.8% | 29.8% |

| Operating Margin | 43.7% | 13.5% | 14.6% |

| Net Margin | 25.4% | 8.0% | 11.1% |

| Return on Assets | 12.2% | 10.9% | 8.0% |

| Return on Equity | -90.0% | -101.7% | 33.8% |

| ROIC | 17.4% | 18.1% | 19.7% |

Stock Rover Rankings: McDonald’s vs. Competitors 2023

| Ticker | Company | Cap ($M) | P/E | Change (%) |

|---|---|---|---|---|

| MCD | McDonald’s | $200,369 | 34.5 | -0.2% |

| SBUX | Starbucks | $123,118 | 37.9 | 0.5% |

| CMG | Chipotle… | $43,354 | 54.5 | 0.8% |

| YUM | Yum Brands | $36,912 | 29.8 | 0.5% |

| YUMC | Yum China… | $24,404 | 29.0 | 2.1% |

Get Stock Rover – The King of Stock Research

McDonald’s is a popular dividend stock. Between March 15, 2023, and October 11, 2024, its management scheduled eight quarterly $1.52 dividends. Dividend.com estimates McDonald’s was offering a $6.08 forward dividend in January 2023.

The value propositions at McDonald’s include the powerful brand, the large revenues, and the dividends.

People always need to eat, and McDonald’s has a reputation for selling cheap, good food. This lets McDonald’s thrive in good times when people can afford Big Macs and in poor economies when consumers need to grab a cheap meal.

In recent years, McDonald’s has been struggling in North America, facing stiff competition from many fast-food chains. McDonald’s has closed stores in North America. McDonald’s closed around 200 stores in North American Walmart (WMT) supercenters.

The McDonald’s locations are closing because there is less demand for burgers. Walmart is replacing McDonald’s with Taco Bell, Domino’s Pizza, and Charley’s Philly Steaks stores.

2. Shake Shack Inc.

Shake Shack (SHAK) is a popular American quality burger chain. Quality burger chains like Shake Shack and In-N-Out Burger sell handmade burgers made from fresh meat and hand-cut fries.

Shake Shack’s business model is based on the belief that people will pay extra for a better burger. The company’s fast growth shows a strong demand for “quality burgers” and handmade fries.

Shake Shack began in one location in New York City in 2004. By 2022, there were 436 Shake Shack locations. They opened 69 Shake Shacks in 2022, and there were plans to open 65 to 70 Shake Shack locations in 2023.

View the Shakeshack Stock Chart & Financials

Shake Shack was originally an urban chain selling burgers from city storefronts. In 2021, it started opening drive-thrus to compete with its West Coast rival, In-N-Out Burger. In-N-Out Burger only operates drive-thrus, and Most locations have no inside dining.

Drive-thru stores can be lucrative. Restaurant Dive claims an Orlando, Florida, Shake Shack sold $86,000 worth of food a week in 2022. Shake Shack CEO Randy Garutti claims a drive-thru can increase Shake Shack’s annual sales to $5 million and increase profits by 20%. Restaurant Drive estimates each company-owned Shake Shack location generated around $3.8 million in sales in 2022.

Shake Shack vs. Its Competitors 2023: Powered By Stock Rover

| Ticker | Company | Cap ($M) | P/E | Change (%) |

|---|---|---|---|---|

| SHAK | Shake Shack | $2,269 | – | 0.0% |

| JACK | Jack In The Box | $1,603 | 14.1 | 0.9% |

| BROS | Dutch Bros | $2,065 | – | 0.1% |

| CNNE | Cannae Holdings | $1,799 | – | -0.6% |

| DIN | Dine Brands | $1,179 | 14.0 | 0.6% |

| BJRI | BJ’s Restaurants | $728 | – | -1.4% |

Get Stock Rover – The King of Stock Research

Management hopes to open 25 Shake Shack drive-thru stores in 2023. Opening drive-thrus allows Shake Shack to expand into suburban areas, which comprise most of the fast-food markets in North America.

Unlike In-N-Out Burger, Shake Shack is a publicly traded company. Its shares trade on the New York Stock Exchange under the SHAK ticker. The value proposition at Shake Shack is a company that could grow into a lucrative fast-food giant.

3. Yum! Brands Inc.

Yum! Brands (YUM) is a diversified fast-food company that resembles Restaurant Brands International.

The value at Yum! is three of the world’s most famous and successful fast-food brands: KFC (Kentucky Fried Chicken), Taco Bell, and Pizza Hut. Yum! competes in the quality burger segment with The Habit Burger Grill. Yum! claims to operate the largest fast food empire with over 53,000 restaurants in 155 countries and territories.

Yum’s value proposition includes three of the world’s most valuable fast food brands in 2022. KFC will be the fourth most valuable fast-food brand worldwide in 2023.

In 2022, Taco Bell was the sixth most valuable fast food brand, with a global brand value of $5.81. Pizza Hut was the eighth most valuable fast brand worldwide, with a brand value of over $5.13 billion.

Yum! Brands is a growing company, according to Stock Rover.

| Stock Rover Growth Rankings | Stock | Industry | S&P 500 |

|---|---|---|---|

| Growth Score | 81 | 67 | 76 |

| Sales Growth Next Year | 5.8% | 8.8% | 5.9% |

| Sales 1‑Year Chg (%) | 2.0% | 41.3% | 0.5% |

| Sales 3‑Year Avg (%) | 6.2% | 4.6% | 13.3% |

| Sales 5‑Year Avg (%) | 2.7% | 3.2% | 11.9% |

Get Stock Rover Free – The King of Stock Research

The value proposition at Yum! Brands are the world’s largest footprint of fast-food restaurants. That footprint does not include China. Another company, Yum China Holdings Inc. (NYSE: YUMC), operates KFC, Pizza Hut, Taco Bell, Little Sheep, and Huang Ji Huang restaurants in the People’s Republic.

The Yum! Value proposition includes dividends. Yum! Brands have scheduled eight 57₵ quarterly dividends between March 10, 2013, and December 9, 2024.

The success of brands such as Burger King shows why fast food is a valuable investment. Value investors seeking recession-resistant stocks must investigate companies such as Restaurant Brands International and Yum! Brands, Yum China Holdings Inc., and McDonald’s.

Burger King History

Keith Kramer and Matthew Burns founded Burger King as Insta-Burger King in Jacksonville, Florida, in 1953. The two had bought the rights to a special grilling machine called the Insta-Broiler and began franchising the chain and the Insta-Broiler.

In 1954, Cornell University classmates James McLamore and David Edgerton bought a Burger King Franchise in Miami. McLamore and Edgerton adapted the Insta-Broiler into a gas grill called a “flame broiler.”

Flame-broiled hamburgers became Burger King’s signature food, differentiating it from competitors. Most burger chains, including McDonald’s, fry burgers on a heated grill.

In 1959, McLamore and Edgerton bought out Kramer and Burns. The new owners restructured the company and changed the name to Burger King. They also introduced the Whopper. In 1967, the Pillsbury Company bought Burger King.

Burger King has had several owners since 1967. They created Restaurant Brands International in 2014 when Burger King merged with the iconic Canadian coffee shop chain Tim Horton’s. Restaurant Brands bought another fast-food icon, Popeye’s fried chicken chain, in 2018. The company also owns Firehouse Subs, an American sandwich chain.

In recent years, Burger King has tried to rebrand itself as “BK.” Management hopes the initials will restore Burger King’s image in North America, where it faces stiff competition from McDonald’s and quality burger chains, such as In-n-Out Burger and Shake Shack (SHAK). Many North American Burger King locations have closed in recent years.

Restaurant Brands Stock

The value proposition at Restaurant Brands International is one of the world’s largest fast-food operations.

Restaurant Brands has over 400 Firehouse Subs franchises, over 3,500 Popeye’s locations, over 5,000 Tim Horton’s coffee shops, and over 18,700 Burger King locations worldwide. Therefore, Restaurant Brands operates over 27,600 fast-food restaurants worldwide—McDonald’s claims to operate over 38,000 restaurants in 118 countries and territories.

Restaurant Brands is a diversified company. It operates four different brands, each selling a different menu. This means Restaurant Brands can keep making money if tastes change. If people stop buying burgers, they could buy submarine sandwiches from Firehouse Subs or chicken from Popeye’s.

Restaurant Brands further diversifies its operations by selling coffee through Tim Horton’s. Tim Horton’s is the fifth largest coffee shop chain in the United States, with 626 locations in 10. The largest coffee shop chain, Starbucks (SBUX), had 51,836 US locations in 2022.

Diversification protects Restaurant Brands from a changing market and aggressive competition in the burger segment. It also allows Them to tap different markets. For example, Firehouse Subs caters to upscale customers, Tim Horton’s serves coffee drinkers, Popeye’s serves chicken lovers, and Burger King serves working-class diners.

Another value proposition at Restaurant Brands is its ability to sell cheap food. This allows Restaurant Brands to profit in a poor economy because people still need to eat and hate to cook in terrible times. There are also many situations where people need to save money but cannot cook.

In good times, people have extra cash for Whoppers, onion rings, Popeye’s Chicken, Tim Horton coffee and donuts, and Firehouse Subs. Restaurant Brands is a company that thrives in any economy.