What is the Price Earnings Ratio – PE Ratio

The PE Ratio is a calculation used to determine the value of a company’s stock. It stands for Price-to-Earnings and is found by dividing the stock price by the earnings per share. The PE Ratio can be used to compare companies within an industry or with each other.

There are two ways to find a company’s PE Ratio: you can use a financial website such as Yahoo Finance or calculate it yourself using information from the company’s most recent annual report.

How to Calculate the PE Ratio

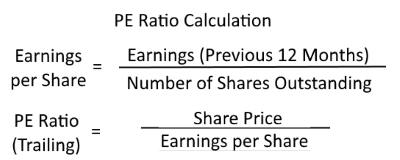

To calculate the PE Ratio yourself, use this formula:

Price of Stock ÷ Earnings Per Share = PE Ratio

For example, if Company A’s stock price is $10 and its earnings per share is $1, its PE Ratio would be 10 ($10 ÷ $1). If Company B’s stock price is $20 and earnings per share are $5, its PE Ratio would be 4 ($20 ÷ $5).

The PE Ratio can be a useful tool for investors, but it is important to remember that it is just one factor to consider when making investment decisions. Factors such as the company’s history, financial stability, and prospects should also be considered.

Why is the PE Ratio Important?

When looking at a company’s PE Ratio, comparing it to other companies in the same industry is important. This will give you a better idea of whether the stock price is expensive or cheap relative to its earnings. For example, if Company A has a PE Ratio of 10 and most other companies in its industry have PE Ratios of 20, then Company A’s stock may be undervalued.

It is also important to remember that the PE Ratio is a historical measure and does not necessarily reflect future performance. A company with a high PE Ratio could be expected to grow faster than a company with a low PE Ratio, but there are no guarantees.

This excerpt from the Liberated Stock Trader Book accompanies the PRO Training Course. Chapter 4 – Section 4 – The P/E Ratio

“Now that we understand there are different types of stocks or companies, we can look at how to evaluate if a business is fundamentally healthy.

Having some knowledge that a company will not be declaring bankruptcy anytime soon is the minimum goal; however, the more refined investor will be looking for stocks that are reasonably priced, have low amounts of debt, or at least can repay that debt easily, strong sales growth or revenue growth, a decent amount of cash in the bank, and solid earnings.

Also, if you are familiar with the company’s product and its importance to the business, it can give you additional insight.”

Try TradingView, Our Recommended Tool for International Traders

Global Community, Charts, Screening, Analysis & Broker Integration

Global Financial Analysis for Free on TradingView

Example Chart: PE Ratio Apple Inc.

A Practical PE Ratio Example

The Price to Earnings ratio is a simple calculation that may take some time to understand. But once you have it, it can be very useful. The P/E Ratio is the Share Price divided by the earnings.

Let us imagine I want to buy an ice cream stand. The Owner wants to sell that stand to me for $10,000. I have estimated a yearly profit (after tax) of $2,000. This means it would take me five years to make my money back on this investment. Therefore, the price I paid divided by the earnings equals 5. This is what the P/E Ratio or the “Multiple” tells us. In the example above, I used the example of buying a whole business, and we are considering all of the profits. The P/E Ratio achieves this goal using the Individual Share Price / Earnings per Share.

The P/E Ratio can tell you what kind of premium investors are willing to pay to get a piece of this company. P/E Ratios should always be considered in the context of the industry group. For example, compare the P/E of companies in the same industry; this will tell you which companies are perceived to have the brightest future or the best products or services, as the investors are willing to pay more for a share of one company as opposed to another company that is in the same line of business.

What is a Good PE Ratio?

Company A – P/E 50 – If 50 is the highest PE in the industry, then people believe this company has the best profit growth potential in the future.

Company B – P/E 25 – If 25 were the industry average, then this company would be seen as a fairly priced stock for the industry.

Company C – P/E 5 – This company would be seen as an underperformer / or a stock with potential value. This could be a good bargain if the earnings suddenly jumped for this stock.

The P/E Ratio needs to be combined with other fundamental measures to get a better picture of the stock.

Ultimate Guide to the PE Ratio

Summary

If you’re considering investing in a company, research and ensure you understand all the factors that could affect the stock price. The PE Ratio is just one tool that can help make investment decisions, but it’s not the only thing to consider.