My research shows that options for creating custom AI models for stock trading are limited. While platforms like TradingView and Trade Ideas offer many algorithms, only TrendSpider lets you fully train your own models. It’s a game-changer for traders looking to create unique strategies!

Trendspider’s AI Strategy Lab is an innovative platform designed to transform traders’ and investors’ approaches by providing them with advanced machine-learning tools tailored specifically for financial markets.

Unlike general-purpose AI models like ChatGPT, this lab focuses on developing AI strategies to predict market trends and identify trading opportunities. The platform allows users to create and customize models based on specific market criteria, offering flexibility and precision for traders of all levels.

Key Takeaways

- The TrendSpider AI Strategy Lab provides advanced, predictive machine-learning tools for trading.

- Users can tailor AI models to specific market needs and criteria.

- AI strategies detect complex patterns, offering advantages over traditional methods.

- Read the full TrendSpider review here.

AI Strategy Lab Overview

The AI Strategy Lab is a revolutionary platform specifically designed to detect trading patterns. Users can personalize models by adjusting parameters such as time frame, risk level, and market type to achieve precise predictions suited to their needs. Through machine learning, computers assess data without explicit instructions, offering traders an innovative approach to uncovering potential trade signals effectively.

Tailoring and Implementing AI Trading Methods

In the AI Strategy Lab, users can design and deploy individual trading strategies without needing extensive technical expertise. The platform simplifies the process by allowing traders to define key elements like desired outcomes and market conditions, making sophisticated data-driven strategies more accessible. It offers a user-friendly interface where traders can select different models, configure inputs, and train them according to their requirements.

These AI models can be utilized for backtesting, chart overlays, and creating custom alerts, offering a comprehensive solution to enhance trading decisions. By enabling traders to focus on strategy rather than complex setups, the platform significantly streamlines the creation of effective trading strategies.

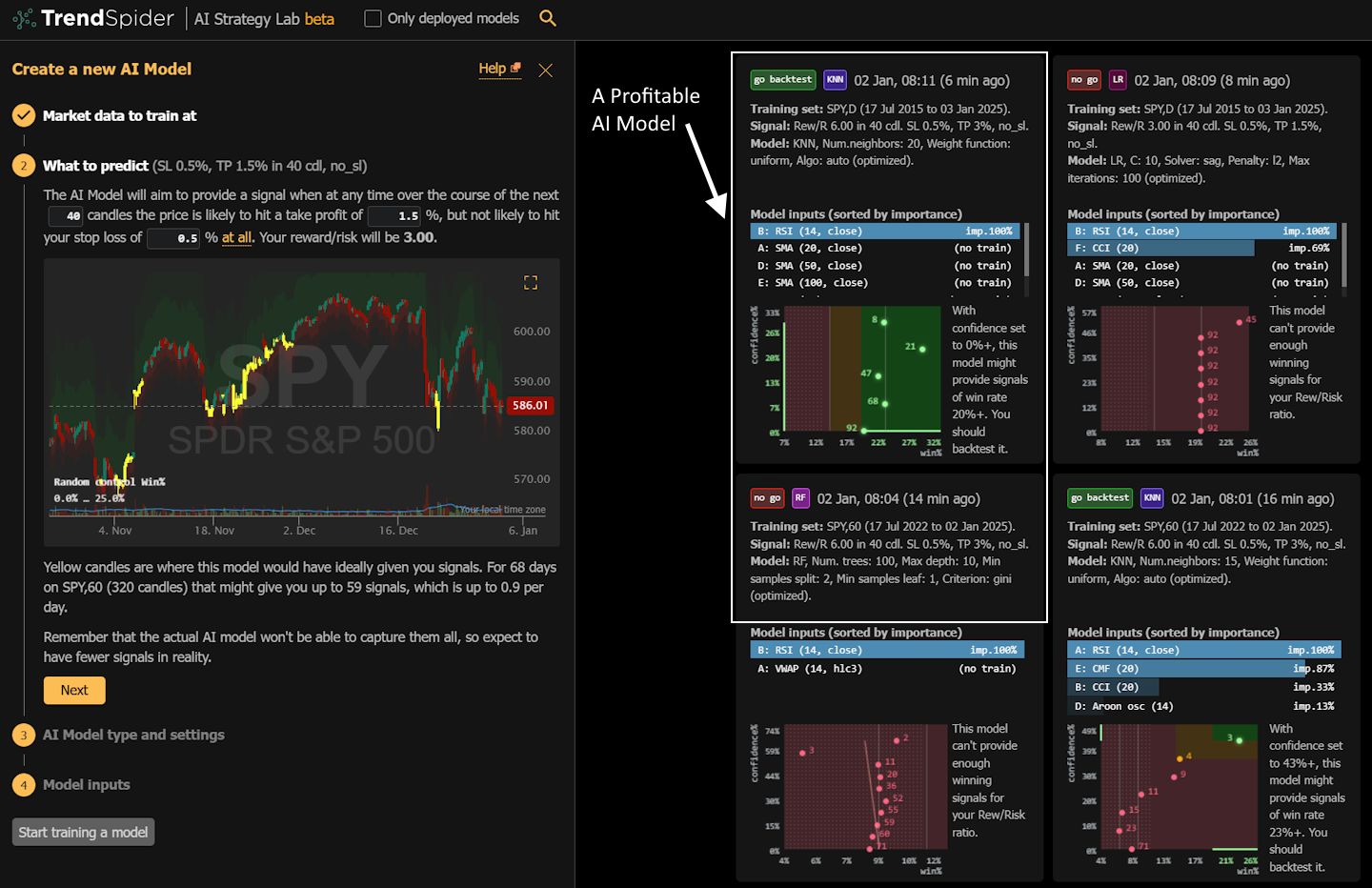

Evaluating AI Model Variations

Differences from General AI Systems

AI systems, such as Chat GPT, are designed to handle a broad array of tasks, including generating text, answering questions, and assisting in coding. These systems are optimized for linguistic capabilities. On the other hand, the AI strategy lab is tailored specifically for the trading environment. It focuses on scrutinizing financial data to pinpoint trading signals. This serves as a crucial distinction, as these specialized AI strategies are crafted to accommodate specific market conditions, timeframes, and trading goals.

✨

Algorithmic Trading

Automates trades using pre-set rules and historical data.

High-speed, precise trading suited for high-frequency markets.

Limited adaptability to real-time, unexpected events.

Limited by the quality of the rules and data.

✧

Machine Learning

Analyzes historical market data to uncover patterns and trends.

Makes predictions about future price movements based on past behavior.

Continuously learns and improves its algorithms with new data.

Struggles to adapt to sudden changes during live trading quickly.

֍

Generative AI

Creates synthetic data and simulates market conditions.

Useful for scenario analysis and stress testing.

Effective for risk assessment and forecasting.

Cannot execute trades directly; requires quality data.

Customized for Trading Activities

Unlike generic AI platforms, the AI strategy lab provides tools specifically for developing trading strategies. Users can shape models to meet varied market conditions and preferences, defining parameters like time frames, risk tolerance, and target outcomes. By leveraging predictive machine learning, these models can identify patterns in price movements without needing detailed programming.

This point-and-click setup allows users of all skill levels to build sophisticated trading strategies, simplifying the process of data-driven decision-making to achieve desired trading outcomes.

Establishing Market Parameters, Duration, and Trading Standards

For effective AI-driven trading strategies, it’s crucial to identify the specific market and time frame for analysis. Users should choose symbols from various assets like stocks or cryptocurrencies. Additionally, specifying the date range enables the model to be trained on a substantial data set, up to 10,000 candles across multiple markets, enhancing its accuracy and reliability.

Another essential step is defining the criteria for triggering signals. Decide on take-profit and stop-loss limits that align with your desired risk-reward ratio. These parameters dictate when to enter or exit trades, helping balance the frequency and reliability of signals. Shorter time horizons may necessitate tighter criteria, while extended periods can accommodate more lenient settings.

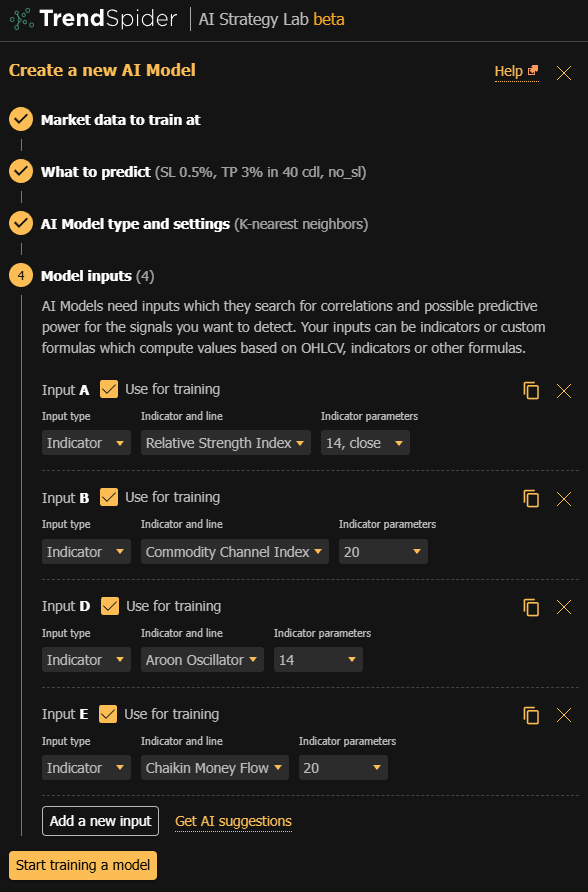

Attributes of Forecasting Machine Learning Models

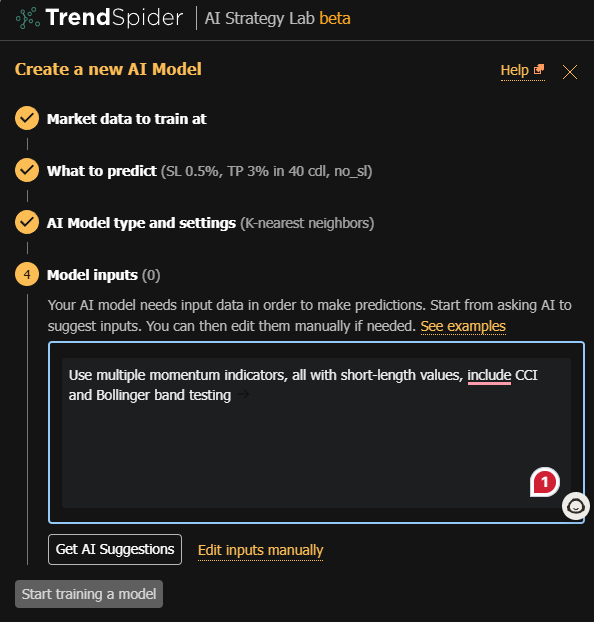

The choice of predictive model type is critical as it influences how data is analyzed. Options include logistic regression, naive Bayes, K-nearest neighbor, and random forest. Each has unique features and applications, with descriptions provided to assist in selection. After establishing the underlying assumptions, users can either input manually or leverage AI-generated suggestions for model inputs.

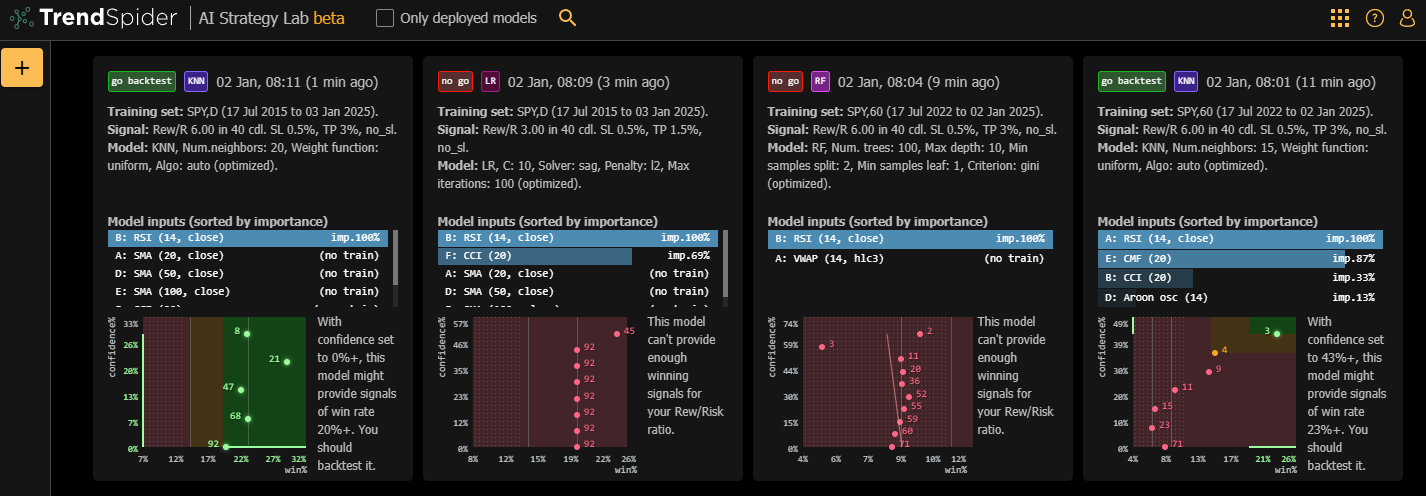

Upon training, evaluate the model based on three principal components: confidence versus win percentage, win rate zones, and the ranking of input significance. These metrics guide users in refining their models by adjusting inputs or trying alternative model types for optimum performance. This iterative process helps in developing robust models that can then be deployed for backtesting, chart overlays, and generating custom alerts and strategies.

Uncovering Patterns Beyond Traditional Analysis

AI methods in trading offer powerful capabilities, allowing users to identify patterns within price movements that may be overlooked by traditional analysis. Machine learning models excel in recognizing complex data patterns without needing precise instructions. Unlike traditional models, AI-based systems can adaptively learn and define entry criteria from historical data. This enables a more dynamic approach, uncovering relationships and signals that predefined rule-based systems might miss, thus expanding the possibilities for traders.

Unique Attributes of AI Compared to Algorithmic Methods

Creation through Learning vs. Predefined Rules

AI strategies differ by using historical data to establish trade entry rules independently. In contrast, traditional algorithmic methods depend on fixed rules designed by traders. AI offers a dynamic, adaptable approach, learning from past market behavior to improve and refine trading decisions.

Advanced Recognition of Complex Patterns

AI systems excel at identifying intricate patterns in market data, often revealing relationships that fixed rule-based algorithms might overlook. This impressive ability enables traders to discover subtle signals and correlations, enhancing their decision-making process in complex market environments. A focus on these capabilities ensures a competitive edge in trading strategies.

Crafting Your AI Trading Model

Setting Market Parameters and Forecast Objectives

When building an AI trading model, the first step is to define the market environment and establish your predictive goals. Choose the specific market, which could include stocks, cryptocurrencies, or other instruments available on the platform. You’ll need to set the time frame and date range for the analysis. You can model up to 10,000 candles and select up to three markets simultaneously. Clearly specify what your model aims to predict, such as whether a take-profit target will be reached before a stop-loss within a certain time horizon. Adjust the profit and loss targets to fit your risk-reward preferences.

Selecting the Model Type and Inputs

After defining the market parameters, decide on the type of model that suits your trading strategy. Options include logistic regression, naive Bayes, k-nearest neighbors, or random forest. Each type has its unique characteristics, which will be briefly described when you make a selection. Further, define the inputs for the model. This can be done through AI prompts or manual input of indicators and formulas.

Educating and Assessing the Model

After selecting your model type and inputs, start the training process. To evaluate the model, look at key elements like the confidence vs. win percentage chart. Ideally, this chart should show an upward trend from the bottom left to the top right, indicating that higher confidence levels lead to better win rates.

Next, check the win rate zones: green indicates strong performance, while red and orange point to areas that need improvement. The input importance list shows how much each input contributes to performance. Use the “build upon it” feature to adjust inputs and improve the model. If necessary, try other model types or combine multiple models to achieve better results.

Once finalized, deploy your model for tasks such as backtesting, chart overlays, and market analyses to improve decision-making in your trading activities.

Adjusting Inputs and Combating Model Techniques

Refining models to fit specific trading criteria involves modifying input settings and experimenting with different model configurations. Options such as logistic regression, naive Bayes, K-nearest neighbor, and random forest allow for extensive customization. By tweaking these inputs and trying various model types, users can effectively optimize predictive outcomes.

Cross-model integration, the process of combining features from multiple models, can uncover unique insights. For this approach, all parent models must use the same type and share identical parameters. This technique enhances model capabilities by leveraging strengths and weaknesses from each parent model, ultimately producing innovative strategies.