The determinants of supply are crucial in economics, forming the foundation of functioning markets and the economy.

Key determinants of pricing, labor, taxes, competition, suppliers, and technology change the supply of goods and services.

The law of supply shows the link between price and quantity that suppliers are willing to produce and sell. However, price is just one of several factors that can influence supply.

Other determinants of the price of goods include production costs, such as labor and materials, and technological advancements that can affect a supplier’s ability to produce.

Government policies, future market conditions, and the number of suppliers are crucial in determining supply. These factors can shift the supply curve, reflecting changes in quantity supplied at different price levels.

Key Takeaways

- Costs, technology, and government policies impact supply.

- These determinants can shift the whole supply curve, altering market dynamics.

- Understanding supply determinants provides insight into economic conditions and production capabilities.

Basic Concepts of Supply

In economics, supply is pivotal, directly impacting the market’s price and quantity of goods and services. Understanding its fundamentals helps predict how producers respond to market changes.

Law of Supply

The Law of Supply states that an increase in price results in an increase in quantity supplied. Producers are willing to supply more of a good or service at higher prices because it yields greater revenue, enhancing profitability.

Supply and Demand Interrelation

Supply and demand are the forces that drive market economies. The demand curve illustrates how much of a good consumers are willing to purchase at different price points, while the supply curve reflects the quantity that producers are willing to sell. Markets reach an equilibrium where these two curves intersect, determining the market price and quantity of the good or service.

Market Structure and Supply

The market structure affects the behavior of producers or firms in a market. Competition influences how a single producer’s supply can impact market price. In competitive markets, individual producers have less influence on setting prices, whereas monopolies can exert greater influence, affecting the overall quantity supplied.

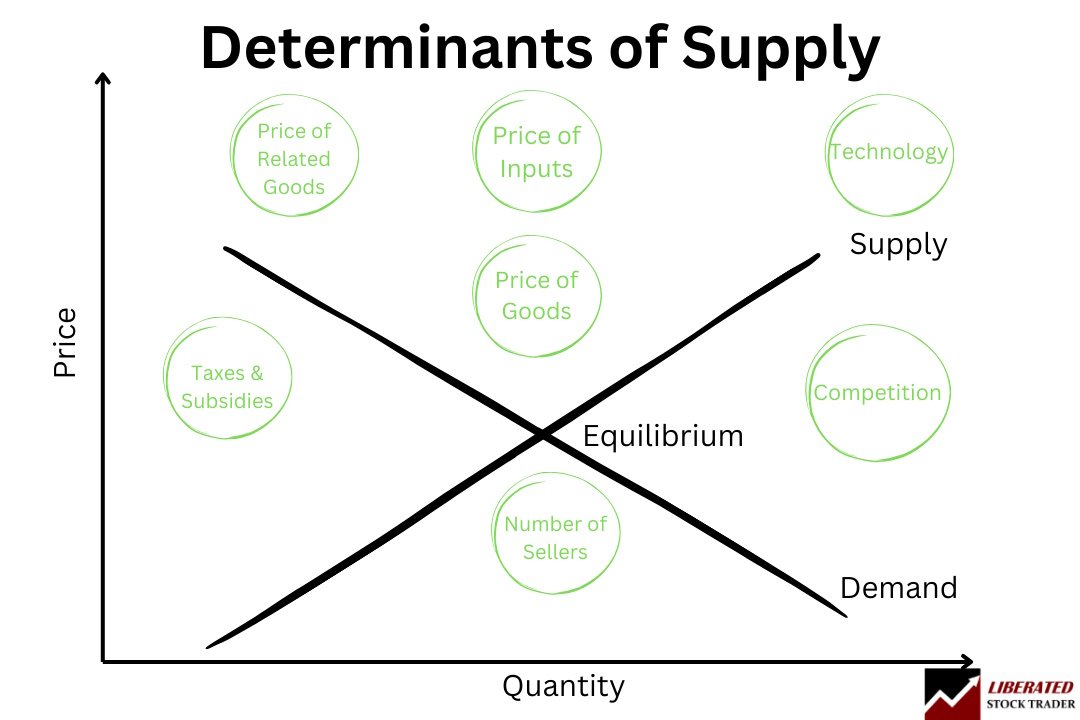

Determinants of Supply

Factors that can cause a change in supply (shift of the supply curve) or a change in quantity supplied (movement along the supply curve) are known as determinants of supply. These include:

- Prices of Related Goods or Services: The price of substitutes or complements can affect supply.

- Technology: Advances can reduce costs, increasing supply.

- Input Costs: Changes in the price of resources needed to produce a good or service will affect supply.

- Expectations: If producers anticipate higher future prices, they may decrease the current supply.

- Number of Producers: More producers generally increase market supply.

- Government Policies: Taxes, subsidies, and regulations can increase or decrease supply.

Each determinant can shift the supply curve to the left (decrease in supply) or right (increase in supply), reflecting a change not in the price of the good or service but in other related variables or factors.

Factors Influencing Supply

The supply of a product is not static and can be influenced by many factors, ranging from the cost of production to technological advancements. Understanding these factors is crucial for producers to navigate the market effectively.

Production Costs

Production costs are a primary factor affecting supply. When the cost of production decreases due to lower labor, raw materials costs, or more efficient production technology, the marginal cost of production also drops. This often enables producers to increase the quantity supplied at the existing price. Conversely, if production costs rise, the supply is likely to decrease.

Technology Advances

Technological advancements can significantly impact productivity and production costs, often positively. Innovations can streamline production, reducing the time and resources needed to produce goods. As technologies improve, they can lead to a shift in the supply curve, suggesting a greater quantity supplied at each price.

Try TradingView, Our Recommended Tool for International Traders

Global Community, Charts, Screening, Analysis & Broker Integration

Global Financial Analysis for Free on TradingView

Producer Expectations

If producers anticipate future price changes or market conditions shifts, their expectations can influence the current supply. For example, if there is an expectation of higher future prices due to market conditions, producers might decrease the current supply to sell later at higher prices.

Number of Suppliers

The number of suppliers in the market can influence supply. An increase in suppliers, possibly due to lower barriers to entry or increased competition, typically leads to a greater supply. This is because more firms produce goods, increasing the quantity of a commodity in the market.

Price of Inputs

The price of inputs—such as raw materials and other resources needed to create a product—directly influences supply. When the price of inputs increases, the cost to produce goods increases, and the supply may decrease. If input prices decrease, production becomes less costly, possibly increasing the supply of the product.

Impact of Economic Policies

Economic policies crafted by governments have significant effects on a producer’s supply. They determine the cost of production and influence market behaviors. Policies such as taxes, subsidies, and regulation can either encourage or hinder the production and supply of goods.

Taxes and Subsidies

Taxes, particularly commodity taxes and excise duties, can increase the cost of production. As a result, suppliers may decrease production due to lower profit margins, which shifts the supply curve to the left. Conversely, subsidies decrease production costs, allowing producers to supply more at every price point. Subsidies can cause the supply curve to shift rightward, signaling an increase in supply.

Government Regulations

Government regulations can have a dual impact on supply. Strict regulations may increase the cost of compliance, thus decreasing supply. Yet, they can also guarantee quality, fostering consumer trust and potentially increasing demand. Regulations that mandate environmental or safety standards are examples where initial supply may decrease as producers adjust. Still, long-term supply might be positively affected due to greater demand for higher-quality output.

Price Ceilings and Floors

Price ceilings, set below the equilibrium market price, can result in shortages as they discourage suppliers from producing more than the price-controlled quantity. On the other hand, price floors can lead to surpluses in which the quantity supplied exceeds the consumers’ willingness to buy at the minimum price. Government policy enforcing these controls must carefully consider the balance between maintaining affordability and ensuring adequate supply.

Market Price and Supply

The equilibrium market price is found where the quantity supplied meets the quantity demanded. When the government’s economic policy directly impacts this price, it alters supply dynamics. A reduced market price can lower supply as producers may not cover costs, whereas an increase in market price can boost supply as potential profits rise. Government interventions that significantly alter market prices can seriously affect supply levels.

Supply in Relation to Other Goods

The price of the good itself does not solely drive supply dynamics but is also influenced by the prices of related goods. These include goods that are complementary or substitute in nature, and even variations like inferior and Giffen goods have a role to play.

Related Goods

Supply can be affected by changes in the price of related goods. Producers may shift resources to produce more of a good if its price increases relative to its alternatives. For example, if Good A and Good B are related and the price of Good B rises, producers may supply more of Good B due to potential increased profits, affecting Good A’s supply as resources may be diverted.

Complementary and Substitute Goods

The supply of a good is interrelated with its complements and substitutes. If there is an increase in the price of Good C, which complements Good D, the supply of Good D might decrease if the demand for Good D falls. Conversely, if Good E is a substitute for Good F and Good E’s price rises, the supply for Good F might increase due to higher demand for the cheaper substitute.

Inferior and Giffen Goods

Inferior goods see an increased supply when the consumer’s income decreases, as they are more affordable alternatives to pricier goods. Giffen goods, a subset of inferior goods, can also experience an increase in quantity supplied despite a price increase. They represent a significant portion of low-income consumers’ budgets, who consume more of these goods when prices rise due to the income outweighing the substitution effect.

Try Powerful Financial Analysis & Research with Stock Rover

External Factors Affecting Supply

Supply is influenced by several external factors that can shift supply curves and alter the quantities supplied at different price points. Understanding these factors is essential for predicting how supply might change in response to external conditions.

Weather Conditions

Weather plays a critical role in the production of goods. Climate conditions can dramatically affect agricultural outputs. Adequate rainfall and favorable temperatures can increase the supply of crops, while droughts or floods might significantly decrease it. Weather disruptions often lead to volatile market conditions, as supply can shift unexpectedly due to natural factors outside human control.

Status and Preferences

The societal status and preferences of consumers can indirectly influence supply. For instance, if a good’s public status elevates and it becomes a symbol of affluence, producers might increase their supply to meet the new market demand. Conversely, changing consumer preferences away from a good can lead suppliers to decrease production.

Economic Expectations

Producers anticipate future market conditions and adjust their supply accordingly. If economic expectations signal an upcoming increase in demand, suppliers might increase their production in advance. However, if they expect the economic conditions to deteriorate, possibly due to predicted recessionary trends, they may reduce the amount supplied to avoid excess inventory.

Competition and Market Influence

The level of competition in a market exerts a substantial influence on supply. An increase in competitors can lead suppliers to lower prices and improve quality, affecting the overall market supply. Additionally, dominant players in a market set trends that smaller competitors often follow, thereby influencing the supply dynamics based on market influence and strategic positioning.

You want to be a successful stock investor but don’t know where to start.

Learning stock market investing on your own can be overwhelming. There’s so much information out there, and it’s hard to know what’s true and what’s not.

Liberated Stock Trader Pro Investing Course

Our pro investing classes are the perfect way to learn stock investing. You will learn everything you need to know about financial analysis, charts, stock screening, and portfolio building so you can start building wealth today.

★ 16 Hours of Video Lessons + eBook ★

★ Complete Financial Analysis Lessons ★

★ 6 Proven Investing Strategies ★

★ Professional Grade Stock Chart Analysis Classes ★

FAQ

What factors can cause the supply curve to shift?

Factors such as input costs, technology advancements, government policies like taxes and subsidies, and the number of available suppliers can shift the supply curve. A shift to the right indicates an increase in supply, while a shift to the left indicates a decrease.

How do taxes and subsidies influence market supply?

Taxes and subsidies directly affect a producer's costs. Taxes increase production costs, potentially reducing supply; subsidies decrease costs, often increasing supply.

What role does technology play in the supply of a product?

Advancements in technology can improve production efficiency, leading to a higher quantity supplied at the same price and thereby causing the supply curve to shift rightward.

Can you list the primary reasons for a change in supply, excluding price?

Changes in supply, excluding price, stem from variations in production costs, technology, producer expectations, number of sellers, and government interventions such as taxes and subsidies.

How do producer expectations affect the quantity supplied?

If producers anticipate higher future prices or demand, they might temporarily reduce the quantity supplied, holding back products to sell later for more profit. Expectations of lower future prices might lead to an increased current supply to avoid future losses.

What is the impact of the number of sellers on the market supply?

As the number of sellers in a market increases, market supply typically increases since more businesses produce and sell goods. Conversely, market supply will likely diminish if the number of sellers decreases.