The Dragonfly Doji is a candlestick chart pattern that indicates an equilibrium between buyers and sellers after a day of trading volatility. Our 1,703 test trades prove it can be profitable under the right circumstances, but the margins are thin.

Is the Doji pattern reliable or accurate? I tested Dragonfly Dojis on 565 years of trading data spanning bull and bear markets to discover the facts.

RESEARCH SUMMARY

- The Dragonfly Doji is an unreliable and risky trade with a low accuracy rate of 55.3%.

- The Dragonfly Doji pattern does not predict market direction with any certainty.

- A small profit per trade of 0.46% and a low Sharpe ratio of -0.01 suggest trading the Dragonfly Doji is highly risky.

- Our evidence suggests that the Dragon Fly Doji pattern should not be used as a primary trading strategy.

Get ready for an eye-opening journey into the world of Dragonfly Doji patterns!

What Is a Dragonfly Doji?

The Dragonfly Doji is a candlestick pattern used in the technical analysis of financial charts. It is formed when the high, open, and close prices are the same or very similar, while there is a long lower shadow (or wick) and no upper shadow.

The Dragonfly Doji is visually distinctive due to its long lower shadow and absence of an upper shadow, resembling a “T” shape. This pattern indicates that sellers could push the price down during the session, but buyers had driven the price back up to the opening level by the close.

What Does a Dragonfly Doji Candle Mean?

A Dragonfly Doji represents a battle for dominance between bulls and bears during the trading day. The bears initially had control and pushed prices down, but the bears fought back to drive prices higher. The day ends with similar open, high, and low prices, suggesting an impending trend reversal.

Other Doji Candles

Did you know there are four main types of Doji candles? These include the Standard, Long-legged, Dragonfly, and Gravestone. The standard Doji looks like a cross, while the Long-legged Doji, also known as a “Rickshaw Man,” has longer wicks, which suggest significant price movement during the period, but with a close near the opening price. The Dragonfly Doji shows a session where both opening and closing prices are at the day’s high, whereas the Gravestone Doji is the opposite, with open and close prices at the day’s low.

Dragonfly Doji Explained

The Dragonfly Doji candlestick pattern takes shape when a trading session’s opening, closing, and high prices are almost identical. This kind of candle resembles a dragonfly with wings, a head on top, and a long body below. It indicates that buyers pushed the prices up against the prevailing trend, and buyers are in control.

The primary market action behind a Dragonfly Doji is an initial bearish move followed by a significant bullish reversal.

Candle Pattern Recognition with TrendSpider

The Dragonfly Doji candle supposedly indicates bullish sentiment and a potential trend reversal, but our testing proves this theory false.

The Psychology of the Dragonfly Doji

The trading day starts, and traders are pessimistic and drive the price aggressively down. But during the day, buyer optimism prevails, and the stock closes at a high for the day. As buyers had control of the price and pushed it higher into the close, psychologically, the impetus was with the buyers, and the Dragonfly Doji was considered a bullish signal.

But is the Dragonfly Doji really a bullish pattern? Our research will go against popular opinion and discover the facts.

Is a Dragonfly Doji a Bullish Reversal Pattern?

No, according to our testing, the Dragonfly Doji is not a bullish reversal pattern. The results from 1,703 tested trades show that the Doji does not conclusively indicate a market reversal. The Doji has a low % accuracy rate of 55%, meaning it fails to predict market direction 45% of the time.

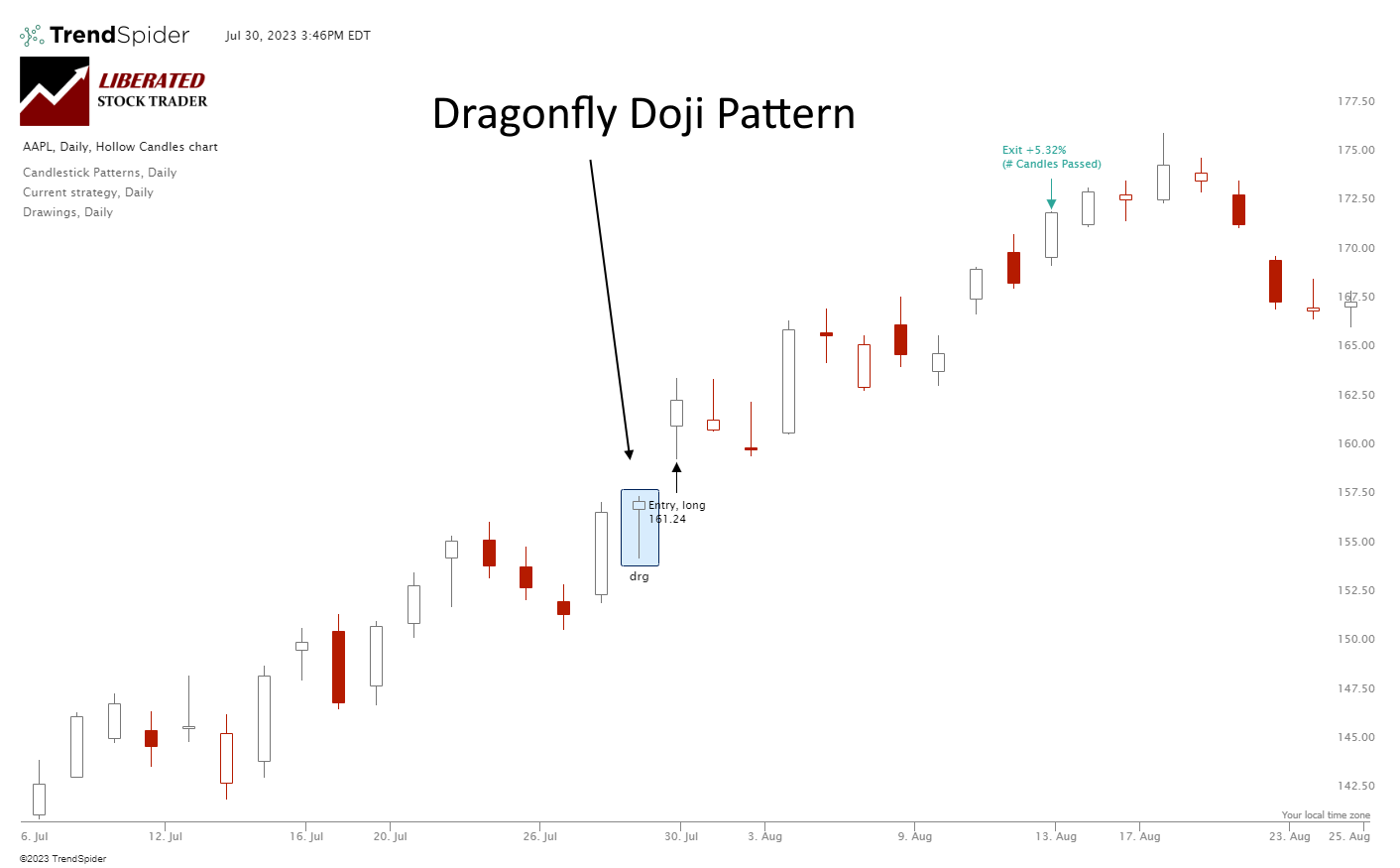

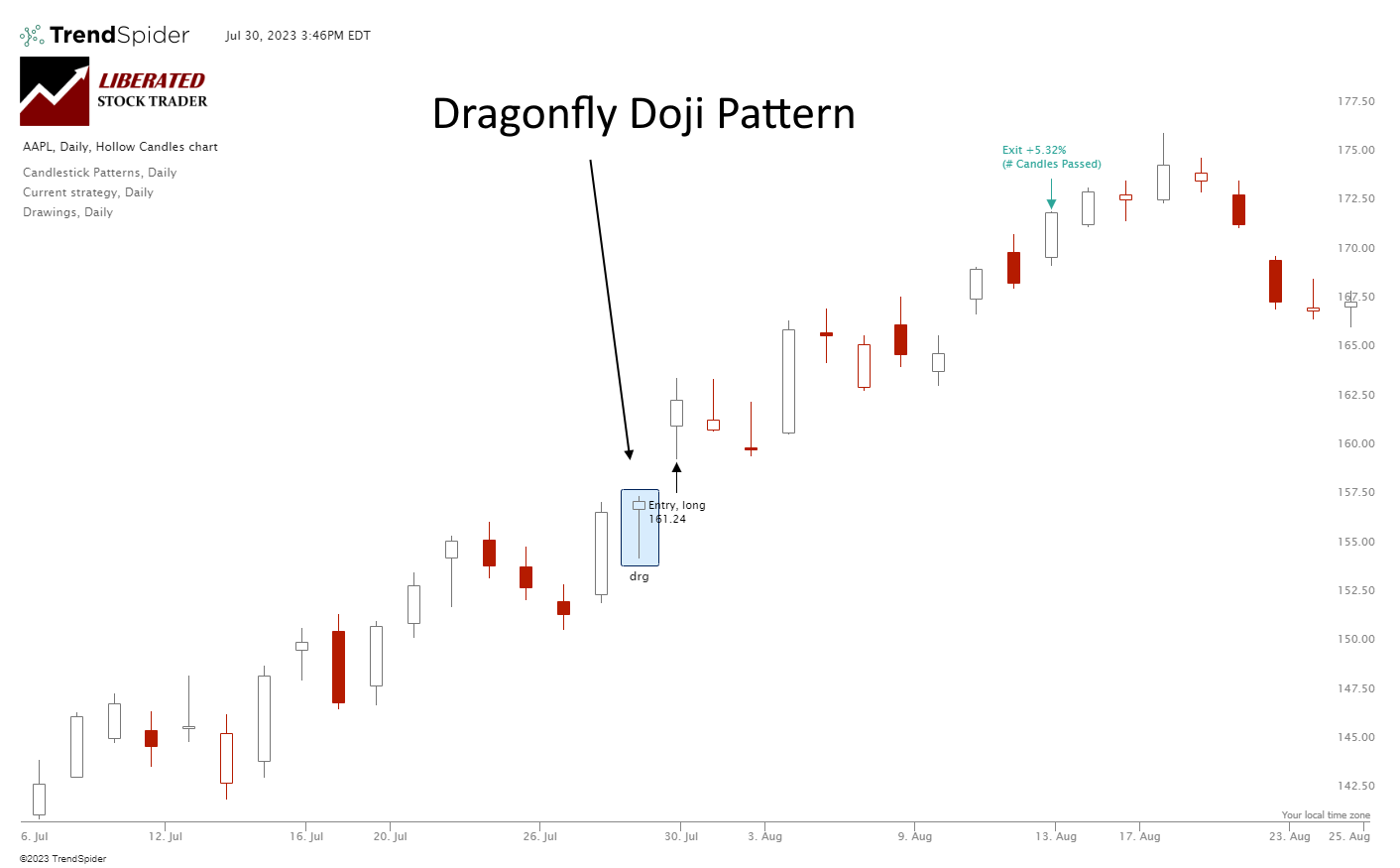

As you can see in the chart above, the Dragonfly Dojis occurs during an uptrend and does not signal a price reversal. This unreliability is reflected in our testing, which indicates that Dragonfly Dojis are not indicative of any future price move.

My thorough testing awarded TradingView a stellar 4.8 stars!

With powerful stock chart analysis, pattern recognition, screening, backtesting, and a 20+ million user community, it’s a game-changer for traders.

Whether you're trading in the US or internationally, TradingView is my top pick for its unmatched features and ease of use.

Explore TradingView – Your Gateway to Smarter Trading!

Trading a Dragonfly Doji?

Trading Dragonfly Dojis is not recommended as they do not offer reliable predictive information. While the Dragonfly Doji signifies a bullish end to the trading day, this does not guarantee the next day will be positive. However, there are many cases where, after a strong downtrend, this pattern with a very long body can be traded for profit. But I advise checking this hypothesis with your own backtesting before trading this pattern.

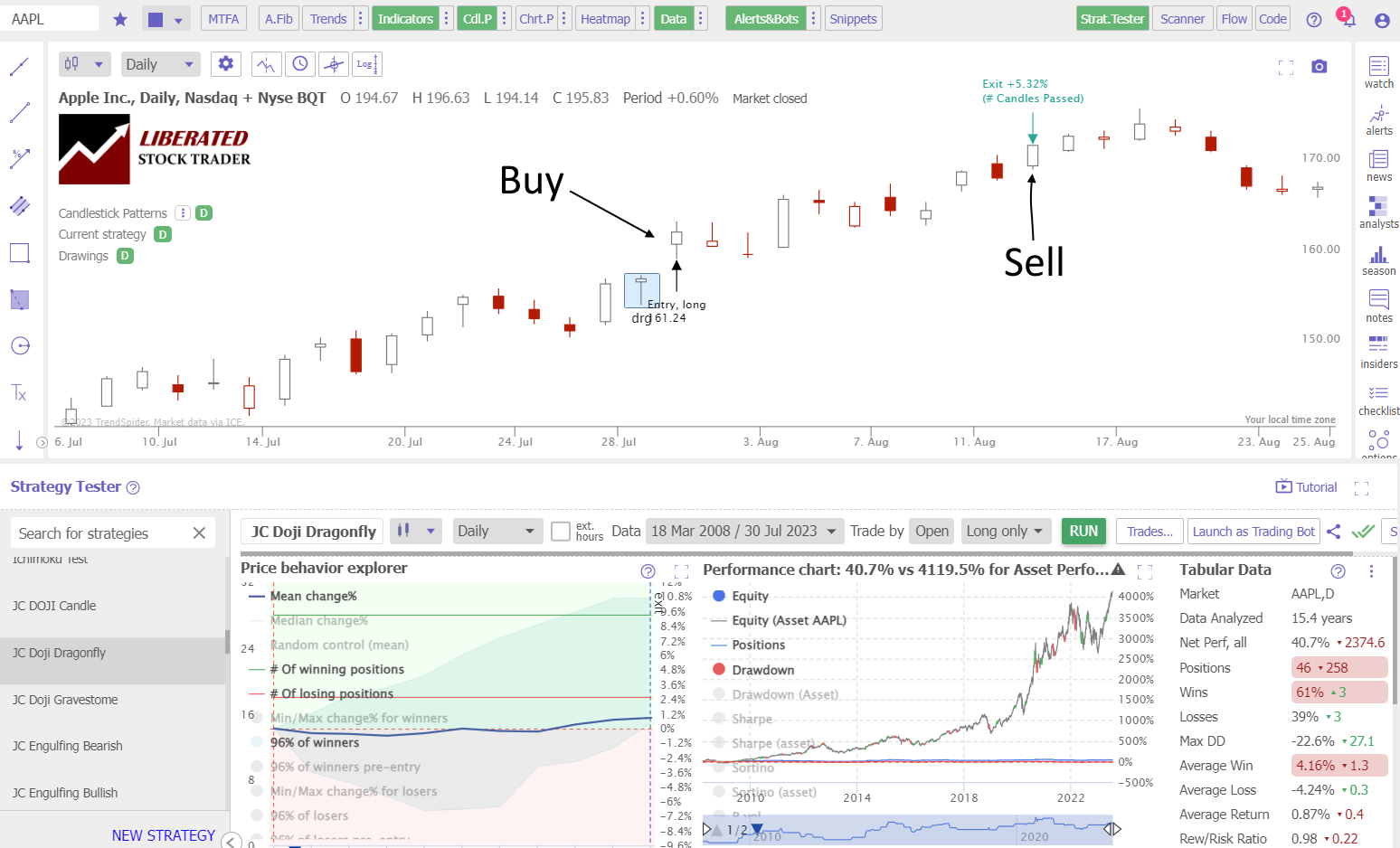

Our backtesting data (see the screenshot below) shows a positive trade on Apple Inc. with a 5.32% profit in 10 days. Trading Apple stock for over 20 years worked well, with a 61% win rate and an average return of 0.98% per trade. But is this because the Dragonfly was predictive or because Apple Inc. is in a continual uptrend? The evidence across all stocks suggests the latter.

Auto-Trade Candles with TrendSpider

When trading a Dragonfly Doji, it’s important to use confirmations in the form of reliable candle patterns, such as an Inverted Hammer or a Bearish Marubozu. Furthermore, reliable indicators such as the Relative Strength Index (RSI), Rate of Change (ROC), or Volume can be used to determine if the trend will likely reverse or continue.

Our Dragonfly Doji Candle Testing

Using TrendSpider, I tested 30 Dow Jones Industrial stocks over 20 years. This amounted to 1,703 Dragonfly Doji trades and 565 years of data. The Dragonfly Doji must be fully formed to enter a trade, and the buy signal must be executed on the next trading day’s open price. Each trade was exited at the open exactly ten days later.

Candle Testing Methodology:

- Pattern: Dragonfly Doji

- 30 DJIA Stocks

- Daily Chart

- Strategy: Buy Long

- Test Period: 2003 to 2023

- Buy at the next open

- Exit after ten days

- Pattern Recognition performed by TrendSpider

Backtesting the Dragonfly Doji

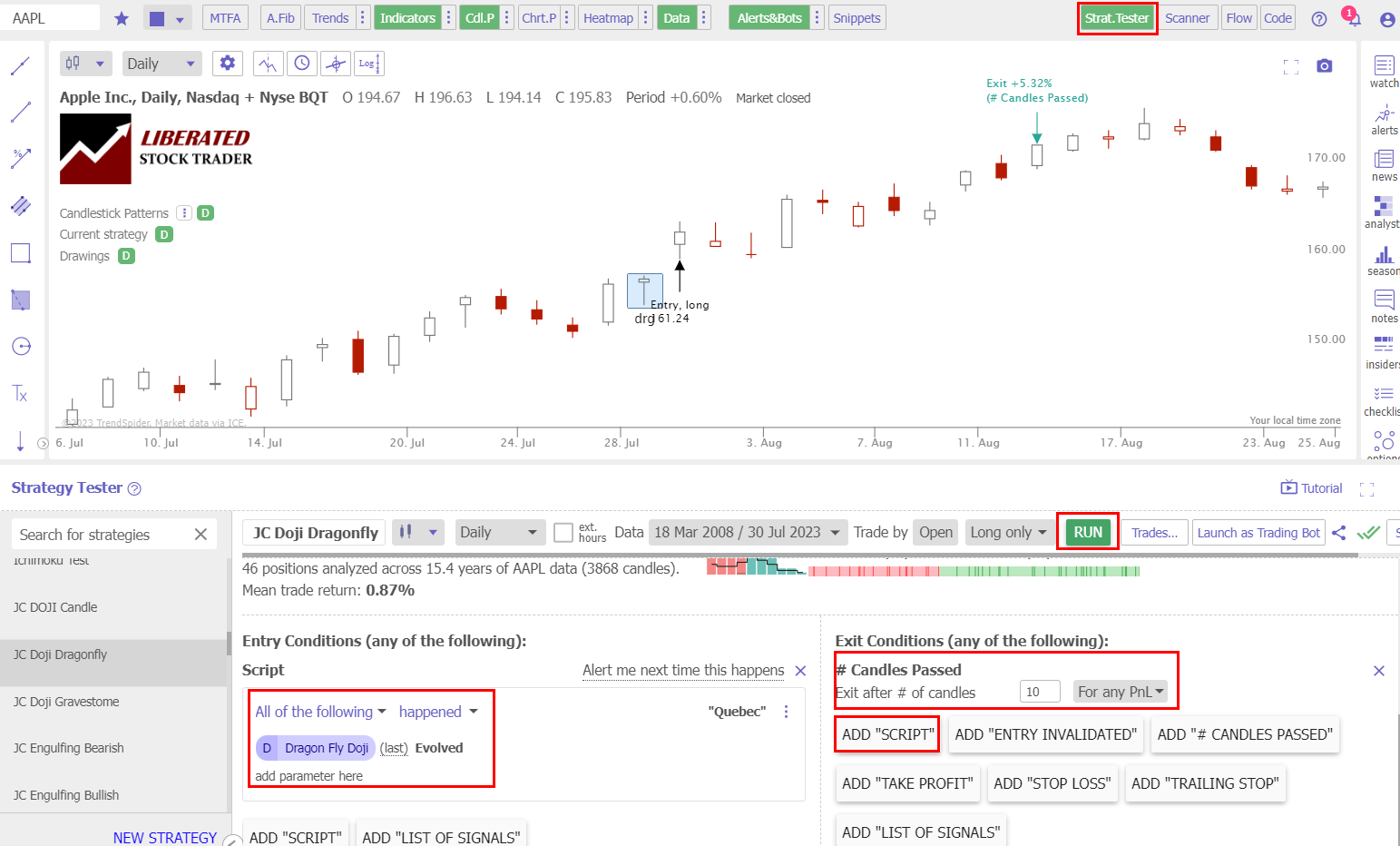

I discovered that utilizing TrendSpider for trade identification and execution yields swift and accurate results. To independently evaluate candlestick patterns and strategies, kindly follow the instructions below and refer to the accompanying screenshot for guidance.

- Register for TrendSpider.

- Buy Signal: Select Strategy Tester > Entry Condition > Add Parameter > Condition > Candlestick pattern > Dragonfly Doji > Evolved.

- Sell Signal: Add # Candles Passed = 10.

- Click “RUN” to execute the backtest.

How to Backtest a Dragonfly Doji. Settings and Methodology Guide.

Backtesting Done with TrendSpider

Test Results

After conducting 1,703 trades on 575 years of data, we confirm the Dragonfly profit per trade to be 0.46%. A 0.46% win rate means that trading a Dragonfly Doji long will net you an average of 0.65% profit per trade if you sell after ten days. Conversely, short-selling a Dragonfly Doji, you should expect to lose 0.46% per trade.

The percentage of Dragonfly Doji winning trades was 55.3% versus 44.7% losing trades, slightly lower than the 58% average performance across all candlestick types. The Max Drawdown was -29.7%, versus the stock’s drawdown of -59.3%, which shows less volatility than a buy-and-hold strategy.

The average winning trade was 3.6% over ten days, but the average losing trade was -3.4%; this represents an incredibly thin profit margin. The reward-to-risk ratio is 1.12, significantly less than many of our backtested and proven chart patterns.

The Sharpe ratio, a measure of risk, is -0.01; a good investment should be higher than 1.0; thus, the Dragonfly Doji is considered an incredibly risky trade. The Sortino ratio of 0.27 is also poor as the target should be 2, so again, it is a risky trade.

Test Results Summary

Ultimately, for every long trade you make after a Dragonfly Doji appears on a daily stock chart, on average, you should make 0.46% after holding for ten days. This is a positive result but lower than the average of all candlestick pattern trades, which is 0.5%. However, the best candlestick for trading is the Inverted Hammer, with a win rate of 0.97%.

Table: Dragonfly Doji Candle Performance Data

| Dragonfly Doji Test Results | Dragonfly Doji |

| Data Analyzed (Years) | 565.1 |

| # Trades | 1703 |

| Wins | 55.3% |

| Losses | 44.7% |

| Max Drawdown | -29.7% |

| Max Drawdown (Asset) | -59.3% |

| Average Win | 3.6% |

| Average Loss | -3.4% |

| Average Return Per Trade | 0.46% |

| Reward/Risk Ratio | 1.12 |

| Sharpe Ratio | -0.01 |

| Sortino Ratio | 0.27 |

My original groundbreaking research on the profitability and success rates of chart patterns and indicators relies on the best backtesting software available. If you want to craft an original, profitable trading strategy, dive into our exclusive review of the best backtesting software to find the perfect solution for your future trading needs!

Does the Dragonfly Doji Candle Work?

Yes, the Dragonfly Doji does work in trading, producing a 55.3% success rate. The average profit per trade for a Dragonfly Doji is small, only 0.46% after ten days. If you sell it short, it will average a 0.46% loss. Such small wins can be erased by slippage and trading costs.

Is It Accurate?

No, a Dragonfly Doji is not a very accurate pattern to trade; it results in 55% of trades winning and 45% of trades losing, plus the average winning trade is 3.8% and losing trade is -3.6%. I believe the Dragonfly Doji is only profitable on long trades because of the inherent upward bias of the stock market. Shorting Dojis results in an average 3.6% loss.

Can the Dragonfly Doji Candle be used for Buy and Sell Signals?

Yes, the Doji can be used as a buy & sell signal, but I do not recommend it. Its accuracy is far from perfect and should not be relied upon as the sole indicator for making trades. In 1,703 trades, the Dragonfly Doji buy signal was accurate only 55% of the time.

Is a Dragonfly Doji Candle Bullish or Bearish?

The evidence of 1,703 trades suggests that the Dragonfly Doji is not a significant bearish or bullish pattern. Our test results show that a Dragonfly Doji is 55% bullish and 45% bearish. In any ten days following a Doji, the market moved up 55% and down 45%; this move is due to the market’s positive bias, not due to any predictive quality of the Dragonfly Doji.

Is a Dragonfly Doji Candle Reliable?

No, according to 1,703 tested trades, a Dragonfly Doji is unreliable. The Doji has a low % accuracy rate of 55%, resulting in a razor-thin 0.46% profit per trade. Factoring in a very low Sortino ratio of 0.27 indicates this is an unreliable and risky trade.

Therefore, I would not recommend using the Doji pattern for trading.

Summary

In conclusion, the Dragonfly Doji is an unreliable and risky trade. It has a low accuracy rate of just 55%, resulting in a small profit per trade of 0.46%. It does not conclusively demonstrate any predictive qualities.

Although the Dragonfly Doji may be profitable for long trades lasting over ten days, it is not recommended for trading due to the narrow margins. Additionally, slippage and fees could potentially wipe out any profits gained.

All traders would benefit from investing in a comprehensive trading training course to help them make more informed decisions while managing their risks properly. So why not check out Liberated Stock Trader’s advanced investing course today?

You want to be a successful stock investor but don’t know where to start.

Learning stock market investing on your own can be overwhelming. There’s so much information out there, and it’s hard to know what’s true and what’s not.

Liberated Stock Trader Pro Investing Course

Our pro investing classes are the perfect way to learn stock investing. You will learn everything you need to know about financial analysis, charts, stock screening, and portfolio building so you can start building wealth today.

★ 16 Hours of Video Lessons + eBook ★

★ Complete Financial Analysis Lessons ★

★ 6 Proven Investing Strategies ★

★ Professional Grade Stock Chart Analysis Classes ★

FAQ

What is the best software for candlestick charts?

TrendSpider is the best software for trading all candlestick patterns due to its integrated candle backtesting and pattern recognition. If you value a large community of traders sharing ideas and strategies, then TradingView is a great alternative.

What is a Dragonfly Doji?

The Dragonfly Doji is a candlestick pattern that reflects market indecision. It is identified by its resemblance to a dragonfly, formed by the candle's open, close, and high prices being closely aligned. This pattern is supposedly bullish, but our testing demonstrates it has little predictive ability.

How can I recognize a Dragonfly Doji?

A typical Dragonfly Doji candle will have an open, high, and close price nearly equal. If you're looking for this pattern on your charts, it's recognizable by its flat top and long lower body that resembles a "T."

What software automatically detects candle patterns?

TrendSpider, TradingView, and Finviz are leading candlestick pattern recognition software. See how they compare in our best pattern recognition software comparison review.

Why is the Dragonfly Doji so popular?

The Dragonfly Doji candle is popular because its name and distinctive shape are easy to remember and identify for traders. According to our testing, the facts are that the Dragonfly Doji is not popular because it is effective, reliable, or highly profitable.

Why is the Dragonfly Doji candle important in trading?

The Dragonfly is significant in trading as traders tend to attribute importance to it. However, our testing shows it is an insignificant pattern with limited predictive integrity, rendering it advisable to steer clear of it.

Is the Dragonfly Doji Candle reliable?

No, the accuracy rate of using the Dragonfly Doji Candle for predicting market direction is only 55%, so it isn't reliable enough for consistent profits. Additionally, its low Sharpe ratio of -0.01 suggests it isn't worth using as a primary indicator for making trade decisions.

What indicators should I use with a Dragonfly Doji Candle?

It is advisable to use indicators such as relative strength index (RSI), moving averages, and rate of change (ROC) in conjunction with Dragonly Doji patterns. Our deep research and analysis have proven these indicators successful.

What strategy should I use when trading Dragonfly Dojis?

The best strategy to use when trading a Dragonfly Doji is not to trade it at all. Due to its low predictive quality, the Dragonfly Doji should be avoided.