To calculate dividend yield, divide the stock’s annual dividend per share by the stock’s current market price.

The dividend yield increases as share prices drop, so to triple your yields, buy stock price panic crashes.

The magic of the dividend yield formula is understanding the inverse relationship between stock price and dividend yield, which can unlock increased portfolio profit performance.

Join me on a journey through dividend yield strategies.

What is a Dividend?

A dividend is a payment made by a corporation to its shareholders. It can be in the form of cash, additional shares, or other property. Companies issue dividends to distribute profits and return value to their investors.

Of the 7,500+ stocks currently available on the major U.S. indexes, circa 2800 companies offer a dividend payout.

A dividend is an offer from the company, confirmed by the board of directors, to pay out a portion of its income (after-tax profits) to its shareholders.

These companies tend to be well-established with a stable income stream, enabling them to offer a constant & consistent dividend. The dividend is a cash reward to the shareholder for holding the stock.

What is Dividend Yield?

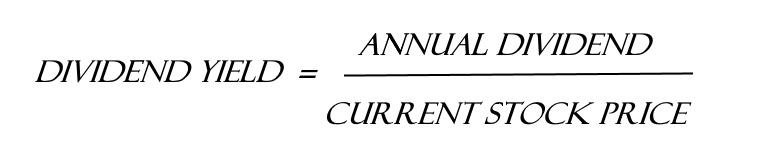

Dividend yield is the ratio of a company’s annual dividend compared to its share price. It is expressed as a percentage and calculated by the formula: Annual Dividend per Share/Share Price = Dividend Yield %.

For example, if a company has an annual dividend of 2 cents per share and its current stock price is $100, the dividend yield will be 0.02/100 = 0.2%

The benefit of a higher dividend yield is the additional cash flow you get to reinvest in other stocks or pocket as extra income.

It’s important to note that your dividend yield can fluctuate with stock prices and dividends.

In its simplest form, if you own one share of company ABC and paid $100 for that share, and the company’s dividend yield is 2%, you will expect to get $2.

The important thing here is that the dividend yield varies with the stock price, so depending on what price you paid for the stock, that will be your yield.

Why Dividend Yield Increases When Price Decreases?

When the stock price decreases, the dividend yield increases because the dividend stays constant while the stock price falls. This means that your $2 dividend is a higher portion of whatever lower amount you paid for the share.

For example, if XYZ’s stock were at $100 and had a 2% dividend yield, then if its stock price decreased to $80, the dividend yield would increase to 2.5%. In this case, you’d still be getting the same dividend amount of $2 but as a higher portion of your investment because you paid only $80 for one share instead of $100.

Get this chart on TradingView.

It’s important to remember that a company’s dividend yield can also be impacted by dividend raises or cuts in addition to price fluctuations. If the company increases its dividend, then the dividend yield will still go up, but it won’t be related to a decrease in price.

It’s also important to remember that while dividends can provide income, capital gains are what drive overall returns when investing in stocks. It’s possible that even if stock prices fall and your dividend yield increases, the value of your investment could still decrease.

Therefore, it’s important to understand how dividend yields affect stock prices to make calculated and informed decisions when investing. Focusing on stocks with higher dividend yields could effectively increase your returns if you’re looking for more income from your investments.

The Dividend Yield Formula

Example: How to Calculate Dividend Yield?

Here is an example of the Dividend Yield. I own 1000 shares of ABC Company at $10 per share; this equals $10,000 invested.

ABC pays out a regular dividend of $0.50 per share. As a single share of the company is worth $10, $0.50 equates to a dividend yield of 5%.

This 5% is essentially what you earn on your money regardless of stock price growth.

Of course, if the stock price deteriorates during the period you hold the stock, your net profit may reduce. For example, you make a 5% profit in dividend yield, yet the stock price has depreciated 5%.

This means your net profit if you were to sell would be zero.

You want to be a successful stock investor but don’t know where to start.

Learning stock market investing on your own can be overwhelming. There’s so much information out there, and it’s hard to know what’s true and what’s not.

Liberated Stock Trader Pro Investing Course

Our pro investing classes are the perfect way to learn stock investing. You will learn everything you need to know about financial analysis, charts, stock screening, and portfolio building so you can start building wealth today.

★ 16 Hours of Video Lessons + eBook ★

★ Complete Financial Analysis Lessons ★

★ 6 Proven Investing Strategies ★

★ Professional Grade Stock Chart Analysis Classes ★

The Inverse Relationship with Stock Price and Dividend Yield

It is important to note that the dividend yield is inversely related to stock price. The dividend yield decreases when the stock price rises, and vice versa. This means you will earn a higher return if the stock price falls, as your total return consists of capital gain and dividend yield.

For example, if you bought 1,000 shares at $10 per share and the stock price rose to $12, your capital gain would be a 20% return. However, if you earned a 3% dividend yield that same year, your total return would still only equal 5%.

However, if the stock price had fallen to $8 per share instead of rising to $12 per share, then even though your capital gain would have been a (20%) loss, the dividend yield of 3% combined with the capital loss would’ve resulted in an overall return of -17%.

Therefore, it is important to consider stock price and dividend yield when investing. Understanding how these two factors interact can help you make more informed decisions about which stocks to invest in.

How Dividend Yield Depends on the Price You Paid

If an investor buys a stock for $1, and the company pays a 5% dividend, the investor gets 5 cents per share. Imagine ten years later, the same investor still holds that stock, but the stock price is $10, and the dividend yield is still 5%. That means the investor will receive 50 cents per share.

Considering the stock originally cost the investor $1, they will receive a dividend yield of 50%.

Time is on the side of the long-term dividend investor.

The dividend yield is also specific to the investor in that your return from a stock depends on how much you pay.

Examples: Inverse Relationship of Dividend Yield & Stock Price

Most people do not understand the inverse relationship between dividend yield and stock price. As a stock price goes down, the dividend yield goes up.

To understand this concept thoroughly, we will look at a chart of Microsoft Inc., a long-time solid dividend payer.

This is a monthly bar chart of Microsoft (Ticker: MSFT) dating back 13 years to 2005. The candlesticks show the stock price, and the green-filled line chart shows the dividend yield.

Get this chart on TradingView.

At first glance, the dividend yield peaks when the stock price falls, and when the stock price hits the top, the yield falls.

Points on the Chart:

- During the financial crisis (2009), MSFT hit a low of $15. If you had purchased the stock at this point, you would have received a dividend yield of 3%

- Here, the dividend yield has spiked to 3% because of the relationship between the stock price and the dividend payment. If the dividend yield is 3% on a $15 stock price, then the dividend payment per share was 45 cents in 2009 ($15 * 3%).

- In quarter 2 in 2013, Microsoft’s stock price has doubled to $30

- At the same time, the dividend yield is 2.75%, so $30 * 2.75% is a dividend per share of 0.75 cents. Interestingly, Microsoft increased its dividend payment per share during this period, ensuring income investors still prized the stock.

- So, although the relationship between the stock price and the dividend yield is mostly inverse, it does vary because of the company’s payment changes. If the dividend per share is decreased or not paid, the dividend yield will decrease with the stock price.

For example, MSFT’s dividend per share payout for May 2017 was $0.36, August 2017 was $0.39, and November 2017 was $0.42, raising the dividend payout.

Try Powerful Financial Analysis & Research with Stock Rover

How to Get the Best Yields on Great Stocks

As we can see from the 13-year Microsoft Inc. chart, the dividend yield on MSFT varied between 1% in 2005 and over 3% in 2013, a dividend income difference of 300%.

Don’t forget the actual yield you will get on a stock depends on when you purchased the stock.

If you purchased the stock today (the most right point on the chart), the dividend yield would be 1.68%. MSFT plans to pay $1.68 (4 quarterly payments of 42 cents), and the stock price is $100 per share.

3 Rules of Dividend Payments on Long-Term Investments

The historical benefit of dividend yield should not be underestimated. Imagine you purchased the Microsoft shares when the stock price was $15 and kept them until today. This year, you would have earned $1.68 per share.

So, your personal dividend yield based on the stock price of $15 would be:

Annual Dividend $1.68 / Stock Price $15 = Dividend Yield of 11.2%

So, anyone who buys MSFT today would get 1.68%, but you would be getting 11.2%; that is something worth understanding.

Would you sell a stock almost guaranteed to net you 11.2% per year in profit? I would not.

3 Dividend Yield Rules to Remember

- Buy dividend stocks when the price is artificially low.

- Ensure that whatever pushes the stock price lower will not intrinsically damage the long-term business profits.

- Always remember your personal dividend yield is based on the price you paid for the stocks.

How to Triple Your Profits with Dividend Yield Investing

You must take advantage of temporary stock price crashes to multiply your dividend yield profits by 2X or 3X. If the stock price of a high-quality dividend-paying company drops by 66%, the dividend yield will triple. This is exactly what happened with Wells Fargo and Company in 2020.

Triple Your Dividend Yield: Wells Fargo Example

In 2020, the Wells Fargo stock price crashed due to the pandemic. This was an excellent opportunity to buy a high-quality dividend-paying company at a bargain price.

If you had purchased Wells Fargo stock at around $20 per share when the crash occurred, your dividend yield rate would have immediately tripled from 2.5% to 7.97%. If the stock had returned to normal within one year, your profits could have multiplied three times the original value.

See this Wells Fargo Chart in TradingView

This example highlights the importance of taking advantage of crashing stock prices. If you are willing to take some risk and invest in high-quality dividend-paying companies, you can potentially triple your dividend yield and enjoy significant profits over time.

To capitalize on these opportunities, do your research and understand the underlying drivers of the stock crash. It is also important to have a risk management plan in place to minimize any potential losses.

Investors can fully capitalize on their investments and enjoy long-term success by exploiting market dips and crashes.

☆ Important Related Article: Finding High-Yield Dividend Stocks: 3 Tested Strategies ☆

Why Dividend Yield Matters

The dividend yield is useful for comparing the relative attractiveness of different dividend-paying stocks. It can help you:

- Identify potential investment opportunities.

- Compare the income generated by different investments.

- Assess the cash return on your investment.

Remember, while a high dividend yield can be attractive, other factors, such as the company’s financial health, payout ratio, and dividend growth rate, must be considered. A high yield might indicate financial distress and a potential dividend cut.

FAQ

What is the best software for dividend yield investing?

Stock Rover is an excellent tool for finding dividend stocks. It has powerful screening capabilities and analytics tools to help you quickly uncover stocks with strong dividend yields and earnings growth.

What is a dividend yield?

The dividend yield is a financial ratio that shows the annual dividend income per share divided by the market price per share. It helps investors understand what return they can expect from their investment in terms of dividends.

How is dividend yield calculated?

To calculate the dividend yield, divide the annual dividends per share by the market price per share. The formula is: Dividend Yield = Annual Dividends per Share / Price per Share.

Why is dividend yield important?

The dividend yield is a key metric for investors since it indicates the income they can expect from an investment relative to its price. It's especially valuable for income-focused investors.

Does a high dividend yield mean the stock is a good investment?

A high dividend yield can be attractive, but it's not the only factor to consider. Investors should also examine the company's financial health, payout ratio, and dividend growth rate. A high yield might indicate financial distress.

Is dividend yield paid annually?

Dividends can be paid at different intervals depending on the company's policy. Commonly, dividends are distributed quarterly, semi-annually, or annually. The dividend yield calculation is based on the annual dividend payment.

Can dividend yield change?

Yes, the dividend yield can change due to stock price fluctuations or dividend payment changes. If the stock price increases and the dividend remains the same, the yield will decrease, and vice versa.

What's considered a good dividend yield?

Generally, a dividend yield between 2% and 5% is considered good. However, it's essential to consider other factors like the company's financial stability and growth prospects.

Do all stocks pay dividends?

No, not all companies pay dividends. Typically, well-established companies with stable profits are more likely to pay dividends, while younger, growth-oriented companies may reinvest profits back into the business.

What's the difference between dividend yield and dividend rate?

The dividend rate is the total expected dividend payments from an investment, security, or portfolio expressed in absolute terms. In contrast, the dividend yield expresses this as a percentage of the investment's cost or current market value.

Can a company stop paying dividends?

Yes, a company can stop paying dividends if it needs to conserve cash or reinvest in the business. This is why it's crucial to consider a company's financial health and sustainability of dividends.

What software calculates dividend yields automatically?

According to our testing, the best software for dividend yield investing is Stock Rover for U.S. investors and TradingView for international markets. Both tools have free and premium services worth using.