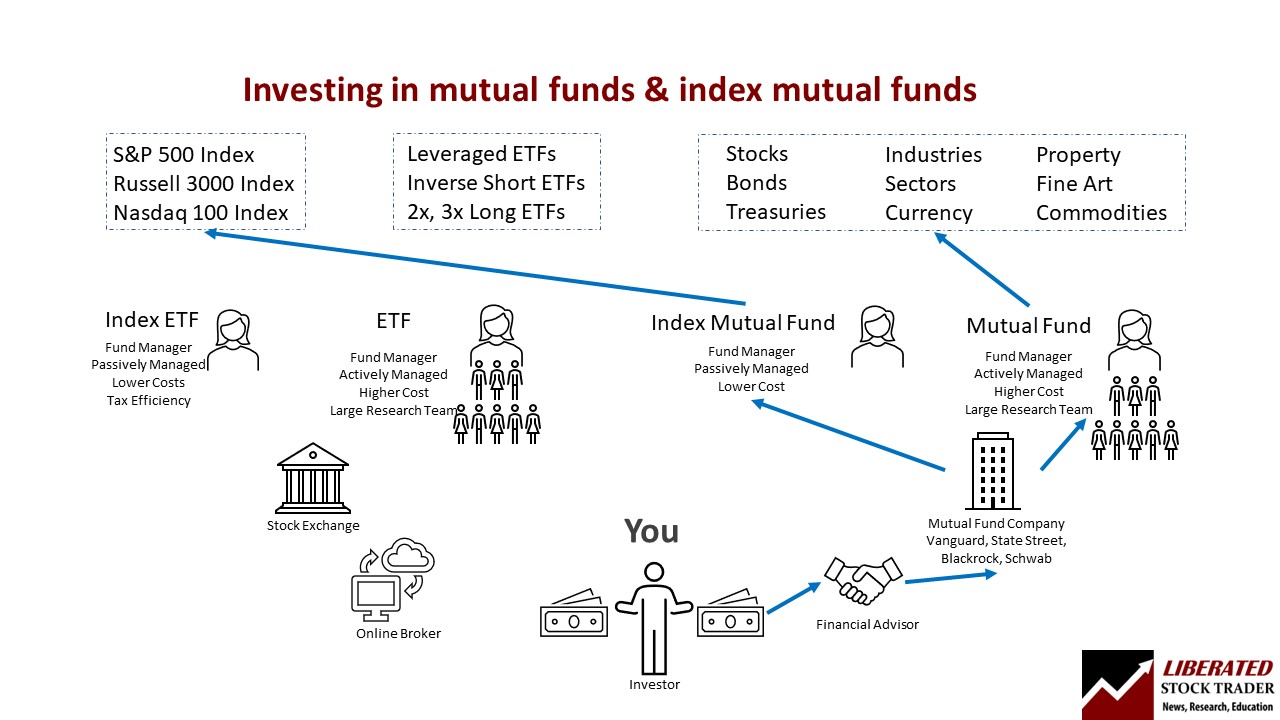

You can safely invest in index funds through mutual fund companies or as an index ETF directly through your broker. Investing in an index fund ETF is the most cost-effective, liquid, and efficient way to diversify your portfolio.

As a 20-year veteran investor and certified financial markets analyst with 80% of my stock portfolio in index funds, I can help you understand how to maximize your long-term index investing profits.

Index funds have become the most popular investment tool in today’s stock market, yet few people understand what they are and how they work. Index fund investing is easy, but you will need to make some decisions to help you avoid hazards, such as taxes and losses.

Should I invest in index funds?

Yes, depending on your goals and risk tolerance, index funds are a great way to increase diversification while avoiding the risks associated with individual stocks. They are also relatively low-cost, making them an attractive option for those who may be new to investing or don’t have much money to invest. For investors looking for a more passive approach, index funds can provide consistent returns over time.

How do you start investing in index funds?

The first step to investing in index funds is choosing the one that best fits your financial goals. Index funds are available for a variety of indices, including the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite. Once you decide which fund to invest in, determine how much money you are willing to allocate toward it. Then, open an account with a brokerage or mutual fund company and make your investment.

It is important to keep in mind that index funds do not guarantee returns, so it is wise to invest with an appropriate level of risk tolerance. Furthermore, you should be aware of any fees and taxes associated with investing in the fund, as they can affect your return.

How to Invest in Index Funds

Investing in index funds is a straightforward process that requires minimal effort. First, you should decide which index fund to invest in. Consider your investment goals and time horizon when choosing an index fund. Once you have chosen your desired index fund, invest your portfolio by investing in different asset classes. Lastly, monitor your investments regularly to ensure they are performing as expected and

The easiest way to invest in an index fund is to purchase an index-tracking ETF through an online broker. Alternatively, you can ask your financial advisor to recommend and purchase an index ETF or mutual fund.

Before investing in an index fund, consider choosing an ETF or mutual fund, taxation, retirement fund, and avoiding stock market crashes. This article discusses all of these.

1. Know where to buy index funds commission-free.

Choosing a trustworthy broker with a large selection of commission-free ETFs is the first step before investing in index funds, as it will save you a lot of money. Many brokers offer free stock trades, but selecting commission-free ETFs is important. Before choosing a broker, review their selection of ETFs and no-load mutual funds.

ETF Fund Fees: Firstrade vs. TDA vs. E-Trade

| Broker | Firstrade | Schwab | Fidelity | E*trade |

| # Commission-Free ETFs | 4400+ | 300+ | 93 | 200+ |

| Morningstar Coverage | 1100+ | 76 | 52 | 53 |

| Number of ETF providers | 100 | 8 | 2 | 13 |

Table 1: Commission-free ETF Comparison

Index funds usually play a role in any well-balanced portfolio. I have an account with Firstrade where all “loaded” and “no-load” funds are commission-free. With over 2,200 funds, the selection will meet most people’s needs.

Commissions: Firstrade vs. TDA vs. E-Trade

| Commissions & Fees | Firstrade | Schwab | E*Trade |

| Online Stock Orders | $0 | $0 | $0 |

| Online Option Orders | $0 | $0 + $0.65/Contract | $0 + $0.65/Contract |

| Online Mutual Fund Trades | $0 | $49.99 | $49.99 |

| Minimum Initial Deposit | $0 | $0 | $500 |

Table 2: Firstrade Commissions vs. Competitors

You can see that Firstrade substantially focuses on having the best commissions in the industry, even though E-Trade, and Schwab have now been forced to join the $0 zero commissions bandwagon; Firstrade still offers the best value across stocks, options, and mutual funds.

2. Understand index fund performance.

The best-performing index funds over the previous ten years are the Nasdaq 100 +450%, Bombay Sensex +242%, S&P 500 195%, and Russell 3000 +183%. It’s important to note that these funds have not had consistent performance; there have been periods of strong returns and dips in the market. The key takeaway is that index fund investing allows investors to diversify risk while also participating in long-term growth potential.

Get the Latest Stock Index Quotes on TradingView

3. Consider how many index funds to own.

You can own as many index funds as you wish. You will not get penalized for owning more index funds and diversifying your investment portfolio with commission-free brokers. Owning three to five index funds should provide enough diversification to a portfolio to reduce risk and ensure long-term profitability.

4. Buy Well Capitalized Broad Market Funds

When selecting index funds, it is important to choose well-capitalized and broad-market funds. These types of funds will have a larger number of holdings, providing even more diversification within the fund. Look for index funds that track major indexes such as the S&P 500 or the Dow Jones Industrial Average.

☆ Vanguard Total World Stock Index (VT)

The Vanguard Total World Stock Index is a low-cost fund that invests in companies across the globe, including both developed and emerging markets. It offers broad diversification and has a track record of strong performance.

The fund is managed passively to maintain a diversified portfolio of developed and emerging market stocks based on market cap weighting. It excludes frontier markets like Vietnam and Kuwait, similar to other peer funds.

☆ Fidelity Nasdaq Composite Index ETF (ONEQ)

This fund seeks to provide investment results corresponding to the total return of the NASDAQ Composite stock market. ONEQ tracks solely Nasdaq-listed companies, excluding those on the NYSE or other exchanges. The index of the underlying funds includes both domestic and international companies listed on Nasdaq.

☆ Schwab Fundamental U.S. Broad Market Index ETF (FNDB)

An index fund that follows the US Total Stock Market’s performance. FNDB begins with the well-known Russell 3000, a market-cap-weighted total market index, and uses fundamental screens to select and weigh its stocks.

☆ iShares Core S&P Total U.S. Stock Market ETF (ITOT)

This ETF aims to mirror the performance of the S&P Total Market Index, providing extensive market coverage in a cost-effective and liquid fund. ITOT is tailored to follow the broad US equity market, encompassing large, mid-, small-, and micro-cap stocks.

☆ SPDR Portfolio MSCI Global Stock Market ETF (SPGM)

An ETF seeking to mirror the investment performance of the Dow Jones U.S. Total Stock Market Index. SPGM contains global stocks that follow a wide-ranging, market-cap-weighted index spanning 23 developed and 27 emerging market countries.

4. Decide how much to invest in index funds.

You should never invest more money in the stock market or an index fund than you can afford to lose. You must ensure you have enough capital to cover your living expenses for at least one year in case of redundancy or family emergencies.

When you have adequate investment capital, modern portfolio theory, and financial advisors suggest you invest your age in percent in fixed-income securities such as bonds or treasuries and the rest in stocks, index funds, or real estate.

| Age | % invested in bonds | % invested in stocks, funds, or real estate |

| 20 | 20 | 80 |

| 30 | 30 | 70 |

| 40 | 40 | 60 |

| 50 | 50 | 50 |

| 60 | 60 | 40 |

| 70 | 70 | 30 |

| 80 | 80 | 20 |

Table 3. Portfolio Allocation – Bonds vs. Stocks

5. Plan your taxes.

How the government taxes a fund can determine how much money you can make. Choosing the wrong taxation method can lead to a high tax bill and conflicts with the IRS. Current tax law gives you three options for index fund investing: Traditional IRAs, Roth IRAs, and taxed investments.

Traditional IRAs

A traditional individual retirement account (IRA) is tax-deferred. You do not pay taxes until you withdraw money from the account. The advantage of a traditional IRA is that the IRS will not tax funds in it, thus reducing your taxable income.

The disadvantage of a traditional IRA is that money is taxable when you withdraw it. Traditional IRAs can be a poor deal for younger and lower-income persons because early withdrawals could increase your income tax bill.

Traditional IRAs can also have tax implications for retirees. The Internal Revenue Service (IRS) taxes traditional IRA withdrawals at the owner’s current tax rate after retirement. Drawbacks to traditional IRAs include strict contribution limits ($6,000 for people under 50 and $7,000 for people over 50 in 2021). The IRA contribution limit can change, so you must check it. The IRS can penalize you for contributing too much money to an IRA.

Current law requires minimum distributions (payouts) from traditional IRAs after age 72. An IRA could increase a person’s taxable income by making payments they do not need. Traditional IRAs are popular because they are easy to set up. Many people get traditional IRAs through their employers.

Investing In Stocks Can Be Complicated, Stock Rover Makes It Easy.

Stock Rover is our #1 rated stock investing tool for:

★ Growth Investing - With industry Leading Research Reports ★

★ Value Investing - Find Value Stocks Using Warren Buffett's Strategies ★

★ Income Investing - Harvest Safe Regular Dividends from Stocks ★

"I have been researching and investing in stocks for 20 years! I now manage all my stock investments using Stock Rover." Barry D. Moore - Founder: LiberatedStockTrader.com

Roth IRAs

Roth IRAs offer more tax advantages than traditional IRAs at a price. Holders pay no taxes on money they withdraw from a Roth IRA. Roth IRA holders, instead, make nondeductible contributions. The Roth IRA holder pays the taxes now to avoid future taxes. A Roth IRA can increase your tax bill.

A Roth IRA can be a good deal for someone who makes a high income while working and can afford taxes. The holder can avoid paying taxes when retiring and living on a limited income.

Roth IRAs are confusing because they resemble traditional IRAs. There are $6,000-a-year Roth IRA contribution limits for people under 50 and $7,000-a-year Roth IRA contribution limits for people over 50.

High-income individuals cannot contribute to Roth IRAs. In 2021, the IRS banned singles making over $161,000 yearly and married couples making over $208,000 yearly from contributing to Roth IRAs.

Taxable Index Fund Accounts

Many people find buying index funds through a taxable account easier and cheaper than IRA investing. Paying taxes is often cheaper than paying the tax penalties associated with IRAs. Younger people and individuals who think they will need to take money out early need to avoid IRAs. A person under 50 could lose money from an IRA if he has to withdraw because of emergencies.

Many people pay high taxes because circumstances, such as job loss, force them to make IRA withdrawals. Buying index funds outside an IRA can be a better tax strategy for persons with unstable incomes, such as the self-employed.

One advantage to taxable accounts is that they can invest over $6,000 annually. You can invest unlimited amounts of money in taxable index accounts. A second advantage is selling taxable index funds for extra cash. Parking extra cash and savings in an index fund can be a smart strategy because index fund return on investment (ROI) exceeds inflation.

A final advantage to taxable accounts is purchasing small index funds to augment your savings. Taxable index funds are a good savings strategy because of their higher returns.

My thorough testing awarded TradingView a stellar 4.8 stars!

With powerful stock chart analysis, pattern recognition, screening, backtesting, and a 20+ million user community, it’s a game-changer for traders.

Whether you're trading in the US or internationally, TradingView is my top pick for its unmatched features and ease of use.

Explore TradingView – Your Gateway to Smarter Trading!

6. Consider index fund diversification or concentration.

Index funds offer broad diversification, a good strategy for people who want to limit risk. Diversified portfolios retain value by holding many stocks and limiting exposure to specific industries or sectors. A tech, retail, banking, or manufacturing downturn will not limit an S&P 500 index fund’s value because it holds stocks in all those sectors.

Diversification can limit returns because different sectors grow at different rates.

Concentrating on your index fund’s scope can be more profitable. Investing in a Nasdaq 100 index ETF means exposure to the 100 largest non-financial stocks on the Nasdaq exchange. Apple, Microsoft, Alphabet, and Amazon are worth over $1 trillion, and all beat the S&P 500 by 15-35% last year.

7. Decide on your time horizon.

Investing in index funds should be the heart of your long-term investing strategy. Major US and European indexes rise over time, averaging 7-10% annually. Combine growth with compounding, and you will be successful.

If you plan to hold index ETFs for a short duration, a concentration strategy makes sense; choosing a hot sector or industry can deliver a higher rate of return. An index fund diversification strategy is best for long-term investors because it limits risks. A long-term investor can afford a diversified portfolio’s lower return on investment.

8. Decide between an ETF or a Mutual Fund.

When deciding on an Index Fund, you need to consider the type of fund: mutual or exchange-traded. Exchange-traded funds are growing widely due to their low tax structure, liquidity, and low costs. Mutual funds, on the other hand, offer more flexibility in terms of investment strategy but have higher capital requirements and lower liquidity.

| ETFs vs. Mutual Funds | ETFs | Mutual Fund |

| Index Funds | ✔ | ✔ |

| Actively Managed | ✔ | ✔ |

| Passively Managed | ✔ | X |

| Fees | 0% – 0-6% | 1% – 3% |

| Traded Like Stocks on Exchanges | ✔ | X |

| Can be traded: | Intraday | End of day |

| Tax Advantages | ✔ | X |

Table 5: ETFs vs. Mutual Funds Comparison

Mutual funds are generally actively managed by teams dedicated to beating the market, but only 17% succeed in their goal. ETFs, on the other hand, are passively managed and follow indexes. This means they have lower fees than mutual funds because there is less time spent managing them. Furthermore, ETFs can be traded intraday on exchanges like stocks, while mutual funds cannot be bought and sold during a trading day. Lastly, since ETFs track an index, they provide greater tax advantages than mutual funds since they have less capital gains taxes. Investing in ETFs is a great option for investors looking to save money and time.

Passively managed ETFs track a specific stock market index to equal the market returns; this beats 82.5% of mutual funds in the long term. Passively managed index-tracking ETFs usually incur lower management fees than actively managed mutual funds. A fee saving of 2% per year compounded for 20 years could mean an extra 48% extra in your investment.

ETFs are exchange-traded funds purchased on the open market during trading hours and typically reflect the stock index price. ETFs can also be shorted and allow options trades.

The Facts About Actively Managed Mutual Funds

According to Standard & Poor’s annual SPIVA report, over the last ten years, 82.51% of actively managed mutual funds underperformed the benchmark. With mutual funds, you have the disadvantages of end-of-year capital gains taxes, you pay up to 3% in management fees, and you have only a 17% chance to attain the performance of a passively managed index ETF.

“Oblivious of the toll taken by costs, mutual fund investors willingly pay heavy sales loads and incur excessive fund fees and expenses, and are unknowingly subjected to the substantial but hidden transaction costs incurred by funds as a result of their hyperactive portfolio turnover.” John C. Bogle – Creator of the first Index investment Trust

For most investors, passive index-tracking ETFs are the best choice because they offer lower taxes and fees and stable performance.

9. Consider index fund costs.

Many indexed mutual funds have higher costs, require an initial large cash investment, and require investors to commit to an automatic monthly investment. Mutual fund costs include sales loads or charges, redemption fees, exchange fees, account fees, management fees, distribution fees, and other expenses.

Federal law requires mutual funds to list all the fees in the prospectus under the heading shareholder fees. You can find the prospectus on the fund manager’s website.

You must study the fee table carefully because some costs can add up. Some funds charge a 5% sales load for purchases. That means a person who purchases $1,000 worth of the fund will only own $950. Funds can also charge a back-end sales load, which means the fund could charge a 5% fee on a sale of $1,000. Hence, the fund owner will receive $950 instead of $1,000.

There are no-load mutual funds. However, many no-load funds charge other exchange or exemption fees.

ETFs can be cheaper than mutual funds because they are often commission-free. Many ETFs charge account service fees and broker-assisted trading fees. You can avoid broker-assisted trading fees by trading yourself and account service fees by signing up for the electronic delivery of documents at the broker’s website.

You can determine the cost of ETFs by checking the fee section of the brokerage’s website.

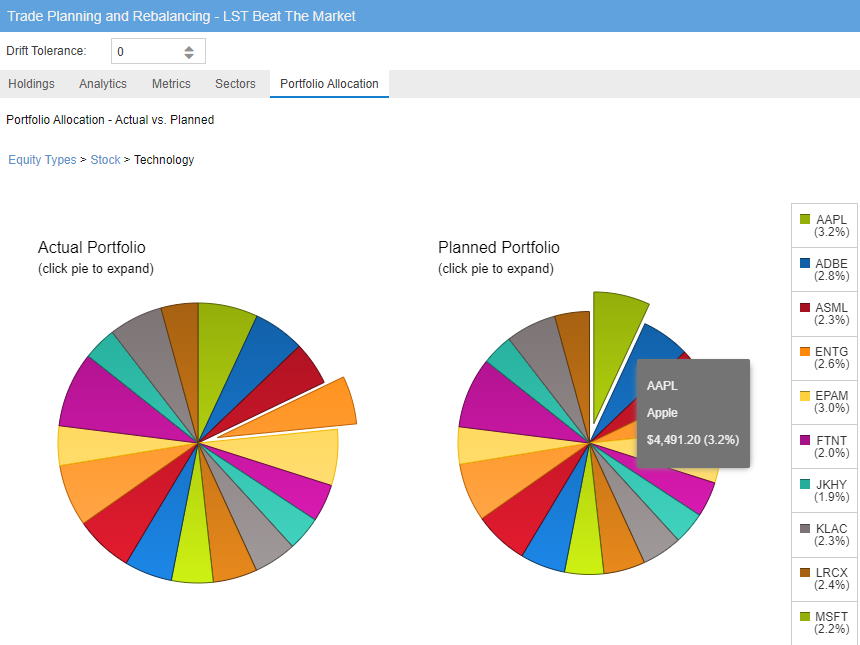

10. Monitor performance & harvest tax losses.

You will need to monitor the performance of your index funds. There is no reason to check index funds every day. The advantage of index funds is that they follow long-term strategies that require no supervision. The disadvantage is that many people do not see problems with their funds until it is too late. However, checking a fund’s performance monthly or bi-monthly is an excellent idea.

There are several effective means of tracking index fund performance. Most funds’ websites offer online tools for performance tracking, and some robo-advisors and apps can track funds’ performance. I track my Index and ETF investments using Stock Rover, which I consider the best stock and ETF portfolio management, research, and screening software today. Monitoring your funds’ performance is a necessary chore if you want to protect your money.

Investing In Stocks Can Be Complicated, Stock Rover Makes It Easy.

Stock Rover is our #1 rated stock investing tool for:

★ Growth Investing - With industry Leading Research Reports ★

★ Value Investing - Find Value Stocks Using Warren Buffett's Strategies ★

★ Income Investing - Harvest Safe Regular Dividends from Stocks ★

"I have been researching and investing in stocks for 20 years! I now manage all my stock investments using Stock Rover." Barry D. Moore - Founder: LiberatedStockTrader.com

Tax-loss harvesting is an attempt to reduce a tax bill by selling assets. Tax-loss harvesting is an effort to convert long-term capital gains into short-term gains. The IRS taxes long-term capital gains at a lower rate than short-term ones. The IRS considers short-term capital gains regular income higher than the capital gains rates of 0%, 15%, or 20% for most taxpayers. The IRS considers stocks, mutual funds, and ETF income long-term capital gains if held for over a year.

A tax-loss harvester tries to avoid capital gains tax by selling losing equities to offset the taxes on the winning equities. The most common use of tax-farming is to avoid dividend taxes. Capital gains taxes do not apply to unsold stocks, but they affect dividends.

11. Avoid stock market crashes.

Whether you actively invest in the stock market or passively invest through mutual funds or exchange-traded funds, you need to reduce any losses you incur over the years of your investment.

The heart of the MOSES System is avoiding or minimizing the impact of major stock market crashes. The Moses strategy has three core indicators; you can use the best approach to eliminate most losses and compound your investments to beat the market.

MOSES will alert you before the next crash or significant decline occurs and show you when the bear market is over.

Beat The Market, Avoid Crashes & Lower Your Risks

Nobody wants to see their hard-earned money disappear in a stock market crash.

Over the past century, the US stock market has had 6 major crashes that have caused investors to lose trillions of dollars.

The MOSES Index ETF Investing Strategy will help you minimize the impact of major stock market crashes. MOSES will alert you before the next crash happens so you can protect your portfolio. You will also know when the bear market is over and the new rally begins so you can start investing again.

MOSES Helps You Secure & Grow Your Biggest Investments

★ 3 Index ETF Strategies ★

★ Outperforms the NASDAQ 100, S&P500 & Russell 3000 ★

★ Beats the DAX, CAC40 & EURO STOXX Indices ★

★ Buy & Sell Signals Generated ★

MOSES Helps You Sleep Better At Night Knowing You Are Prepared For Future Disasters

12. Use Dollar Cost Averaging.

If you have not managed to avoid the stock market crash, your best alternative is to buy more index funds during the crash. Known as dollar-cost averaging, this popular strategy allows you to reduce your average cost per share during a crash, enabling you to maximize your profits as the market begins recovering.

Dollar Cost Averaging (DCA) Examples & Strategy For Investors

FAQ

What is the best software to find good index funds?

Stock Rover is the best software for researching index funds. It offers a comprehensive suite of tools to analyze the performance of any ETF or Mutual Fund and compare it against its benchmark. Stock Rover also provides portfolio optimization and analysis and interactive charts for visualizing your results.

What are index funds?

Index funds are a type of mutual fund or exchange-traded fund (ETF) that aims to replicate the performance of a specific index. They offer diversification and lower costs, making them a popular choice for many investors.

Why should I invest in index funds?

Index funds offer several benefits:

- Diversification: They spread risk across many stocks or bonds.

- Low cost: They typically have lower fees than actively managed funds.

- Simplicity: They're easy to understand and manage.

How can I start investing in index funds?

Here's a simple step-by-step process:

- Open a brokerage account.

- Decide which index you want to track.

- Choose an index fund that tracks your chosen index.

- Purchase shares of the index fund.

What are some popular index funds and tickers?

The most popular index funds include the Vanguard Total Stock Market Index Fund (VTSMX), Fidelity 500 Index Fund (FXAIX), iShares S&P 500 Index Fund (IVV), and the Schwab Total Stock Market Index Fund (SWTSX)

How much money do I need to start investing in index funds?

The minimum investment required varies by fund. Some funds allow you to start with as little as $1, while others may require several thousand dollars.

What are the risks of investing in index funds?

While index funds are generally considered low-risk, they're not risk-free. Market risk is a significant factor – if the index declines, so will your investment.

Can I lose all my money in index funds?

While it's unlikely that you'll lose all your money in index funds, it's possible to experience losses, especially in the short term. It's important to invest only money you can afford to lose.

How often should I check my index fund investments?

As a long-term investment, index funds don't need to be checked daily. A quarterly or semi-annual review is generally sufficient.

What fees are associated with index funds?

Index funds typically charge an expense ratio covering management, administrative, and operational expenses. The expense ratio is usually a small percentage of your invested amount.

Can I invest in index funds in my retirement account?

Yes, index funds can be a good choice for retirement accounts, thanks to their diversification, low costs, and potential for steady long-term growth.

Do index funds pay dividends?

Yes, many index funds pay dividends to their investors. These dividends can be reinvested to purchase more fund shares or cashed out for regular income.

How do I choose the best index fund?

Look for funds with low expense ratios, strong track records, and indices that align with your investment goals.

Are index funds safe?

While no investment is completely risk-free, index funds are considered relatively safe due to their diversification and passive management style.

Can I withdraw money from my index fund?

Yes, you can sell your shares at any time. However, selling shares may have tax implications, so consulting with a financial advisor is wise.

What happens when an index fund closes?

If an index fund closes, shareholders typically receive the net asset value of their shares. They can then reinvest this money in another fund or use it as they see fit.

Thanks for also talking about how commissions would come into play when it comes to investing on index funds. I’d like to diversify my investment portfolio soon because I’m planning to have a college fund for my kids someday. As such, it would be important to look for easy ways to grow my money gradually.