To research stocks, investors need to use trustworthy research tools and reports to find good investments.

Stock research involves analyzing a company’s financial health, industry and market trends, and future growth potential. Understanding financial, business, and industry trend changes is the key to thorough stock research.

Online platforms have made accessing financial information and stock research reports easier than ever. Yet, the challenge for many lies not in obtaining the data but in discerning the quality of sources and understanding how to use this information effectively.

Key Takeaways

- Stock research reports are crucial tools for informed stock investing, and understanding different types is key.

- Investors can perform their own financial analysis or use research reports to save time.

- Access to research reports is abundant, but effective interpretation and application is the critical challenge.

- Investors can access up-to-date research reports for the 30 biggest US companies for free.

How to Research Stocks & Find the Hidden GemsWhether through free resources or specialized subscription services, investors today have an array of channels to guide their stock assessments and potentially become adept at analyzing stocks autonomously.

What are stock research reports?

A stock research report prepared by a financial analyst analyzes a publicly traded company. The report may include the company’s financial performance, competitive landscape, and potential investments.

The purpose of a stock research report is to provide investors with the information they can use to make informed investment decisions.

Understanding Research Reports

Stock analysis reports are comprehensive documents created by financial analysts. They scrutinize various elements of a company’s operational and financial health. Here’s what they typically include:

- Financial Health: Review of balance sheets, income statements, and cash flow.

- Operational Strengths: Assessment of management and business models.

- Market Position: Evaluation of the company’s place within the industry.

- Investment Potential: Insights on the stock’s future performance.

These insights serve as valuable guides for investors weighing the merits of different stocks. They blend both quantitative figures and qualitative assessments to furnish a detailed picture of a company’s prospects.

How to get stock research reports

Stock Rover, Motley Fool, Benzinga, Morningstar, Zacks, IBD, and Seeking Alpha are great sources for stock research. Below is a table comparing the research services.

| Research Service | Rating | Price Per Year |

| Stock Rover Premium Plus | ★★★★★ | $0-$279 |

| Motley Fool Stock Advisor | ★★★★★ | $199 |

| Benzinga Pro Real-time News | ★★★★★ | $799 |

| Morningstar Premium | ★★★★☆ | $249 |

| Zacks Ultimate | ★★★★☆ | $2995 |

| IBD Leaderboard | ★★★☆☆ | $828 |

| Seeking Alpha Pro | ★★★☆☆ | $2400 |

Free stock research reports

Free stock research reports may be available with your brokerage account, but if not, Stock Rover provides free research reports for all companies on the Dow Jones 30 Index.

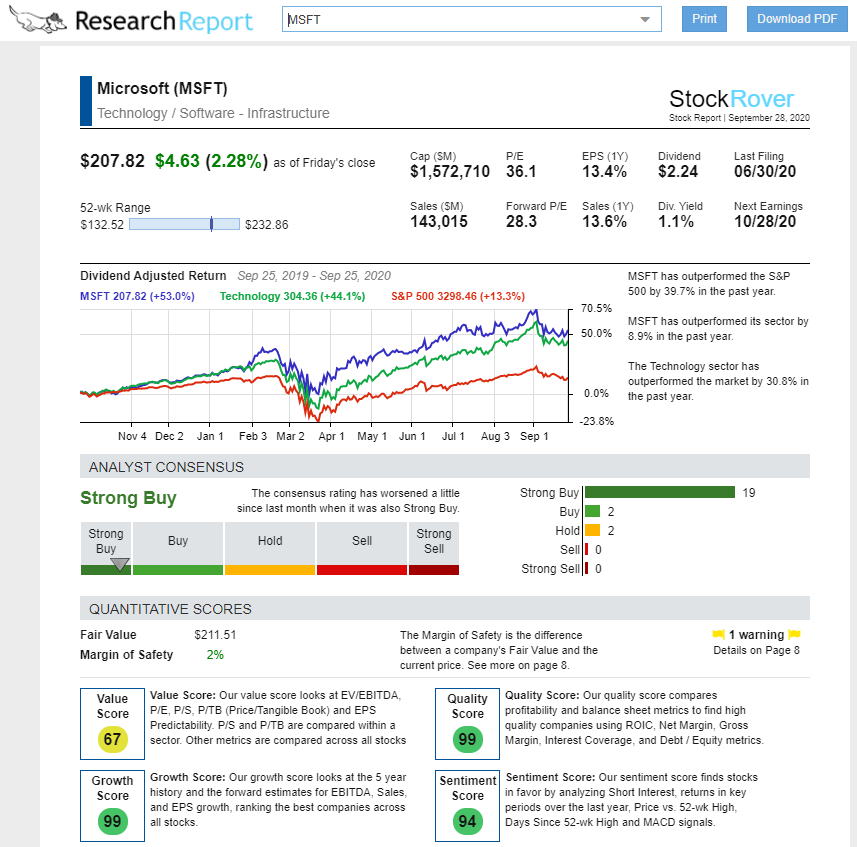

One of the best features of the Stock Rover platform is the Dynamic Research Report. This service lets you generate a professional, readable PDF report on any stock’s current and historical performance.

The research report creates something new: a human-readable, real-time research report highlighting a company’s competitive position, market position, and historical and potential dividend and value returns. The image below shows the dividend-adjusted commentary on Microsoft, a company I invested in because I found its excellent potential using my Buffett Stock Screener.

The best thing about Stock Rover’s Research Reports is they are Real-time, so the information is always up-to-date.

The Stock Rover research reports provide a comprehensive summary of any of the 10,000+ stocks in Stock Rover on the US and Canadian exchanges. Research reports can be viewed in the browser and produced in PDF format for portability and sharing.

- Download a complimentary Stock Rover Research Report Now

Types of Stock Research

Fundamental Overview: Typically, research documents start with insights into a company’s core operations, financial trajectory, and recent impactful events.

Performance Analysis: Reports might then assess stock price fluctuations, integrating factors contributing to its movement and chart-based evaluations.

Market Position: Assessment of the competitive environment often follows, detailing industry rivals, market share, and comparative advantages or disadvantages.

Investment Outlook: Further sections scrutinize products, services, and market opportunities to gauge investment potential.

How to Research Stocks

To research stocks, you can use reports from financial analysts employed by research firms, such as Moody’s, Morningstar, or Zacks.

These research companies provide stock ratings and analysis written by market analysis. But there are biases in institutional stock research, as detailed in the book Full of Bull by Stephen T. McLennan:

“The analysts tend to avoid negative opinions as they tend to receive flack from the management teams and pressure that they may lose access to the companies they cover. Analysts are not paid for the performance of their stock ratings; therefore, they have limited motivation to be truthful.”

“Wall Street Analysts are bad at stock picking.”

“Does buy really mean buy the stock? What if the highest rating used is a strong buy? Does that mean that buy is more negative than strong buy?”

“Wall Street is oriented towards increasing stock prices; they must be positive to convince people to continue buying.”

“In a 2006 CFA Magazine Research article by Mike Mayo, it was noted that of the recommendations on the Top 10 Largest Cap stocks in the US, There were 193 Buy Ratings and only 6 Sell Ratings. Systemic Bias…?”

Source: Stephen T. McLennan – Book Full of Bull

So, if you cannot rely on rating and research agencies, you must learn to research stocks yourself.

Stock Research Checklist

- Start with financial statements: Examine the income statement, balance sheet, and cash flow statement to assess a company’s financial health.

- Consider analyst reports with caution. Financial analysts often refrain from negative commentary, which may result in a skewed positive bias.

- Understand the language: Differentiate between terms such as “buy” and “strong buy,” which could mislead investors about an analyst’s true sentiment. Our article on rating agencies will help.

- Look for indications of systemic bias. Be aware that analysts have historically favored “buy” recommendations over “sell.”

- Perform independent research: Develop your process for examining and selecting individual stocks to create a portfolio aligned with your investment goals.

By carefully analyzing these details, investors can forge a more balanced research approach, moving beyond Wall Street’s optimistic tendencies and into a more individualized analysis of stocks.

Stock Research Services

Investors can obtain comprehensive stock analyses from various reputable online platforms. Below are highlighted services catering to research needs:

- Stock Rover Premium Plus: Offers exceptional insights for value, growth, and dividend investors.

- Motley Fool Stock Advisor: Renowned for its expert stock recommendations at an annual fee.

- Benzinga Pro: Provides real-time news services to subscribers.

- Morningstar Premium: Delivers in-depth financial research with a rating system.

- Zacks Ultimate: Charges a premium for exclusive investment strategies and data.

- IBD Leaderboard: Features investment tools aimed at growth stocks.

- Seeking Alpha Pro: A higher-end service focusing on stock market analysis.

The US Securities and Exchange Commission’s EDGAR database is an excellent resource for regulatory filings for Form 10-K and Form 10-Q reports. These forms offer annual and quarterly data essential for thorough company evaluation.

10 Important Financial Metrics in Research Reports

- Earnings per share (EPS) to understand the company’s profitability growth on a per-share basis.

- Price-to-earnings (P/E) ratio to assess the stock’s valuation relative to its earnings.

- Return on equity (ROE) to evaluate how effectively the company utilizes shareholders’ equity.

- Return on assets (ROA) to gauge how efficiently the company generates profits from its assets.

- Annual and quarterly financial statements for insights into net income and revenue growth trends.

- Cash flow statements to analyze the company’s liquidity and cash management practices.

- Management team’s background and experience to assess leadership quality and direction.

- Debt-to-Equity Ratio shows the relative proportion of shareholder equity and debt used to finance a company’s assets.

- Dividends analysis to understand the company’s dividend policy and commitment to shareholder returns.

- Overall industry and sector analysis to contextualize the company’s financial performance and competitive position.

Stock Research Strategies for Intraday Trading

Day traders often rely on technical analysis and real-time market updates to inform their decisions. Unlike investors analyzing a company’s long-term potential through financials, day traders focus on short-term price movements.

They utilize a variety of indicators on stock charts to predict potential price changes within the same trading day. Identifying patterns on these charts can be key to deciding when to enter and exit trades.

Options trading also plays a part, as it can offer insights into market sentiment. Here are key tools and concepts for day traders:

- Real-time stock price: Access to instantaneous price data is crucial for timely decision-making.

- Chart analysis: Examining price and volume histories to identify trends.

- Indicators: Moving averages and Bollinger bands are used to determine entry and exit points.

- Options: Monitoring the options market for possible directional moves in stock prices.

LiberatedStockTrader’s Data-Driven Guide to Day Trading Strategy & Tools

Steer Clear of Social Platforms in Stock Research

Social media platforms feature posts from self-proclaimed savvy investors, but relying on stock picks without validating data can lead to bad decisions. Social media should be used to gather ideas and perspectives rather than the sole basis for making investment choices.

Social Networks to Avoid:

- TikTok is awash with stock pickers and influencers claiming to have the inside scoop on hot stocks. However, many of these individuals do not have substantial experience or expertise in the financial markets.

- Twitter can also be a source of misleading information, with users sharing rumors and false claims about certain stocks without providing sufficient evidence or research.

- Facebook groups dedicated to investing can also be problematic, as they often lack proper moderation and attract unqualified individuals looking to exploit naive investors.

Therefore, it is important to thoroughly research any stock recommendations on social media before making investment decisions.

Evaluating Influencers:

- Question the motives of individuals promoting certain stocks or crypto on social media. Are they truly knowledgeable and experienced in the financial markets, or are they simply trying to manipulate stock prices for their gain?

- Look for evidence-based research and analysis to back up any recommendations. A reputable source should provide data and facts to support their claims rather than just emotional or biased opinions.

- It is also important to consider if the individual has a track record of successful investments. Do they have a proven track record of accurately predicting market trends and making profitable trades? If not, it may be wise to question their expertise.

- Pay attention to disclaimers and disclosures provided by influencers. Some may have hidden agendas or conflicts of interest that could impact their recommendations.

- Maintain skepticism and critical thinking when evaluating recommendations made on social media platforms. While these can be great sources of information, it is important to do your own research and fact-checking before making any investment decisions.

Beginner Steps for Stock Research

For novices entering the stock research arena, follow these initial stages:

- Set Clear Objectives: Identify your financial aims and risk appetite.

- Start with Large Companies: Begin with well-known, stable companies to study.

- Fundamental Analysis: Review the company’s financial statements, market position, and competition.

- Utilize Financial News: Stay informed with credible financial news sources and market analysis.

Investors are encouraged to utilize stock research reports to enhance their decisions. However, before committing to investment choices, one must conduct personal due diligence beyond these reports. This proactive approach ensures a more comprehensive understanding of potential risks and opportunities.

FAQ

What is a stock research report?

A stock research report is prepared by an investment firm that analyzes a publicly traded company, including its financial health, industry position, and future growth prospects. It often includes recommendations, such as buy, hold, or sell.

How can I access stock research reports?

Stock research reports can be accessed through various financial databases and investment platforms. For example, Stock Rover offers free research reports.

What should I look for when reading a stock research report?

When reading a stock research report, look for the investment thesis, analysis of the company's financials, industry overview, management assessment, and the risks and opportunities the company may face. It's also essential to consider the analyst's price target and recommendation.

How often are stock research reports updated?

The frequency of updates for stock research reports varies. Traditional reports are updated quarterly, coinciding with the company's earnings releases, while others, such as those from Stock Rover, are updated daily.

Can I trust the information in stock research reports?

While stock research reports can provide valuable information, it's important to consider potential biases, as analysts may have conflicts of interest. Using reports as part of a broader research strategy and cross-referencing information with other sources is wise.

Are stock research reports free?

Some stock research reports, such as those from Stock Rover, are free, while others may require a subscription or a fee. Public companies often provide annual reports for free, which can offer valuable insights into the company's performance.

What is the difference between equity research reports and technical analysis reports?

Equity research reports focus on the fundamental analysis of a company's financial health and market position. In contrast, technical analysis reports examine stock price movements and trading volumes to predict future price trends based on patterns and indicators.

How do analysts determine their price targets in stock research reports?

Analysts determine price targets by forecasting a company's future earnings and applying an appropriate multiple based on the company's growth prospects, risk profile, and industry comparables.

Do stock research reports consider macroeconomic factors?

Yes, stock research reports often consider macroeconomic factors such as interest rates, inflation, economic growth, and geopolitical events, which can significantly impact a company's performance and stock price.

Can stock research reports predict stock prices accurately?

No! While stock research reports aim to provide an educated analysis of a stock's potential future price, they do not predict stock prices with absolute certainty. Various factors influence markets, and unexpected events can lead to price movements that deviate from analysts' predictions. A study even explored the relationship between Google Trends data and stock prices, suggesting that while there may be correlations, prediction is inherently uncertain.