In technical analysis, Fibonacci retracement is used by traders to predict levels of support and resistance by drawing horizontal lines according to the Fibonacci sequence.

Fibonacci levels indicate where prices could stabilize or reverse after a significant price movement and are commonly set at 23.6%, 38.2%, 50%, 61.8%, and 76.4%.

This method is based on the idea that markets may move in predictable patterns reflecting the natural order and ratios within the Fibonacci sequence. But Does It Work?

I decided to put Fibonacci Retracement to the test. Our backtested research reveals a 63% failure rate, meaning it should be avoided in trading. Our tests and ten academic research papers demonstrate why traders and investors should avoid it.

Fibonacci’s Numbers

Leonardo of Pisa, better known as Fibonacci, was a 13th-century Italian mathematician who was the first to introduce the world to Hindu-Arabic arithmetic. He is best known for his work on the Fibonacci sequence, where each number is the sum of the two preceding numbers: 0, 1, 1, 2, 3, 5, 8, 13, 21, etc. This sequence appears in many places in nature and has been studied extensively by mathematicians.

What are Fibonacci Numbers?

Fibonacci numbers are a sequence of numbers in which each is the sum of the two preceding ones. The sequence starts with 0 and 1 and looks like this: 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, and so on. The sequence can be found in many natural phenomena, such as the arrangement of branches on a tree or the spirals on a seashell. The Fibonacci sequence was first introduced to the Western world by Leonardo of Pisa, also known as Fibonacci, in his book Liber Abaci, published in 1202.

Fibonacci Trading Explainer Video

What is the Fibonacci Sequence?

The Fibonacci sequence is a mathematical sequence that follows a specific pattern. Each number is the sum of the two numbers that came before it. For example, 0+1 = 1, 1+1 = 2, 2+1 = 3, 3+2 = 5, and so on. This sequence of numbers has fascinated and perplexed mathematicians for centuries. It seems to be a fundamental pattern of nature that appears everywhere, from the spiral patterns of shells and galaxies to the structure of human DNA.

My thorough testing awarded TradingView a stellar 4.8 stars!

With powerful stock chart analysis, pattern recognition, screening, backtesting, and a 20+ million user community, it’s a game-changer for traders.

Whether you're trading in the US or internationally, TradingView is my top pick for its unmatched features and ease of use.

Explore TradingView – Your Gateway to Smarter Trading!

What is Fibonacci Retracement?

Fibonacci Retracement is a technical analysis tool traders use to identify potential support and resistance levels in markets. It is based on the mathematical concepts of the Fibonacci sequence, which has fascinated mathematicians for over 800 years.

Fibonacci Retracement is a technical analysis tool that uses horizontal lines to indicate areas of support or resistance at the key Fibonacci levels before the price continues in the original direction. The Fibonacci Retracement levels are a sequence of horizontal lines drawn on a chart indicating where the support and resistance levels are likely to be. The most commonly used levels are 23.6%, 38.2%, 50%, 61.8%, and 78.6%. These indicate the price levels most likely to reverse the current trend.

Why do Traders Think Fibonacci is Useful?

Traders attempt to use Fibonacci Retracement levels to identify potential areas of support and resistance in markets. The theory behind Fibonacci Retracement is that markets will often retrace a predictable portion of a move, after which the original trend will continue. By identifying the key Fibonacci levels, traders can enter and exit positions at key points in the trend, potentially maximizing profits and minimizing losses.

How to Use Fibonacci in Trading?

To use Fibonacci in trading, identify the high and low points of the chart you are analyzing. Then, draw the Fibonacci levels on the chart using the retracement tool. The levels will give you potential entry and exit points when trading. However, it is important to note that Fibonacci Retracement levels should never be relied upon alone; traders should always use other tools, such as price action or fundamental analysis, to confirm their trades.

Get the Best Fibonacci Tools on TradingView

What is the Fibonacci Golden Ratio?

The Fibonacci Golden Ratio is the ratio between two numbers in a sequence. This ratio, called Phi (φ), equals 1.618 or its inverse 0.618. It can be seen in many aspects of nature, including the spiral pattern of a nautilus shell. When applied to financial charts, Fibonacci Retracement can identify support or resistance levels that may indicate a reversal in price direction.

The golden ratio can supposedly identify potential turning points in a trend, but we will test this assertion later in this article.

The most popular Fibonacci Retracement levels are 23.6%, 38.2%, 50%, 61.8%, and 100%. These percentages correspond to the ratio of numbers in the Fibonacci sequence. For example, a 50% retracement would correspond to the 0.50 ratio between the numbers 5 and 8 in the Fibonacci sequence (5/8 = 0.62). Traders often use these support and resistance levels to enter or exit trades or confirm their trades.

What is the 61.8 Rule?

The 61.8% Fibonacci Retracement level is also often referred to as the “golden ratio” or “golden mean” and is considered a significant level of support and resistance. This is based on the hypothesis that 61.8% of a prior move tends to be retraced before an asset resumes its trend. In addition, it is often used as an entry or exit point for trades. Knowing this level will supposedly help traders identify and capitalize on high-probability trade opportunities.

Testing Fibonacci in Trading.

It is possible to test the effectiveness of Fibonacci Retracement levels in trading. One way to do this is to look at historical data and see if the levels have been held in the past. This can be done by backtesting a trading system to see how the Fibonacci levels have performed in different markets. If the results show that the Fibonacci Retracement levels are accurate and reliable, then it is likely that they will be useful for traders.

Backtesting Fibonacci in trading is still a manual process today. The best backtesting software, like TrendSpider, TradingView, and Trade Idea, has not incorporated this Fibonacci into its backtesting engines. Why? Because the rules for Fibonacci trading are so loose and open to individual interpretation, it defies systemization. Like Elliott Waves, Fibonacci is more of a drawing tool than a tested indicator and should be used as such when backtesting.

So, to test my thesis, I manually tested Fibonacci to see if I would use it in trading.

Fibonacci Backtest Methodology

To backtest Fibonacci, I drew the retracement lines on each stock in the Nasdaq 100, the Nasdaq 100 Index, and the S&P 500 Index. Each chart covered the 2022 crash and recovery, which is an excellent test for a retracement.

- Start: December 2021, the start of the crash

- End: July 2023, almost full recovery

- Any 3-5-day price reversal within 5% of the Fibonacci line = Success

- Any price reversal outside 5% = Failure

- Document at which level reversal occurs to test the Golden Ratio

My Fibonacci Test Results

Across the 102 stocks and indexes tested, Fibonacci retracement failed to predict a stock price turning point 63% of the time. Additionally, my testing suggests that the golden ratio of 61.8% retracement is no more likely to be hit than any other Fibonacci level.

| Fibonacci Levels | Success Rate |

| 23.6 | 23% |

| 38.2 | 20% |

| 50 | 20% |

| 61.8 | 21% |

| 100 | 16% |

| Overall | 37% |

| Failure Rate | 63% |

Overall, Fibonacci retracement was accurate only 37% of the time. If you exclusively used this indicator for trading, you would have more losing trades than winners. Additionally, the golden rule of 61.8% was no more likely to be reliable than any other Fibonacci level.

Results: S&P 500 Example

Using the S&P 500 as a broad-based, heavily traded index should be a fair test for Fibonacci retracement. Still, the results show this indicator was successful only 40% of the time, with 60% of price reversals missing any retracement level. This means the Fibonacci levels are less predictive than a coin toss. Obviously, with these results, using this tool would not be advisable.

Get Fibonacci Indicators on TradingView

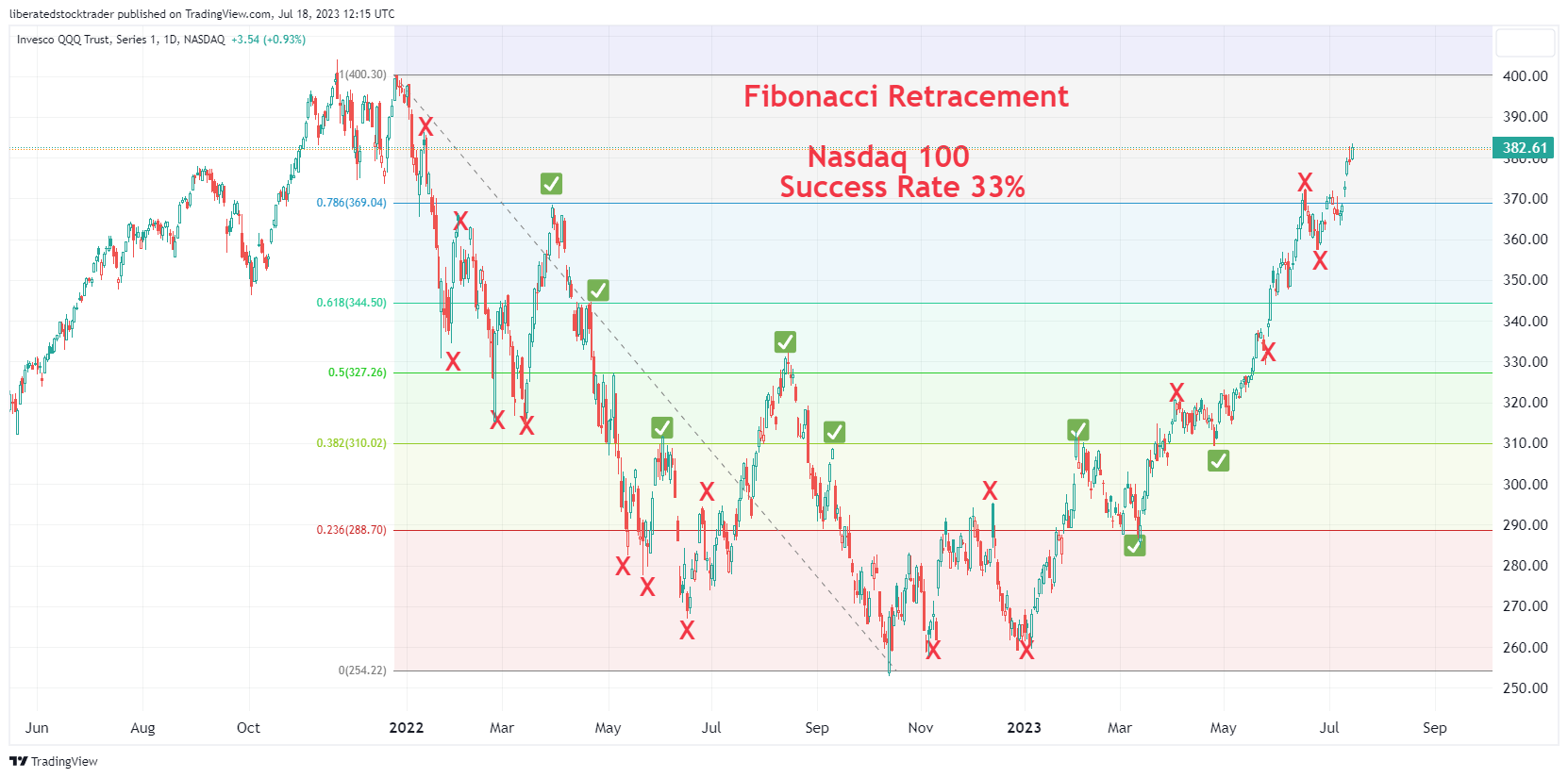

Results: Nasdaq 100 Example

Using Fibonacci retracement on the Nasdaq 100 yielded a high failure rate of 67%, meaning it failed to predict price reversals more than two-thirds of the time. This indicates that Fibonacci retracement should not be the sole basis of trading decisions. Additionally, considering our findings, one must question if Fibonacci should be used as a part of any trading system, even in combination with other indicators.

Does Fibonacci Retracement Work?

No, according to our research and testing, Fibonacci Retracement does not work more than 50% of the time. Across 102 charts, Fibonacci was successful at spotting price reversals only 37% of the time on average, making it worse than a coin toss.

While we observed some stock charts where Fibonacci provided good predictive insights, the indicator failed most of the time across many stocks.

Why Should You Avoid Using Fibonacci Retracement?

Fibonacci retracement is not a reliable technical indicator. When applied to stock charts, it often generates false signals and can yield unreliable results. With an average 67% failure rate, we recommend that you avoid using Fibonacci Retracement altogether and instead focus on combining other indicators with sound fundamental analysis.

Furthermore, Fibonacci Retracement is based on the self-fulfilling prophecy – traders will take positions when they see a support or resistance level at a Fibonacci level, thus creating the very thing they are looking for. But if not enough traders use this failing indicator, it fails to be self-fulfilling. Therefore, it has no value.

We recommend that Fibonacci Retracement be used cautiously or not at all.

Why Fibonacci Sequences Do Not Work in Trading

The Fibonacci Retracement tool is controversial in trading, and many traders believe it does not work. While the Fibonacci sequence and other mathematical patterns can be found in markets, they are unreliable enough to base trading decisions on. Many factors, including economic news, political events, and market sentiment, influence markets. These factors can quickly change the trend, making the Fibonacci retracement levels irrelevant.

Why Trading Fibonacci is a Self-fulfilling Prophecy

Finally, the main issue with using Fibonacci Retracement in trading is that it is a self-fulfilling prophecy. The more traders use the Fibonacci levels, the more they become significant for traders, which leads to the market reacting around those levels. It is important to remember that the markets are unpredictable, and any technique employed should be used cautiously.

Why Fibonacci Trading Self-Fulfilling Prophecy is a Fallacy

The theory is that if trading Fibonacci retracement was a self-fulfilling prophecy, our tests and the results of the 11 academic papers we cited would indicate that this indicator had a high success rate. There are only two explanations for this. Firstly, not enough traders are using Fibonacci in trading. Secondly, many traders use it but do not trust it to make trading decisions. Either way, the fact remains that this indicator does not work.

Academic Research into the Efficacy of Fibonacci Trading

The effectiveness of trading using Fibonacci retracements is explored extensively in the financial literature. However, it’s important to note that the results are mixed. I have compiled a list of external academic and industry papers so you can assess whether to use Fibonacci.

- A computational exploration of the efficacy of Fibonacci Sequences in technical analysis and trading indicates a certain level of similarity with the Fibonacci numbers used by traders and chartists who advocate for Fibonacci retracements 1.

- Research on implementing Fibonacci retracements and exponential moving average (EMA) trading strategy in the Indonesia Stock Exchange found this strategy effective 2.

- However, a study on energy crypto currencies and leading US energy stock prices found that Fibonacci retracement is not an effective trading model for these specific markets 3.

- An LSTM-based decision support system for swing trading in the stock market established the efficacy of the Fibonacci retracement in determining common margins for stock bounce 4.

- An examination of the impact of Fibonacci Retracement to forecast the support and resistance of select Indian Stocks and Indices also showed some efficacy of Fibonacci in different time frames of trading in the stock market.

- An econometric test for Fibonacci Retracements suggested that investors could use the test to determine the potential profitability of technical trading rules 6.

- An empirical study from three equity markets on automatic identification and evaluation of Fibonacci retracements examined its effectiveness as a technical trading rule 7.

- A guide on using Fibonacci retracement to predict the forex market suggests that Forex, stocks, futures, and commodities can all be traded using the Fibonacci retracement 8.

- A study on the effectiveness of vertical Fibonacci retracements and extensions across major indexes continued to explore the success of Fibonacci retracements in financial markets 9.

- Finally, a paper on Fibonacci Retracements and Self-Fulfilling Prophecy discussed how traders use Fibonacci retracements to predict trend interruption points, suggesting a self-fulfilling prophecy dynamic 10.

Though these studies provide varying results, they reflect the diverse application and potential of Fibonacci retracements in different markets and situations. It’s crucial to consider these factors when applying such a technique.

FAQ

What is the best software for Fibonacci trading?

The best software for Fibonacci trading is TradingView. TradingView has automated pattern recognition for Fibonacci retracement and extension, plus 8 Fibonacci drawing tools, including retracement, extension, time zone, fan, spiral, arc, and wedge.

Can I use Fibonacci retracement for intraday trading?

Yes, Fibonacci retracement can be used for intraday trading. The key is to identify potential support and resistance levels based on the Fibonacci levels and then use them as guideposts, not fixed buy and sell signals, as our research shows this indicator is unreliable.

Does Fibonacci trading work?

No, Fibonacci trading is not an effective strategy, according to our testing. Our research has shown that this type of trading is 60 percent unreliable and does not consistently produce profitable results. Our day trading indicator tests show RSI, Heiken Ashi, ROC, and VWAP are much more reliable indicators.

How to use Fibonacci numbers in stock trading?

Use Fibonacci numbers to identify potential support and resistance areas. Check Fibonacci levels on your chart to see if they align with market structure or turning points. Consider using these levels as guideposts in your trading strategy. Remember, Fibonacci retracements are not reliable buy-and-sell signals.

Is Fibonacci effective in trading?

No, Fibonacci numbers are not reliable trading indicators. It is important to remember that Fibonacci numbers are a mathematical pattern and can't predict the market's future. While it may be helpful to use Fibonacci retracements as support and resistance levels, in the end, it still relies on individual interpretation. As such, this type of analysis should never be considered a buy-and-sell signal. I

Is Fibonacci good for day trading?

No, Fibonacci numbers should not be relied upon as a buy-and-sell signal for day trading. Day traders should use technical indicators that help determine supply and demand at specific price points, not magical natural numbers. Reliable day trading indicators proven by data are ROC, VWAP, WMA, and RSI.

Why do so many websites recommend Fibonacci trading?

The internet can be an echo chamber; if Investopedia says it is good, everyone else follows. The fact is large websites like Investopedia do not perform original research or challenge the status quo; they hire interns to write cookie-cutter articles.

What is the 61.8 Fibonacci level?

The 0.618 Fibonacci level is a popular technical indicator that draws lines between two points on a chart according to the Fibonacci sequence of numbers. The theory is that if the price moves above or below this line, it could indicate market strength or weakness. However, this should not be relied upon as an accurate buy-and-sell signal.

What is the difference between Fibonacci Retracement and RSI?

The Fibonacci Retracement Tool is used to identify possible support and resistance levels during a retracement in price. The RSI, on the other hand, is an oscillator indicator designed to measure market momentum.

How to use Fibonacci retracement for swing trading?

Our data suggests you should avoid Fibonacci retracement for swing trading as it has a 60 percent failure rate. Instead, you should use ROC, VWAP, WMA, and HMA with a Heikin Ashi chart, as they are tested at above 70 percent success rates in trading.

Is Fibonacci trading good?

No, Fibonacci trading is not good, and there is no conclusive evidence to suggest that using Fibonacci yields better results than flipping a coin. As such, it should not be relied upon as an accurate buy-and-sell signal.

Is Fibonacci trading profitable?

No, our tests show Fibonacci trading is unprofitable, as 63 percent of signals are false. It should not be relied upon for buy-and-sell decisions. Instead, traders should use proven trading indicators such as the Relative Strength Index (RSI), Price Rate of Change, or Volume Weighted Average Price (VWAP).

Do professional traders use Fibonacci retracement?

No, while many websites suggest Fibonacci is used broadly by professional traders, they are wrong. Institutional backtesting of Fibonacci reveals it is unreliable, and therefore very few professional traders would incorporate it into a systemic trading plan. Fibonacci is only for inexperienced traders.

Which software has the best Fibonacci tools?

TradingView is the go-to software for Fibonacci trading. Its advanced automated Fibonacci pattern recognition and 8 Fibonacci drawing tools, including retracement, extension, time zone, fan, spiral, arc, and wedge, provide everything traders need.

Academic Research Sources

You want to be a successful stock investor but don’t know where to start.

Learning stock market investing on your own can be overwhelming. There’s so much information out there, and it’s hard to know what’s true and what’s not.

Liberated Stock Trader Pro Investing Course

Our pro investing classes are the perfect way to learn stock investing. You will learn everything you need to know about financial analysis, charts, stock screening, and portfolio building so you can start building wealth today.

★ 16 Hours of Video Lessons + eBook ★

★ Complete Financial Analysis Lessons ★

★ 6 Proven Investing Strategies ★

★ Professional Grade Stock Chart Analysis Classes ★