The term insider trading has two meanings in finance, one is legal and the other illegal.

Legal insider trading happens when corporate insiders trade their own company’s stock following SEC reporting rules. Illegal insider trading, in contrast, involves trading a public company’s stock based on nonpublic, material information.

Understanding how to analyze insider trading data is crucial for both investors and regulators. Carefully examining insider transactions can reveal trends and potentially illegal activities. This analysis often involves reviewing SEC Form 4 filings, which corporate insiders must submit whenever they trade their company’s stock. Investors use this data to gauge the confidence of those who know the company best.

Key Takeaways

- Insider trading can be legal or illegal depending on whether the information used is public or nonpublic.

- Analyzing data from SEC filings helps detect trends and possible illegal trading.

- Monitoring insider trades provides insights into a company’s potential future performance.

- Look for clusters of buying and selling within a short timeframe or close to earnings announcements.

- Combining insider trades, retail trading volume, and social media mentions data can form a leading sentiment indicator.

When done correctly, the use of insider trading data can provide valuable insights into a company’s future performance. Detecting unusual patterns or clusters of insider trading can signal significant upcoming corporate events not yet known to the public. To use this data effectively, it’s essential to stay updated with the latest tools and techniques for data mining and interpreting insider transactions.

Understanding Insider Trading

Insider trading involves transactions in a company’s stocks or other securities by individuals with access to nonpublic, material information about the company. Depending on regulatory guidelines, this practice can be legal or illegal.

Insider trading is when company executives, employees, or others buy or sell stock based on confidential information. This information is not available to the general public and could impact the stock’s price.

The U.S. Securities and Exchange Commission (SEC) plays a critical role in regulating insider trading. Under the Securities Exchange Act, insiders must report their trades to the SEC. Illegal insider trading happens when insiders trade based on material and nonpublic information, violating their fiduciary duty to the company and its shareholders.

Regulations such as Rule 10b-5 under the Exchange Act are in place to prevent unfair advantages. Proper insider trading policies require insiders to obtain approval before trading and disclose their transactions, ensuring transparency.

Finding Insider Trading Data

Insider trading data can be found in two ways: through the SEC’s EDGAR database or specialized research tools like TrendSpider.

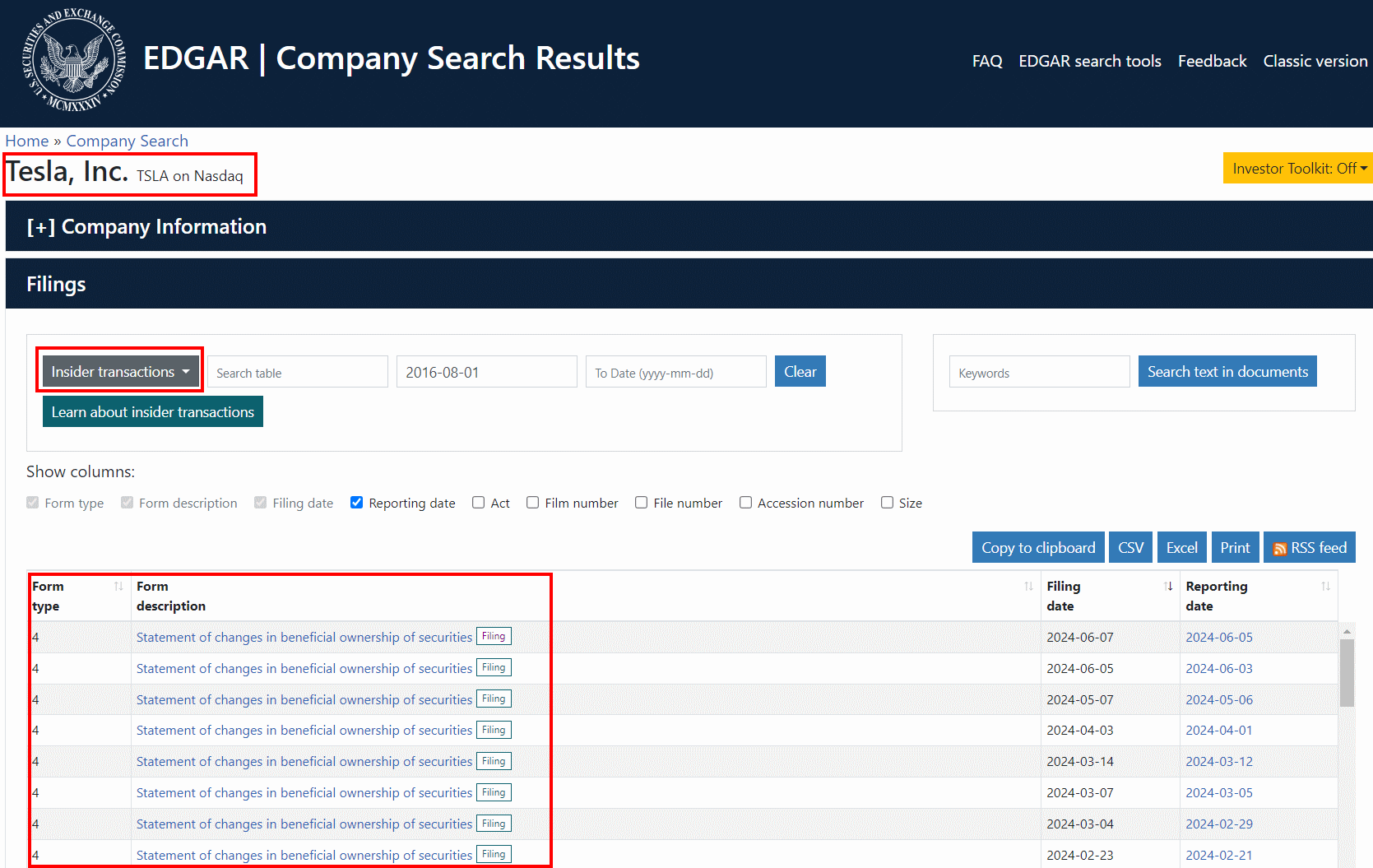

SEC Edgar Database

The EDGAR database is a free resource provided by the SEC that includes all Form 4 filings. It does not provide any analytics, as it can only be searched by entering a specific stock ticker. However, it is a useful tool for finding the most recent insider trading activity for a specific company.

Free Insider Trading Data

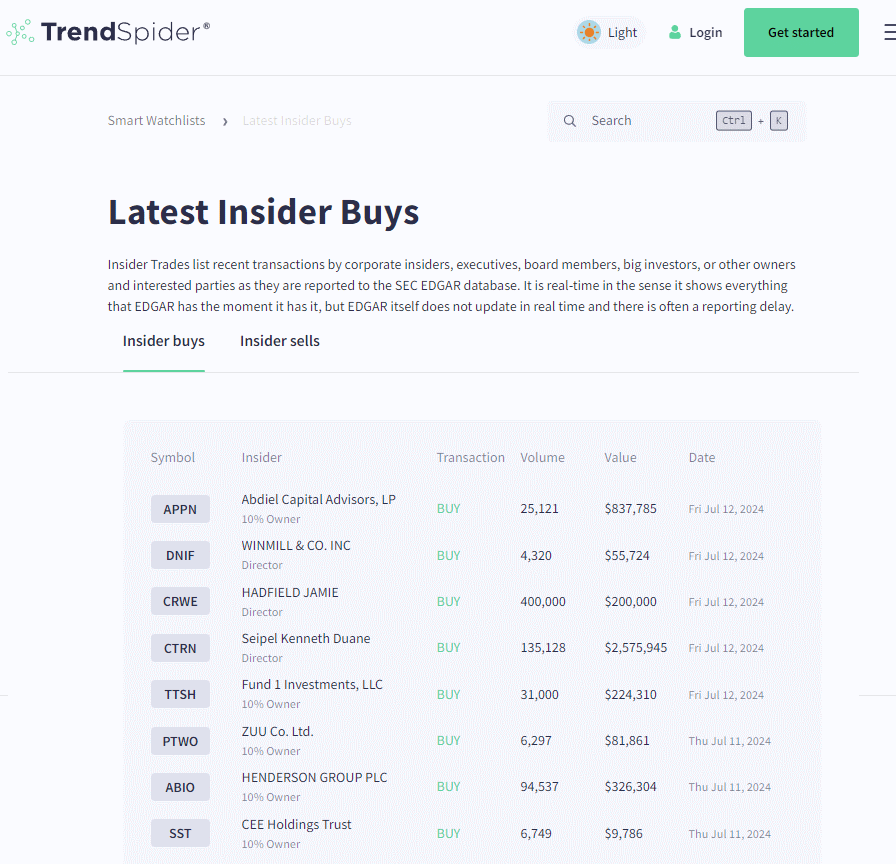

To quickly browse the most recent insider trading data across the entire market, you can visit TrendSpider’s market analysis dashboard.

TrendSpider is a specialized research tool that helps traders analyze and visualize stock market data. It offers advanced features such as insider trading detection and analysis, trend recognition, and backtesting functionality.

Analyzing Insider Trading Data

Successfully analyzing insider trading data involves looking at trades made by insiders to uncover trends and understand their impact on stock prices. Focusing on insider transactions, including buys and sells, can provide insights into the actions of those with potential inside knowledge of a company.

A key aspect of analyzing insider trading data is identifying trends and patterns in the purchase and sale of shares. For instance, cluster buying occurs when multiple insiders buy shares within a short time frame. This can signal confidence in the company’s future performance.

Conversely, significant insider sales may indicate potential troubles ahead. Monitoring these patterns helps investors gauge a company’s sentiment. Informative insider trades—those that correlate with future stock performance—are particularly valuable.

Intelligent Insider Trading Analytics with TrendSpider

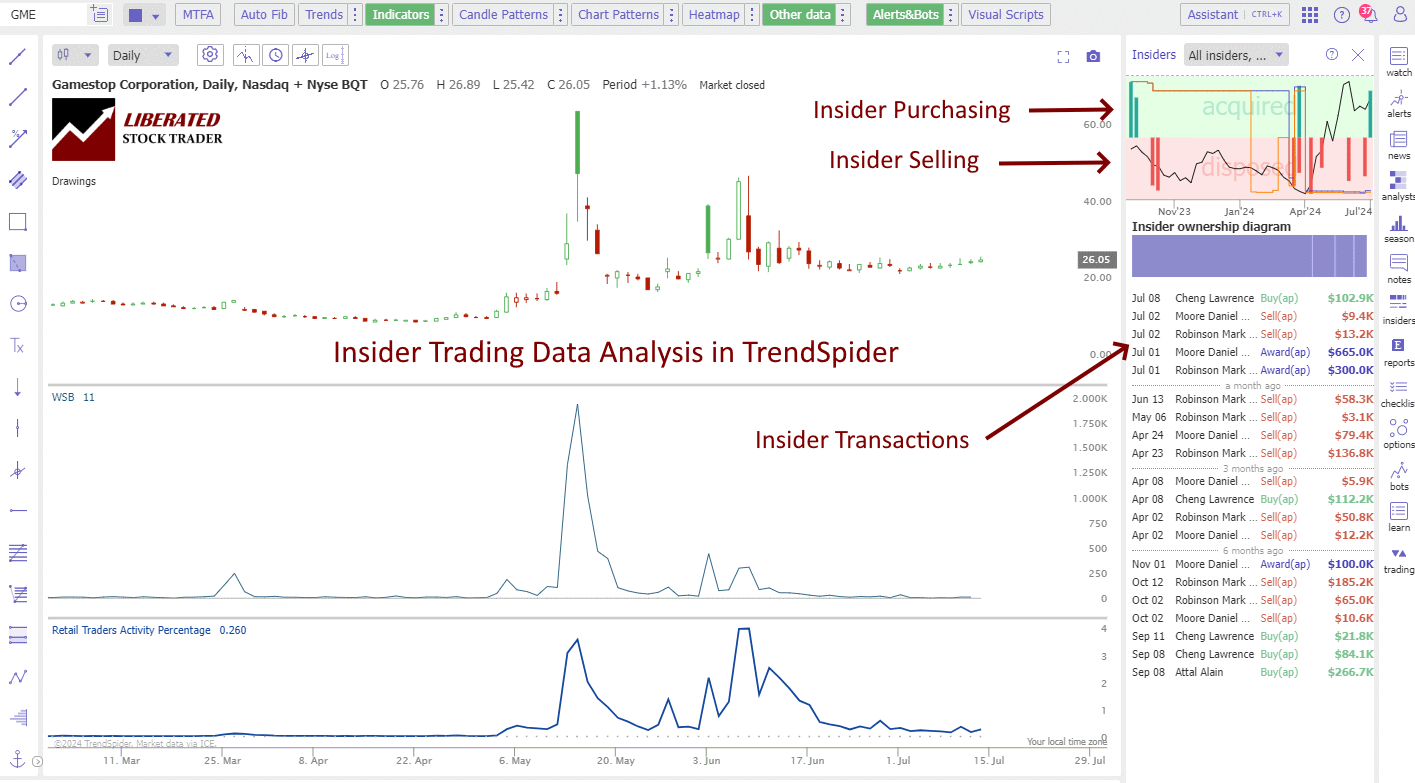

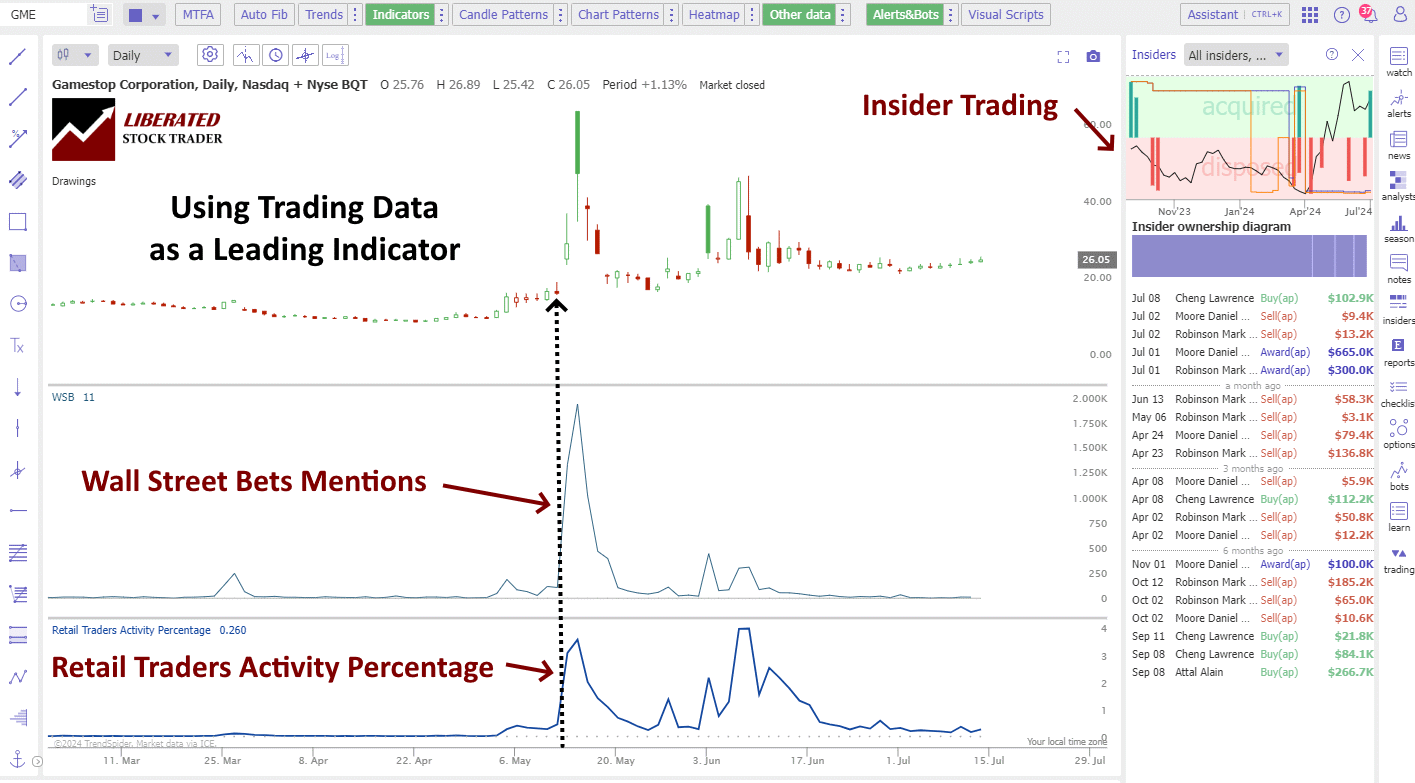

TrendSpider offers a unique insider trading analysis, combining the volume and value of insider buying and selling. The chart below shows an example of this analysis for GameStop Corp. (GME):

Try TrendSpider’s Powerful Insider Trading Analytics

As you can see, the green bars represent insider buying, and the red bars represent insider selling. The size of the bar indicates the volume of shares bought or sold. All transactions are listed along with the reason for the transaction, be it a buy, sell, or a stock award.

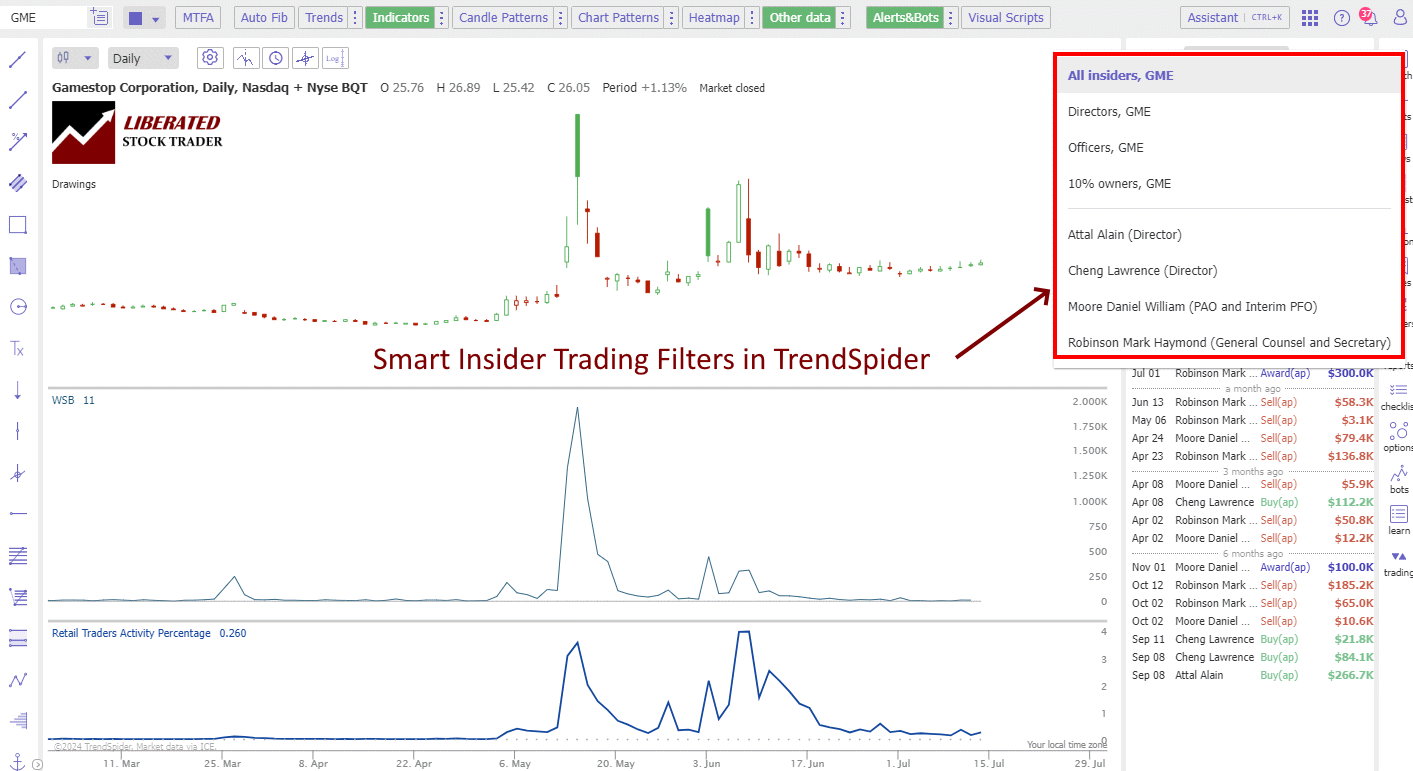

TrendSpider also includes a helpful feature that allows you to filter trades based on the executive’s role in the company, their name, or even their current ownership percentage.

Using this tool, investors can easily visualize and track insider buying and selling patterns over time. This can provide valuable insights into management sentiment and help identify potential buying or selling opportunities.

Combine Insider Trading, WallStreetBets & Retail Investing Data

TrendSpider has unique features for analyzing the impact of retail and social media sentiment on stock prices. By combining insider trading data with WallStreetBets and retail investing data, users can get a comprehensive view of market trends.

The chart below shows an example of how this feature can be used. In this case, the green bars represent insider buying activity, while the red bars indicate insider selling. The middle window represents WallStreetBets mentions, and the lower pane shows the percentage of trades by retail investors.

Try TrendSpider’s Powerful Insider Trading Analytics

I have mapped the surge of mentions on Reddit’s WallStreetBets forum and the surge of retail trading activity. Together, they form a leading indicator that precedes the 120% stock price surge that occurred a few days later.

In today’s fast-paced and ever-changing market, having access to accurate and timely information is crucial for successful trading. With TrendSpider’s insider trading analysis, investors can stay ahead of the game by monitoring executive transactions and tracking overall market sentiment.

This powerful tool provides valuable insights that can help investors make smarter investment decisions and achieve their financial goals. So why wait? Sign up for TrendSpider now and start using its insider trading analysis features to take your trading strategy to the next level.

My thorough testing awarded TradingView a stellar 4.8 stars!

With powerful stock chart analysis, pattern recognition, screening, backtesting, and a 20+ million user community, it’s a game-changer for traders.

Whether you're trading in the US or internationally, TradingView is my top pick for its unmatched features and ease of use.

Explore TradingView – Your Gateway to Smarter Trading!

Impact of Insider Actions on Stock Prices

The actions of insiders can have a measurable impact on stock prices. For instance, predictive analysis of insider transactions often shows that insider buying leads to stock price increases, as it suggests insiders believe the stock is undervalued.

On the other hand, substantial insider sales can lead to price drops, as they may signal overvaluation or upcoming negative news. Analyzing these movements helps investors understand how insider transactions might influence market behavior. Important figures like Peter Lynch have emphasized the significance of tracking insider trades to make more profitable investment choices.

Legal Obligations and Reporting

Insider trading involves various legal obligations and specific reporting requirements. Understanding these aspects ensures compliance with federal laws and helps maintain market integrity.

SEC Forms and Filing Requirements

The SEC mandates different forms for reporting insider transactions. Form 3 is the initial statement of beneficial ownership. This form must be filed within 10 days of becoming an officer, director, or beneficial owner.

Form 4 is used to report changes in beneficial ownership. It covers transactions like sales and purchases of securities and must be filed within two business days following the transaction.

Form 5 is the annual statement of changes in beneficial ownership. It is filed to report transactions that were not required to be reported during the year or to correct previous filings. Forms are submitted through the SEC’s EDGAR database, which makes this information publicly accessible.

Common Myths and Misconceptions

One common myth is that all insider trading is illegal. In reality, legal insider trading occurs regularly when insiders trade stock and report these transactions to the SEC.

Another misconception is that insider trading is only about financial gains. Sometimes, trades are made for non-financial reasons, like tax planning, which may still require regulatory compliance.

Many believe insider trading is hard to detect. However, the SEC has sophisticated tools to monitor trading activities and detect suspicious patterns.

Lastly, some think insider trading only involves high-level executives. In truth, it can involve anyone who accesses material nonpublic information, including employees, consultants, or even family members.

Understanding Ownership and Insider Relationships

Insiders typically include officers, directors, executives, and beneficial owners who own more than 10% of a company’s shares. Their positions and transactions must be disclosed to ensure transparency and prevent illegal insider trading.

An ownership position outlines the number of shares held by an insider. Insiders must also disclose their relationship to the company, which adds context to their transactions.

Insider transactions can include both direct and indirect ownership changes. Executives often use Rule 10b5-1 trading plans to plan trades in advance, providing a defense against accusations of insider trading. These plans must still comply with reporting requirements and SEC rules. Using planned transactions promotes transparency and reduces the likelihood of illegal activity.

Frequently Asked Questions

This section addresses common concerns about using insider trading data for investment decisions and highlights reliable sources, legal implications, detection methods, and notable impacts on stock prices.

What is the best software for insider trading analysis?

According to my research, TrendSpider has the most advanced insider trading analytics covering the volume, size, and roles of insider traders.

What are some reliable sources for insider trading data?

Regulative agencies, such as the SEC's EDGAR database, are reliable sources for insider trading data. TrendSpider provides detailed insider trading analytics, which can be combined with social media mentions and retail trading volumes.

How can investors use insider trading information to make investment decisions?

Investors can track insider buying and selling to gauge a company's future performance. For example, insiders trading on price trends often signal confidence in the company's growth.

What are the legal implications of insider trading for investors?

Illegal insider trading can lead to civil, criminal, and administrative actions. Enforcers use various insider trading doctrines to operationalize these cases. Investors must ensure that any trades they make based on insider data comply with the law to avoid severe penalties.

Can insider trading be detected through analysis, and if so, how?

Insider trading can be detected through patterns in trading volumes and prices. Analysts look for unusual spikes that coincide with access to nonpublic information.

What are examples of insider trading impacting stock prices?

One notable example is the United States v. Newman case, which highlighted how insider trading laws aim to maintain capital market efficiency. This case had a significant impact on stock prices and raised awareness of the legal boundaries of insider trading.