Our research shows that long-term buy-and-hold investing leads to significant profits.

Over the past 30 years, annual stock market returns have averaged 10.7%, bonds and real estate yielded 4.8%, and gold returned 6.8%.

Are you seeking a hassle-free, straightforward investing approach requiring minimal time or effort? If so, look no further than buy-and-hold investing!

What is Buy-and-Hold Investing?

The buy-and-hold investing strategy involves purchasing stocks, bonds, or other assets and holding them for a long period, regardless of short-term market fluctuations. It’s based on the belief that investment values will increase in the long run.

Understanding Buy-and-Hold Investing

Buy and hold is a passive investment strategy where investors purchase stocks, bonds, or other assets and hold them for a long period, usually years or decades. The premise of this strategy is based on the belief that despite short-term market fluctuations, investment values will generally increase over a longer time horizon.

The History of Buy-and-Hold Investing

This strategy traces back to the investing philosophy of renowned investors like Benjamin Graham and Warren Buffett. They advocated for buying shares in good businesses and holding them for an extended period, allowing the power of compound interest to grow your wealth.

How It Differs From Other Investment Strategies

Unlike active trading strategies, such as day trading or swing trading, which involve frequent buying and selling to capitalize on market volatility, buy-and-hold investors stay put with their investments. Short-term market movements do not sway them; instead, they focus on their investments’ long-term potential.

What is a Buy-and-Hold Stocks Strategy

Investments that are typically good fits for this strategy include blue-chip stocks, index funds, and dividend-growth stocks. These assets usually have a consistent performance history and are expected to grow over time. As for the type of investor, the buy-and-hold strategy is well-suited to those who prefer lower risk, have a long-term investment horizon, and do not wish to spend significant time managing their portfolio.

Real-Life Buy-and-Hold Examples

Warren Buffet’s Berkshire Hathaway is a classic example of the successful implementation of this strategy. Buffett bought shares in companies like Coca-Cola and American Express and held onto them for decades, reaping substantial returns. Other well-known investors who practice this strategy include David Dreman, Seth Klarman, and Peter Lynch. All three have used the buy-and-hold method to generate great returns.

Buy-and-hold vs. Short-term Trading

Unlike short-term trading, which seeks to profit from short-term price fluctuations, buy-and-hold investing focuses on long-term growth. However, it’s essential to understand that this strategy has risks. While historical trends show that markets tend to rise over time, there can be periods of significant downturns. Therefore, diversification and regular portfolio review are crucial to mitigating these risks.

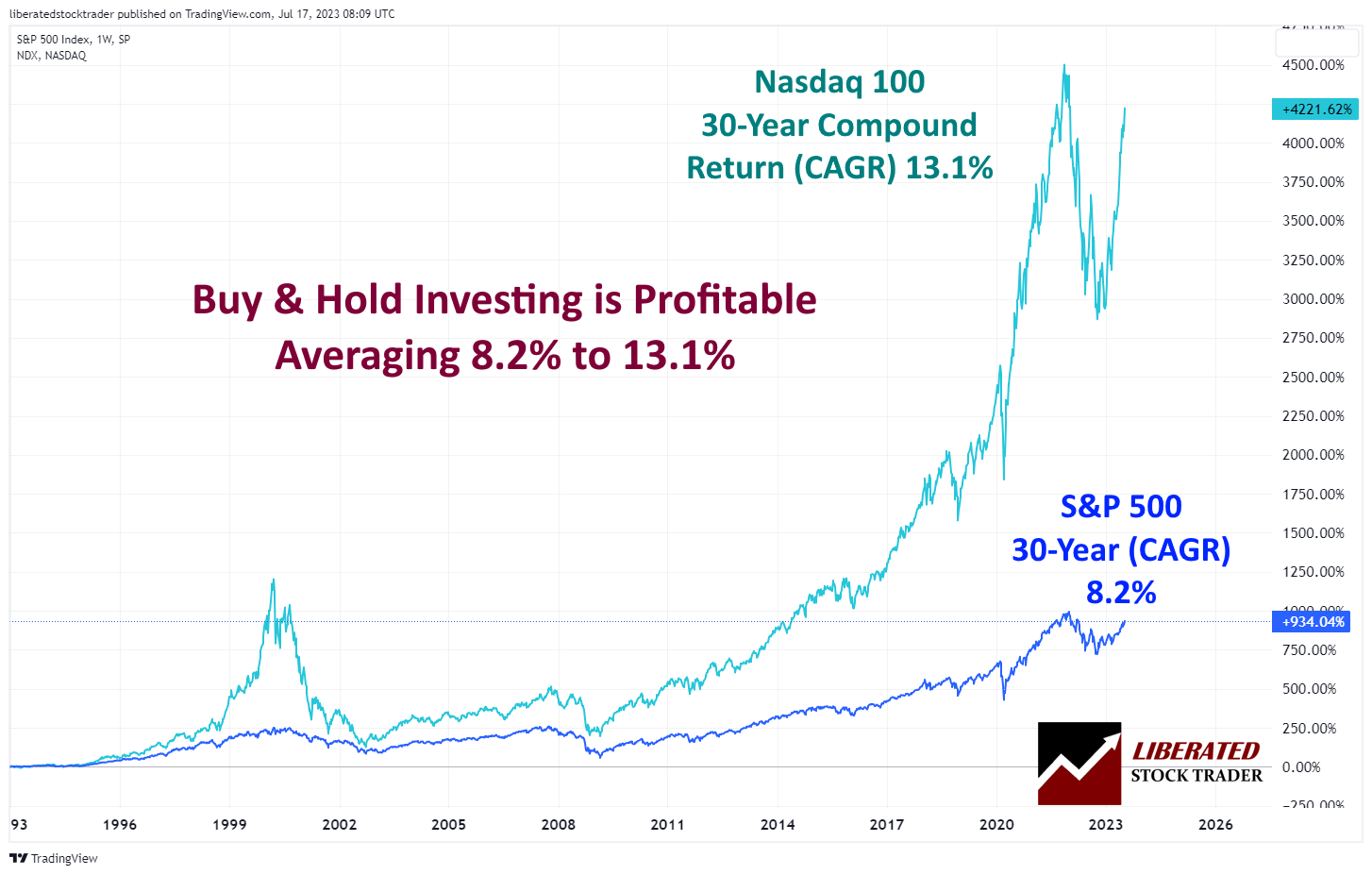

30-Year Success Rates of Buy-and-Hold Strategies

Over the past 30 years, our research shows that the Nasdaq 100 returned 13.1% annually, the S&P 500 8.2%, and corporate bonds 7.2%. Additionally, 3-month T.Bills averaged 2.2%, US T. Bonds 4.9%, and real estate 4.8%. Finally, gold returned 6.8% during the same period.

Therefore, this strategy can effectively generate positive returns in any asset class over time for investors with a long-term investment horizon and the ability to withstand short-term market downturns.

Buy and Hold Stock Investing Returns

Our original research shows that a buy-and-hold stocks strategy is profitable. Between 1993 and 2023, the S&P 500 index returned an average annual compound growth of 8.,2%, and the Nasdaq 100 returned 13.1%.

This included holding stocks through three major crashes in 2000, 2008, and 2021.

This suggests that stocks are a reliable long-term investment with a higher return potential than other asset classes, such as corporate bonds, real estate, and gold.

Open this Chart in TradingView

Buy and Hold Real-Estate Returns

According to Revolution Realty Capital, residential real estate has returned 10.6% over the past two decades, and commercial real estate has yielded an average annual return of approximately 9.5%. However, a study by NYU suggests that real estate has returned an average of 4.8%,

The return on investment in real estate is contingent upon the type of property being acquired. Moreover, the S&P 500 Real Estate Index gauges the nationwide average return on investment in real estate, encompassing various real estate assets such as single-family residences, apartments, and commercial buildings.

Buy and Hold Bond Returns

According to the Federal Reserve Bank of St. Louis, which has measured the returns of stocks, Treasury bills, and 10-year Treasury bonds since 1928, T-bills and T-bonds averaged 3.33% and 5.11%, respectively, from 1960-2023.

For those looking to diversify their investments, bonds offer a more stable return that is less volatile than stocks. Bonds are also often used for long-term goals such as retirement since the returns are predictable and don’t fluctuate wildly as stock values can.

In addition, T-bonds do not require sophisticated financial analysis or knowledge of the markets as stock investments do. Bonds provide an attractive option for those who prefer a hands-off approach to investing.

Buy & Hold Profits: Real Estate vs. Stocks, Bonds & Gold

Our research shows that 30-year stock market annual returns (10.7%) are greater than bonds (4.8%), real estate (4.8%), corporate bonds (7.2%), and gold (6.8%). That said, stock volatility is much higher than bonds and other investments. Therefore, it is important to understand how different investment classes can fit into a portfolio to minimize risk while maximizing returns.

| Invested Asset | 30-Year Avg Return |

| S&P 500 | 8.2% |

| Nasdaq 100 | 13.1% |

| 3-month T.Bill | 2.2% |

| US T. Bond | 4.9% |

| Corporate Bonds | 7.2% |

| Real Estate | 4.8% |

| Gold | 6.8% |

Source: Liberated Stock Trader Statistics & NYU

Real estate has unique advantages over stocks, bonds, and gold as an asset class because it provides a steady income stream for investors through rent payments, plus the potential for long-term capital gains through appreciation. In addition, real estate has tax advantages, such as the ability to deduct interest payments on mortgages and depreciate properties for tax purposes.

Bonds are attractive investments because they provide a steady return with minimal risk. The principal amount is generally repaid at maturity, and coupons (interest payments) are paid regularly over the bond’s life. Government bonds are considered the safest investment option within this class, as they are backed by the government’s full faith and credit.

My thorough testing awarded TradingView a stellar 4.8 stars!

With powerful stock chart analysis, pattern recognition, screening, backtesting, and a 20+ million user community, it’s a game-changer for traders.

Whether you're trading in the US or internationally, TradingView is my top pick for its unmatched features and ease of use.

Explore TradingView – Your Gateway to Smarter Trading!

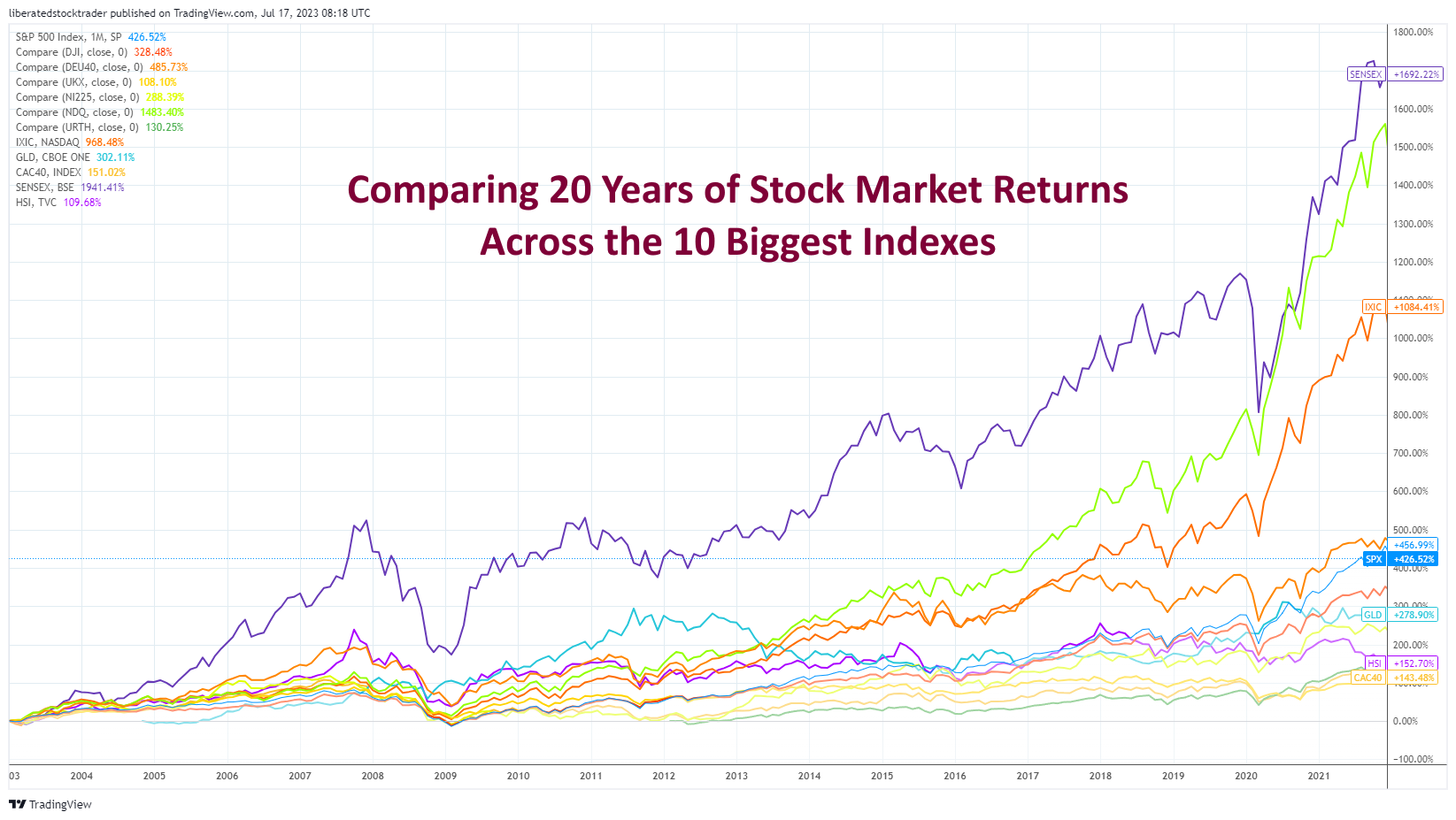

How to Compare Buy-and-Hold Stock Returns Internationally

Using comparison charts, you can easily compare stock market returns worldwide. Below, I have curated a TradingView stock market comparison chart to assist you in identifying the most lucrative stock indexes for investment purposes.

Open this Chart in TradingView

The chart above compares global stock indices, including the S&P 500, NIKKEI 225, FTSE 100, DAX, CAC40, and the Indian Sensex. To maximize investment returns, look at each index’s historical performance over different periods. This will help you make an informed decision on where to invest your money. Additionally, remember that there are tax implications when investing in foreign stocks. Be sure to check the tax regulations of each country you’re considering investing in and any risks associated with their currency or political situation.

Buy and Hold vs. Other Investments.

While buy-and-hold investing is a popular passive strategy, other strategies can yield positive returns.

For example, active trading strategies like day trading or swing trading have unique advantages and risks. Day traders seek to capitalize on short-term price fluctuations in the market, while swing traders look for longer-term trends with higher potential returns.

It is also important to note that different investors may prefer various strategies depending on their risk appetite and financial goals.

For example, an investor with a higher risk tolerance might be better suited for active trading. At the same time, those seeking more stability and consistency would find buy-and-hold investing more suitable.

Ultimately, the best investment strategy should reflect an individual’s needs and objectives.

What Software is Best for Buy-and-Hold Investing

Fundamental analysis is the preferred approach to buy-and-hold investing. Stock Rover is the ultimate software for long-term value, dividend, and growth investing. With Stock Rover, evaluating a company’s financials to determine its long-term prospects and compatibility with one’s portfolio becomes a breeze.

Stock Rover’s Screening & Portfolio Tools Full Test & Rating

Buy-and-Hold ETF Investing

Looking to safeguard your investments and outperform the market in the long run? Look no further! Introducing the MOSES ETF Investing System. This powerful tool harnesses five core indicators to shield you from major stock market crashes and keep your portfolio on the winning track!

Get the Moses ETF Strategy Now

Key Benefits of Buy-and-Hold Investing

One key advantage of adopting a buy-and-hold strategy is that it requires little effort. This allows you to focus on your other commitments, such as your career, family, and hobbies, while still pursuing potential returns from the market.

Another benefit of this approach is its lower trading cost than actively managed strategies. Since you are not buying and selling regularly, the associated fees and commissions are also lower.

Finally, buy-and-hold investing allows investors to capture long-term advantages such as compounding returns from dividend payments or stock splits, which can significantly boost their investments.

Limitations of a Buy-and-Hold

One of the primary drawbacks of a buy-and-hold strategy for certain investors is its lack of flexibility. It can be difficult to rapidly adapt to changing market conditions and swiftly move in and out of investments, as may be required by active trading strategies. Furthermore, this approach requires a disciplined long-term mindset that some investors may find challenging or unappealing.

Common Buy-and-Hold Misconceptions

One common misconception about the buy-and-hold strategy is that it eliminates portfolio risk. While this approach generally reduces the risk involved, there are still potential risks associated with investing in any asset class.

Another misconception is that this strategy will guarantee positive returns. This is false since markets can be unpredictable, and past performance does not guarantee future results.

Finally, buy-and-hold investing is not suitable for all investors. As discussed earlier, different strategies may suit different investors depending on their risk appetite, financial goals, and long-term investment horizon.

Best Practices for Buy-and-Hold Investing

Thorough research is the most important step to ensuring a successful buy-and-hold strategy. It is essential to select investments with strong fundamentals and long-term potential. Investors should also diversify their portfolios across asset classes such as stocks, bonds, and ETFs.

Next, it’s important to stay up-to-date with market movements so you can make necessary adjustments if required. Finally, investors should stay disciplined and avoid making emotional decisions when markets fluctuate, enabling them to reap the benefits of their long-term investments.

Selecting the Right Assets for a Buy-and-Hold Portfolio

Investors should select assets that match their personal goals and objectives. When selecting stocks, for example, investors should look for companies with healthy balance sheets, significant operating income, and potential for long-term growth. Evaluating the underlying assets and management fees before investing is important for ETFs.

In addition, investors should consider factors such as liquidity, volatility, and dividend yields to make informed decisions.

Lastly, selecting investments with a low cost basis is important so that the ongoing management fees can be minimized. This will ensure that investors can maximize their returns from the buy-and-hold strategy.

Key Buy-and-Hold Metrics to Track

Investors should track various metrics to measure their investments’ performance. This includes tracking the total return, capital gains, plus dividends minus fees and taxes. Other important metrics include cost basis, dividend yield, total portfolio value, and rate of return.

In addition, it is also helpful to track key financial indicators such as the stock’s price-earnings ratio and dividend payout rate. By tracking these metrics, investors can gain valuable investment insights and make more informed decisions.

By learning about the buy-and-hold strategy, its benefits, potential limitations, and best practices for implementation, investors can create long-term wealth hassle-free. With adequate research and a disciplined approach, investors can achieve their financial goals by investing in the market for the long term.

Is Buy-and-Hold Worth It?

Yes, buy-and-hold is worth it. Our research reveals that over 30 years, buy-and-hold strategies have historically yielded annual returns of 10.7% in the stock market, 4.8% in bonds and real estate, 7.2% in corporate bonds, and 6.8% in gold.

Conclusion

Buy-and-hold investing effectively captures long-term gains from stock, bonds, and real estate while minimizing trading costs. It requires minimal effort to maintain and allows investors to focus on other commitments while pursuing potential returns.

The buy-and-hold strategy is a popular passive investment approach that suits investors with lower risk tolerance and long-term investment horizon. While it has advantages, it is important to note that different strategies may suit different investors depending on their goals and risk appetite.

Therefore, thorough research and a disciplined mindset are essential for successfully implementing this strategy. With these best practices in mind, buy-and-hold investing can be a great way to build long-term wealth.

FAQ

What is the best software for buy-and-hold investing?

When it comes to buy-and-hold investing, Stock Rover is our top choice. With its robust features, this software empowers you to thoroughly research stocks, ETFs, REITs, and bonds, helping you craft a well-diversified, long-term portfolio with confidence.

What is buy-and-hold investing?

Buy-and-hold investing is a long-term investment strategy where an investor buys stocks, bonds, or other assets and holds them for a long period, typically years or decades. The idea is that in the long run, financial markets will give a good rate of return despite periods of decline.

How does buy-and-hold investing compare to active trading?

Active trading involves buying and selling securities more frequently, with the aim of outperforming buy-and-hold investors. The evidence suggests 85 percent of active traders do not outperform a buy-and-hold strategy.

What types of investments are suitable for buy-and-hold investing?

Investments with a history of steady growth, such as blue-chip stocks, index funds, and dividend-growth stocks, are usually good fits for buy-and-hold investing. These assets have a track record of consistent performance and are expected to grow over time.

What's an example of a successful buy-and-hold investment?

An example of a successful buy-and-hold investment would be Warren Buffett's purchase of Coca-Cola stock in 1988. He purchased the stock at $20 and still holds it today; He has reaped substantial returns, as its value is now over $600 per share.

Does buy and hold mean I never sell my investments?

Not necessarily. While the strategy implies holding onto investments for the long term, it doesn't mean you never sell. If a company's fundamentals deteriorate or better investment opportunities arise, it may be wise to sell.

What are the risks associated with buy-and-hold investing?

The main risk is the possibility that the entire market declines over the long term. Another risk is that the chosen investment underperforms the market. It's important to diversify your portfolio to mitigate these risks.

Is buy-and-hold investing only for stocks?

No, buy-and-hold investing can be applied to various asset classes, including bonds, real estate, mutual funds, and ETFs.

What other strategies can I use to invest in the stock market?

Many other strategies are available, including value investing, swing trading, day trading, and options trading. Each strategy has its own unique set of risks and benefits.

How does buy and hold investing fare during market downturns?

During downturns, buy-and-hold investors generally do not panic sell. They recognize that markets have always recovered from declines and believe in their long-term investing strategy.

How much time do I need to dedicate to buy and hold investing?

One of the benefits of buy-and-hold investing is that it requires less time than active trading strategies. Once you've done your initial research and made your investments, you may only need to check on your portfolio periodically.

Can anyone succeed with buy-and-hold investing?

While anyone can utilize this strategy, success with buy-and-hold investing requires patience, discipline, and a long-term perspective. It's also essential to start with thorough research to select sound investments.

Can you buy and hold ETFs?

Yes, ETFs can be held long-term as part of a buy-and-hold strategy. ETFs are baskets of securities that allow investors to diversify their portfolios and gain exposure to different sectors or markets. They can provide a low-cost way to invest in the stock market while minimizing risk.

Does the buy-and-hold strategy work?

Yes, the buy-and-hold strategy has been proven effective for long-term investors, with our research showing that 30-year stock market annual returns (10.7%) are greater than bonds (4.8%), real estate (4.8%), corporate bonds (7.2%), and gold (6.8%).

How to buy and hold foreign currency?

The buy-and-hold strategy can be applied to foreign currencies in various ways. For example, investors may buy physical currency notes or coins, store them in their safekeeping, and buy and sell them when the exchange rate is more favorable. Alternatively, investors may invest in foreign bonds or ETFs that track a basket of foreign currencies.

How to buy and hold real estate?

Real estate can be a great investment due to its potential for appreciation and steady income from rent. To buy and hold real estate, investors should research the local market, compare properties in the area, determine their budget and financing options, and find a reputable realtor or property manager.

Is buy and hold a good strategy?

Yes, buy-and-hold is a good profitable long-term strategy. Our research indicates that over 30 years, the annual returns of the stock market (10.7%) surpass those of bonds (4.8%), real estate (4.8%), corporate bonds (7.2%), and gold (6.8%).

Is buy-and-hold dead?

Despite what some may say, The buy-and-hold strategy is far from dead. It remains a popular investment approach for many investors, particularly those looking to build wealth over the long term.

What did Warren Buffett say about buy-and-hold investing?

Warren Buffett has famously said he views buy-and-hold investing as a method of building wealth over time. He says, "If you aren't willing to own a stock for ten years, don't even think about owning it for ten minutes. "

Is buy and hold the best strategy?

The answer to this question depends on the individual investor. Buy and hold can be a great strategy for long-term investors with the discipline and patience to stick with their investments despite market fluctuations. However, it isn't necessarily the best strategy for all investors; some may succeed more with active trading strategies or other approaches.

Is it better to buy and hold or trade?

This depends on the individual investor's goals, risk tolerance, and investment strategy. Active trading strategies can be profitable if done correctly but also have greater risks. On the other hand, buy-and-hold investing tends to be more conservative and requires less active involvement from investors.

You want to be a successful stock investor but don’t know where to start.

Learning stock market investing on your own can be overwhelming. There’s so much information out there, and it’s hard to know what’s true and what’s not.

Liberated Stock Trader Pro Investing Course

Our pro investing classes are the perfect way to learn stock investing. You will learn everything you need to know about financial analysis, charts, stock screening, and portfolio building so you can start building wealth today.

★ 16 Hours of Video Lessons + eBook ★

★ Complete Financial Analysis Lessons ★

★ 6 Proven Investing Strategies ★

★ Professional Grade Stock Chart Analysis Classes ★