Day traders and hedge fund managers would have you believe that value investing is dead, but published research by French and Fama shows value still outperforms growth.

This article will discuss why so many investors today are shying away from value stocks and look at the data to show that value investing is still alive and well.

Is Value Investing Dead?

No, Value investing is still very much alive. According to research by French and Fama, “smaller companies and those with high book-to-market values (value stocks) are likely to outperform the market over the long run.”

Value Investing Performance 20-Years

We can see that the classic value investing stock Berkshire Hathaway (BRK.B) has outperformed the S&P 500 over the past 20 years. BRK.B has returned 552% versus the S&P 500’s 341%.

While short-term performance may be variable, long-term evidence shows that value investing still lives.

Example Chart: Value Investing vs. The Stock Market

Get this chart free on TradingView

French and Fama Research on Value vs. Growth Investing

French and Fama’s research is a seminal work in the field of finance, providing critical insights into the value and growth investing styles. Here are the main findings from their research.

Is Value Investing Dead? The Evidence

One of the key findings from French and Fama’s research is that value stocks tend to have higher average returns than growth stocks. This ‘value premium’ is observed across different markets and periods. Their research suggests that the market often undervalues these distressed (value) stocks and overvalues growth stocks.

The Fama-French Three-Factor Model

The Fama-French three-factor model is a well-known finance model that expands on the Capital Asset Pricing Model (CAPM) by adding two additional factors: size and book-to-market value. According to this model, smaller companies and those with high book-to-market values (value stocks) are likely to outperform the market over the long run.

In practical terms, a positive HML (high minus low) value in a month indicates that value stocks outperformed growth stocks.

The Role of Book-to-Market Value

French and Fama’s research also focused on realized earnings performance rather than any forecasts. They found that low book-to-market value growth stocks do not necessarily equate to high future growth and that high book-to-market value stocks, typically classified as value stocks, tend to yield higher returns.

The Impact of Earnings Growth

Further research has indicated that the performance of value and growth strategies can be sensitive to earnings growth. However, it’s important to note that while value stocks might outperform growth stocks on average, this does not mean that all value stocks will outperform all growth stocks.

The Performance During COVID-19

A study examining the Fama-French model during the COVID-19 pandemic found that the model’s performance held up, suggesting the continued relevance of value investing even during market disruptions.

The research of French and Fama provides compelling evidence for the viability of value investing, demonstrating that value stocks can offer higher average returns than growth stocks. However, it’s essential to consider market dynamics, individual stock characteristics, and broader economic conditions when making investment decisions.

Remember that investing always carries risk, and it’s important to do your own research or consult with a professional before making any investment decisions.

The Current State of Value Investing

Value stocks have traditionally been viewed as less volatile than the broad market due to their conservative pricing. This stability has appealed to many investors seeking a safer haven amid market volatility. However, growth stocks have outperformed value stocks in the recent past, leading some to question the viability of value investing.

Investing In Stocks Can Be Complicated, Stock Rover Makes It Easy.

Stock Rover is our #1 rated stock investing tool for:

★ Growth Investing - With industry Leading Research Reports ★

★ Value Investing - Find Value Stocks Using Warren Buffett's Strategies ★

★ Income Investing - Harvest Safe Regular Dividends from Stocks ★

"I have been researching and investing in stocks for 20 years! I now manage all my stock investments using Stock Rover." Barry D. Moore - Founder: LiberatedStockTrader.com

Buy Businesses, Not Stocks

Warren Buffett, a value investor who lives by Graham’s advice, has made vast amounts of money in the 21st century.

Buffett spends his time searching for good businesses the market overlooks while ignoring most investment news. Those businesses are often in sectors Buffett loves, such as insurance, heavy industry, media, and transportation.

One Buffett strategy that still holds up is to seek companies with management teams he likes and respects. According to Buffett himself, he only works with “people he can see himself working with forever.”

Buffett employs the classic value strategy of buying only well-managed companies. Buffett famously does not try to manage the companies Berkshire buys because he trusts the management teams. Berkshire Hathaway reputedly only employs 20 people at its Omaha headquarters.

Another famous Buffett quote goes further by saying:

“I try to invest in businesses that are so wonderful that an idiot can run them. Because sooner or later, one will.”

This is an excellent insight into the fact that many businesses begin to fail when the third generation of family owners takes over. A business that is so simple that any idiot can run it is a maxim that reminds us of the risks of nepotism.

Berkshire Hathaway makes money by locating well-managed companies that make a lot of money and investing in them.

Is Value Investing Dead Because of Automated Trading?

Value investing has been around for over a century, and while the methods have changed since Warren Buffett’s heyday, it’s still an effective way of picking stocks. Automated trading is making waves in the stock market, but that doesn’t mean value investing isn’t a viable strategy.

In fact, automated trading can provide valuable insight into which stocks are undervalued and, therefore, ripe for value investors. Automated trading can also help spot buying opportunities before anyone else does. All in all, it’s just another tool that can make the job of a value investor easier and more profitable. So don’t count value investing out yet! It is still alive and well.

The short answer is no; trading automation is moving towards more sophisticated value investing strategies.

According to the Economist & Deutsche Bank, “90% of equity-futures trades and 80% of cash-equity trades are executed by algorithms without human input. Equity-derivative markets are also dominated by electronic execution, according to Larry Tabb of the Tabb Group, a research firm.”

This means that computers run the vast majority of trading in the market. More and more, computer algorithms are not just using arbitrage strategies to scrape a few tenths of a cent per trade but increasingly employing value investing strategies. A new force in the market is Robo Advisors; let’s take a close look.

Are Robo Advisors Using Value Investing?

The rapid rise of robo-advisors, which essentially automate building and maintaining a portfolio around your specific investing needs, is leading to something new. Many robo-advisors will recommend a selection of ETFs for you to invest in, but few implement a value investing strategy as a core part of the investing methodology.

Having reviewed and researched over 20 robo-advisors, I found that most offer different ETFs to match the client’s risk profile. Many do, however, rely on accruing dividends.

Many investors have forgotten that value and dividends make a huge difference to the compounded returns of your investment over the long term.

My thorough testing awarded TradingView a stellar 4.8 stars!

With powerful stock chart analysis, pattern recognition, screening, backtesting, and a 20+ million user community, it’s a game-changer for traders.

Whether you're trading in the US or internationally, TradingView is my top pick for its unmatched features and ease of use.

Explore TradingView – Your Gateway to Smarter Trading!

Does Trading Beat Value Investing?

The short answer is no; no evidence supports the notion that hedge fund traders beat the underlying stock market index over five years.

In fact, according to our research, Buffett managed to beat the market through value investing, averaging a compound rate of return of over 24.7%. This is not through trading; this money is earned by investing real capital in real businesses.

There is no evidence to support the fact that trading stocks outperform a well-structured value portfolio. As shown in our stock market statistics research

Actively managed mutual fund performance is looked at here; fund managers seem excellent at making profits for themselves but not so good at making profits for their clients.

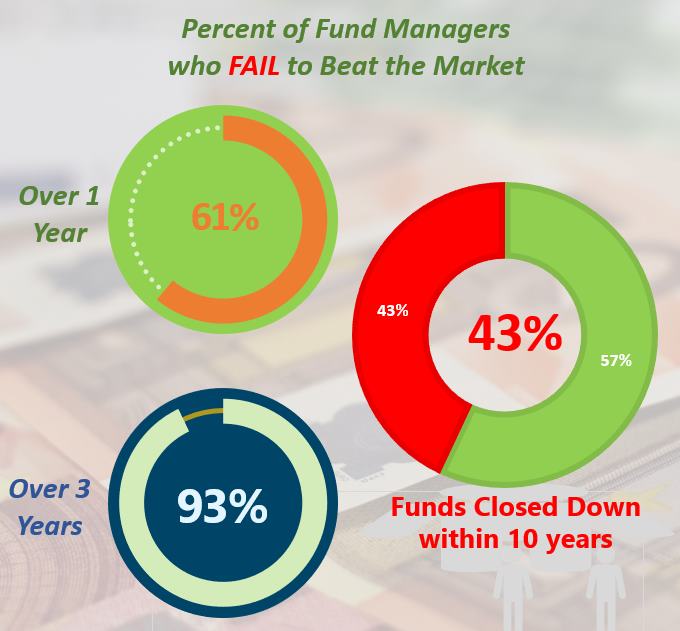

- Over 1 year, 60.49% of fund managers failed to beat the market index.

- Over 3 years, 92.91% of fund managers failed to beat the market index.

- Over 15 years, 82.23% of fund managers failed to beat the market index.

- 21.22% of actively managed funds are closed down after 5 years

- 42.87% of actively managed funds are closed down within ten years

As most mutual funds do not beat the underlying index and incur much higher costs than passive index-tracking funds, we can assume that at least 2% less compounding of your wealth will occur.

Mastering Value Investing: Our Complete Strategy Workbook +pdf

The Outlook for Value Investing

In spite of the recent performance, many experts believe that the phase of underperformance is merely a temporary setback. Some investors believe that we are in the early innings of value leadership, suggesting that value investing may regain its footing in the coming years.

The world of investing is evolving, and simply considering stocks as either growth or value may not be the most effective approach. As the market dynamics change, investors may need to rethink their investment style and strategies.

Summary

While the performance of value stocks has been trailing behind growth stocks in the recent past, it would be premature to declare value investing dead. With a long-term perspective and an understanding of market dynamics, value investing continues to be a viable strategy for many investors.

Value investing principles are still valid, but value investors need to change their strategies and use the power of modern stock screeners to find great value investments and great dividend investment strategies to generate income over the long term.

Sources:

I would agree with that Erik

I belie Value becomes more relevant when the market gets overpriced in general.