Optuma has been in the technical analysis market for three decades. They cater to individual investors and fund managers and are a big hit with their customers due to their innovation, original charting, robust technical analysis, and customer support.

Optima’s platform offers a wide range of tools, including advanced charting and drawing tools, backtesting capabilities, and market analysis.

Test Results & Ratings

My Optuma testing reveals a comprehensive market analysis platform developed for professional technical analysts in financial institutions that is also available to retail investors. Optuma specializes in exotic charts such as Gann, Seasonality, and Relative Rotation. Its main customers are financial institutions, and it has the pricing and support team to match.

| Optuma Rating | 4.1/5.0 |

|---|---|

| 💸 Pricing & Software | ★★★★✩ |

| 🚦 Trading | ★★★★✩ |

| 📡 Screening | ★★★★★ |

| 📰 News & Social | ★★★✩✩ |

| 📈 Charts & Analysis | ★★★★★ |

| 🔍 Backtesting | ★★★★✩ |

| 🖱 Usability | ★★★★✩ |

One of the key features that sets Optuma apart from its competitors is its proprietary scripting language, called the Optuma Script Language (OSL). This powerful tool allows users to create customized indicators and trading strategies to fit their specific needs. This level of customization gives traders a competitive edge in the market.

One of the key features that sets Optuma apart from its competitors is its proprietary scripting language, called the Optuma Script Language (OSL). This powerful tool allows users to create customized indicators and trading strategies to fit their specific needs. This level of customization gives traders a competitive edge in the market.

Pros

✔ Great Technical Analysis Charts

✔ Gann Charts & Seasonality Charts

✔ Good Broker Integration with Interactive Brokers

✔ High-Quality Quant Backtesting

✔ Point & Figure Charts

✔ Market Profile Charts

✔ Good Customer Satisfaction

✔ Professional Enterprise Services

Cons

✘ Separate Datafeed Required

✘ Pricing Targeting Professional Investors

✘ No Social

Key Features

| ⚡ Features | Powerful Charts, Real-time Data, Screening |

| 🏆 Unique Features | Gann, Seasonality, Astrological Charts |

| 🎯 Best for | Technical Analysts |

| ♲ Subscription | Monthly, Yearly |

| 💰 Price | $70-$225/mo |

| 💻 OS | PC |

| 🎮 Trial | 14-Day |

| 🌎 Region | Global |

Compared to its Rivals

When comparing Optuma, TrendSpider, TradingView, MetaStock, and Trade Ideas, our analysis reveals that TrendSpider stands out as the best overall stock analysis software, excelling in 10 out of 12 tests. With its powerful features for automated chart analysis, backtesting, and bot trading, TrendSpider emerges as our top recommendation for traders seeking advanced, reliable tools.

TradingView is better for a global trading community. Stock Rover is better than Optuma for long-term growth, dividend, and value investors. For AI-driven robotic day trading, Trade Ideas is better. For trading real-time news, Benzinga Pro is a better alternative.

| Features | Optuma | TrendSpider | TradingView | Trade Ideas | MetaStock |

| Rating | 4.1 | 4.8 | 4.7 | 4.6 | 4.4 |

| Pricing | $70-$225/m | $107/m or $48/m annually | Free | $13/m to $49/m annually | $254/m or $178/m annually | MetaStock R/T $100/m, Xenith $265/m |

| Global Market Data | ✔ | USA | ✔ | USA | ✔ |

| Powerful Charts | ✔ | ✔ | ✔ | ✘ | ✔ |

| Stocks | ✔ | ✔ | ✔ | ✔ | ✔ |

| Futures | ✔ | ✔ | ✔ | ✘ | ✔ |

| Forex | ✔ | ✔ | ✔ | ✘ | ✘ |

| Cryptocurrency | ✘ | ✔ | ✔ | ✘ | ✘ |

| Social Community | ✘ | ✘ | ✔ | ✔ | ✘ |

| Real-time News | ✘ | ✘ | ✘ | ✘ | ✔ |

| Screeners | ✔ | ✔ | ✔ | ✔ | ✔ |

| News Scanning | ✘ | ✔ | ✘ | ✘ | ✔ |

| Backtesting | ✔ | ✔ | ✔ | ✔ | ✔ |

| Code-Free Backtesting | ✘ | ✔ | ✘ | ✘ | ✘ |

| Automated Analysis | ✔ | ✔ | ✔ | ✔ | ✔ |

Pricing & Software

Optuma is at the top end when it comes to price. You will need a powerful PC to run it, but with IQFeed, GFT, and MT4 data integration, excellent customer services, and the full range of instruments covered (Stocks, EFTs, Mutual Funds, Options, Futures, FOREX, Bonds) for the premium price you get the premium package.

Optuma is a super slick technical analysis platform designed for professional technical analysts in the Financial Industry. However, it is also priced to appeal to individual investors and traders. Starting at a very reasonable $70/m for “Optuma Trader,” you will get the end-of-day data from 5 country groups, which is more than enough. Stepping up to “Optuma Enterprise” at $225/m adds many unique features like Market Intelligence Charts, Full Relative Rotation Graphs (RRG), 3D Charts, Regression Charts, and, importantly, Quantitative Signal Testing.

The team prides itself on first-class customer support, and its clients expect that level of service. Optuma runs natively on PCs and is also available on Tablets.

Trading

With Optuma connected to your Interactive Brokers account, you will get all the functionality you need to trade from charts and advanced portfolio tracking and measurement. You will need to open an Interactive Brokers account, but why not? Interactive Brokers are widely considered to be among the best and lowest-cost stock brokers out there.

Video Overview of Optuma

Scanning and Screening

As you can see from the price, Optuma is squarely aimed at professional traders and wealth managers. Their clients are tier-one Wall Street investment houses. But you can still take advantage of their first-class solution. If you have a Bloomberg feed already established, this also offers a new world of data and fundamental analytics. This slick integration of fundamentals into the charting and analysis means this is a significant improvement over a Bloomberg terminal and warrants it as a clear leader in this space.

You can build watchlists with fundamental data, and everything operates in real-time; advanced scanning includes an excellent 3-dimensional sector map.

A well-thought-out real-time scanning and filtering engine and the fundamental watchlists are well implemented.

My thorough testing awarded TradingView a stellar 4.8 stars!

With powerful stock chart analysis, pattern recognition, screening, backtesting, and a 20+ million user community, it’s a game-changer for traders.

Whether you're trading in the US or internationally, TradingView is my top pick for its unmatched features and ease of use.

Explore TradingView – Your Gateway to Smarter Trading!

News & Social

If you can afford or have a Bloomberg feed, you will get the top-end real-time market data you need. You can also publish and share ideas with your team or workgroup, allowing improved collaboration through chat functionality.

Charts & Indicators

Another perfect 10 for Optuma. It offers a fantastic array of technical indicators (400+) and drawing tools. Of course, there is a rich choice of chart types, including bar, line, and candlestick charts, but there are many more, such as point-and-figure charts.

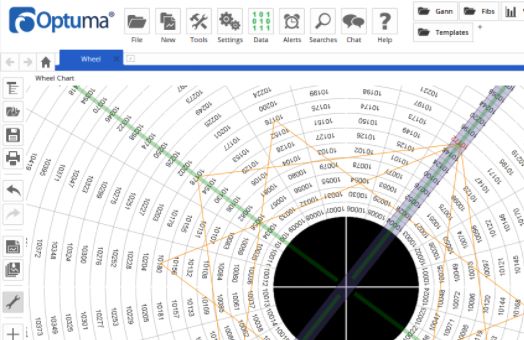

Optuma also specializes in Gann tools, including a full suite of them, including Gann Grid Lines, Gann Fans, Gann Swing, and even a square of nine charts.

They have the best selection of indicators on the markets, including Elliott Wave, Darvas Box, Ichimoku, and Parabolic SAR; the full set of exotic indicators is present.

To top it off, they have also implemented an excellent astrological analysis suite as an upgrade for those of you who believe in that sort of thing; yes, commodity traders, I am talking about you :).

Also, one nice charting benefit is the unique market depth in the price scale of charts.

Stock Systems & Backtesting

Optuma also covers backtesting well, with a well-implemented backtesting and system analysis toolset that is up there with the industry leaders. Still, unlike the others, you do not need a Ph.D. in mathematics to set up and test your system. The advanced programming language that connects all of Optuma is simple to use, and many detailed and helpful videos are available so you can also teach yourself. The code runs lightning-fast, and you can scan entire markets quickly and effectively.

The quality of the backtesting and advanced statistical analysis is because the CEO, Mathew Verdouw, and many development team members are certified Chartered Market Technicians (CMT) and Certified Financial Technicians (CFTe) like myself. So, the quality of the testing tools is first-class.

Ease Of Use

Optuma requires a High-End PC workstation to function at speed, but this should not be a problem if you are a serious trader. Also, Optuma is at home on touchscreen devices using multi-touch to allow you to manipulate charts intuitively.

The interface, the shortcuts, and the whole thought process implemented into Optuma warrant a good score in an important section. They also have an extensive video training library, which is valuable to the new customer.

Hello, and thanks for the review. I found this review as I googled “Optuma keeps crashing on me”.

I believe you are largely spot on and I am trying to make it a point that I will not need Bloomberg whatsoever as long as I have Optuma, and I think Optuma is very close to being able to do that for me if it wasn’t for a few interesting things I have encountered as a power user. I have such aspirations for this software, but it just can’t seem to get the little (but necessary) things right. It has tons of great bells and whistles and everything you could ever want or need (and more) when it comes to TA tools.

I have been an Optuma user for 2 years now, and am largely very happy with it. It has allowed me to do things I could never have done with other software. However, I find my frustrations are as much as my happiness as I have run into countless issues with the program bogging down, being slow, etc. You definitely need a high power pc to run it, as I indeed upgraded mine to a $3,000 laptop with a solid state drive and top of the line Nvidia graphics card after it would continuously crash my system after just a few weeks use/building out workbooks (before I even really learned how to write scripts in it). I still find to today the software crashes on me daily and there are at least 10 times in a day where it bogs down “importing some ticker” for 10-20 seconds to sometimes up to a minute in time. I have talked with the CEO about adding a feature that could help this (an x button to stop a background process, but it’s still not implemented yet).

I have recently been told I am simply, “asking too much of the program” and have deleted about 10 out of 75 sheets in the primary workbook I use to try to help. Of note, I have zero of the GANN functionality. One thing I notice, though, is my workbook is only 4Mb in size, so the reality of the issue is I am probably asking too much of the servers and/or my cache that is communicating with the servers, not too much of my own computer (but I am by no means a software/hardware guru). From what I understand, the software continuously pulls all data and historical data and does not save sany of it locally, even historical data, (as far as I know), so each and every day it goes and downloads the same data over and over and over again, which I believe could be a major reason why I have so many more system issues with Optuma than I ever did with Tradestation. All I know is I continue to run into at least some issue each and every day.

In the aggregate the issues are an absolute killer in productivity and heightened frustration offset by the positive productivity all of the other great features it provides me (many of which you discuss).

I believe a part of the reason is also the 3rd party real time data feeds (I use DTN) as I haven’t had it crash on me after hours (albeit I don’t use it that much after hours). I come from the world of Tradestation where I would have 10s to 100s of tabs open in the program at once and never have an issue with them bogging down my computer (a much slower computer at that). I also paid Tradestation for the data, not a 3rd party, so it ran directly from them to my computer. It seems this difference may be significant with Optuma because of the way they source their data (all a hunch of mine admittedly).

On the plus side I have gotten quick and tons of great back and forths with support who are always quickly turning around requests. It helps that half of them are in Australia with the other half on this side of the world. They really do try to help you when you are having issues.

This program could be the end all be all for technical analysts and quants if they could just figure out a few of these known issues.

Also, if I had to say something else that is lacking (and you point out with Bloomberg a lot of this is solved), but without bloomie the portfolio management piece leaves a lot to be desired. There’s not an easy way to see each day how the portfolio did (with weights, etc). You can only get close using averages and medians across watch lists. It would be nice if it also integrated with other APIs, such as Koyfin or Yahoo Finance or even our custodians to update account values, watch lists, etc seamlessly. Finally a ticker bar is something that would be amazing (which TStation had), but supposedly can’t be done in Optuma. There’s also no trading integration (except maybe Bloomberg), so not sure how I could give it 4 out of 5 stars for that.

The headline to my post would be: “Optuma could be so frickin awesome it kills me, if it could just get out of its own way!” I’d probably give it 4/5 with some 2s and 3s on news, ease of use and 5/5 on the backtesting as you get plenty of good quick results that you can also export to excel to add analysis around.

Hi Chad, this is great feedback, and I am sure it will help other technical analysts and professionals make a better decision.

thank you

Bary

Hi Barry,

I wanted to jump in on this one. It turns out that Chad’s workbook was one of the most complex which we have ever seen at Optuma. The real issue came down the flexibility of the Watchlists which allowed for multiple columns of complex calculations across the whole S&P with real-time data. A calculation which takes 100ms is not an issue when it is a tool on a chart – but when it is repeated around 6,000 times in a watchlist (multiple columns for 500 securities) it becomes a real issue. We are really grateful for Chad because working with him on this allowed us to repeat the issue and make Optuma handle even these extreme cases.

From the start I have always designed Optuma to be as flexible as possible. The issue with that is that we can not possibly test everything that a user will do with the software. That’s why we really do appreciate clients like Chad who are willing to work with us so we can make sure that Optuma meets their specific requirements. In Chad’s case, the delay was my fault as I needed to be involved but I was not able to spend the time looking into the issue. Our understanding is that the stability issues for Chad have been resolved in Optuma 1.5 and hopefully he will add an update here to confirm.

Our goal is always to build a premium Technical and Quantitative analysis program. One of our largest sources of inspiration comes from listening to client requests. While we would love to implement everything requested, we do have to review each request in light of the following criteria:

– How hard is it to implement (what will it cost us)

– Does it fit with the direction we are taking Optuma

– How many clients are asking for this feature

– Is there an alternative solution

Trading interfaces is a prime example. While we have built them in for some of our retail feeds (like Interactive Brokers) we hove not bothered for the Institutional Feeds (as mentioned by Chad). It would take an enormous effort to interface with the various platforms and there are not enough clients using any one platform to make it worthwhile. News is another case. There are so many good news services that we do not see the value in integrating news into the charting platform (although we do have a horrible News chart for IQFeed as a test). Portfolio Interfaces is another matter and that is something we are working on as our resources allow.

We’ve also been starting to ask clients to leave feedback on Optuma at https://au.trustpilot.com/review/optuma.com

All the best

Mathew Verdouw, CMT, CFTe

CEO / Founder

Optuma

Hi Mathew, thank for taking the time to provide such detailed feedback, I appreciate it.

Barry