The rising wedge pattern chart pattern is used in technical analysis to signal a potential trend reversal.

It is formed by connecting the highs and lows of a price movement with two converging trend lines, creating a wedge shape.

According to multi-year testing, the rising wedge pattern has an 81% success rate in bull markets and an average potential profit of +38%. The ascending wedge is a reliable, accurate pattern that, if used correctly, gives you an edge in trading.

I will show you how to identify and trade the rising wedge pattern to help you succeed.

Key Takeaways

- The rising wedge has a reliability of 81% in testing 1.

- The pattern breakout is bearish 60% of the time.

- The pattern is more reliable if the wedge is in an uptrend.

- The target of a rising wedge breakout can be calculated by adding the height of the wedge’s widest apex to the breakout zone.

What Is a Rising Wedge Chart Pattern?

A rising wedge is a powerful technical analysis pattern with a predictive accuracy of 81%. The pattern can break out up or down but is primarily considered bearish. The rising wedge is formed when a stock’s price rises, but instead of continuing its upward trajectory, it contracts as the trading range tightens. This contraction is reflected in the slope of two rising and converging trend lines plotted above and below the price action.

Traders should be cautious when they see the rising wedge form. As the price action continues to rise, the trading range tightens, indicating less buying pressure pushing the stock upward. The result is that prices begin to decline as profit-taking starts to outpace new buyers.

A rising wedge has two inclining trendlines that connect a series of higher highs and lows. Depending on the direction of the price breakout, a rising wedge can be bearish or bullish or a reversal or continuation pattern.

We know chart patterns’ success rates and profitability because Tom Bulkowski, the author of The Encyclopedia of Chart Patterns, has spent decades researching patterns. I thank Tom for his permission to use a few of his valuable insights.

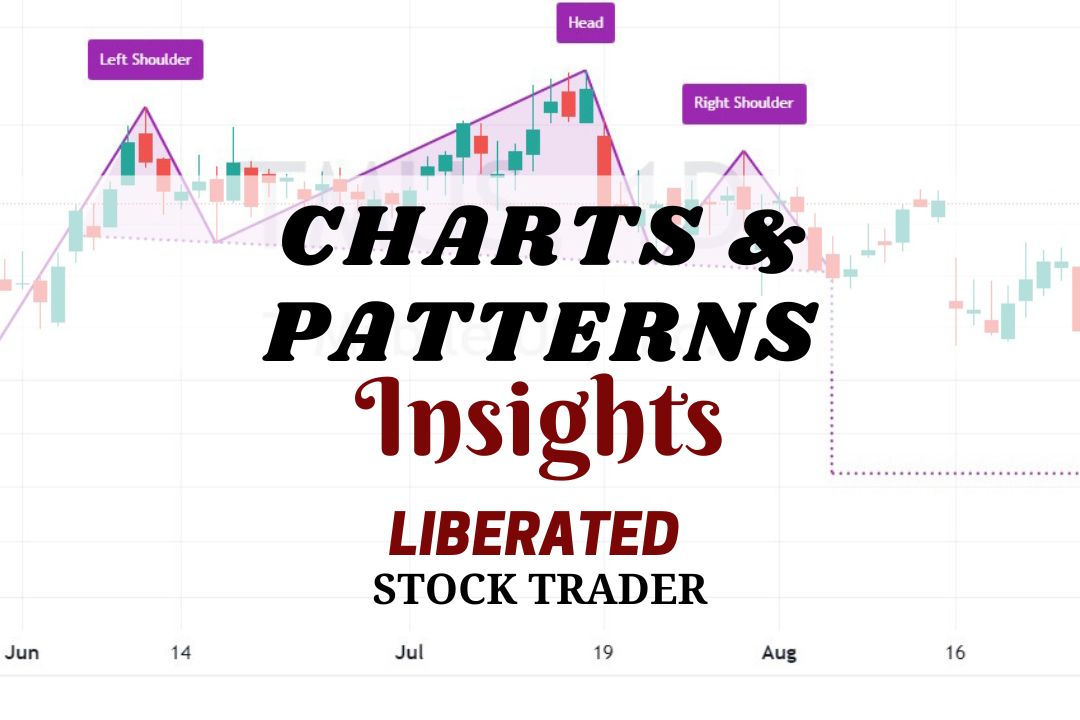

TradingView’s powerful pattern recognition algorithms have autodetected this rising wedge pattern. TradingView detected the pattern and set a price target equal to the length of the wedge’s apex. Once the target was achieved, it was flagged green.

Auto-detect this Chart Pattern with TradingView

What the Rising Wedge Indicates

The rising wedge chart pattern occurs when buyers are in control. As sellers become more active, supply starts to outstrip demand, and eventually, a downside breakout occurs, forcing an aggressive price decline averaging 9%. The rising wedge is a reliably bearish signal, as buyers cannot sustain the uptrend.

How Reliable is a Rising Wedge Pattern?

A rising wedge is very reliable, with an 81% success rate on an upside breakout of an existing uptrend. When the price breaks through resistance, it has an average 38% price increase. Following a downtrend, the pattern is 51% successful, with an average price decrease of 9%.

| Chart Pattern | Success Rate | Average Price Change |

| Rising Wedge | 81% | +38% |

It should be noted that this pattern does not guarantee a profit.

How to Identify a Rising Wedge?

A rising wedge is identified by two converging inclining trendlines on a chart. The upper trendline represents the resistance, while the lower line represents support. As the price moves up and down between these lines, it creates a wedge pattern as price volatility decreases.

When the price breaks above or below one of these lines, it indicates that either bullish or bearish momentum is gaining strength. Investors should watch for a break above the upper trendline to enter long positions and look for a break below the lower trendline to enter short positions.

My thorough testing awarded TradingView a stellar 4.8 stars!

With powerful stock chart analysis, pattern recognition, screening, backtesting, and a 20+ million user community, it’s a game-changer for traders.

Whether you're trading in the US or internationally, TradingView is my top pick for its unmatched features and ease of use.

Explore TradingView – Your Gateway to Smarter Trading!

It is important to note that rising wedges can be either continuation or reversal patterns, depending on the direction of the prior trend. If the market was in an uptrend before the wedge formed, then a break above the upper trendline is likely to lead to prices continuing in the direction of the prior trend. Similarly, if the market was in a downtrend before forming a rising wedge, then a break below the lower trendline could signal a continuation.

ExampleChart : 4 Rising Wedges

This Abbot Laboratories (ABT) chart shows four rising wedges with plotted price targets. Notice how the first rising wedge fails to meet its price target. The next three hit their downside target. All four rising wedges developed during a bear market, signaling a continuation of the trend.

How to Draw a Rising Wedge?

There are two simple steps for drawing the rising wedge to prepare for the trade. (See the chart below)

- Draw the rising resistance trendline joining the price highs

- Draw the rising support trendline connecting the higher lows

If the security price breaks out above the wedge resistance, especially with volume increases, it signals a possible 81% chance of going higher. Generally, the pattern should be visible on an intraday or daily chart. After identifying the wedge, we must measure and set a price target.

Trading a Rising Wedge

A rising wedge chart pattern generally signals a bearish reversal when the price breaks out of the wedge. A trader that finds a clear ascending wedge formation should prepare for a potential short trade.

When trading a rising wedge, it is important to set your stop loss inside the wedge pattern and adjust your target level based on the breakdown size. You can expect a target of 50% up to 100% of the distance from the entry point to the wedge resistance line.

Auto-detect this Chart Pattern with TradingView

Traders should pay attention to volume when trading a rising wedge chart pattern. Lower volume during the rising wedge formation confirms the impending trend reversal in this setup. In the above chart, both wedges display decreasing volume during formation.

Entry and Exit Points

The entry point for a rising wedge pattern is at the price breakout of the wedge, either up or down. Traders should place a stop-loss order below or above the breakout to protect against potential losses. The exit point can be determined by placing an initial target at 50% of the wedge’s height. (See Chart Above)

It is also important to remember that rising wedges can fail at a rate of 19%, and traders should always have an exit strategy in case of a failed pattern. Furthermore, managing risk during any trade is essential, as the potential for loss is still real.

Setting a Price Target

If the distance from the wedge’s starting apex is 10%, the logical price target should be 10% above or below the breakout. It is calculated by adding the pattern’s starting height to the breakout point. This gives traders a good indication of where to expect prices to move following a successful breakout. Once the rising wedge breakout is confirmed, traders should set their stop-loss order inside the wedge. For clarification, see the above charts Measure = Target annotations.

Pattern Timeframe

Ascending wedges can form on any chart timeframe and occur frequently during bear markets. This makes the rising wedge a great pattern for all short-sellers. However, the pattern is most reliable when it forms over a longer time frame. It’s important to note that rising wedges can also form in uptrends and are considered reversal patterns. The price action after the breakout should be opposite to what was happening before the wedge’s formation.

It is important to consider volume as an additional indicator when attempting to identify and trade the rising wedge pattern.

What Happens After a Rising Wedge Forms?

Two decades of research by Tom Bulkowski show that after a rising wedge pattern is confirmed on a break of either the support or resistance line on higher volume, the price increase averages +38%.

Once the rising wedge pattern is confirmed, traders should consider opening a long or short position depending on the direction of the price move.

What Happens with a Failed Rising Wedge Pattern?

A rising wedge in a bull market fails 17% of the time. When a rising wedge pattern fails, the stock price fails to achieve the price target or reverses back to the breakout zone. At this point, you should exit your trade.

A Rising Wedge Pattern in a Downtrend

The rising wedge often forms within an existing bear market. This is usually a short-term sign of strength during market weakness. Traders should be aware that this pattern may provide false signals, as it does not guarantee that the trend will continue, and prices could reverse at any time.

Automatically Identify Rising Wedges

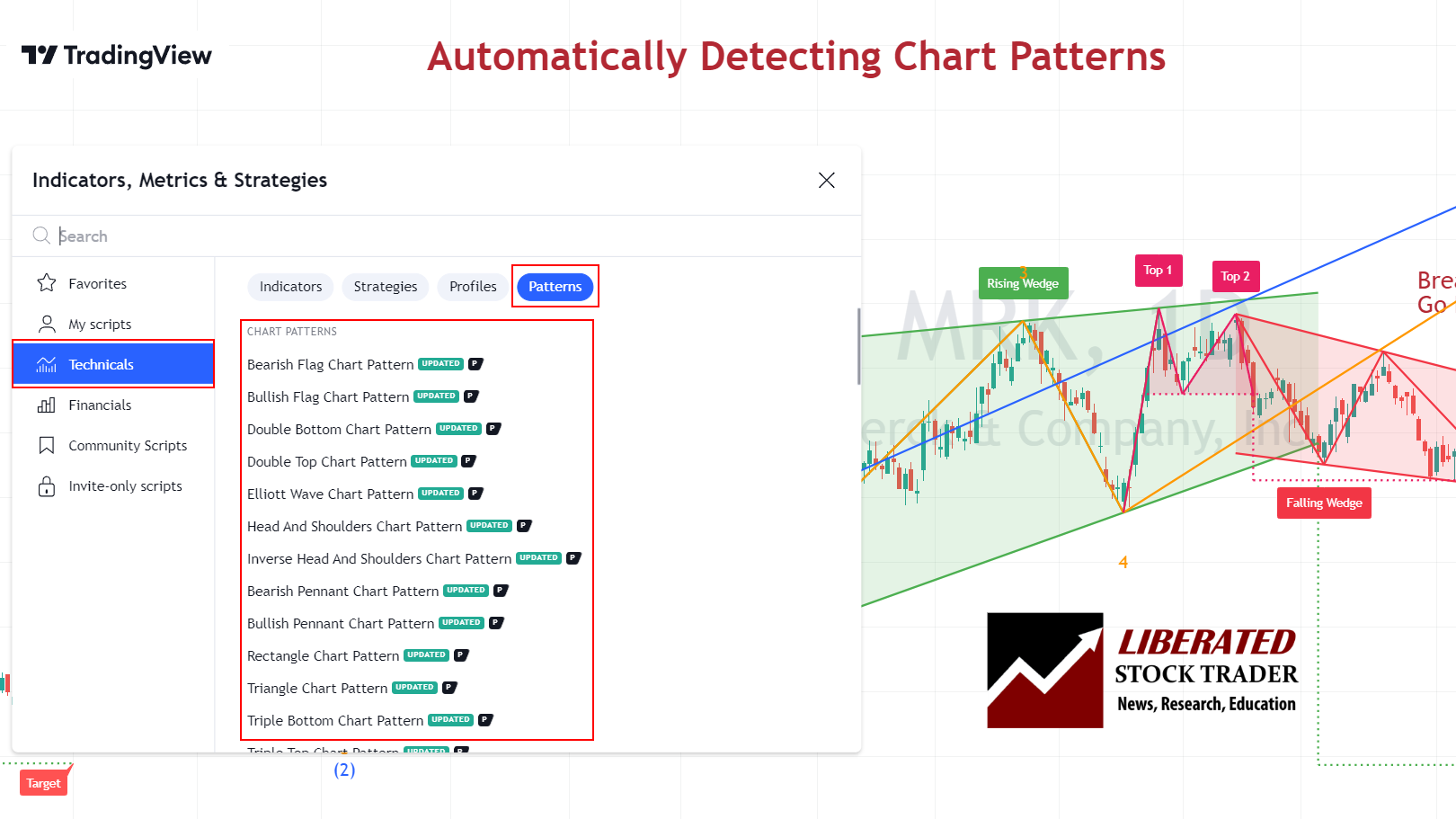

You can automatically identify rising wedge patterns using TradingView. Go to TradingView and click Indicators > Technicals > Patterns. Next, select the “Rising Wedge” chart pattern. Now, a chart with a rising wedge pattern will be clearly marked.

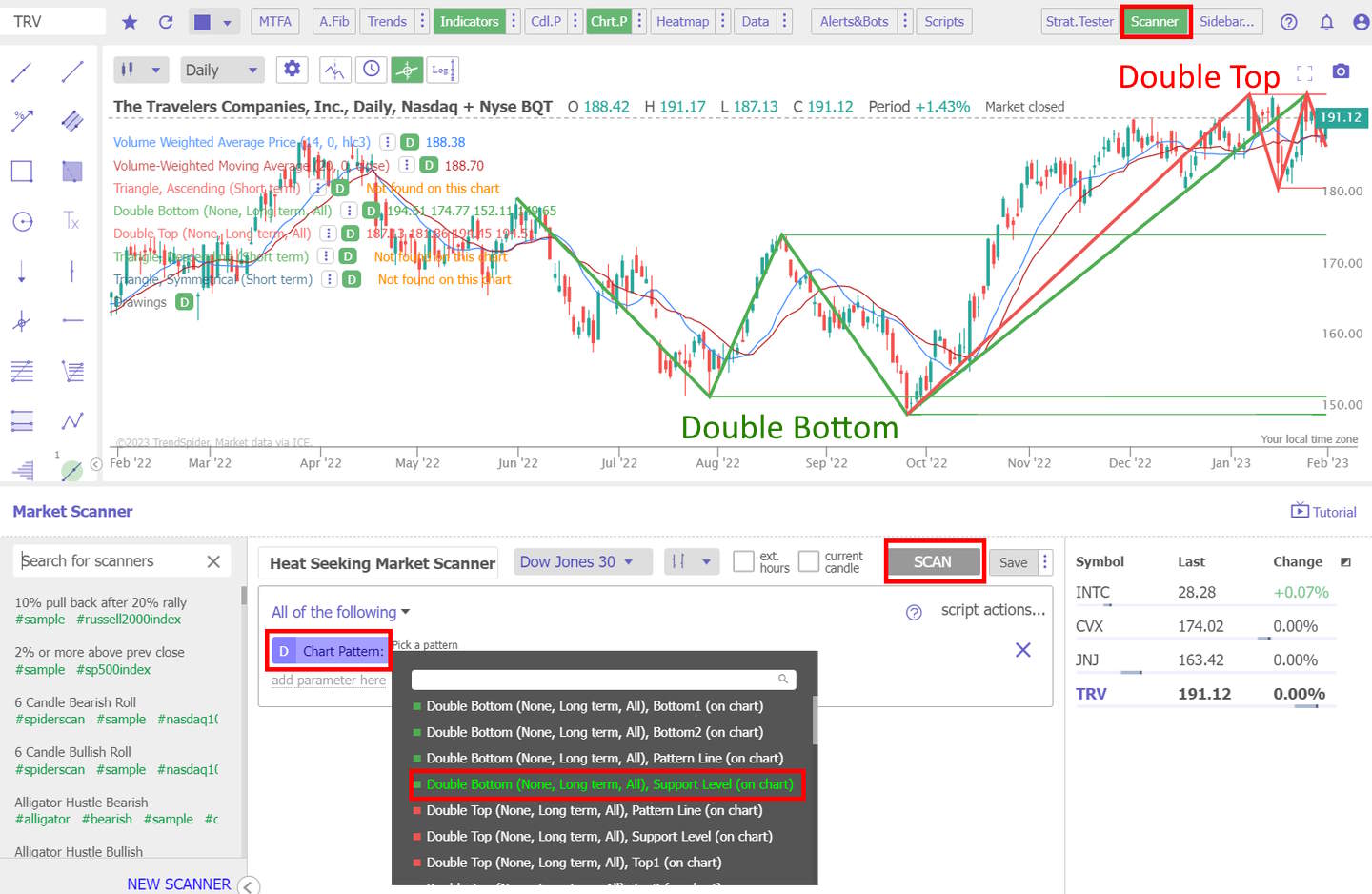

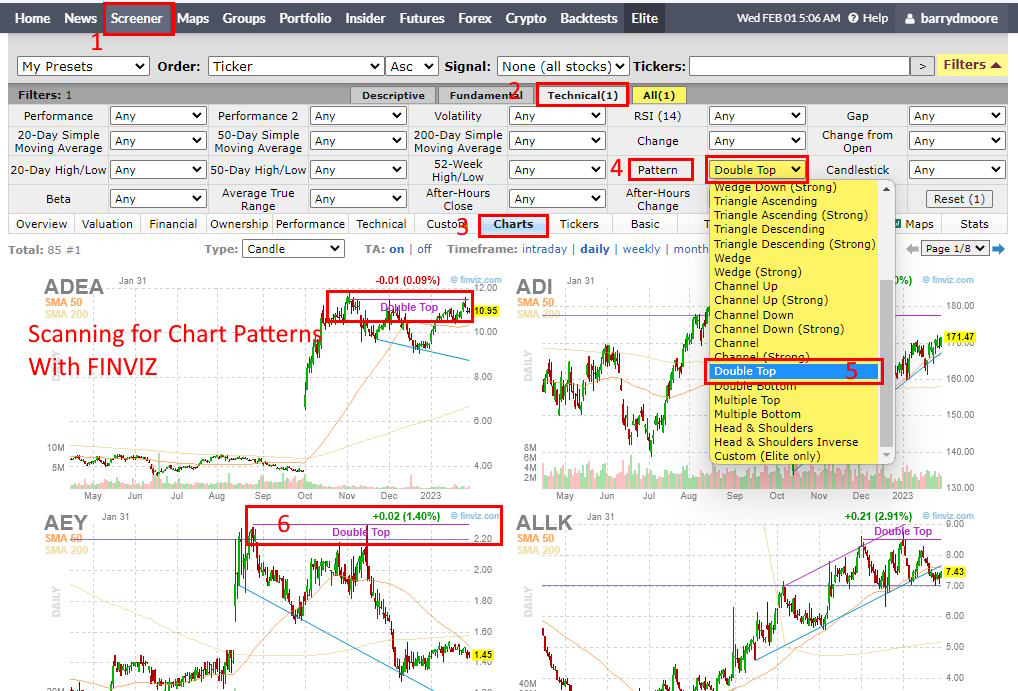

Rising Wedge Pattern Scanners

There are currently two trading platforms offering rising wedge scanning and screening. TrendSpider and FinViz enable complete market scanning for rising wedges. Finviz is a good free pattern scanner, whereas TrendSpider enables full backtesting, scanning, and strategy testing for chart patterns.

TrendSpider Pattern Scanning in Action

Scanning for rising wedge patterns with TrendSpider is easy. Visit TrendSpider, select Market Scanner > All of the Following >Chart Pattern > Wedge, Rising > Scan, and you will be presented with a list of stocks with rising wedge patterns.

Scan for this Chart Pattern with TrendSpider

Using AI-Driven Pattern Scanning

One of the major benefits of using AI-driven technical analysis tools like TrendSpider is the ability to backtest historical data. This allows traders to compare the performance of their strategy over different periods and markets. With TrendSpider, you can go back in time to find stocks exhibiting rising wedge patterns and then use the platform’s advanced analytics tools to analyze how effective this pattern was for trading at any given time. TrendSpider’s AI-driven algorithms also help traders identify the most reliable entry and exit points for rising wedge patterns.

By combining AI-driven technical analysis with traditional charting methods, TrendSpider helps traders take full advantage of market opportunities presented by the rising wedge pattern. With features such as automated alerts, backtesting, and real-time market data, you can quickly spot and take advantage of rising wedge patterns as they emerge.

How to Find Rising Wedge Pattern Stocks

FinViz has a great feature for scanning for rising wedge patterns. By selecting “Wedge Up” as your scan criteria, you can easily find stocks exhibiting this pattern. This is especially useful to traders who want to monitor potential trading opportunities.

Scan for this Chart Pattern with FinViz

The first step to finding stocks with potential rising wedge patterns is to select a set of criteria. FinViz offers a range of pre-defined filters and sorting options, enabling traders to quickly narrow their search by sector, industry, market capitalization, and more. After selecting the desired criteria, traders can apply the filter to the Finviz screener.

FAQ

How accurate is a rising wedge pattern?

Descending wedge patterns are 81 percent accurate as an uptrend continuation pattern in a bull market. The accuracy changes if in a bear market and if the pattern acts as a continuation or a reversal pattern. Consult Tom Bulkowski's book, The Encyclopedia of Chart Patterns, for details.

Is a rising wedge bullish?

According to research, a rising wedge is 60% bearish and 40% bullish. It acts as a bearish pattern when it occurs in a market during a price downtrend. When formed in an uptrend during a bull market, it can be either bullish or bearish, depending on how the price responds when exiting the pattern.

How do you trade rising wedges?

The best risk-reward for the ascending pattern is a bullish play. According to testing, an upward breakout of the wedge increases on average 38 percent, versus a downward break which only averages -9 percent.

Can a rising wedge be bearish?

Yes, according to studies, a rising wedge is bearish 60% of the time. This also means that it has a 40% chance of being bullish. Traders should watch how the stock responds when it reaches resistance and the direction it breaks out above or below the wedge.

Is a rising wedge good or bad?

A rising wedge is generally good for bearish short-sellers 60% of the time, generating a 9% profit. It is also good for long traders because the pattern is bullish 40% of the time, which nets an average of 38% profit.

What is the success rate of a rising wedge?

According to Tom Bulkowski's research, the success rate of a rising wedge is an 81 percent chance of a 38 percent price increase in a bull market on a continuation of an uptrend.

How do you target stop losses in ascending wedge patterns?

Traders should set the approximate target stop loss level in a rising wedge at the point below the breakout of the wedge. The exact percentage stop loss depends on the price target expectations and the timeframe.

What are the benefits of trading rising wedges?

The benefits of trading rising wedges include predicting when a trend is about to reverse. The success rate for rising wedges can be quite high, with research reporting up to a 60% chance of generating at least a 9% profit on the short side.

What are the risks of trading a rising wedge?

The main risk of trading rising wedges is that they can be difficult to predict precisely. A trader may incur losses due to incorrect stop-loss placement if the wedge breaks out and reverses. This pattern has a 72% throwback rate, meaning a pattern failure after the breakout.

Do rising wedges fail?

Ascending wedges fail approximately 19% of the time during a bull market. But even when a wedge has a successful breakout, there is always a 72% chance of a pullback before the pattern hits its target. This can force traders out of an otherwise successful trade.

What is the psychology behind rising wedges?

The psychology behind rising wedges is that the bulls are trying to break out of a price range they have been stuck in. This can lead to traders pushing prices higher even though the underlying fundamentals may not support it. Rising wedges symbolize a state of indecision in the market. Buyers and sellers battle back and forth until they reach a point where one side gains control and breaks the pattern with a new direction.

How reliable is a rising wedge pattern?

The rising wedge pattern is a reliable chart indicator, with success rates of 81 percent during a bull market on an upward breakout. During a downtrend, the pattern is 60% reliable.

Do rising wedges hold?

Yes, rising wedge patterns hold 81 percent of the time, according to decades of research compiled by Tom Bulkowski in his book The Encyclopedia of Chart Patterns.

How to identify rising wedges?

Rising wedge patterns can be identified automatically with TradingView or TrendSpider. Alternatively, you can manually identify it by looking for a pattern with two rising trendlines that converge at the apex.

How to measure a rising wedge pattern?

TradingView can automatically measure a rising wedge pattern and set a price target. Alternatively, to measure manually, use an arithmetic chart and plot the distance between the wedge's broadest points. This distance will be the future price target you should plot on the chart's pattern breakout.

What is the failure rate of the rising wedge?

Rising wedges have a failure rate of 19 percent based on 1,400 trades conducted by Tom Bulkowski over multiple years and documented in his book The Encyclopedia of Chart Patterns.

How many waves are in a rising wedge?

Testing shows that there should be at least five waves in a rising wedge pattern, meaning that the price should touch the inside of the wedge five times.

What invalidates a rising wedge pattern?

A rising wedge pattern can be invalidated if the price goes sideways instead of continuing to trend upwards. Additionally, the wedge is invalidated if the price breaks higher and lower than the wedge trendlines due to volatility.

Learn the Success Rates of 65 Chart Patterns

The Encyclopedia of Chart Patterns by Tom Bulkowski details the reliability and success rates of 65 chart patterns and shows you how to trade them. It is an indispensable resource for traders and investors looking to increase their profitability by taking advantage of stock chart patterns. This comprehensive reference book contains in-depth explanations and detailed illustrations of more than 65 different patterns, including Head and Shoulders, Double Tops, Wedges, Flags, Gaps, and more.