Many gamers and investors want to own a piece of Rockstar Games because the company makes and markets Grand Theft Auto and Red Dead Redemption 2, both popular and fast-growing gaming franchises.

Parents are interested in buying Rockstar Games stock because they see how much time and money their kids spend on Grand Theft Auto and Red Dead Redemption 2.

But is investing in Rockstar Games actually a sound financial decision? Let’s take a closer look at the company and its stock performance.

Rockstar Games Stock

You can buy Rockstar Games stock by purchasing shares in Take-Two Interactive. You cannot buy Rockstar Games stock directly because Rockstar is one of 17 individual companies that are wholly owned subsidiaries of Take-Two Interactive Software Inc.

Take-Two Interactive Software Inc., based in New York City, has 99 subsidiary companies incorporated in North America, Europe, and Asia.

See the Rockstar Games (TTWO) Chart Live

Note: This is an unbiased research report. The author or Liberated Stock Trader is not affiliated, paid by, or owns stock in any of the companies mentioned in this report.

My thorough testing awarded TradingView a stellar 4.8 stars!

With powerful stock chart analysis, pattern recognition, screening, backtesting, and a 20+ million user community, it’s a game-changer for traders.

Whether you're trading in the US or internationally, TradingView is my top pick for its unmatched features and ease of use.

Explore TradingView – Your Gateway to Smarter Trading!

Rockstar Stock

You can buy stock in Rockstar, the makers of Grand Theft Auto, by buying TTWO shares. Grand Theft Auto V is one of the critically acclaimed and commercially successful video games of all time, with 145 million copies sold, according to the TTWO financial reports.

Rockstar Games sold over 400 million Grand Theft Auto games between 1997 and today.

Who owns Rockstar Games?

Take Two Interactive Software Inc. (TTWO) is the current owner of Rockstar Games. TTWO is a leading games developer and publishing house that owns 2K games.

Rockstar Games Stock Symbol (TTWO)

The stock ticker symbol for Rockstar Games, the publisher of Grand Theft Auto, is TTWO, representing Take Two Interactive Software Inc., commonly known as Take2Games. Take2 trades on the NASDAQ stock exchange as TTWO.

Take2Games is the parent company that owns Rockstar Games, 2K, Socialpoint, Ghost Story, Private Division, and other game publishers.

Rockstar Stock Price

Rockstar/Take-Two Interactive’s stock price has risen 380% in the last five years. This values Take2 at $20 billion, compared to its current stock price of around $170.

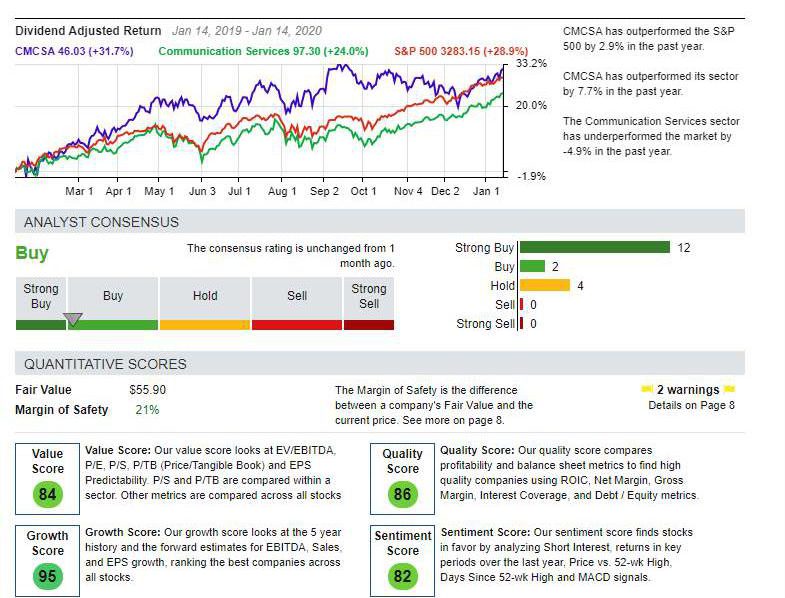

According to Stock Rover, Take-Two Interactive is overvalued because its current margin of safety is -17 %. The Margin of Safety is the calculation investors use to value a company based on its forward discounted cash flow. This means that investors may be overpaying for Rockstar stock.

Take2 generates cash flow from Massive Multiplayer Online Games (MMOGs) like Blizzard Activision and Tencent Holdings. MMOGs, such as Fortnite and League of Legends, make money because thousands pay to play them daily.

However, the SocialPoint and Nordeus mobile games could earn money from subscriptions. Rockstar Games and 2K can build MMOGs of popular games such as Red Dead Redemption and Grand Theft Auto.

Today’s market provides many excellent alternatives to Take2 Interactive.

3 Alternative Investments to Rockstar/Take 2 Stock

1. Microsoft Corporation (MSFT)

Microsoft is one of the world’s largest gaming companies and the world’s biggest and most famous software company. Microsoft is the fourth-largest gaming company globally, with $11.6 billion in gaming revenues.

Microsoft recently purchased Activision Blizzard in a high-profile takeover. This acquisition makes Microsoft the owner of popular game franchises such as Call of Duty, World of Warcraft, and Candy Crush.

The purchase of Activision Blizzard solidifies Microsoft’s position in the gaming industry and further diversifies its revenue streams. Owning some of the most successful titles in the market also gives Microsoft a competitive advantage over other gaming companies.

View the Microsoft Chart Live on Trendspider

The popular Xbox game consoles make Microsoft a major player in gaming.

Download a Free Microsoft Stock Research Report From Stock Rover

Microsoft’s gaming division has been steadily growing, largely due to the success of its Xbox Game Pass subscription service, which offers access to a wide selection of games for a monthly fee.

With the addition of Activision Blizzard’s game library and resources, Microsoft is poised to further expand its gaming offerings and potentially attract even more subscribers. This could lead to continued growth and increased profitability for the company.

On the financial side, the acquisition may also bring some potential challenges for Microsoft. The hefty price tag of $68.7 billion could put pressure on the company’s already high levels of debt. Additionally, integrating such a large company into Microsoft’s operations will require careful planning and execution.

2. Sony Group Corp (SONY)

Sony is the largest gaming company on Earth, with $25 billion in gaming revenue in 2020. Sony manufactures and markets the world’s most popular next-gen video game console: the PlayStation 5.

Sony trades on the New York Stock Exchange as SONY, although the company is based in Tokyo. Sony’s American deposit slips trade on the NYSE as SNE.

Sony makes enormous amounts of money.

View the Sony Stock Chart Live

Sony is growing. Sony’s success can be attributed to its strong brand recognition and loyal fan base. The PlayStation has become a household name and Sony consistently delivers high-quality gaming experiences that keep gamers coming back for more.

However, like Microsoft, Sony also faces risks in the highly competitive gaming industry. With new players such as Google Stadia and Amazon Luna entering the market, Sony must continuously innovate and adapt in order to stay ahead.

In addition, Sony’s reliance on gaming revenues makes it vulnerable to any downturns or changes in consumer spending habits. This was evident during the COVID-19 pandemic, when production delays and supply chain disruptions affected the release of

3. Tencent Holdings ADR (TCEHY)

The publicly traded Chinese company Tencent Holdings ADR (OTCMKTS: TCEHY) owns WeChat or Weixin. WeChat is the world’s fifth-largest social media solution. WeChat accounts for 30% of mobile internet use in the People’s Republic of China.

Tencent Holdings Limited, the Chinese multinational conglomerate, has been active in the news, with several recent developments affecting its business.

Tencent has seen positive developments in gaming with China’s approval of new games, a key area for the company’s revenue. The Chinese regulators granted publishing licenses to 44 foreign games, including titles from Tencent, signaling an easing of the freeze on game approvals that had impacted the industry.

Furthermore, Tencent is diversifying its business model and exploring new revenue streams. The company’s cloud services division slashed prices by up to 40% in an intense price war, aiming to capture a larger market share in China’s competitive cloud computing industry.

These moves reflect Tencent’s strategic adjustments to navigate regulatory pressures, focus on profitability, and leverage growth opportunities in its diverse portfolio of businesses. Investors and industry analysts closely watch the company’s actions as indicators of broader trends in the Chinese tech sector.

Invest in yourself! Get all our courses & strategies for 50% off

★ Liberated Stock Trader Pro Stock Investing & Trading Course ★

★ M.O.S.E.S. Market Outperforming ETF Strategy ★

★ LST Beat the Market Stock Picking Strategy ★

★ Exclusive Bonus Course – The Stock Market Crash Detector Strategy ★

★ Fully Guided Videos, eBooks & Lifetime Email Support ★

★ 108 Videos + 3 Full eBooks + 5 Scripts for TradingView & Stock Rover ★

Take2 Games (Rockstar Stock)

Take2 Games has one of the most impressive game catalogs in the industry. In terms of revenue, Take2 Interactive is the eighth-largest gaming company in the world.

Take2 sold over 70 million copies of its Red Dead Redemption and Red Dead Redemption 2.

2K publishes high-profile games, including Marvel’s Midnight Suns, which stars the Marvel Superheroes. 2K partners with Disney (DIS) subsidiary Marvel Entertainment to make superhero games.

2K also develops games for the National Basketball Association (NBA) and World Wrestling Entertainment (WWE).

Rockstar & Grand Theft Auto VI

Recently, Rockstar Games, a subsidiary of Take-Two Interactive, made headlines by announcing the upcoming release of Grand Theft Auto VI, slated for launch in 2025. The announcement came after an accidental trailer leak, but it excited gamers and investors.

See the Rockstar Games (TTWO) Chart Live on TradingView

This announcement is significant as the Grand Theft Auto series is one of the most successful video game franchises in history, and a new installment is highly anticipated by fans and investors alike.

The reveal of Grand Theft Auto VI has substantial implications for Take-Two Interactive. From a financial perspective, new entries in major franchises typically drive large revenue streams for video game publishers, given their high sales potential. A new Grand Theft Auto game could significantly boost Take-Two’s earnings upon release and subsequent quarters through game sales and potentially through recurrent consumer spending in online modes.

Latest Take-Two-Interactive News

In 2024, Take-Two Interactive has reported several significant financial updates:

- Earnings Reports: Take-Two Interactive announced its financial results for the first quarter of fiscal year 2024, highlighting a 20% increase in total net bookings, reaching $1.20 billion compared to $1.00 billion in the same period the previous year. This growth reflects the company’s strong performance and popular game releases.

- Adjusted Earnings Expectations: For the current quarter ending September 30, 2024, Take-Two expects to earn an adjusted 40 cents per share on net bookings of $1.45 billion. This forecast indicates confidence in their upcoming titles and ongoing sales momentum.

- Revenue Performance: In the fourth quarter of fiscal year 2023, Take-Two reported net revenue of $1.40 billion, which was slightly down 3% year-over-year but still surpassed estimates of $1.30 billion. This performance showcases the company’s resilience in a competitive gaming market.

- Financial Challenges: Despite the positive growth, Take-Two faced challenges, including a reported loss of $22.01 per share in fiscal 2023, compared to a profit of $5.09 per share in fiscal 2021. This decline underscores the shifting dynamics in the gaming industry and the impact of various market factors.

- Upcoming Releases: The company continues to build anticipation for future game releases, which are expected to drive further revenue growth. Take-Two’s portfolio includes several high-profile franchises, which are critical to its long-term financial strategy.

These updates indicate that Take-Two Interactive is navigating a complex financial landscape while maintaining a focus on growth and strategic planning for future game releases.

Should You Invest in Rockstar or Take 2 Interactive?

If Take2 is to grow and survive, it will need to invest heavily in MMOGs and other subscription games. Subscription-based multiplayer platforms are the future of gaming.

Despite that, Take2’s value is growing. The problem is that the growth is not generating more revenue at Take2.

Take2 stock might be a poor investment because it pays no dividends, and the stock price can underperform the S&P 500, according to Stock Rover. Investors who want to make money need to seek alternatives to Take2.

Beat The Market, Avoid Crashes & Lower Your Risks

Nobody wants to see their hard-earned money disappear in a stock market crash.

Over the past century, the US stock market has had 6 major crashes that have caused investors to lose trillions of dollars.

The MOSES Index ETF Investing Strategy will help you minimize the impact of major stock market crashes. MOSES will alert you before the next crash happens so you can protect your portfolio. You will also know when the bear market is over and the new rally begins so you can start investing again.

MOSES Helps You Secure & Grow Your Biggest Investments

★ 3 Index ETF Strategies ★

★ Outperforms the NASDAQ 100, S&P500 & Russell 3000 ★

★ Beats the DAX, CAC40 & EURO STOXX Indices ★

★ Buy & Sell Signals Generated ★

MOSES Helps You Sleep Better At Night Knowing You Are Prepared For Future Disasters

Summary

The market offers excellent alternatives to Take2 Interactive for those who want value game investments. I do not consider Take2 a value investment in gaming, but I think Sony, Microsoft, and Activision Blizzard are good investments.