Scanz is designed to enable day traders of all experience levels to scan the entire stock market for short-term trading opportunities.

With real-time news and level I/II exchange data, it is worth considering as a tool of choice.

I recommended Scanz for day traders who want a simple and slick workflow, real-time streaming charts, news, unique level II data, dollar volume information, and broker integration.

With their slogan “Scan It, Find It, Profit,” Scanz is considered a feature-rich tool for day traders. However, with the advent of TradingView, the largest trading community platform, Scanz has fierce competition.

Test Results & Ratings

I think Scanz is worth it for day traders who need real-time news events, LII data, and dollar volume surge data. Scanz is a solid, reliable stock market scanning software that is worth trying.

| Scanz Rating | 4.0/5.0 |

| 💸 Pricing & Software | ★★★✩✩ |

| 🚦 Trading | ★★★★✩ |

| 📡 Screening | ★★★★★ |

| 📰 News | ★★★★✩ |

| 📈 Charts & Analysis | ★★★✩✩ |

| 🔍 Backtesting | ★✩✩✩✩ |

| 📈 Data, Liquidity, Time & Sales | ★★★★★ |

| 🖱 Usability | ★★★★✩ |

Scanz is designed for US day traders, offering unique Level I/II real-time prices and real-time news scanning in a single price tag of $169 monthly. Real-time SEC filings and market scanning are included, enabling you to trade news events effectively. Scanz is a solid product offering, and although the price tag might seem high, you get a lot for your money.

I recommended Scanz for day traders who want a simple and slick workflow, real-time streaming charts, news, unique level II data, dollar volume information, and broker integration.

Pros

✔ Powerful In-Built Technical Stock Scanning

✔ Broker Integration For Trading

✔ Well Organized Real-time News Engine

✔ Very Easy To Use + LII Data

✔ Dollar Volume Live Streaming

✔ Price, Liquidity, and Technical Filters

Cons

✘ Higher Than Average Price

✘ No Social Community

✘ No Backtesting

Having access to real-time, comprehensive, and customizable scanning tools is essential for identifying profitable trading opportunities. Scanz is designed for day traders and offers a wide range of features. Let’s delve into what makes this software a worthy addition to your trading toolkit.

Key Features

| ⚡ Features | Charts, Real-time News, Screening |

| 🏆 Unique Features | LII Data, Dollar Volume, Broker Integration |

| 🎯 Best for | Day Traders |

| ♲ Subscription | Monthly, Yearly |

| 💰 Price | $169/mo |

| 💻 OS | PC |

| 🎮 Trial | 14-Day |

| 🌎 Region | USA |

What is Scanz?

Scanz is a financial analysis and trading platform designed for US day traders. It offers advanced charting and market scanning tools, real-time level I/II data and news, SEC filings, direct broker integration capabilities, dollar volume metrics, and more. This package allows you to easily make informed market decisions, helping you maximize profits while minimizing risk.

Scanz can scan and screen the entire US stock market in real-time, enabling traders to find short-term technical trading situations.

Compare to Similar Products

Comparing Scanz to TrendSpider, TradingView, MetaStock, and Trade Ideas, our tests show that TrendSpider is the best overall stock analysis software passing 10/12 tests. For automated stock chart analysis, backtesting, and automated bot trading, TrendSpider is our top pick. TradingView is better for a global trading community. Stock Rover is better than Scanz for long-term growth, dividend, and value investors. For AI-driven robotic day trading, Trade Ideas is better. For trading real-time news, Benzinga Pro is a cheaper alternative.

| Features | Scanz | TrendSpider | TradingView | Trade Ideas | MetaStock |

| Rating | 4.1 | 4.8 | 4.7 | 4.6 | 4.4 |

| Pricing | $169/m | $107/m or $48/m annually | Free | $13/m to $49/m annually | $254/m or $178/m annually | MetaStock R/T $100/m, Xenith $265/m |

| Global Market Data | USA | USA | ✔ | USA | ✔ |

| Powerful Charts | ✔ | ✔ | ✔ | ✘ | ✔ |

| Stocks | ✔ | ✔ | ✔ | ✔ | ✔ |

| Futures | ✘ | ✔ | ✔ | ✘ | ✔ |

| Forex | ✘ | ✔ | ✔ | ✘ | ✘ |

| Cryptocurrency | ✘ | ✔ | ✔ | ✘ | ✘ |

| Social Community | ✘ | ✘ | ✔ | ✔ | ✘ |

| Real-time News | ✔ | ✘ | ✘ | ✘ | ✔ |

| Screeners | ✔ | ✔ | ✔ | ✔ | ✔ |

| News Scanning | ✔ | ✔ | ✘ | ✘ | ✔ |

| Backtesting | ✘ | ✔ | ✔ | ✔ | ✔ |

| Code-Free Backtesting | ✘ | ✔ | ✘ | ✘ | ✘ |

| Automated Analysis | ✘ | ✔ | ✔ | ✔ | ✔ |

Key Benefits

- Real-Time Scanning: The scanner shines with its ability to scan the market in real time from 4:00 a.m. to 8:00 p.m. EST. This broad time range allows users to capture market movements throughout the trading day.

- Customizable Scans: The software allows users to create custom scans based on specific rules and variables, providing personalized results that align with their trading strategies.

- Preconfigured Scans: With over 70 preconfigured scans, users can quickly start scanning without setting up their own parameters. This feature is especially beneficial for beginners still learning about market indicators.

- Price, Liquidity, and Technical Filters: The software provides many filters, allowing users to narrow their search based on various price, liquidity, and technical variables. These include but are not limited to Last Price, Volume, Moving Averages, and MACD.

- Fundamental Filters: The software also includes a comprehensive list of fundamental variables, such as Financials, Market Capitalization, and Short Data. This helps users thoroughly analyze a company’s financial health before making investment decisions.

- Scan by Market and Stock Types: This feature allows users to scan specific markets or stock types. Whether you’re interested in Nasdaq-listed stocks, ETFs, or foreign stocks, this software covers you.

- Auto-Sorting/Ranking: This feature lets users quickly identify stocks with the highest volatility and liquidity, saving valuable decision-making time.

- Powerful Data Columns: The software remembers the data columns set up on a particular scan, making subsequent scans highly relevant and personalized.

Beyond these key features, the Scan Software provides real-time news and SEC filings, streaming charts, level 1 and 2 data, chart indicators and drawing tools, notifications, and integration with popular brokers for seamless trading.

Pricing & Software

Scanz has a high $169/mo price tag, but you get a lot for your money. Real-time news and exchange data are included; these benefits are critical for day traders. Data speeds are excellent, and it has excellent US data coverage, including Over-The-Counter markets (OTC: BB, OTCQX, OTCQB, OTCPINK, GREY)

Trading

Scanz has a “Chart Montage” functionality, enabling an ultrapowerful way of trading charts. This single window contains a wealth of critical trading information, including real-time streaming news, and level 2 data, including time and sales. Also, Scanz is the only software that offers dollar volume data.

Scanz has integrations with your broker to enable trading directly from the charts, saving you time while trading. Broker integration is enabled for Schwab and Interactive Brokers, two of the brokerage world’s powerhouses, and more are planned.

My thorough testing awarded TradingView a stellar 4.8 stars!

With powerful stock chart analysis, pattern recognition, screening, backtesting, and a 20+ million user community, it’s a game-changer for traders.

Whether you're trading in the US or internationally, TradingView is my top pick for its unmatched features and ease of use.

Explore TradingView – Your Gateway to Smarter Trading!

Scanning

Scanz contains many technical and fundamental filters on which to screen. But what is the key for day traders? With the ability to scan entire markets for liquidity and volume patterns to find volatility, you can trade for a profit. This functionality makes Scanz a unique offering.

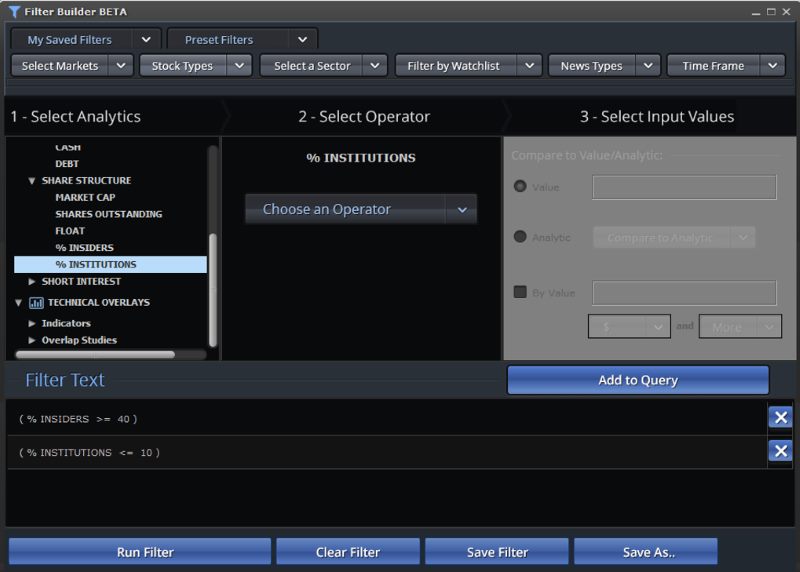

The screen capture below shows how flexible and powerful the scanning is. No coding is required; simply select your markets and scanning rules.

In this screenshot, I demonstrate how to filter a scan on % institutional ownership; other options are insiders or float.

Real-time News

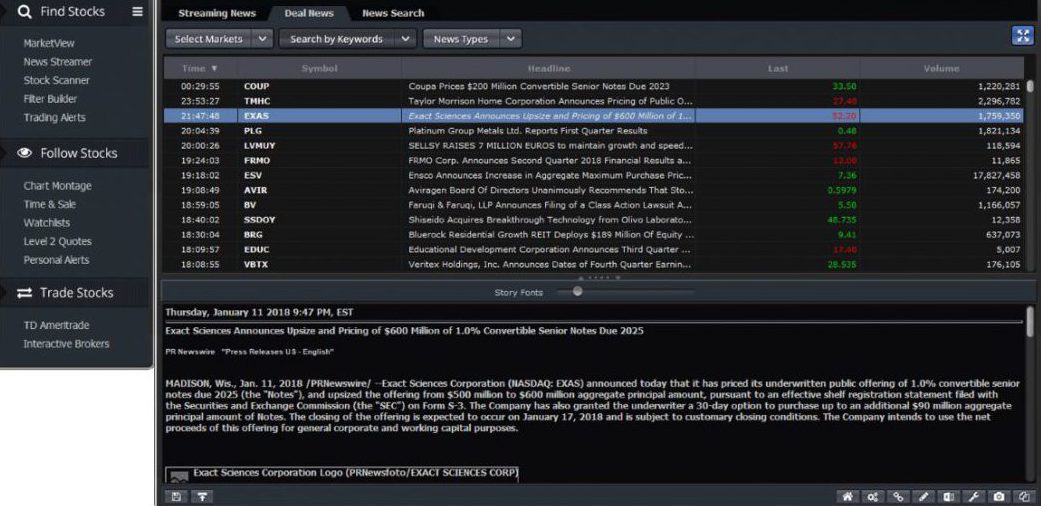

This year, the deal news section in Scanz is at the top and worth mentioning. I like the simple implementation; you can get the lowdown on contracts and deals between companies. Quantifying the deal’s impact on the company’s bottom line can give you an edge.

Only three products can offer true real-time news at a price point that will not break the bank: Scanz, Benzinga Pro, and MetaStock R/T.

Charting

Scanz does not offer as many chart patterns or chart indicators as MetaStock or TradingView, but it does not have to. Most traders will only use 5% of the indicators available, and fortunately, Scanz covers all the important ones. The power here is in the technical analysis screening, which is fast, seamless, and flexible.

Backtesting

Scanz is not designed for backtesting, which is a shame, especially at this price point. But it is designed to help you streamline your day trading system. Plenty of off-the-shelf technical and liquidity scans will greet you when you open the program. The great thing is they all operate in real-time, so they continue to update.

Ease of Use

In the development process, Scanz has opted to keep everything on the surface simple and intuitive. However, don’t be fooled by the power underlying the streamlined interface, which, in a few clicks, you will be viewing Level II liquidity data and buying directly from the charts.

I have been extremely impressed with the progress Scanz is making in its product and carving out its day trader niche.

Scanz is highly recommended for its ease of use, excellent management of real-time news, and extremely powerful scanning. Add to this the broker integration options with Interactive Brokers and Schwab, and you have a robust package.

Is Scanz Worth It?

I think Scanz is worth it for day traders who need real-time news events, LII data, and dollar volume surge data. Scanz is a solid, reliable stock market scanning software that is worth trying.

Summary

Scanz uniquely offers Level I/II streaming price, volume, and dollar volume data, fast real-time news, and SEC filings scanning. Also, it offers fast news scanning, including SEC filings, which is excellent.

Whether you’re a beginner or an experienced trader, the Scan Software’s wide range of features and real-time data access can enhance your ability to identify profitable trading opportunities. Thus, it’s worth considering as a valuable addition to your trading toolkit.

Bear in mind that while this software offers robust capabilities, it’s crucial to complement its use with sound trading strategies and risk management practices, as no tool can guarantee success in the inherently risky stock market.

Scanz is limited in its scope, missing backtesting and social features.

| Scanz Features | Details |

|---|---|

| Pricing & Software | $169/mo |

| Customer Service & Education | Email Only |

| Market Data Coverage | USA inc OTC |

| Data Speed | Excellent |

| Stocks | ✔ |

| ETF | ✔ |

| Mutual Funds | X |

| Options | X |

| Futures | X |

| Forex | X |

| Bonds | ✔ |

| Trade Management | |

| Broker Integration Stocks | ✔ |

| Broker Integration Options | ✔ |

| Place Trades from Charts | ✔ |

| Live Position P&L | ✔ |

| P&L Analysis | ✔ |

| Fundamental Scanning & Screening | |

| Real-Time Scanning & Filtering | ✔ |

| Fundamentals Scanning | ✔ |

| Watch Lists with Fundamentals | ✔ |

| Extended Economics Fundamentals (New) | X |

| Technical Analysis & Charts | |

| Multiple Charts Per Desktop | ✔ |

| Bar Line HLC Candlestick | ✔ |

| Point & Figure | X |

| Equivolume | X |

| Indicators | |

| Bollinger Bands | ✔ |

| Directional Movement | X |

| Ichimoku Cloud | X |

| MACD | ✔ |

| Momentum | ✔ |

| Money Flow | X |

| Moving Averages | ✔ |

| Parabolic SAR | X |

| Rate of Change | X |

| Relative Strength / RSI | ✔ |

| Stochastics | ✔ |

| Volume at Price | X |

| Custom Indicator Development | X |

| Volume | ✔ |

| Darvas Box | X |

| Elliot Wave | X |

| Total Number of Indicators | 11 |

| Drawing Tools | ✔ |

| Fibonacci | ✔ |

| Fibonacci Time | X |

| Fibonacci Fan | X |

| Trend Lines | ✔ |

| Text Overlay | X |

| Automated Alerts | ✔ |

| News & Social | |

| News Feed | ✔ |

| Real-Time News Feed | ✔ |

| Economics & Deal News | Deal News |

| Market Commentary | ✔ |

| Community Chat | X |

| Systems & Back-testing | |

| System Marketplace | X |

| Create Customizable Systems | ✔ |

| Backtesting Point & Click | X |

| Backtesting Programmatic | X |

| Forecasting | X |

| Robotic Trading | X |

| Setup & Usability | |

| SW Setup Score | 5 |

| Ease of Use Score | 5 |