TradingView is today’s most popular stock trading platform, but TrendSpider, Trade Ideas, Stock Rover, and Benzinga Pro offer enormous benefits for alternative investing scenarios.

If you are looking for a TradingView alternative, our research shows TrendSpider has superior chart pattern recognition and backtesting, while Trade Ideas’ has better AI-powered trading algorithms.

Benzinga Pro offers leading real-time financial news screening and chart, and Stock Rover offers exceptional benefits for long-term dividends, growth, and value investors.

7 Top TradingView Alternatives

My recommended alternatives to TradingView include TrendSpider for better chart pattern recognition and backtesting, Trade Ideas for AI-powered trading algorithms, and Benzinga Pro for real-time trading news.

- TrendSpider: Better for AI-powered automated analysis.

- Trade Ideas: Better for black box AI day trading.

- Benzinga Pro: Better for real-time news.

- Stock Rover: Better for investors.

- MetaStock R/T: Better price forecasting

- Tickeron: Better for AI screening

- FinViz: A free alternative to TradingView

TradingView has good charts, community, free global stock data, integrated trading, heatmaps, and backtesting. However, it lacks real-time news, forecasting, value investing data, and AI-automated trading.

Compare TradingView to Similar Products

My tests compare TradingView versus TrendSpider, MetaStock, and Trade Ideas. TrendSpider is the best alternative, passing 10 of 12 tests for automated stock chart analysis, backtesting, and bot trading. Stock Rover is better for long-term growth, dividend, and value investors. Trade Ideas is better for AI-driven black box robotic day trading. For trading real-time news, Benzinga Pro is a better alternative.

| Features |

TrendSpider | TradingView | Trade Ideas | MetaStock |

| Awards | ||||

| Rating | 4.8 | 4.7 | 4.6 | 4.4 |

| Pricing | $107/m or $48/m annually | Free | $13/m to $49/m annually | $254/m or $178/m annually | MetaStock R/T $100/m, Xenith $265/m |

| Global Market Data | USA | ✅ | USA | ✅ |

| Powerful Charts | ✅ | ✅ | ❌ | ✅ |

| Stocks | ✅ | ✅ | ✅ | ✅ |

| Futures | ✅ | ✅ | ❌ | ✅ |

| Forex | ✅ | ✅ | ❌ | ❌ |

| Cryptocurrency | ✅ | ✅ | ❌ | ❌ |

| Social Community | ❌ | ✅ | ✅ | ❌ |

| Real-time News | ❌ | ❌ | ❌ | ✅ |

| Screeners | ✅ | ✅ | ✅ | ✅ |

| News Scanning | ✅ | ❌ | ❌ | ✅ |

| Backtesting | ✅ | ✅ | ✅ | ✅ |

| Code-Free Backtesting | ✅ | ❌ | ❌ | ❌ |

| Automated Analysis | ✅ | ✅ | ✅ | ✅ |

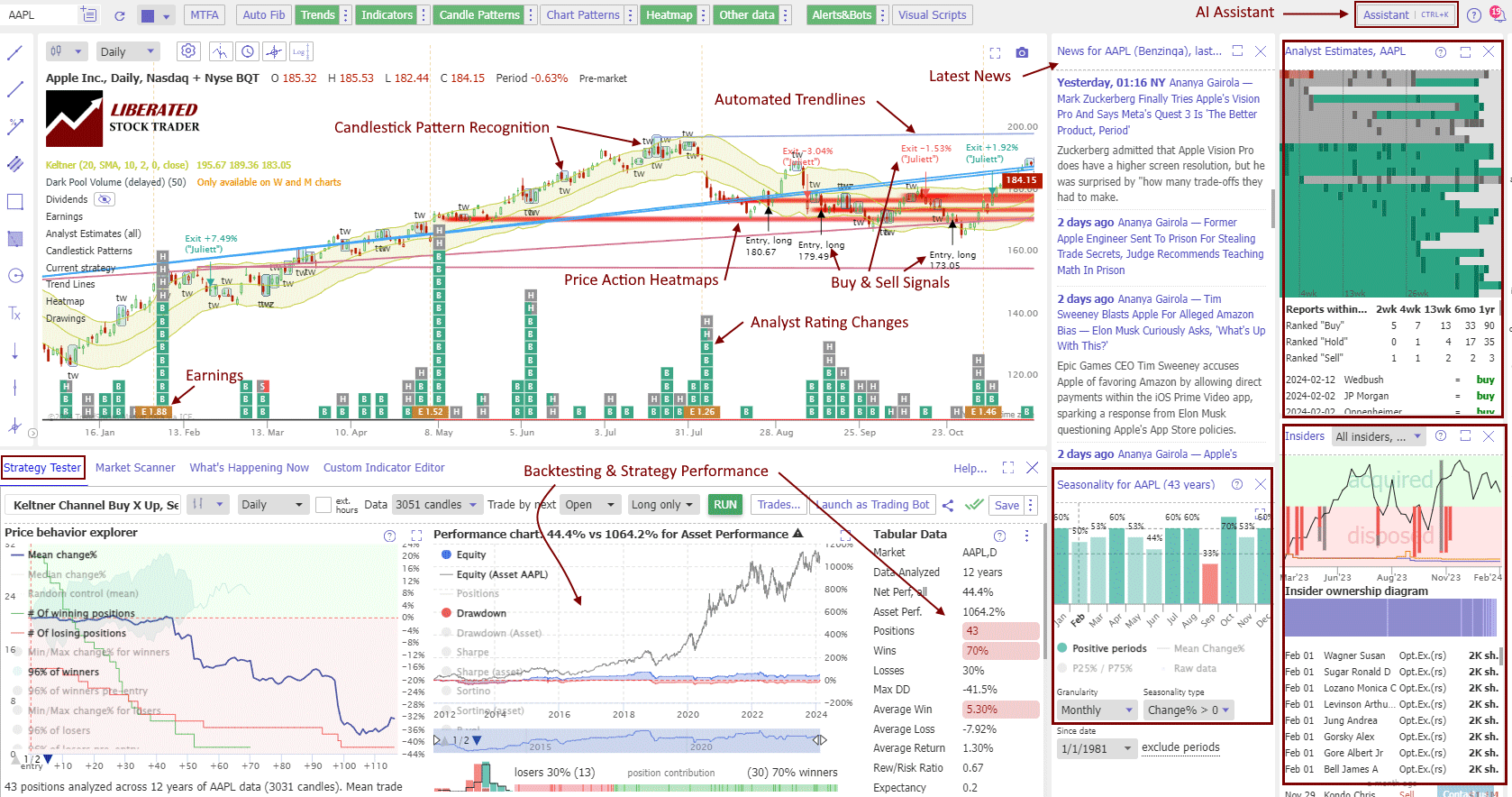

1. TrendSpider: Better for AI pattern recognition.

TrendSpider beats TradingView for automated candle and chart pattern recognition, code-free backtesting, AI-powered automation, and trading with AI Bots.

TrendSpider leverages AI to identify trendlines, chart patterns, and candlesticks automatically. Its automated trading bots and robust backtesting capabilities have solidified its position as an industry innovator. TrendSpider even includes free real-time data and in-person 1-on-1 training.

I’ve relied on TrendSpider for seven years to automate my chart technical analysis and craft advanced trading strategies. Using TrendSpider, I’ve rigorously tested more than 100 indicators and patterns.

Our testing of TrendSpider reveals its suitability for US traders seeking AI-driven charting, pattern identification, and stock, index, futures, and forex backtesting. TrendSpider autonomously spots trendlines, Fibonacci levels, and candlestick patterns. Its robust backtesting and multi-time-frame analysis make it a top pick for seasoned technical traders.

TrendSpider distinguishes itself by harnessing AI and machine learning to enhance traders’ processes, introducing automated trend and pattern detection to the forefront. Through TrendSpider, traders access sophisticated analytical tools and strategic testing functionalities, superseding conventional methods in both scale and efficiency.

TrendSpider instantaneously detects stock chart support and resistance trendlines, 123 candlesticks, and Fibonacci numbers on multiple timeframes. Trendspider’s AI algorithms allow automated market scanning and backtesting for trend detection across entire exchanges. Read the full TrendSpider review and test to find out more.

Upgrade your Trading with TrendSpider

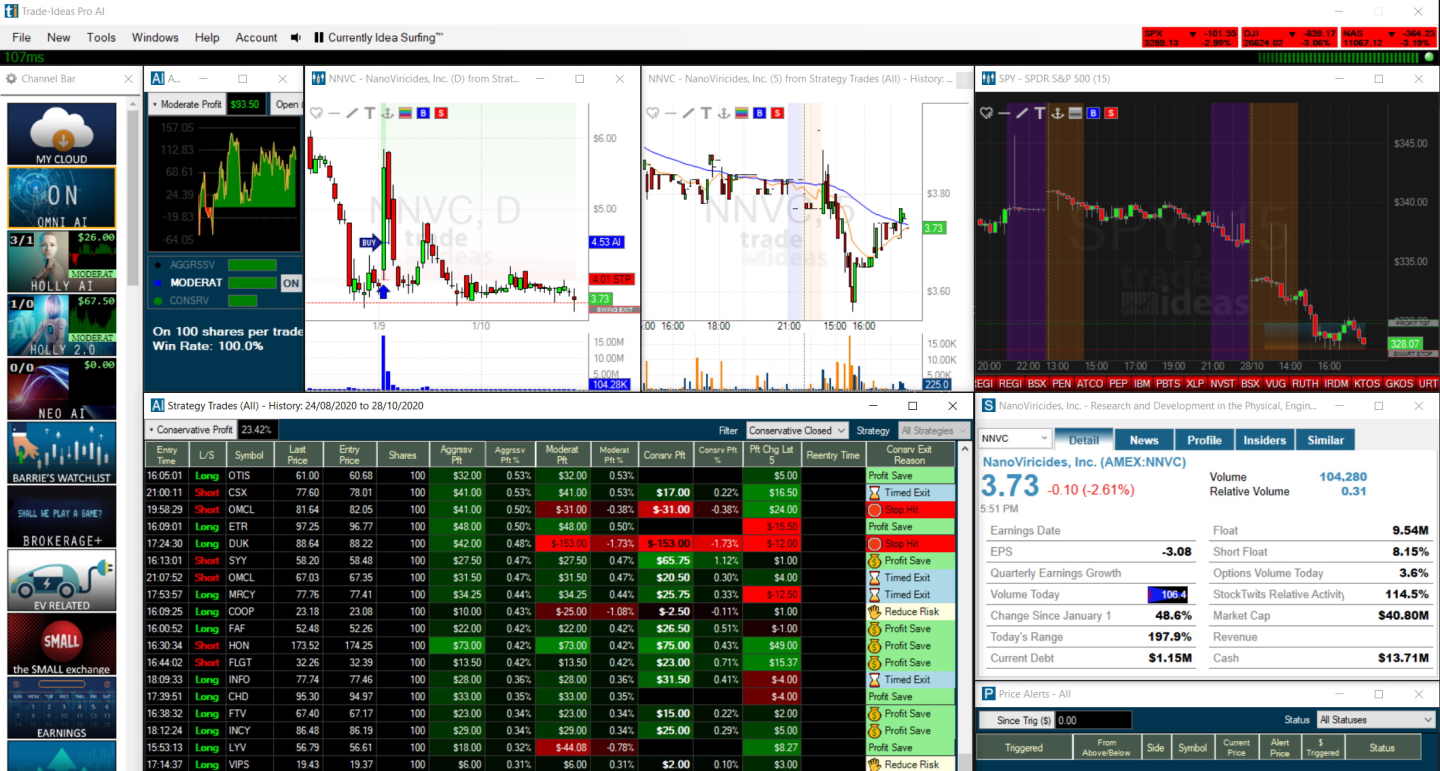

2. Trade Ideas: Better for AI day trading.

Trade Ideas is a great alternative to TradingView because it offers AI-automated trading and signals for day traders. AI and using bots to trade the market automatically are huge trends now and in the future.

TradingView does not have automated trading or the ability to run robots around the clock. The best-of-breed AI trading services provide real-time trade opportunities and the ability to execute trades with a winning audited trade history.

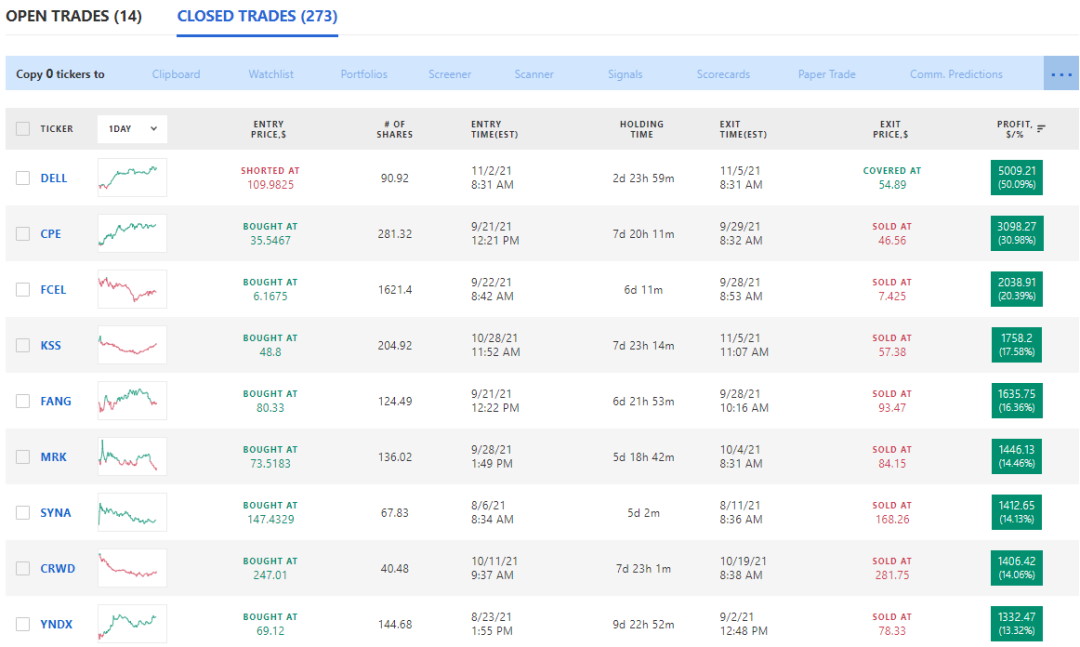

Our research shows the leaders in AI trading software are Trade Ideas and Tickeron. Trade Ideas has automated AI trading Bots for stocks and a proven track record. Tickeron offers 34 AI stock trading systems and hedge fund-style AI model portfolios with audited track records.

Rules-based AI and day-trading bot platforms are becoming pervasive. However, machine learning and deep learning software are still in their infancy. Trade Ideas is an advanced, high-performing AI trading software with three automated AI trading Bots.

Trade Ideas: A good AI day trading alternative to TradingView

Trade Ideas is the leading AI trading software for finding day trading opportunities. Trade Ideas has three cutting-edge AI stock trading bots that backtest all US stocks in real time for high-probability trading opportunities.

Trade Ideas is one of the few fully automated stock trading services. It lets you connect to eTrade or Interactive Brokers for automated trade execution. Trade signals generated from Holly AI cannot be autotraded. Still, alert window scans can be auto-executed in a sandbox or live with your brokerage using Brokerage Plus (available in the premium plan). Read the full Trade Ideas review and test to find out more.

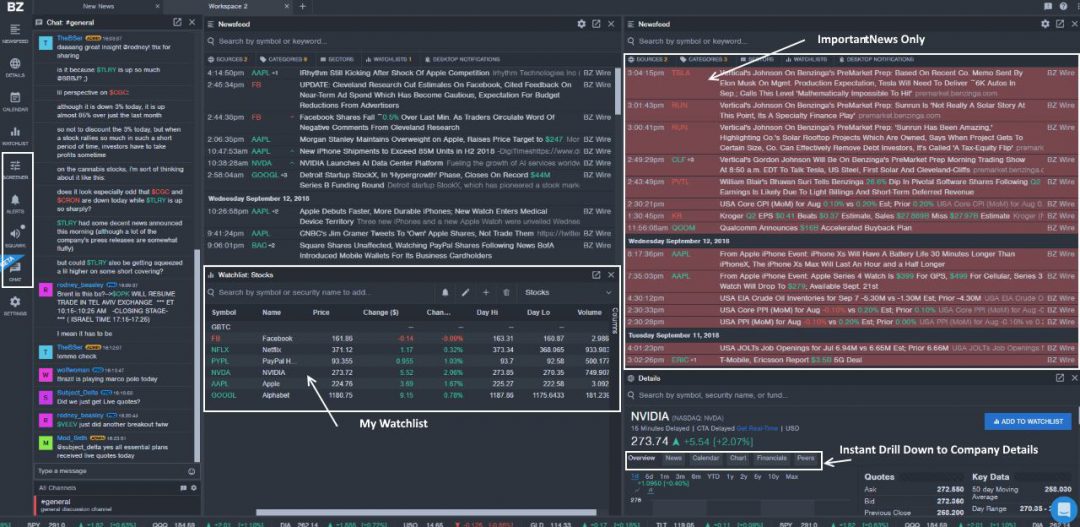

3. Benzinga Pro: Better for real-time news.

Benzinga Pro is a better alternative to TradingView if you are a day trader looking to take advantage of breaking news. Based on news events, stocks move fast during trading days, so you need real-time news to make quick trades and daily profits.

TradingView has a newsfeed, but it is significantly delayed. Our best real-time news services review reveals two winners if you want to trade news events.

Benzinga Pro: The best real-time news alternative to TradingView

Benzinga Pro is the best real-time stock market news feed for traders, delivering cost-effective, actionable news, charts, financials, screening, and a powerful calendar suite to get a trading edge. Benzinga Pro’s platform is designed to be the place where you get stock news first.

Our testing of Benzinga Pro has shown it to be ideal for US traders seeking a high-speed, actionable, real-time news feed at a fraction of the cost of a Bloomberg terminal. Benzinga Pro offers charts, financials, screening, options mentoring, and a robust calendar suite to provide a competitive edge in trading. I recommend Benzinga Pro for active day traders and investors interested in leveraging exclusive features such as news sentiment indicators, newsdesk access, and market-moving news alerts for trading news events.

Benzinga Pro is designed for news traders and costs 1/10th of the cost of a Bloomberg Terminal. What makes it unique is the fast delivery of news, insider interviews, and direct access to the reporters at the news desk. It also has a considerable amount of news content unavailable to regular subscribers. Read the full Benzinga review and test to find out more.

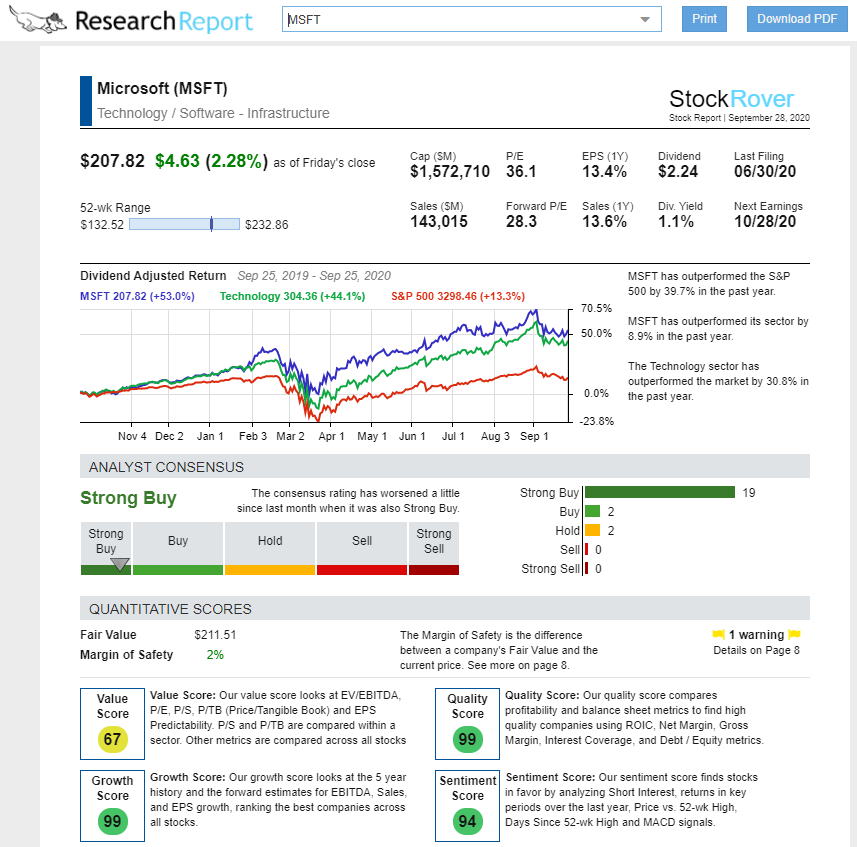

4. Stock Rover: Better for investors.

Stock Rover is a better alternative to TradingView for long-term investors in stocks and ETFs. However, if you are an investor seeking to implement a detailed growth, value, or dividend investing strategy, TradingView is not the best choice.

My research reveals that Stock Rover is the best software for financial stock screening, portfolio management, and deep stock research.

Our Stock Rover review and test reveals an advanced stock screening and research tool for US value, income, and growth investors. With 650 financial metrics on 10,000 stocks and 44,000 ETFs, we rate Stock Rover the number one stock screener.

Easy to use yet incredibly powerful, Stock Rover is the best stock screener for US investors.

I have been a premium subscriber to Stock Rover for the last five years and have developed strategies for its platform. I use Stock Rover daily.

Stock Rover has a 10-year financial database and impressive stock ratings. Stock Rover enables the development of intricate dividend, value, and growth investing strategies, making it an industry-leading platform.

Stock Rover is best for USA and Canadian value, growth, and income investors seeking detailed fundamental and financial analysis stock screening and research software. Its ease of use hides its flexibility and underlying strength.

5. MetaStock R/T: Better price forecasting.

MetaStock R/T is the best global real-time financial news feed for technical traders because it delivers institutional-grade data from Refinitiv. It is the leading technical analysis stock charting and backtesting service.

I recommend MetaStock R/T for traders who need real-time news and access to a huge stock systems market; all backed up with excellent customer service.

One thing TradingView cannot do is provide stock market forecasting. If you are looking for software that has a forecasting engine, your only option is MetaStock.

The MetaStock Forecaster is unique in the industry because it allows you to use hundreds of different strategies to predict the future price of stocks. The forecaster analyzes past events, the impact on the stock price, and forecasts for the future.

Our evaluation of MetaStock highlights robust charting capabilities, advanced system backtesting, accurate forecasting, and real-time financial news through Xenith for traders. While MetaStock offers unparalleled charts, indicators, and drawing tools, its usability could be enhanced.

Tailored for traders seeking potent scanning, screening, system backtesting, and forecasting features, MetaStock also integrates the Refinitiv Xenith service for swift access to global financial news. Renowned as one of the premier technical analysis platforms available, MetaStock stands out for its comprehensive offerings.

The forecaster strategies are called recognizers, and there are over 70 recognizers available to use. Recognizers are based on common technical chart setups like new 52-week highs or lows, candlestick patterns, or MACD crossovers.

You are then presented with an interactive report that enables you to scan through the many predictive recognizers, which help you plan for realistic outcomes and profits for a particular trade setup.

6. Tickeron: Better for AI screening.

Tickeron is an excellent AI trading software alternative to TradingView that uses stock chart pattern recognition to predict future trends by providing 45 streams of trading ideas. Tickeron allows you to build your own AI portfolios with predictive returns. Tickeron is a wholly-owned subsidiary of SAS Global, a leader in data analytics whose services are used by most Fortune 500 companies. Tickeron uses AI rules to generate trading ideas based on pattern recognition.

Our review of Tickeron unveils a remarkable AI-powered investment platform that merges portfolio management and chart pattern recognition. What sets it apart is its trading algorithms‘ audited and backtested results. Explore Tickeron’s array of in-house and community-crafted strategies and scans to enhance your trading experience.

They use a database of technical analysis patterns to search the stock market for stocks that match those price patterns using their pattern search engine. Of course, each detected pattern has a backtested track record of success, and this pattern’s success is factored into the prediction using their Trend Prediction Engine. Read the full Tickeron review and test to find out more.

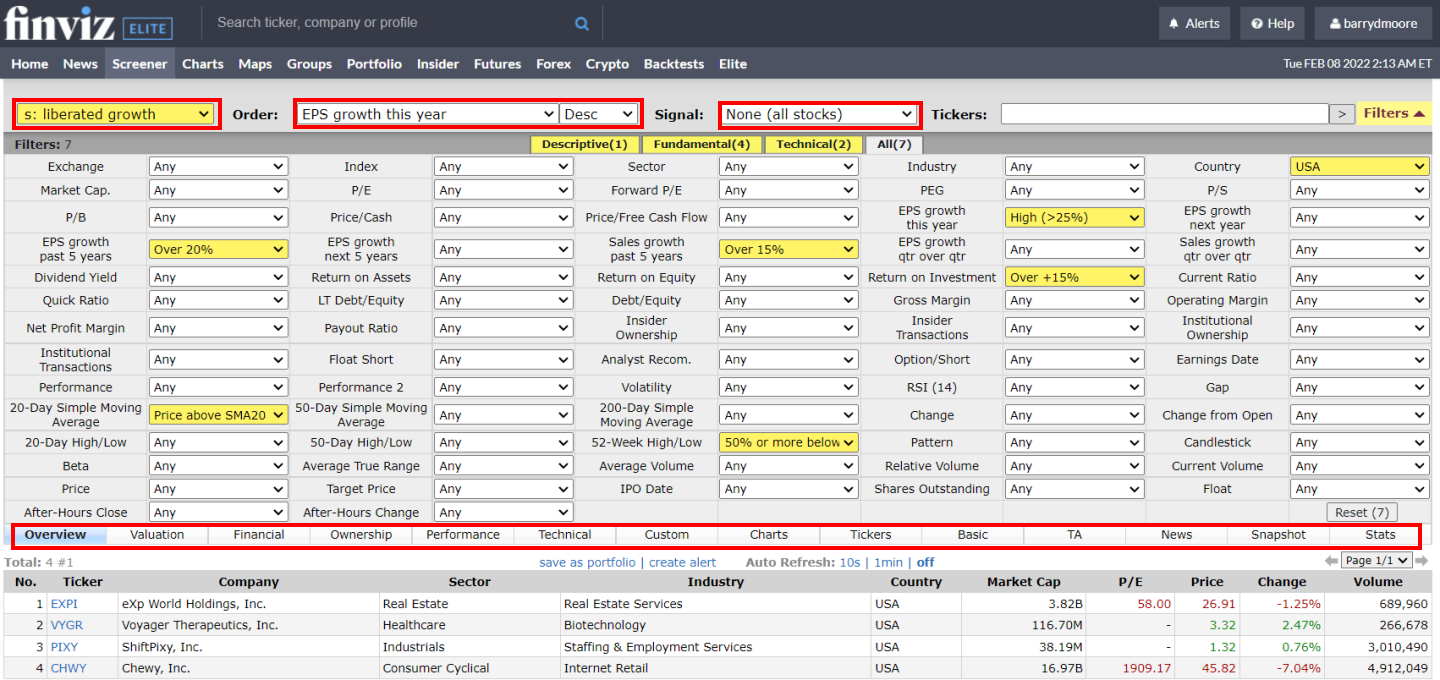

7. FinViz: A free alternative to TradingView.

FinViz is a good alternative to TradingView because it provides free access to similar features, such as heatmaps, screening, and chart pattern recognition.

Our review of Finviz uncovers an efficient free stock screener, rapid market heatmaps, and stock chart pattern recognition. Finviz Elite provides real-time data, interactive charts, and backtesting at a competitive price point.

Having utilized Finviz for over 14 years, I embarked on testing this platform with high hopes. To my delight, Finviz has significantly enhanced charting, pattern recognition, and backtesting. Moreover, Finviz continues to offer exceptional free stock screening services.

Finviz’s free plan is ad-supported but provides great value for beginner investors. Without registering, you can scan and screen over 10,000 stocks and use the delayed charts and news stream. The free plan is ideal for beginner investors who want to check the markets fuss-free. Read the full Finviz review and test to find out more.

Why TradingView is Still Worth It!

TradingView is great for novice investors because of its powerful charting, indicators, community, backtesting, live trading, and heat maps. For the best overall trading experience, there is no better alternative to TradingView. Here are seven reasons why TradingView still rules.

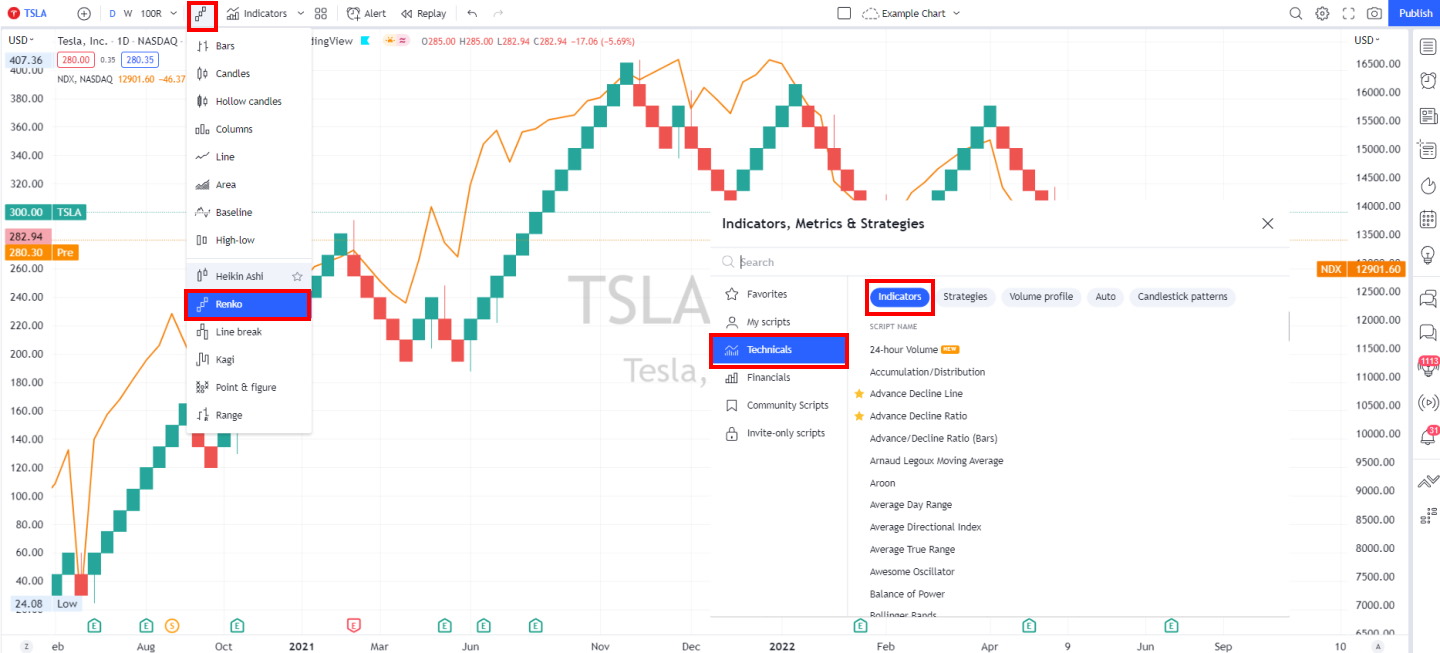

Powerful Charts & Indicators

TradingView has 14 chart types that enable powerful financial market analysis and visualization. Of course, you get Candlesticks and OHLC bars, but you also get a range of specialist charts such as Heikin Ashi, Renko, Line Break, Kagi, and Point & Figure.

There are also 101 different technical chart indicators and 60 financial indicators that can be mapped onto your charts.

Finally, TradingView excels at enabling you to develop your own chart indicators. TradingView has developed its own Pine script code, which makes developing indicators and strategies simple and quick. Below is a screenshot of the MOSES indicators I developed for TradingView.

Free Stock Data Globally

TradingView has the largest selection of global financial market data available for free on any platform. It covers 56 global stock exchanges, 21 foreign exchange data providers, and 63 cryptocurrency exchanges.

Data streamed from the BATS exchange is real-time; the rest usually has a 15-minute delay. Additionally, TradingView offers the market’s most cost-effective solution if you need real-time data for trading. As you can see below, TradingView charges only $2 or $3 monthly for real-time data, whereas most stock software vendors charge at least $9.99 monthly. This can save you a considerable amount of money.

A Huge Active Trading Community

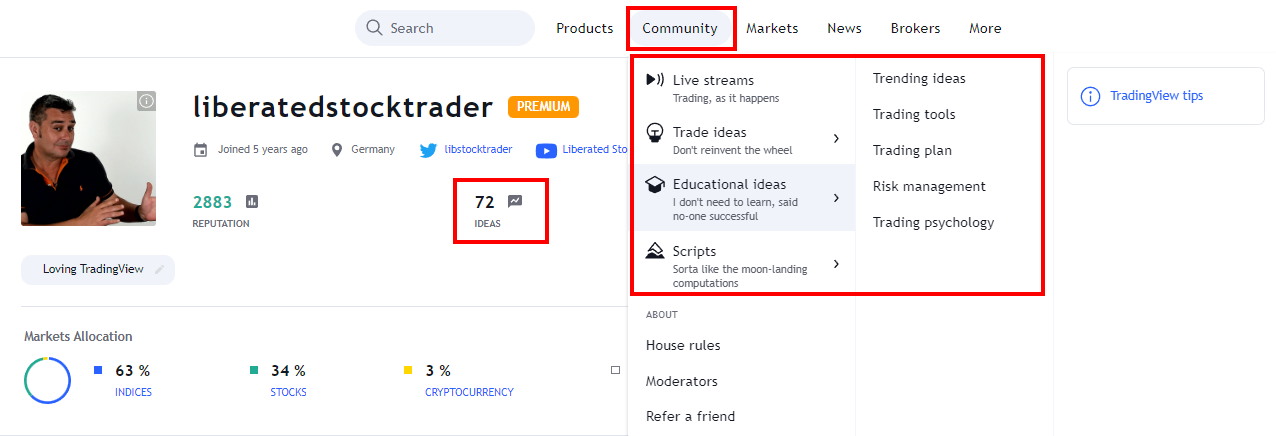

According to Bloomberg, TradingView has 29 million active monthly users, making it the world’s largest trading community. But how does the trading community benefit you?

TradingView has the concept of ideas; any user can submit an idea, whether it is an educational article, a trading idea, a hypothesis on the direction of a security, or even indicators and strategies. All this adds up to a wealth of knowledge from which you can benefit.

The screenshot above shows my profile page; I have submitted many ideas. You can also find a wealth of live-streaming videos, trade ideas, and educational content. You can also join chat groups and message other traders.

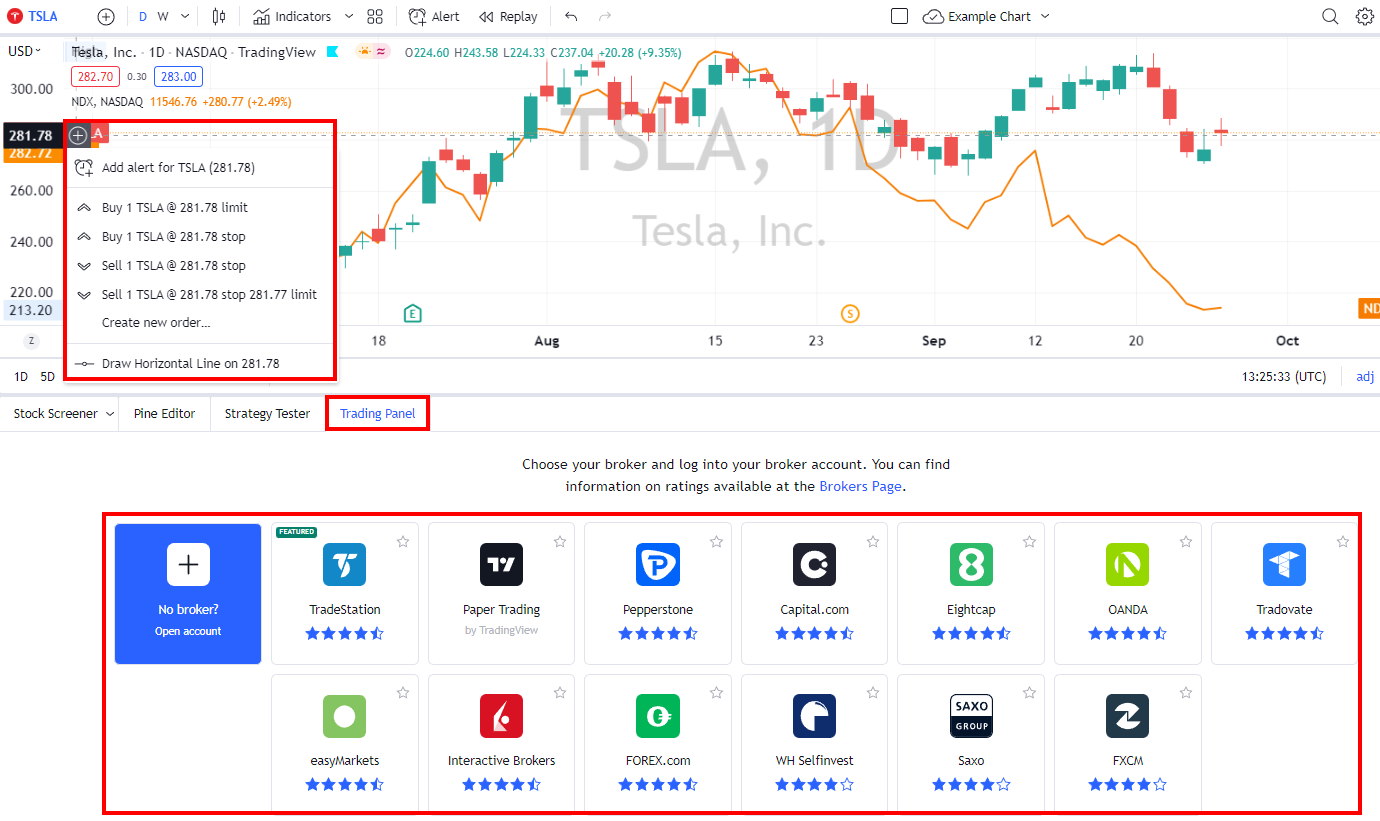

Integrated Brokers & Trading

If you want to live trade directly from charts, TradingView is a great choice. It offers tight trading integration with 43 brokers. Within a few clicks, you can select and sign up for a broker to trade FX, stocks, or currencies.

The most established brokers integrated into TradingView are Interactive Brokers, TradeStation, Ally Invest, and Tradier. Even better, TradeStation offers free stock traders with TradingView: Stocks: $0, Options: $0.60 per contract, Micro Futures: $0.50 per contract, and Futures: $0.85 per contract.

To connect to a broker, select [Trading Panel] and choose paper trading or a broker of your choice. The screenshot above also shows how to execute a trade by clicking the [+] sign on an asset you want to trade.

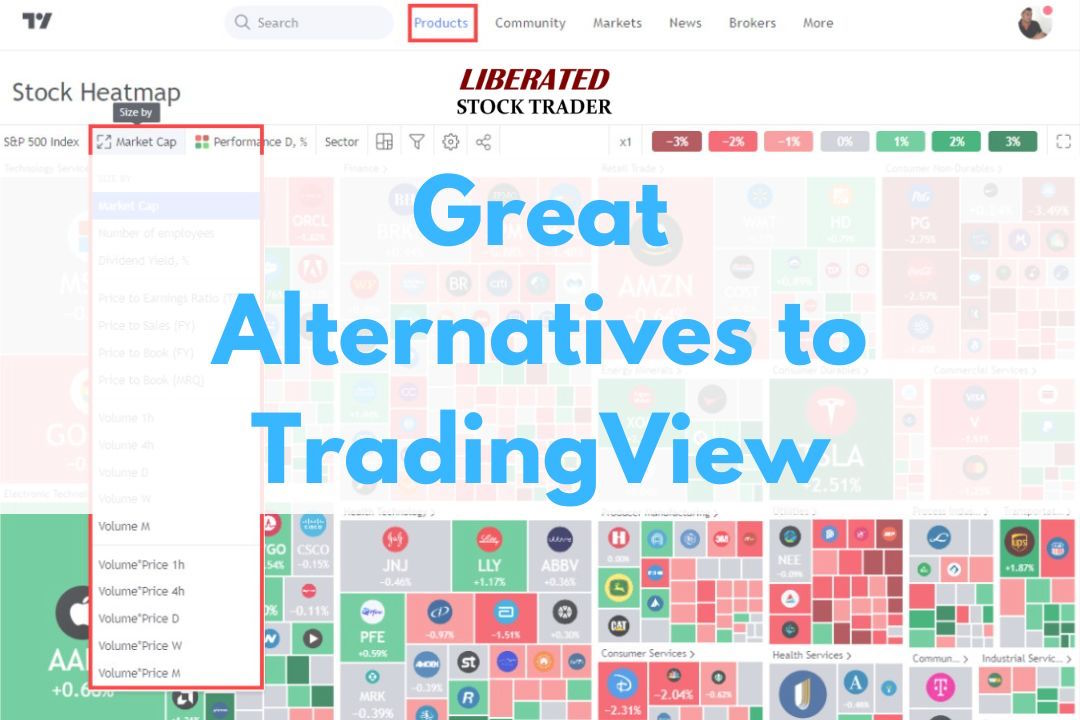

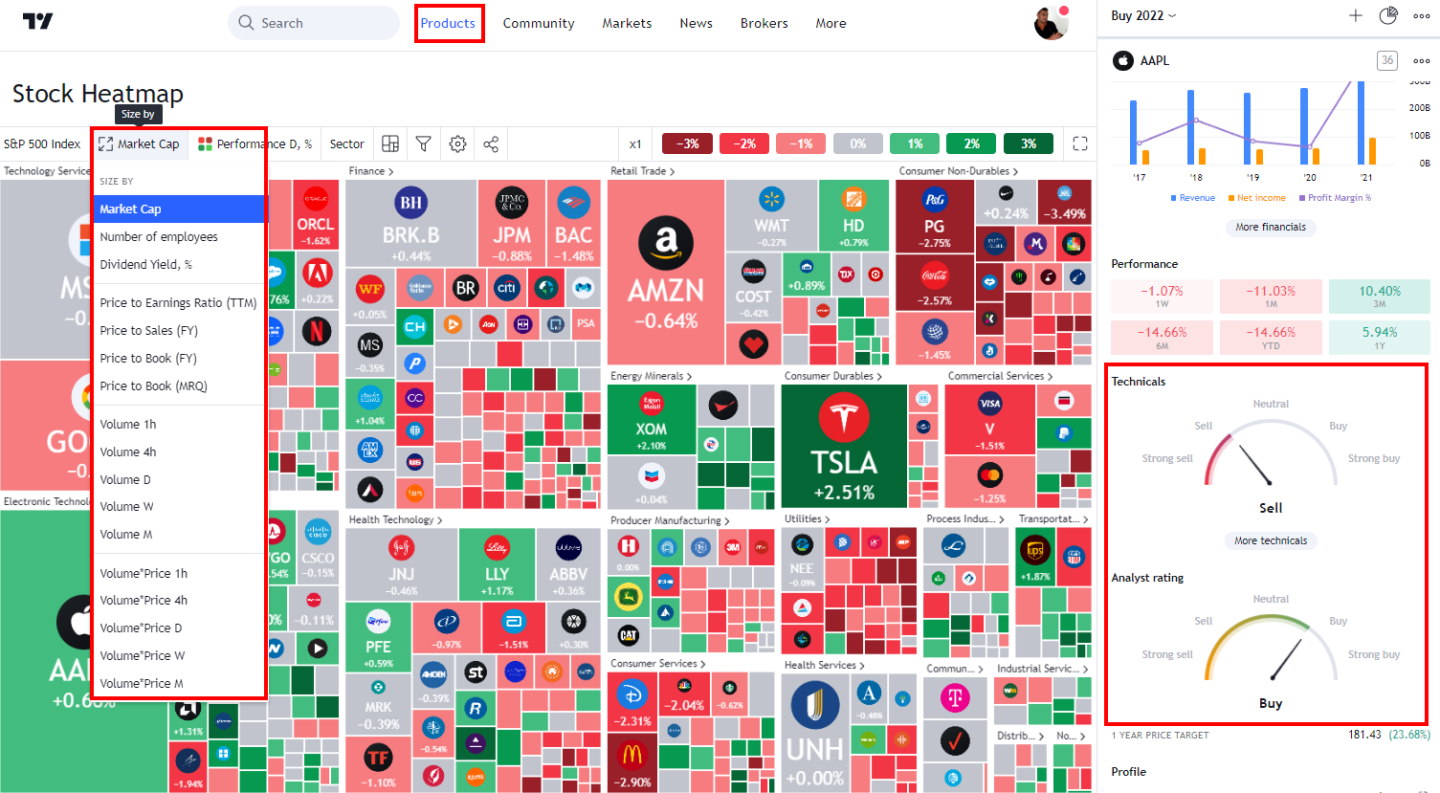

Heatmaps & Stock Ratings

Another unique benefit of TradingView is the ability to hone in on stocks or cryptocurrencies using a real-time configurable heatmap. The heatmap allows visualizing an entire stock exchange to find trading opportunities. What I like about TradingView heatmaps is that Market Cap, Dividend Yield, PE Ratio, Volume, or Volume/Price can be configured.

The screenshot shows the heatmap based on market capitalization, and companies in green have a positive stock price for the day.

Finally, a unique aspect of TradingView is the Buy/Sell gauges. On the right of the above screenshot, you can see two dials. The first is the Technical Buy/Sell gauge, based on the average reading of 26 technical indicators, such as RSI, Moving Averages, ADI, and Stochastics.

Additionally, you can see the Analyst Rating dials, which show you the stock’s average rating by Wall Street analysts.

I think you will agree that the heat maps, buy/sell gauges, and analyst rating dials are extremely useful for helping you make better trading decisions.

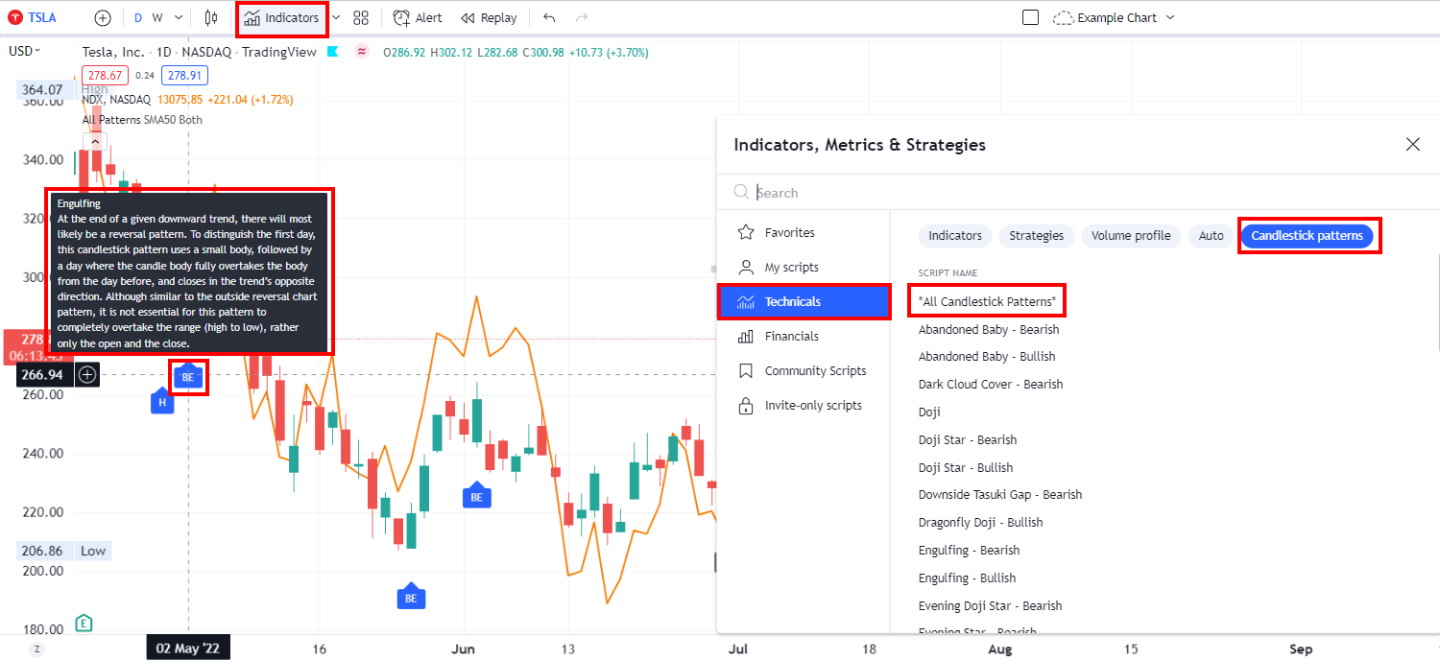

Pattern Recognition

One of the toughest areas of technical analysis is memorizing hundreds of Candlestick patterns. TradingView makes your life easy by recognizing over 40 candlestick patterns.

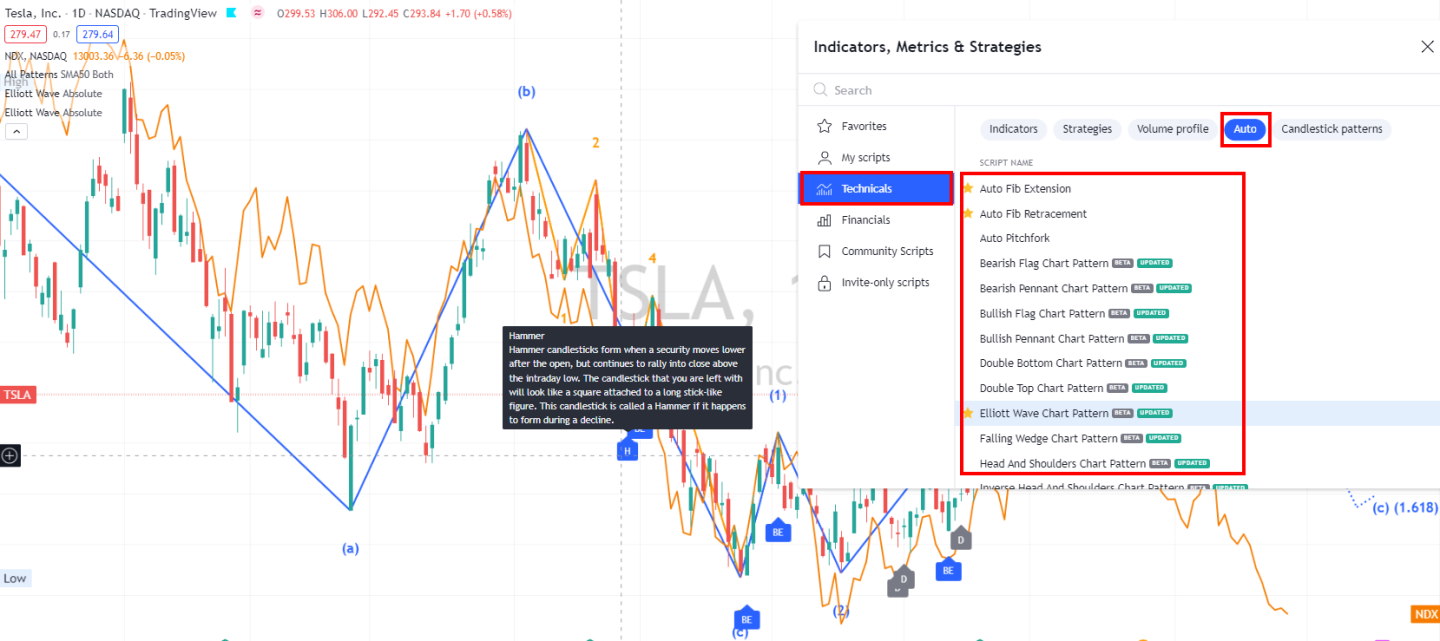

Select [Indicators] -> [Technicals] -> [Candlestick patterns] -> [All Candlestick Patterns], and your chart will automatically update with detected patterns and a description of what each pattern means. (See screenshot below)

TradingView also supports pattern recognition for Fibonacci, Elliott Waves, and chart patterns such as pennants, flags, and double tops and bottoms. To enable automated pattern recognition, click [Indicators] -> [Technicals] -> [Auto] -> [Choose Your Pattern]. See the screenshot below.

I know this might all sound a little complex, especially if you are a novice trader, but believe me, this is an innovative technology that you will want to use in the future.

Real-time Stock Scanning

The TradingView stock screener enables screening for technical indicators, providing real-time scanning and filtering on 172 metrics, including 42 financial filters. TradingViews stock screener includes a useful scan for technical buy and sell ratings.

TradingView’s screening watchlists have fundamental data separated into Performance, Valuation, Dividends, Margin, Income Statement, and Balance Sheet. TradingView stands out with its charting of economic indicators, for example, comparing the civilian unemployment rate versus the growth in company profits.

Final Thoughts

If you seek a TradingView alternative, my research indicates that TrendSpider excels in chart pattern recognition and backtesting. Trade Ideas offers superior AI-powered trading algorithms, while Benzinga Pro stands out with top-notch real-time financial news. While TradingView is a solid platform, TrendSpider, Trade Ideas, and Benzinga Pro are exceptional alternatives. Long-term investors should try Stock Rover.

You want to be a successful stock investor but don’t know where to start.

Learning stock market investing on your own can be overwhelming. There’s so much information out there, and it’s hard to know what’s true and what’s not.

Liberated Stock Trader Pro Investing Course

Our pro investing classes are the perfect way to learn stock investing. You will learn everything you need to know about financial analysis, charts, stock screening, and portfolio building so you can start building wealth today.

★ 16 Hours of Video Lessons + eBook ★

★ Complete Financial Analysis Lessons ★

★ 6 Proven Investing Strategies ★

★ Professional Grade Stock Chart Analysis Classes ★