Using the Shiller PE Ratio and the Dividend Yield of the S&P 500 are effective ways to understand if the stock market is overvalued.

Using these indicators in our historical charts, you can decide if the US stock market is overvalued or priced fairly.

According to the Shiller PE Ratio, the US stock market is currently overvalued compared to its 200-month moving average. The S&P 500’s PE ratio is close to an all-time high.

This article will help you understand if the market is overpriced and the complexities of market valuation.

How do you measure if the stock market is overvalued?

The Shiller PE Ratio, a 10-year Cyclically Adjusted Price Earning Ratio (CAPE Ratio) of the S&P 500 Index, and the S&P 500 Dividend Yield are excellent ways to measure if the stock market is overvalued.

Three signs the stock market is overvalued.

- When earnings growth slows down but stock prices increase rapidly, this is a sign that the market may be overvalued.

- Another sign of an overvalued market is when shares are trading at high price-to-earnings ratios. A high P/E ratio indicates that investors are willing to pay more for a company’s earnings.

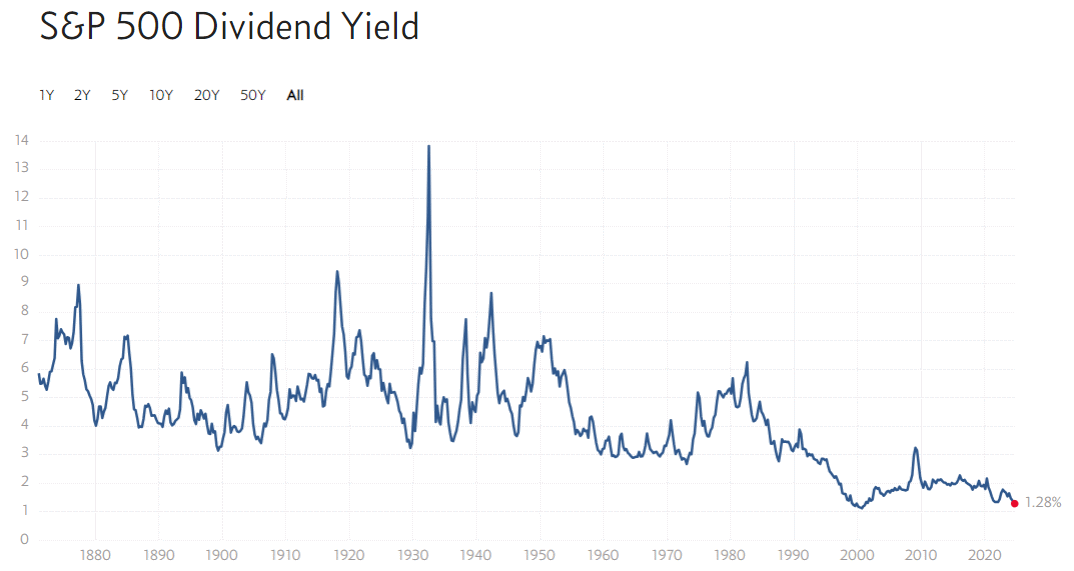

- The last sign we will discuss is a low dividend yield. A low dividend yield means companies are not paying out much in dividends relative to their share price. This can signify that companies use their cash to buy back their stock or engage in other activities rather than return money to shareholders.

The historical context of stock market valuation.

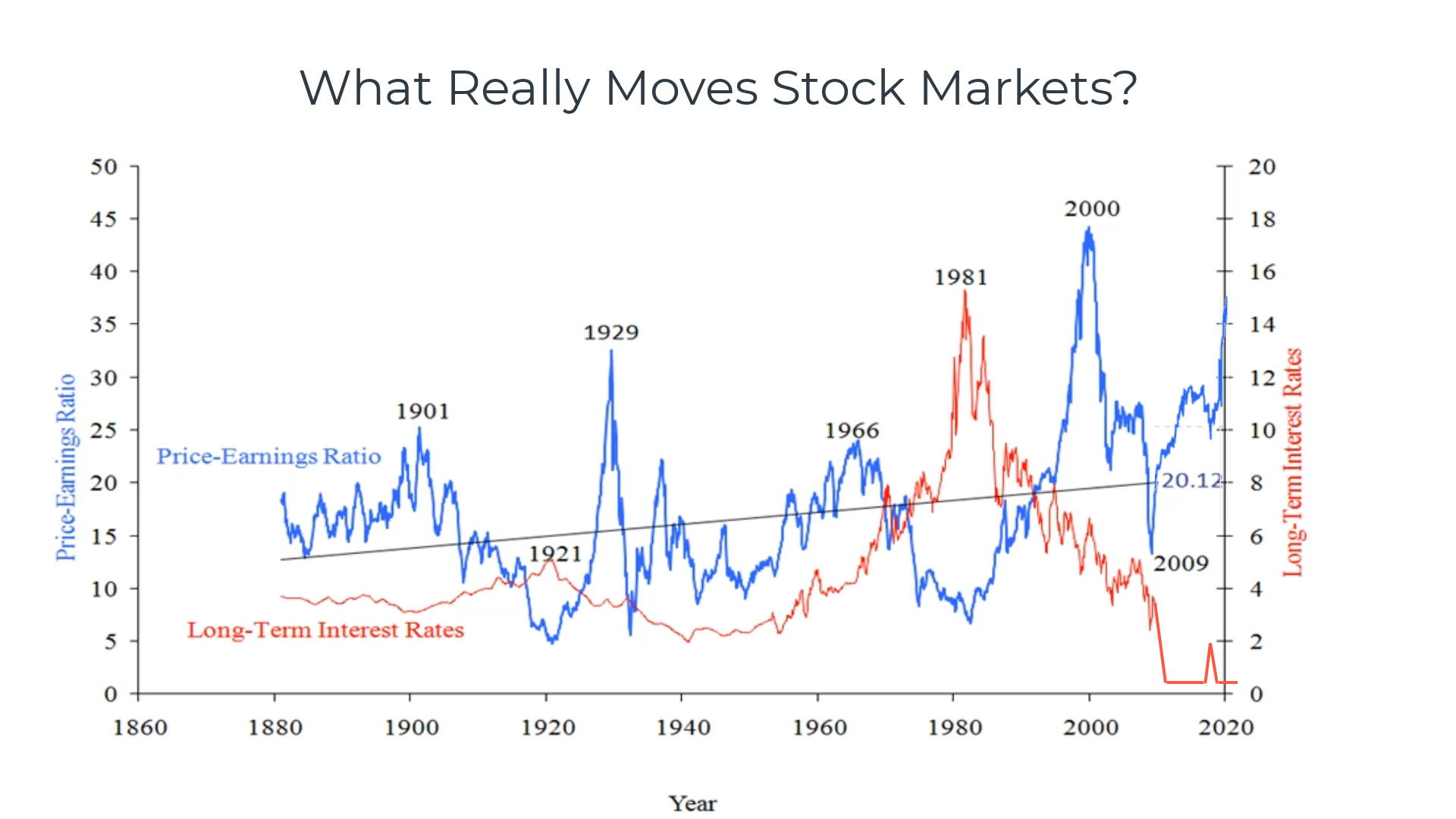

Here is a chart from 1860 to 2024 comparing the US long-term interest rates to the Shiller Price Earnings Ratio of the S&P Composite Index. Interestingly, there is a correlation between long-term interest rates being at extreme lows and stocks being extremely overpriced.

Shiller PE Ratio Chart Live on TradingView

The Price Earnings Ratio line shows that in relation to earnings, stock prices were too high in 1901, 1929, 1966, and 2000. We know the stock market was overvalued at this point because the market went through a correct/crash after reaching these highs.

Research shows that the 1929 stock market crash and the 2000 DotCom crash were caused by poor institutional risk management, which caused equity bubbles and an overvalued stock market.

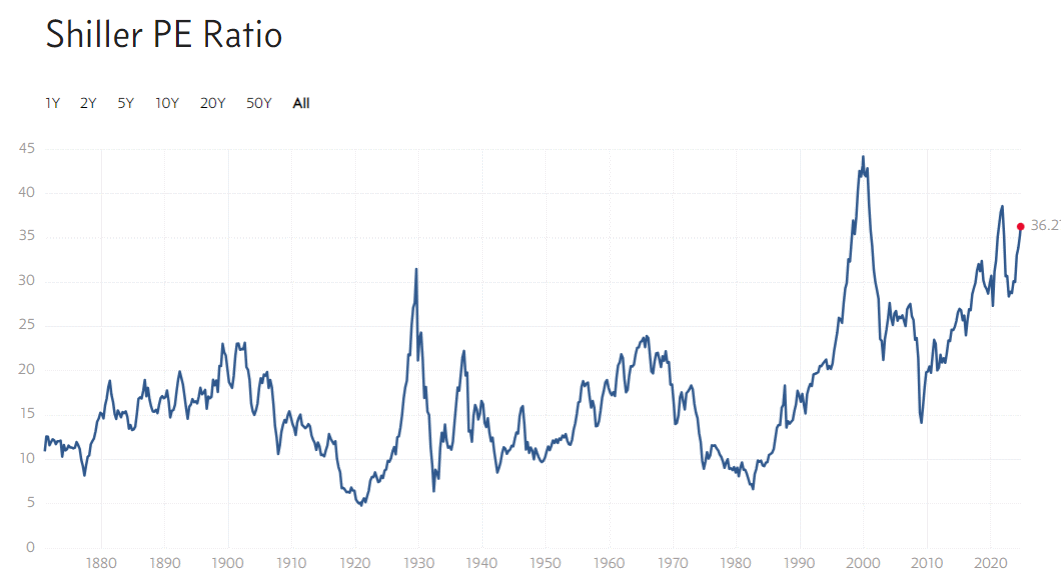

If we see the Shiller CAPE PE Ratio of the S&P 500 rise above 35, then stocks may be overpriced. Be very wary of an overpriced market. The Shiller PE Ratio shows us how stocks are priced relative to earnings. So, a market PE of 20 would mean that, based on the capital invested, it would take those companies 20 years to pay back the investor. Or viewed another way, an investor is willing to pay 20 times the company’s earnings for a stake in the business.

Is the stock market overvalued?

Yes. According to our research, the stock market is 19% overvalued. The current Shiller PE of 31 is 19% above the 200-month moving average of 26. This is above the historic median but way off the peaks of 40 and 44 over the last 100 years.

Are stocks overvalued? The Shiller PE Ratio.

The S&P 500’s PE ratio is 31, suggesting that the US stock market is 19% overvalued.

Using the Shiller PE Ratio, we can see that the stock market was extremely overvalued in 1929, 2000, and 2021, reaching peaks of 32, 42, and 38, respectively. The historical median PE ratio for the S&P 500 is 16, but now it is 36.

Example: Shiller PE Ratio Chart

Get TradingView Economic Charts Free

This interactive chart from TradingView shows the current Shiller PE Ratio for the S&P Composite Index from 1914 to today. Historically, stocks look overpriced, but as this article discusses, much has changed economically and in capital markets over the last 100 years.

Are stocks overvalued? S&P 500 Dividend Yield.

The dividend yield of the S&P 500 is 1.28, near an all-time low, suggesting that stocks are overvalued historically.

However, the nature of companies’ dividend payments has changed over the last 100 years. Today, only 25% of companies pay a dividend, and dividend yields are smaller than 50 years ago, largely due to historically high stock prices compared to earnings.

Example: S&P 500 Dividend Yield 100-Year Chart

What happens when the stock market is overvalued?

If a stock market is overvalued, there are two possible outcomes. Initially, governments will try to manage the situation to ensure an orderly return to balance using conservative fiscal and monetary policy. However, a surge in inflation, a financial shock, or governmental attacks on the corporate sector could change the balance and cause a crash in equities.

How do we know if a stock is overvalued?

To understand what it means for a stock to be overvalued, we first need to understand valuation. Valuation is the process of determining the worth of an asset. Regarding stocks, this usually refers to estimating the future cash flow the stock will generate and then discounting it back to present value.

There are various ways to value a stock, but one of the most common methods is the price-to-earnings (P/E) ratio. This ratio divides the stock’s price by the earnings per share (EPS), which is determined by dividing the company’s net income by the number of outstanding shares.

So, what does it mean if a stock has a high P/E ratio? That typically means that investors expect high growth from the company in the future and are willing to pay more for each dollar of earnings today. Conversely, a low P/E ratio could indicate that investors expect slower growth or are worried about potential problems with the company.

Now that we know how to value a stock, let’s discuss what it means when it is overvalued. A stock is overvalued if a company’s stock price is higher than its fair value. In other words, investors are paying too much for each dollar of earnings today. This can happen for various reasons, such as investor optimism or hype around a certain company or sector.

Paying too much for a stock can be dangerous because it increases your downside risk. If the company doesn’t live up to expectations or there’s some negative news, you could see significant losses in your investment. That’s why it’s important to be aware of overvalued stocks and research before investing your hard-earned money.

Try TradingView, Our Recommended Tool for International Traders

Global Community, Charts, Screening, Analysis & Broker Integration

Global Financial Analysis for Free on TradingView

How overvalued stocks affect investors.

Overvalued stocks can have several effects on investors. Perhaps most obviously, overvaluation can lead to losses if stock prices eventually drop back down to their intrinsic value.

Additionally, overvalued stocks may be more volatile than their underlying fundamentals suggest, meaning they may be more susceptible to sharp price movements (up or down) in response to changes in market conditions.

Finally, overvalued stocks may be more prone to “corrections”—meaning a sustained 10% or greater decline from recent highs—than other stocks.

Video: Is the Stock Market Overvalued?

Video From The Liberated Stock Trader Pro Masterclass Course

How do you invest in an overvalued stock market?

Investing in an overvalued stock market involves a decision only you can make. You can continue investing as stock markets can stay overvalued for a long time or diversify into other investments or cash.

1. Continuing Investing

As the stock market’s default direction is up, if you remain invested, eventually, the market will recover, and you will continue to make money. Suppose you are regularly contributing to your stock investment. In that case, you can use Dollar-Cost Averaging (DCA) to accumulate more equities at lower prices as the market falls. This option allows you to remain invested without having to time the market.

This solution has drawbacks, especially if you are close to retirement and do not have the time to wait to recoup your losses. This leads us to option two.

- Related Article: How to Protect Your 401K During a Stock Market Crash

2. Diversify

Timing the market is not for the faint-hearted; most people get it wrong. Government bonds have staged a comeback due to increasing interest rates, so they now represent a good option for diversifying your portfolio.

Beat The Market, Avoid Crashes & Lower Your Risks

Nobody wants to see their hard-earned money disappear in a stock market crash.

Over the past century, the US stock market has had 6 major crashes that have caused investors to lose trillions of dollars.

The MOSES Index ETF Investing Strategy will help you minimize the impact of major stock market crashes. MOSES will alert you before the next crash happens so you can protect your portfolio. You will also know when the bear market is over and the new rally begins so you can start investing again.

MOSES Helps You Secure & Grow Your Biggest Investments

★ 3 Index ETF Strategies ★

★ Outperforms the NASDAQ 100, S&P500 & Russell 3000 ★

★ Beats the DAX, CAC40 & EURO STOXX Indices ★

★ Buy & Sell Signals Generated ★

MOSES Helps You Sleep Better At Night Knowing You Are Prepared For Future Disasters

There are technical systems to help you judge whether the time is right to cash in your investments and move to cash. The MOSES System that I have developed is one such system; I think it is good, but no system is fool-proof. I have also developed the Liberated Stock Market Fear & Greed Index to help you decide if the market is in Greed Mode (a Bull Market) or Fear Mode (a Bear Market).