A stock market rally is a sudden and sustained growth in equity prices.

Stock rallies are triggered by increased investor confidence, reduced risk, and frenzied buying activity. A rally can be cyclical, sector, broad market, short, medium, or long-term.

I will show you the technical and fundamental analysis techniques and strategies you need to identify a rally and profit from it

Definition: Stock market rally

A stock market rally is a sustained rise in equity price trends, typically characterized by positive investor sentiment and strong buying activity, which pushes share prices higher. The duration and percent increase of rallies can vary greatly, ranging from minutes to years. A stock market rally fueled by available demand outstripping supply on a stock exchange.

Why do stocks rally?

Stock market rallies are fueled by strong earnings reports, improved economic outlooks, and positive news about a company’s products or services. Additionally, stocks can rally as investors buy in anticipation of future growth prospects or speculation on the potential success of a new business venture.

A stock rallies when demand exceeds supply, pushing prices upwards.

Generally speaking, stocks gain when there’s a perception that the company and its underlying products or services will perform well in the future. Positive news like financial results that beat expectations, partnerships with larger companies, strategic acquisitions, and new product launches can all be potential catalysts for a stock rally.

Technological advances, changes in laws that may drive consumer behavior, and industry-wide trends can also be factors in the rise of stocks. All of these events cause investors to become more confident in a company’s ability to generate strong returns. As investor confidence increases, so does share demand, which causes their prices to appreciate, leading to a stock rally.

Why do stock markets rally?

Entire stock markets rally when there is a combination of positive economic news and investor sentiment. Rallies can be caused by positive economic data, rising corporate profits, improving economic forecasts, or even the expectation of future government policies that will benefit the market.

In addition, when governments worldwide are taking steps to stimulate the economy, global investors become more confident in the stock markets. A stimulus can lead to increased demand for equities and a corresponding rise in share prices, resulting in a market rally.

The stance of central banks has an important role in the stock market’s direction and the rally’s power that fuels stock market price increases. A dovish federal reserve can be a key momentum driver in broad market rallies. There is even a Santa Claus Rally phenomenon.

Hawks vs. Doves Explained: How Fed Decisions Impact Investors

How central banks make stock markets rally

Stock markets rally because investors believe they are a better investment than alternatives such as treasuries, corporate bonds, or property. Low interest rates mean low returns for treasuries or currencies, which means capital flows into stocks and real estate. High interest rates mean company profits are impacted, and bonds and treasuries are preferential investments.

What types of rallies are there?

There are three main types of stock market rallies: cyclical, sectoral, and broad-based. A cyclical rally is due to the business-specific cycle, innovations in technology or innovation fuel sector rallies, and a broad-based rally is caused by pro-business economic conditions.

A cyclical stock rally

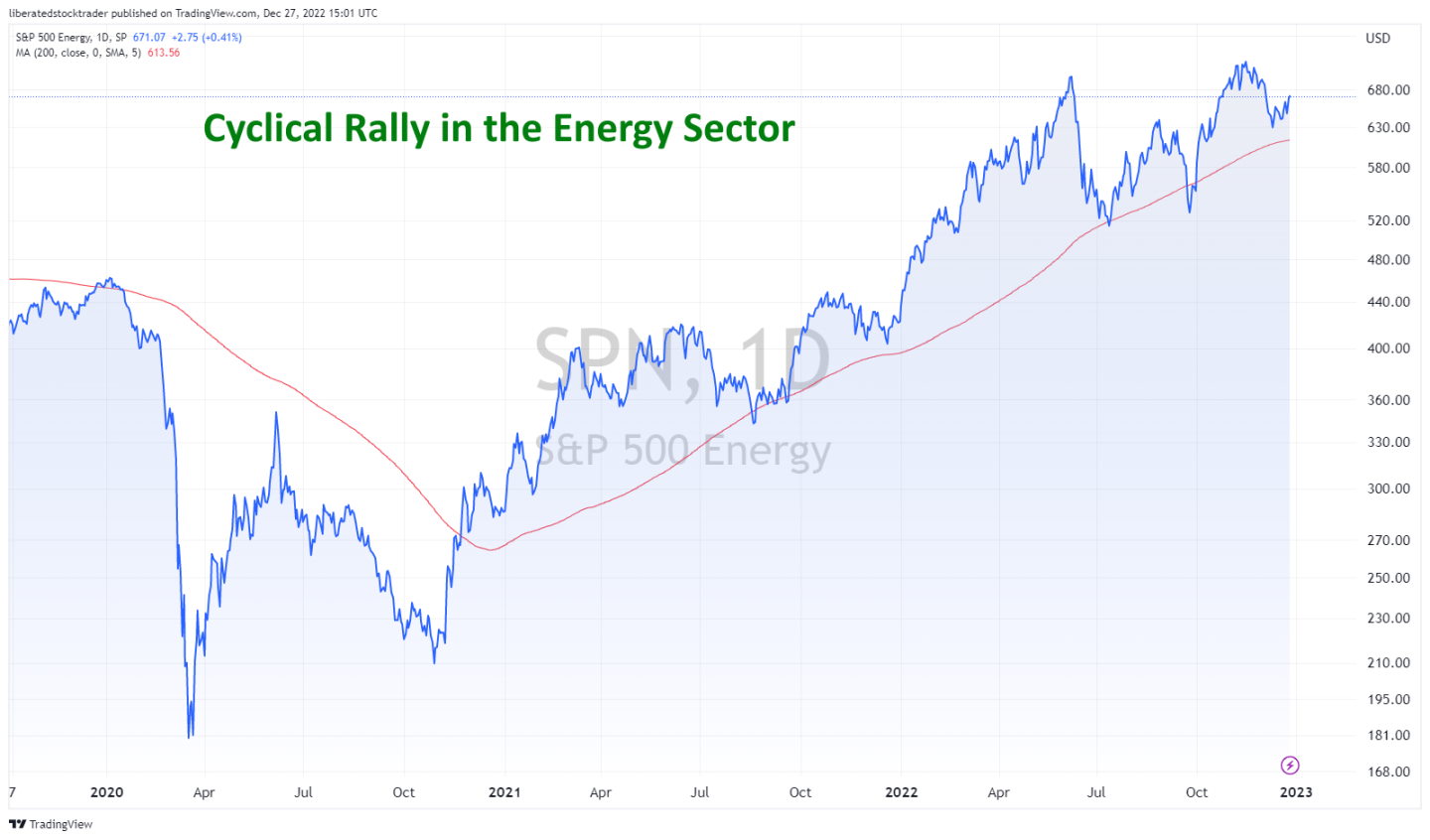

A cyclical rally occurs when a particular stock or sector is in high demand due to certain economic conditions. An example of a cyclical stock rally is when the price of oil rises. Rallies often happen when there is a sudden surge in demand for oil due to increased global economic activity. This can lead to companies heavily invested in the oil sector experiencing a surge in their stock prices as investors anticipate increased profits from higher oil prices. There is even a cyclical phenomenon known as the Santa Rally.

The example above shows the energy sector rally that bucks the overall stock market trend. 2022 has seen an overall bear market, while the energy sector, due to restricted supply, has seen a big rally-

A sector rally

A sector rally occurs when stocks within a particular industry or sector rise together due to industry-wide trends. For example, a sectoral rally may occur when the technology sector experiences increased demand due to innovations or advancements.

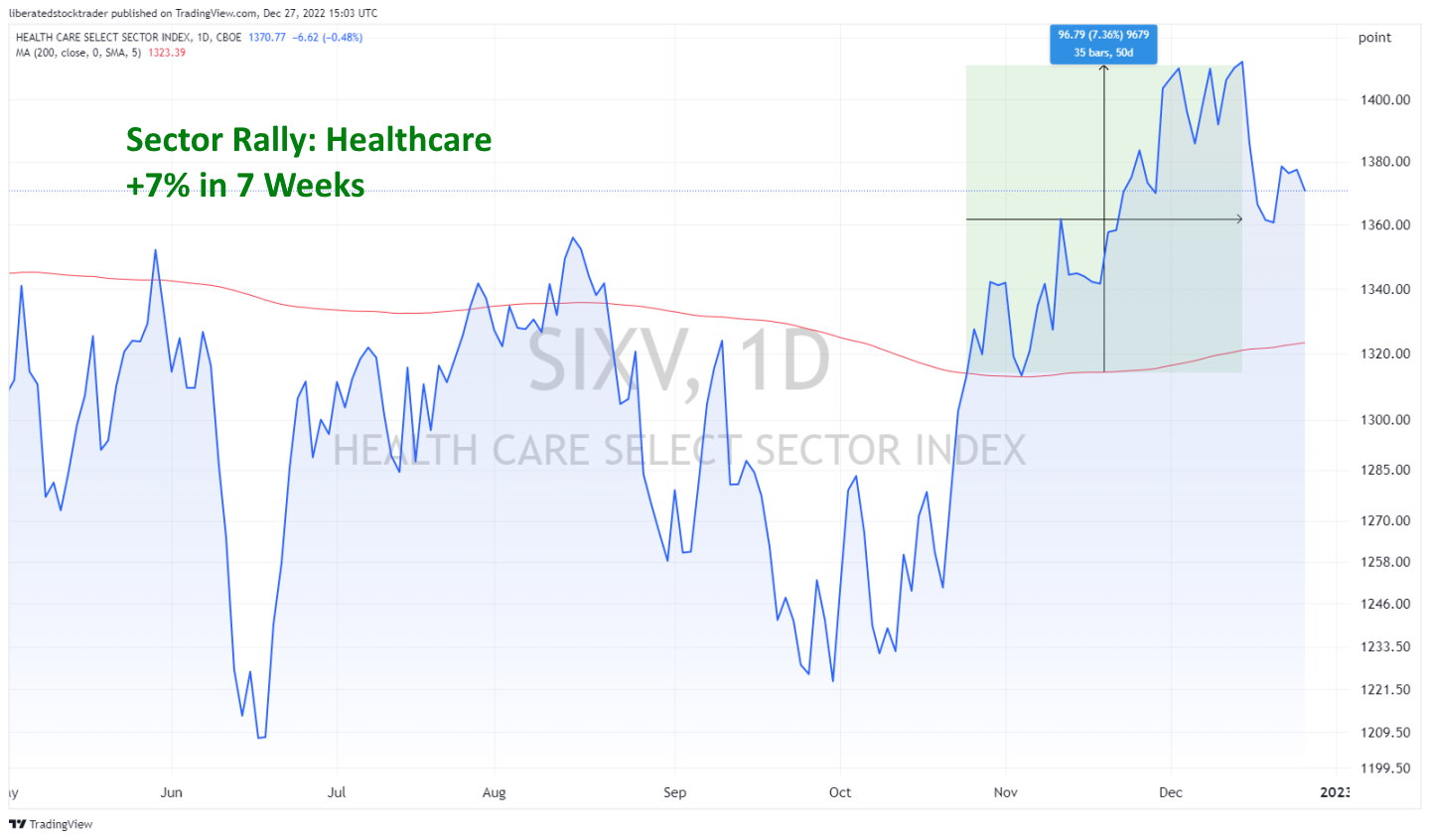

An example of a sectoral stock rally is when companies within the healthcare sector experience increasing share prices as investors become more confident in the industry’s prospects. A combination of factors such as increased investment in medical research, promising developments in disease treatments, or the approval of new medications could cause this.

A sectoral rally happens when all stocks within a certain industry rise together due to increased investor sentiment.

A broad-based rally

Lastly, a broad-based rally occurs when the entire market experiences an increase in share prices due to positive economic news or strong investor sentiment.

An example of a broad-based rally occurred in March 2020, when the S&P 500 rose 11%, its third-best month ever. This was due to positive news about the coronavirus pandemic and promises of government stimulus packages. Investors were confident that the economic effects of the pandemic would be temporary and that the stock market would eventually recover, leading to a broad-based rally in share prices. Additionally, investors’ confidence in the Federal Reserve’s ability to keep interest rates low and provide market liquidity also contributed to the rally.

In conclusion, stock market rallies can be caused by various factors, such as positive economic news, sector-specific developments, or broad-based investor sentiment. Understanding these drivers is important for investors to identify potential opportunities for buying and selling stocks.

What is a bear market rally?

A bear market rally is where investors generally lose a lot of money. As a stock market declines due to a poor business and economic climate, money pours into stocks due to perceived good news. However, the price rally is short-lived as the overall macroeconomic situation is still poor.

- I wrote an article on TradingView, “The Al Pacino Rule of Investing,” predicting the continuing bear market rallies and subsequent investor losses.

- During bear market rallies, many investors experience fear of missing out (FOMO).

Using Advance/Decline indicators with rallies

Advance/Decline Indicators are technical analysis tools that measure the number of stocks advancing versus declining in a given market. They can be used to gauge the overall direction of a market, such as a broad stock index, and to assess rallies or corrections. By tracking the ratio of these two indicators, traders and investors can identify when buying or selling pressure is increasing.

The advance/decline ratio shows how many stocks have advanced versus those that have declined in value. When the indicator line is at 10, it means ten stocks have increased in price compared to one that has decreased.

My thorough testing awarded TradingView a stellar 4.8 stars!

With powerful stock chart analysis, pattern recognition, screening, backtesting, and a 20+ million user community, it’s a game-changer for traders.

Whether you're trading in the US or internationally, TradingView is my top pick for its unmatched features and ease of use.

Explore TradingView – Your Gateway to Smarter Trading!

In the example above, you can see that before the March 2020 rally, the average advance/decline ratio was 2, and during the rally, the moving average (red line) moved to 4. This huge sustained increase indicates a powerful broad market rally.

Reasons why stocks rally

Individual stocks rally due to many factors, including increased earnings, positive news, and analyst coverage, and also participating in a broad market rally due to economic conditions.

1. Earnings reports

Shares of a company often rise when they report positive earnings results since investors respond to good news. Companies with stronger-than-expected financial outlooks tend to see their stocks jump significantly, as investors believe the company is in better shape than anticipated and will continue to show future growth.

It is also possible for a stock to rally even if its earnings don’t meet market expectations; if a company manages to beat its internal targets, it can prompt investor reactions. In addition, improved investor sentiment can cause broader gains in a range of stocks and sectors beyond the company that reported the earnings. All these factors combine to make investors look for opportunities before an earnings announcement is made – though caution should be used with such speculation as no one knows what will happen until the figures are revealed.

2. Analyst ratings

When analysts rate a stock highly, investors take this as a sign to buy shares in the company. Analysts can provide investors with unique insights into a company’s prospects that are not necessarily available to casual observers.

A positive rating from an analyst implies that their research has been favorable and suggests an opportunity to profit from investing in the stock. Because of this, analysts’ ratings tend to affect the demand for stocks, which subsequently drives up the share price and sends the market into a rally. As such, analyst ratings are important in how stocks perform in the financial markets.

3. Economic conditions

Stocks rally when economic indicators point to a healthy economy, signaling that businesses and markets are declining and investors can expect strong returns. Economic indicators are measurements, such as GDP, inflation, unemployment figures, and retail sales, that gauge an economy’s present and future financial health.

Hawks vs. Doves Explained: How Fed Decisions Impact Investors

When these indicators suggest favorable economic conditions, stock prices tend to rise. Investors buy stocks anticipating potentially high returns and capital growth due to increased confidence in a company’s profitability.

This increased demand for a given security drives its price up, leading stocks to rally overall. Therefore, individual and institutional investors need to monitor economic indicator readings to predict whether or not stocks will rally.

How do central banks fuel stock market rallies?

When the Federal Reserve leans towards lower interest rates and is more willing to engage in quantitative easing, borrowing becomes more affordable for businesses and individuals. This can lead to increased demand for certain stocks as businesses have more access to credit, and investors look for companies with strong fundamentals. When a dovish policy is in place, it can increase stock prices as companies can expand and grow more easily.

The example chart above shows the rally after the announcement of low interest rates and mass government stimulus after the Coronavirus outbreak in 2020. The US stock markets rallied by 44% in 10 weeks.

Types of stock rallies

A stock rally can occur when a specific industry or sector experiences higher-than-average growth. Such rallies often arise from news of new products, acquisitions, mergers, and collaborations that can affect the market positively. Markets may also rally when strong investor sentiment follows better-than-expected earnings reports, rising profits, or upbeat economic data. Even fear of missing out (FOMO) can fuel rallies.

A sector-wide rally can be caused by macroeconomic events outside the control of individual stocks, such as an improving global economy and surging oil prices. Finally, blindside rallies are brought about by unexpected news from a company that never appeared to be doing well before suddenly skyrocketing in value after the positive news release. Investors must be prepared to capture gains within a short period, whatever type of rally, as these stock movements tend to be short-lived.

Short-term stock rally

A short-term stock rally is when a given stock sees abnormally high gains, typically within hours or days. Such rallies often take advantage of small market corrections that sometimes occur when investor sentiment shifts, likely due to news reports or other events. Those who participate in a short-term stock rally usually aim to capitalize on the quick movement.

However, it is important to note that these same stocks may experience similar drops once the rally ends. Thus, investors must pay careful attention and understand how the markets work before trying their hand at a short-term stock rally.

Intermediate-term stock rally

Intermediate-term stock rallies can be lucrative for investors who want to get more market involvement. These rallies, which typically last from several weeks to several months, are characterized by stock prices that climb steadily or undergo periods of alternating rises and falls, often referred to as volatility.

However, even during volatile times, smart investors can use rising stock prices to increase their profits by regularly trading in and out of different stocks. By knowing when to buy and sell during an intermediate-term rally, an investor can significantly increase their portfolio value in only months – making it an ideal investment activity for those looking to gain bigger returns in shorter time frames.

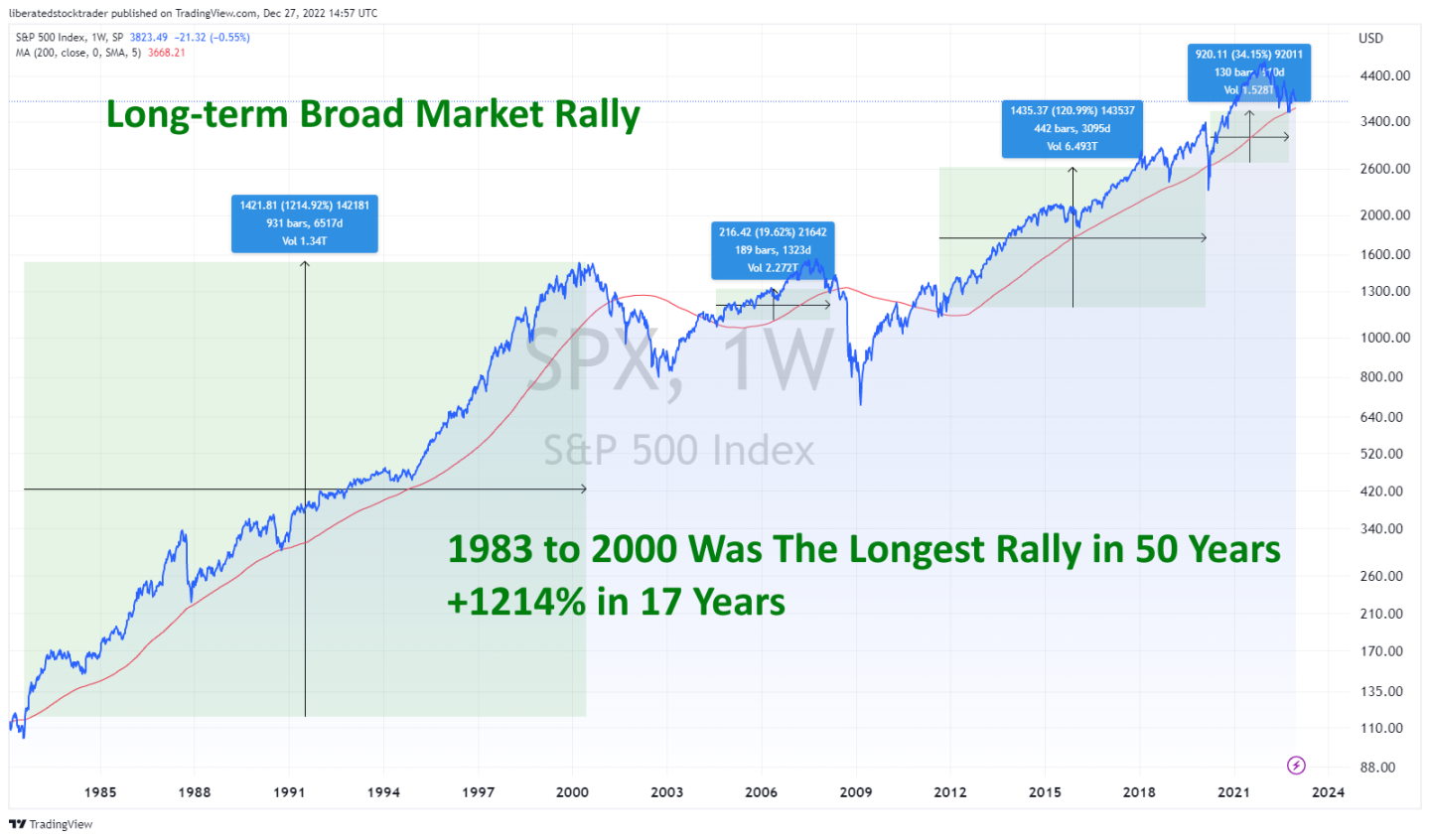

Long-term stock rally

Long-term stock rallies are a phenomenon that has been seen throughout the history of the markets. They are characterized by an extended rate of increased market value, often over multiple years. These periods of bullish market action offer investors steady, sustained growth and potential significant returns on their investment.

Many analysts point to long-term stock rallies as a sign that investors are optimistic and confident in the long-term outlook of the markets; this sentiment can be especially beneficial for those looking to make investments with a focus on capital appreciation. Overall, long-term stock rallies provide valuable opportunities to yield profitable results for astute investors.

How to Identify A Stock Rally

The best rallies occur after a significant downtrend, so using a technical indicator like the 200-day moving average on a stock chart will identify it. When the stock price on a daily chart crosses up through the 200-day moving average, you have a 29% probability of a profitable stock market rally.

When the 200-day moving average works, it can be very profitable, but according to our testing, it only works 29% of the time.

How to profit from a stock rally!

Identifying and profiting from a stock market rally requires a strategy that has been backtested over decades and all market conditions. The Market Outperforming Stock & ETF System (MOSES) identifies when a stock market is about to crash and when a new market rally is about to happen. This strategy took me ten years to develop and is a reliable solution to profiting from crashes and rallies.

Beat The Market, Avoid Crashes & Lower Your Risks

Nobody wants to see their hard-earned money disappear in a stock market crash.

Over the past century, the US stock market has had 6 major crashes that have caused investors to lose trillions of dollars.

The MOSES Index ETF Investing Strategy will help you minimize the impact of major stock market crashes. MOSES will alert you before the next crash happens so you can protect your portfolio. You will also know when the bear market is over and the new rally begins so you can start investing again.

MOSES Helps You Secure & Grow Your Biggest Investments

★ 3 Index ETF Strategies ★

★ Outperforms the NASDAQ 100, S&P500 & Russell 3000 ★

★ Beats the DAX, CAC40 & EURO STOXX Indices ★

★ Buy & Sell Signals Generated ★

MOSES Helps You Sleep Better At Night Knowing You Are Prepared For Future Disasters

Summary

A stock market rally is when stock prices rise for a sustained period. Stocks can rally for different reasons, like when companies release strong earnings reports or analysts give the stock a positive rating. There are also different rallies, depending on how long stock prices stay high. Short-term rallies last for days or weeks, intermediate-term rallies last for months, and long-term rallies can last for years. If you want to learn more about analyzing the stock market and making profitable investments, sign up for our Liberated Stock Trader Pro training course today.

You want to be a successful stock investor but don’t know where to start.

Learning stock market investing on your own can be overwhelming. There’s so much information out there, and it’s hard to know what’s true and what’s not.

Liberated Stock Trader Pro Investing Course

Our pro investing classes are the perfect way to learn stock investing. You will learn everything you need to know about financial analysis, charts, stock screening, and portfolio building so you can start building wealth today.

★ 16 Hours of Video Lessons + eBook ★

★ Complete Financial Analysis Lessons ★

★ 6 Proven Investing Strategies ★

★ Professional Grade Stock Chart Analysis Classes ★

FAQ

What is a stock rally?

A stock rally refers to a sustained increase in the prices of stocks in the market. Positive investor sentiment, improved economic indicators, or favorable corporate news often drive a rally.

What strategies can I use during rallies and crashes?

The MOSES ETF investing strategy is perfect for helping to predict rallies and crashes. It's a powerful suite of indicators meticulously backtested over 100 years to empower you to outperform the market.

How long does a stock market rally last?

As defined by Charles Dow, a short-term stock rally can last from days to weeks, a medium-term rally is weeks to months, and a long-term rally is months to years.

What triggers a stock rally?

A loose monetary policy and a positive business climate trigger long-term stock market rallies. Short-term rallies are driven by market news, economic policy changes, and improving corporate earnings.

How can I profit from a stock rally?

Investors can potentially profit from a stock rally by buying stocks early in the rally and selling them when prices are higher. It requires careful timing, analysis, a mix of proven stock chart indicators, and tested stock price patterns. Combine this with a backtested investing strategy, and you have a chance.

Can a stock rally be predicted?

Yes, but not 100%. No indicators or chart patterns are guaranteed, but there are probabilities you can consider worth the risk. Many bullish chart patterns are from 70% to 95% successful. For example, the cup and handle pattern is proven to be 95% bullish.

What's the difference between a stock rally and a bull market?

A stock rally is characterized by a temporary surge in stock prices, whereas a bull market signifies a long-term trend where prices are anticipated to climb persistently over months or even years.

Can a stock rally lead to a market bubble?

Yes, if a rally leads to excessively high stock prices that surpass their intrinsic value, it can create a market bubble, which could burst and lead to a market crash.

What are the signs of a stock rally ending?

Signs a stock rally is ending include slowing price momentum, negative economic data, declining investor sentiment, and a change in market trend from upwards to down.

Do all stocks participate in a stock rally?

While a broad market rally can lift many stocks, not all participate. Using the advance-decline ratio indicator, data shows that 80% of stocks may rise on a particular day in a very strong broad market rally.

Can a rally occur in a bear market?

Yes, even in a bear market, there can be short-term bear market rallies. For example, during the 2008 financial crisis, stock markets experienced numerous rallies that eventually fizzled out and turned into more losses overall.

Can a Stock Rally affect other financial markets?

Yes. A stock rally can directly affect other financial markets, such as bonds, foreign exchange rates, and commodities. For example, if stocks rally, demand for safe-haven assets like bonds might decrease. Conversely, a stock market crash can increase demand for safe-haven assets such as bonds and gold.

How can I track a Stock Rally?

You can track a stock rally using various technical indicators, such as the advance-decline ratio, moving averages, and momentum oscillators. Additionally, you can use our favorite stock charting software, TradingView, to keep track of stock prices.

What role do institutional investors play in a Stock Rally?

Institutional investors such as hedge funds, mutual funds, pension funds, and insurance companies have significantly influenced stock prices. When institutional investors believe that stocks may rise in price soon, they often move large amounts of capital into the market, which can cause a rally in stock prices.

Can market sentiment cause a Stock Rally?

Yes, positive market sentiment can drive a stock rally, as increased investor confidence can lead to more buying activity. Fear and greed play a defining role in stock price movements.

Is a Stock Rally a good time to short-sell?

Short selling during rallies is incredibly risky, as rising prices can lead to exponential losses. Short selling is a strategy for professional institutions, and they only use it as insurance against downside risk.