TradingView wins our head-to-head testing vs. TC2000 with superior charting, pattern recognition, backtesting, community, and global exchange data. TC2000 is better for broker integration and options trading.

TradingView’s depth of features is the key difference versus TC2000. TC2000 offers powerful charts, scanning, and stock and options trading in the USA. But TradingView enables charting, screening, backtesting, and trading stocks, forex, futures, and crypto globally.

TC2000 vs. TradingView Ratings

Our testing of TradingView vs. TC2000 shows that TradingView is best for international trading, community, backtesting, and pattern recognition. TC2000 excels at scanning and options trading. TradingView beats TC2000 on price and strategy development. Both platforms offer excellent ease of use.

| TradingView vs TC2000 Ratings | TradingView | TC2000 |

| 🏅 Rating |

4.6/5.0 | 3.7/5.0 |

| 💸 Pricing |

★★★★★ | ★★★★★ |

| 💻 Software |

★★★★★ | ★★★★★ |

| 🚦 Trading |

★★★★★ | ★★★★★ |

| 📡 Scanning |

★★★★✩ | ★★★★✩ |

| 💡 Pattern Recognition |

★★★★✩ | ★✩✩✩✩ |

| 📰 Newsfeed |

★★★★✩ | ★★★✩✩ |

| 👥 Social |

★★★★★ | ★✩✩✩✩ |

| 📈 Chart Analysis |

★★★★★ | ★★★★★ |

| 🔍 Backtesting |

★★★★✩ | ★✩✩✩✩ |

| 🖱 Usability |

★★★★★ | ★★★★★ |

| 🤝 Customer Support |

★★★✩✩ | ★★★★★ |

| 📑 Visit | TradingView | TC2000 |

🏅 TC2000 vs. TradingView Results

TradingView scores 4.6/5 due to its global community, charts, backtesting, news, and screening. TC2000 scores 3.7/5 because it lacks social community, news, backtesting, and pattern recognition capabilities.

TC2000, like TradingView, provides excellent stock charting and a broad range of indicators, but TradingView offers a social community of 50 million users and talented chartists who share ideas constantly.

Let’s take a look at the outstanding features head to head.

⚡Features Comparison

TradingView and TC2000 cover stock and index charting, but TradingView also covers cryptocurrency, foreign exchange, and commodities. The big difference is that TC2000 is for US markets only, and TradingView covers all markets globally. TradingView features a news stream and a vibrant and active social community of 10 million users sharing charts and ideas. TC2000 has no news or social component.

| Features | TradingView | TC2000 |

| ⚡ Features |

Charts, News, Watchlists, Screening | Charts, Watchlists, Screening |

| 🏆 Unique Features |

Trading, Backtesting, Community | Options Scanning & Trading |

| 🎯 Best for | Stock, Fx & Crypto Traders | Stock & Options Traders |

| ♲ Subscription | Monthly, Yearly | Monthly, Yearly |

| 💰 price | Free | $13/m to $49/m annually | Free or $60/m or $50/m annually |

| 💻 OS | Web Browser | PC, Mac |

| 🎮 Trial | Free 30-Day | Free 30-Day |

| 🌎 Region | Global | USA, Canada |

| ✂ Discount | Use Code "LST30" for -30% on monthly or -63% off annual plans | -25% Discount |

| 🏢 Visit | Try TradingView Free | Try TC2000 Free |

| 📒 In-depth Review | TradingView Review | TC2000 Review |

As a certified financial technician, I am uniquely positioned to compare the key important differences between the TradingView and TC2000 chart analysis tools, so I hope you enjoy the review.

🔦Feature Differences

TradingView stands out with its extensive range of features, setting it apart from TC2000. While TC2000 offers robust charts, scanning, and trading options for US stocks, TradingView goes beyond by providing advanced charting, screening, backtesting, and a vibrant social community. Moreover, TradingView facilitates trading in stocks, forex, futures, and crypto on a global scale.

💸 Pricing

TradingView and TC2000 offer free access to their platforms; however, TradingView’s free service has more functionality than TC2000’s. TradingView allows scanning and screening, backtesting, watchlists, and Candlestick chart recognition for free; with TC2000, scanning and watchlists are disabled.

TradingView pricing starts at $0 for the basic ad-supported plan: Pro costs $14.95, Pro+ $29.95, and Premium costs $59.95 monthly. Opting for a yearly subscription will reduce those costs by 16%, representing a significant saving. There is an additional $2 cost per exchange if you want real-time data. I recommend the Pro or Pro+ services to strike the right balance of power and price.

TC2000 pricing is $9.99 monthly for the Silver subscription, enabling basic features like charting and watchlists. For any real benefits, you need the Gold service, which provides advanced stock chart indicators, market scanning, customizable watchlists, and simulated paper trading. With TC2000, you will also need a monthly data subscription, costing $9.99.

✂ TradingView Discounts

Sign up for an annual Pro or Premium plan, and TradingView will offer you a 16% discount. Find out more in our dedicated TradingView discounts article.

✂ TC2000 Discounts

Our partnership with TC2000 enables us to share a discount coupon worth $25 off your first purchase. You can also combine it with a bi-annual subscription, which saves an additional 25%. Additionally, you will receive ebooks and training discounts worth $199 from LiberatedStockTrader.com via email. Claim your TC2000 Bonuses.

💾 Software & Apps

Both TradingView and TC2000 offer excellent, stable, and reliable platforms that are easy to use. TradingView offers considerably more functionality than TC2000 for a lower price point.

When comparing TradingView to TC2000, we can see that Trading View offers news, a social community, backtesting, and screening for stocks, forex, futures, and crypto globally, while TC2000 does not.

| Key Features | TradingView | TC2000 |

| Market Data | Global | USA |

| Powerful Charts | ✔ | ✔ |

| Stocks | ✔ | ✔ |

| Futures | ✔ | ✘ |

| Forex | ✔ | ✘ |

| Cryptocurrency | ✔ | ✘ |

| Social Community | ✔ | ✘ |

| Market News | ✘ | ✘ |

| Screeners | ✔ | ✔ |

| Backtesting | ✔ | ✘ |

| Options Trading | ✘ | ✔ |

🚦 Trading

TradingView supports over 40 high-quality brokers, meaning tight integration, so you can directly trade from charts and view your profit and losses directly in TradingView. TC2000 integrates with one broker, TC2000 Brokerage, which offers $1 stock trades and $1 + 65c per options contract.

TradingView integrates TradeStation, an excellent broker offering zero commissions stock trades, and other brokers trading futures, forex, and cryptocurrency.

🎥 TradingView Video

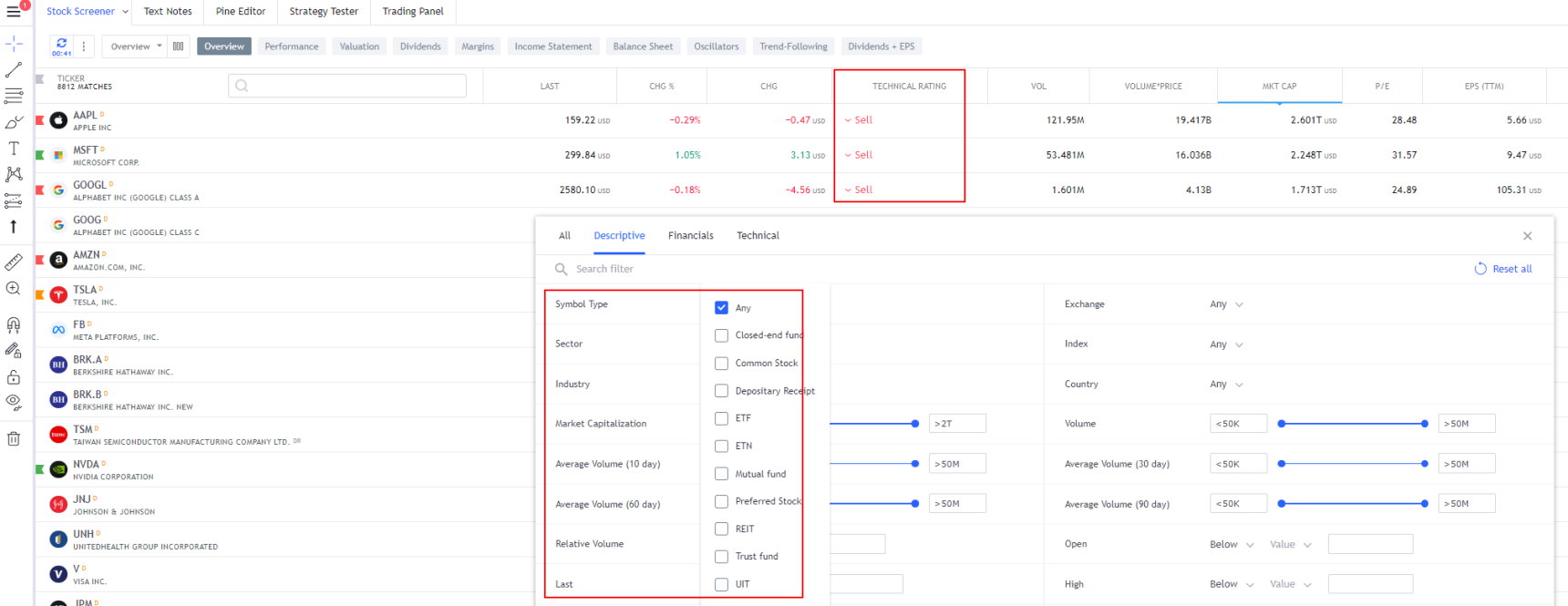

📡 Scanning & Screening

TradingView has integrated stock, forex, crypto screeners, and heatmaps, covering fundamental analysis and price/volume indicator scanning. TC2000 primarily focuses on the technical screening of price, volume, and indicators.

The TradingView stock screener comes complete with 160 fundamental and technical screening criteria. All the usual criteria are there, such as EPS, Quick Ratio, Pre-Tax Margin, and PE Ratio. But it also goes into more depth with more esoteric criteria, such as the number of employees, goodwill, and enterprise value.

TC2000’s EasyScan has 108 technical indicators, such as MACD, Moving Averages, and RSI. TC2000 also has a coding window for customizing scans and indicators, but it is not as flexible or powerful as TradingView’s Pine script coding engine.

💡 Chart Pattern Recognition

For chart pattern recognition, TradingView is much better than TC2000. TC2000 enables gold subscribers to scan for price and create custom indicators. TradingView automatically recognizes 28 candlestick patterns, Elliott waves, and 16 chart patterns in its free service. TradingView also has thousands of community-developed indicators and systems.

📰 News & Social

TradingView is built with social at the forefront and is the best for social sharing and learning; forget StockTwits; TradingView is the best. TradingView’s fully integrated chat forum and publishing system are excellent ways to share your charts and ideas. TC2000 does not have an interactive social community or a newsfeed.

Chart, Scan, Trade & Join Me On TradingView for Free

Join me and 20 million traders on TradingView for free. TradingView is a great place to meet other investors, share ideas, chart, screen, and chat.

📈 Chart Technical Analysis

Both TC2000 and TradingView offer broad, powerful features for chart analysis. TradingView has 160 different indicators, and TC2000 offers 108 chart indicators.

TradingView offers 12 stock chart types, including unique specialty charts like LineBreak, Kagi, Heikin Ashi, Point & Figure, and Renko. TC2000 has seven chart types, including Candlesticks and Heiken Ashi.

TradingView has 65 drawing chart annotation tools, including capabilities unavailable on other platforms, such as extensive Gann & Fibonacci tools and hundreds of icons for your charts, notes, and ideas. TC2000 offers 28 different chart annotation tools.

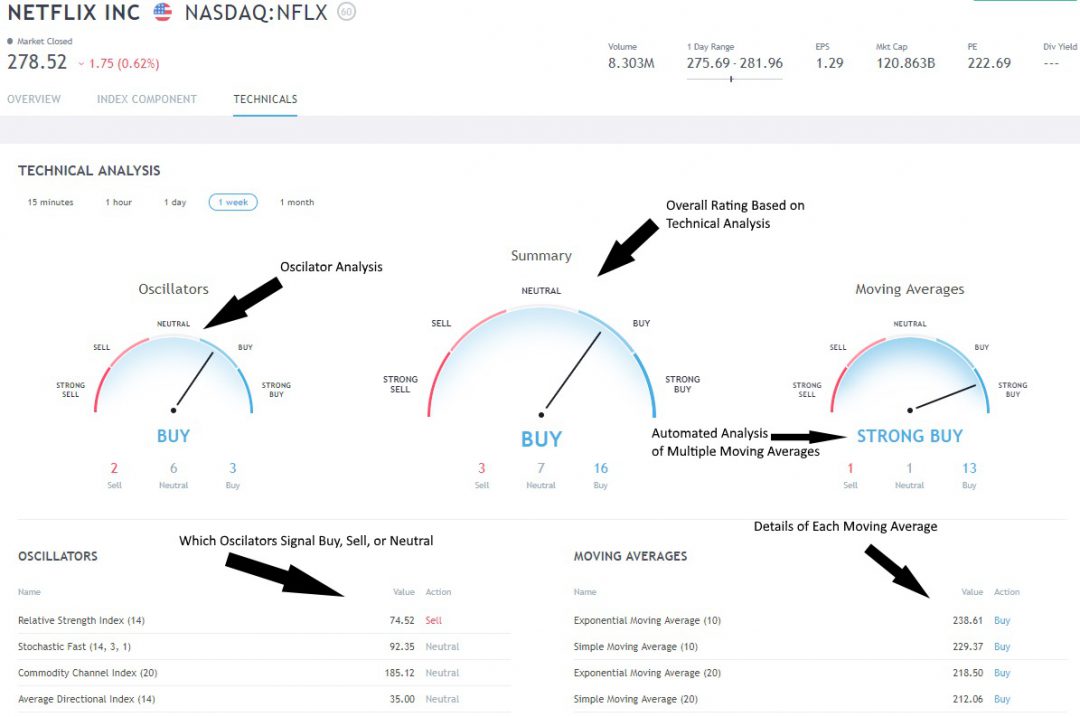

TradingView’s unique and innovative Buy and Sell gauges save you time by providing an instant readout of which stocks are bullish, bearish, or neutral; TC2000 does not have this functionality.

TradingViews’s stock indicator ratings are well implemented because there are two critical technical analysis indicators: moving averages based on price and oscillators based on price and volume. Based on my observations, the TradingView buy and sell indicators are a good measure of sentiment and are featured in my Fear & Greed Index Dashboard.

The left gauge shows the oscillating indicators like relative strength, stochastics, and the Average Directional Index. On the right, you have a selection of Moving Averages, Simple, Exponential, and even Ichimoku Cloud.

Even though TradingView has more indicators and annotation tools, TC2000 ACP is a good platform with good future potential.

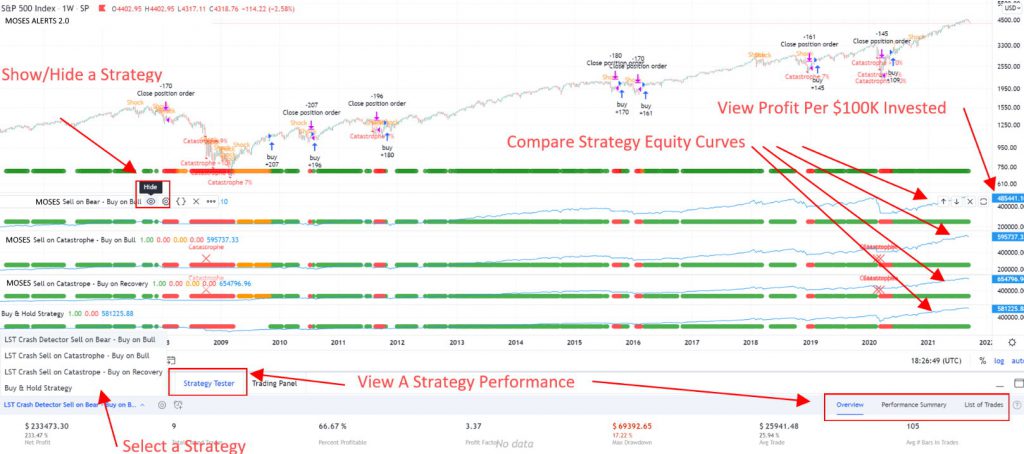

🔍 Strategy Backtesting

TradingView has implemented powerful backtesting features, whereas TC2000 does not have backtesting functionality. Scanning for chart patterns and indicator conditions in a specific historical timeframe with TC2000 is possible, but that is not the same as backtesting.

TradingView has robust backtesting reporting showing trades, profit, loss, and capital drawdown; TC2000 does not.

TradingView has a backtesting system called Strategy Tester, but you must develop scripting skills using the proprietary Pine code to develop original backtesting systems. I have even implemented my MOSES ETF Trading strategy into TradingView; I am no developer, but the Pine Script language is so natural anyone can do it.

My thorough testing awarded TradingView a stellar 4.8 stars!

With powerful stock chart analysis, pattern recognition, screening, backtesting, and a 20+ million user community, it’s a game-changer for traders.

Whether you're trading in the US or internationally, TradingView is my top pick for its unmatched features and ease of use.

Explore TradingView – Your Gateway to Smarter Trading!

🖱 Usability

TradingView and TC2000 are incredibly easy to use, requiring zero installation or configuration. Both platforms are easy for beginners and offer advanced features for more experienced traders.

🔍 TC2000 vs. Trade Ideas

While TC2000 is good for traders, Trade Ideas is best for day traders. TC2000 enables market scanning, but Trade Ideas delivers specific AI-tested trading signals to traders. Trade Ideas is a superior product for day traders but costs significantly more than TC2000.

🏁 Final Thoughts

TradingView is the best overall stock analysis and trading software. It is perfect for beginner and experienced traders, with a vibrant community and excellent charts, backtesting, scanning, and screening globally. The rating section shows that TradingView equals or beats TC2000 in every category. The key reason to go for TC2000 would be to trade options and use advanced stock options strategies; TradingView does not have this feature.

If you need real-time news, the best backtesting, and stock chart indicators, I recommend MetaStock. Stock Rover is the best software to build long-term value, income, and growth portfolios. Finally, if you want to use the power of AI for short-term day trading, then Trade Ideas is the best choice.

🙋 FAQ

Which is better, TC2000 trading or TradingView?

Both TC2000 and TradingView enable trading directly from charts. To trade with TC2000, you need TC2000 brokerage, which charges $1 per trade. TradingView's model is better with integrated brokers, like Interactive Brokers with low trading costs and TradeStation with free stock trades.

Is TC2000 better for Options trading than TradingView?

Yes, TC2000 is much better for trading stock options than TradingView. TC2000 enables advanced options charting, planning, and execution of complex options contracts. TradingView has no stock options functionality whatsoever.

Does Tradingview have Options charts?

No, TradingView does not have stock options charts and is unsuitable for options trading. A better alternative is TC2000, which offers complex options strategies, charting, immediate order execution, and order management directly from the chart.

Can I trade options on Tradingview?

No, you cannot trade options natively on TradingView. Some third-party providers offer coding to bridge the gap for options trading, but you would be better off opting for TC2000, which offers a full options trading experience.

What is a good TC2000 alternative?

Our testing shows that a good alternative to TC2000 is TradingView. While TC2000 is superior for options trading, TradingView wins in social trading, backtesting, charting, exchange coverage, free and low-cost data plans, and asset coverage with stocks, ETFs, crypto, and forex.

Can you trade futures on TradingView or TC2000?

Yes, trading future is possible on TradingView with comprehensive commodities coverage and broker integration. TC2000 does not have any functionality covering future contract trading.

Which is best, TC2000 paper trading or TradingView?

Both TradingView and TC2000 offer a comprehensive paper trading service so you can practice trading. TC2000 is best for paper trading stocks, options, and ETFs in the USA. TradingView is better for paper trading stocks, ETFs, futures, and cryptocurrency globally.