Investing in international stocks is a great way to diversify your portfolio and gain exposure to global markets.

Trading international stocks can open up new opportunities and risks. However, you can also trade international ETFs from your home country, which will give you exposure and reduce risk through diversification.

To start trading international stocks, set up a brokerage account that allows for international transactions. Research the companies listed in various countries and consider currency exchange rates.

Key Takeaways

- International stocks offer portfolio diversification and access to new opportunities.

- Set up a brokerage account that supports global trading and understand market conditions.

- Research companies and consider currency exchange rates.

- Many US and international ETFs are available in your home country.

Understanding International Stocks

International stocks provide opportunities to invest in companies outside one’s home country. This includes companies from developed markets with stable economies and emerging markets with high growth potential. Investing in international stocks can offer benefits but also involves unique risks.

Types of International Stocks

There are three main types of international stocks: developed markets, emerging markets, and frontier markets. Developed markets include countries like the United Kingdom, Germany, and Japan. These markets have established economies and lower volatility.

Emerging markets, such as Brazil, China, and India, offer higher growth potential but come with greater risks, including political and currency risks. Frontier markets, which are less developed than emerging markets and include countries like Vietnam and Nigeria, can offer significant returns but are highly volatile and carry substantial risks.

TradingView – Our Recommended International Trading Software

TradingView is perfect for analyzing and trading international stocks. With a vast selection of global markets, including developed, emerging, and frontier markets, TradingView provides all the tools you need to make informed investment decisions.

In addition to its comprehensive charting capabilities, TradingView also offers real-time data from major exchanges worldwide. This allows you to stay on top of market trends and make timely trades based on accurate information.

Try TradingView, Our Recommended Tool for International Traders

Global Community, Charts, Screening, Analysis & Broker Integration

Global Financial Analysis for Free on TradingView

Another great feature of TradingView is its social network aspect. You can connect with other traders from around the world to share ideas and strategies, as well as follow expert analysts for valuable insights into international markets.

The platform also offers advanced features such as backtesting and alerts, making it suitable for both beginner and experienced traders looking to diversify their portfolios with international stocks.

Benefits of Diversifying with International Stocks

Diversification is a key benefit of investing in international stocks. By holding stocks from different countries, investors can reduce their exposure to local economic downturns. For example, if the US market declines, gains in European or Asian markets may offset some of those losses.

International stocks can also offer access to industries and sectors that are not available in an investor’s home country. For instance, an investor interested in advanced manufacturing might find attractive opportunities in Germany or Japan. Additionally, investing in emerging and frontier markets can provide high growth potential, as these economies often expand faster than developed ones.

Risks Involved in International Stock Trading

Investing in international stocks includes several risks. Political risk is significant in emerging and frontier markets where government stability can affect market performance. For example, regulatory changes in China can impact foreign investments.

Currency risk is another concern. Fluctuations in exchange rates can affect the value of investments. For instance, if the US dollar strengthens against the Japanese yen, the value of Japanese stocks held by a US investor may decrease.

Additionally, international stocks may face different regulations and accounting standards, making it challenging to evaluate investment opportunities. Higher volatility in emerging and frontier markets can lead to larger swings in stock prices, which can be both a risk and an opportunity.

Setting up for International Trading

Setting up for international trading involves choosing the right broker, understanding currency conversions and fees, and considering various account types and regulatory requirements. This guide will help you navigate these critical steps to ensure a smooth trading experience.

Choosing the Right Broker and Trading Platform

Selecting a broker and trading platform is crucial for trading international stocks. Firstrade, Fidelity, Charles Schwab, and Interactive Brokers are popular choices for global investing services.

Look for brokers that provide access to multiple international markets. Ensure the platform is user-friendly, with robust research tools and real-time market data. Assess the cost structures, including commission fees and spreads, which can impact your returns. Opt for brokers with dedicated international trading specialists who can assist with navigating foreign markets.

Why Firstrade is a great international broker

Firstrade stands out as a top choice for international trading. It offers access to more than 25 international markets, including popular exchanges like the London Stock Exchange and Tokyo Stock Exchange.

The platform is intuitive and user-friendly, making it ideal for beginners or traders looking for a smooth trading experience. Firstrade also provides extensive research tools, market data, and real-time quotes to help with decision-making.

Our Firstrade Review Rating

| Firstrade Rating |

4.7/5.0 |

| 💸 Trades & Commissions |

★★★★★ |

| 📈 Trading Platform |

★★★★★ |

| 🙋♂️ Customer Support |

★★★✩✩ |

| 📰 Research & News |

★★★★★ |

| 💵 Account Opening Balance | ★★★★★ |

| 🔍 Regulation | ★★★★★ |

Our review testing indicates Firstrade is perfect for investors looking for zero commissions trading on stocks and options and an industry-leading 2,200 commission-free ETFs. With full MorningStar research access and a complete range of IRA accounts, Firstrade is an excellent brokerage option.

Stock Tracking & Watchlist Reporting – Firstrade commissions are competitive, starting at just $0 for US stocks and ETFs, and foreign stock trades cost only $10 per trade. Plus, there are no account maintenance fees or minimum balance requirements. This makes Firstrade an affordable option for those wanting to invest in international stocks.

Additionally, Firstrade has a team of dedicated customer service representatives available via phone, email, and live chat to assist with any questions or concerns. They also offer educational resources, such as webinars and articles, to help users improve their trading strategies.

Understanding Currency Conversions and Fees

Trading international stocks often involve dealing with multiple currencies. Currency conversions can affect your trade values, so it’s important to understand how your broker handles these.

Be aware of currency conversion fees, which vary by broker. Some, like Interactive Brokers, have competitive rates, while others might charge higher fees. Knowing this helps manage costs and improves profit margins. Check if your broker offers accounts that allow holding foreign currencies, reducing the need for frequent conversions and associated charges.

Account Types and Regulatory Considerations

When setting up an account, choose the type that suits your risk tolerance and investment goals. Non-retirement brokerage accounts are common for international trading. These accounts typically have fewer restrictions compared to retirement accounts.

Understand the regulatory requirements in both your home country and the countries where you trade. Compliance varies, including taxation and reporting requirements. Brokers like Charles Schwab provide support with understanding different regulations. Research the specific rules regarding foreign investment to avoid legal complications. Being aware of these considerations ensures you comply with all necessary regulations and optimize your trading strategy.

Executing International Trades

Executing international trade involves understanding diverse markets, developing strategies for trading foreign equities, and managing risks. Investors need to be aware of market mechanics and effective strategies to optimize their portfolios.

Understanding Markets and Their Mechanics

International markets function differently than domestic ones. Investors must familiarize themselves with various market structures. Trading often occurs on a local exchange, such as the London Stock Exchange or Tokyo Stock Exchange. Each market has unique trading hours and regulations.

Liquidity can vary greatly between markets. Higher trading volumes typically mean better liquidity, reducing the impact of trading on stock prices. Stock market capitalization also affects trading; larger-cap stocks generally offer more stability.

Currency fluctuation is another crucial factor. Exchange rates can significantly affect returns, so monitoring currency trends is vital. For instance, a depreciating foreign currency can erode profit margins even if the stock price increases.

Strategies for Trading International Equities

Several strategies can be employed when trading international equities. One common method is to invest in Exchange-Traded Funds (ETFs) or mutual funds that focus on foreign stocks. These funds spread the risk across multiple companies and industries, providing a diversified portfolio.

American Depositary Receipts (ADRs) and Global Depositary Receipts (GDRs) are another option. ADRs allow US investors to buy shares in foreign companies with fewer risks. They are traded on US exchanges and thus follow US regulations.

Using market or limit orders wisely can help in executing trades efficiently. Market orders allow immediate execution at the current price, while limit orders let investors set a maximum purchase price or minimum sale price.

Minimizing Risks and Maximizing Opportunities

Identifying and managing risks is key. Geopolitical risks, such as political instability, can impact markets. Investors should stay informed about global events and their potential effects on the markets they are interested in.

Foreign tax withholding can reduce returns. Understanding the tax implications of trading in foreign markets is essential. Different countries may have different tax rates and regulations.

Expense ratios in ETFs and mutual funds can also impact overall returns. Lower expense ratios generally mean higher net returns. Additionally, trading commissions and fees should be considered when calculating the total cost of international trading. For example, using services like the Schwab Global Account may provide lower commission rates and advantageous currency conversion.

By considering these factors, investors can optimize their international trading strategies and minimize potential drawbacks.

Navigating International Market Access

Trading international stocks can be rewarding but also complex. Investors need to understand the nuances of different markets, the effects of global events, and the implications of foreign taxes on earnings.

10 Biggest International Stock Markets Compared

Investors should start by choosing which foreign markets to access. Popular choices include countries with robust economies like Germany, Japan, and Canada.

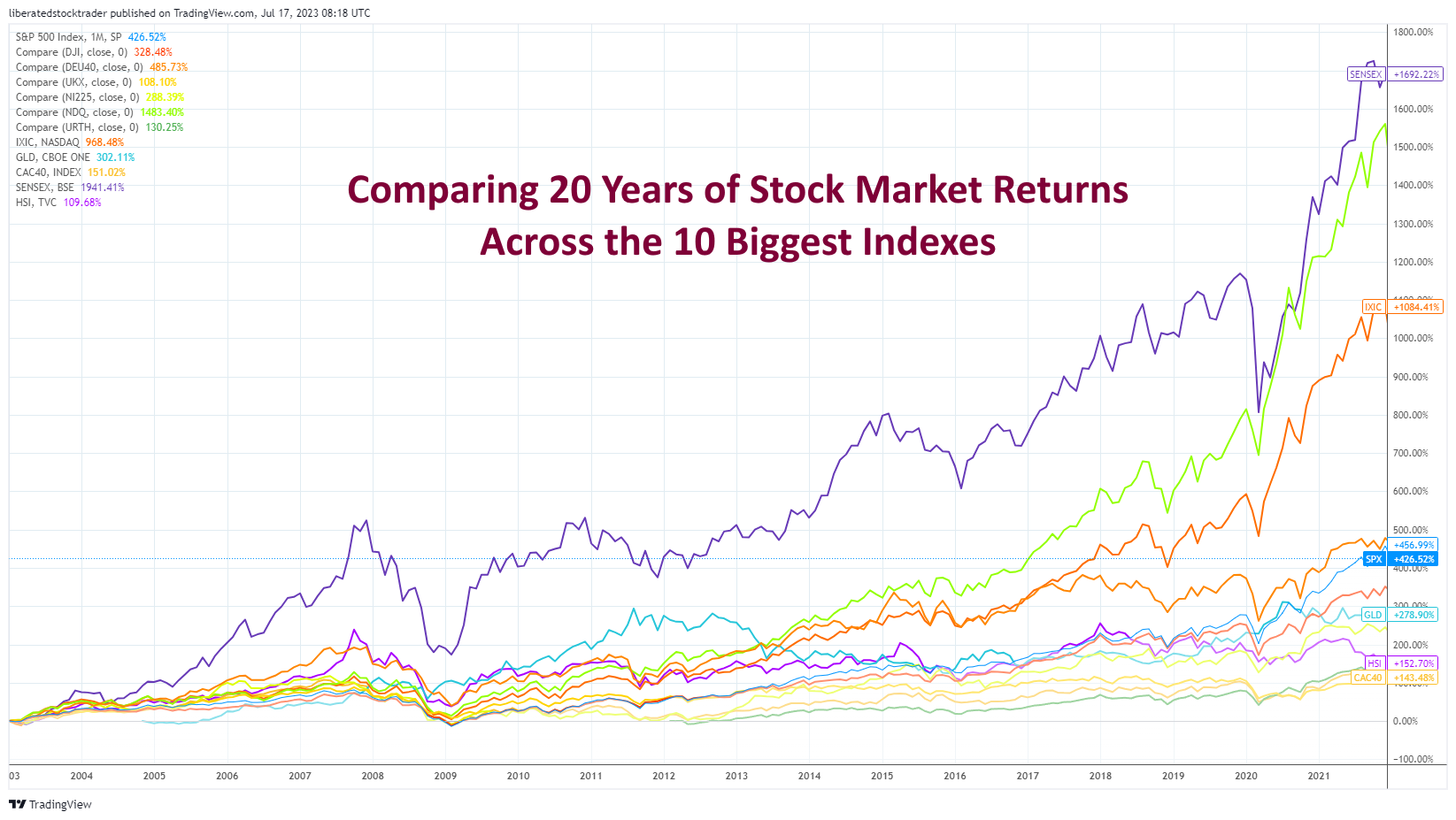

The best-performing index funds over the previous ten years are the Nasdaq 100 +450%, Bombay Sensex +242%, S&P 500 195%, and Russell 3000 +183%. It’s important to note that these funds have not had consistent performance; there have been periods of strong returns and dips in the market. The key takeaway is that index fund investing allows investors to diversify risk while also participating in long-term growth potential.

How to Compare Buy and Hold Returns Across the 10 Major Global Stock Market Indexes

Get the Latest Stock Index Quotes on TradingView

An effective strategy involves diversifying across several regions, such as Europe, Asia, and Australia. Index funds that focus on international stocks provide a lower-risk way to gain exposure. By expanding beyond familiar markets, you can avoid home country bias.

Consider investing in foreign ordinaries listed on local exchanges. Tools like ADRs (American Depository Receipts) can make it easier to trade international companies in your home market’s currency.

International ETFs Worth Investing In.

When selecting index funds, it is important to choose well-capitalized and broad-market funds. These types of funds will have a larger number of holdings, providing even more diversification within the fund. Look for index funds that track major indexes such as the S&P 500 or the Dow Jones Industrial Average.

☆ Vanguard Total World Stock Index (VT)

The Vanguard Total World Stock Index is a low-cost fund that invests in companies worldwide, including developed and emerging markets. It offers broad diversification and has a strong track record of performance.

The fund is managed passively to maintain a diversified portfolio of developed and emerging market stocks based on market cap weighting. It excludes frontier markets like Vietnam and Kuwait, similar to other peer funds.

☆ Fidelity Nasdaq Composite Index ETF (ONEQ)

This fund seeks to provide investment results corresponding to the total return of the NASDAQ Composite stock market. ONEQ tracks solely Nasdaq-listed companies, excluding those on the NYSE or other exchanges. The index of the underlying funds includes both domestic and international companies listed on Nasdaq.

☆ Schwab Fundamental U.S. Broad Market Index ETF (FNDB)

An index fund that follows the US Total Stock Market’s performance. FNDB begins with the well-known Russell 3000, a market-cap-weighted total market index, and uses fundamental screens to select and weigh its stocks.

☆ iShares Core S&P Total U.S. Stock Market ETF (ITOT)

This ETF aims to mirror the performance of the S&P Total Market Index, providing extensive market coverage in a cost-effective and liquid fund. ITOT is tailored to follow the broad US equity market, encompassing large, mid-, small-, and micro-cap stocks.

☆ SPDR Portfolio MSCI Global Stock Market ETF (SPGM)

An ETF seeking to mirror the investment performance of the Dow Jones U.S. Total Stock Market Index. SPGM contains global stocks that follow a wide-ranging, market-cap-weighted index spanning 23 developed and 27 emerging market countries.

The Impact of Global Events on International Stocks

Global events can significantly influence foreign markets. Political changes, trade agreements, or financial crises can impact stock performance. For instance, tensions in the United Kingdom over Brexit affected European markets.

Events in Asia, such as economic policies in China or disruptions in Hong Kong, can have regional and global effects. Investors must monitor global news and understand how international incidents affect their holdings.

Local currencies also play a role. An appreciating or depreciating currency can impact the value of international investments. For example, fluctuations in the Japanese yen may alter the returns on Japanese stocks when converted back to the investor’s home currency.

Dealing with Taxes and International Earnings

International stock investors need to navigate the complexities of foreign taxes. Countries like Germany and Singapore may withhold taxes on dividends of foreign stocks. Understanding these tax treaties is crucial to avoid unexpected tax liabilities.

Retirement accounts can sometimes offer tax advantages when holding foreign stocks. However, investors must ensure compliance with both local and foreign tax regulations. Consulting a tax advisor experienced in international investments can be beneficial.

Tracking international earnings accurately is essential. Different countries have varied rules for reporting and settling such earnings. Settlement procedures and timelines in markets like Japan and South Africa may differ from those in the United States, impacting cash flow timing.

FAQ

What international broker can you recommend?

Firstrade is my preferred broker. It offers a wide range of international markets, competitive fees, and excellent customer service.

Are there any countries where it is not recommended to invest in stocks?

It ultimately depends on your risk tolerance and investment goals. However, some countries, like China, may have unstable political or economic situations that could impact the stock market.

What platforms allow for trading international stocks online?

Many platforms allow users to trade international stocks online. Some popular ones include Firstrade, Charles Schwab, Firstrade, Fidelity Investments, and E*TRADE. These platforms offer access to various global markets, making it easier for investors to diversify their portfolios.

What is the best international trading software?

TradingView is the top-rated international trading software among traders and investors. It offers real-time data from multiple markets, customizable charts and indicators, and the ability to trade directly from the platform.

Is it worth investing in emerging markets?

Investing in emerging markets can offer higher growth potential than investing in developed markets. However, it also comes with significantly higher risks, as these countries may have weaker economies, political instability, and less regulatory oversight.

How can one invest in foreign stocks through online brokers?

Online brokers simplify investing in foreign stocks. Once you have an account, you can buy shares directly or through American Depositary Receipts (ADRs). ADRs represent shares in foreign companies and trade on US exchanges, making it easier for investors.

What should one consider when selecting international stocks for investment?

When selecting international stocks, consider the company's financial health, the country's economic stability, and currency exchange rates. Additionally, stay updated on global events that may impact stock prices and monitor market trends to make better decisions.

What are the tax implications of trading international stocks for US residents?

US residents trading international stocks must consider foreign taxes and US tax laws. Foreign investments may be subject to withholding taxes in the country where the company is based. Additionally, gains from these trades are taxable in the US, and you may need to report the income on your tax return.