Our hands-on TradingView vs. TrendSpider test resulted in Trendspider winning with 4.7/5 stars and TradingView with 4.5/5.

TradingView excels at live trading, community, and global data, and TrendSpider’s strengths are AI pattern recognition and backtesting.

As a certified market analyst and an active subscriber to both TrendSpider and TradingView, I believe I am uniquely positioned to compare the important strengths and weaknesses of these great chart analysis tools.

TradingView vs. TrendSpider Ratings

My testing of TradingView vs. TrendSpider reveals that TrendSpider is best for AI-automated pattern recognition, scanning, backtesting, and auto-trading. TradingView is better for the social community and international traders. Both platforms offer excellent charts and usability.

| TradingView vs. TrendSpider Ratings | TrendSpider | TradingView |

| 🏅 Rating |

4.7/5.0 | 4.5/5.0 |

| 💸 Pricing |

★★★★★ | ★★★★★ |

| 💻 Software |

★★★★★ | ★★★★★ |

| 🚦 Trading |

★★★★★ | ★★★★★ |

| 📡 Scanning |

★★★★★ | ★★★★✩ |

| 💡 Pattern Recognition |

★★★★★ | ★★★★✩ |

| 📰 News |

★★★★✩ | ★★★✩✩ |

| 👥 Social |

★★★✩✩ | ★★★★★ |

| 📈 Chart Analysis |

★★★★★ | ★★★★★ |

| 🔍 Backtesting |

★★★★★ | ★★★★✩ |

| 🖱 Usability |

★★★★★ | ★★★★★ |

| 📑 Visit | Try TrendSpider | Try TradingView |

🏅TradingView vs. TrendSpider Summary

TradingView scores 4.5/5.0 because it does everything well, but TrendSpider scores 4.7 because it has superior screening, newsfeeds, pattern recognition, backtesting, and live trading. TrendSpider excels at using AI to auto-detect trendlines, Fibonacci, and candlestick patterns on multiple timeframes on a single chart.

Let’s take a look at the outstanding features head to head.

⚡TradingView vs. TrendSpider Features

TradingView and TrendSpider cover stocks, Forex, futures, and crypto; the difference is that TrendSpider is US-only, and TradingView is global. TradingView features a news stream and 20 million active users sharing charts and ideas. TrendSpider has no social component.

| Features | TradingView | TrendSpider |

| ⚡ Features |

Charts, News, Watchlists, Screening | Charts, Watchlists, Screening |

| 🏆 Unique Features |

Trading, Backtesting, Community | AI Pattern Recognition, Trading, Backtesting |

| 🎯 Best for | Stock, Fx & Crypto Traders | Stock, Fx & Crypto Traders |

| ♲ Subscription | Monthly, Yearly | Monthly, Yearly |

| 💰 price | Free | $13/m to $49/m annually | $107/m or $48/m annually |

| 💻 OS | Web Browser | Web Browser |

| 🎮 Trial | Free 30-Day | ❌ |

| 🌎 Region | Global | USA |

| ✂ Discount | $15 Discount Available + 30-Day Premium Trial | Use Code "LST30" for -30% on monthly or -63% off annual plans |

💸 Pricing & Discounts

TradingView beats TrendSpider for price, offering free and cheaper premium services. However, TrendSpider is an industry price leader for AI multi-timeframe pattern recognition.

TradingView pricing starts at $0 for the basic ad-supported plan: Pro costs $14.95, Pro+ $29.95, and Premium costs $59.95 monthly. Opting for a yearly subscription will reduce those costs by 16%, representing a significant saving. There is an additional $2 cost per exchange if you want real-time data. I recommend the Pro or Pro+ services as they strike the right balance of power and price.

✂ TradingView Discounts

To get a 16% discount on TradingView, simply sign up for a 30-day annual subscription. Find out more in our dedicated TradingView discounts article.

TrendSpider has radically simplified its pricing model for 2025. All plans include real-time data, futures, AI-powered pattern recognition, backtesting, news, options, crypto, and even automated bot trading with broker integration.- The standard price is $107 per month, and Enhanced costs $197. The best deal is opting for an annual prepaid plan, which offers a 50% discount on all services.

- Adding our partner code LST30 during checkout will save an additional 30% on your first year.

- Using our partner link will grant you an exclusive 7-day discounted trial with TrendSpider.

| TrendSpider Pricing | Monthly Subscription | Annual Subscription |

| Standard (Casual Traders) | $107 | $53.50 |

| Enhanced (Active Traders) | $197 | $98.50 |

| Professional (Professionals) | $397 | $198.50 |

| Additional Year 1, 30% Discount | -30% With Code LST30 | |

TrendSpider Coupon Code Discount

Trendspider discount coupon code "LST30" is verified and valid for 2025. It grants a 30% discount on all plans. Use coupon code "LST30" at checkout.

Using this coupon on a TrendSpider monthly subscription could save you over $2,400.- Read this article for a step-by-step guide to claiming your 30% TrendSpider Discount.

💾 Software & Apps

Both TradingView and TrendSpider offer powerful, easy-to-use software. TradingView has global market data and community, but TrendSpider’s data is US-only and lacks social interaction.

| Key Features | TradingView | TrendSpider |

| Global Market Data | ✔ | USA |

| Powerful Charts | ✔ | ✔ |

| Stocks | ✔ | ✔ |

| Futures | ✔ | ✔ |

| Forex | ✔ | ✔ |

| Cryptocurrency | ✔ | ✔ |

| Social Community | ✔ | ✘ |

| Real-time News | ✘ | ✘ |

| Screeners | ✔ | ✔ |

| Backtesting | ✔ | ✔ |

| Automated Analysis | ✔ | ✔ |

🚦 Trading

TradingView supports 50 high-quality brokers, meaning tight integration, so you can directly trade from charts and view your profit and losses directly in TradingView. TrendSpider integrates with 25 brokers, and you can launch trading bots to automate your stock, Forex, or crypto trading.

🎥 TradingView Review Video

📡 Scanning

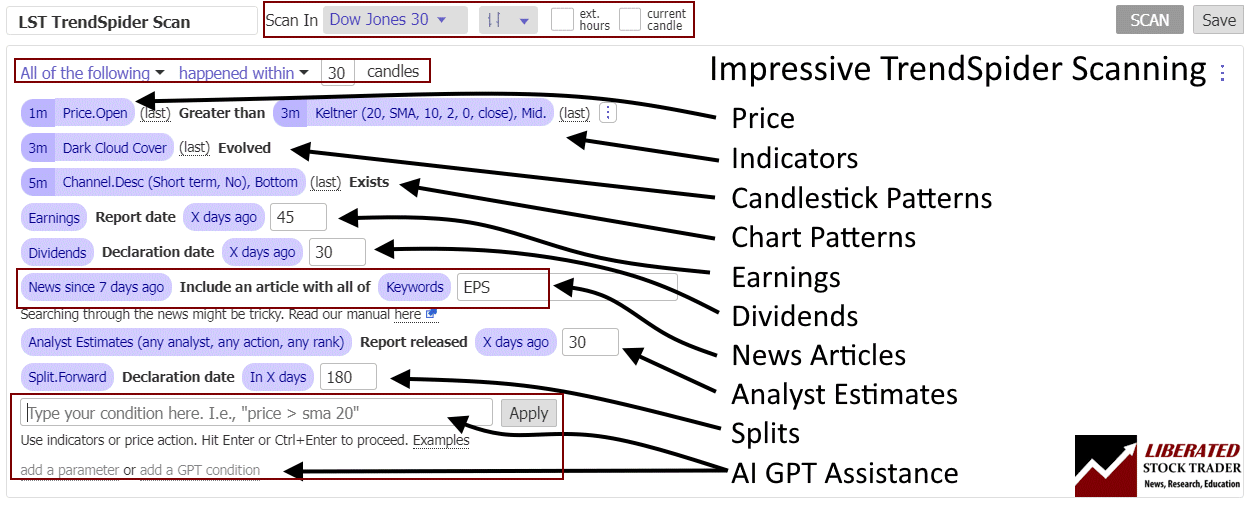

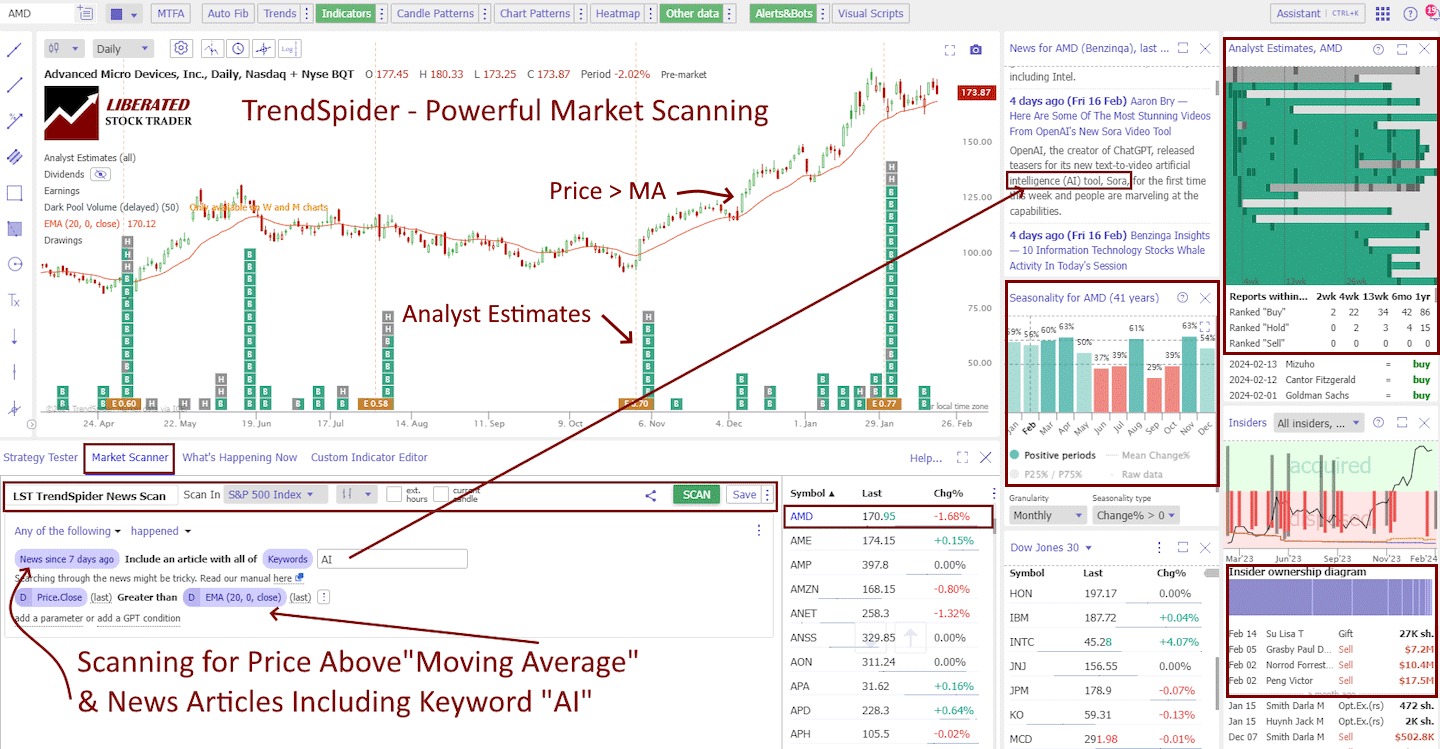

TrendSpider’s scanning is more powerful and flexible than TradingViews’. The screenshot below encompasses the important elements of the platform’s power and flexibility to demonstrate why TrendSpider is our winner for screening. You can screen for any criteria related to price, indicators, patterns, earnings, dividends, analyst estimates, and stock splits. The financial news scanning is also impressive, providing the ability to scan for any article mentioning one or multiple keywords.

For example, you can scan for companies that release their earnings in the next seven days, where analysts expect a positive earnings surprise, and where the news reports mention “AI.”

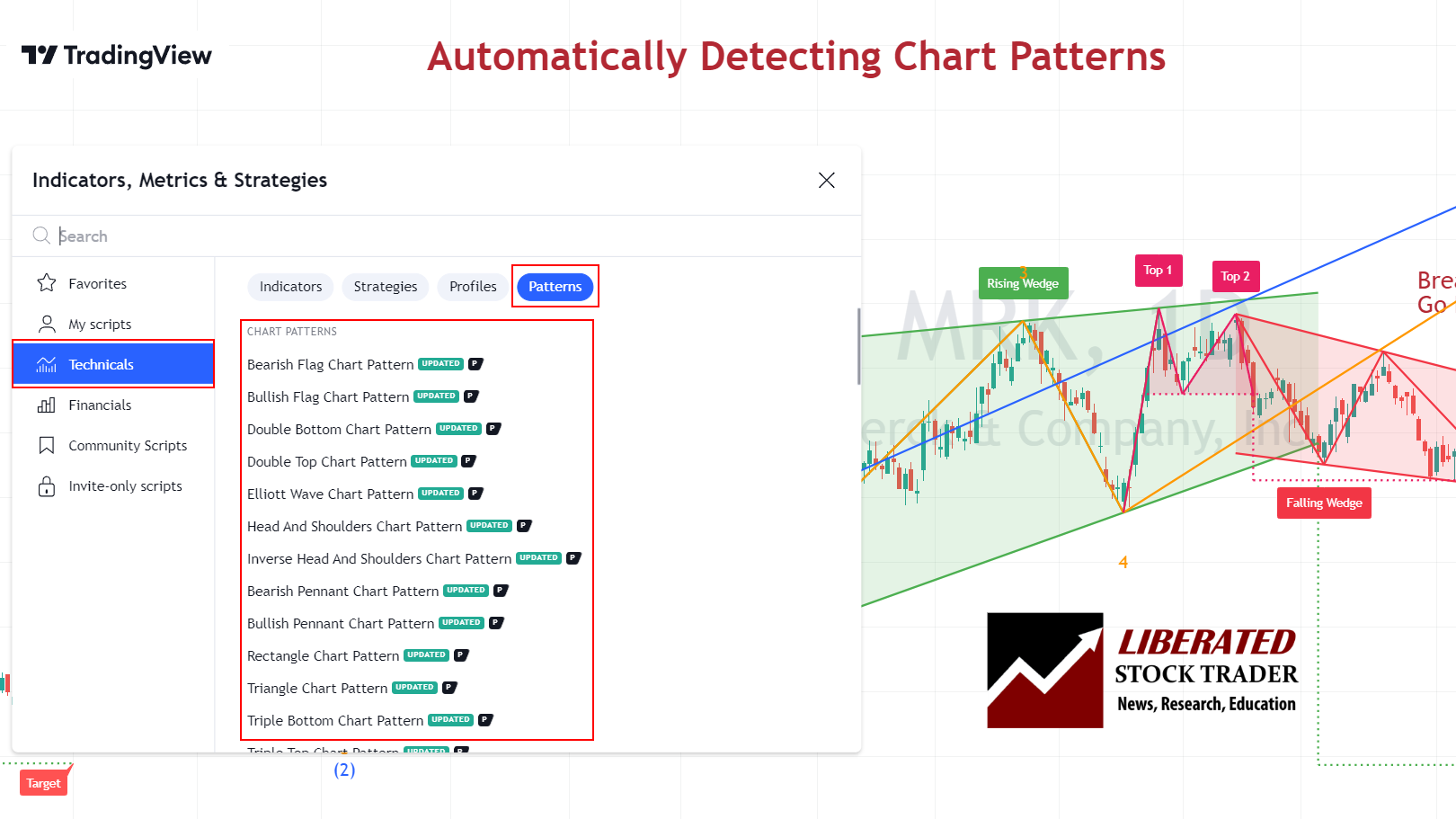

The TradingView stock screener comes complete with 160 fundamental and technical screening criteria. All the usual criteria are there, such as EPS, Quick Ratio, Pre-Tax Margin, and PE Ratio. But it also goes more in-depth with more esoteric criteria, such as the number of employees, goodwill, and enterprise value.

TrendSpider’s Market Scanner enables you to scan a specific stock and the entire market for stocks matching your technical criteria; combining AI trend detection and analysis with the ability to scan the whole stock market is powerful.

🎥 TrendSpider Scanner Video

💡 Chart Pattern Recognition

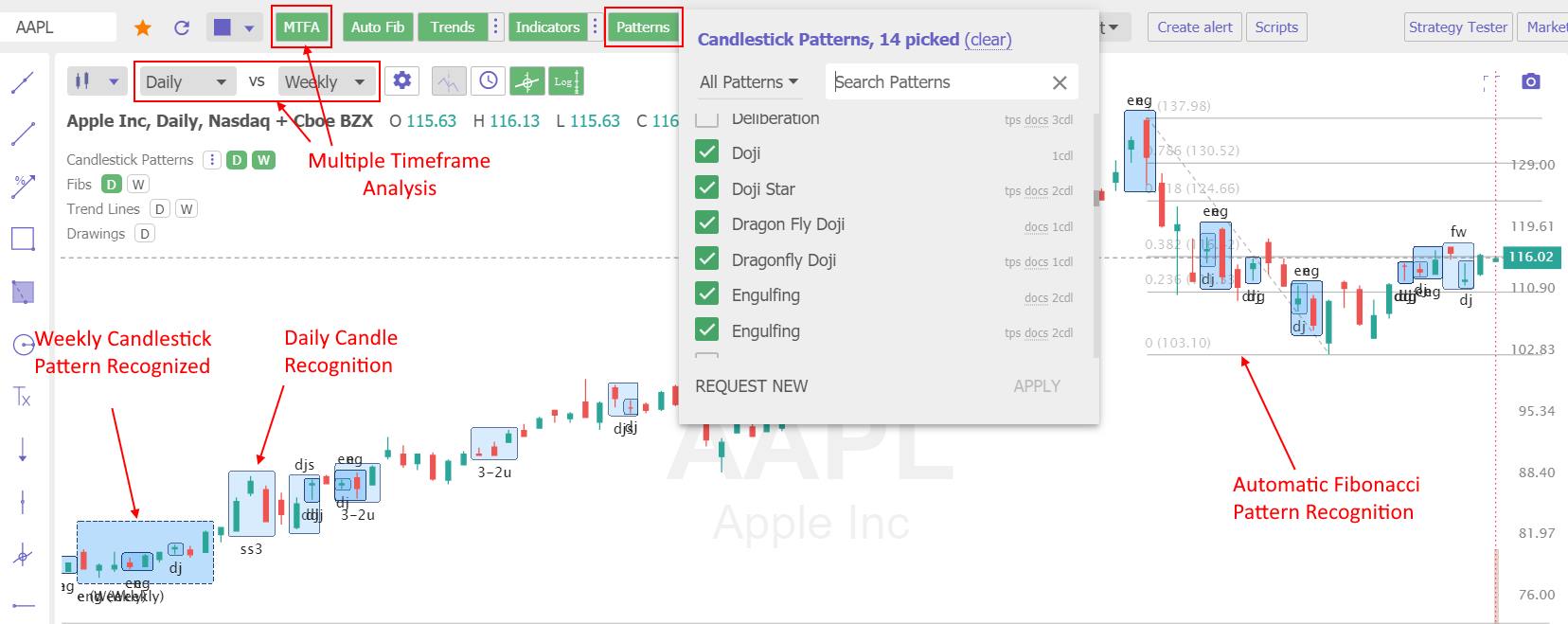

TrendSpider beats TradingView for automated AI chart patterns and indicator recognition. TrendSpider can analyze millions of data points across multiple timeframes, which gives you a unique edge as a pattern trader. TradingView is also no slouch, providing automated candlestick recognition and thousands of community-developed indicators.

TrendSpider’s automated trendline detection saves a lot of time for traders, speeds up morning trade review preparation, and improves accuracy. TrendSpider’s algorithm correlates all the bars on a chart and draws the trendlines automatically, ready for your review.

TrendSpider’s automated chart trendline detection and plotting do a better job than a human can. TrendSpider’s algorithms can detect thousands of trendlines and flag the most important ones with the highest backtested probability of success.

Multi-timeframe analysis means viewing multiple timeframe charts on a single chart with the trendlines plotted automatically. Another great feature is the advanced plotting of support and resistance lines into a subtlely integrated chart heatmap. TrendSpider’s multi-timeframe analysis is not just for trendlines; it works with 42 stock chart indicators to ensure you do not miss anything.

📰 News & Social

TradingView beats TrendSpider for social community and financial news. TradingView is built with the community at the forefront and is best for social sharing and learning; forget StockTwits; Tradingview is the best. TradingView’s fully integrated chat forum and publishing system are excellent ways to share your charts and ideas. TrendSpider does not have a social community or a newsfeed.

Check out my published ideas on TradingView and follow me for stock market analysis ideas and commentary.

Chart, Scan, Trade & Join Me On TradingView for Free

Join me and 20 million traders on TradingView for free. TradingView is a great place to meet other investors, share ideas, chart, screen, and chat.

📈 Chart Analysis

Both TrendSpider and TradingView offer broad, powerful chart analysis features. TradingView has 160 indicators and unique specialty charts such as LineBreak, Kagi, Heikin Ashi, Point & Figure, and Renko. TrendSpider has over 200 chart indicators and patterns and offers line, bar, candlestick, Heiken Ashi, and patented Raindrop charts.

TradingView has an exceptional selection of chart drawing tools, including tools unavailable on other platforms. These include extensive Gann & Fibonacci tools, 65 drawing tools, and hundreds of icons for your charts, notes, and ideas. TrendSpider offers 23 different chart annotation tools.

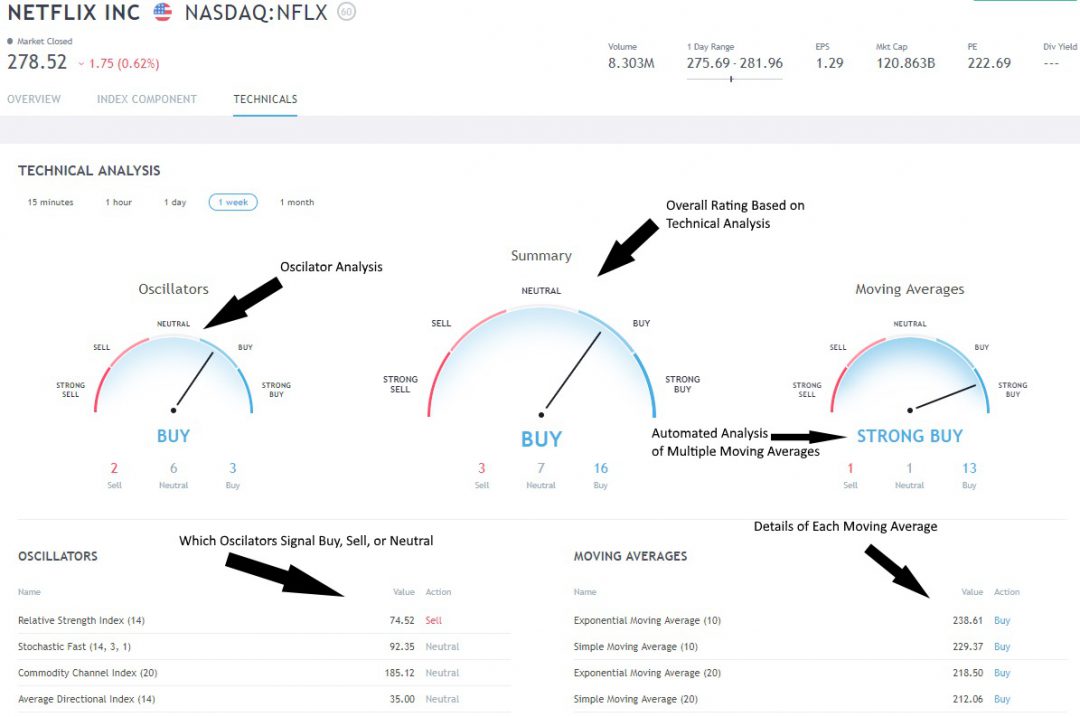

TradingView’s innovative Buy and Sell gauges save you time by providing an instant readout of which stocks are bullish, bearish, or neutral.

TradingViews’s stock indicator ratings are well implemented because there are two critical technical analysis indicators: moving averages based on price and oscillators based on price and volume. Based on my observations, the TradingView buy and sell indicators are a good measure of sentiment and are featured in my Fear & Greed Index Dashboard.

You can click on “Technicals,” and you are presented with three gauges when you view a chart. The left gauge shows the oscillating indicators like relative strength, stochastics, and the Average Directional Index. On the right, you have a selection of Moving Averages, Simple, Exponential, and even Ichimoku Cloud.

With TradingView and TrendSpider, you will have everything you need as an advanced trader, day trader, or swing trader.

🔍 Strategy Backtesting

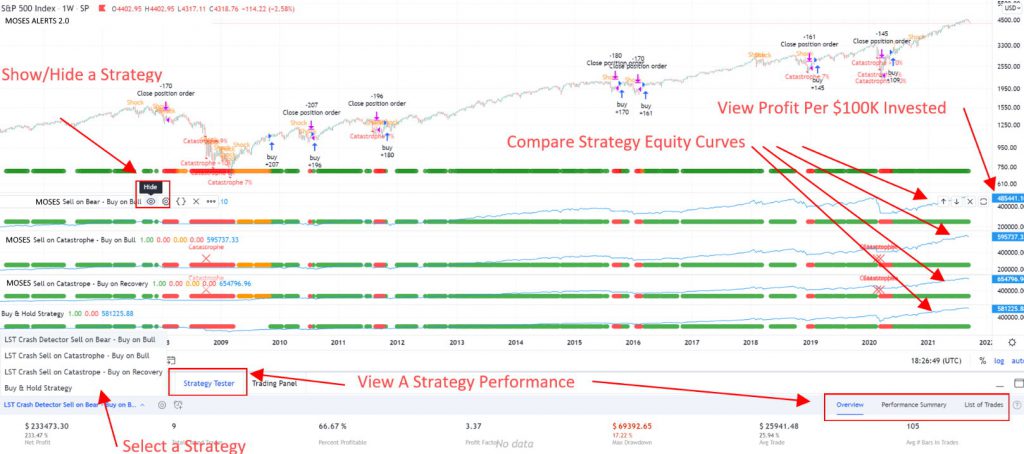

Our backtesting test shows TrendSpider to be better than TradingView, but it is close. TradingView backtesting is more flexible than TrendSpider’s but requires Pine script knowledge. TrendSpider’s multilayered backtesting is point-and-click, which is much easier to use but is also incredibly powerful.

TradingView has a backtesting system called Strategy Tester, but you must develop scripting skills using the proprietary Pine code to develop original backtesting systems. I have even implemented my MOSES ETF Trading strategy into TradingView; I am no developer, but the Pine Script language is so natural anyone can do it.

TrendSpider has made this process much simpler, eliminating the need for coding by implementing a point-and-click system to develop scans that can be backtested.

TrendSpider has also implemented a strategy tester that allows you to type what you want to test freely, and it will do the coding for you. It was a smooth and powerful implementation that had me develop a strategy in minutes.

TrendSpider and TradingView have robust backtesting reporting showing trades, profit, loss, and capital drawdowns.

🖱 Usability & Support

TradingView and TrendSpider are incredibly easy to use, requiring zero installation or configuration. The biggest difference is that TrendSpider provides the personal touch with free one-to-one training with a support staff member.

🏁 Final Thoughts

TrendSpider won our head-to-head comparison over TradingView, but it was close. If you want intelligent AI pattern recognition, no-code backtesting, and bot trading for US markets, then TrendSpider is a great choice. TradingView is the best stock analysis and trading software for international markets. It is perfect for beginner and experienced traders, with a vibrant community and excellent charts, backtesting, scanning, and screening globally.

If you need real-time news, the best backtesting, and stock chart indicators, I recommend MetaStock. Stock Rover is the best software for building long-term value, income, and growth portfolios. Finally, if you want to use the power of AI for short-term day trading, Trade Ideas is the best choice.

My thorough testing awarded TradingView a stellar 4.8 stars!

With powerful stock chart analysis, pattern recognition, screening, backtesting, and a 20+ million user community, it’s a game-changer for traders.

Whether you're trading in the US or internationally, TradingView is my top pick for its unmatched features and ease of use.

Explore TradingView – Your Gateway to Smarter Trading!

FAQ

Is TradingView or TrendSpider better for stock trading?

Both TradingView and TrendSpider are great for stock trading. TradingView is better for stock trading from charts than TrendSpider. TradingView integrates with over 50 brokers globally. However, TrendSpider has broker integration and also automated bot trading..

Is TrendSpider better at pattern recognition than TradingView?

While both TradingView and TrendSpider offer excellent stock chart pattern recognition, TrendSpider's pattern recognition is superior. TrendSpider recognizes patterns, trendlines, Fibonacci, and candlesticks natively on multiple timeframes on a single chart.

TradingView or TrendSpider, which is better?

TrendSpider is better for pattern recognition and backtesting for non-programmers. TradingView is better for a social trading community and powerful charting and backtesting for those who can code.

Which is easier to use, TrendSpider or TradingView?

Both TrendSpider and TradingView are elegantly designed and intuitive to use. TradingView covers more assets and markets. TrendSpider offers free personal 1-to-1 training, which gives it the edge.

What is the big difference between TradingView and TrendSpider?

TradingView has 20 million active users and a vibrant social trading community, and it covers stocks, currencies, and crypto globally. TrendSpider has the best stock chart pattern recognition, the easiest-to-use backtesting and better screening for the US markets.

- Related Article: StockCharts vs. TradingView: Head-to-Head Comparison

- Related Article: Finviz vs. Tradingview: Rated & Ranked, Who Gets Spanked?

- Related Article: TC2000 vs. TradingView: We Do The Test To See Who’s Best?

Still undecided? Please look at our Top 10 Best Stock Trading Analysis Software Programs.