Stock charts are the core of technical analysis, encompassing OHLC and Candlestick charts showing the open, high, low, and close prices.

Raindrop charts add volume data to chart analysis. Heikin Ashi charts smooth out price volatility. Finally, Kagi, Line Break, and Point & Figure charts remove the timeline from chart analysis, showing only trends.

Our research shows the most effective chart types for traders are Heikin Ashi, Candlestick, OHLC, Raindrop, and Renko charts. These charts provide the best balance of price and trend reversal information to help investors build effective trading strategies.

Learn to trade the best stock charts with our original research.

9 Important Stock Charts for Traders

1. Heikin Ashi Charts

According to our testing, Heikin Ashi (HA) charts are the best-performing charts. They factor in recent price action to create more reliable and accurate data points than regular candlestick charts. It makes them ideal for traders who need to identify potential trading signals and long-term investors who want to confirm their investment strategies.

Heikin Ashi combines candlestick charting and price averaging to create an enhanced visual representation of trends. Essentially, Heikin Ashi smooths out daily volatility to unveil actionable price trends, making it a superior chart for developing trading strategies.

Get Heikin Ashi Charts on TradingView for Free

Heikin Ashi candles are a relatively recent approach to trading stocks and other financial assets. Although they have existed since the 1600s, their popularity has surged only recently due to their capacity to provide traders with more accurate trend data.

Heikin Ashi charts can identify support and resistance levels, recognize trading signals, and determine potential entry and exit points. Additionally, Heikin Ashi candles allow for measuring momentum, volatility, and volume, providing a comprehensive overview of the market’s behavior.

Our backtesting of Heikin Ashi charts shows that they beat buy-and-hold strategies with a 60% success rate versus 10% for standard OHLC bars and candlesticks.

How to Trade Heikin Ashi Charts

The most important factor when reading Heikin Ashi charts is identifying the trend. By looking at the color of each candle, traders can determine whether the price is trending upwards or downwards. If a succession of candles has colors consistent with an uptrend (i.e., all green), then it is likely that the price will continue to go up in the coming days. If, however, the colors are red, then it is likely that the price will continue to go down.

Our Heikin Ashi Charts Explainer Video

Once a trend has been identified, traders can use Heikin Ashi candles to spot support, resistance levels, and trading signals, which help them make better decisions when entering or exiting a trade.

My thorough testing awarded TradingView a stellar 4.8 stars!

With powerful stock chart analysis, pattern recognition, screening, backtesting, and a 20+ million user community, it’s a game-changer for traders.

Whether you're trading in the US or internationally, TradingView is my top pick for its unmatched features and ease of use.

Explore TradingView – Your Gateway to Smarter Trading!

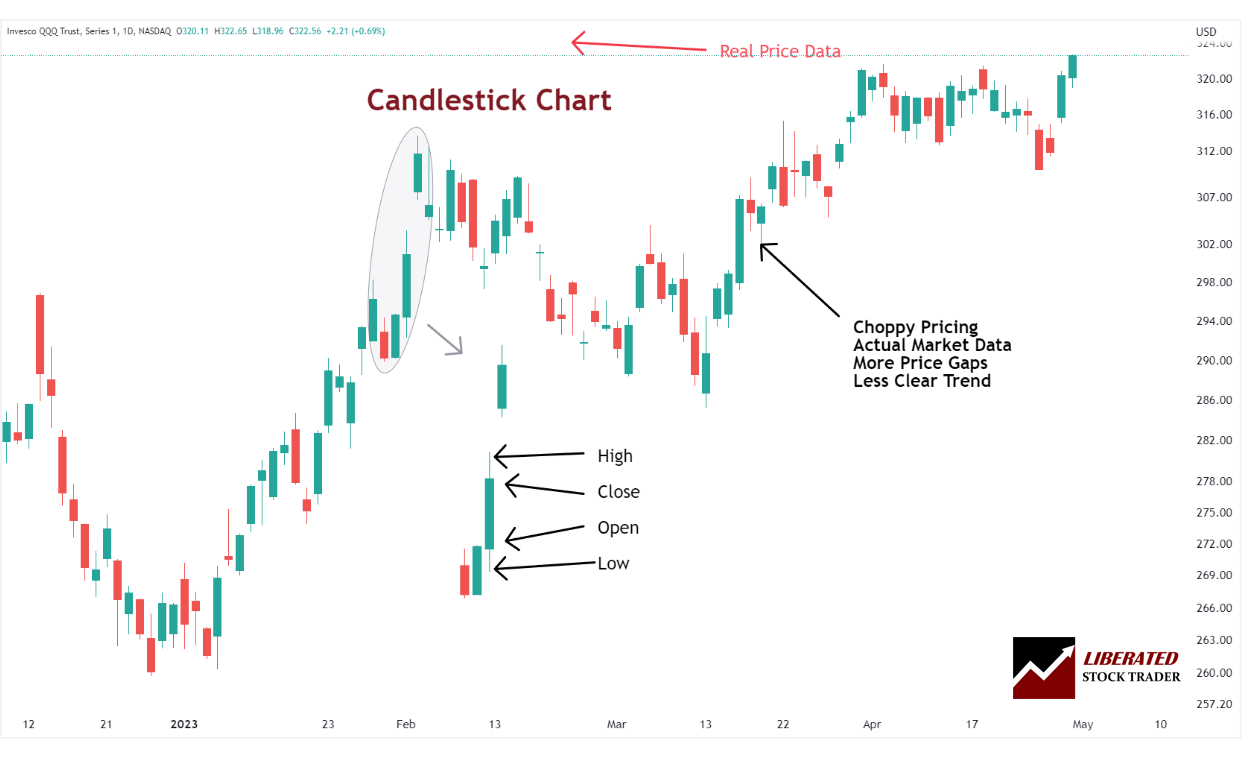

2. Japanese Candlestick Charts

Japanese Candlestick charts originated in the 1700s when rice traders in Japan began using them to predict and track price movements. They provide a graphic representation of price data over time. They comprise a body (the area between the open and closing price) and shadows (the area above or below the body).

The key benefit of using candlestick charts is that they allow traders to quickly identify potential patterns in the market, which can help them decide when to enter or exit a trade. For example, if a pattern appears where the upper shadow is consistently larger than the lower shadow, then this could indicate that buying pressure is increasing.

On the other hand, if there is consistently more selling pressure than buying pressure, it might be time for traders to exit their positions. By combining pattern recognition with support/resistance levels identified from candles, traders can make informed decisions about when to buy or sell within their trading strategy.

Get Candlestick Charts on TradingView for Free

How to Trade Japanese Candlestick Patterns

Japanese Candlestick patterns are a powerful tool many traders use to identify trends and potential reversal points in the market. The ability to see these candlestick patterns can help traders identify important support/resistance levels or attempt to predict what direction the price may go next. By combining technical analysis with fundamental analysis and news events, traders can get an edge over the markets.

However, it is important to remember that no system or method is perfect. You should always use sound risk management when trading and properly backtest any trading strategy. With proper practice, traders can use candlestick patterns to their advantage and generate consistent profits.

How many candlestick patterns are there?

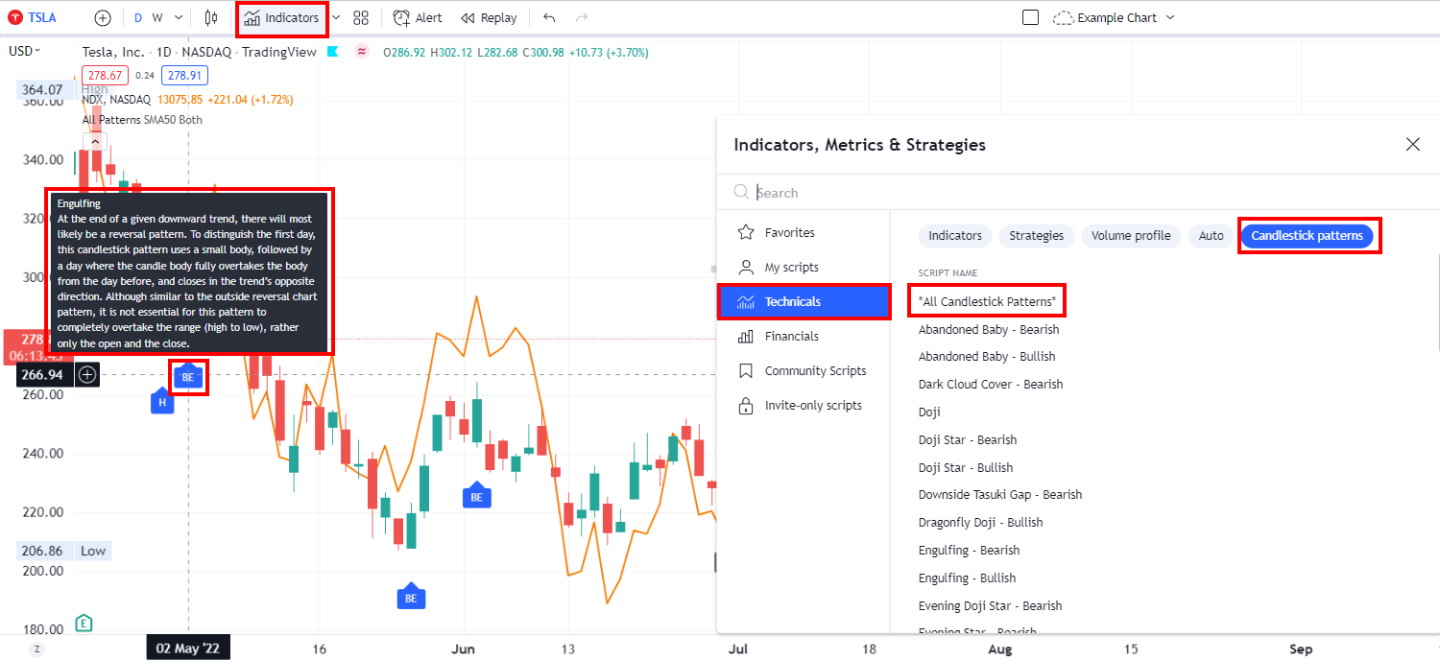

There are over 200 candlestick patterns; some more commonly used ones include Engulfing, Bearish Harami, Bullish Harami, Doji, and the highly profitable Inverted Hammer and Marubozu.

Each pattern has its unique characteristics that can be used to identify potential trading opportunities. It is important to note that the interpretation of each pattern may vary depending on the timeframe being used. Additionally, some patterns may be more reliable than others. As a trader, it is important to understand the nuances of each pattern and how they can be applied in different market scenarios.

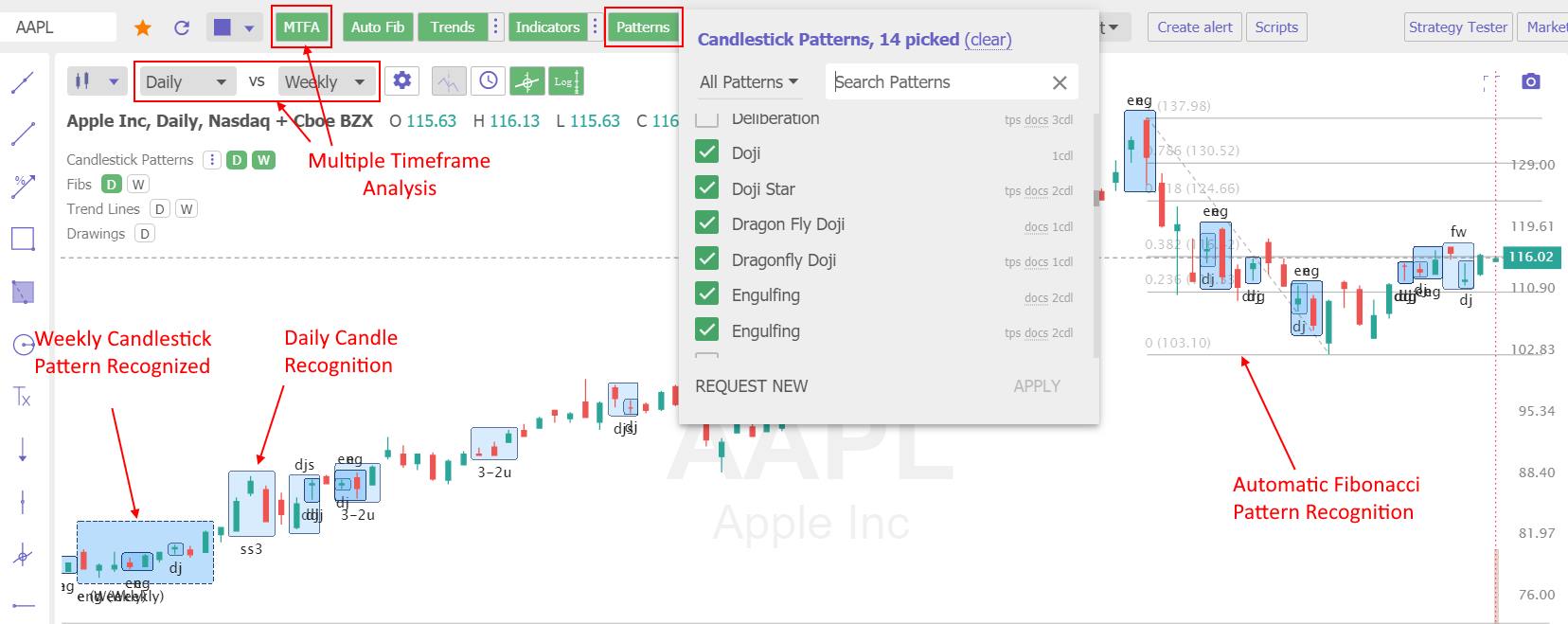

Using TrendSpider Candlestick Pattern Recognition

The problem with candlestick patterns is there are so many to remember, and it is time-consuming to identify them accurately. That is where software like TradingView and TrendSpider can help.

TrendSpider is the only trading software that enables scanning and point-and-click backtesting of 230 candlestick patterns. It is a great place to start if you want to gain an edge in trading.

Get TrendSpider’s Pattern Recognition & Charts

Using TradingView Candlestick Pattern Recognition

TradingView includes intelligent candlestick pattern recognition for free, but you must learn pine script coding to perform any backtesting.

TradingView has powerful and intuitive candlestick chart pattern recognition.

Get TradingView’s Pattern Recognition for Free

Remember that candlestick patterns are only one tool among many in technical analysis. Combining other indicators and methods is important for a comprehensive approach to trading.

| Candlestick Software | TrendSpider | TradingView | MetaStock |

| Rating | ★★★★★ | ★★★★ | ★★★★ |

| Candlestick Patterns Recognized | 123 | 27 | 52 |

| Pricing | Included | Included | $349 add-on |

| Full Review | Read the Review | Read the Review | Read the Review |

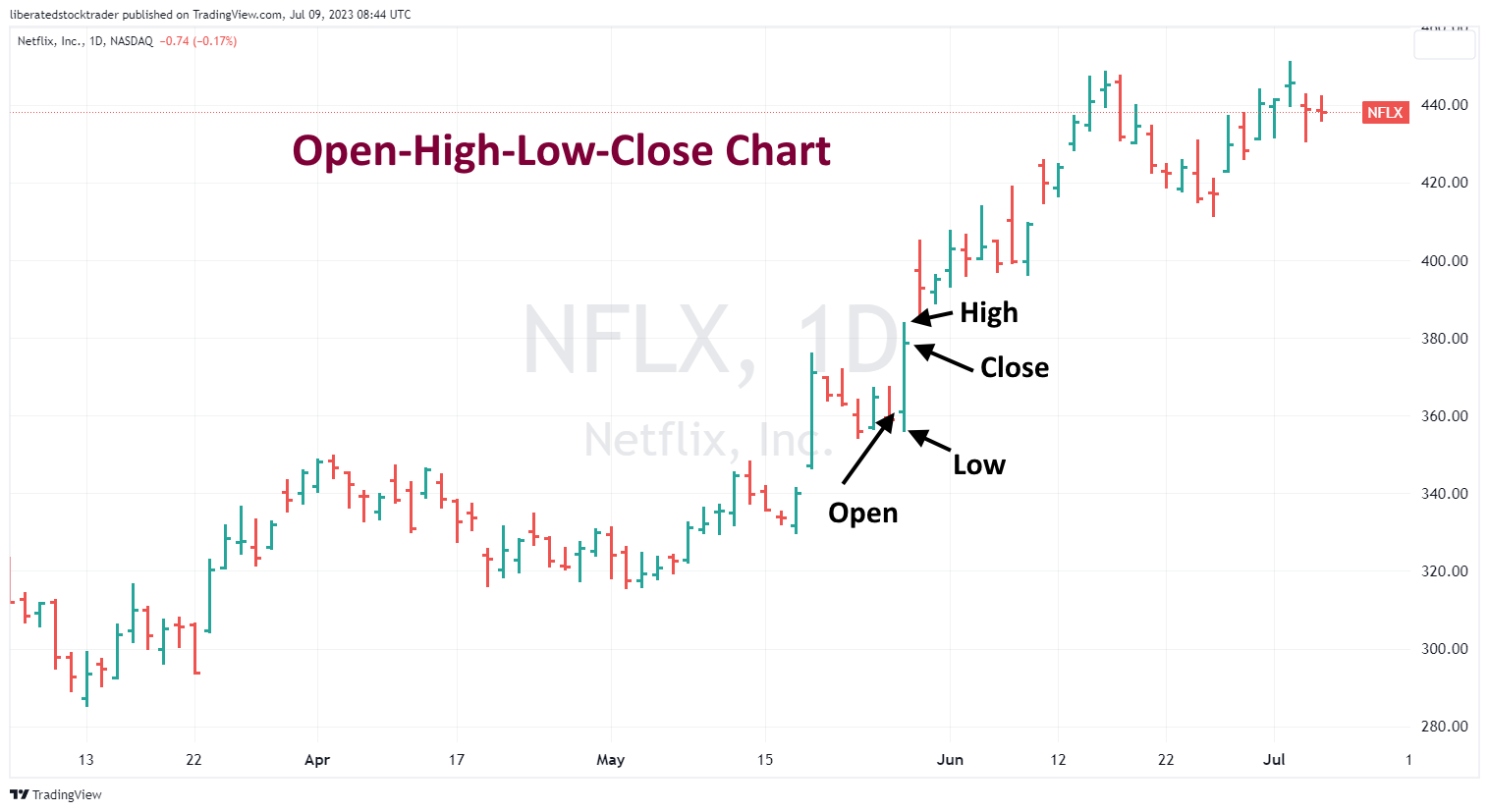

3. OHLC Charts

For the more traditional traders, OHLC charts can also be used to analyze patterns and price trends. These bar charts show a given security’s opening, high, low, and closing prices over a specified period. While they don’t have the same level of detail as candlestick charts, they still provide useful information for traders looking for entry and exit points.

Get OHLC Charts on TradingView for Free

How to Trade OHLC Charts?

When trading with OHLC charts, traders should look for patterns that indicate a trend. Common patterns to look for include breakouts, flags, pennants, double bottoms, and cup and handle patterns. By analyzing these patterns, traders can identify market entry and exit points. Traders should also pay close attention to support and resistance levels, as they can provide useful information on the strength of a trend. Additionally, traders should be aware of any news or economic events that could affect the traded security.

4. Raindrop Charts

Raindrop charts are a unique charting style developed by TrendSpider that helps traders visualize a security’s price and volume action. This chart type comprises a series of candles, each representing one trading session.

Raindrops, unlike traditional candlesticks, do not possess open or close prices. Instead, they are formed by combining a high, low, left VWAP, and right VWAP. The left side represents the first half of the trading period, while the right side represents the second half. The width of each segment corresponds to the trading volume at different price levels. The dashes indicate the VWAP for each respective period. This unique representation provides a comprehensive view of the trading dynamics, empowering traders with valuable insights.

Get TrendSpider’s Raindrop Charts

How to Trade Raindrop Charts

Raindrop charts use VWAP and Volume Profile to provide valuable insights into the correlation between price and volume movements. These charts visually represent whether buyers or sellers dominate the market, empowering traders to make well-informed decisions based on support and resistance levels.

Moreover, Raindrop charts are useful in identifying moments of market indecision. The appearance of Blue Doji Raindrops (as seen in the above chart) often signifies a battle between buyers and sellers, hinting at a potential trend reversal. Additionally, this analysis technique aids in pinpointing crucial support and resistance levels.

By leveraging Raindrop charts’ advantages, traders can enhance their understanding of market dynamics and sharpen their trading strategies. Find out more about Raindrop charts at TrendSpider’s help page.

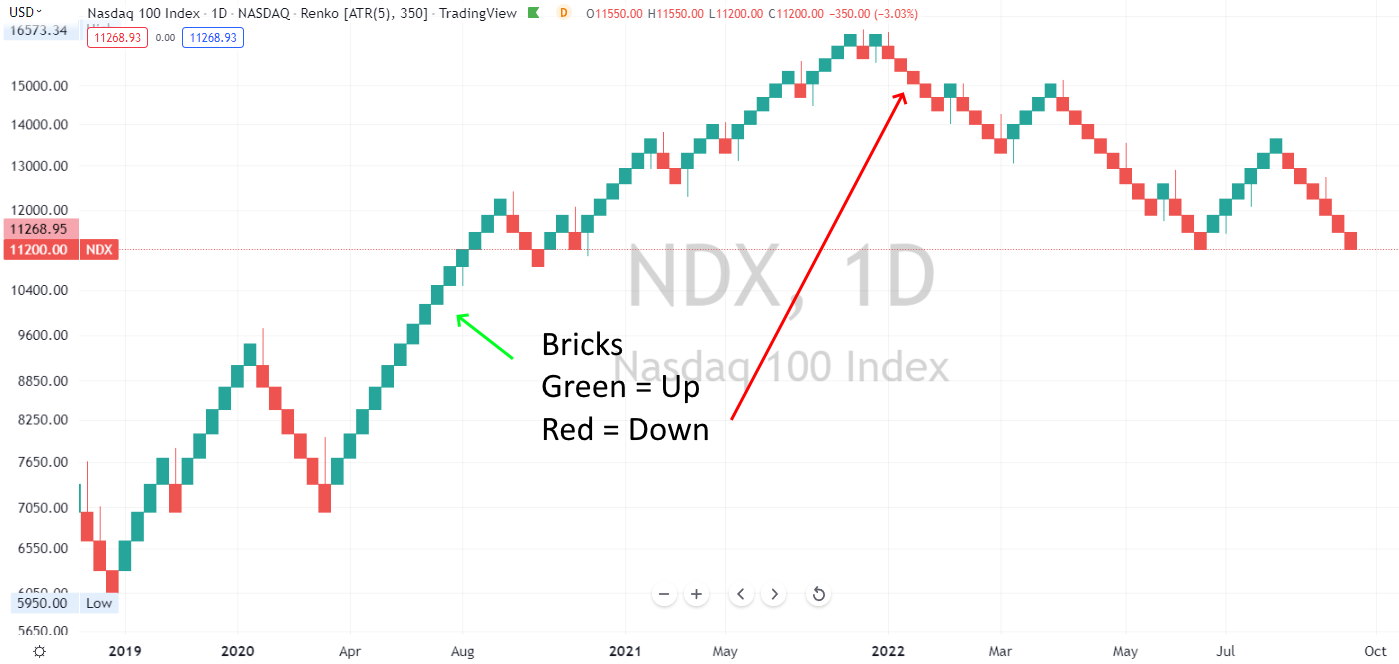

5. Renko Charts

Renko charts (also known as Brick Charts) are another popular analysis tool used to identify support and resistance levels in the market. Unlike traditional candlestick charts, Renko bricks have equal sizes, regardless of the trading range. This makes them especially useful for spotting trends within markets that tend to experience high levels of volatility.

The chart is composed of a series of price-based boxes with no time component – meaning that each box represents a certain price move. A new brick appears on the chart when an asset reaches a specific price level or surpasses it. By analyzing Renko charts over different timeframes, traders can pinpoint potential buy and sell signals and entry and exit points for their trades.

Get Renko Charts on TradingView for Free

How to Trade Renko Charts

Renko charts offer an effective means to detect potential buy and sell signals. The process usually involves scouting for clusters of bricks that materialize at support and resistance levels. To capitalize on a buy signal, it is prudent to await the price exceeding the resistance level before executing the trade. Conversely, when a sell signal emerges, it is advisable to wait for the price to dip below the support level before entering the trade.

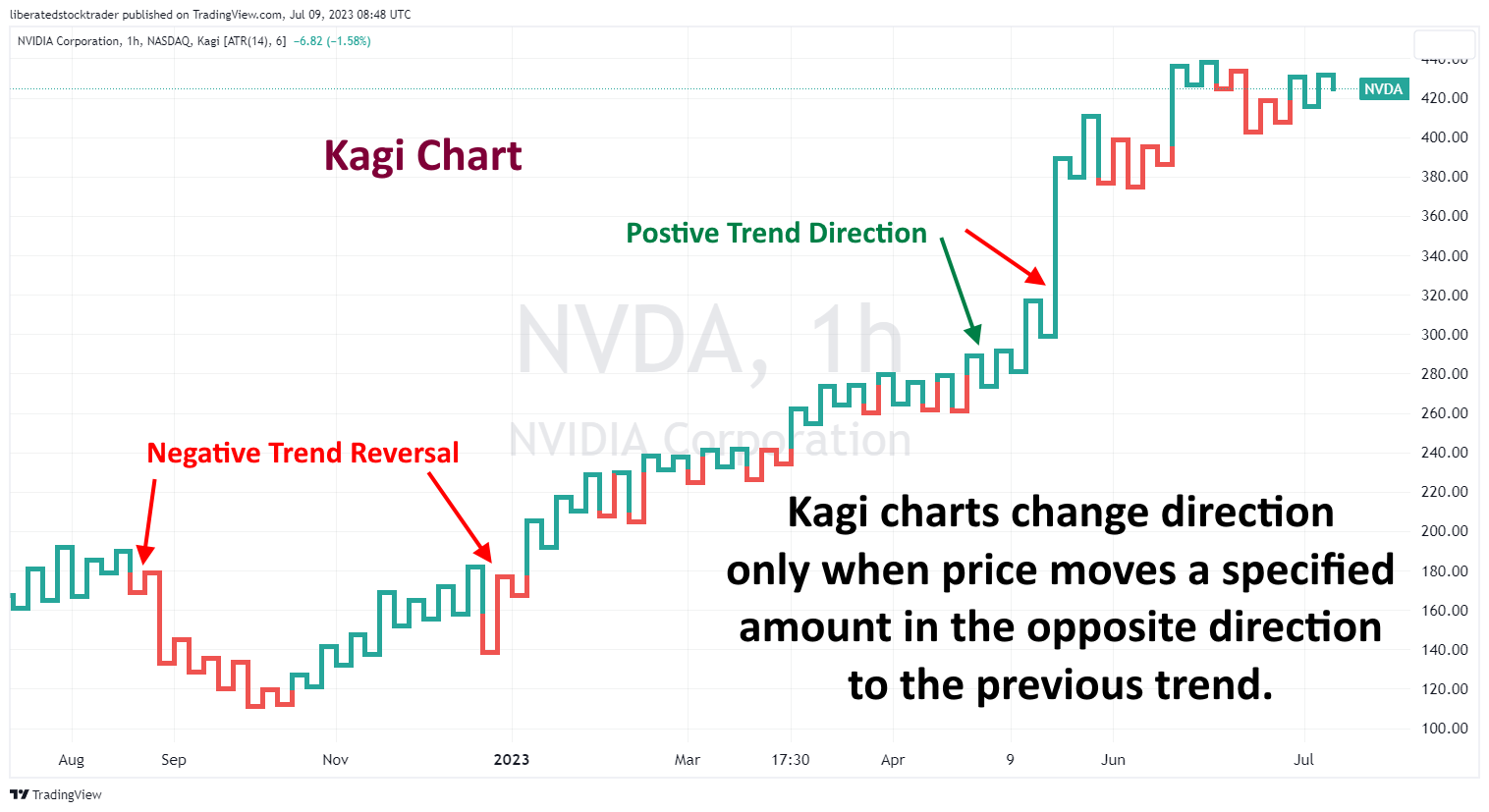

6. Kagi Charts

Kagi charts identify support and resistance levels to find buy and sell signals. Opposite to Renko Charts, Kagi Charts use price action instead of price movement. The x-axis of a Kagi Chart doesn’t represent time but rather the change in the price of an asset: when the price increases, the line plotting it rises; when the price decreases, the line plotting it falls.

If the high or low of two consecutive trading sessions is not exceeded by a specified amount (the reversal amount), then that session is not charted – maintaining a record of only significant movements. This allows traders to spot potential support and resistance levels much faster than other techniques. By watching for these lines to cross over each other, it’s possible to detect buy and sell signals and entry and exit points for their trades.

Get Kagi Charts on TradingView for Free

How to Trade Kagi Charts

Kagi Charts completely disregard time intervals and effectively filter out the associated noise. When considering price movement as the sole important variable, the generation of new lines becomes significant. Noteworthy line changes usually require substantial price movements. Therefore, minor natural price variations occurring over time can be disregarded. Kagi Charts find various practical applications, including basic line reversal trading signals, support and resistance identification, and analysis of sequence-based reversal patterns.

7. Line Break Chart

Line break charts are similar to Kagi Charts, focusing on price movement as the only important variable. The difference is that line break charts generate new lines each time the closing price exceeds the high or low of a previous period, typically set at 3 bars. This chart type also disregards time intervals, allowing traders to identify potential entry and exit points based on the reversal of trend signals. Line break charts can also be used for support and resistance identification and analysis of sequence-based reversal patterns.

Get Line Break Charts on TradingView for Free

How to Trade Line Break Charts

Line Break Charts help traders identify support and resistance levels by providing easy-to-see horizontal lines that signify the reversal of a previous trend. Traders can use these to spot entry points when prices break out from one level to another and potential exit points when prices return toward their original trend.

By analyzing the sequence of horizontal lines on a Line Break Chart, traders can look for patterns that indicate a potential reversal in the trend. These often occur when prices move from one level to another and back to their original level before continuing in the opposite direction.

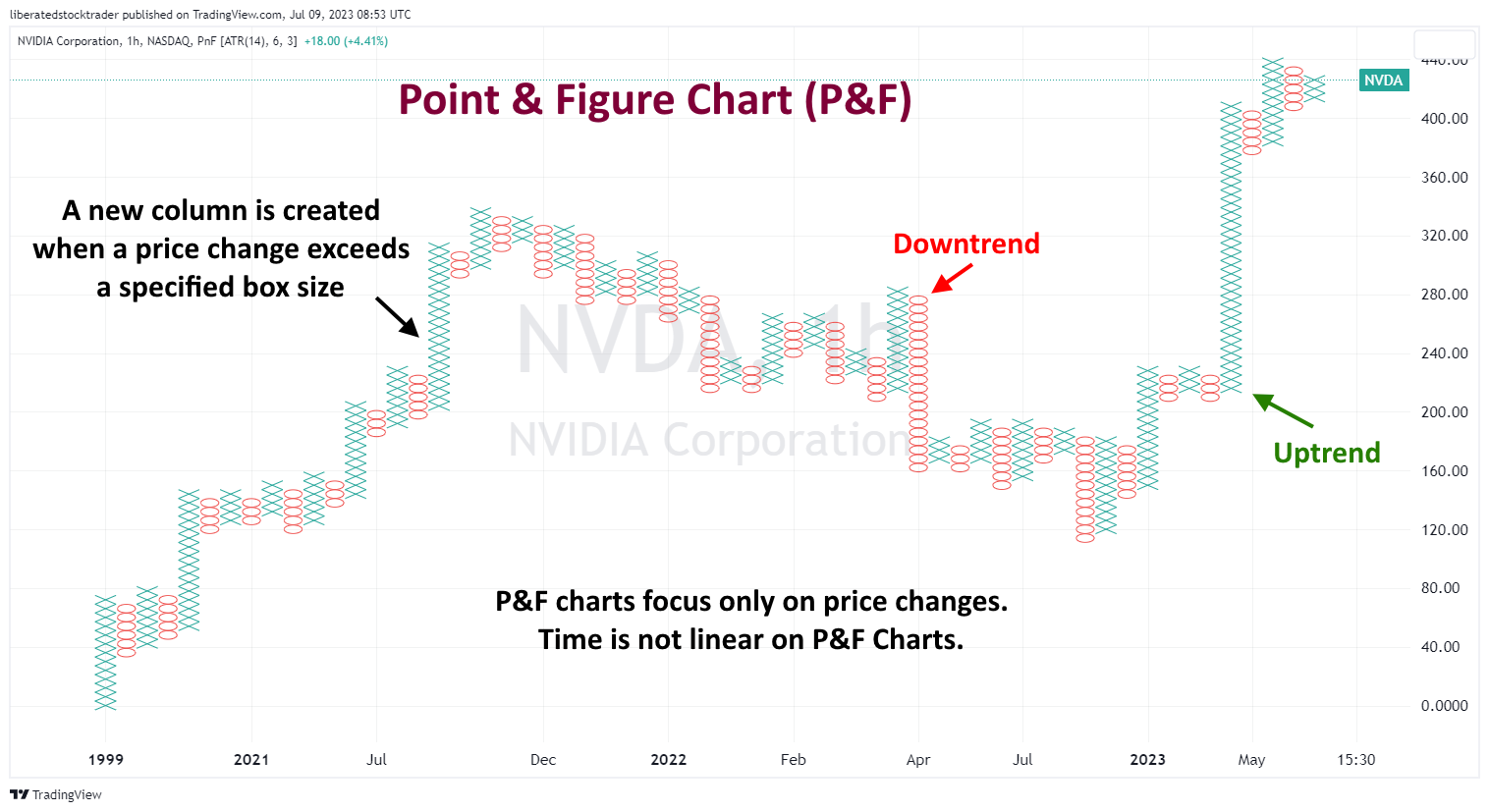

8. Point & Figure Charts

Point-and-figure charts (P&F) are composed of ‘Xs’ and ‘Os,’ representing price movements. When prices increase, an ‘X’ is plotted on the chart, and an ‘O’ is plotted when they move down. These charts help traders identify support and resistance levels by plotting points that signify a reversal in the trend. P&F charts ignore time and volume, making them ideal for identifying long-term trends.

Each point on a P&F chart represents a set price movement (the box size). This eliminates noise and helps traders identify similar trends. For example, a box size of $5 would mean that each ‘X’ or ‘O’ represents the stock moving up or down by at least $5.

Get P&F Charts on TradingView for Free

How to Trade P&F Charts

By studying Point and Figure Charts, traders can identify resistance and support levels by looking for patterns of ‘Xs and ‘Os that indicate a potential reversal in price movement. They can also look for breakouts when prices move out of the pattern and continue in the opposite direction. This is often seen as an indication that the trend is changing and may be used as a signal for entering or exiting a position.

Point and Figure Charts can also help identify consolidation areas when prices move within a range without making any significant progress, either up or down. This type of charting allows traders to identify potential opportunities to enter or exit positions based on their analysis.

9. Line Chart

Line Charts are one of the most commonly used forms of stock charting and are created by connecting data points (closing prices) with a line. This type of chart is simple to read and will give traders an indication of the overall trend over time. Line charts are often used to identify support and resistance levels and areas of consolidation. They can also identify price patterns that may signal potential reversals in price movement. Additionally, they provide an easy way to compare current prices with previous periods, allowing traders to make more informed decisions about how best to enter or exit a position.

Get Line Charts on TradingView for Free

How to Trade Line Charts

Although line charts provide less information than other chart types, they are good for comparing different asset prices on the same chart. For example, a line chart can compare the stock prices of multiple companies in the same sector over time.

In addition to viewing simplistic line charts on TradingView, traders can add indicators and overlays to get detailed insights into their trading positions. For example, a trader can add a 200-day moving average to their line chart and then look for price divergence between the current stock vs. its expected trading range. Additionally, traders can use TradingView’s ‘Compare’ tool to compare different assets on the same chart. This provides an easy way to visualize how different assets perform relative to one another.

FAQ

How do I create a stock chart?

You can easily create stock charts using TradingView. Log in to the platform, select a symbol from the toolbar, and adjust the chart settings to your preferences. TradingView will automatically save any changes you make to your chart.

What are the different types of stock charts?

There are 9 different types of stock charts you should consider using when trading. Our favorites include Heikin Ashi, Japanese Candlesticks, OHLC, Renko, Kagi, and Line Break charts. Each of these charts has a unique design and benefits.

What are the most popular stock chart types?

The most popular types of stock charts are line charts, bar charts, and candlestick charts. Line charts show how a security's price changes over time. Bar charts provide more information by showing each period's open, high, low, and closing prices. Candlestick charts use color-coded and hollow/filled bars to show market sentiment and help traders identify potential opportunities for trading.

Which software offers the most different chart types?

TradingView has 17 different chart types, the largest selection of charts available today. MetaStock has ten chart types and over 300 indicators. Finally, TrendSpider has seven chart formats and the best AI-powered pattern recognition and backtesting.

How can I compare different stocks on one chart?

TradingView's 'Compare' tool lets you compare multiple stocks on the same chart. This feature is particularly useful if you are looking for divergences or correlations between multiple assets.

How do I add indicators and overlays to my chart?

To add indicators and overlays to your existing chart, click on Studies or Indicators at the top of your screen and select an indicator from the dropdown list. You can further customize each indicator with parameters like average true range or time periods.

How do I read candlestick patterns?

Candlesticks consist of four parts – open price, high price, low price, and closing price – represented as colored bars in a chart. Depending on whether prices moved up or down during that period, traders can gain deeper insight into market sentiment by reading candlestick patterns such as "hammer" or "Doji."

What is the best stock chart for traders?

According to our testing, the most profitable and accurate chart type is Heikin Ashi. The smoothing effect of its bar improves the performance of the chart indicators it is paired with. Candlestick Charts are another great option for trading patterns. Both TradingView and TrendSpider offer Heikin Ashi and Candlestick charts.

What is the best stock chart for long-term investors?

For long-term investors, Stock Rover offers the finest stock charts available. These charts display fundamental data like earnings, cash flow, and financial ratios. For long-term investors, Stock Rover is the top choice for insightful stock charts.

What is volume analysis in charts?

Volume analysis is a technical analysis method used to measure buying & selling pressure in securities markets by monitoring changes in traded volumes over certain periods. By combining volume data with other technical indicators, such as momentum or oscillators, traders can more accurately identify potential buy & sell signals.

Market profile stock charts certainly must be a goto for day traders. Gotta spot activity during each time frame.

I have to say that for the past few of hours i have been hooked by the amazing trading articles on this blog. Keep up the good work.