Bonds are a great way to earn steady returns while reducing risk.

Bonds are debt instruments that allow governments, corporations, and other entities to borrow money from investors in exchange for paying an interest rate on the loan and returning the principal amount at maturity.

When buying bonds, investors essentially lend their money to a borrower in return for periodic interest income payments.

What Are Bonds?

Bonds are debt securities issued by governments, companies, or other entities that offer investors a fixed rate of return on their investment. They are among the safest and most secure investments since they usually have low defaults. Bonds can also provide a steady income stream over time due to their fixed coupon payments.

How do Bonds Work?

When investors purchase a bond, they loan money to the issuing government, company, or other entity. In exchange for this loan, the issuer agrees to pay a fixed coupon rate each year and return the principal amount of the loan upon maturity. The coupon rate is determined by several factors, including the bond’s rating (the higher its rating, the lower the coupon rate), its type (government or corporate), and its term (length of time until the bond matures).

Investors can hold a bond until maturity, receive their principal back, or sell it on the secondary market before maturity. The price that investors receive when selling a bond will depend on current interest rates; if they are higher than the interest rate on the bond, investors will receive a lower price than they paid.

Conversely, if current interest rates are lower than the bond coupon rate, investors may receive more money than they originally invested. This is known as capital appreciation. Ultimately, bonds can provide great stability to an investment portfolio and protect against market volatility.

What to Consider Before Buying Bonds?

Investors should consider several factors when determining which bonds to buy: credit quality, coupon rate, maturity date, and duration. Credit quality is the ability of the issuer to pay back the proceeds from the bond; generally speaking, higher-rated bonds are considered safer investments than lower-rated ones. The coupon rate is the interest paid on the bond principal each year and can range anywhere from

How to Find Information on Bonds?

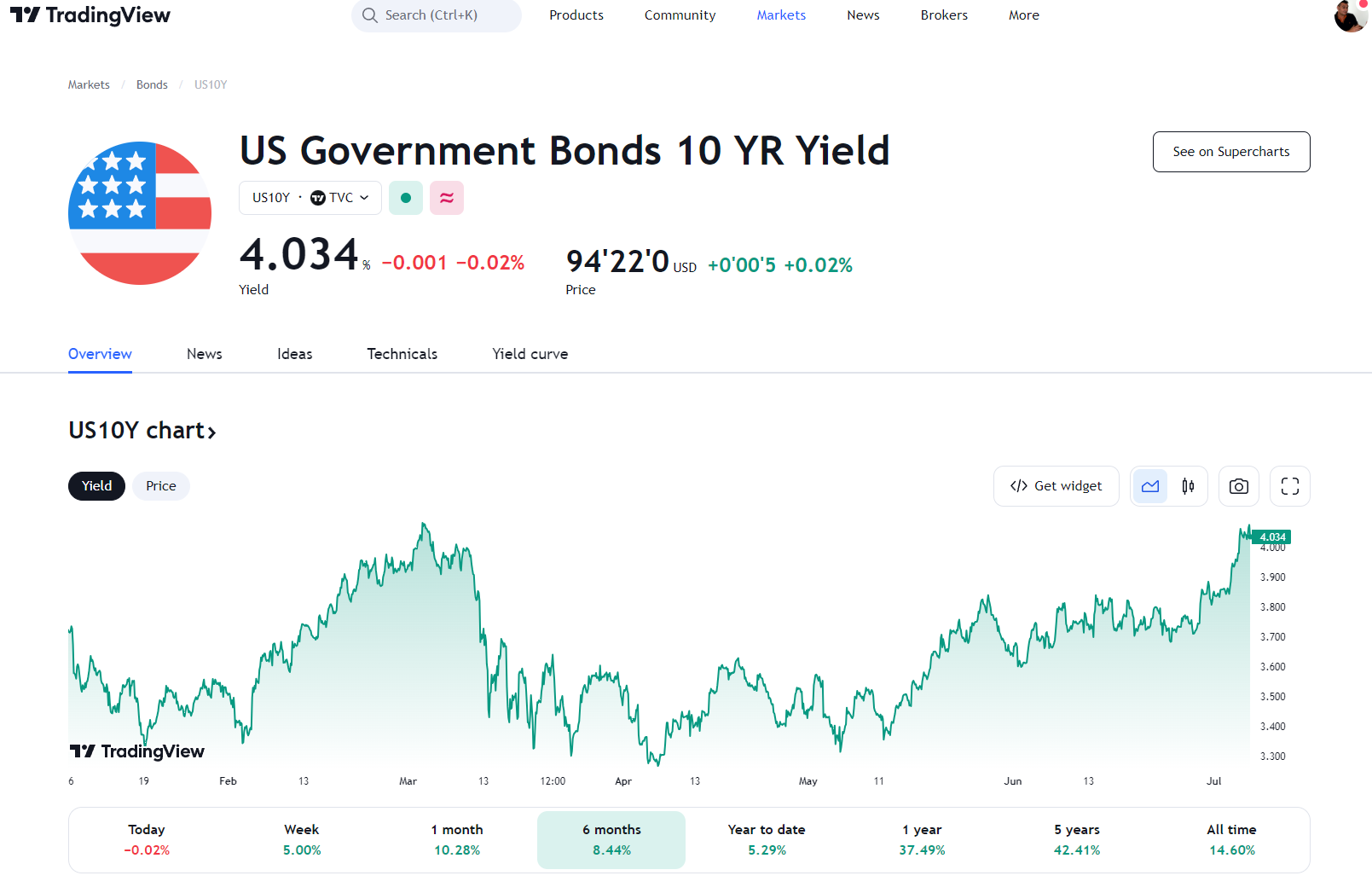

Investors can use online resources such as TradingView for up-to-date bond information to evaluate a bond’s potential returns. The most important factors include the coupon rate, maturity date, and bond duration. Additionally, investors may want to review credit ratings from agencies such as Standard & Poor’s or Fitch to help gauge a bond’s credit quality.

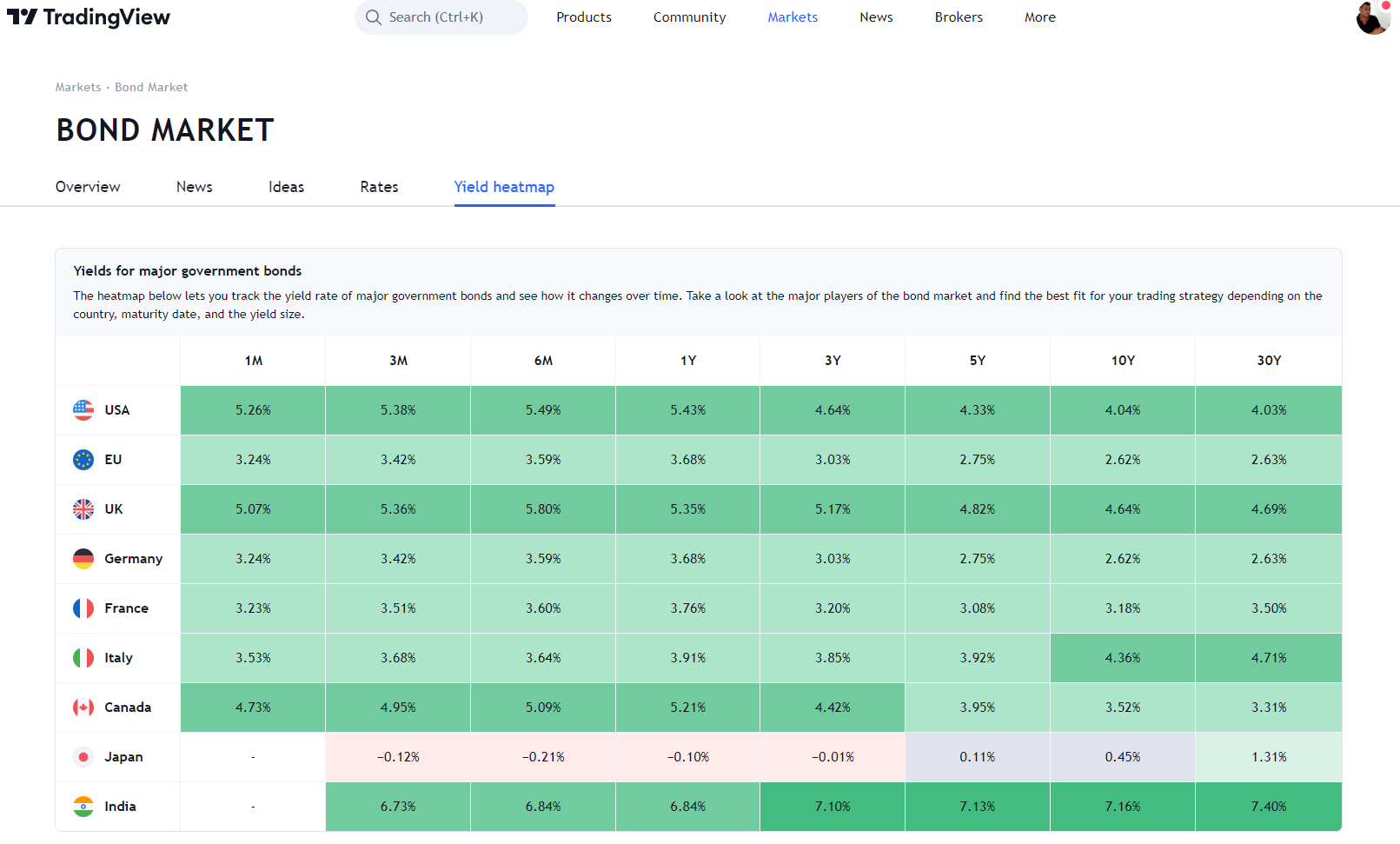

The World Bond Markets In Charts

Using TradingView, you can see the world’s Bond markets in charts. This will help you better understand the overall bond market and make it easier to analyze individual bonds and evaluate their potential returns. The charts show the performance of global sovereign debt, corporate debt, emerging markets debt, mortgage-backed securities, and covered bonds.

Get Bond Investing Information in TradingView for Free

Bonds are sometimes broken down into different categories: government, corporate, and municipal. Government bonds tend to be the safest investments since the full faith and credit of the issuing government backs them. Corporate bonds can offer higher returns but require more research due to their lower credit rating.

How to View Bond Investing Charts?

TradingView provides detailed news and charts for thousands of bonds worldwide. With TradingView, you can track and compare bond performance – including yields, ratings, returns, spreads, and more. You can also see how macroeconomic factors such as US interest rates, inflation, or economic growth may impact your investments.

Get Bond Investing Information in TradingView for Free

How do I invest in bonds profitably?

Investing in bonds can be a profitable venture, but it requires a strategic approach and research. Here are eight tips for successful bond investing:

1. Understand the different types of bonds:

As mentioned above, there are several types of bonds available for investment. Each type has its own risk and return profile, so it is essential to understand them before making any investment decisions.

2. Consider your investment objectives:

Before investing in bonds, you should determine your financial goals and objectives. Are you looking for regular income or long-term growth? This will help you choose the right type of bond to invest in.

3. Evaluate credit ratings:

Credit ratings indicate the issuer’s ability to repay debt obligations. Bonds with higher credit ratings tend to have lower risk and, therefore, lower interest rates. On the other hand, bonds with lower credit ratings offer higher returns but come with a higher risk of default.

4. Diversify your bond portfolio:

Just like with stocks, it is crucial to have a diversified bond portfolio. This means investing in different types of bonds from various issuers and industries to spread risk.

5. Keep an eye on interest rates:

Bond prices are inversely related to interest rates. Bond prices tend to fall when interest rates rise, and vice versa. Therefore, it is essential to monitor current market trends and adjust your investments accordingly.

6. Consider the duration of the bond:

Duration refers to the length of time until a bond matures. Bonds with longer durations tend to have higher interest rates, but they are also more sensitive to changes in interest rates. If you want stability and predictability, consider investing in shorter-duration bonds.

7. Understand the bond’s credit rating:

Bond issuers receive credit ratings from agencies like Standard & Poor’s and Moody’s to determine their creditworthiness. Bonds with higher credit ratings usually offer lower returns but have less default risk. On the other hand, bonds with lower credit ratings offer higher returns but come with a higher risk of default. Understanding the credit rating of the bonds you are considering is important to make an informed decision.

8. Consider tax implications:

Interest earned on taxable bonds is subject to income tax, while municipal bonds may be exempt from federal and sometimes state taxes. Therefore, it is important to consider the tax implications of different types of bonds when making investment decisions. Consult with a financial advisor or tax professional for guidance on which type of bond may benefit your situation more.

The 7 Common Types of Bonds

The most prevalent types of bonds are Treasury, Corporate, Municipal, High-Yield, and Floating Rate. Additionally, Mortgage-backed and Inflation-protected securities are also considered loan assets.

1. Treasury Bonds

Treasury bonds are issued by the government and are guaranteed to pay investors a fixed interest rate over a certain period. They often have maturities ranging from 10 to 30 years and offer investors higher returns than other investments due to their low default risk.

Treasury bonds are generally considered a safe investment since the government has never defaulted on debt obligations.

Pros:

- Low default risk; protected by the full faith and credit of the US government.

- Attractive yields, especially compared to other fixed-income investments.

Cons:

- Long maturity periods can lock up capital for extended periods.

- Limited upside potential since interest rates are fixed at purchase.

Investing in Treasury Bonds

Treasury bonds can be purchased directly from the US Treasury through its website or with a broker. Investors can buy them on secondary markets such as bonds and exchange-traded funds (ETFs). Additionally, investors can purchase I Bonds, inflation-protected bonds issued by the Treasury that earn a fixed interest rate plus an additional variable rate based on the inflation rate.

When purchasing Treasury bonds, it is important to understand how bond yields and prices interact; when interest rates rise, the price of older bonds falls as they pay out a lower yield than newly issued ones. Therefore, investors looking for short-term gains may be better off investing in newer bonds with higher yields.

Understanding the characteristics of different bonds is also important when selecting an investment, as these will determine its risk and return potential. It is recommended to consult a financial adviser for advice tailored to your circumstances.

Moreover, investing in Treasury bonds can be a secure way to diversify your portfolio and grow your money with relatively low risk over time.

Try TradingView, Our Recommended Tool for International Traders

Global Community, Charts, Screening, Analysis & Broker Integration

Global Financial Analysis for Free on TradingView

2. Corporate Bonds

Corporations issue corporate bonds, allowing investors to earn higher returns than Treasury bonds. Still, they also carry more risk due to the inherent nature of corporate creditworthiness. Corporate bonds usually have maturities ranging from 1 to 30 years and pay a fixed interest rate.

Pros:

- Higher yields than Treasury bonds

- Potential capital appreciation

- Diversification benefits of a corporate bond portfolio.

Cons:

- Increased risk of default compared to treasury bonds

- Lower liquidity in the secondary markets due to fewer buyers and sellers

- Interest rates may be more volatile than those of Treasury bonds

Investing in Corporate Bonds

Investors can purchase corporate bonds directly from the issuer or through a broker. When buying bonds directly, investors need to consider the issuer’s creditworthiness and be aware of any call provisions in the bond.

When investing through a broker, investors can buy into mutual funds or exchange-traded funds (ETFs) specializing in corporate debt. These funds can help diversify a bond portfolio and protect against default risk. Additionally, many ETFs offer leveraged exposure to corporate debt, which can provide higher returns but carries greater risk.

Finally, investors should always consider the duration of the bonds when selecting investments, as this will determine how sensitive they are to changing interest rates. Longer-term bonds will be more sensitive to interest rate changes than shorter-term ones, so investors must ensure they have the risk tolerance and financial resources to withstand shifts in values due to changing rates.

Investing in corporate debt can be challenging, but diligence and careful research can be a great way to diversify a portfolio and generate returns over time.

3. Municipal Bonds

Local governments issue municipal bonds to finance public projects such as schools, roads, bridges, etc. Municipal bonds offer investors tax-free income due to their exempt status under federal and state income taxes. They usually have maturities ranging from 10 to 30 years and pay a fixed interest rate.

Pros:

- Tax-free income due to exempt status under federal and state income taxes

- Fixed-rate of interest

- Potential for long-term appreciation of the principal value

Cons:

- Interest payments are subject to changes in the tax laws.

- Municipal bonds are subject to rising interest rates.

- Default risk if the municipality fails to pay on the bonds.

- The limited liquidity of some municipal bonds may make it difficult to sell quickly.

- The lack of diversification is due to the lack of a secondary market for certain bonds.

- Buying and selling transaction costs may be higher than other types of securities.

- Higher minimum investment requirements compared to other investments such as stocks or mutual funds.

- Generally, lower returns when compared to other investments with higher risk profiles.

Investing In Municipal Bonds?

Investors can invest in municipal bonds directly or through mutual funds and ETFs. When investing directly, investors should look for the highest yields available to maximize their returns. They should also consider diversifying their portfolios by investing in various maturities and credit ratings.

When investing through mutual funds or ETFs, investors need to pay attention to the fees and expenses associated with the fund and its track record of performance compared to similar funds. Additionally, investors should research the fund’s portfolio holdings and management team before investing.

Investors also need to understand the risks associated with municipal bonds, including credit, liquidity, inflation, call, and interest rate risks.

Try Powerful Financial Analysis & Research with Stock Rover

4. High Yield Bonds

High-yield or “junk bonds” are issued by companies with weaker creditworthiness and offer higher returns than traditional Treasury or corporate bonds. Because they present a greater risk to investors, high-yield bonds carry higher yields than other types of bonds, and the associated interest payments are often subject to federal, state, and local taxes. High-yield bonds typically have maturities ranging from 5-20 years.

Pros:

- Offer investors the potential for higher returns than other types of bonds.

- Longer maturity periods make them appealing to long-term investors.

Cons:

- Higher associated risk due to the lower credit rating of issuers.

- Interest payments are subject to federal, state, and local taxes.

- Potential for default on principal repayment if issuer experiences financial distress.

- Limited liquidity of high-yield bonds compared to stocks and other investments.

- Early redemption penalties may be applied if the issuer calls the bond before its maturity date.

- The potential for varying maturities, coupon rates, and yields can make investing in high-yield bonds complex.

Investing in High-yield Bonds?

Investing in high-yield bonds can be done through several methods. Investors can purchase them directly from issuers or through brokerages and mutual funds specializing in them. Before investing, it is important to consider the associated risks, such as default, liquidity, and interest rate. It is also important to research the issuer’s creditworthiness to ensure the bonds are a safe investment. Lastly, make sure to diversify your high-yield bond portfolio and keep an eye on potential changes in market conditions that could affect the value of your investments. Investing in high-yield bonds can be profitable with careful research and planning.

5. Floating Rate Bonds

Floating-rate bonds are a type of bond that pays an adjustable coupon rate based on a benchmark interest rate such as LIBOR or the Federal Funds Rate. The coupon rate is reset periodically, and thus, the interest payments may change over time. These bonds tend to be short-term investments and are subject to federal, state, and local taxes.

Pros

- Pay a variable coupon rate based on prevailing market interest rates, which can be higher than fixed-rate bonds in a rising-rate environment.

- Interest payments are predictable since the rate is reset periodically.

- They are not subject to significant price movements due to changes in market conditions, making them attractive for investors with shorter holding periods.

Cons

- Coupon rates can be lower than fixed-rate bonds in a falling-rate environment.

- Interest payments are taxed as ordinary income, potentially resulting in higher tax liability.

- Short-term investments may not provide enough time to recover from any losses incurred during the investment period.

Investing in Floating Rate Bonds?

Investors interested in floating rate bonds can do so through various channels, including direct purchases from the issuer or a broker. Investors should assess their risk tolerance and investment goals to determine which type of bond is right for them. Before investing, investors should also understand the bond terms, such as coupon rate, reset frequency, and maturity date. Ensuring that the bond terms suit the investor’s situation and financial goals is important.

Additionally, investors should consider diversifying their portfolio by including other fixed-income investments alongside floating-rate bonds. This can help reduce portfolio risk and provide access to different types of income streams.

6. Inflation-Protected Securities

Governments, including the US Treasury, issue inflation-protected securities to protect investors from inflationary forces. The principal value of these securities is indexed to inflation, so the security’s principal value will change as inflation fluctuates. The coupon payments from these securities are also adjusted for inflation. These securities tend to have longer maturity periods and are subject to federal, state, and local taxes.

Pros:

- Maintenance of principal value when inflation rises.

- Fixed income stream adjusted for inflation.

- Diversifies a portfolio and helps reduce risk.

Cons:

- Potential for lower returns than other investments

- Longer maturity period (so it is less liquid)

- Subject to federal, state, and local taxes.

- Interest payments are not guaranteed. They can be reduced or eliminated if the issuing government has financial difficulties.

- Downside risk when inflation falls. Inflation-protected securities’ principal value could decline with a drop in inflation rates.

Investing in Inflation-Protected Securities?

Inflation-protected securities (IPS) are an important way to protect against the risk of inflation and offer investors a fixed income stream that is adjusted for changes in price levels. Before investing in IPS, it’s important to research the different types available and their terms and conditions.

- Research available options and choose the right type of inflation-protected security.

- Consider the rate, maturity date, taxes, and other factors before investing.

- Evaluate the issuing government’s creditworthiness. Determine if it will honor its obligations to make payments over time.

7. Mortgage-Backed Securities

Mortgage-backed securities are a type of debt instrument backed by mortgages. These securities are issued and sold by financial institutions and government agencies such as the Federal National Mortgage Association (FNMA) and the Government National Mortgage Association (GNMA). Investors who purchase these types of securities will receive regular payments backed by mortgage repayments. The principal value of these securities is affected by changes in interest rates, so investors should be aware of any potential risks when investing in them.

Pros:

- Investing in mortgage-backed securities allows investors to gain exposure to the housing market without buying a home.

- Mortgage-backed securities are generally considered low-risk investments and can provide investors with regular income payments.

- These securities also have the potential to appreciate if interest rates fall.

Cons:

- Investors may be exposed to credit risk if the mortgages backing them are not paid back.

- Mortgage-backed securities may be less liquid than stocks and bonds, which makes it difficult to sell them quickly if needed.

- These investments may also be affected by changes in interest rates, leading to potential losses for investors depending on how rates fluctuate.

Investing in Mortgage-Backed Securities?

Investors interested in mortgage-backed securities can purchase them through a broker or financial institution. Before investing, it is important to understand the risks and returns associated with these investments and any fees involved. Additionally, investors should evaluate their risk tolerance and investment goals before investing in this type of security.

Bonds vs. Stocks – Long-term Profits

When considering bonds vs. stocks, it is important to consider each type of investment’s long-term potential. While stocks can offer a higher return over long periods, bonds tend to have more consistent returns over short to medium timeframes, making them good investments for retirement savings.

Additionally, risk tolerance must be considered when evaluating this asset class. Bonds generally require less risk than stocks, making them ideal for conservative investors looking to maximize their return without taking on too much risk. When investing in bonds vs. stocks, it is important to keep an eye on the market and ensure that you are investing in a portfolio that will provide the most consistent returns over the long run.

What are the Yearly Profits of Bonds vs. Stocks?

Typically, stocks return 7% to 10% per year over ten years, while bonds return a lower 4-6%. Bond investments tend to be less volatile than stocks and, thus, provide more consistent returns. Bond investing is also less risky because the bond’s principal amount is repaid at maturity. This means that even if the bond’s market value fluctuates, investors can still expect their original investment back when they cash out. Bonds are a great choice.

Final Thoughts

Bonds are a great option for investors looking for a relatively low-risk way to generate income. They can be purchased directly from the government or through brokers and financial institutions. Investors should understand the associated risks, returns, fees, and other factors before investing in bonds. Additionally, it is important to diversify one’s investment portfolio by investing in different types of bonds and other investments. By doing so, investors can reduce their risk while potentially generating returns over the long term.

Investing in stocks is also popular for investors looking to generate income from their portfolios. Stocks represent company ownership, which usually provides dividend payments or appreciation in value as the company grows.

You want to be a successful stock investor but don’t know where to start.

Learning stock market investing on your own can be overwhelming. There’s so much information out there, and it’s hard to know what’s true and what’s not.

Liberated Stock Trader Pro Investing Course

Our pro investing classes are the perfect way to learn stock investing. You will learn everything you need to know about financial analysis, charts, stock screening, and portfolio building so you can start building wealth today.

★ 16 Hours of Video Lessons + eBook ★

★ Complete Financial Analysis Lessons ★

★ 6 Proven Investing Strategies ★

★ Professional Grade Stock Chart Analysis Classes ★

FAQ

What is a bond?

A bond is a debt instrument, typically issued by governments or corporations, to borrow money for various reasons. When investors purchase bonds, they lend money to the issuer in exchange for periodic interest payments and repayment of the principal amount at a future date.

What are the risks associated with investing in bonds?

Bond investment carries certain risks, including credit, liquidity, and interest rate risks. Credit risk means that investors may not receive any of their principal back if the issuer defaults on their payment obligations. Liquidity risk refers to an investor's ability to easily sell their bond before maturity without losing too much value due to fluctuating market prices. Lastly, interest rate risk occurs when interest rates rise and lower the value of existing bonds as new bonds become more attractive investments than older ones with lower yields.

Are there different types of bonds?

Yes, there are several different types of bonds available for investors to choose from, including government bonds, corporate bonds, municipal bonds, mortgage-backed securities (MBS), asset-backed securities (ABS), floating-rate notes (FRN), zero coupon bonds (ZCB) and many more. Each type of bond has its own set of associated characteristics and risks that potential investors should be aware of before investing.

How do I know which type of bond is right for me?

The best type of bond for you will depend on your specific investment goals and objectives, your tolerance for risk, and other factors, such as your current financial situation and long-term plans for your portfolio investments. It is important to consult an experienced financial advisor or broker before deciding which type of bond best suits you or your investment portfolio needs.

How do I buy bonds?

Bonds can be purchased through various sources, including brokers, online trading platforms, mutual funds, or directly from the issuer themselves if available through a direct purchase program such as TreasuryDirect from the US Government or Canada Savings Bonds from the Canadian Government. Before making any investment decisions, it is important to carefully research all available options to find the one that best fits your needs and goals when investing in bonds.

What is a bond yield?

Bond yield refers to how much income an investor can expect from an investment, such as a bond, over time, based on its current market price versus its initial face value (the amount initially paid out when the bond was issued). Typically, yield is expressed as an annual percentage rate, but other measures can also depend on how often interest payments are made on the investment. For example, if an investor bought a $1 000 face value 5-year bond paying 10% per year, they would expect to earn $100 every year until maturity, resulting in a yield-to-maturity percentage rate of 10%.

What happens if I want out before my bond matures?

Investors can sell their bonds before maturity through a broker or online trading platform at whatever price buyers are willing to pay. This price may differ from what you originally paid due to market fluctuations since the purchase. As long as enough buyers are looking for similar types of debt instruments, it would be best if you didn't have trouble finding someone willing to pay close enough to what you're asking so that both parties are satisfied with the agreement.

What happens when my bond matures?

When a bond matches its maturity date, its total face value plus all accrued interest will be repaid by the issuer unless otherwise specified in the original agreement between the parties. Depending on the situation, this could mean either cashing out the entire principal amount invested or rolling into another similar instrument where money continues to work hard, earning dividends until the next scheduled maturity date.

Are there tax implications associated with investing in bonds?

Generally speaking, taxes will likely apply in some form, whether it's income tax related capital gains tax – these vary by jurisdiction, so it's important to familiarize yourself with local laws, regulations surrounding taxation rules applicable to investments like stock ownership debt obligations like those found buying holding specific types individual institutional level corporate, municipal government issued debts securities. Additionally, when cashing out before the maturity date, you may incur additional taxes as well, depending situation. It's always best practice to consult a qualified tax professional if uncertain about what applicable laws are in given jurisdiction.

Are I-bonds a good investment?

I-Bonds are a form of government-issued debt security offered by the US Treasury Department, and they can be a good way to diversify your portfolio with minimal risk and provide you with a steady rate of return. However, like any other investment, there are pros and cons associated with I-bonds

Are treasury bonds a good investment?

Treasury bonds are one of the safest investments you can make. They are backed by the full faith and credit of the US government, so they carry virtually no risk of default or loss of principal. As such, they offer a predictable rate of return that is usually higher than most other types of investments. The downside is that treasury bonds have relatively low returns.