Defensive stocks are considered lower-risk investments, as they are less likely to decline in value during market volatility.

They are typically found in industries that provide essential goods or services, such as healthcare, consumer staples, and utilities. These industries tend to have consistent demand regardless of economic conditions, making them more resilient during market downturns.

Defensive stocks withstand economic recessions and bear markets by providing critical human services. The best way to find defensive stocks is by using Benjamin Graham’s timeless rules for the defensive investor:

Stability, earnings, dividends, price-to-book ratio, and the price-to-Graham number.

Learn exactly how to find the best defensive stocks and ETFs for your portfolio.

Several factors should be considered when choosing defensive stocks. The most important is whether the company provides an essential product or service that people will continue to need regardless of the economy. Another key consideration is the company’s financial stability; you want to invest in companies likely to remain profitable even during tough times.

What are defensive stocks?

Defensive stocks are companies providing essential services like infrastructure, utilities, transportation, or communications. Thus, defensive stocks maintain stable profits, earnings, and dividends during economic recessions and stock bear markets.

A defensive stock is less volatile and holds its value better during market turbulence. Defensive stocks provide essential products or services, regardless of the economic climate. They are often utilities, transportation, or other essential infrastructure companies.

When the market turns for the worse, defensive stocks tend to hold their value better than other investments. This makes them a wise choice for investors who want to protect their portfolios from short-term declines.

What are good defensive Stocks?

Health care, food, and other basic needs are always in demand, so companies that provide these products and services are typically good defensive stocks. Utilities, transportation, and other essential infrastructure companies are often defensive stocks.

While there’s no such thing as a guaranteed investment, choosing defensive stocks can help you weather market volatility and protect your portfolio from short-term declines. Look for companies that provide essential products and services and have strong financial stability when selecting defensive stocks for your portfolio.

These companies will weather tougher economic times better and continue to generate profits even when the market is down.

Defensive stocks provide stable profits, earnings, and dividends during economic and market turbulence. However, some defensive stocks still face stock price decreases during recessions.

Pros

- Defensive stocks are less volatile than other stocks, making them a safer investment for some investors.

- They offer stability and dividends, even in difficult economic times.

- They are less volatile than other stocks, making them a safer investment for some investors.

Cons

- Defensive stocks offer lower potential returns than cyclical stocks.

- They may not be as growth-oriented as other types of stocks.

- They may not be as volatile as other stocks, making them a safer investment for some investors.

Try Powerful Financial Analysis & Research with Stock Rover

Examples of defensive stocks

Examples of defensive stocks include healthcare, food, utilities, transportation, and essential infrastructure companies. These stocks are less volatile and hold their value better during market turbulence. They are often essential products or services that people will continue to need regardless of the economy.

Defensive stocks are companies that provide essential products and services regardless of the economic climate and can be a valuable part of any investor’s portfolio. There is no such thing as a risk-free investment, but some stocks are better bets than others in times of market volatility.

Defensive stocks list by market sector

Popular defensive stocks include Johnson & Johnson, Pfizer, Merck, Hershey, Kraft Heinz, General Mills, Duke Energy, Southern Company, and American International Group (AIG). For the full list, see below.

- Healthcare: Johnson & Johnson, Pfizer, Merck

- Food: Hershey, Kraft Heinz, General Mills

- Utilities: Duke Energy, Southern Company, American Electric Power

- Transportation: FedEx, UPS, CSX.

- Consumer Staples: Coca-Cola, PepsiCo, Procter & Gamble

- Telecommunications: AT&T, Verizon, Sprint

- Materials: Dupont, DowDuPont, 3M

- Industrials: General Electric, United Technologies, Honeywell

- Bank: JP Morgan Chase, Bank of America, Citigroup

- Real Estate Investment Trust (REIT): Simon Property Group, Prologis, Public Storage

- Insurance: Berkshire Hathaway, American International Group (AIG), Metlife

- Technology: Apple, Microsoft, Amazon

Should I buy defensive stocks?

It depends on your risk tolerance and investment goals. Defensive stocks are less volatile than other stocks, making them a safer investment for some investors. However, they offer lower potential returns than cyclical stocks. It’s important to weigh each option’s pros and cons before deciding.

What financial criteria are used to find defensive stocks?

Defensive stocks generally have strong balance sheets, consistent dividend yields, and above-average profit margins. They also tend to be large, established companies with a wide reach in their respective industries. For example, some common defensive stocks include Coca-Cola, Johnson & Johnson, and Walmart. These companies have decades of experience managing their businesses and are less likely to suffer from market downturns.

Other criteria for identifying defensive stocks include long-term debt levels, cash flows, and insider trading activity. Examining these factors can help investors determine which companies offer a low-risk, conservative investment strategy. Additionally, analyzing the performance of defensive stocks over time can provide insight into whether or not they are suitable for your portfolio.

Investing in defensive stocks

There are two ways to invest in defensive stocks: you can invest in defensive stock ETFs or buy defensive stocks that pay dividends and have low volatility.

4 Defensive stock ETFs worth considering

Defensive stock ETFs are great ways to build a portfolio during economic downturns. ETFs offer built-in diversification and lower costs than traditional mutual funds.

Pros

1. They offer stability and dividends, even in difficult economic times.

2. They are less volatile than other stocks, making them a safer investment for some investors.

3. They can provide a steady income stream even during bear markets.

4. They are a relatively safe investment option.

Cons

1. They offer lower potential returns than cyclical stocks.

2. They can be less exciting to invest in than growth stocks.

3. They may not perform as well as other stocks during bull markets.

Beat The Market, Avoid Crashes & Lower Your Risks

Nobody wants to see their hard-earned money disappear in a stock market crash.

Over the past century, the US stock market has had 6 major crashes that have caused investors to lose trillions of dollars.

The MOSES Index ETF Investing Strategy will help you minimize the impact of major stock market crashes. MOSES will alert you before the next crash happens so you can protect your portfolio. You will also know when the bear market is over and the new rally begins so you can start investing again.

MOSES Helps You Secure & Grow Your Biggest Investments

★ 3 Index ETF Strategies ★

★ Outperforms the NASDAQ 100, S&P500 & Russell 3000 ★

★ Beats the DAX, CAC40 & EURO STOXX Indices ★

★ Buy & Sell Signals Generated ★

MOSES Helps You Sleep Better At Night Knowing You Are Prepared For Future Disasters

4 Best Defensive Stock ETFs

1. SPDR S&P Dividend ETF (SDY)

This fund aims to generate positive returns while still investing in high-yield dividends. To do this, it generally invests 80% or more of its total assets into securities that comprise the index – which measures performance based on increasing annual dividends every year for 20 consecutive years!

| SPDR S&P Dividend ETF (SDY) | US Equity |

| Category | Large Value |

| Morningstar Rating | ★★★★★ |

| Net Assets ($M USD) | $20,504 |

| Average Volume (3m) | 627,378 |

| Expense Ratio | 0.35% |

Open this chart live in TradingView

2. iShares Select Dividend ETF (DVY)

Investing wisely is all about balance. If you want a reliable return on your money with some upside potential, defensive investments like dividend stocks might best suit you! The iShares Select Dividend ETF (DVY) offers high-quality shares from 100 companies that have delivered regular annual dividend payments. These assets need proof of five years’ worth of uninterrupted payouts before being included in this fund’s portfolio.

| iShares Select Dividend ETF (DVY) | US Equity |

| Category | Large Value |

| Morningstar Rating | ★★★★ |

| Net Assets ($M USD) | $21,251 |

| Average Volume (3m) | 1,141,132 |

| Expense Ratio | 0.38% |

Open this chart live in TradingView

3. Vanguard Utilities ETF (VPU.)

Is it heavily invested in the stock market? This fund uses an indexing investment approach to track the performance of large, mid-size, and small US companies within the utility sector as classified under the Global Industry Classification Standard(GICS). It attempts to replicate the target index by investing all or substantially all its assets into stocks that make up this particular collection—holding each one at about equal proportions to its weightings; non-diversified means there isn’t any protection against bad times if others are doing well.

| Vanguard Utilities ETF (VPU.) | Sector Equity |

| Category | Utilities |

| Morningstar Rating | ★★★★ |

| Net Assets ($M USD) | $7,271 |

| Average Volume (3m) | 323,329 |

| Expense Ratio | 0.10% |

Utilities remained stable in 2022, when the S&P 500 lost 30%. However, as you can see below, utilities did not fare well during the 2020 post-COVID recovery.

Open this chart live in TradingView.

4. Vanguard Dividend Appreciation (VIG)

VIG’s top holdings include some of America’s most stable and profitable companies, like healthcare giant Johnson & Johnson (JNJ). This ETF has been around for nearly ten years and has dividend-paying stocks that have delivered higher profits over time. With every industry under attack, from rising interest rates to trade wars and increased taxes on products, this fund offers ways to invest safely in tried-and-true winners while also accessing growth through defensive plays.

| Vanguard Dividend Appreciation (VIG) | US Equity |

| Category | Large Blend |

| Morningstar Rating | ★★★★ |

| Net Assets ($M USD) | $70,809 |

| Average Volume (3m) | 1,718,166 |

| Expense Ratio | 0.06% |

Open this chart live in TradingView.

How do you find defensive stocks?

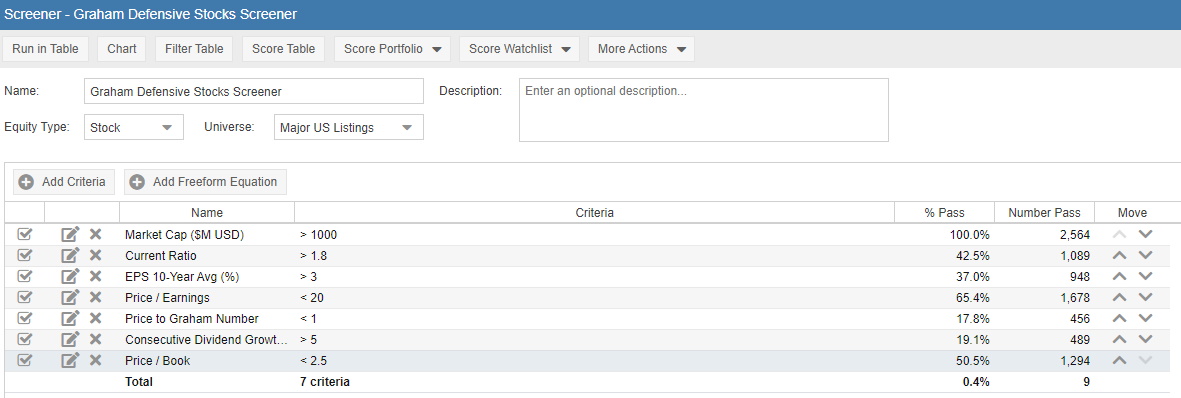

Using the criteria developed by legendary investor Benjamin Graham, you can use a stock screener to find the best defensive stocks. Graham’s book was published in 1972, so we have updated the following criteria for the present day. In his book “The Intelligent Investor,” Benjamin Graham lays down the following rules.

Graham’s 7 Criteria for Good Defensive Stocks

1. Adequate size of the enterprise

Graham suggested we use $100 million as a company’s minimum market capitalization, but now it makes sense to use $1 billion.

2. Sufficiently strong financial condition

Ben Graham suggested that a 2:1 current ratio should ensure a company has twice the current assets to current liabilities. This ratio should help a company weather the storm of a bad business climate.

Our screener will use 1.8:1, as 2:1 is slightly too restrictive in the current modern stock market.

3. Earnings stability

Graham vaguely suggested the company should have “some earning for the common stock in each of the past ten years.”

4. Dividend record

“Uninterrupted payments for at least the past 20 years” was Graham’s recommendation for a good dividend record. In our screener, we will go one better with consecutive dividend growth for the past five years.

5. Earnings Growth

Ben Graham suggested a company needs a minimum increase of at least 30% in earnings per share over the last ten years. We can use the criteria EPS greater than 3% every year for the last ten years.

6. Moderate price/earnings ratio

Ben Graham recommends that the P/E Ratio be less than 15; this has since become the gold standard for investors. In our screening, we will use a PE ratio of less than 20; otherwise, the screener becomes too restrictive.

7. Moderate Ratio of price to assets

The current price should not be more than 2.5 times the book value, according to Martin Zweig’s updated guidance in the Intelligent Investor (Page 374). In our defensive stock screener using Stock Rover, we can go one better and use a Price/Book Ratio of 2.5 or use the Price to Graham Number of Less than 1.

Finding Defensive Stocks With Stock Rover

Using award-winning Stock Rover, our favorite stock screening and research tool, you can create the ultimate defensive stock screening strategy. Sign up for Stock Rover and import this Ben Graham Stock Screener. Download the Ben Graham stock screener import file now.

DOWNLOAD – Stock-RoverScreener-Graham-Defensive-Stocks-Screener.txt

Implementing the Defensive Stocks Screener Strategy

Using Stock Rover to implement the Ben Graham defensive stocks strategy, the screening criteria look like the screenshot below.

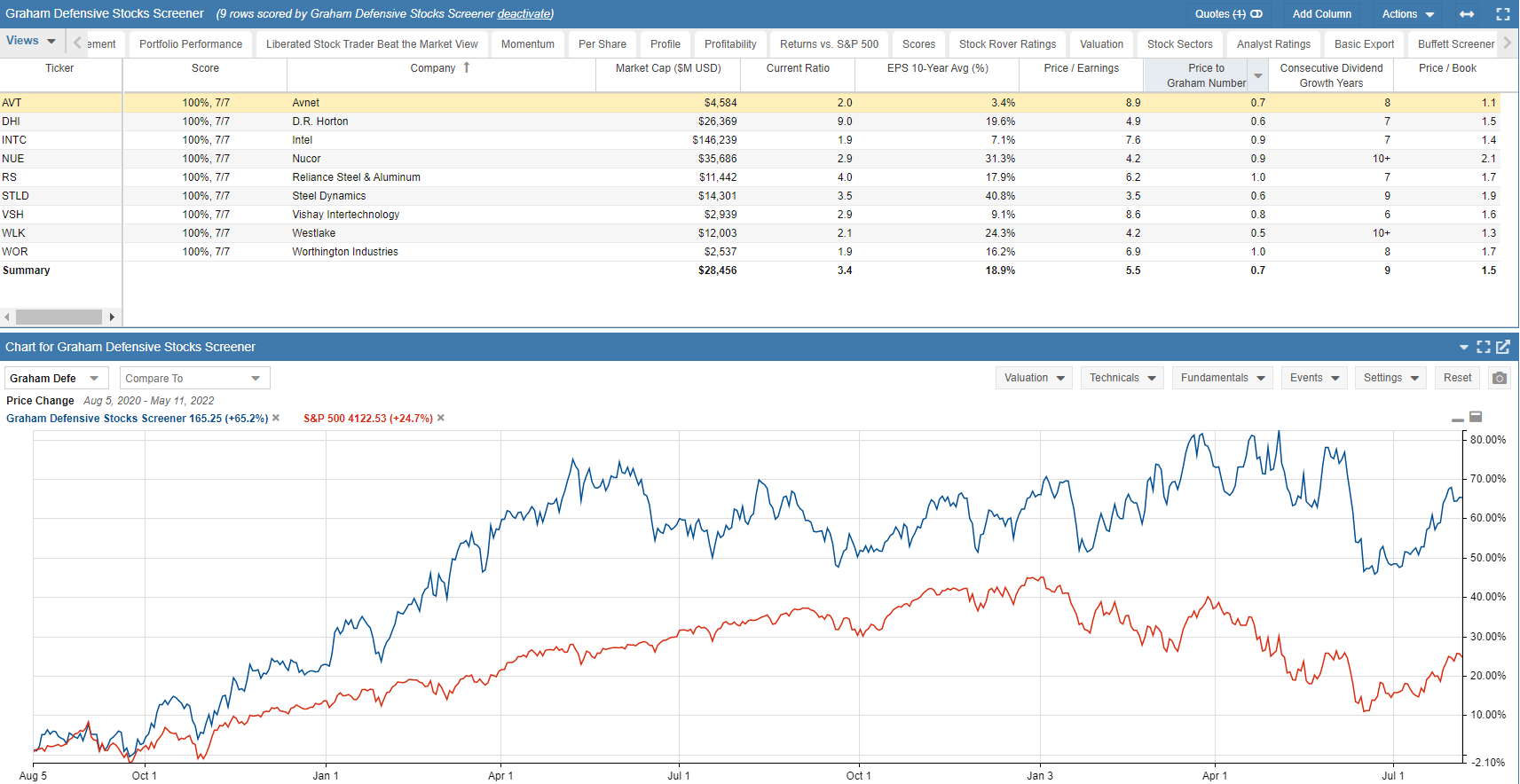

Example: Ben Graham’s Defensive Stocks

According to Ben Graham’s timeless strategy, Avnet, D.R. Horton, Granite REIT, Nucor, Otter Tail, Steel Dynamics, UFP Industries, and Westlake are the best defensive stocks.

| Ticker | Stock Rover Score | Company | Market Cap ($M) | Current Ratio | EPS 10-Year Avg (%) | Price / Earnings | Price to Graham Number | Consecutive Div. Growth Years | Price / Book |

| AVT | 100%, 7/7 | Avnet | $3,938 | 2 | 8.00% | 5.5 | 0.5 | 9 | 1 |

| DHI | 100%, 7/7 | D.R. Horton | $31,787 | 10.9 | 19.10% | 5.6 | 0.6 | 8 | 1.6 |

| GRP.U | 100%, 7/7 | Granite REIT | $3,708 | 2.2 | 10.80% | 8.7 | 0.6 | 8 | 0.9 |

| MDC | 100%, 7/7 | MDC Holdings | $2,533 | 9 | 24.60% | 4 | 0.4 | 6 | 0.8 |

| NUE | 100%, 7/7 | Nucor | $38,586 | 3.1 | 34.90% | 4.8 | 0.9 | 10+ | 2.2 |

| OTTR | 100%, 7/7 | Otter Tail | $2,567 | 1.9 | 18.80% | 8.8 | 0.9 | 9 | 2.2 |

| STLD | 100%, 7/7 | Steel Dynamics | $18,676 | 3.7 | 40.90% | 4.7 | 0.7 | 10+ | 2.3 |

| UFPI | 100%, 7/7 | UFP Industries | $5,186 | 3 | 39.30% | 7.6 | 0.9 | 10+ | 2.1 |

| VSH | 100%, 7/7 | Vishay Intertechnology | $3,095 | 2.9 | 13.10% | 8.1 | 0.8 | 7 | 1.6 |

| WLK | 100%, 7/7 | Westlake | $13,989 | 2.5 | 21.70% | 5.3 | 0.8 | 10+ | 1.5 |

Get Stock Rover Now For Powerful Investing Strategies

1. Avnet (AVT.)

Avnet is a global distributor of electronic components, connecting suppliers of semiconductors and other components to a base of 2.1 million small—and mid-sized customers in 140 countries. It is the third-largest semiconductor distributor in the world and the largest for European chip distribution.

| Sector | Technology |

| Industry | Electronics & Computer Distribution |

| Market Cap ($M) | $3,941 |

| Short % of Float | 6.9% |

| Employees | 15,300 |

| Avnet vs. Industry | Stock | Industry | S&P 500 |

|---|---|---|---|

| Stock Rover Value Score | 74 | 80 | 74 |

| Price / Earnings | 5.5 | 9.6 | 21.0 |

| Price / Sales | 0.2 | 0.3 | 2.3 |

| Price / Free Cash Flow | – | – | 20.9 |

| Price / Book | 1.0 | 1.4 | 4.0 |

| Price / Tangible Book | 1.2 | 13.3 | 491.5 |

Get Stock Rover Now for a Detailed Analysis

See the Chart Live on TradingView

2. D.R. Horton (DHI.)

D.R. Horton is a leading homebuilder in the United States, operating in 106 markets across 33 states. D.R. Horton builds single-family detached homes (over 90% of home sales revenue) and offers products to entry-level, move-up, luxury buyers, and active adults.

| Sector | Consumer Cyclical |

| Industry | Residential Construction |

| Market Cap ($M) | $31,860 |

| Short % of Float | 7.0% |

| Employees | 13,237 |

| D.R. Horton vs. Industry | Stock | Industry | S&P 500 |

|---|---|---|---|

| Stock Rover Value Score | 87 | 74 | 74 |

| Price / Earnings | 5.6 | 6.1 | 21.0 |

| Price / Sales | 1.0 | 0.8 | 2.3 |

| Price / Free Cash Flow | 79.4 | 27.9 | 20.9 |

| Price / Book | 1.6 | 1.2 | 4.0 |

| Price / Tangible Book | 1.7 | 1.1 | 492.7 |

Get Stock Rover Now for a Detailed Analysis

See the Chart Live on TradingView

3. Granite REIT (GRPU)

Granite Real Estate Investment Trust, or Granite, is a real estate investment trust engaged in acquiring, developing, and managing primarily industrial properties in North America and Europe. Granite’s portfolio comprises various manufacturing, corporate office, warehouse and logistics, and product engineering facilities.

Most of the company’s assets are logistics and distribution warehouses and multipurpose buildings, which are split fairly evenly among Canadian, Austrian, and US locations.

| Sector | Real Estate |

| Industry | REIT – Industrial |

| Market Cap ($M) | $3,708 |

| Employees | 58 |

| Granite REIT vs. Industry | Stock | Industry | S&P 500 |

|---|---|---|---|

| Stock Rover Value Score | 77 | 66 | 74 |

| Price / Earnings | 8.7 | 13.0 | 21.0 |

| Price / Sales | 11.4 | 11.7 | 2.3 |

| Price / Free Cash Flow | 18.8 | 22.5 | 20.9 |

| Price / Book | 0.9 | 2.1 | 4.0 |

| Price / Tangible Book | 0.9 | 8.5 | 492.5 |

Get Stock Rover Now for a More Detailed Analysis

See the Chart Live on TradingView

4. MDC Holdings (MDC)

MDC Holdings Inc. is an American holding company that operates home construction, mortgage, insurance, and title companies.

The company focuses on single-family and residential communities via its Richmond American Homes brand in Arizona, California, Colorado, Florida, Virginia, Nevada, Utah, and Washington.

| Sector | Consumer Cyclical |

| Industry | Residential Construction |

| Market Cap ($M) | $2,542 |

| Short % of Float | 6.7% |

| Employees | 2,080 |

| MDC Holdings vs. Industry | Stock | Industry | S&P 500 |

|---|---|---|---|

| Stock Rover Value Score | 98 | 74 | 74 |

| Price / Earnings | 4.1 | 6.1 | 21.0 |

| Price / Sales | 0.5 | 0.8 | 2.3 |

| Price / Free Cash Flow | 13.4 | 27.9 | 20.9 |

| Price / Book | 0.8 | 1.2 | 4.0 |

| Price / Tangible Book | 0.9 | 1.1 | 492.4 |

Get Stock Rover Now for a Detailed Analysis

See the Chart Live on TradingView

5. Nucor (NUE.)

Nucor Corp manufactures steel and steel products. The company also produces direct reduced iron for use in its steel mills.

The operations include international trading and sales companies that buy and sell steel and steel products manufactured by the company and others.

The operating business segments are steel mills, steel products, and raw materials; the steel mills segment derives the maximum revenue.

| Sector | Basic Materials |

| Industry | Steel |

| Market Cap ($M) | $38,676 |

| Short % of Float | 3.7% |

| Employees | 28,800 |

| Sales ($M) | 43,153 |

| Shares Outstanding | 256,544,000 |

| IPO Date | 07/12/1972 |

| Ex‑Dividend Date | 12/29/22 |

| Last Reported Qtr. | 09/30/22(GAAP) |

| Next Quarter Report Date | 01/26/23 |

| Nucor vs. Market | Stock | Industry | S&P 500 |

|---|---|---|---|

| Stock Rover Value Score | 97 | 81 | 74 |

| Price / Earnings | 4.8 | 3.7 | 21.0 |

| Price / Sales | 0.9 | 0.4 | 2.3 |

| Price / Free Cash Flow | 4.9 | 5.7 | 20.9 |

| Price / Book | 2.2 | 0.8 | 4.0 |

| Price / Tangible Book | 3.7 | 2.9 | 492.2 |

| EV / EBITDA | 3.2 | 2.8 | 15.3 |

| EV / FCF | 5.1 | 6.4 | 19.9 |

| EPS Predict. Pctl. | 59 | 32 | 68 |

| Cash Flow Predict. Pctl. | 79 | 43 | 76 |

Get Stock Rover Now for a Detailed Analysis

See the Chart Live on TradingView

Defensive Stocks Results

This chart shows that the Graham defensive investor stock strategy has beaten the market for the past two years, including the Covid and 2022 crashes.

Using Graham’s seven defensive stock investing criteria, the nine companies in our results returned 65%, while the S&P 500 returned only 25% in the two years to January 2023.

FAQ

What is the best software for defensive investing?

Our testing shows that Stock Rover is the best overall stock analysis software for defensive, dividend, value, and growth investing. It's the only screener with the margin of safety, intrinsic value, price-to-book, and price-to-graham number ratios.

What are defensive stocks?

Defensive stocks belong to companies that provide essential services or commodities, like utilities, healthcare, and consumer goods. Regardless of the economic climate, these industries tend to remain stable because their demand is consistent.

Why are defensive stocks called 'defensive'?

They are termed 'defensive' because they can protect your portfolio during economic downturns. Their steady dividends and stable earnings act as a shield against market fluctuations.

How do defensive stocks perform during a recession?

Evidence suggests defensive stocks hold up well or decline less than others during a recession. As they belong to sectors that aren't heavily influenced by economic swings, their revenue and profits tend to remain stable, providing reliable returns.

Are defensive stocks suitable for all investors?

Yes, they can be a good fit for risk-averse investors seeking stable dividends and relatively secure capital. However, they may not suit those looking for high-growth investments.

Can defensive stocks outperform the market?

While defensive stocks generally offer lower growth, they can outperform the market during economic downturns due to their stability and consistent demand.

What are some examples of defensive stocks?

Some examples include Procter & Gamble, Johnson & Johnson, and The Coca-Cola Company. These companies produce goods and services that are always in demand.

Do defensive stocks pay dividends?

Yes, many defensive stocks pay dividends. This is why they are popular among investors seeking reliable income. Depending on the stock and market conditions, dividend yields can range from low 1% to high 5%.

Are there any risks associated with investing in defensive stocks?

Yes, as with all investments, there is always a risk involved. Defensive stocks may be unable to keep up with the market during bull runs, and too much reliance on these stocks can cause an investor to miss out on potential returns.

How can I identify defensive stocks?

A reliable method to identify defensive stocks is by applying Benjamin Graham's enduring principles for the defensive investor. Key factors to consider include stability, earnings, dividends, price-to-book ratio, and the price-to-Graham number.

Are defensive stocks a good long-term investment?

Defensive stocks can be an excellent choice for long-term investors seeking stability and regular income. They offer steady growth and are less likely to be affected by market volatility.

Do defensive stocks have low volatility?

Yes, defensive stocks typically have lower volatility than the broader market because of their steady earnings and consistent demand for their products or services.

Can defensive stocks help in portfolio diversification?

Yes, including defensive stocks in your portfolio can provide balance, reduce risk, and increase the potential for stable returns.

Are all utility and consumer goods companies defensive stocks?

While many are, it's not a rule. Some companies in these sectors may have inconsistent earnings or be heavily indebted, affecting their stability.

Is investing in defensive stocks a form of passive investing?

No, while they require less active management due to their stability, choosing the right defensive stocks still requires research and analysis.

Can I lose money on defensive stocks?

Yes, while defensive stocks are generally safer, they are not risk-free investments. Market conditions, company performance, and other factors can affect stock prices. Always conduct thorough research before investing.

Are banks defensive stocks?

Yes, banks are considered defensive stocks because they offer stability and dividends, even in difficult economic times. The most popular banks include JPMorgan Chase, Bank of America, and Citigroup.

Are REITs defensive stocks?

Yes, real estate investment trusts (REITs) are considered defensive stocks. Some of the most popular REITs include Simon Property Group, Prologis, and Public Storage.

Are utilities defensive stocks?

Yes, utilities are considered defensive stocks because people still need gas, electricity, and water even in difficult economic times. The most popular utilities include Duke Energy, Southern Company, and American Electric Power.

What are cyclical vs. defensive stocks?

Cyclical stocks are those that tend to rise and fall with the economic cycle, while defensive stocks are those that tend to remain stable even in difficult economic times. Examples of cyclical stocks include airlines, retailers, and automakers, while examples of defensive stocks include banks, REITs, and utilities.

You want to be a successful stock investor but don’t know where to start.

Learning stock market investing on your own can be overwhelming. There’s so much information out there, and it’s hard to know what’s true and what’s not.

Liberated Stock Trader Pro Investing Course

Our pro investing classes are the perfect way to learn stock investing. You will learn everything you need to know about financial analysis, charts, stock screening, and portfolio building so you can start building wealth today.

★ 16 Hours of Video Lessons + eBook ★

★ Complete Financial Analysis Lessons ★

★ 6 Proven Investing Strategies ★

★ Professional Grade Stock Chart Analysis Classes ★