OTC stocks trade outside major exchanges and are less regulated, making them difficult to find and trade.

Those looking for bargains could consider over-the-counter (OTC) and pink sheet stocks, which offer a chance to buy shares in companies that mainstream investors may overlook.

I would warn against investing in OTC stocks.

This article will answer all your questions on OTC stocks and address the difficulties and risks of trading pink sheet stocks.

OTC Stocks Quick Overview

OTC stocks are not traded on a major stock exchange and are less regulated. You can buy and sell them during normal market hours and out-of-hours. OTC stocks are Optionable, can be leveraged, and can be bought in a Roth IRA. Some OTC stocks pay dividends. The safest OTC stocks are ones that are listed on the OTCQX market.

What are OTC stocks?

OTC stocks are not listed on a major stock exchange like the NYSE or NASDAQ. OTC stocks are traded over the counter, which means they are traded between investors directly through broker-dealers.

For this reason, OTC stocks tend to be less liquid (meaning it’s harder to buy and sell them) than stocks listed on exchanges.

One advantage of OTC stocks is that they can be a more affordable way for the company to raise capital because they don’t have to meet the same listing requirements or pay the high listing fees as companies on major exchanges.

What is a pink sheet stock?

Pink sheet stocks are less regulated and less liquid than other OTC stocks. They are not traded on an exchange; instead, they are traded over the counter through a system known as the “pink sheets.” The pink sheets are a list of OTC stocks published by OTC markets.

What is OTCBB?

OTCBB is an acronym for Over the Counter Bulletin Board. It was a US OTC stock exchange regulated by the Financial Industry Regulatory Authority (FINRA). The OTCBB has ceased operations since November 2021. The main advantage of the OTCBB was that it provided a listing venue for small companies that are too small to list on major exchanges like the NYSE or NASDAQ.

Are penny stocks OTC?

Yes, penny stocks are typically OTC stocks, but not always. Roughly 350 stocks on the NASDAQ and NYSE have a share price of under $1. However, the OTC markets have over 4,000 stocks priced under $1.

My thorough testing awarded TradingView a stellar 4.8 stars!

With powerful stock chart analysis, pattern recognition, screening, backtesting, and a 20+ million user community, it’s a game-changer for traders.

Whether you're trading in the US or internationally, TradingView is my top pick for its unmatched features and ease of use.

Explore TradingView – Your Gateway to Smarter Trading!

What is an OTC penny stock?

An OTC penny stock has a stock price under $1 and is traded in the over-the-counter market. This means that it is not traded on a major stock exchange but is traded between investors directly. This can make it difficult to find information about OTC penny stocks, and it can be difficult to sell them because there tends to be less liquidity (meaning fewer buyers and sellers) than other stocks.

How to trade OTC stocks?

OTC stocks can be traded through various methods, including online brokerages, over-the-counter markets, and pink sheets. Online brokerages allow investors to trade stocks directly from their computers. This can be a convenient way to trade OTC stocks, especially if you are comfortable with online trading.

Over-the-counter (OTC) markets are venues where investors can buy and sell OTC stocks. Brokerages usually run these markets, and they can provide a convenient way to trade OTC stocks.

What are Pink Sheets?

The pink sheets list OTC stocks published by the OTC Markets Group (previously known as the National Quotation Bureau). This can be useful for investors looking for information about OTC stocks.

How to buy OTC stocks?

To buy an OTC stock, you must find a broker that offers OTC trading. This broker will provide a platform to buy and sell OTC stocks. You can usually find a list of brokers that offer OTC trading on major exchanges like the NYSE and NASDAQ websites.

Once you have selected a broker, you must open an account with them. This account will give you access to the platform to trade OTC stocks.

Once you have opened an account, you can deposit money to buy stocks. You can then use this money to buy shares in any OTC stock you choose.

How to sell OTC stock?

Once you have shares in an OTC stock, you can sell them using the platform provided by your broker. You must enter the order details (including the number of shares you want to sell and the price at which you want to sell them) and submit it. Once submitted, your order will be matched with a buyer interested in buying at that price.

Are OTC stocks hard to sell?

OTC stocks can be harder to sell than those traded on major exchanges. OTC markets generally have a low volume of stocks traded, making it difficult to find a buyer for your stock. Additionally, OTC stocks are less liquid, resulting in less efficient bid/ask pricing.

Which US brokers support OTC & Pink Sheet Stock Trading?

Firstrade, Schwab, Interactive Brokers, Tradestation, Webull, and Fidelity are mainstream brokers that allow OTC trading. These brokers usually restrict trading to more liquid OTC stocks, primarily those that disclose financials.

The SEC has amended Rule 15c2-11 to restrict trading in stocks classified as Pink No Information, Grey Market, and Expert Market OTC securities. This amendment protects investors from potentially fraudulent activity.

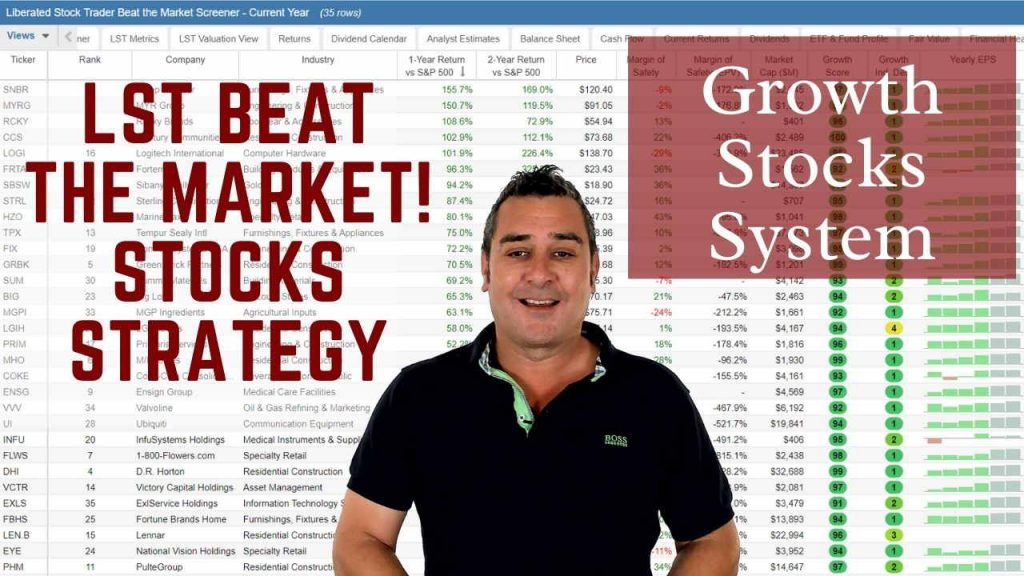

Ever Dreamed of Beating the Stock Market

Most people think that they can't beat the market, and stock picking is a game only Wall Street insiders can win. This simply isn't true. With the right strategy, anyone can beat the market.

The LST Beat the Market Growth Stock Strategy is a proven system that has outperformed the S&P500 in 8 of the last 9 years. We provide all of the research and data needed to make informed decisions, so you no longer have to spend hours trying to find good stocks yourself.

The LST Beat the Market System Selects 35 Growth Stocks and Averages a 25.6% Annual Return

★ 35 Stocks That Already Beat The Market ★

★ Buy The Stocks & Hold For 12 Months - Then Rotate ★

★ Fully Documented Performance Track Record ★

★ Full Strategy Videos & eBook ★

Take The Pain Out Of Stock Selection With a Proven Strategy

Can you short OTC stocks?

Yes, you can short OTC stocks, but it is an incredibly risky trade. Before buying an OTC stock, it is worth checking the OTC Markets Screener to see if it has a high short interest. The OTC market provides information on short interest and the percentage of stocks shorted.

Short selling is allowed on securities traded OTC but comes with serious problems. These stocks generally trade in low volumes, making them illiquid. An investor trying to cover an unprofitable short position could get stuck if they lack enough cash.

OTC likewise has been the focus of pump-and-dump schemes, where con artists use social media or email heavily to promote thinly traded stocks whose prices spike high; this can cause serious losses to the short seller.

What is the process of shorting an OTC stock?

Shorting an OTC stock is similar to shorting a stock traded on a major exchange. The problem is that some low-quality OTC securities do not have enough volume to make shorting a safe trade.

You must find a broker offering OTC trading and open an account with them.

To short an OTC stock, you must enter the order details (including the number of shares you want to sell and the price at which you want to sell them) and submit it. Once submitted, your order will be matched with a seller interested in buying at that price.

What Is OTC Markets Group?

OTC Markets Group is a financial services company that operates in OTC markets. In these markets, investors can buy and sell securities not listed on major exchanges. OTC Markets Group provides information about these securities, including pricing and volume data. It also provides tools to help investors make informed investment decisions.

How to find OTC stocks

The easiest way to find OTC stocks is by using the OTC Stock Screener on the OTCMarkets.com website. Select the OTC market, the country, and the security type, and you will be presented with OTC stocks.

Are OTC stocks safe?

OTC stocks can be safe to trade, but it is important to research before buying any stock. OTC stocks are not traded on major exchanges; it can be difficult to find information about them. Additionally, OTC markets generally have a low stock trading volume, making it difficult to find a buyer for your stock.

The 5 OTC Markets

OTC Markets Group categorizes all OTC stocks it lists into five main markets, which helps investors select the quality of OTC stock they wish to invest in.

- OTCQX market – high-quality companies and strict regulation

- OTCQB market – newer companies and good regulation

- OTC Pink market – less regulation, restricted listings

- OTC expert market – only broker/dealers

- OTC Grey market – no regulation

What is the OTCQX market?

The OTCQX market is a market where high-quality OTC stocks are traded. OTCQX is the highest tier of the OTC markets and is meant for companies that meet strict financial and disclosure requirements. It includes many well-known international blue chip companies such as Air Canada, BASF, Deutsche Telekom, and Lufthansa. These OTCQX International Premier companies use OTC to launch a second listing to get exposure to US capital markets.

What is the OTCQB market?

The OTCQB market is a market where less-established companies are traded. To be listed on the OTCQB, a company must meet certain financial and disclosure requirements, including being current with its financial filings. Many companies listed on the OTCQB are in the technology and healthcare industries and are regulated by the SEC or FDIC.

What is the OTC Pink market?

The OTC Pink market has lower financial and disclosure requirements than the OTCQX and OTCQB markets. This market is for companies that are in the pre-revenue or development stage, have been delisted from a major exchange, or are considered to be a “risky investment.” Some companies in the OTC Pink market are in financial distress or face defaulting on their financial obligations. Since November 2021’s SEC ruling 15c2-11, all OTC Pink companies must provide regular, up-to-date financial disclosures.

What is the OTC expert market?

The OTC Export market is a private Broker/Dealer network that shields prices from the standard retail investors because the listed stocks provide no information or disclosures. Only broker-dealers and sophisticated investors are allowed access to this market.

The Expert Market imposes restrictions on who can view quotations in its securities. Only broker-dealers and professional or sophisticated investors are permitted to view quotations. However, the Expert Market does not restrict who can trade these securities. Rule 15c2-11 governs a broker’s ability to submit, publish, or distribute quotations (i.e., bids and offers) in OTC securities. The Rule does not apply to the underlying transactions or the ability of an investor to buy or sell a security.

What is the OTC Grey market?

The gray market is an over-the-counter (OTC) trading market in which securities never trade on an exchange. Instead, they trade in securities suspended from other exchanges or that have not yet begun official trading, such as a pre-IPO.

The Grey Market is often misunderstood and misrepresented. Broker-dealers are unwilling or unable to publicly quote over-the-counter (OTC) securities due to a lack of investor interest, company information, or regulatory compliance. This market is often seen as a place for criminals and scammers to operate. Still, in reality, it is a place where legitimate businesses can find investment opportunities that are not available on public exchanges.

You want to be a successful stock investor but don’t know where to start.

Learning stock market investing on your own can be overwhelming. There’s so much information out there, and it’s hard to know what’s true and what’s not.

Liberated Stock Trader Pro Investing Course

Our pro investing classes are the perfect way to learn stock investing. You will learn everything you need to know about financial analysis, charts, stock screening, and portfolio building so you can start building wealth today.

★ 16 Hours of Video Lessons + eBook ★

★ Complete Financial Analysis Lessons ★

★ 6 Proven Investing Strategies ★

★ Professional Grade Stock Chart Analysis Classes ★

How to identify OTC stocks

There are several ways to identify OTC stocks. One is to use the OTC Markets Screener to see which OTC market a stock belongs to. Another is to look for the pink sheet symbol on a stock quote. Finally, you can check the company’s financial filings to see if they are listed in the OTCQB or OTCQX markets.

Do OTC stocks have options?

Yes, you can buy options on OTC stocks. Like all OTC trades, options trades are less regulated and less standardized and are direct private transactions between the seller and buyer. This means they are best avoided unless you are an institution or a sophisticated investor.

To trade options on an OTC stock, you must find a broker that offers them. You can use the FINRA BrokerCheck tool to find a list of broker-dealers offering trading options.

Are OTC stocks marginable?

Yes, you can trade OTC stocks on margin, but the margin requirements may be higher than those for stocks that are listed on an exchange. The broker-dealer you trade with sets the margin requirements for OTC stocks, so it’s important to check with them before you start trading.

Can I buy OTC stocks in a Roth IRA?

Yes, you can buy OTC stocks in a Roth IRA. However, the rules for doing so may vary depending on the broker-dealer you trade with, so it’s important to check with them before trading.

Are OTC stocks a good investment?

The short answer is that it depends on the company. Some companies in the OTC markets are well-established and have met financial and disclosure requirements, while others may be in financial distress or face defaulting on their financial obligations. Please research before investing in any company, whether listed on an exchange or in the OTC markets.

Do OTC stocks pay dividends?

Yes, according to Stock Rover data, 1,905 OTC stocks pay a dividend yield between 2% and 40%. When buying OTC stocks for dividend income, you must carefully check if the stock is eligible for payouts.

Are OTC pink sheet stocks risky?

Pink sheet stocks are often seen as risky investments because little information is available about them, and they can be difficult to sell. For this reason, they tend to trade at a discount to other stocks.

Are pink sheet stocks legal?

Yes, Trading Pink sheet stocks is entirely legal, but that does not mean the companies listed operate entirely legally. Many foreign stocks are listed in the pink sheets, and therefore, possibly fraudulent activity. The SEC is improving the regulatory rules around pink sheet stocks to lessen frauds and scams, but even so, pink sheet stocks are less regulated and standardized than other types of stocks, so they may be riskier to invest in.

Advice on OTC Stocks

As a novice or experienced investor, it may be tempting to invest in penny stocks on the OTC markets, but there is no proof that the additional risk of OTC stocks presents greater rewards. There is such a broad selection of well-regulated, high-growth companies available on the NYSE and NASDAQ exchanges that you do not need to take the extra risk of trading in OTC markets.

Ultimately, investing in OTCV stocks is Caveat Emptor (buyer beware).

FAQ

How to know if a stock is OTC?

To determine if a stock is OTC is to look for the symbol "OTC" on financial websites or in newspaper listings of stock prices. OTC stocks are also generally listed in the "pink sheets," a publication that provides information about less-liquid stocks.

Can institutions buy OTC stocks?

Yes, institutions can buy OTC stocks. However, many large institutional investors avoid OTC markets due to a lack of liquidity and financial regulation.

How to buy OTC stocks on Robinhood?

Robinhood does not allow OTC or Pink Sheet stock trades on its platform. However, Robinhood covers all the NYSE and Nasdaq stocks, circa 5,000 stocks.

Where to buy OTC stocks for free?

Tradestation, Fidelity, Firstrade, and Interactive Brokers offer free stock trades on selected "higher quality" OTC stocks. Very few mainstream brokers offer free OTC stock trades.

Do OTC stocks trade after hours?

Yes, OTC stocks do trade after hours. The hours may vary depending on the broker-dealer you trade with, so it's important to check with them before you start trading.

When do OTC stocks trade?

OTC stocks trade during normal market hours (9:30 am to 4:00 pm EST), but some broker-dealers may offer after-hours trading. The hours for OTC stocks may vary depending on the broker-dealer you trade with, so it's important to check with them before you start trading.

How many OTC stocks are there?

Currently, there are 12,468 OTC stocks listed on the OTCQX, OTCQX, and OTC Pink markets. 1,349 of these stocks also pay dividends. OTC Pink is the biggest OTC market listing 10,539 stocks.

What are the best OTC stocks?

The highest quality and safest OTC stocks are listed on the OTCQX market; this includes international blue chip companies such as Air Canada, BASF, Deutsche Telekom, and Lufthansa. There are over 600 stocks on the OTCQX market and over 130 pay dividends.

Beat The Market, Avoid Crashes & Lower Your Risks

Nobody wants to see their hard-earned money disappear in a stock market crash.

Over the past century, the US stock market has had 6 major crashes that have caused investors to lose trillions of dollars.

The MOSES Index ETF Investing Strategy will help you minimize the impact of major stock market crashes. MOSES will alert you before the next crash happens so you can protect your portfolio. You will also know when the bear market is over and the new rally begins so you can start investing again.

MOSES Helps You Secure & Grow Your Biggest Investments

★ 3 Index ETF Strategies ★

★ Outperforms the NASDAQ 100, S&P500 & Russell 3000 ★

★ Beats the DAX, CAC40 & EURO STOXX Indices ★

★ Buy & Sell Signals Generated ★

MOSES Helps You Sleep Better At Night Knowing You Are Prepared For Future Disasters