Through Berkshire Hathaway’s subsidiaries, CEO Warren Buffett owns 62 companies and has a major stakeholding in hundreds of companies in a broad market portfolio. Warren Buffett owns many companies via Berkshire Hathaway. He owns stocks and entire companies such as Dairy Queen & GEICO.

Warren Buffett’s holdings are far greater than most people think because Berkshire Hathaway (NYSE: BRK.A) owns both stock and entire companies. Currently, Berkshire Hathaway (NYSE: BRK.B) has 65 subsidiaries, ranging from the famous BNSF Railway to obscure Marmon Holdings.

The Warren Buffett Company?

When people say “the Warren Buffett Company,” they mean Berkshire Hathaway Inc., the 9th largest listed company in the USA and worth over $889 billion. Warren Buffett is famously known as the “Oracle of Omaha” and is loved for his folksy humor. He is one of the best investors in the world.

What Does Warren Buffett Own?

Through his holding company Berkshire Hathaway, Warren Buffett owns Stakes in Apple, Bank of America, American Express, Goldman Sachs, Wells Fargo, Coca-Cola, Visa, and Mastercard. With over $211 Billion invested in over 60 companies, the Buffett/Berkshire portfolio is one of the largest and most profitable globally.

Who Owns Berkshire Hathaway?

Warren Buffett founded Berkshire Hathaway and is the current chairman and CEO, but he does not own Berkshire Hathaway. Berkshire Hathaway is a public company whose shares are 68% owned by financial institutions. Vanguard, SSgA, and Blackrock are the largest investors, owning 21% of Berkshire Hathaway.

Berkshire Hathaway’s Success

Warren Buffett’s Berkshire Hathaway is one of the most stable and successful companies of all time, with its stock price having increased by 817% over the last 20 years.

View Berkshire Hathaway’s Chart & Financials Live on TradingView

How Many Companies Does Warren Buffett Own?

Warren Buffett and Berkshire Hathaway own over 65 companies and are diversified across the technology, consumer cyclical, energy, financial services, and healthcare industries. 47% of the portfolio is dedicated to financial services, and 27% to technology companies. The most substantial investments are in Apple and Bank of America, totaling over $90 billion.

Listed Company Stocks Warren Buffett Owns

Davita Inc – 40.1% Ownership

Occidental Petroleum – 20.9% Ownership

American Express – 20.3% Ownership

Bank of America Corp – 12.8% Ownership

Coca-Cola – 9.2% Ownership

Bank of New York Mellon – 8.3% Ownership

Apple – 5.6% Ownership

General Motors – 3.6% Ownership

Warren Buffett and Berkshire Hathaway own sizable stakes in many household names. Those companies include General Motors, American Express, and 5.6% of Apple, one of the world’s largest companies. Wells Fargo, Bank of New York Mellon, and 9.2% of Coca-Cola are also significant holdings.

Investing In Stocks Can Be Complicated, Stock Rover Makes It Easy.

Stock Rover is our #1 rated stock investing tool for:

★ Growth Investing - With industry Leading Research Reports ★

★ Value Investing - Find Value Stocks Using Warren Buffett's Strategies ★

★ Income Investing - Harvest Safe Regular Dividends from Stocks ★

"I have been researching and investing in stocks for 20 years! I now manage all my stock investments using Stock Rover." Barry D. Moore - Founder: LiberatedStockTrader.com

Berkshire Hathaway (BRK.A) Subsidiaries

The most famous Berkshire Hathaway subsidiaries are Dairy Queen, GEICO, Home Services of America, See Candies, and the Nebraska Furniture Mart, where it all began.

Warren Buffett/Berkshire Hathaway Company 20-Year Performance

Berkshire Hathaway, led by the legendary Warren Buffett, stands as a paragon of stability and success. Over the past two decades, its stock price has surged an astonishing 800%, illustrating its remarkable growth and prosperity.

View Berkshire Hathaway’s Financials

The Companies Warren Buffett Owns

Warren Buffett, through Berkshire Hathaway Inc., owns 65 distinct companies divided into a complex web of over 260 subsidiaries.

- Acme Brick Company

- HomeServices of America

- Applied Underwriters

- International Dairy Queen, Inc.

- Ben Bridge Jeweler

- IMC International Metalworking Companies

- Benjamin Moore & Co.

- Johns Manville

- Berkshire Hathaway Automotive

- Jordan’s Furniture

- Berkshire Hathaway Direct Insurance Company (THREE)

- Justin Brands

- Berkshire Hathaway Energy Company

- H. Brown Shoe Group

- Berkshire Hathaway GUARD Insurance Companies

- Larson-Juhl

- Berkshire Hathaway Homestate Companies

- LiquidPower Specialty Products Inc. (LSPI)

- Berkshire Hathaway Specialty Insurance

- Louis – Motorcycle & Leisure

- BH Media Group

- Lubrizol Corporation

- biBERK Business Insurance

- Marmon Holdings, Inc.

- BoatU.S.

- McLane Company

- Borsheims Fine Jewelry

- MedPro Group

- Brooks

- MiTek Inc.

- Buffalo NEWS, Buffalo NY

- MLMIC Insurance Company

- BNSF

- National Indemnity Company

- Business Wire

- Nebraska Furniture Mart

- Central States Indemnity Company

- NetJets®

- Charter Brokerage

- Oriental Trading Company

- Clayton Homes

- Pampered Chef®

- CORT Business Services

- Precision Castparts Corp.

- CTB Inc.

- Precision Steel Warehouse, Inc.

- Duracell

- RC Willey Home Furnishings

- Fechheimer Brothers Company

- Richline Group

- FlightSafety

- Scott Fetzer Companies

- Forest River

- See’s Candies

- Fruit of the Loom Companies

- Shaw Industries

- Garan Incorporated

- Star Furniture

- Gateway Underwriters Agency

- TTI, Inc.

- GEICO Auto Insurance

- United States Liability Insurance Group

- General Re

- XTRA Corporation

- Helzberg Diamonds

Source: Berkshire Hathaway Annual Reports

The companies listed above are just a small sampling of the many firms in Berkshire Hathaway’s vast empire. Berkshire Hathaway makes everything from candy to industrial equipment.

Therefore, Berkshire is one of the world’s most diversified companies because it operates in an incredible variety of sectors.

How Buffett Runs Berkshire Hathaway

In addition, Berkshire Hathaway owns some famous brands outright, making it more like a hedge fund than a traditional corporation. For instance, Buffett provides no direction or guidance to Berkshire’s subsidiaries. In a Letter to Shareholders, Buffett admits there is no corporate budget for Berkshire Hathaway.

Instead, Buffett lets each management team make all the decisions for each Berkshire subsidiary. That frees Buffett and his team to concentrate on what they do best: investing.

How Does Warren Buffett Select Companies To Invest In?

Warren Buffett finds companies to invest in using value investing. He inherently values a company based on the Intrinsic Value of the company’s future cash flows. Then, he calculates the Margin of Safety; this is how much he is willing to pay for the stock below the current price. Essentially, the margin of safety is how much a stock price could fall before it starts losing money. Learn about Warren Buffett’s investing style in this article on building your own Buffett Stock Screener.

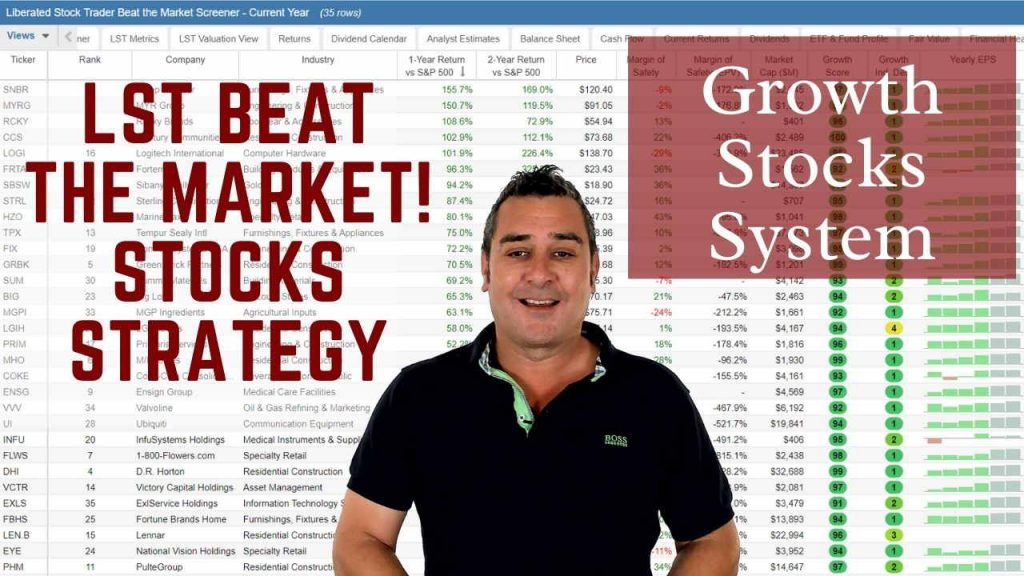

Ever Dreamed of Beating the Stock Market

Most people think that they can't beat the market, and stock picking is a game only Wall Street insiders can win. This simply isn't true. With the right strategy, anyone can beat the market.

The LST Beat the Market Growth Stock Strategy is a proven system that has outperformed the S&P500 in 8 of the last 9 years. We provide all of the research and data needed to make informed decisions, so you no longer have to spend hours trying to find good stocks yourself.

The LST Beat the Market System Selects 35 Growth Stocks and Averages a 25.6% Annual Return

★ 35 Stocks That Already Beat The Market ★

★ Buy The Stocks & Hold For 12 Months - Then Rotate ★

★ Fully Documented Performance Track Record ★

★ Full Strategy Videos & eBook ★

Take The Pain Out Of Stock Selection With a Proven Strategy

Famous Companies Warren Buffett Owns

Amongst the most famous consumer brands in the USA, Warren Buffett owns Dairy Queen, Kraft Heinz, Duracell, Fruit of the Loom, and Geico.

1. The Burlington Northern Santa Fe Railway BNSF

The BNSF combines the operations of over 390 historic American railroads. Its most famous predecessors are Santa Fe, Atchison, Topeka, and Santa Fe.

The Santa Fe, which ran between Chicago and Los Angeles, was featured in many Western movies. During the mid-20th Century, Santa Fe’s most famous train, the Super Chief, was the favorite ride of movie stars traveling to Hollywood.

Other historic railroads owned by the BNSF include the Great Northern, the Frisco, the Colorado and Southern, the Northern Pacific, the Denver Road, the Colorado Midland, and the Chicago, Burlington, and Quincy. The BNSF operates 32,500 miles of rail lines in the United States. BNSF assets include three transcontinental rail lines between Chicago and the Pacific Coast.

The BNSF is a classic value investment because it provides the necessary infrastructure other industries need to operate railways. Additionally, the BNSF right of way can be used for pipelines, fiber-optic networks for the internet and the cloud, and even next-generation transportation systems like the Hyperloop.

2. Duracell

This battery maker cashes in on our love of electronics by providing power for everything from watches to boats.

Duracell is poised to profit from America’s aging population with a line of hearing-aid batteries. Notably, nearly 53.742 million Americans are over 65. That’s a huge market for just one Duracell product because many seniors need hearing aids.

Moreover, Duracell is a significant player in LED lighting, rechargeable, alkaline, and coin and button batteries. Given our love of electronic gadgets, demand for Duracell batteries will likely skyrocket in the coming years.

Try Powerful Financial Analysis & Research with Stock Rover

3. Fruit of the Loom

America’s best-known underwear manufacturer is a perfect example of a low-profile company that makes products that are not glamorous. However, Fruit of the Loom manufactures a product everybody needs: underwear.

Interestingly, Fruit of the Loom is one of several clothing makers Berkshire Hathaway owns. Fruit of the Loom is often cited as a classic value investment because Buffett bought it from a bankruptcy court. Fruit of the Loom also owns the Russell Athletic, Spalding, Jerzees, and Vanity Fair brands.

4. GEICO

This auto insurance giant is Berkshire Hathway’s highest-profile holding because of vast amounts of innovative advertising. In particular, Geico’s mascot, the Gecko, is a constant presence on American television.

GEICO is one of Berkshire’s most lucrative holdings, generating $1.259 billion from underwriting.

GEICO claims to insure 28 million vehicles through 17 million auto insurance policies in the United States. The name GEICO stands for Government Employees Insurance Company. GEICO will sell auto, home, general liability, professional liability, workers’ compensation, medical malpractice, rideshare, business, or commercial cars to anybody.

Notably, GEICO is one of many insurance companies Berkshire Hathaway owns. Buffett loves insurance because insurance premiums generate float. Float is a steady stream of cash Berkshire Hathaway can tap for acquisition and other purposes.

5. Gen Re

Gen Re provides financial backing to insurance companies through reinsurance. The reinsurance market is huge and lucrative. Gen Re claims to have $14 billion in capital and $9 billion in premiums.

Even though most of Berkshire’s operations focus on the USA, Gen Re operates 40 offices worldwide. Like several Berkshire Hathaway subsidiaries, Gen Re has several subsidiaries, including General Star, USAU, and Faraday. Faraday underwrites insurance through the historic British insurance market Lloyd’s of London.

6. Kraft Heinz (NYSE: KH)

The historic American food manufacturer is the only publicly traded company listed as a subsidiary on Berkshire Hathaway’s website. However, Kraft-Heinz is an independent publicly traded company, and Berkshire owns 26.7% of it.

In detail, Berkshire and 3G Capital created Kraft Heinz by merging Kraft Foods with HJ Heinz. However, the company has struggled to compete with private-label brands.

View the Kraft Heinz Chart & Financials Live on TradingView

This food manufacturer owns many famous brands that have been staples in American kitchens for generations. Notable Kraft Heinz Products include Heinz ketchup, Maxwell House coffee, Jell-O, Velveeta, Kraft Cheese, Grey Poupon Mustard, Planters Peanuts, Kool-Aid, Ore Ida Potatoes, and Oscar Meyer meat products.

In recent years, Heinz has struggled because consumers prefer cheaper private-label products. Buffett himself admits Costco’s Kirkland brand now outsells Kraft Heinz.

7. Berkshire Hathaway Energy Company

Most people do not realize it, but Berkshire Hathaway is a major player in electricity generation in the United States.

For example, Berkshire Hathaway Energy invested $6.5 billion in solar projects in the United States and now owns two of the largest solar polar projects in the country.

Berkshire Hathaway Energy owns a utility portfolio that includes NV Energy in Nevada, Northern Powergrid in England, Northern Natural Gas, and PacifiCorp.

8. Home Services of America

Home Services of America offers everything a potential homebuyer might need, including real estate brokerages, title and escrow companies, mortgages, insurance, and relocation services.

Home Services of America operates through franchises throughout the United States. Specifically, it caters to Buffett’s faith in the United States and the American dream.

Buffett is a strong advocate of homeownership who has great faith in the resilience of the American economy. Thus, subsidiaries like Home Services of America reflect Buffett’s patriotism. Consequently, Buffett owns several housing-related companies, including Clayton Homes and Scott Fetzer Companies.

My thorough testing awarded TradingView a stellar 4.8 stars!

With powerful stock chart analysis, pattern recognition, screening, backtesting, and a 20+ million user community, it’s a game-changer for traders.

Whether you're trading in the US or internationally, TradingView is my top pick for its unmatched features and ease of use.

Explore TradingView – Your Gateway to Smarter Trading!

9. BH Media Group

Warren Buffett is a lifelong fan of journalism and newspapers who delivered newspapers as a college student. Buffett owns 30 daily newspapers and many other holdings through the BH Media Group.

BH Media’s most notable properties include Buffett’s hometown newspaper, The Omaha World-Herald, which Warren once delivered. In addition, BH Media owns the Richmond-Times Dispatch, The Tulsa World, The Charlottesville Daily Progress, The Eagle, The Winston-Salem Journal, and The Roanoke Times.

Berkshire Hathaway also owns one of the largest newspapers in upstate New York, The Buffalo News, through a separate subsidiary. Newspaper holdings reflect Buffett’s commitment to investing in industries and businesses he loves.

10. The McLane Group

McLane provides a wide variety of goods and services to retailers and restaurants all over the United States. In particular, it delivers cigarettes, snacks, candy, and other merchandise to convenience stores and gas stations.

Additionally, it services major discounters like Family Dollar and offers alcoholic beverages through Empire Wine & Spirits. McLane trucks can be seen on almost every highway in America.

McLane represents the traditional value investing strategy of buying into companies that provide essential services. In detail, Berkshire profits from retail without taking any of the risks of operating brick-and-mortar stores. Instead, McLane services whatever company is operating in an area.

11. Helzberg Diamonds

Oddly, Berkshire’s investment in jewelry and diamonds is usually overlooked. Helzberg sells various diamonds and other jewelry through its website and stores.

In addition to Helzberg, Berkshire Hathaway owns the jewelry retailers Borsheims and Ben Bridge Jeweler. Buffett likes jewelry because it is a small, high-value product many buy on credit. Consequently, diamonds generate float for Berkshire Hathaway.

12. International Dairy Queen

Dairy Queen is a famous American fast food brand that operates Orange Julius stores. Dairy Queen restaurants are commonplace in small American towns, and Orange Julius franchises are a common feature of American malls.

Dairy Queen is not as famous or glamorous as McDonald’s (NYSE: MCD), but it is profitable. One reason is that it avoids urban and suburban markets with intense competition.

13. Marmon Holdings Inc.

Marmon is a giant billion Berkshire Hathaway subsidiary you probably never heard of.

However, Marmon makes everything from railroad tank cars to restaurant fixtures, electrical wire, cranes, and plumbing. Although Marmon is low profile, it is profitable.

14. Johns Manville

Johns Manville is another unsexy company that makes boring products, such as insulation and roofing. However, Johns Manville makes products that almost everybody needs.

Once again, Berkshire Hathaway profits by owning an obscure company that provides vital products. Interestingly, Johns Manville is a high-technology company.

Johns Manville is researching glass fibers and other composites that could be used in automobiles and other manufacturing. Consequently, Berkshire Hathaway could one day manufacture your car’s or airplane’s components.

15. The Acme Brick Company

Acme Brick could be the most boring company Berkshire Hathaway owns. However, it makes a widely used product that people use every day.

Acme Brick offers products such as paving stones, bricks for construction, and even glass bricks for decoration. It is another example of Buffett’s betting on Americans’ habit of homeownership. Brick is still one of the main building materials in American homes, ranging from suburban ranch houses to inner-city condos.

16. Fechheimer Brothers

The Fechheimer Brothers Company manufactures uniforms for police, the military, and firefighters. It also makes gear for a wide variety of workers, including Justin Flame-resistant garments.

Once again, Berkshire Hathaway is servicing a steady but necessary market that could be recession-proof. To explain, law enforcement and the military have a steady source of revenue in the form of taxes.

17. Berkshire Hathaway Automotive

Surprisingly, Warren Buffett is buying auto dealerships around the United States through Berkshire Hathaway Automotive. Berkshire Hathaway currently offers 46,360 vehicles for sale through 103 franchises.

I guess that Buffett thinks dealerships will generate float through auto financing. Notably, over 30% of new cars in the United States are leased. That means the leasers must make a monthly payment to keep their cars.

Additionally, Berkshire Hathaway could make more money by selling GEICO insurance policies through its dealerships. Future markets Berkshire Hathaway could tap include rideshare services such as Uber (NASDAQ: UBER) and Lyft (NYSE: LYFT).

Uber and Lyft drivers will need vehicles and insurance, and Berkshire Hathaway Automotive could provide those vehicles through its dealerships. Meanwhile, GEICO could insure rideshare vehicles.

18. The Oriental Trading Company

Oriental Trading sells party, teaching, and other supplies to organizations through catalogs and a website. Oriental Trading makes money by tapping obscure markets like Vacation Bible School and classroom decorations.

However, the markets Oriental Trading can tap are vast. There are over 132,853 public schools in the United States. Thus, Oriental Trading has hundreds of thousands of potential customers all over the United States.

Oriental Trading is another example of a Berkshire Hathaway subsidiary that taps a vast market most people are unaware of. Therefore, studying obscure statistics helps Buffett locate great investments.

[Related Article: The Top 100+ Warren Buffett Quotes – With Explanations]

Warren Buffett Company List

| 1. Acme Brick Company |

| 2. HomeServices of America |

| 3. Applied Underwriters |

| 4. International Dairy Queen, Inc. |

| 5. Ben Bridge Jeweler |

| 6. IMC International Metalworking Companies |

| 7. Benjamin Moore & Co. |

| 8. Johns Manville |

| 9. Berkshire Hathaway Automotive |

| 10. Jordan’s Furniture |

| 11. Berkshire Hathaway Direct Insurance Company (THREE) |

| 12. Justin Brands |

| 13. Berkshire Hathaway Energy Company |

| 14. H. Brown Shoe Group |

| 15. Berkshire Hathaway GUARD Insurance Companies |

| 16. Larson-Juhl |

| 17. Berkshire Hathaway Homestate Companies |

| 18. LiquidPower Specialty Products Inc. (LSPI) |

| 19. Berkshire Hathaway Specialty Insurance |

| 20. Louis – Motorcycle & Leisure |

| 21. BH Media Group |

| 22. Lubrizol Corporation |

| 23. biBERK Business Insurance |

| 24. Marmon Holdings, Inc. |

| 25. BoatU.S. |

| 26. McLane Company |

| 27. Borsheims Fine Jewelry |

| 28. MedPro Group |

| 29. Brooks |

| 30. MiTek Inc. |

| 31. Buffalo NEWS, Buffalo NY |

| 32. MLMIC Insurance Company |

| 33. BNSF |

| 34. National Indemnity Company |

| 35. Business Wire |

| 36. Nebraska Furniture Mart |

| 37. Central States Indemnity Company |

| 38. NetJets® |

| 39. Charter Brokerage |

| 40. Oriental Trading Company |

| 41. Clayton Homes |

| 42. Pampered Chef® |

| 43. CORT Business Services |

| 44. Precision Castparts Corp. |

| 45. CTB Inc. |

| 46. Precision Steel Warehouse, Inc. |

| 47. Duracell |

| 48. RC Willey Home Furnishings |

| 49. Fechheimer Brothers Company |

| 50. Richline Group |

| 51. FlightSafety |

| 52. Scott Fetzer Companies |

| 53. Forest River |

| 54. See’s Candies |

| 55. Fruit of the Loom Companies |

| 56. Shaw Industries |

| 57. Garan Incorporated |

| 58. Star Furniture |

| 59. Gateway Underwriters Agency |

| 60. TTI, Inc. |

| 61. GEICO Auto Insurance |

| 62. United States Liability Insurance Group |

| 63. General Re |

| 64. XTRA Corporation |

| 65. Helzberg Diamonds |

Table Source: Berkshire Hathaway Annual Reports

The companies listed above are just a small sampling of the many firms in Berkshire Hathaway’s vast empire. In fact, Berkshire Hathaway makes everything from candy to industrial equipment.

Therefore, Berkshire is one of the world’s most diversified companies because it operates in an incredible variety of sectors.

A Lesson in Value Investing

Studying Berkshire’s holdings and studying them can give you a comprehensive lesson in value investing.

Studying Berkshire’s many insurance holdings will give you a good idea of how float works and why Buffett values it. In addition, the unsexy nature of Berkshire Hathaway Holdings demonstrates how you can make money by ignoring the market.

Understanding the characteristics of companies Buffett and his team buy can show you what to look for in stocks. Those who want to learn value investing should study Berkshire Hathaway’s subsidiaries.

FAQ

How does Warren Buffett analyze and value a company?

Warren Buffett values companies using a value investing method from his mentor Benjamin Graham. Buffett estimates the predicted earnings for the next ten years and discounts the cash flow against inflation. This is the intrinsic value of the business. If the intrinsic value per share is lower than the stock price, that is the margin of safety. Buffett targets a margin of safety higher than 30%.

What companies does Warren Buffett fully own?

Warren Buffett's Berkshire Hathaway fully owns 65 companies, including Dairy Queen, Duracell, Geico, General Re, Fruit of the Loom, and See's Candies.

Does Warren Buffett own a railroad company?

Yes, Warren Buffett's company Berkshire Hathaway owns 100% of the Burlington Northern Santa Fe Railway (BNSF).

How many companies does Warren Buffett invest in?

Warren Buffett's company Berkshire Hathaway currently owns stock in 50 companies, according to its latest 13F SEC securities filing.

How to invest in the Warren Buffett company?

To invest in Warren Buffett's company, you must buy Berkshire Hathaway Inc (BRK) shares. There are two types of BRK shares, the BRK.A class stock costs $465K per share. The class b stock BRK.B costs $300 per share. Both classes of BRK stock make the same percentage increases and decreases, but the class B stock has a lower price making it more accessible to retail investors.

What biotech company did Warren Buffett invest in?

In 2020 during the Covid pandemic, Buffett's Berkshire Hathaway invested in Biogen Inc., Merck & Co., and Bristol-Myers Squibb. Since then, Berkshire Hathaway has sold all its Biogen shares and has significantly reduced its exposure to Merck and Bristol Meyers Squibb.

What candy company does Warren Buffett own?

Warren Buffett's Berkshire Hathaway famously owns See's Candies. At the Berkshire Hathaway annual shareholder meeting, there is always a See's Candies stand where investors can purchase the sweeties.

What insurance company does Warren Buffett own?

Warren Buffett's Berkshire Hathaway owns three insurance companies, Berkshire Hathaway Reinsurance, General Re, and GEICO. Most people will know GEICO because of its TV advertising campaigns.

What does Warren Buffett look for in a company?

According to the book Buffettology, Warren Buffett looks for the following in any company he invests in. 1. Stable growing earnings. 2. Strong cash flow for the next 10 years. 3. A margin of safety of 30% or more.

What 5g company did Warren Buffett invest in?

Warren Buffett's Berkshire Hathaway owns stakes in the following 5G related companies. Taiwan Semiconductor, Verizon, and T-Mobile.

Does Warren Buffett improve companies?

There is plenty of evidence to suggest Warren Buffett's Berkshire Hathaway management team are skilled leaders who are able to improve the efficiency and profitability of the companies they own. Berkshire stock has increased 190,070% since 1979.

Does Warren Buffett own trucking companies?

Warren Buffett's Berkshire Hathaway owns a 38% stake in Pilot Corporation, the largest privately owned Truck stop operator in the USA.

Does Warren Buffett own vacuum cleaning companies?

Warren Buffett's Berkshire Hathaway no longer owns shares in any vacuum cleaner companies. In 2021 Berkshire Hathways Scott Fetzer Companies sold Kirby, the manufacturer of premium vacuum cleaners.

Wheres Apple there??

Hi Renny, Berkshire Hathaway owns a 5.4% Stake in Apple – it is mentioned in the article.

Barry

Apt and informative. Good one!