Short selling is a risky trading strategy that involves selling securities borrowed from a broker.

The idea is to sell the borrowed shares and then buy them back at a lower price, profiting from the difference between the two prices.

Short-selling is the most difficult trading skill to master. The stock market’s default direction is up, so betting against a company in a bull market is extremely risky and likely to result in losses.

Short selling should only be undertaken by experienced investors who are comfortable with the risks and understand how to manage them. Novice investors or those not comfortable with risk should avoid it.

Short selling can be done with stocks, options, and other securities. Shorting is often used to bet against the market or individual stocks.

This article will discuss short selling in detail and how it works!

What is short selling?

Short selling is a strategy that allows traders to benefit from downward price movements in a security. To do this, the speculator borrows the security at a cost and sells it. The trade ends when the stock is purchased, ideally at a lower price, called covering. The difference between the two prices is the profit or loss.

The meaning of sell short.

The meaning of selling short is to sell a security you do not own and hope to buy the same security back at a lower price so you can make a profit. Shorting is also known as going short or taking a short position.

For example, an investor who believes XYZ Company stock will go down in value may “sell short” 100 shares of XYZ Company stock.

What is a short-seller?

A short seller is an investor who bets a stock will decrease in value. Short selling is often used as a hedge against an already-made investment or as a way to profit from an anticipated decline in the price of a security.

Short-sellers typically borrow shares of the stock they hope to sell from another investor and then sell them, hoping to buy them back at a lower price so they can return the shares to the original owner and pocket the difference. If the price of the stock does indeed decline, the short seller will profit. However, if the stock price increases, the short seller will incur a loss, possibly an exponential loss if using leverage.

Short selling is a risky strategy and is not suitable for all investors. Before considering short selling, you should understand all the risks and implications.

Why most traders should avoid short selling.

Short-selling is the most difficult trading skill to master. The stock market’s default direction is up, so betting against a company in a bull market is extremely risky and likely to result in losses.

When you short-sell a stock, you are essentially betting that the price of the stock will go down. If the stock price goes up instead, you will lose money. Short selling is risky, but it can be profitable if done correctly. Before shorting any stock, do your homework and understand the risks involved. Use stop-loss orders to limit your risk.

The other big risk is the potential for a squeeze. A short squeeze happens when a stock rises sharply, and short-sellers are forced to buy it to cover their positions. This buying can drive the stock price even higher. Short squeezes are often associated with stocks that have been heavily shorted and can be difficult to predict.

What is a naked short?

The term naked short comes from the seller’s not borrowing the securities before selling them, as in a conventional short sale.

The risk of loss in a naked short sale is theoretically unlimited since there is no limit to how high the stock price can go.

In practice, broker-dealers must close out failing trades by buying securities on the open market to deliver to the customer. They will not allow customers to short-sell a stock if they do not have reasonably good faith that the shares can be borrowed.

A practical example of short selling.

To short-sell a stock, you borrow shares from somebody else, sell the stock, and hope the price falls so you can buy it back at a lower price and give the shares back to the person you borrowed them from.

Let’s say you think XYZ Company is overvalued and due for a fall, so you borrow 100 shares from your broker and sell them immediately at $50 per share. Now, let’s say that XYZ’s stock does fall to $40 per share.

You buy 100 shares at $40 and return them to your broker. Your profit on the trade is $1000 (100 x ($50-$40)).

Now let’s say that XYZ Company’s stock goes up to $70 per share instead of falling. You buy 100 shares at $70 to give back to your broker and lose $2000 on the trade.

Your broker handles the process of borrowing, leveraging, and selling the stock short, but there are specific trading account requirements.

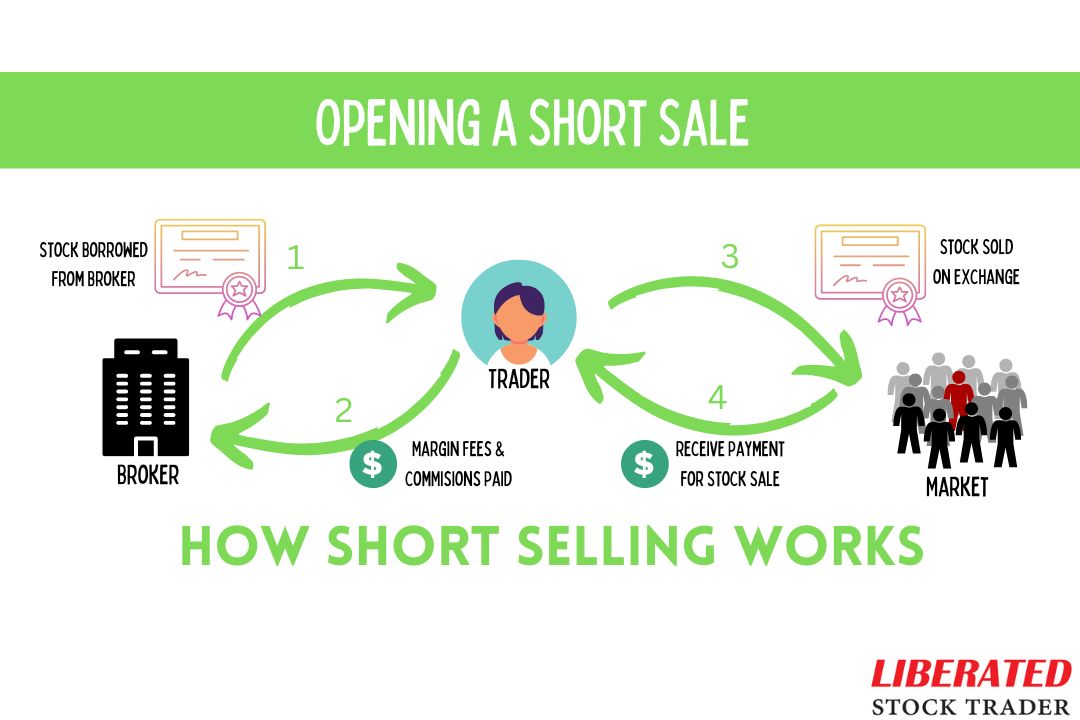

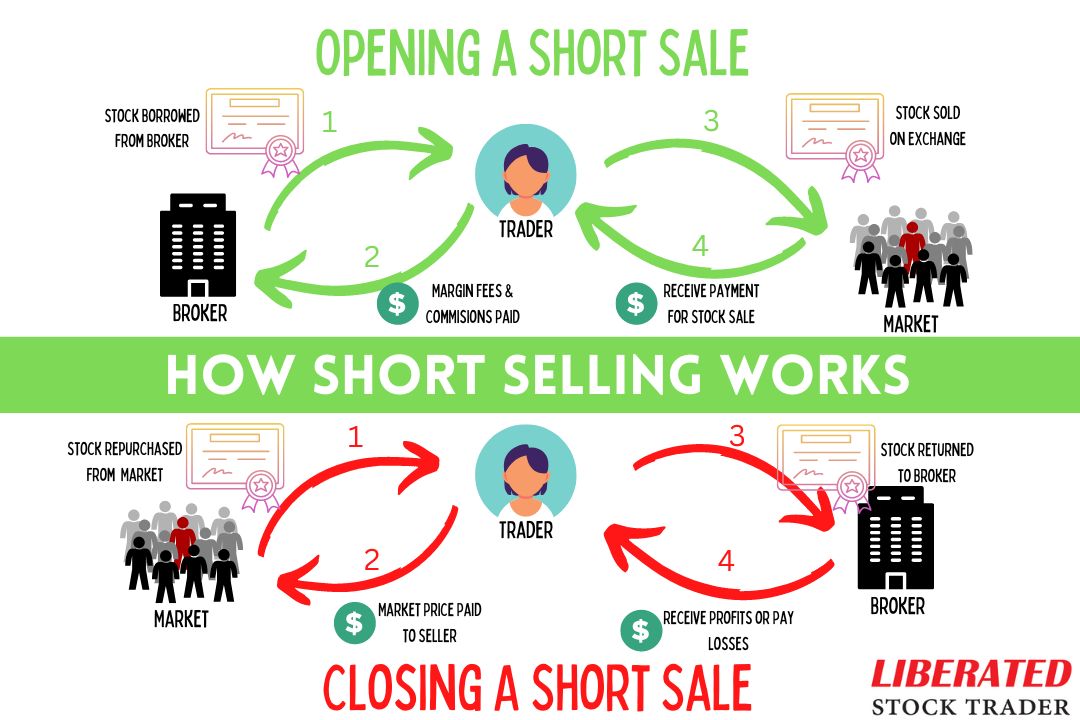

Four steps to open a short stock trade.

To open a short sell trade, an investor:

- Borrows the security to be sold from another investor or a broker.

- Margin fees and commissions are paid to the broker.

- The security is then sold in the open market.

- The proceeds are placed in a margin account.

If the security price falls when the investor holds it, the investor can buy it back at a lower price and give the security back to the person or broker from whom it was borrowed.

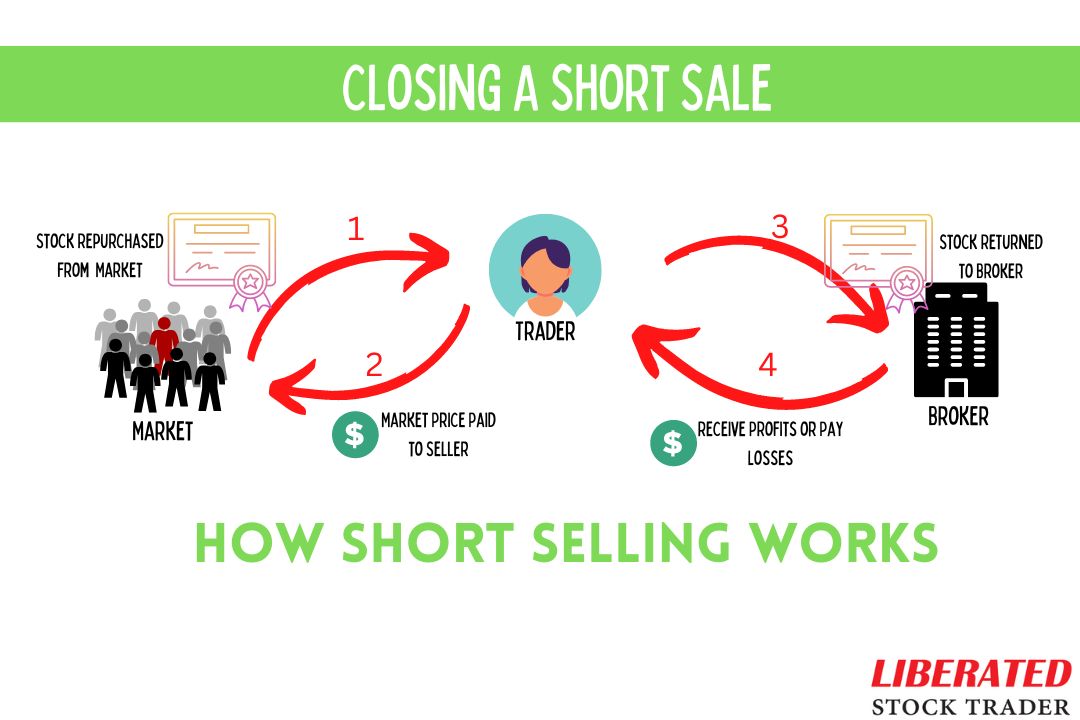

Four steps to close a short stock trade.

To close a short-sell trade, the investor:

- Buys the security back in the open market.

- The seller is paid the market price for the stock.

- The stock is returned to the lender (usually the broker).

- If the security price has fallen since it was sold, the difference between the price at which it was bought back and the price at which it was sold is profit for the investor. If it has risen, the difference is a loss.

Trading account requirements for short selling in the USA.

To engage in short selling in the United States, a trader must have a margin account with a broker-dealer. The trader must post a margin with the broker to borrow the security to sell short. The margin requirement varies depending on the security and the broker, but it is typically 50% of the cost of the security.

Why do investors dislike short selling?

Short selling is sometimes criticized because it can exacerbate falling prices in a security or market. For example, suppose many investors believe a stock is overvalued and attempt to profit from a price decline by shorting it. In that case, their actions could create a self-fulfilling prophecy, where the falling price triggers stop-loss orders and further selling, leading to an even sharper decline.

Example of short-sell losses.

It is not uncommon for a stock to be “shorted” by investors who believe the stock price will fall in the future. However, these short sellers can sometimes be caught off guard when the stock price unexpectedly rises.

One example occurred with Hertz Global Holdings, Inc. (NYSE: HTZ). In late April 2020, shares of Hertz rose sharply after the company announced it would raise $500 million through a new debt offering. This news caught many short-sellers by surprise, leading to heavy losses.

According to S&P Global Market Intelligence data, 26.85 million shares of Hertz were sold short as of April 30th, 2020. This means that short-sellers bet against nearly 27% of all outstanding shares.

One month later, Hertz canceled raising new debt and filed for bankruptcy. Ultimately, the short-sellers were correct, but too early. Market timing was the problem that cost them heavily.

While Hertz is just one example, it reminds us that short sellers are not always right about a stock’s direction. Sometimes, even the most bearish investors can be caught off guard by positive news. As such, it is important to always do your research before making any investment decisions.

Beat The Market, Avoid Crashes & Lower Your Risks

Nobody wants to see their hard-earned money disappear in a stock market crash.

Over the past century, the US stock market has had 6 major crashes that have caused investors to lose trillions of dollars.

The MOSES Index ETF Investing Strategy will help you minimize the impact of major stock market crashes. MOSES will alert you before the next crash happens so you can protect your portfolio. You will also know when the bear market is over and the new rally begins so you can start investing again.

MOSES Helps You Secure & Grow Your Biggest Investments

★ 3 Index ETF Strategies ★

★ Outperforms the NASDAQ 100, S&P500 & Russell 3000 ★

★ Beats the DAX, CAC40 & EURO STOXX Indices ★

★ Buy & Sell Signals Generated ★

MOSES Helps You Sleep Better At Night Knowing You Are Prepared For Future Disasters

What is a short squeeze?

A short squeeze is when a stock price jumps sharply, forcing traders who bet the price would fall to buy the stock to cover their losing position. This buying can drive the stock price even higher. Short squeezes can happen in any market, but they are most common in stocks that have been declining for some time and then start to rebound.

When a stock starts to rise after a period of decline, some traders will bet that it is just a temporary rebound and that the stock will soon resume its downward trend.

Short selling to hedge risk.

Hedging refers to limiting your risks by making a trade that moves in the opposite direction to which you expect your stock to go. So, if the stock moves against your other investment, it will decrease or limit your risk.

Example: Mary owns 100 shares of Google Inc. at $500 per share, worth $50,000. She has already made a huge profit on the stock, but she fears the stock will have a temporary fall due to a bad earnings report. She decides to short her stock. Mary opened a short trade for 100 shares of Google Inc. at $500 per share.

The broker credits the amount of $50,000 to her account, but she does not need to borrow the stock because she already owns it.

Mary now has $100,000 in her account. The stock moves down 10% to $450 per share. Mary closes the trade by purchasing the stock. Mary made $5,000 on the trade, 10% of $50,000. Her investment pot is now still worth $50,000. She has $45,000 worth of Google stock and $5,000 cash. This means that even though the stock she owned decreased in value, her capital amount remained unchanged.

Mary could then invest this $5,000 in 5 more shares of Google, meaning she now has 105 shares worth $50,000.

Summary.

If you’re thinking of short selling, do your homework and understand the risks. It’s not a strategy for everyone, but it can be a profitable way to trade if you know what you’re doing.

Short selling can be risky, but it can be profitable if done correctly. Do your homework before shorting any stock, and always use stop-loss orders to limit your risk.

FAQ

What is the best software for short-selling?

Our testing shows that Finviz is the best software for potential short-sell trades. Finviz has filtering criteria for float short, option/short, short interest, and bearish chart patterns, which are essential for short sellers.

What is short selling?

Short selling is an investment strategy where an investor borrows shares to sell them in anticipation of a price drop. They aim to buy back the shares at a lower price, returning them to the lender while pocketing the difference.

How does short selling work?

Investors borrow stocks from a broker, sell them, and then repurchase and return them when the price drops. The profit comes from the difference between the selling and repurchasing price.

Is short selling risky?

Indeed, engaging in short-selling entails significant risk. If, instead of declining, the stock price rises, one would have to repurchase it at a higher price, resulting in detrimental financial outcomes.

Can anyone short-sell?

While anyone can theoretically short-sell, it's typically done by experienced investors due to the high level of risk involved. Your broker will require a disclaimer and confirmation of your experience.

What can I short-sell?

Most markets allow you to short-sell stocks, bonds, currencies, commodities, and derivatives. However, not all brokers offer access to these assets. It's important to check your broker's requirements.

What are the costs of short selling?

Costs include borrowing fees for the stock, commission to the broker, and interest on the margin account used for short selling ranging from 1.5% to 6% per month .

What is a short squeeze?

A short squeeze occurs when a heavily shorted stock's price rises sharply, forcing short sellers to buy it back to limit their losses, further increasing the price.

What is covered short-selling?

Covered short selling means you already own the underlying asset or other instruments that offset the risk of short selling.

What is naked short selling?

Naked short selling is selling shares you don't have without arranging to borrow them. It's considered illegal in many markets due to its potential to manipulate market prices.

What is a margin call in short selling?

A margin call happens when the broker demands that an investor deposits more money to cover potential losses when the market moves against their positions.

What are the tax implications of short selling?

Short-selling profits are generally subject to capital gains tax. However, tax laws vary by country, so consult a tax advisor for accurate information.

Can I short-sell ETFs and Mutual Funds?

Yes, you can short-sell ETFs and some mutual funds. The process is similar to short-selling individual stocks, but additional rules may apply.

Can I short-sell in a bear market?

Certainly! Short selling is a common strategy to profit from falling prices in a bear market.

What is buy-to-cover in short selling?

Short sellers utilize the buy-to-cover order type to close their positions effectively. This involves the repurchase of shares that were initially borrowed and sold.

How long can I hold a short position?

There is no definitive time limit for holding a short position, but your chosen duration will directly impact the interest payable on the borrowed shares. The longer you hold the position, the greater the interest accrues.