According to our research, using 53 years of stock exchange data, the best time to buy stocks is in October, and the best time to sell stocks is in July.

Although each day, week, and month differs from year to year, there are common trends across the decades. I will answer these questions using 53 years of statistical stock market data.

This article also contains interactive seasonality charts and all the data you need to decide for yourself when to buy and sell stocks.

31-Year Seasonality Chart for the S&P500

Data By TrendSpider: Our Favorite Trading Analysis Tools

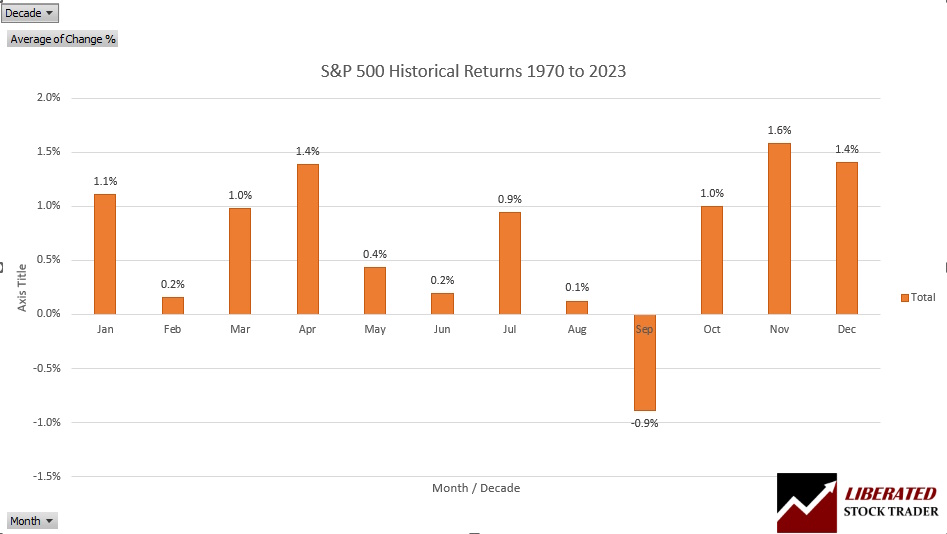

What is the Best Month to Buy Stocks?

The best month to buy stocks is October, as the S&P500 has increased 1.2% in 16 of the last 23 years. Using stock market data from 1970 to 2023, October returns 1%, November 1.6%, and December 1.4%.

The high performance in December might also show evidence of the Santa Claus Rally.

What is the Worst Month for Stocks?

Our data research shows that from 1970 to 2023, the worst month for stocks was September, with an average loss of -0.90%. So, if you are considering selling stock, it would be strategically better to sell towards the end of August.

Table: S&P 500 Monthly Returns 1970 to 2023

| Month | % Return |

| Jan | 1.1% |

| Feb | 0.2% |

| Mar | 1.0% |

| Apr | 1.4% |

| May | 0.4% |

| Jun | 0.2% |

| Jul | 0.9% |

| Aug | 0.1% |

| Sep | -0.9% |

| Oct | 1.0% |

| Nov | 1.6% |

| Dec | 1.4% |

The Best Months to Buy Stocks: 1970 to 2023

From 1970 to 2023, the best month to buy stocks was October because October, November, December, and January are the four strongest months, returning a cumulative average of 6%.

If you bought stocks in March and held them for six months, the cumulative average return is 4.1%.

The 3 Best Months to Buy Stocks

Over the past 50 years, November (+4.1%), December (+1.4%), and April (+1.4%) have been the three best months to buy stocks. February, June, and August return very little profit, less than 0.2% per month.

The 3 Best Months To Buy Stocks Over 53 Years

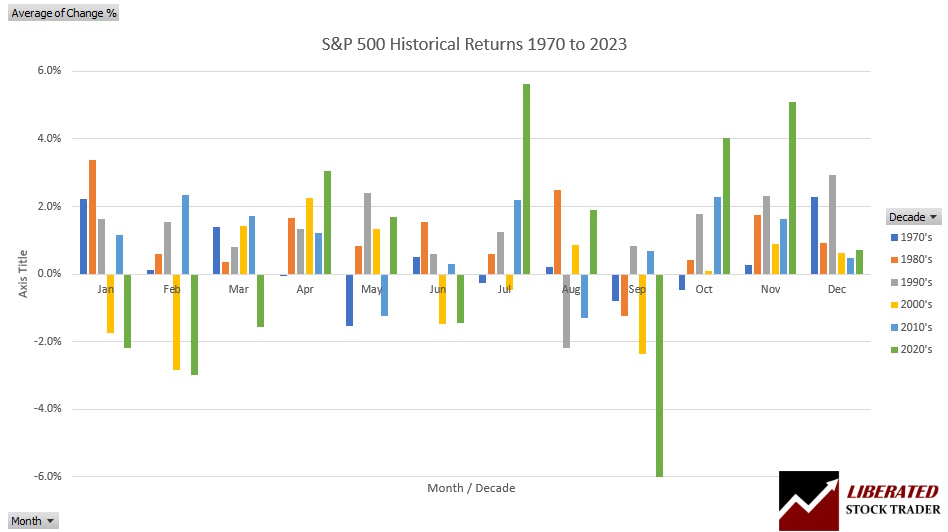

Breaking down the last 53 years into returns per month and decade, a different picture emerges. The 2000s and the first three years of the 2020s have changed expectations. The years 2000 to 2010 saw terrible economic and stock market recessions. 2020 to 2023 has been extremely volatile, both on the upside of positive returns and the stock market crash of 2022.

The 3 Golden Months to Buy Stocks

Despite the 1970s crash, the 2000 Dotcom crash, the 2008 financial crisis, and the 2020 Covid crash, October, November, and December all returned a positive 1% to 1.6% return.

This chart details the average monthly returns in percent broken into decades: 1980s, 1990s, 2000s, and the three years 2020 to 2023. Incredibly, October, November, and December remain positive throughout all crashes and recessions.

My thorough testing awarded TradingView a stellar 4.8 stars!

With powerful stock chart analysis, pattern recognition, screening, backtesting, and a 20+ million user community, it’s a game-changer for traders.

Whether you're trading in the US or internationally, TradingView is my top pick for its unmatched features and ease of use.

Explore TradingView – Your Gateway to Smarter Trading!

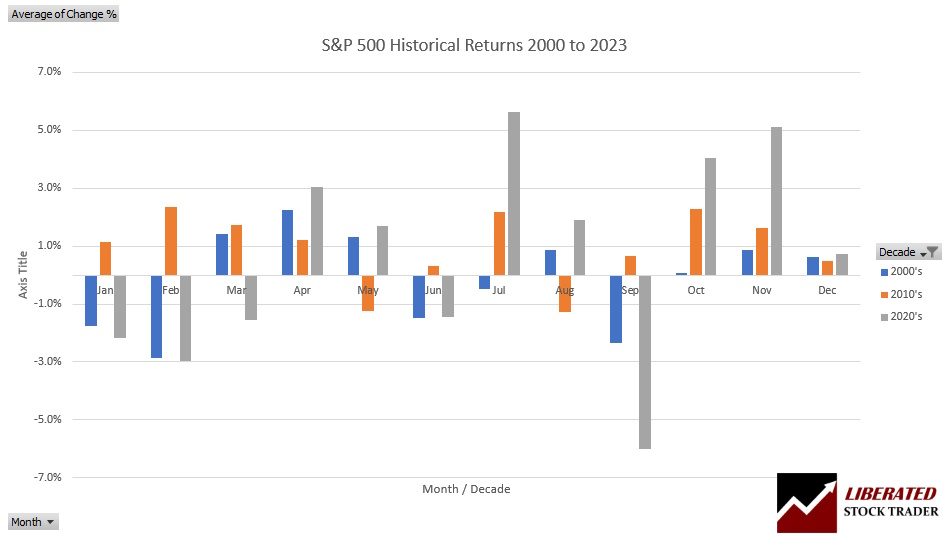

The Best Months to Buy Stocks: 2000 to 2023

From 2020 to 2023, October was the best month to buy stocks, and the stock was held for three months until the end of December. October, November, and December are the only three months that have returned positive results over the last 23 years.

How the Stock Market Has Changed Since the 1970s

Not all decades are created equally; the 1970s and 1980s were relatively stable despite the oil shock and inflation of the 1970s. However, the advent of the Internet, online trading, the popularity of stock options, high-frequency trading, and the growth of trillion-dollar corporations have made the stock market much more volatile.

S&P 500 Historical Returns 2000 to 2020

2020 to 2023 has been exceptional due to a pandemic crash in 2020, a boom in 2021, and a crash again in 2022. Any monthly statistical reference should exclude the 2020s.

The Best Months to Buy & Hold Stocks (1970 to 2020)

For the last five decades, you can see that buying stock in October and holding until July has, on average, been a good strategy.

Invest in yourself! Get all our courses & strategies for 50% off

★ Liberated Stock Trader Pro Stock Investing & Trading Course ★

★ M.O.S.E.S. Market Outperforming ETF Strategy ★

★ LST Beat the Market Stock Picking Strategy ★

★ Exclusive Bonus Course – The Stock Market Crash Detector Strategy ★

★ Fully Guided Videos, eBooks & Lifetime Email Support ★

★ 108 Videos + 3 Full eBooks + 5 Scripts for TradingView & Stock Rover ★

The Seasonal Effect on the Stock Market

There is a seasonal effect, and it does repeat itself. This could be due to retail sales, summer commodities harvest, and the build-up to the Christmas selling period.

Ultimately, the economy’s state and the government’s fiscal and monetary policy stewarding play a leading role here. The ’80s and ’90s were decades of unprecedented growth, and the 2000s was a decade of payback with two severe crashes, the Dotcom bust (2000) and the Financial Crisis (2007); this is reflected in the chart above.

From 1980 to 2000, January to June was positive, and October to December was negative. Only August and September were not 100% positive in terms of gains—10 of the 12 months.

From 2000 to 2009, 5 of the 12 months were negative: January, February, June, July, and September.

The Best Months to Buy Stock: 2000 to 2023

| Months 2000-2023 | Average % Return |

| Jan | -0.5% |

| Feb | -0.6% |

| Mar | 1.2% |

| Apr | 1.9% |

| May | 0.3% |

| Jun | -0.7% |

| Jul | 1.5% |

| Aug | 0.1% |

| Sep | -1.5% |

| Oct | 1.6% |

| Nov | 1.8% |

| Dec | 0.6% |

The Best Months to Buy Stock

In the 2022 bear market, the best months to buy S&P 500 stocks were March +3.59%, July +9.11%, October +7.99%, November +5.38%, and December +3.74%; all other months returned losses.

What is the Best Month to Sell Stocks?

Our data analysis shows that August is the best month to sell stocks from 1970 to 2023. Specifically, the best time to sell would be toward the end of August, as September is typically the worst month for stock market declines. September averaged a loss in all five decades from 1970.

You want to be a successful stock investor but don’t know where to start.

Learning stock market investing on your own can be overwhelming. There’s so much information out there, and it’s hard to know what’s true and what’s not.

Liberated Stock Trader Pro Investing Course

Our pro investing classes are the perfect way to learn stock investing. You will learn everything you need to know about financial analysis, charts, stock screening, and portfolio building so you can start building wealth today.

★ 16 Hours of Video Lessons + eBook ★

★ Complete Financial Analysis Lessons ★

★ 6 Proven Investing Strategies ★

★ Professional Grade Stock Chart Analysis Classes ★

Summary

The single best month to buy stock over the last 50 years and in every decade has been October.

Of course, what you buy is key. If you invest in an Exchange Traded Fund that tracks the S&P 500 or any major market index, this trend should hold until the trend changes.

If you invest in individual stocks, this market index analysis will bear little correlation to your purchased stock. The charts above show the performance of all the stocks in the index.

Remember, although a stock may increase or decrease due to the ebb and flow of the underlying market direction, the fundamentals of the stock you purchase, combined with your timing, will ultimately determine the long-term profitability of the investment.

FAQ

What is historically the best time to buy stocks?

Historically the best time of year to buy stocks is in October. Based on 53 years of data, October is the start of 5 months of positive returns to the end of January, averaging a 5.1% return.

What are the best and worst months for the stock market historically?

Over the past 50 years, November has been the best month to buy stocks, as it has the highest average return of 1.6%, followed by 1.4% in December. The worst month to buy stocks is the start of September, which has lost 0.9% every decade since 1970.

What month is historically the best month to sell stocks?

The best month to sell stocks before a stock market decline is the end of July. Using 50 years of data, we determine that August has both positive and negative returns, and September is, in every decade, the month to avoid.

What months are stocks the lowest?

Our 50-year research shows that stocks are at their lowest at the end of September. Summing all the S&P 500 gain and loss percentages in September since 1970, the loss would be -46.9%. So avoid September at all costs.

What are the worst months in stock market history?

The worst month in the last 50 years of stock market history was October 1987, the S&P 500 index lost 28.8%. October 2008 was the second worst, losing 16.9%. August 1998 was also bad, losing 14.6%.

Do stocks typically go down in December?

No, stocks do not typically go down in October. Our research shows that October is a great time to buy stocks because October market the start of the best four months of stock market returns. From 1970 to 2023, the average monthly return from October to January is 1% to 1.6%.

Is November the best month for stocks?

Yes, November has been the best month for the stock over the last 53 years. November returns on average 1.6%. Historically, it is worth buying stocks in October because October returns 1%, November 1.6%, December 1.4%, and January 1.1%.

Do stocks usually go down in January?

No, stocks do not usually go down in January. From 2000 to 2010, stocks went down on average 1.9% in January. However, looking at the longer term, from 1970 to 2023, stocks increased by 1.1% in January.

Why do stocks go down in January?

On average, stocks do not go down in January. From 2000 to 2009 and 2020 to 2022, stocks have declined on average by 2%. But over the long term, January is a good month to buy stocks, with an average gain of 1.1% since 1970.

Do stocks rise or fall around Christmas?

Stocks typically rise around the Christmas period. Over the last 50 years, October through to January have been the best time to buy stocks, with each month averaging between 1% and 1.6% per month gain on the S&P 500.

Is it better to buy stocks before or after Christmas?

It is better to buy stocks before Christmas. Our research proves buying stocks in October is the best strategy. October marks the start of a four-month run of above-average stock market gains between 1% and 1.6% per month to January.

Is December the best time to buy stocks?

While December is a good month to buy stocks, the best months are October and November. September typically averages a 0.9% loss, so buying stocks at the start of October, rather than December, usually returns the best profits over the Christmas period.

Is February a good month for stocks?

No, February is not a good month for stocks. From 2000 to 2023, the stock market lost on average 0.6%, making it one of the worst months to buy stocks. Data suggests waiting until the start of March to buy stocks, as March and April typically return 3.1%

Are stocks higher in January?

Over the last 53 years, stocks are higher in January. However, from 2000 to 2009, stocks lost 1.8% on average, and from 2020 to 2023, stocks lost 2.1%. January is a mixed bag of returns and cannot be accurately predicted.

Why do stocks go down in winter?

Stocks typically do not go down in winter. In the northern hemisphere, winter starts in November, and November is the single best month for stocks historically from 1970 to 2023. November through to January (the Winter months) are the best months for stocks.

Why do stock prices fall in December?

Typically stock prices do not fall in January. Of course, in any specific year, stocks can rise or fall, but on average, from 1970 to 2022, December has seen S&P 500 stock prices rise by 1.4%.

Is it better to sell stock in December or January?

From 1970 to 2023, data suggests it is better to sell stocks at the end of January. However, our chart above suggests if you consider data from 2000 to 2023, it is better to sell at the end of December.

Why do investors sell in December?

Investors who only analyze data from the last 20 years consider January a bad month and sell stocks. But over the long term, January is a positive month. Investors might sell in January because February is the second worst month to hold stocks.

Are stocks higher in summer or winter?

Analytical data proves that stocks move much higher during winter rather than summer. In this chart, four of the best six performing months are October through January.

When is the best time to buy stocks?

If you live in the northern hemisphere, the best time to buy stocks is when the leaves on the trees turn golden and the nights get colder. Yes, October and November are statically the best time to buy stocks.

Is a recession the best time to buy stocks?

This is a great question, and yes, during the worst times of a recession is the best time to buy stocks. Just be careful not to buy stocks in companies that might go bankrupt, as you will lose all your invested capital. During a recession, buy companies with a strong cash flow and balance sheet.

This is my first time to view your site.

Truly marvellous.

Looking at the average values, isn’t it best to buy stocks at the END OF February and END OF September?

I mean, then they’re usually at their cheapest point, followed by the best growth, right?

Hi Alex,

Yes, that is also a good strategy

Barry

Want to buy stock for each grandchild. How do I keep them from cashing in immediately after giving them the certificates?

I think it would be best to keep the certificates

It appears that q3 results influence the good buy in Oct & Nov and q4 & YOY for April buying, in other words q1& q2 have less influence on buying trends. q1 & q2 creates un certainty in moods as one is beginning of the year and another is just starts to give signs.

If you are a buy and hold long time investor, would be be prudent to invest in the months when the stock market is falling, so as to have bigger gains for the future ?

Yes, buying at the end of the falling period is a good idea.

As a newly retired couple we will have to sell some ETF S&P 500 shares each year to meet our spending needs. Does your data show a best time a year to sell to get the best price?

Hi Steve, thanks for the question.

The numbers suggest that April is the best month on average for stock price increases. So perhaps the end of April.

thanks

Barry

I have a small flat. If I sell and invest in stock market, will I be able to get the value for buying bigger flat. If possible or say yes, please give me the time period I have to wait to make a valuable consideration for a big flat which is normally avaialbel at 1. to 1.5 cr. At the same time being a greedy like, I do not want to

land in loss and be a bankrupt.

Awaiting your sincere advice at practical experience and exposure to the stock market.

My name is Ramachandran Chandrasekaran

Hi Rama,

I would highly recommend that you do not sell your flat to invest in the stock market with the hope of profiting and buying a bigger apartment. The stock market is volatile, you should only invest a portion of your available capital in stocks.

This is useful and interesting data, but couldn’t you update the charts with 2010-2020 data?

I will think about it for the next update.

Barry